Financial markets, built on the premise of speculation, are natural breeding grounds for volatile price action. Crypto markets, in particular, are notorious for their excessive volatility which is the result of a myriad of factors such as the relative lack of liquidity, regulatory concerns, adoption-related developments, media hype, etc.

Now, as a participant in this market, how do you hedge your positions? For most people, the optimal decision is to ride out periods of extreme volatility by converting a portion of their holdings to a reserve currency of some type. For some, this might be a stablecoin pegged to a fiat currency like the dollar and to others, it might be a comparatively less volatile asset like Bitcoin. Among stablecoins, the use of ‘algorithmic’ stablecoins has especially picked up steam in the past few years due to rising concerns of safety and regulation in the stablecoin ecosystem.

In this article, we explore what exactly ‘algorithmic’ stablecoins are, why they are an integral part of the crypto ecosystem, and if they really are safer than centralized stablecoins like Tether, BUSD, etc.

What are Algorithmic Stablecoins?

Let’s break down the phrase. An ‘Algorithm’ refers to a set of instructions that a program or application self-executes when certain conditions are fulfilled. A ‘Stablecoin’ refers to a crypto asset or token that is pegged to a particular fiat currency, asset, or some other value function and is expected to maintain that value irrespective of market conditions or external factors.

By derivation, ‘Algorithmic Stablecoin’ can be defined as a stablecoin that maintains its peg through a decentralized self-sustaining protocol or economic system. As for how they achieve this stability, the most common mechanism used is supply manipulation. Most algorithmic stablecoins are built with an economic system and protocol that automatically increases or decreases the supply through functions of burning or minting tokens to maintain its peg. Most algorithmic stablecoins in the current market follow a non-collateralized model, this means that the stablecoins do not have any sort of economic or real-world financial backing/reserves.

Why do we need Algorithmic Stablecoins?

I’m sure you’ve heard of the Tether incident last year. This has left a lot of us worried over centralized stablecoin issuers’ compliance to their advertised claims of a fully-collateralized treasury or reserve structure. Moreover, centralized stablecoin issuers are also susceptible to all sorts of interference via ‘regulation’ by governments of the jurisdictions they are incorporated in. This means that if the government of a country where a centralized stablecoin issuer is incorporated decides to freeze the bank accounts of said stablecoin issuer for any such reason, then the redeemability of the stablecoin becomes zero, bringing its inherent value to zero. While this might seem more than unlikely, it is a very real risk.

An algorithmic stablecoin project, on the other hand, would be able to protect itself from any sort of legal regulation as long as it remains decentralized and independent of any fiat-based reserves or collateralization. This idea resonates strongly with those who align themselves with the vision of a truly decentralized independent global financial system. Besides, aren’t trustless transactions the backbone of crypto?

