Recently, I came across a great podcast series called Planet Money Summer Series hosted by NPR. There are three chunks of the podcast, spread out over multiple episodes, each about 20 minutes long. The first part is Economics 101, an introduction to economic terms applied to everyday use. At the end of each episode, listeners are given some "homework" by applying these concepts to what they can find in their everyday lives. I thought it would be great to do this using blockchains and look into blockchain revenue and profit.

In this article, come explore with me as I look at blockchains from the angle of the economist. Together, we review blockchain activity in economic terms, which may be helpful to investors, providing them with an approach from more familiar ground. We will also consider the feasibility of blockchain profits and how blockchain revenue occurs. By the end of the piece, I hope that it has given you a new perspective when evaluating blockchain projects for investment purposes.

Blockchain Space as a Product

Before we go into any kind of economic terms, we need to first understand what is the product being offered for sale. If we take a moment to think about what blockchains offer, the service they provide is the storing and managing of data. The data is stored in the blockchain space, so the product they are selling is blockchain space. Let's look at what's actually being sold here:

Take the Bitcoin blockchain. Every 10 minutes, a block is manufactured and ready for sale. It contains 1 MB worth of transactions. Compare that to Ethereum, which manufactures a block every 15 seconds and contains 80kb worth of transactions. That comes out to about 4MB of transactions every 10 minutes if we're doing apples with apples.

So what makes one blockchain's space worth more than the others? Or even backtracking a bit, why bother putting data on the blockchain, to begin with?

Why buy this product?

Well, the data on the blockchain is permanent and cannot be changed. This makes the record of the data secure. That is very appealing to a lot of people, although it also has its drawbacks. The main one is that mistakes are also irreversible. In order to have good security, blockchains need to pay people to safeguard that security. This is done by issuing block rewards in the form of tokens to anyone who wants to play a role in securing the safety of the blockchain, ensuring that transactions are accurately recorded on the blockchain.

Aside from security, another key reason for wanting to buy the block space of a particular product is the value of having that data on that particular blockchain. Transactional data, in general, like the buying and selling of tokens, pretty much carry the same value in any blockchain. It almost doesn't matter which blockchain it sits on as long as the transaction itself is recorded accurately. Although, if someone wants to split hairs, they can argue that a transaction involving tokens sent through the wrong blockchain is useless, compared to the ones sent on the right blockchain.

Sometimes, the content of the data itself has value on its own. For example, the value of the action of minting an NFT differs according to the collection and which blockchain it's minted on. A popular collection on Ethereum is going to be worth far more than the same NFT mint for a lesser-known collection on Tezos. In this case, there is a good reason for securing space on the Ethereum network and people are willing to pay a premium for that to happen. That same amount of space is worth a lot less on the Tezos chain.

Having answered our previous question: why space on one blockchain is worth more than the other, this brings us to our first economic term: supply and demand.

Supply and Demand

Blockchain space is like real estate. Land that can only be used to build houses is less valuable than mixed-use land, which is land available for multiple purposes. Think housing + office buildings + shoplots + malls. The price, measured in transaction fees, for single-use blockchain space is likely cheaper than blockchains that have lots of utility. On the other hand, if everyone is selling the same thing, and yours is the best of the best, even if it's only one thing, you can still charge a premium if what you're selling is deemed valuable enough by others.

The story of supply and demand is basically the reflection of power dynamics between the buyer and the seller. More people buying gives power to the seller when there's less available, and the reverse is also true.

Inelastic demand

For a movie like Star Wars or any of the Marvel comic book films, no matter how good or bad the review is, there will always be someone ready to watch it. They call movies like that critic-proof. If you're a seller, you want to be selling something that is price-proof. In other words, no matter the price, someone is willing to pay for it. That's known as inelastic demand in economic terms.

Products that can be categorised as such must have quite an impact on someone's life, enough for them to obtain it at all costs. Coffee and medicinal drugs are two examples of products with inelastic demand.

Applying this to blockchain space, it means that the blockchain has so much utility and value that regardless of the transaction fee, having one's data on it is a must-have. I still remember those crazy transaction fees for minting the Otherside deeds when it was first launched. Although it didn't last, demand for those NFTs were so high that people were willing to pay hundreds in transaction fees for something priced a lot less. The Otherside deeds was a product deemed to have inelastic demand, and because it was minted on the Ethereum blockchain, the space also enjoyed the same status for a while.

