What is ByteBall? The Cryptocurrency With No Blockchain

Byteball is an interesting project that many in the Bitcoin community may have heard of recently. This is because the ByteBall coins were distributed to Bitcoin holders during 2017 in a proportion to how much they held.

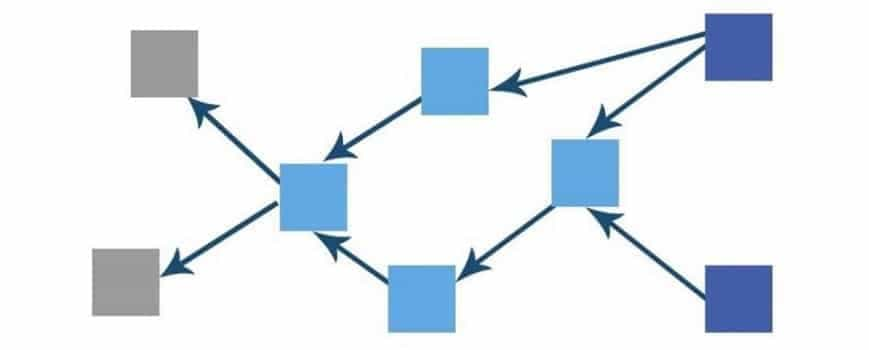

Something else that is intriguing about ByteBall is that it does not use a blockchain. It makes use of a revolutionary new technology called a Directed Acylic Graph or "DAG". Many people have considered this a great way to overcome blockchain growing pains.

There are also a number of unique features of the ByteBall project. For example, you can send conditional payments, hedge against uncertain events, take part in prediction markets and P2P betting. This is all based on the smart contract technology.

Let us dig deeper into the project and see why you may want to HODL your airdropped coins.

ByteBall Overview

The project began its journey in late 2014 when the Russian technologist, Anton Churyumov, was looking for ways to solve issues that he saw existed on the Bitcoin blockchain. Thus ByteBall was born and it was launched around the Christmas of 2016.

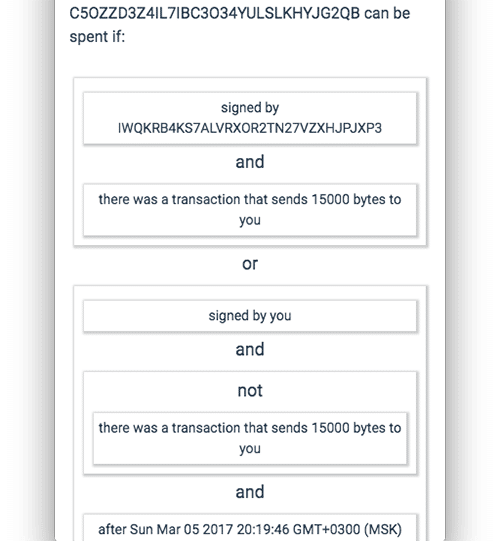

The main benefits of the ByteBall contract come from the fact that one is able to design specific smart contracts that will be validated among all of the nodes on the network. The rules that are coded into the contract are immutable which means that they cannot be changed.

When many people think of these contracts, they think of Ethereum. While they are relatively similar, Ethereum smart contracts are much more powerful and flexible as they make use of the proprietary language, Solidity.

Yet, what the ByteBall developers have given up in terms of functionality, they have made up for in simplicity. The goal of Anton was to allow non-developers to easily create these smart contracts. This smart contract simplicity also means that less coding mistakes such as the Parity wallet freeze are likely to occur.

So what sort of functionality is available for those users of ByteBall? Below are a list of the potential applications as well as some simple examples.

Risk Free Payments

One of the disadvantages of a Bitcoin payment is that once it has been paid, there is no way to get it back. Hence, if you need to make a payment based on certain conditions having being met, then you will have to use some form of an escrow service.

However, with ByteBall, you have the opportunity to create simple conditional payments that will only verify the final transactions once these have gone through. In technical terms, you will be "binding" the payment to a specific condition.

If the condition has not been met by the other party then your bytes are sent back to your wallet. This is all done in a direct Peer-to-Peer fashion and there are no intermediaries. You can read the exact requirements on the Byteball application. These are the series of IF / AND / OR conditions.