Types of Algorithmic Stablecoins

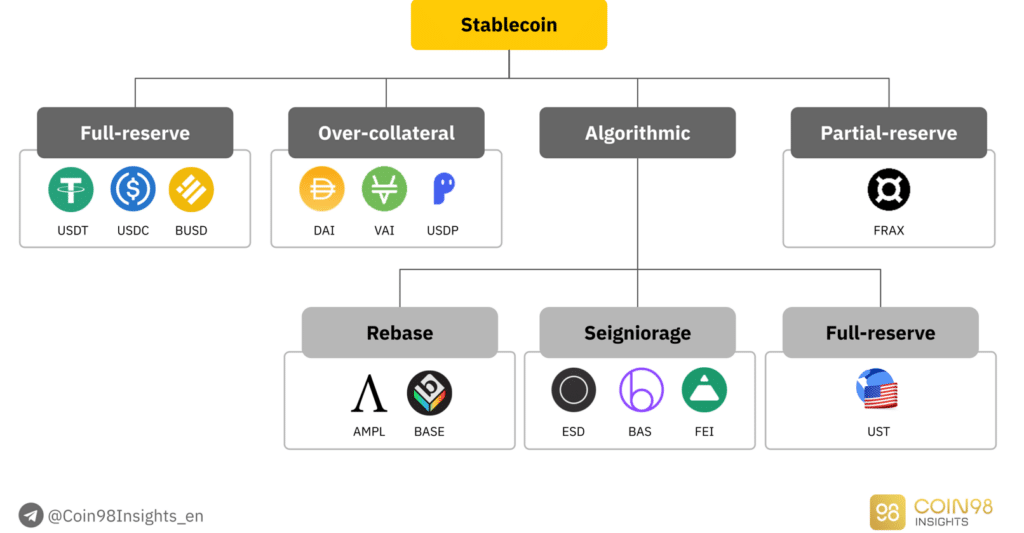

While many algorithmic stablecoin projects have launched over the years, this article has been curated to include the most innovative and diverse set of algorithmic mechanisms that projects have undertaken for maintaining their price peg. We can broadly categorize them into four models-

- Rebasing Algorithmic Stablecoins

- Seigniorage Algorithmic Stablecoins

- Over-collateralized Algorithmic Stablecoins

- Fractional Algorithmic Stablecoins

Categorization of Stablecoins via Coin98 Insights

Categorization of Stablecoins via Coin98 Insights Let us go over each model in detail and analyze the pros and cons of their economic structure.

Rebasing Algorithmic Stablecoins

The ‘Rebasing Algorithmic Stablecoin’ is one of the first models for a decentralized algorithmic stablecoin. Under this model, the token price is stabilized by a ‘rebasing’ of the total token supply. What does ‘rebasing’ mean? To put it simply, the total supply of the token is either reduced or increased every day across all wallets that hold the token. This increase or decrease in the token supply is proportional to the percentage of price increase/decrease from the peg price.

Let me break this down in numbers; say for example you bought 100 tokens at the price of $1 today and the price increases to $1.1 (a 10% increase) tomorrow, the protocol will automatically increase the total supply by 10% the next day. This means after the rebase, the number of tokens in your wallet would have increased by 10%, since we had 100 tokens before the rebase, we would have 110 tokens after the rebase. This rebasing mechanism is non-dilutive. Since all wallets automatically have their tokens increased or decreased, the wallet owner’s percentage stake in the total supply remains constant.

Now, the example above is a very simplified demonstration of the rebasing mechanism. In reality, most rebasing stablecoins don’t have a strict rebasing from the peg. They usually have a price tolerance band above and below the peg, within which the rebasing mechanism doesn’t kick in. The industry standard is a 5% tolerance above and below the peg.

But wait, didn’t I say that with an increase in token price, we get more tokens? So, wouldn’t that mean at the token price of $1.1, instead of having 100 tokens worth $110, I now have 110 tokens worth $121 after rebasing? How is this stable you ask? Let me explain.

While the algorithm does take care of the supply volatility, the price stabilization is done by us! That’s right, market participants like us make use of arbitrage opportunities. Since DEXs work on liquidity pools, the supply of the rebase tokens in the pool is automatically adjusted, bringing the price down instantly. However, in centralized marketplaces, the sudden increase in token supply would create additional sell pressure from existing holders looking to book profits from the rebase. The greater the volatility in price from the pegged value, the longer it takes for the rebasing mechanism to bring the price back to peg.

Pros - Since most rebasing stablecoins are non-dilutive, this means there is an opportunity to make a profit from holding the stablecoin provided you get in early. The most important metric for a rebasing token is the market cap. With increased adoption and usage, the market cap also increases. At the early stages, buying the token at a smaller market cap gives you a bigger percentage stake in the total supply. With an increase in market cap, the fatter your bag of algorithmic stablecoins becomes.

Cons - The same metric of the market cap also brings us to the con of holding rebasing algorithmic stablecoins. Similar to an increase in market cap making you richer, the converse is also true. With a fall in market cap, the value of your holdings decreases. This makes rebasing stablecoins similar to other traditional crypto-tokens.

In essence, rebasing tokens are ‘stable’ only in the fact that each token will always stay around the pegged price however this is not true for the stability of your holding’s total value. If you’d like to understand a bit more about the debate surrounding the viability of rebasing tokens, I suggest you check out this insightful video by Boxmining.