Blockchain Revenue and Costs

We've established that blockchains sell space. Subsequently, revenue is in the form of transaction fees charged. This is how much people are willing to pay to buy the amount of space on the blockchain.

When it comes to blockchain costs, developers aside, it's the security of the blockchain that costs blockchains the most. The people helping to secure the network is paid in token emissions or block rewards. So far, this is the only way to incentivise people to become node operators or validators for the blockchain.

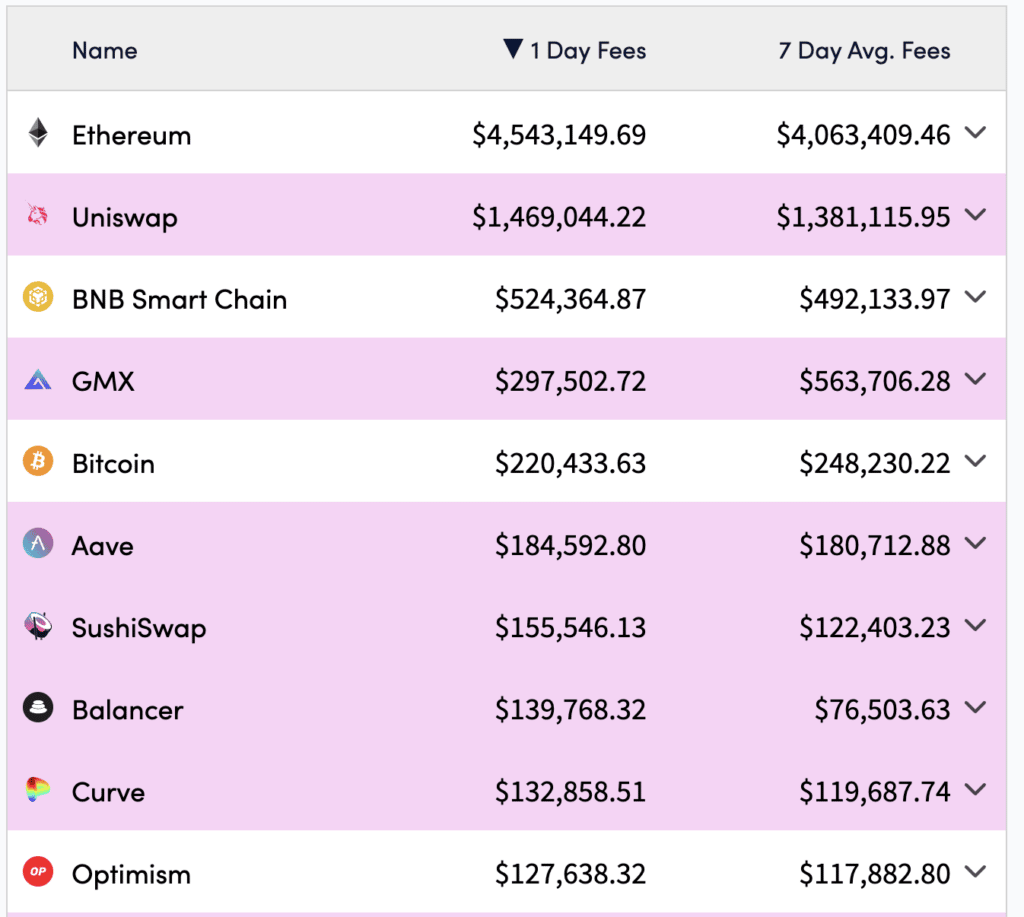

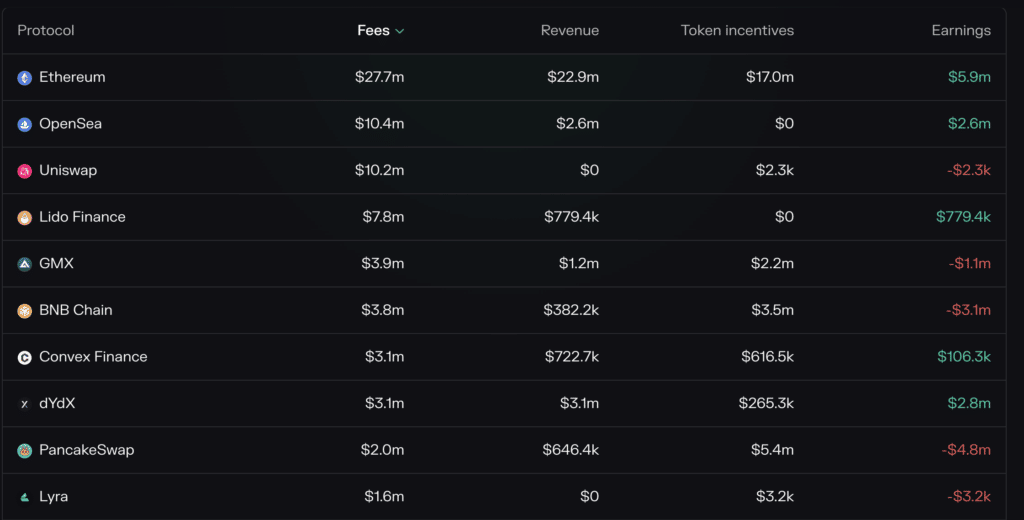

The above image shows:

- Fees: the transaction fees paid by users

- Revenue: the burn rate of tokens

- Token Incentives: what has been given as block rewards

- Earnings: Token incentives - Revenue. I wonder why they're not taking Fees into account.

Who are the customers?

Like any company, blockchain as a business needs customers to survive. The types of customers can be categorised into three buckets:

Retail / Individuals: people like you and me don't pay much in transaction fees and probably don't do many transactions anyway. This means low volume for blockchains. Not really the ideal customer but we make up for it in mass.

Applications: Any dApp built on a blockchain requires space. These are mini-companies, if you will, that need lots of blockchain space. Depending on the amount of usage the dApp gets, it can be quite a nice chunk of change for the blockchain. Look at how much traffic Uniswap is generating in fees for Ethereum.

Other blockchains: When a blockchain decides to build on another blockchain, that's the big-fish customer blockchains want. It's getting a combination of both types of customers from one large customer. Get a few more and you'll be rolling in the dough. Gavin Wood had a great idea with the parachains concept, which is essentially encouraging other blockchain builders to build on Polkadot. If you wanna find out more, please check out Guy's take on the top 5 Polkadot projects in 2022.

Blockchain Profitability

One thing you might have noticed from both the Token Terminal and Cryptofee images is that not many blockchains are actually profitable. In fact, out of the 10 listed in the picture, only Ethereum, BNB, Balancer, and Optimism are blockchains, out of which, Optimism is a Layer 2 for Ethereum, so it's only three individual blockchains that made it. The rest are dApps, and a majority of them are on the Ethereum network.

As with any business, the bottom line matters. The two ways to influence profitability are to reduce cost and increase revenue.