You could therefore structure your very own escrow smart contract that will pay the recipient once someone else has verified that the condition has been met and only after a certain period has elapsed.

The ByteBall team is also looking to the possibility of including contracts that reference outside events into these payments. These external parties are termed oracles and they are already becoming an important part of other smart contract ecosystems.

Insurance

We have all been in those situations when an unfortunate event has impacted cost us financially. Although many people may take out insurance on these events, claiming the money back is not quite as clear as one may think.

Would it not be ideal if there was a solution where a line of code would simply pay out in the event that said negative event were to occur? This is exactly what the ByteBall simple contract insurance can help you to develop.

You can structure an insurance agreement in the code of ByteBall where someone who took out insurance will get the funds transferred to them from the issuer if the condition is met. You could either buy this insurance from someone else or you could sell it to them.

These insurance smart contracts are the ones that are most likely to gain from the oracle technology. Given that insurance events are mostly external, these oracles can feed information on the event to the smart contract itself.

A simple example of this can be a cancelled flight. When someone is buying flight insurance, it can be structured as a contract that will pay them out in the event that the flight is cancelled for some reason. The oracle in this case can be an external flight information tracker.

This would automatically send the information to the smart contract so that it can be executed the moment that the flight has been cancelled. There are no doubt numerous other examples that one can think of.

Prediction & Betting

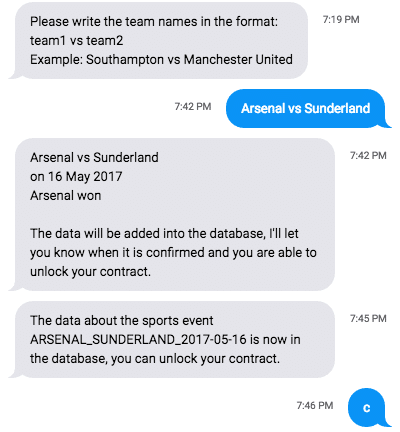

When one places a bet or makes a prediction, the payoffs of these are generally conditional in nature. You will be paid out a certain amount that is based on the outcome of some external event.

In the case of the P2P betting, you can enter into a smart contract agreement with someone else on a particular sporting event. Based on the outcome of this event, the winner will then get the payment from the loser as defined by the contract rules.

You can also use the P2P smart contract to bet on the movement of a particular price. For example, in this example where you will be betting on the price of Bitcoin. This could be used to hedge a current position for example.

In the example given, the bet will be a binary one. There will be a winner and a loser that will be determined post event by the code in the smart contract. Similar to the flight example above, the oracle will give the information on the price to the contract.

Identity Management

While one of the primary motivations behind cryptocurrencies was for it to be anonymous, the ByteBall developers have given users the option of storing their ID in the wallet and determining exactly who to share this information with.

This could be an interesting proposal for those people who need to prove who they are in a largely anonymous ecosystem. One of the most prevalent examples of this is the KYC requirements that companies have to undertake when completing an ICO.

Earlier this year, ByteBall had partnered with Jumio in order to verify the identity of the person that was creating a particular ByteBall address. This will no doubt make the process that much more simple.

ByteBall Technology

As mentioned, ByteBall has done away with the notion of a blockchain and Proof-of-Work (POW) mining and instead opted for DAG data storage technology. This has a few advantages over traditional blockchain based cryptocurrencies.

These are all outlines in detail in ByteBall's whitepaper. Below are some of the unique use cases for the ByteBall network.

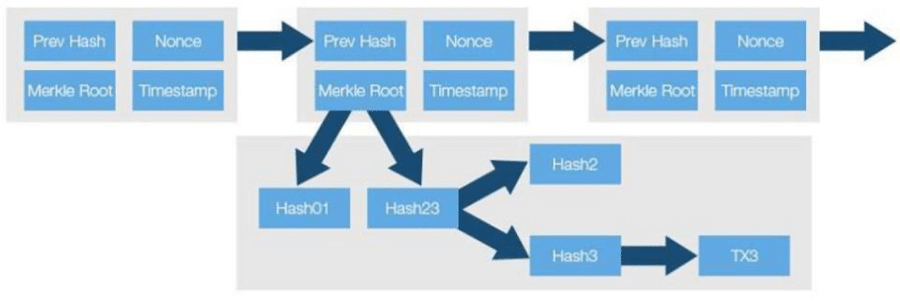

DAG Data Storage

In the case of the Bitcoin blockchain, all of the blocks are linked in one long chain since the beginning of the genesis Bitcoin block. Miners will have do the PoW in order to add new blocks to this chain. This occurs about every 10 minutes due to the nature of the protocol.

