M6 Labs: BTC & ETH Surge, Market is Risk ON

The following report is a guest post by M6 Labs created exclusively for the Coin Bureau audience. M6 Labs is a crypto-native research firm dedicated to high-quality research. The Coin Bureau team find their analysis and reports insightful and we are happy to be sharing their research with our community. None of the views or opinions expressed in this report reflect those of the Coin Bureau.

If you want to see the Coin Bureau provide more insights like this let us know! Send your feedback to: [email protected]

Welcome to this week's Crypto Market Watch! Here, we delve deep into the crypto realm to provide you with a thorough examination of noteworthy occurrences and emerging patterns. BTC and ETH are experiencing remarkable surges, while Polygon is rapidly gaining ground in the gaming sector. On-chain activity is on the rise, and astute investors are strategically positioning themselves, indicating a resurgence in risk appetite. Now, for the grand finale: the impending confirmation of the ETF, could it be this year? It appears to be the final puzzle piece awaiting placement.

This is just a preview, be sure to check out the full version of this report here.

Get our crypto-native industry insights and research in your inbox, subscribe now.

Alpha Take Of The Week

If you’re reading this, take note of how early you are, Anon.

Narratives of the Week: Market Surge & What Is Happening In Gaming And NFTs

Market Overview

Firstly, the move by BlackRock to register an iShares Ethereum Trust in Delaware has drawn attention to Ethereum as an institutional-grade investment. Ethereum experienced a surge in price, breaking the $2K barrier for the first time since July. This development indicates growing institutional interest in Ethereum and its potential as a valuable asset class.

Moving on, Bloomberg analysts suggest an 8-day window starting on November 9, during which there is potential for the approval of several spot Bitcoin ETFs. However, it's important to note that the SEC has not indicated definitive approval, and the opening of this window does not guarantee ETF approvals. Investors are hopeful due to factors such as the SEC's request for comments on proposals and changes made by applicants to address concerns, including market manipulation safeguards and surveillance-sharing agreements. The outcome remains uncertain, but the possibility of multiple ETF approvals within this timeframe is noteworthy.

Meanwhile, MicroStrategy has reaped substantial profits from its Bitcoin holdings as it rallied to a yearly high of over $37K. With MicroStrategy having acquired 158,400 BTC for $4.68B as of September 30, their investment has shown an impressive unrealized gain of $1.2B.

Bitcoin itself has seen remarkable price volatility, reaching a yearly high and pushing its market cap to surpass that of Tesla. This surge in Bitcoin's market cap is largely attributed to the optimism surrounding the potential approval of a spot Bitcoin ETF. The market cap increase marked a significant one-day percentage change and served as a testament to Bitcoin's resilience and appeal as a digital asset.

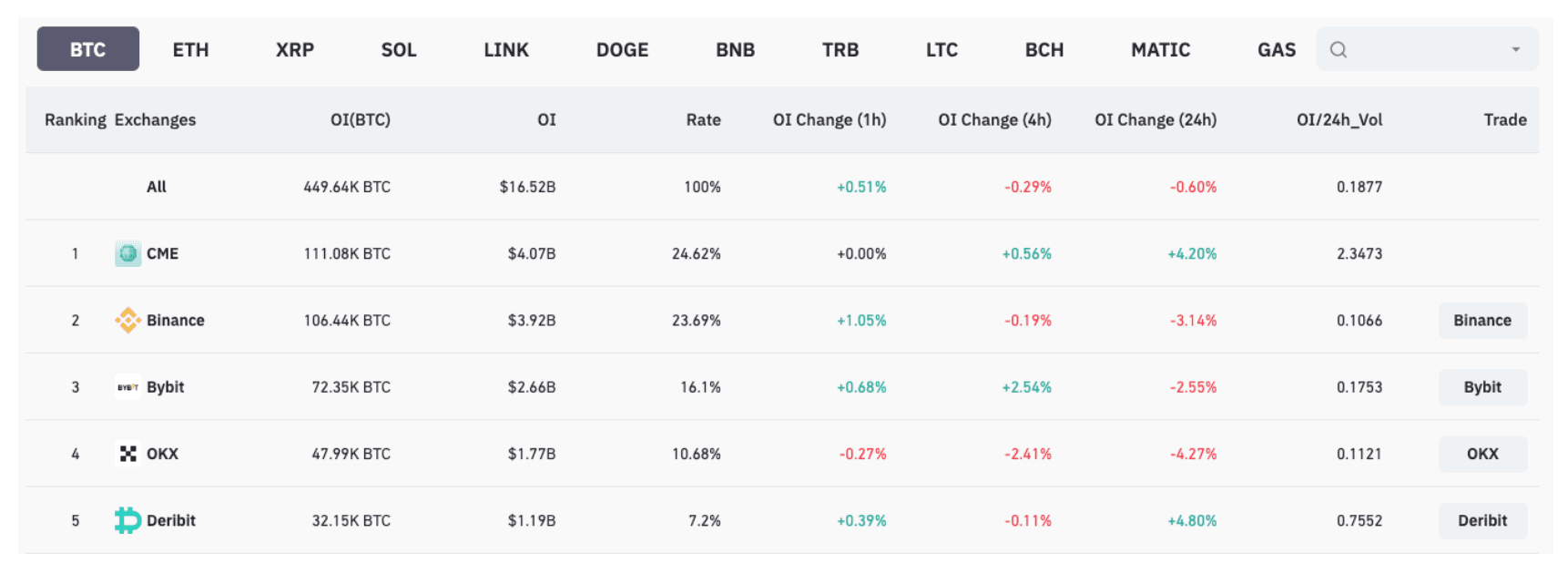

Furthermore, Bitcoin's futures market has witnessed a surge in open interest, indicating a growing interest in Bitcoin trading contracts. Moreover, open interest in Bitcoin futures contracts decreased by over 5%, with CME now surpassing Binance as the largest exchange in this regard.