Cost Reduction

The amount of block space supplied is pretty much fixed barring any major changes. Regardless of the demand, it won't affect the number of blocks produced. This is quite different from manufacturing most kinds of products because the supply changes according to demand. That's also because most companies are able to control, more or less, the amount of profit they can get from their business. One way of doing that is to produce less when demand is low.

If blockchains want to do something similar, the quickest way is to increase/decrease block rewards, which would lead to more/less people participating as node operators. However, there needs to be a certain minimum amount that people can rely on getting before they decide it's worth jumping onto the bandwagon for. Plus the change in block rewards can't be too frequent as that makes it difficult for people to make their assessments.

Even if they were to consider reducing block rewards in the long term over a longer period of time, they run the risk of not having enough validators to act as the security network on which blockchains are ultimately reliant on. A key feature most blockchains tout is decentralisation, but as we know, there are many different layers of decentralization.

On the surface, more validators mean a more secure network as there is a high probability that all transactions are accurately recorded without bias. A smaller number of validators leads to a high probability of collusion amongst the validators, hence less guarantee for the accuracy of the transactions, not only in what gets added but also in whether the content gets changed.

How much to issue without giving the farm away while also maintaining a certain level of security for the blockchain is the fine balance all blockchains need to strike if they want to remain in business in the long run.

Increase Revenue

In most cases, increasing revenue is almost equal to increasing demand. Give people reasons to want what you're selling. These can be numerous or strong or both. Take Apple for example. It offers a fairly solid line of products and together with branding, has managed to elevate its products to the level of "necessary luxury". Every time they come up with a new iPhone, even if it's of little difference to the previous version, there are still eager buyers. Of course, they can't raise prices to sky-high levels before people start finding it too expensive, but there are plenty of people who wouldn't think twice about buying one even though they could probably get a MacBook Air for what they pay.