This limitation that is placed on block creation is one of the reasons that transaction times and fees can spike in times of network congestion. ByteBall does away with this by using a completely different data structure. Below is an image of a DAG.

As you can see, all of the transactions in the DAG are cryptographically linked to one another. Other transactions will be added on top of yours when they are entered. The advantage of this is that all the nodes on the network (users) will help verify the transactions.

Not only does this mean that payments can be verified more quickly, but it also means that the network is kept sufficiently decentralised. One of the other problems that many see with Bitcoin is the large centralised mining pools which can threaten the network.

The benefits of DAGs are quite clear and there are a number of other coins that use the technology including IOTA and Nano. In the case of IOTA, this is termed the "Tangle".

In order to reduce transaction spam on the network, ByteBall makes use of transaction "Witnesses" who will charge a fee of 1 byte per byte of data that is stored on the DAG.

Untraceable Bytes

ByteBall also has another built-in cryptocurrency that is designed specifically for anonymity. These are called Blackbytes which have much more supply than the standard bytes tokens. They are used specifically for private transactions.

These Blackbytes can be sent between two different parties who are communicating via encrypted messaging. The DAG will register that the previous owner of the Blackbytes is no longer in possession of it, yet it won’t register the recipient of the new Blackbytes.

This has a number of benefits over Bitcoin as all transactions on the Bitcoin network are stored on the blockchain and can be traced. This is one of the reasons that so many users are moving to privacy concious coins.

Other Assets & Atomic Exchange

Another feature of the BlackBytes network is that users are able to define their own unique currencies. This can be done by mixing the various other properties of the ByteBall network. For example, a financial institution could use the ByteBall network to define its very own asset such as a loan for example.

They would require a host of KYC checks to be done through the application as part of the smart contract underlying the loan asset. This is one of the reasons why Anton decided to include the KYC functionality. It would allow ByteBall to easily be used as for these types of institutions.

The ByteBall network also has the ability to complete an atomic exchange. These essentially allow for a transaction to happen instantaneously at both ends. If they are not executed simultaneously then the transaction does not happen at all.

Where to Get Bytes?

The distribution of ByteBall Bytes (GBYTE) to Bitcoin holders occurred either in the initial launch on the 25 Dec 2016 or throughout a series of 10 further distributions in 2017. This means that about 65% of the total supply was distributed already.

However, you can still buy Bytes on a number of exchanges with your BTC. Currently, Bytes are available on exchanges including Bittrex, the Cryptopia Exchange, Changelly and a few others. The full list of exchanges is available on the ByteBall website.

There is not that much volume on these exchanges currently with total daily volume on Bittrex at roughly $614k. Hence, you should take caution when you enter your buy order as you do not want to have an adverse impact on the price.

Once you have bought your Bytes, cryptocurrency best practices means that you will want to withdraw them from the exchange. This is where the ByteBall wallet enters the picture. You can download it from the official website and it is available on a number of operating systems for PCs and Macs. There are also mobile versions for Android and iOS.

ByteBall Prospects

While ByteBall is still a relatively new cryptocurrency compared to the likes of Bitcoin, it is quite established when compared with all the other coins and tokens that have hit the market over the past 2 years.

Hence, there has not been as much buzz around ByteBall as there have been for other newer and "hotter" tokens. This is possibly down to the nature of the project. The developers wanted to create a cryptocurrency that was technically superior with promotion being a secondary goal.

To that end, it seems as if they have indeed met that goal. While DAG technology is still to be fully tested at scale, it could theoretically be a much more scalable alternative to traditional blockchains.

Either way, ByteBall is an unique project with an enthusiastic community and a strong team behind it. It will be interesting to see how it progresses over the year.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.