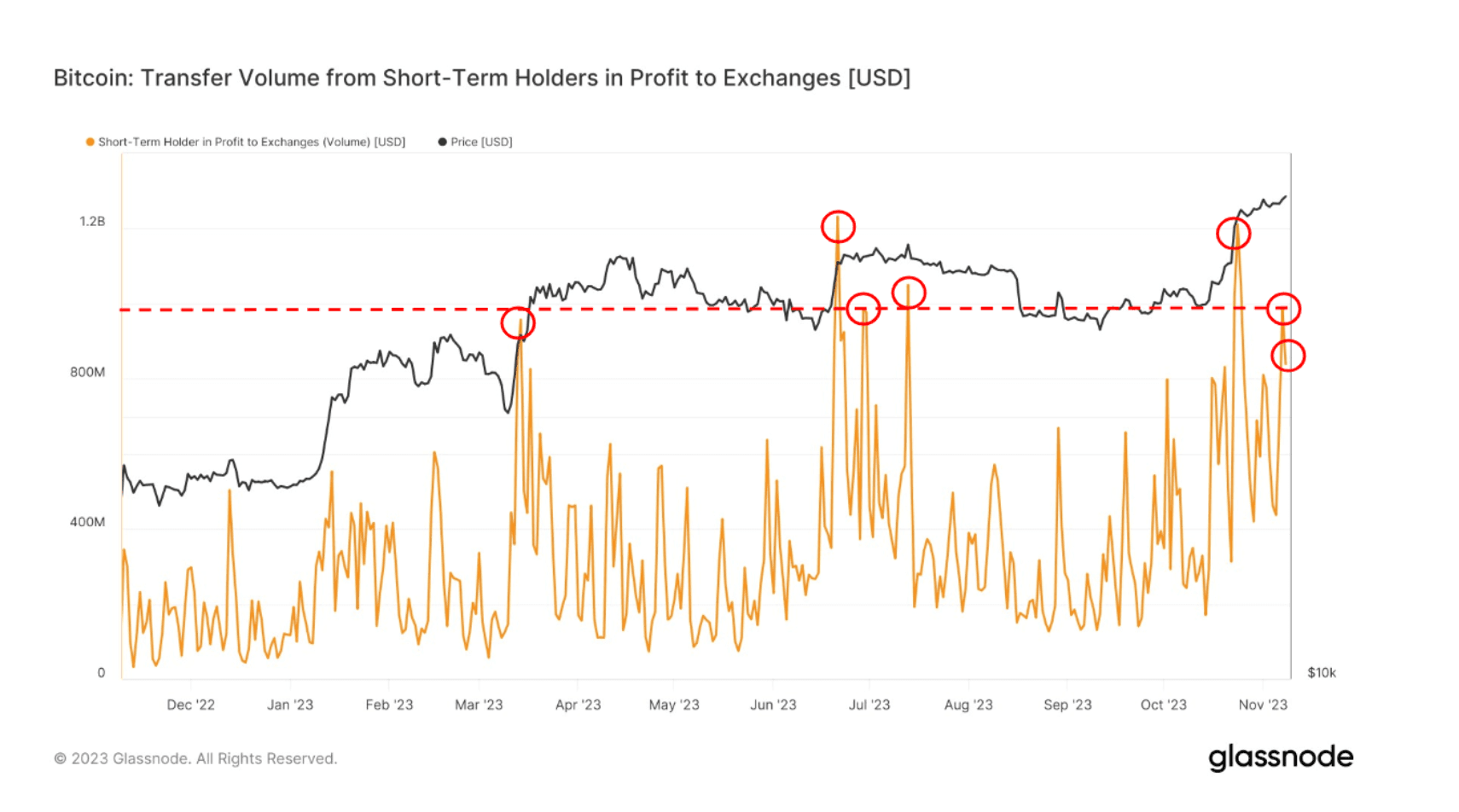

Lastly, short-term Bitcoin holders have reaped substantial profits over a 48-hour period, indicating significant profit-taking by this segment of investors. These short-term holders have extracted $1.8b in profits, showcasing their cautious approach in a volatile market.

NFTs

*All the data below was sourced from Footprint Analytics unless otherwise stated.

Setting the stage: Gaming and NFTs have recently experienced a significant surge in activity, and it's clear that both of these markets are here to stay. They are poised to play a pivotal role, not only in the realm of crypto, but also in the broader landscape of the internet. Why, you ask? Well, internet culture is in a constant state of evolution, and one of the most noteworthy innovations in recent years that has fueled this evolution is the widespread adoption of NFTs in various forms.

It's important to note that NFTs extend far beyond profile pictures and gaming; their utility spans countless areas. In a world where most assets are non-fungible, NFTs provide a groundbreaking solution by enabling the representation of these unique assets on the blockchain. While some may still dismiss NFTs as insignificant, those of us who have remained engaged in the crypto space for an extended period know better. We can see the trajectory of the world.

Looking ahead 10 to 15 years, when AI, crypto, VR, and AR seamlessly converge into an experience almost indistinguishable from "real life," where the majority of human activities across all domains will converge, who will still be skeptical?

In summary, it's essential to stay closely attuned to these developments, as this is where we anticipate witnessing the most remarkable advancements, even if the current state of activity of many games and NFT collections is disappointing. But enough preamble; let's dive into the data!