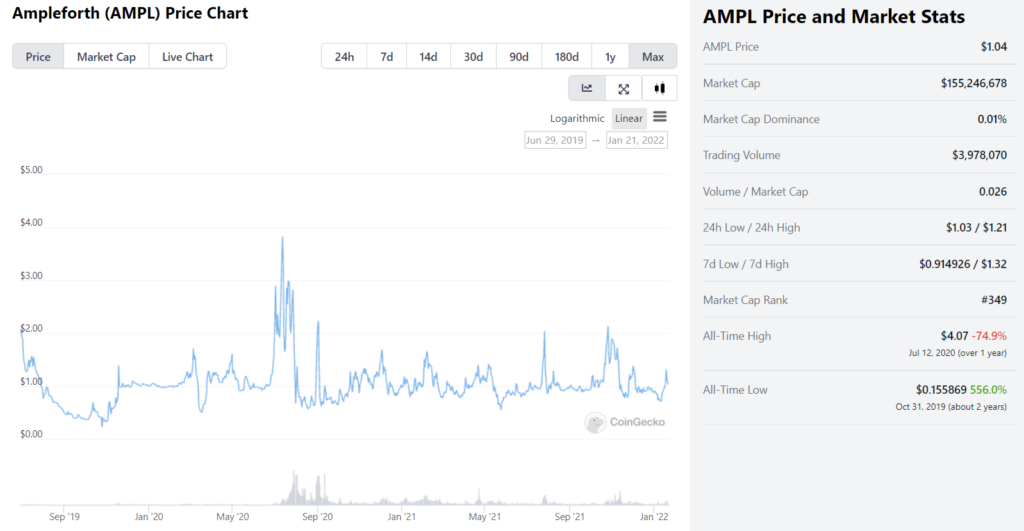

AMPL seems to have more or less maintained its price peg via CoinGecko

AMPL seems to have more or less maintained its price peg via CoinGecko Some of the popular rebasing algorithmic stablecoins are AMPL (Ampleforth) and Base Protocol. While Ampleforth is pegged to the CPI-adjusted 2019 US dollar, Base Protocol follows a more novel approach in that it is pegged to the total cryptocurrency market cap. Of the two, currently, AMPL seems to be maintaining its peg somewhat consistently whereas Base Protocol seems to be failing in maintaining its peg. The team behind Base Protocol also seem to have gone radio silent with parts of their website being non-functional. As we've seen - in crypto, while some succeed, most fail.

Seigniorage Algorithmic Stablecoins

Seigniorage refers to the difference between the face value of a coin and its production costs. Put simply, it refers to a system where network participants are incentivized directly to maintain the value of a coin through mechanisms of minting and burning the token. In crypto, the ‘Seigniorage Algorithmic Stablecoin’ model follows a multi-token system to maintain its price peg. This usually involves one token that is pegged to a stable value and one or more tokens that function as incentives to maintain the stable price peg of the main token.

To understand how this works, it’s best to study the two projects that have utilized this model - Basis Cash and Terra Stablecoin.

BASIS Cash - Basis Cash follows a three-token system to achieve its price stability. The three tokens are:

- Basis Cash (BAC) - The token that is pegged to the dollar value

- Basis Shares (BAS) - An incentive token that facilitates reducing prices when the value of the stablecoin rises above $1

- Basis Bonds - An incentive token that facilitates raising prices when the value of the stablecoin falls below $1

The simplified version of the system is that when basis cash rises above its peg of $1, the protocol mints new tokens that are distributed to holders of Basis Shares. This leads to additional sell pressure that brings the price down. Similarly, when Basis Cash falls below its peg of $1, the protocol incentivizes users to burn Basis Cash tokens in return for bond tokens that are distributed 1:1. Users can exchange these bond tokens for Basis Cash tokens once the price peg of the token rises above $1.

