Cryptocurrency spoofing has now come into the spotlight.

What was once an underground tactic that was used by large whales and algorithms to manipulate the market has now gained the attention of the CFTC and US regulators. It has also opened up an debate into the actions being taken in unregulated markets.

Bitcoin spoofing has left many cryptocurrency traders scratching their head at seemingly unexplained market moves. There are also some who have fallen victim to the tactics of these participants. There is nothing more frustrating than feeling made the fool by a much wealthier trader.

In this post we will take an in depth look at the spoofing tactics that are taking place in the market today as well as how regulators are likely to respond and how you can avoid falling victim.

What is Spoofing?

Spoofing (also called dynamic layering) is not something that is new to the cryptocurrency markets. In fact, it has been used to a great extent in other markets including the commodities and Equity markets. It has more recently been used by High Frequency Traders (HFT).

Basically, spoofing is the practice of placing multiple visible orders for an asset in order to manipulate the market's perception of supply and demand for said asset. The Swedish Financial Supervisory authority has defined spoofing / layering as:

a strategy of placing orders that is intended to manipulate the price of an instrument, for example through a combination of buy and sell orders

While the goal of spoofing is to make a profit by moving the markets slightly, there have been some catastrophic market movements that were caused by excessive spoofing. One of these was the 2010 flash crash on the Dow Jones index.

Of course, spoofing to this extent in regulated financial markets come with great risk to the trader. The order books are often open and can be traced back to a trader or HFT brokerage. That is how authorities were able to find and prosecute a number of traders over the past few years.

But, what about the cases of an unregulated market where traders are largely anonymous and the exchanges themselves are often quite opaque?

Add to that the average skill level of a cryptocurrency trader and you have the ideal conditions for some really profitable spoofing.

Examples of Cryptocurrency Spoofing

Cryptocurrency spoofing is something that is not all too hard to notice after the fact. Essentially, you are likely to notice a large buy or sell wall of orders that seem to convey strong market interest in a particular cryptocurrency.

For example, if you take a look at the below order books from the GDAX exchange you can see massive sell walls. This will appear to most market participants to be a bearish sign as it gives off the impression that someone is looking to sell a great deal of Bitcoin. It also makes it seem that a bull run is almost impossible.

Large sell walls of orders on GDAX

Large sell walls of orders on GDAXFor most cryptocurrency traders, this could be slightly intimidating and they will elect to either sell their Bitcoin or completely withdraw any buy orders that they may have. However, this is exactly what the spoofing agent would want.

The moment that the market has panic sold some of their coins, the spoofer will pick them up and completely cancel the massive sell orders that they have placed in the books. You will be left stunned with your Bitcoin bought from you and the sell orders eliminated.

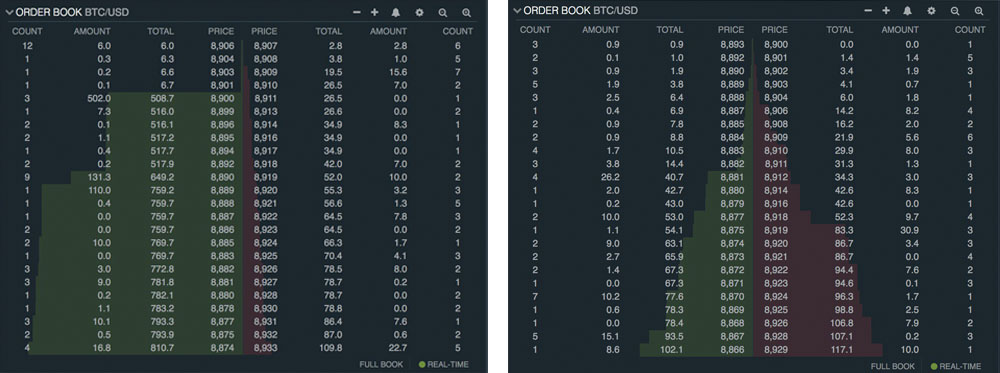

Below is another pretty obvious spoof and abuse on the buy side. On the left you have Bitfinex order books for Bitcoin with massive buy walls with a single 500 BTC order placed at $8,900. Then, on the right you can see the order book a mere few seconds later.

Before & After Order Books. Source: Bitfinex'ed

Before & After Order Books. Source: Bitfinex'edAs you can see, the massive 500 BTC buy order has been removed from the books. This was perhaps done after the participant noticed that the orders could be executed and hence he pulled it.

Indeed, the fact that such market manipulation could so blatantly happen on Bitfinex is not all too shocking. Bitfinex has constantly been facing accusations related to Tether and their rather opaque operating structure. Traders on Bitfinex could feel quite comfortable with their spoofing tactics.