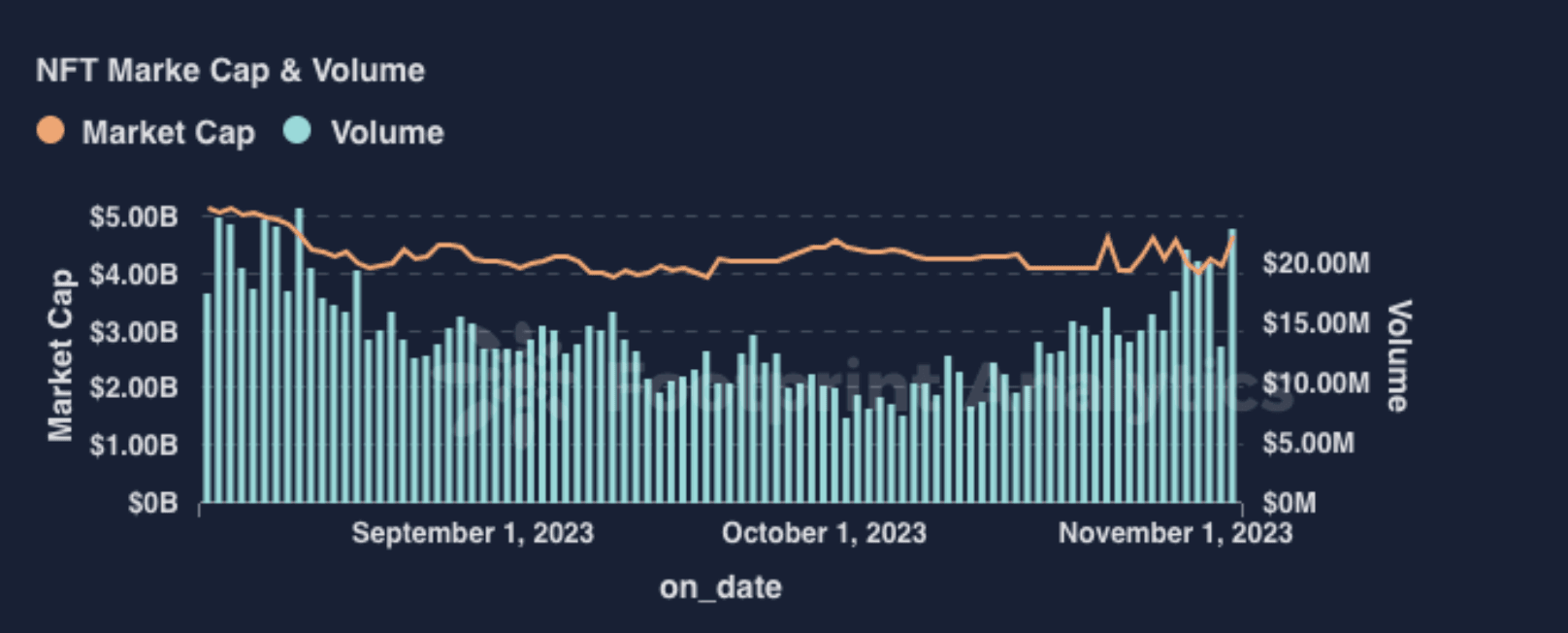

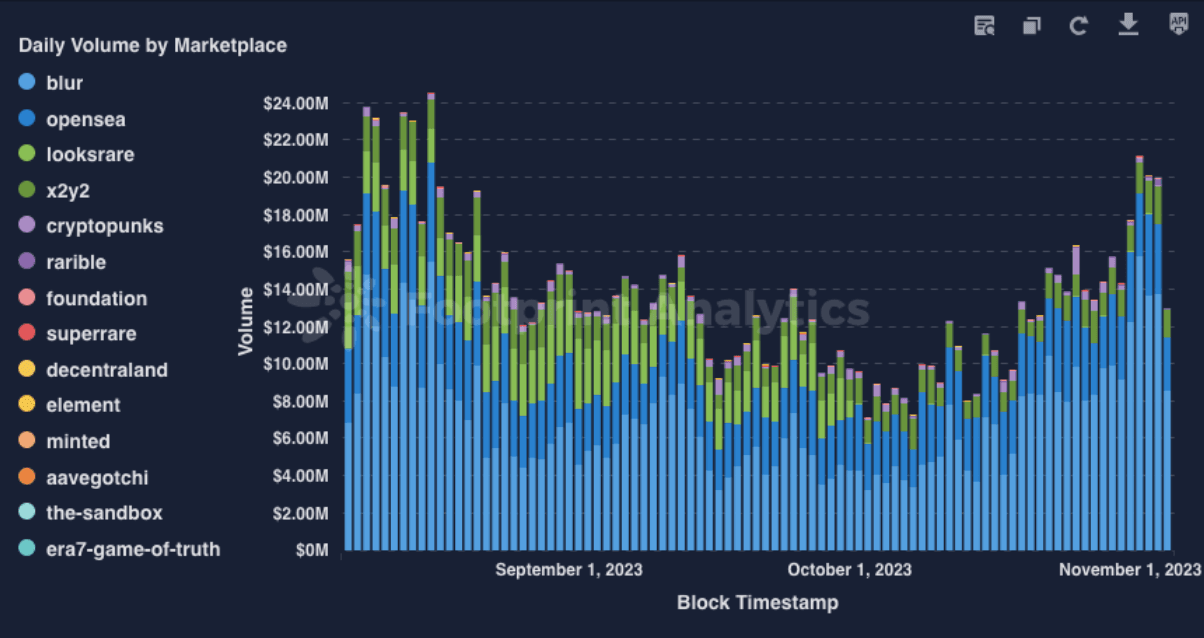

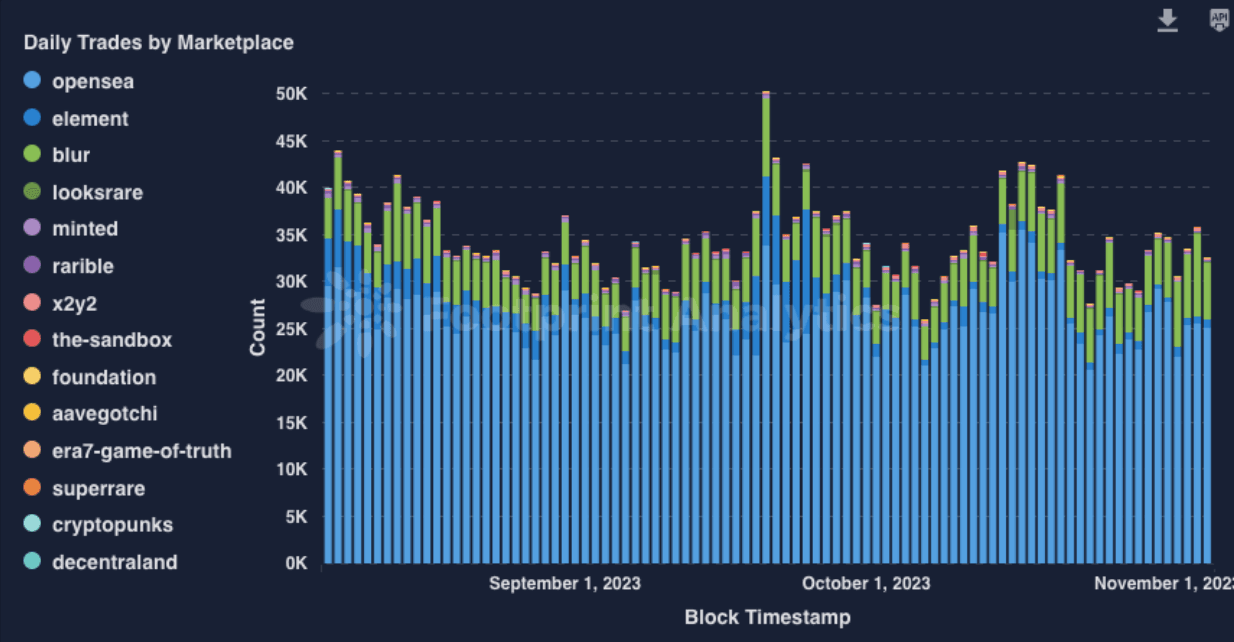

Volume and market cap have seen a significant surge since the lows of early October.

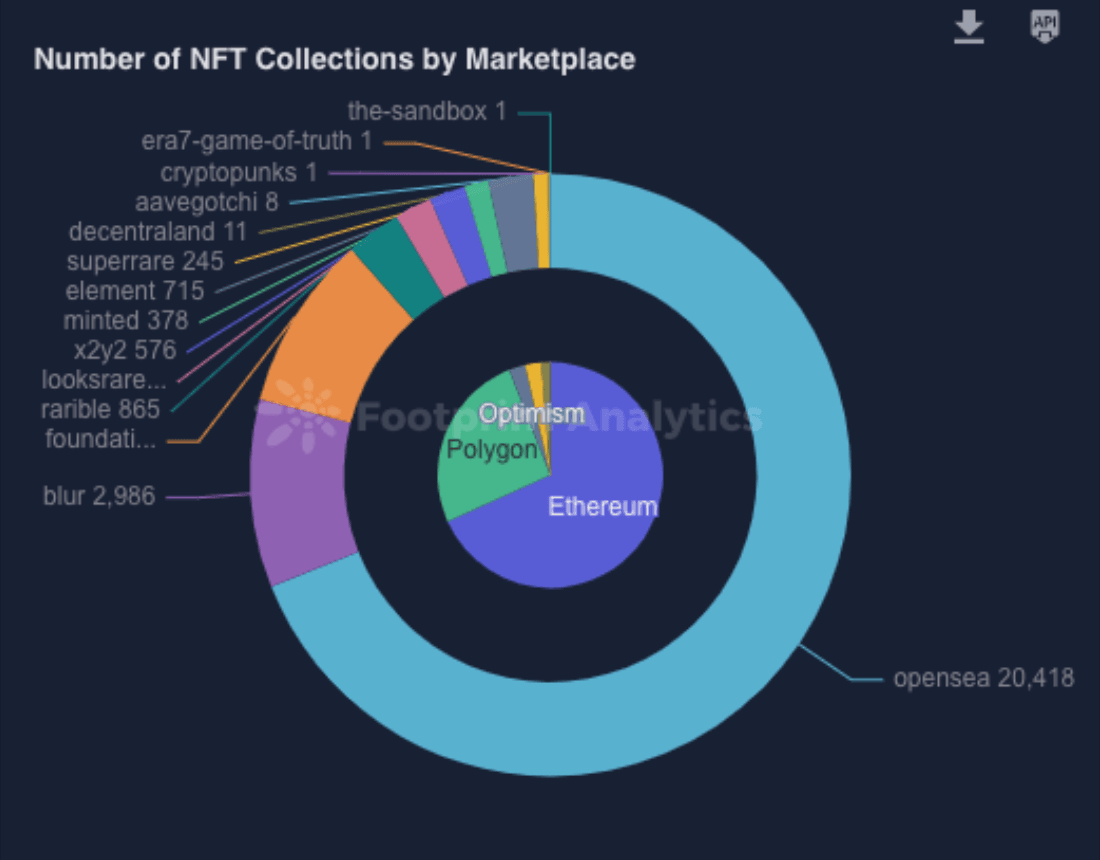

OpenSea maintains its dominance in the NFT market when it comes to its number of collections, leaving Blur trailing far behind. It's worth noting that Blur garnered substantial interest, especially considering its launch took place after the peak of the bull market. Unlike older platforms that launched during the height of the bull market and even offered airdrops, they couldn't generate the same level of interest.