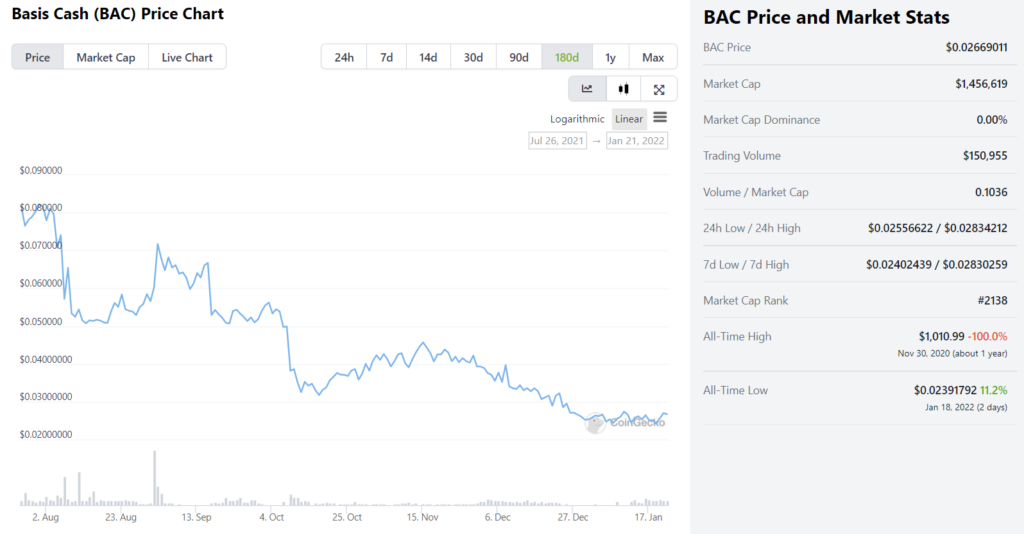

Basis Cash's complete fall from pegged value via CoinGecko

Basis Cash's complete fall from pegged value via CoinGecko Looking at the current chart of Basis Cash, it is safe to say that this system did not work as intended. Though contributing to its failure were a variety of factors like the hack in which nearly 1 million BAC was market sold, Basis Cash also had fundamental issues with how the bond token system was devised. The bond token in itself did not possess the necessary value-driving utility, which is something that the next project we are going to look at seems to have perfected.

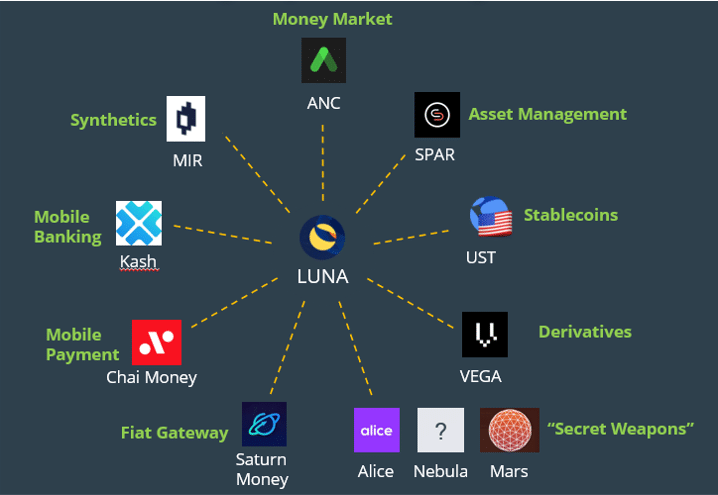

Terra Stablecoins (UST) – The Terra Luna ecosystem follows a two-token seigniorage system for maintaining the price peg of its stablecoins. The two tokens are:

- Terra Stablecoin (UST, KRT, EUT, etc.) – These are the stablecoins that are pegged to different fiat currencies.

- LUNA- this is the native crypto asset of the terra ecosystem. It is used to pay transaction fees while transacting on the network.

To explain simply how this works, the blockchain offers a protocol in which Terra Stablecoins like UST can be minted in exchange for LUNA tokens, and LUNA tokens can be minted in exchange for burning UST or another Terra stablecoin. Through the mechanism of arbitrage, the fiat peg of the stablecoin is maintained. When the dollar peg of UST dips below $1, participants in the ecosystem can burn UST in exchange for LUNA at current market prices, which makes them a profit. Similarly, when the dollar peg of UST rises above $1, participants in the ecosystem can mint UST in exchange for LUNA at current market prices, which makes them a profit. All of this is possible only because LUNA as a token holds independent value and utility in the ecosystem.