For those of you who are still unaware exactly of what Tether is and how it falls into the broader cryptocurrency equation, we have this helpful overview for you to peruse.

Algorthmic Bitcoin Spoofing

With the advent of exchange APIs and advanced trading algorithms, it is entirely possible that a great deal of the spoofing that is being done today is as a result of bots.

These bots are the type that are developed by software engineers to interact with the exchanges and place the orders. They are not to be confused with Bitcoin Trader robots which is a well known scam in the cryptocurrency industry.

In fact, there have been allegations of large automated trading bots that have been used in order to manipulate exchange order books. One such bot has aptly been named "Picasso" that engaged in painting the market with spoofed orders in the Dec 2017 bull run.

This is only logical as a great deal of spoofing involves speed. The agent that is trying to spoof the market cannot risk getting a large fill on the spoofed order. This could result in the price moving in the opposite direction.

Hence, the algorithms will be coded in order kill open orders expeditiously. It is also entirely possible that some of these larger whales have trading bots that will have preferable API access which will give them an execution edge over the rest of the market.

The extent of spoofing in the Bitcoin markets in December 2017 was pronounced because of the introduction of Bitcoin futures.

Enter BTC Futures

When the CFTC and CBOE started introducing Futures for Bitcoin in late 2017, it opened a whole new opportunity for whales to profit from a moves in the price of the underlying Bitcoin price.

Moreover, when a whale (or a group of them) have such a large impact on the price of the underlying asset, they can comfortably profit from the positions that they take in the futures markets. It is also much harder to make a connection between large futures positions and massive orders in the underlying market.

There are many theories out there that the fall in the price of Bitcoin from the highs of $20,000 was driven by whales in the physical Bitcoin market while profiting from massive shorts in the futures markets.

Of course, this will be nearly impossible to prove and could be the reason that the Justice Department now wants to get more involved in regulating these previously unregulated markets.

Criminal Probe by DOJ

These rumours of manipulation and spoofing in the cryptocurrency markets has prompted officials from the US Justice Department to start a criminal probe.

Image via Wikipedia

Image via WikipediaThey are also looking at other forms of manipulation including wash trading. This is similar to spoofing expect that the executed trades are completed by the same entity in order to give the perception of volume when there was none. This is something that many have accused Bitfinex of doing.

Hence, it is likely that one of the first targets of the probe into the manipulation will be Bitfinex. In fact, earlier in January we had the news that the CFTC had sent Bitfinex and Tether a Subpoena for information.

This clearly shows that some of the larger exchanges will now have more scrutiny for any manipulation or cryptocurrency spoofing. However, given how widespread the practice is, it is likely that participants are still engaging in this on a number of exchanges.

Hence, how do you as a single cryptocurrency trader avoid falling trap to the tactics of a cryptocurrency spoofer?

Avoiding CryptoCurrency Spoofing

Spotting a cryptocurrency spoofing attempt is not that straightforward. What you will usually see is the large orders in the order books with no way of verifying that they are "legitimate".

One of the best ways to avoid the risks of this are to avoid exchanges that are known to operate with a veil of secrecy. For example, exchanges such as Gemimi in the USA have requested the help of the Nasdaq exchange to monitor for any suspicious activity which helps to eliminate the practice.

You can also trade with a healthy dose of skepticism. Whenever you see order books that appear to be too good to be true, then there is a realistic chance that it is. Indeed, caution should always be embraced in general when investing in unregulated markets.

You can also observe the order books for a number of days before trading to see whether there is any evidence of spoofing. If the order books suddenly change and orders disappear and reappear on a regular basis then you should be suspicious that some spoofing is under way.

It is perhaps better to avoid that exchange in the future if this is observed. You can never be sure that you will be getting the short end of the stick from traders who have much more assets and technical resources than you.

And, even if they do not get you by using tactics such as spoofing, they could use other more legal methods to get the better of you like cryptocurrency stop loss hunting.

Of course, some of the best methods that you can use to avoid the risk of spoofing is to only use those exchanges that are known to be reputable. These include the likes of Binance or the Kraken exchange. You

Conclusion

Cryptocurrency spoofing / layering and wash trading are some of the forms of market manipulation that has been given the industry a bad name recently.

While these practices have now started to attract the attention of the authorities, they still have a long way to go before they can effectively clamp down on the participants in a largely unregulated market. It is more likely than not that the spoofers may move to exchanges with less scrutiny.

Whether you will fall victim to it depends on how you approach your cryptocurrency trading. If you are the individual who likes to buy and hold, then the appearance of buy / sell walls is unlikely to change your view.

However, if you are a trader that relies on market signals to inform your positions, you should always be aware of the fact that may be being manipulated.