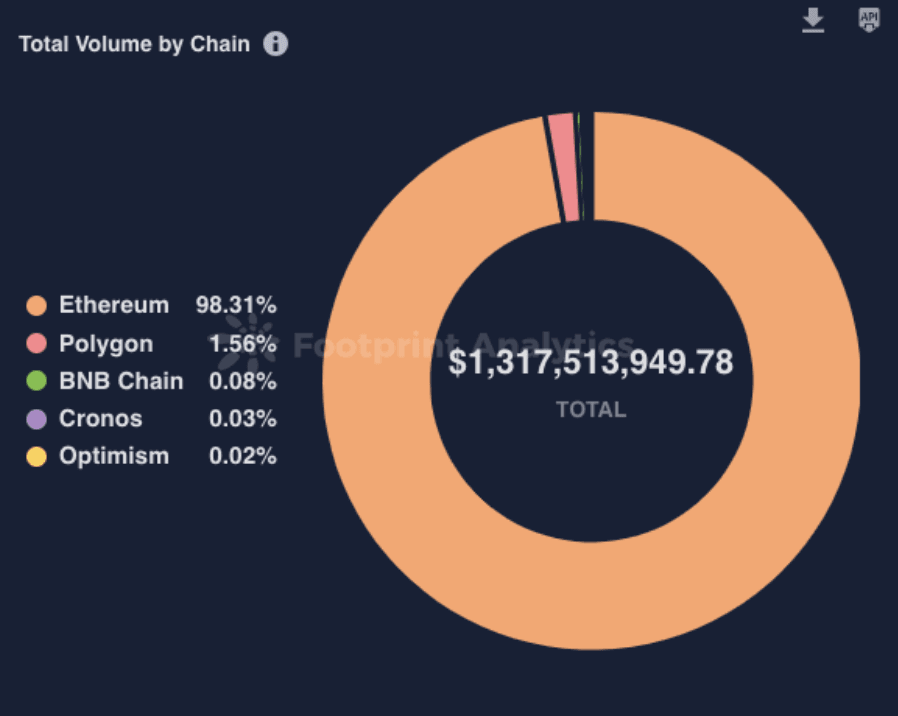

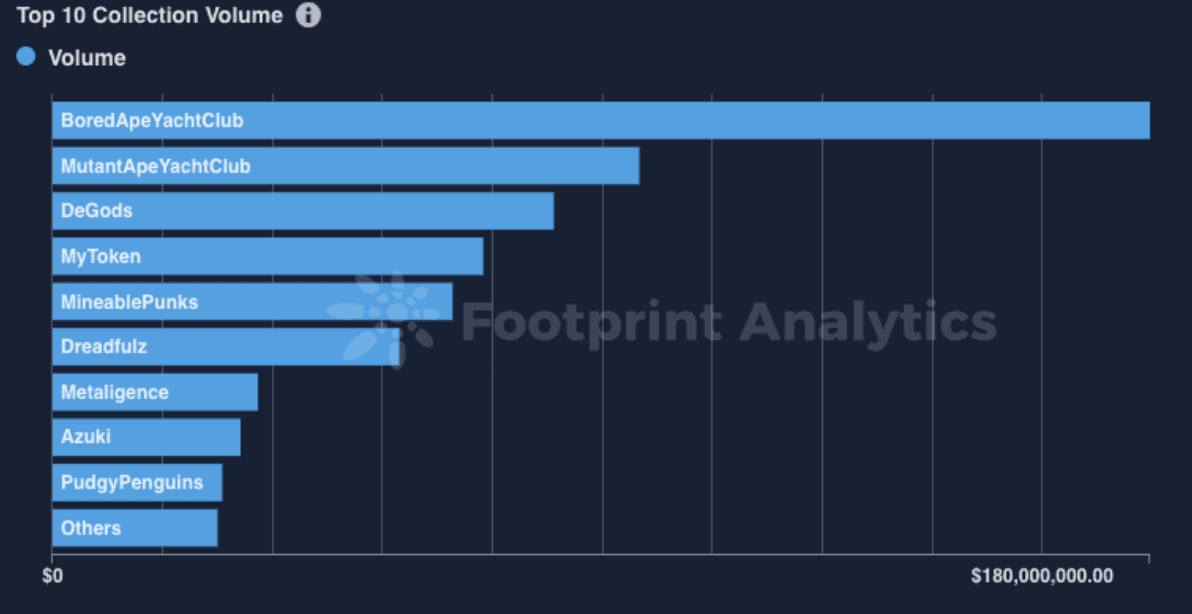

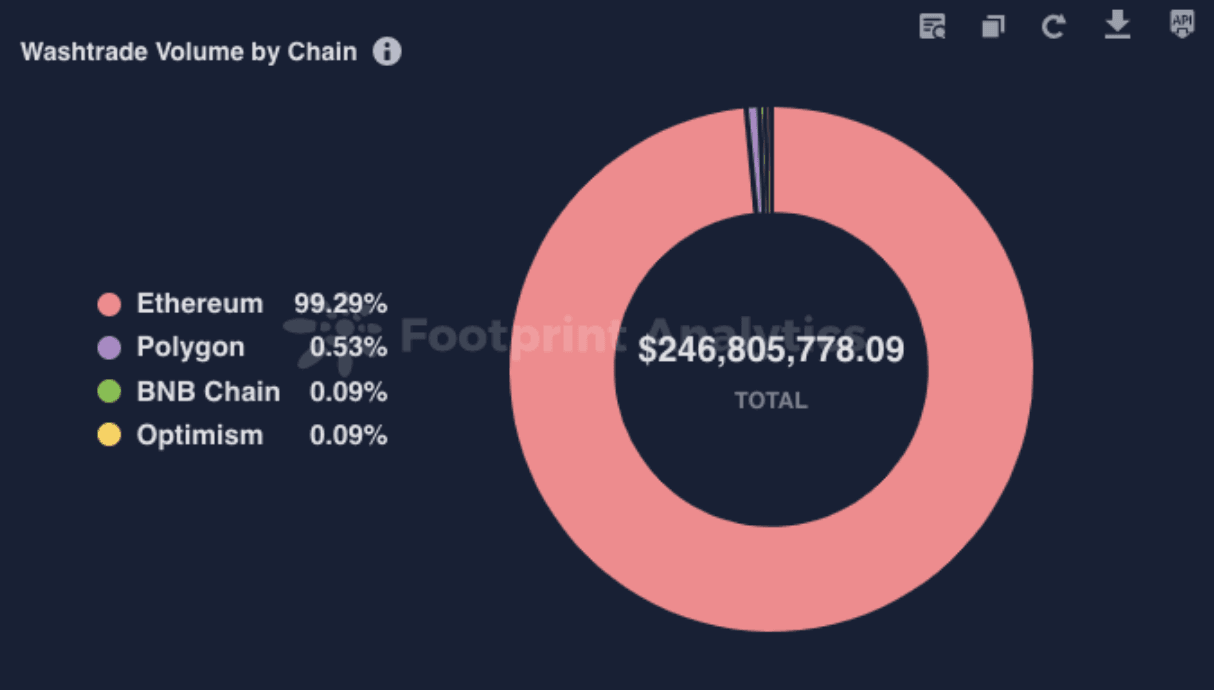

Ethereum still continues to dominate most of the NFT volume. The usual suspects continue to generate the most interest when it comes to traditional NFTs and the top 10, though there have been some recent new collections rotating into the top 10.