Terra Ecosystem providing utility and value for LUNA token via CoinGecko

Terra Ecosystem providing utility and value for LUNA token via CoinGecko While most seigniorage stablecoins have failed, Terra stablecoins seemed to have perfected the model by focusing on the one thing that most other projects failed to develop - a functioning value-driven ecosystem. The Terra stablecoins form an integral part of the Terra blockchain as they are used for most trading pairs on the Terra blockchain. The blockchain aims to achieve mass adoption by becoming the easiest and most stable global payment system on the blockchain.

They can act as a decentralized bank, giving higher rates and reduced fees, thanks to their Anchor Protocol and Mirror Protocol. While Mirror Protocol brings in participants through its function of being able to create tokenized representations of real-world assets, Anchor Protocol helps keep the money flowing into the ecosystem within the ecosystem by offering attractive staking rewards for their stablecoins.

Over-collateralized Algorithmic Stablecoins

Before we begin discussing this particular model, I’d like to make it clear that most people consider the definition of an algorithmic stablecoin to be completely derived from an algorithm (i.e anti-collateral). However, while defining an algorithmic stablecoin at the beginning of this article, I mentioned that it includes any protocol that maintains its peg through a self-sustaining economic model without the need for trust. Therefore, I find it important to include one of the biggest players in the decentralized stablecoin ecosystem that fit this definition in this article - that’s right, you guessed it, we are talking about DAI.

DAI - While MakerDAO has renounced the title of an algorithmic stablecoin for DAI, we must include it in this article because DAI’s mechanisms for maintaining its price stability include smart contracts that burn and mint tokens based on the price volatility of its underlying collateral. This is similar to how seigniorage algorithmic stablecoins function and unlike a traditional centralized fiat-reserve stablecoin, the collateralization of DAI is roughly 1.5 times the average amount of DAI in circulation. This number can change depending upon the volatility of the assets used to collateralize DAI.

For example, when a person wants to mint $100 worth of DAI, they have to pledge 150$ worth of any accepted cryptocurrency. When the underlying price of the cryptocurrency falls, the user must repay a proportional amount of DAI to prevent the partial liquidation of their underlying asset. On the other hand, if the underlying price of the cryptocurrency rises, the user can unlock and mint more DAI tokens. In case the user fails to pay back the required amount of DAI, the collateral is automatically liquidated up to the extent required to pay the interest rate and penalty.

This is only a simple explanation of how MakerDAO’s DAI stablecoin ecosystem functions, but it's enough to understand the process.

Fractional Algorithmic Stablecoins

This particular model of algorithmic stablecoins can best be described as the love child of seigniorage stablecoins and collateralized stablecoins. Like seigniorage stablecoins, fractional algorithmic stablecoins also have a multi-token system usually consisting of a secondary token that is utilized to mint the stablecoin. Fractional Algorithmic Stablecoins aim to achieve a middle ground between purely algorithmic stablecoins like UST, AMPL, BAC, etc., and purely collateralized stablecoins like USDC, USDT, BUSD, etc.

They achieve this by partially collateralizing themselves with fiat-backed stablecoins like USDC and partially burning the second token that drives the ecosystem through defi initiatives. The ultimate goal for fractional algorithmic stablecoins is achieving capital efficiency. This means that the fractional reserve of these stablecoins tends to lower in the long run as this provides users with more value for the token in comparison to its reserves.