How then, can blockchains be in a similarly enviable position, where the blockchain spaces they sell are in such high demand for them to command high transaction fees? The most obvious way is to attract lots of dApps to be built on its blockchain. The more dApps with high usage, the better.

By giving developers a good reason to launch their dApps on your blockchain, you are not only selling blockspace to them, but you're also getting the benefits from the demand for the dApp from retail consumers. This increases the attractiveness of the blockchain to the regular user. In all honesty, a few years from now, I can totally imagine a situation where the average user would know the popular dApps by heart and spare no thought to the blockchain supporting the dApps. Why should they if, underneath it all, there is seamless cross-chain functionality, making it a frictionless experience for users like you and me?

Only when space on a blockchain is at a premium can it be in a position to charge whatever it wants in transition fees and still be certain that there are willing buyers. This is likely a goal for all blockchains to strive towards as they aim towards profitability.

Which Blockchains Are Profitable?

Having seen the general picture of how things are, it's time to turn our attention to some actual blockchain examples. Let's see where these blockchains are at in terms of profitability, what they can potentially do to increase demand for their block space, and the risks they could face.

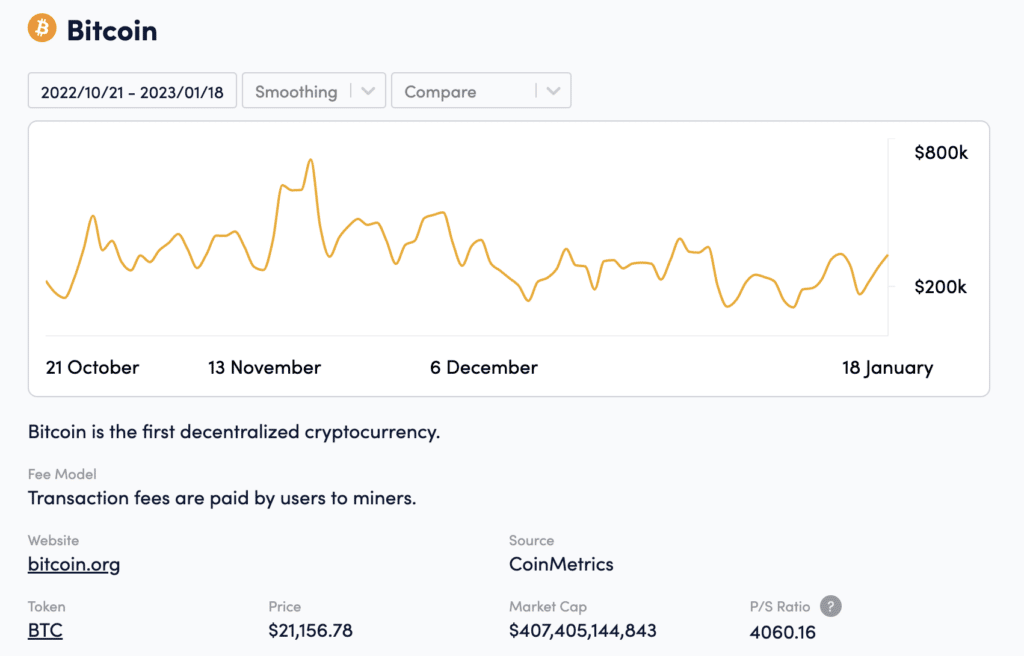

Bitcoin

As the most well-known crypto, oldest blockchain, and the highest market cap, it's also unsurprisingly terribly unprofitable. According to Token Terminal, Bitcoin earns $7.3 million in fees but issues $480.9 million tokens to miners with no burn rate for the tokens (per current design). The main reason for any transactions occurring on the Bitcoin blockchain is security. It's as decentralised as it'll ever be, despite a drop in hash rate as the price of Bitcoin makes it difficult for miners to turn a profit.

The number of dApps developed on Bitcoin is painfully little, and there isn't much development happening on the mainnet, which some say is part of why security is solid. On the other hand, there are other developers working hard to give more reasons for people to use the blockchain. Notable examples are:

- Lightning Labs created the Lightning network, enabling speedy transactions on the blockchain

- Stacks with the vision of creating a Bitcoin-centric Web3. If you don't know anything about it, check out Guy's video for a crash course.