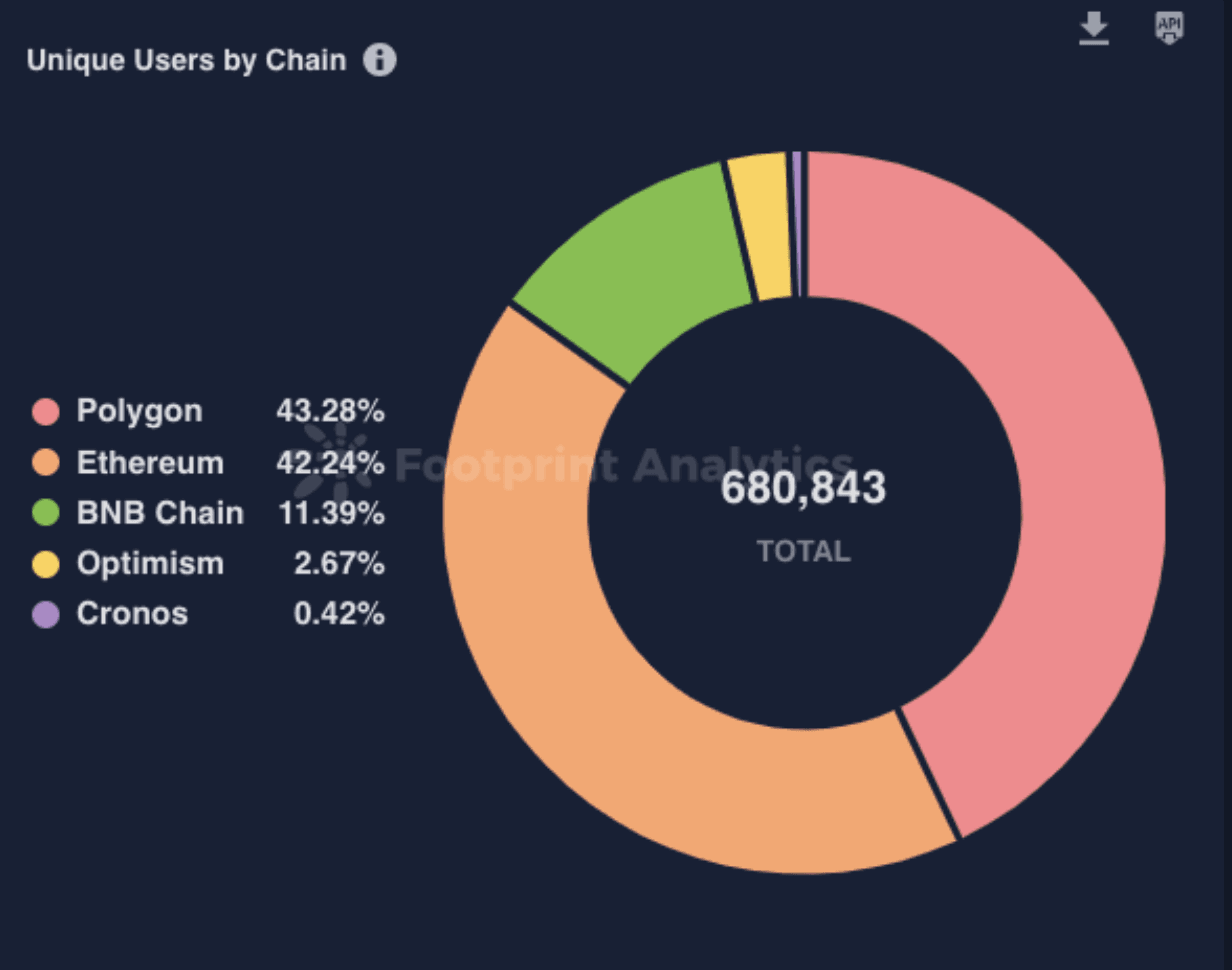

Polygon has come to be the dominant chain for NFT activity. This is likely due to the explosion of gaming activity on the chain.

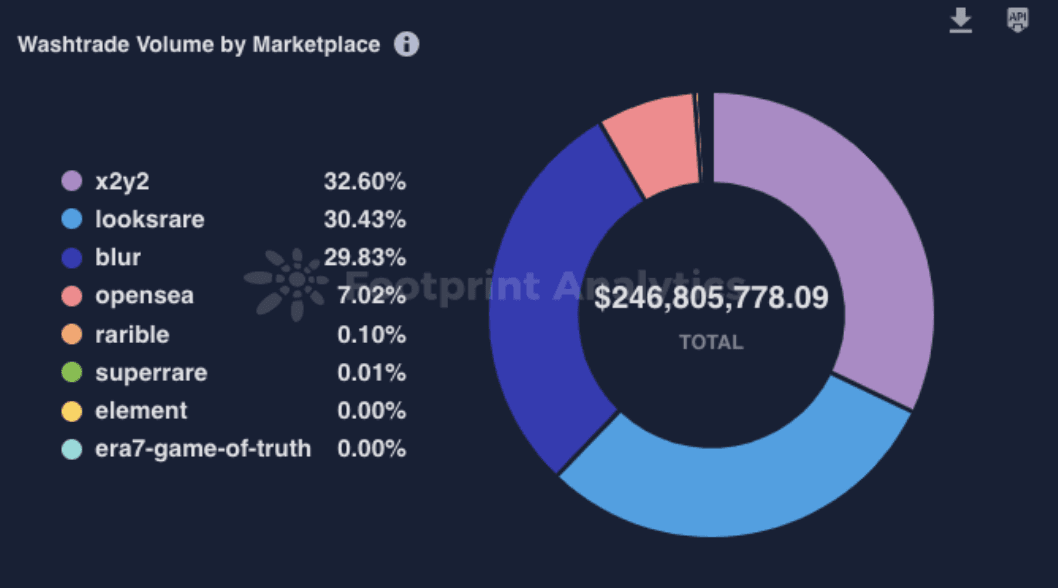

Blur is currently leading in NFT volume, with Opensea taking the lead in daily trades. However, it's worth noting that Blur has been flagged for more wash trading compared to Opensea. This increase in volume could be related to the upcoming anticipated airdrop on Blur. It will be intriguing to observe if Blur can sustain these metrics after the airdrop. Additionally, users should keep in mind that rumors about an OS token have been circulating since the 2021 bull run, which could be a significant factor for OS in the upcoming bull run.

It's worth noting that the majority of wash trading is happening on Ethereum. This is interesting because it suggests that the growth observed on chains like BNB and Polygon could be more organic and reflect actual user activity.