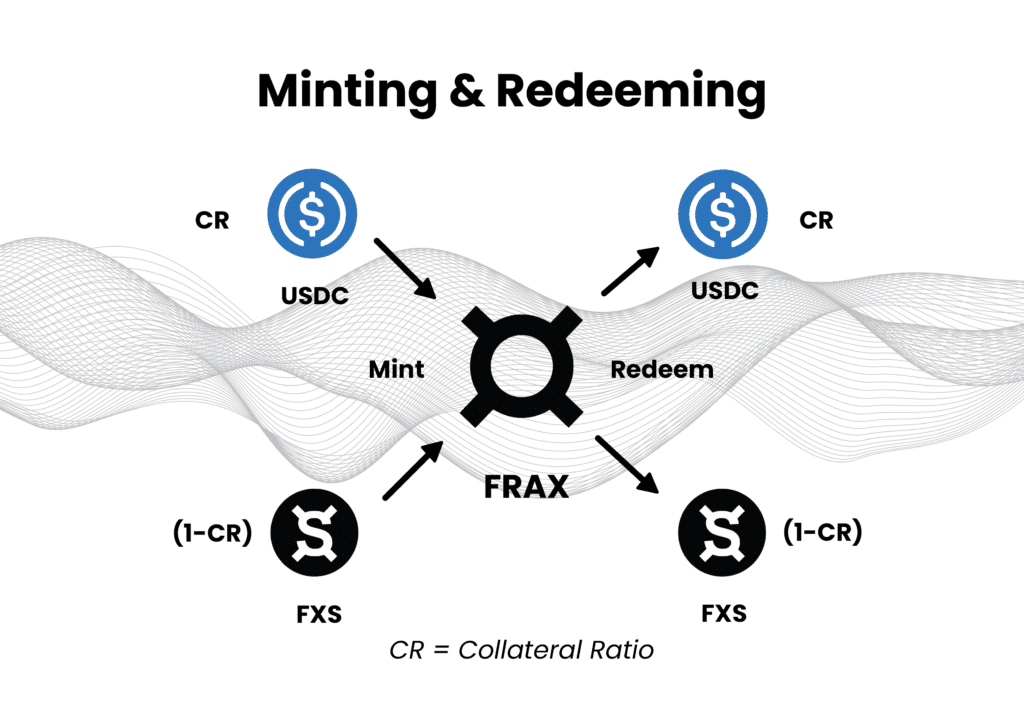

Frax mechanism via Frax Finance

Frax mechanism via Frax Finance There are two important concepts for fractional algorithmic stablecoins they are target collateral ratio (TCR) and Effective Collateral Ratio (ECR). These ratios help maintain the longevity and liquidity of the project, so let’s see what they are.

TCR - TCR is used during the minting of the stablecoin. It refers to the optimal collateralization ratio needed to bring the price to $1. If the time-weighted average price of the stablecoin has been higher than $1 during the past few days, the collateralization ratio will decrease, meaning you will need a lesser percentage of USDC than usual to mint the fractional stablecoin.

On the other hand, if the time-weighted average price of the stablecoin has been lower than $1 during the past few days, the collateralization ratio will increase. This mechanism works with the simple idea of lowering the USDC components required for minting during consecutive days of high prices in the fractional stablecoin. By lowering the USDC requirement, we increase the burning speed of the secondary token which brings down the price of the token more effectively and vice versa.

ECR – ECR is used during the redeeming mechanism of the fractional stablecoin to determine the ratio of USDC and secondary token distributed. It is calculated as the current USDC reserve divided by the total fractional stablecoin supply. If TCR is lower than ECR, this means there is excess collateral in the system. Similarly, if ECR is lower than TCR, then the protocol is undercollateralized.

There are two notable fractional algorithmic stablecoin projects with varying results- FRAX and Iron Finance

FRAX - Frax Finance has a dual token system- FRAX and Frax Shares (FXS). FRAX is a stablecoin pegged to $1 and FXS acts as a utility token that is used to mint FRAX when the price of FRAX rises above $1. The ratio of collateralized and algorithmic depends on the market's pricing of the FRAX stablecoin. If FRAX is trading at above $1, the protocol decreases the collateral ratio.

If FRAX is trading at under $1, the protocol increases the collateral ratio. The collateral ratio to mint 1 FRAX is usually 75 cents of USDC and 25 cents of Frax Shares (FXS). The FXS token also acts as a store of excess uncollateralized value. FRAX also has a buyback and re-collateralization function in its protocol that helps increase and maintain the peg of the token, which at the same time burns the FXS token.

