Virtues of the Hodl: Why the Current Crypto Crash Isn't Doomful

To newcomers to the cryptocurrency ecosystem, the ongoing market crash is undoubtedly horrifying. But with a little perspective, cooler heads will prevail.

So we're here to bring you some much-needed perspective on why this crash is happening and why holders should still be bullish for the future.

Reasons for the dip

First off, it's worth noting that considerable market slouches are common in the cryptocurrency space in the month of January.

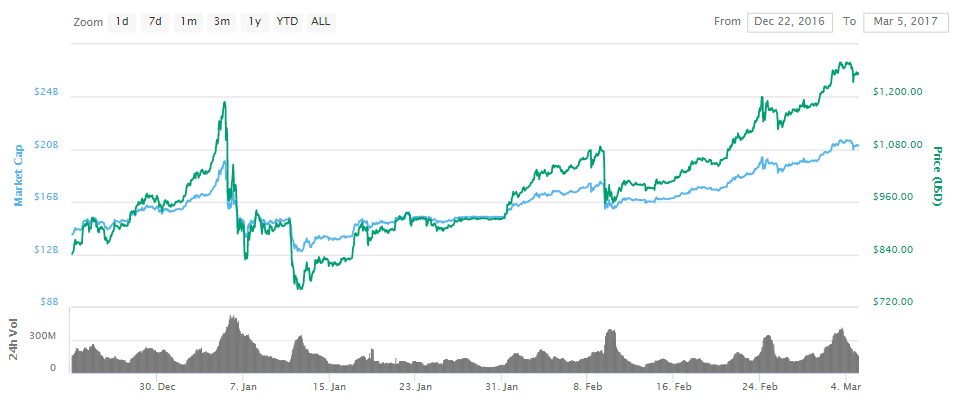

Rewind one year back to January 2017, for example. The market suffered an extreme dip before correcting back to previous highs within two months:

Many speculate that the regularity of this market movement suggests that its derived from Asian investors withdrawing en masse to cover their Chinese Lunar New Year festivity expenses.

But that's just one theory, as many others abound.

There's no doubt that the South Korean regulatory ambiguity toward cryptocurrencies has played a part in engendering the ongoing bearish trend. Many panicked just days ago when a top South Korean official announced a coming crypto trading ban in the nation, though that official was quickly rebuked by other South Korean agencies.

The very public inter-agency strife hasn't calmed anxious traders, in Asia or in the West. Trading volume has indeed plummeted in South Korea in recent days accordingly. So that's a dynamic that's surely contributing to the current shakeout.

Another theory?

Manipulation is occurring through massive sell-offs so that bitcoin futures "shorts" can be successful. As Business Insider's Oscar Williams-Grut notes:

“Some people are speculating that aggressive selling activity could have been used to drive down the price of bitcoin on the exchange to turn the futures contracts into winning bets.”

Don't color us surprised if true, because where there's money to be made, the big players will play. But even still, this kind of manipulation triggers further organic sell-offs in panicked amateur investors, and as such, it's wouldn't be the sole cause of the current dip anyways.

But regarding that last point, it's inevitable that part of this current plummeting market is newcomers to the space who "bought at the top," near all-time price highs, and are panic selling.

But there's no need for panic selling. Here's why.

Time for cooler heads

Trees can't grow to the sky, and neither can the crypto market. A sharp crash was in order, and even expected, considering they seem common in January.

But will all-time price highs be reached again? It's all but inevitable, and the next climb up will likely be steadier and stabler and occur over perhaps 8 weeks or so.

If you're not a daytrader, then, there's no point fretting the current downtrend. Do you think the worth of your portfolio will be higher one year from now? If so, then unplug from the charts and the let the markets work themselves out.

Not every crypto project is a winner, but there are revolutionary, titanic projects in this space that will drive mainstream adoption into cryptocurrencies in general. Over the next few years, the market capitalization of the ecosystem is likely going to climb into the trillions of dollars.

Hodl now and make it easy on yourself to capitalize on that impressive future. Crashes will come, and crashes will go. But you can't make back lost profits that you evaporate by making rash decisions in times of duress.

Steel yourself now, and you'll steel your financial future in crypto.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.