Gaming

Although the realm of crypto gaming has yet to attain mainstream recognition, astute observers believe that the tokens associated with these projects hold the potential for astronomical growth. Given the relatively limited participation in this nascent field, there exist abundant opportunities for early entry and substantial returns.

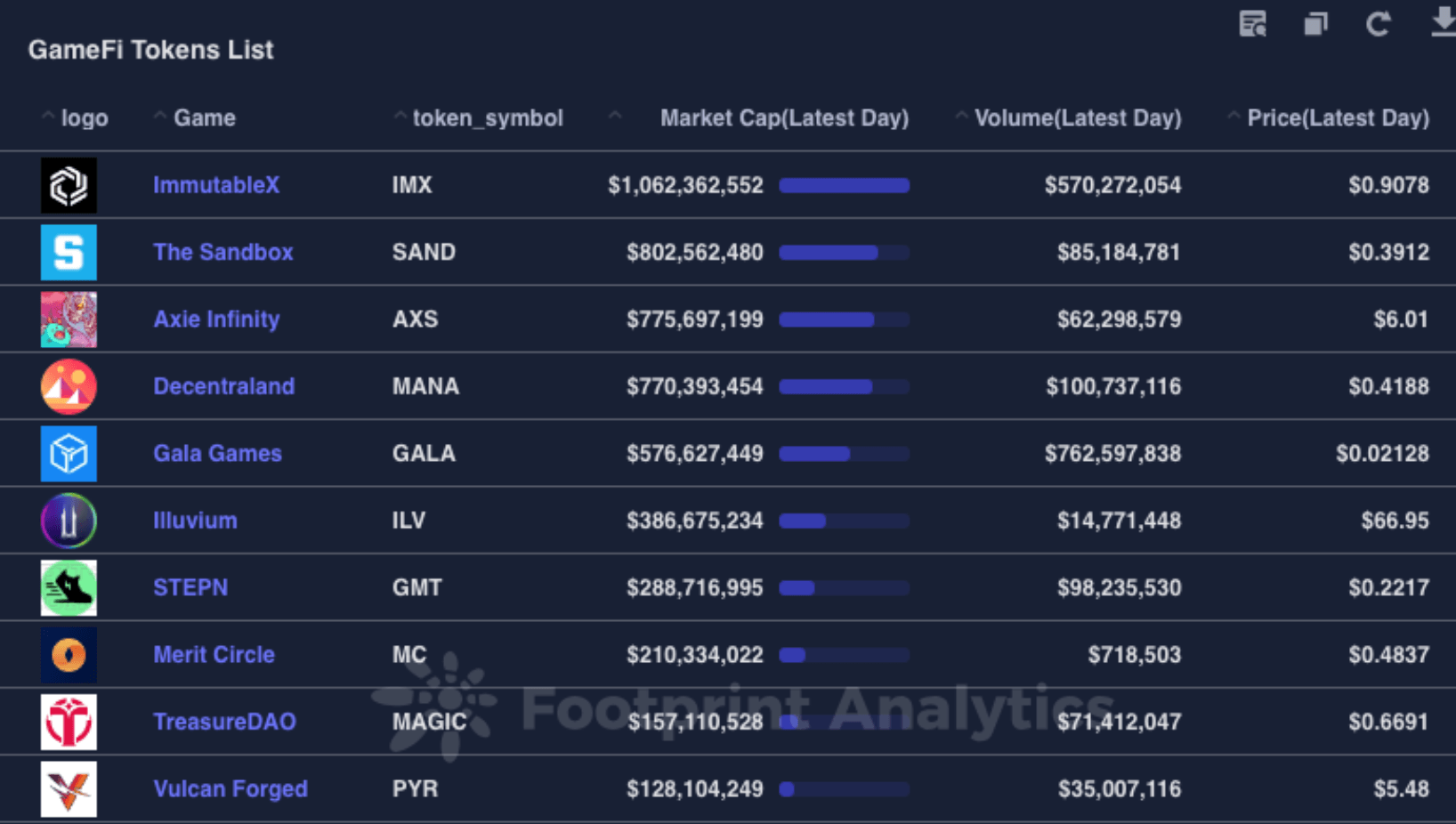

A recent report by Dapp Radar found that the GameFi market presently boasts an impressive market capitalization of $9.9B. Across the GameFi landscape, there are a staggering 650,000 active users, with 16% of them actively engaged in the AlienWorlds ecosystem. The proliferation of innovative protocols within this space signals a forthcoming explosion in the burgeoning green market, indicative of significant growth and potential.