The success of these projects would increase demand for block space, thus generating more transaction fees. This is a feasible way for the Bitcoin blockchain to increase revenue. Still, it's a long way for it to be truly profitable. This leads me to the next question: does it need to be profitable?

Bitcoin has a haloed status in the crypto world. I'd even go so far as to say that it's bulletproof in some ways. It doesn't matter what's being said about it, good and bad. There will always be people who will hold Bitcoin until the day before their dying day, as either an inflation hedge, or maybe they feel like Bitcoin may be the future. It has no need for being profitable. Of course, there's always room for improvement but its success is not contingent on how quickly or well it improves. As long as it exists, that's its value to the world right there. It's a good that has inelastic demand.

Still, if Bitcoin wants to be of more use to the world than it is, it can rely on something called an externality. This is an economic term for referring to things that occur outside of the immediacy of a transaction. In this case, the energy is used to solve the algorithmic puzzle for generating block rewards. That energy has often been said to be wasteful because it requires a huge amount of energy input but the output itself is not useful in any sense. If that output energy can be used as a power source of some kind, this would be a beneficial externality to the mining of Bitcoin rewards.

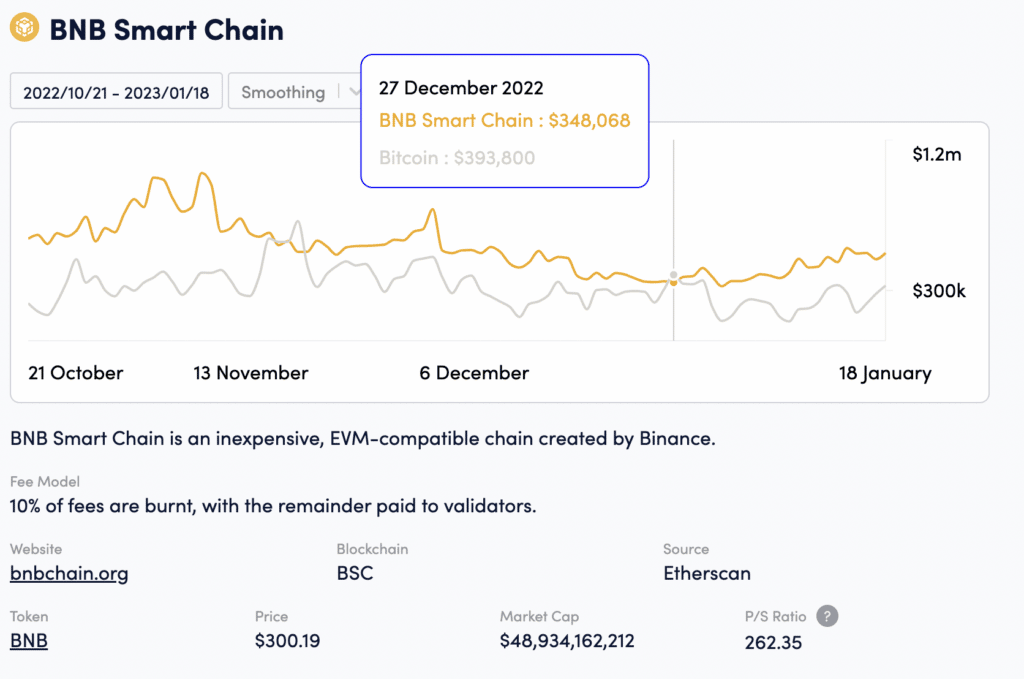

Binance Smart Chain

For a blockchain often criticised as being too centralised, it's actually not doing too bad according to the stats. At the very least, the transaction fees earned are greater than the token rewards given out, which makes it a rare entity known as a profitable blockchain. Pancake Swap, one of the Dexes on the chain, is a top 10 Dex, netting $6 million in fees (but issues $23.5 million in CAKE).

Not quite a running joke in the industry, BSC's 21 validators are the main focal point of its critics. Viewed from the angle of security = decentralised, one would be hard-pressed to say that this is a secure blockchain since there are so few validators. The suspicion of collusion is high and who knows if any transactions have been "missed out" from being added to the chain. Despite all this though, there are a fair number of users who choose to transact on it, as evidenced by the number of transaction fees paid.

BSC has positioned itself to be a whack-all blockchain, inviting all sorts of dApps to build on it, thus driving demand for its block space and providing utility to the blockchain. If it can't win in the security arena, it might as well get a win in the utility space.