Iron Finance - This project follows a model similar to FRAX but unfortunately fell victim to the death spiral. The death spiral refers to an algorithmic stablecoin’s eventual journey to zero because of a negative feedback loop. The reasons that made Iron finance fail were massive sell pressure from big whales and the failure of the oracle within the protocol that shifted undercollateralized reserves away from the target collateralization.

The case against Algorithmic Stablecoins

As promising as the model is, algorithmic stablecoins also come with their own set of challenges. The most important one is the difficulty in creating a sustainable and efficient mechanism behind its peg maintenance. Many algorithmic stablecoins have tried different systems, but less than half have survived and proved viable. Two common factors influence an algorithmic stablecoin’s long-term viability - a positive incentive loop, and an ecosystem-wide utility for secondary tokens in a multi-token model.

A positive incentive loop works and maintains the price of the stablecoin as long as the users don’t lose trust in the stability of the token. When it comes to purely algorithmic stablecoin models like the seigniorage model, they become more susceptible to a failure in the positive feedback loop during periods of high volatility as users’ trust in the token falters due to its lack of inherent value. Fractional stablecoins are also susceptible to this particular risk but have a higher level of resistance due to their partially collateralized nature.

Most multi-token stablecoin systems that fail, seem to be unable to balance the risk-reward ratio of their secondary tokens below a certain demand level. This is because the secondary token usually serves no other utility apart from maintaining the price stability of the primary token. Once it breaks a particular price level, the algorithmic stablecoin begins descending into a death spiral. However, some multi-token stablecoin projects like the Terra Stablecoins have perfectly balanced the independent demand for their secondary token LUNA by using the token to pay for gas costs in the network. This ensures that the primary stablecoin token has strong price confidence from investors due to the utility provided by the secondary token.

Regulation surrounding Algorithmic Stablecoins

As of this writing, there is yet to be any clarity on the regulatory status of algorithmic stablecoins in any jurisdiction in the world. But it is safe to assume that as long as the algorithmic stablecoin projects remain decentralized, they should be free from being classified as securities.

Closing Thoughts

Most algorithmic stablecoins strive to become the reserve currency of the decentralized finance ecosystem. This is a fine goal, but it is important that they also have utility apart from the stability they offer to be viable for the long term.

Rebasing Algorithmic Stablecoins- Rebasing tokens are heavily dependent on mass adoption to positively impact their holders and achieve equilibrium in the market cap of the token. Only once the token has achieved equilibrium in its market cap can it truly be considered stable, both in terms of price and purchasing power.

Seigniorage Algorithmic Stablecoins- The most important factor in ensuring a successful seigniorage stablecoin seems to be a multi-token system that has independent value apart from maintaining the price of the primary stablecoin. It is also important that the primary stablecoin finds utility by partnering with as many projects as possible to generate the adoption of the token.

Over-collateralized Algorithmic stablecoin- While this model is not strictly a pure algorithmic stablecoin, it offers a functioning model for decentralized stablecoins to follow and maintain a relatively stable price peg.

Fractional Algorithmic Stablecoins- The idea behind this model is to limit the tendency of a pure algorithmic stablecoin to fall into a death spiral. The fractional reserve aims to lock the trust of the market participants regarding the inherent value of the token. By locking a fully-collateralized fiat stablecoin instead of a fiat currency directly as a reserve, the platform gains the trust and reliability of a centralized stablecoin without having to deal with centralized regulators directly.

However, this does not make a fractional algorithmic stablecoin completely reliable. The token can still dive into a death spiral due to unforeseen events like a hack or whale dumping that the protocol is not equipped to handle. Moreover, fractional algorithmic stablecoins also face the core problems that all centralized stablecoins face. (i.e the risk of regulation and freezing of assets).

Ultimately, the algorithmic stablecoin ecosystem is still very young. It is without a doubt that the only way we will find more functioning models for algorithmic stablecoins is by experimenting and failing as many times as possible.