Could a Trading Bot be Behind the Coinbase Pricing Discrepancies?

This was a really interesting week in the wild west of the cryptocurrency markets.

One of the most interesting developments was the release of Bitcoin Cash on Coinbase and the ensuing market rally that led to numerous allegations.

Many people saw the extensive run up in the price of BCH prior to the announcement of the listing. This led them to believe that there was some insider trading taking place.

Yet, could there be another explanation as to the market irregularities?

Enter "Picasso", a Painting Bot

According to the post of a well-known blogger called Bitfinex'ed, another possible explanation for the wild swings is a trading bot.

He has labelled the bot "Picasso" becuase it trys to "paint" the market. Very simply, market painting is when a group of traders get together to make it look like there is more activity in the market than there actually is.

This is a form of market manipulation that is considered illegal by the SEC. However, given that cryptocurrency markets are unregulated these actions can be commonplace.

Bitfinex’ed has been tracking the actions of Picasso for some time as it has attempted to paint the tape in the Bitcoin market. He was also able to expose a similar Bot called "Spoofy" a few months ago.

What was Picasso Up To?

According to the analysis, Picasso was trying to inflate the price of Bitcoin and Bitcoin cash on GDAX / Coinbase vs. the other exchanges.

The author looked at an example on the 7th of December where Bitcoin was trading for a significant premium on Coinbase than it was on other exchanges such as Bitfinex for example.

For example, there were still buy orders being placed on Bitcoin when the price was considerably above market rates on other exchanges. This was unlikely to have been placed by human traders.

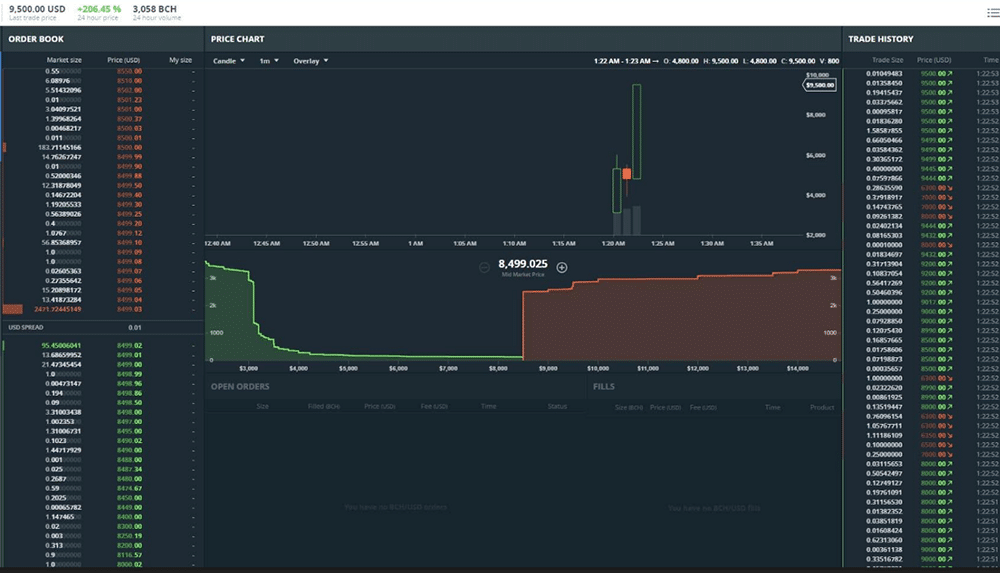

This was also on demonstration to a large degree in the Bitcoin Cash fiasco. Looking at the below screenshot from GDAX, you can see the price of BCH jumped very quickly on the orders.

Given that the order books were quite light at that time, the orders that came from the Bot drove the price up by almost 200%.

Why is Picasso Doing This?

One thing that Bitfinex’ed did pick up was that the volume on the Bitfinex exchange was quite well correlated with that on Coinbase. In other words, when there was a lot of buying on Coinbase, the same was going on through Bitfinex.

For example, when Coinbase went down recently, the trading volume on Bitfinex and Bitstamp dropped off quite precipitously.

This is most likely an indication that the Bot is using the other exchanges as hedge positions. More specifically, it is trying to arbitrage the profit between Bitfinex and Coinbase.

The Bot will buy the Bitcoins at a low price on the Bitfinex exchange and then sell it on Coinbase at a significant premium.

Of course, from market perception and manipulation perspective, the trading by Picasso creates the perception that the prices on Bitfinex are great value.

This may have the effect of convincing potential customers to jump through all the hoops in order to get an account funded in Fiat currency on Bitfinex.

Whether this is the actually underlying intention of Picasso or an interesting side effect, no one can say definitively.

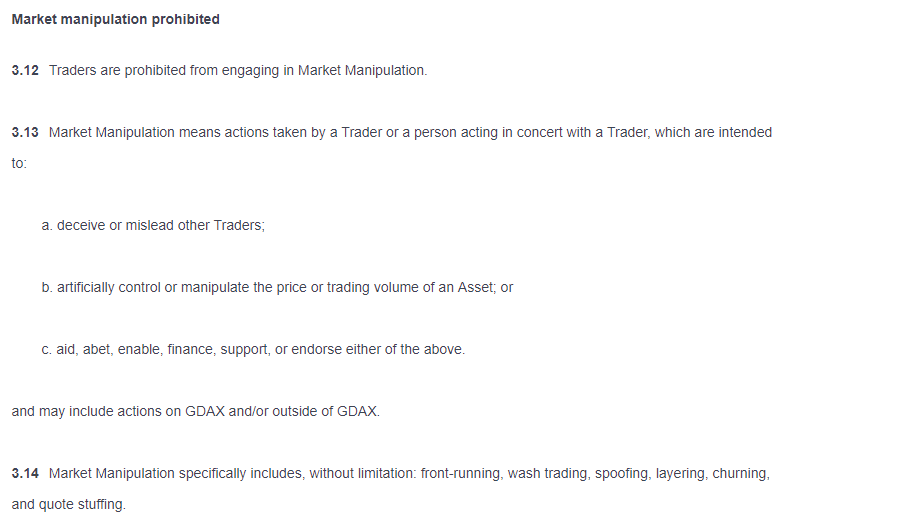

Breach of Coinbase Terms

While he wanted to make it clear that he did not think that Coinbase was behind Picasso, Bitfinex’ed did bring up the Coinbase Terms of Service. These actions are clearly in violation of some clauses.

More particularly, actions designed to manipulate the market are prohibited on Coinbase. Given that it was really unlikely that these trades were actually completed by a human trader, Coinbase should investigate the accounts.

It will also allow Coinbase to appear proactive in stamping out these practices in a time when it is being hit with the insider trading accusations.

Keeping a Watch

Irrespective of the outcome, it is comforting to know that there are people in the cryptocurrency community who are monitoring the markets and calling instances out.

Bitfinex'ed had the effect of considerably reducing the activity of "Spoofy" when he brought it to light a few months ago.

One can only hope that the with the exposure given to Picasso, it is hopeful that the operators will dial it back or considerably or shut the activity entirely.

Honest and complete markets are healthy markets.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.