The Top Five Things Bitcoin Opponents Just Don't Get

Bitcoin & Co.'s prices are still on a roller coaster ride. Bitcoin, the flagship of all cryptocurrencies, recently fell below $6,000.

Now it's over $7,000 again. Recent causes of turbulence were a possible crypto ban in India and the ordered phase-out of crypto mining in China. Then came some regulatory actions in the US and EU that were rather neutral but had a negative impact on the price.

The critics felt immediately confirmed. The price is falling, the bubble is bursting. But are the sceptics correct?

In the following, we will debunk the top five things Bitcoin opponents just don't understand.

1. Bitcoin is a new technology, not an investment

Behind the hype around bitcoin and cryptocurrencies is a technology, the so-called blockchain. Blockchain is a relatively simple use of existing cryptographic algorithms. Since January 2009 Bitcoin has proven that Blockchain works and is safe.

The biggest mistake of the Bitcoin opponents is to consider Bitcoin as an investment. The claim that Bitcoin is a pyramid scheme or Ponzi scheme comes precisely from this point of view. What the opponents forget is that behind Bitcoin is neither an organization nor an individual who could dictate the course. Last year's performance was the result of the free market.

The following price collapse was the result of legal uncertainty. This after various states, including China, South Korea and India, made unclear statements about the legality of cryptocurrencies. This legal uncertainty will continue to affect the crypto courses in the coming months.

Bitcoin and Blockchain, however, continue to develop and enter the already digitized society. Even if cryptocurrencies would be banned globally, the blockchain technology is not leaving. As a disruptive technology, Blockchain will replace existing business models, with or without the cryptocurrency Bitcoin.

2. Cryptocurrencies have global potential

Bitcoin opponents argue that Bitcoins have no value and are therefore not good means of payment. The fact that banknotes also have no real value only moderately disturbs opponents. All you have to do is put a central bank behind the paper money. It implies security.

Central banks control the money supply and set inflation targets. This is for the common good or at least for the good of one's own economy. Since the value of money is directly linked to the competitiveness of a country, currencies are generally depressed rather than raised. This leads to international tensions and trade conflicts. The damage to savers caused by real negative interest rates tends to be marginal.

Because Bitcoin and many other cryptocurrencies are not subject to a central control body, they have the potential to be accepted internationally as a means of payment. By contrast, the creation of a global single currency through an international central bank would be a mere utopia.

3. Money is a Tool

Money was invented because bartering in kind is a tedious and inefficient means of exchange. A good monetary asset has the following properties: it can be stored for a long time, it is easy to transport, it can be easily exchanged, it can be divided into smaller units, the monetary units are limited, equivalent and difficult to counterfeit.

All these requirements are met by cryptocurrencies better than real currencies and even better than coins and precious metals in the past.

Cryptocurrencies are digital money and a further step in digitalization. With a cryptocurrency, amounts of any size can be stored securely without banks, and values can be transferred quickly and easily globally.

All you need to use cryptocurrencies is a computer or a mobile phone and an Internet connection. Ok, a hardware wallet is also good thing to have, so you can sleep at ease. Things, in other words, that everyone owns and carries around with them today.

4. Early Growing Pains are being eradicated

Since November, countless bitcoin transactions have been stuck. Only recently the Bitcoin network was able to process the outstanding transactions. The cause of the blockage lies on the one hand in the fixed block size of one megabyte and on the other hand in the block interval of about 10 minutes. Thus, the transaction maximum of Bitcoin is optimistically estimated at about seven transactions per second.

For this reason, many Bitcoin opponents believe Bitcoin is not a good international currency. That's true, of course, seven transactions per second is far too few. As a global currency, several thousand transactions per second would be a minimum.

Bitcoin is the very first cryptocurrency there is, and it still struggles with a few teething troubles. But one does not judge today's Internet by the download speed of 1992.

Numerous cryptocurrencies have already massively increased the transaction limit. To think that Bitcoin's transaction limit is a physical limit that cannot be technically moved is naive.

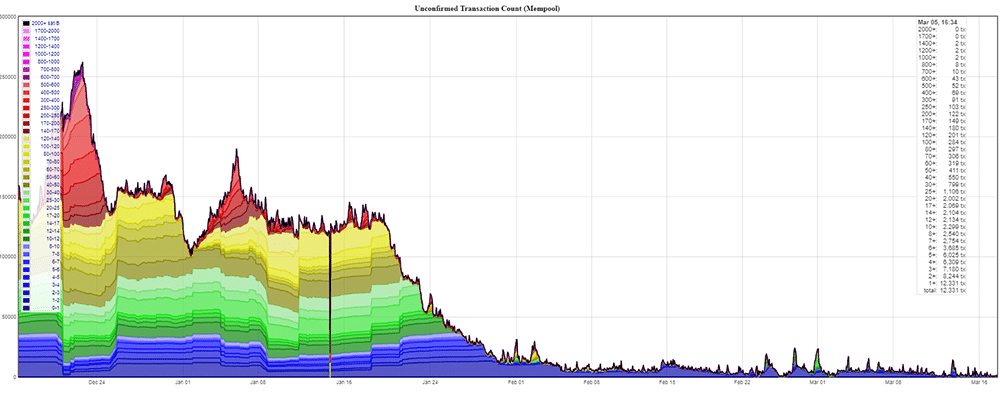

Even Bitcoin itself has been innovating with improvements that have drastically reduced transaction times as well as uncomfirmed transactions. In the below image we have the Bitcoin memepool.

As you can see, the size of the Bitcoin memepool (uncomfirmed transactions) has been decreasing steadily since November of last year. This could be down to a number of factors including further SegWit adoption as well as new innovations such as the lightning network.

5. Regulation could be a new beginning and not the end

The regulation of cryptocurrencies and especially of ICOs is urgently needed. Cryptocurrencies can be misused as illegal money, for money laundering and for tax evasion. Up to now, the existing money has been used for this purpose.

Bitcoin is new and therefore even more difficult for the authorities to assess. In principle, however, the problem remains exactly the same, and it can be expected that authorities, above all tax offices and the police, will be able to deal with cryptocurrencies in the future.

Many Bitcoin opponents believe that the regulation of Bitcoin can only have negative consequences on the price. It is more likely that regulation and the resulting legal certainty will lead to a renewed boom and to a permanent spread and use of cryptocurrencies.

Conclusion

It is unlikely that Bitcoin will ultimately become the global currency. The Bitcoin developers and the Bitcoin network are too divided for Bitcoin to position itself as a global currency. However, it is to be expected that a cryptocurrency will prevail in the long term.

The only alternative would be to ban or over-regulate cryptocurrencies on a global level. However, this is unlikely with such a promising technology and would be in clear contradiction to the technological development of the last 20 years.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.