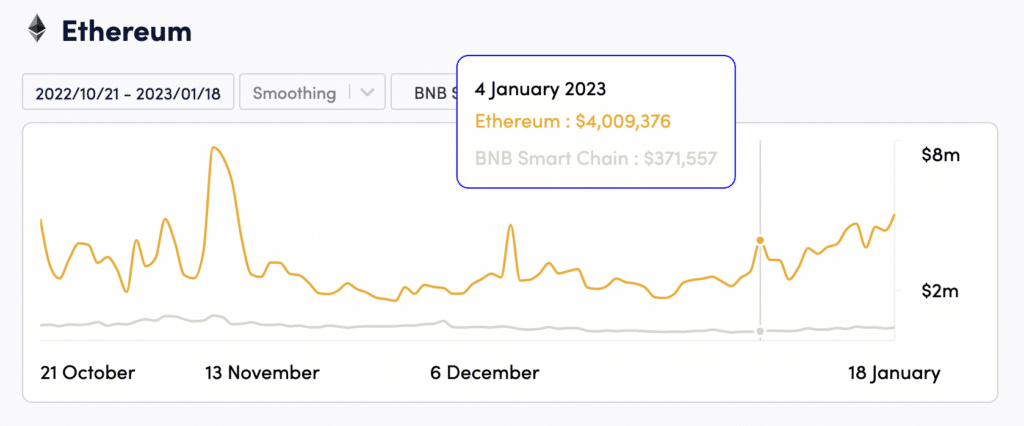

Ethereum

Long heralded as the truly decentralised blockchain, Ethereum, no. 2 in the industry in terms of market cap, is often trumpeted as the model that all other blockchains should aspire to, which is why it makes it onto our Top Crypto Investments in 2023 list. Since moving from Proof of Work to Proof of Stake, its token burn rate has finally exceeded its emissions rate, making it a deflationary blockchain. Coupled together with the transaction fees paid, it is officially a profitable blockchain.

It is also the liveliest blockchain in the industry, with the most high-valued dApps on its blockchain. All the famous NFT collections, Uniswap, Sushiswap, and many more form a huge demand for block space. In addition, Layer-2s (L2) like Optimism, Arbitrum, and Polygon, all blockchains in their own right, utilise Ethereum as the security and settlement layer for their transactions. They represent the kind of large-scale customers businesses hope to get.

While transacting on the L2s are pennies to the dollar compared with a direct transaction on the Ethereum mainnet, a fraction of those pennies naturally drop into Ethereum's own bucket. While the amounts are small, the L2s bring huge volumes to the mainnet, contributing a good portion of transaction fees to the blockchain.

One point I'd like to bring up as food for thought is how secure the Ethereum network is. Since the Merge, there have been reports that transactions involving MEV have been found to be excluded from making it into the blockchain due to sanctions imposed by the US. This might be a somewhat disturbing fact for people to accept and many in the community are, no doubt, wrestling with it.

Ethereum has managed to show other blockchains what it looks like to be a successful and profitable blockchain. Others looking to emulate its success would do well to learn any lessons they can from it.

Blockchain Revenue and Profit: Conclusion

As we saw from the examples above, it is possible for blockchains to be profitable. Those that are not might have a unique proposition that places them beyond the need for profitability. Remember too that what is happening now may not always be the case in the future. Does this blockchain have the potential to be profitable? If it remains unprofitable, does that make it a bad investment?

Profitability isn't everything, as in the case of the Bitcoin blockchain. There are also a few other things to take into consideration if blockchains want to pivot or expand their offerings. There are a few economic terms that can help put things in perspective:

Opportunity cost - by choosing one thing over the other, you acknowledge that the choice results in having to give up certain things. Like in the blockchain trilemma of decentralisation vs security vs scalability, choosing two of them might result in abandoning the third element.

Sunk cost - what you cannot get back. If the direction of the pivot is vastly different from the original design, and it's been deemed necessary, it's better to bite the bullet and make the changes, even if it means redoing from scratch.

Adverse selection - be careful that the intended design of the blockchain does not end up incentivising the wrong kind of users. For example, in a DeFi project, you don't want to only have borrowers and few lenders or vice versa.

In summary, blockchain profits are merely one of the many factors to consider when deciding whether to invest in a project or not. As long as the project's foundations are solid, with a practical use case that can be applied to many areas, the chances of it pulling ahead of the pack is there. Good luck!

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.