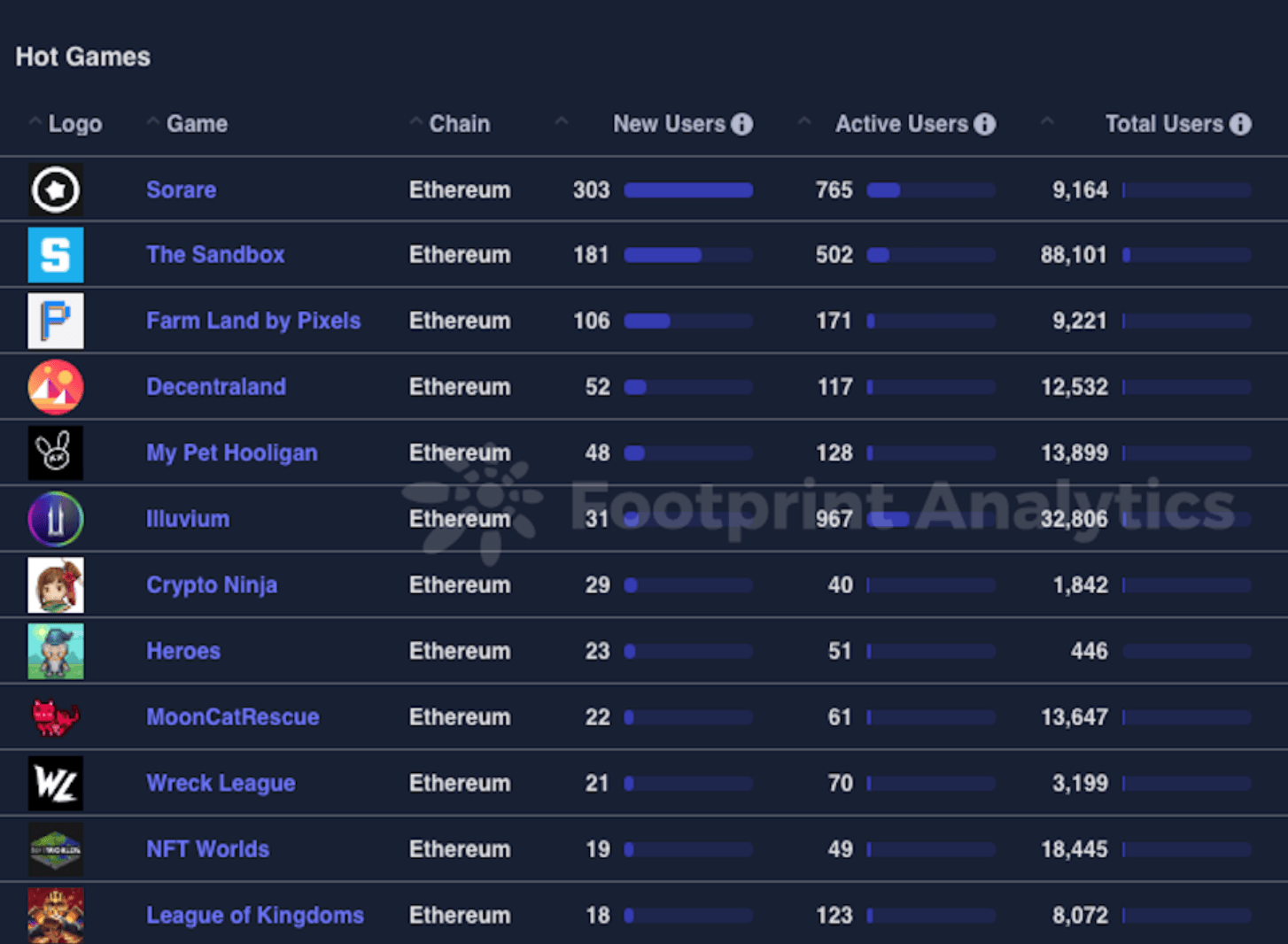

Blockchain gaming maintains its strong presence in the blockchain space. In the latest month, there has been a notable 17% increase in Unique Active Wallets (UAW) engaging with gaming compared to September, resulting in a total of 1.7M unique active wallets. This uptick has also solidified gaming's dominance in the market, marking a 10% increase. Notably, in October, approximately 62% of all Dapp activity stemmed from gaming projects. Within the realm of NFT gaming collections Sorare, Axie Infinity, and Gods Unchained have consistently maintained their positions as some of the most actively traded NFT collections.

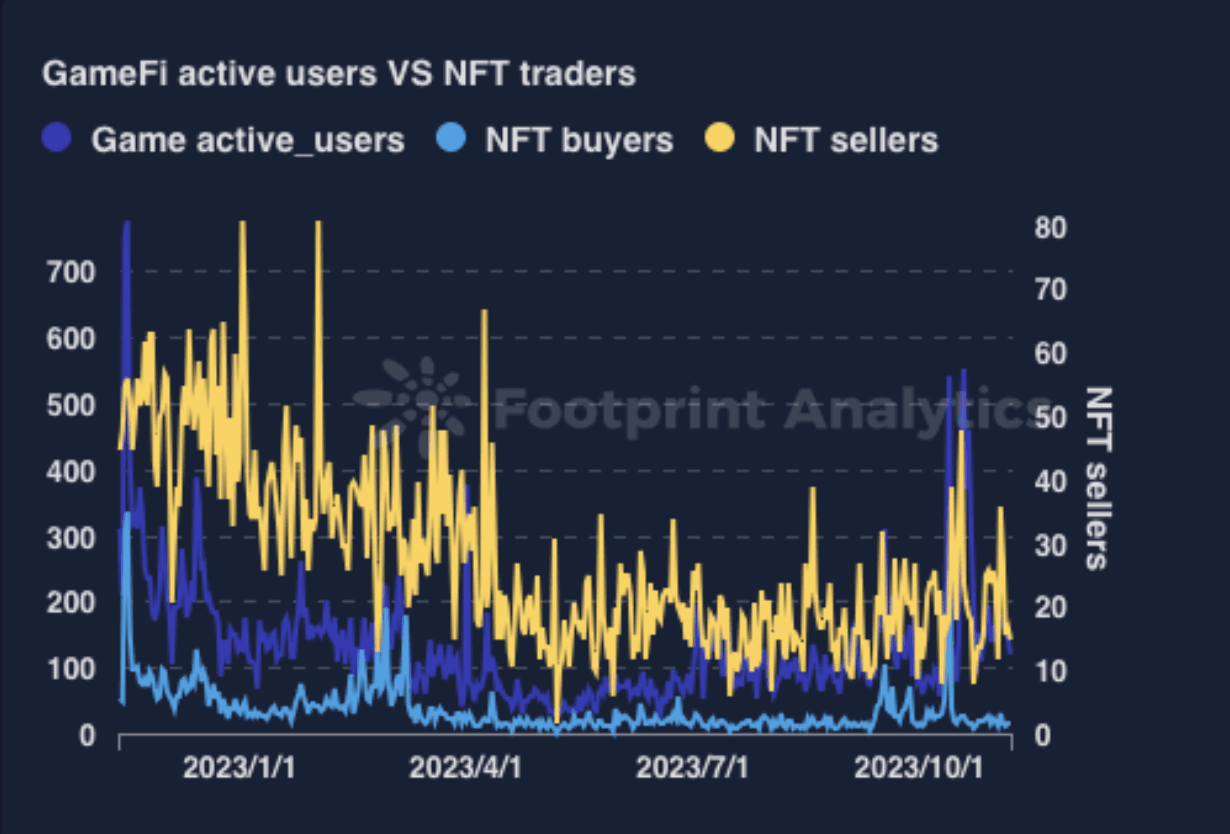

NFT buyers and sellers make up the majority of activity on all chains. This metric reveals how underutilized the GameFi ecosystem really is.

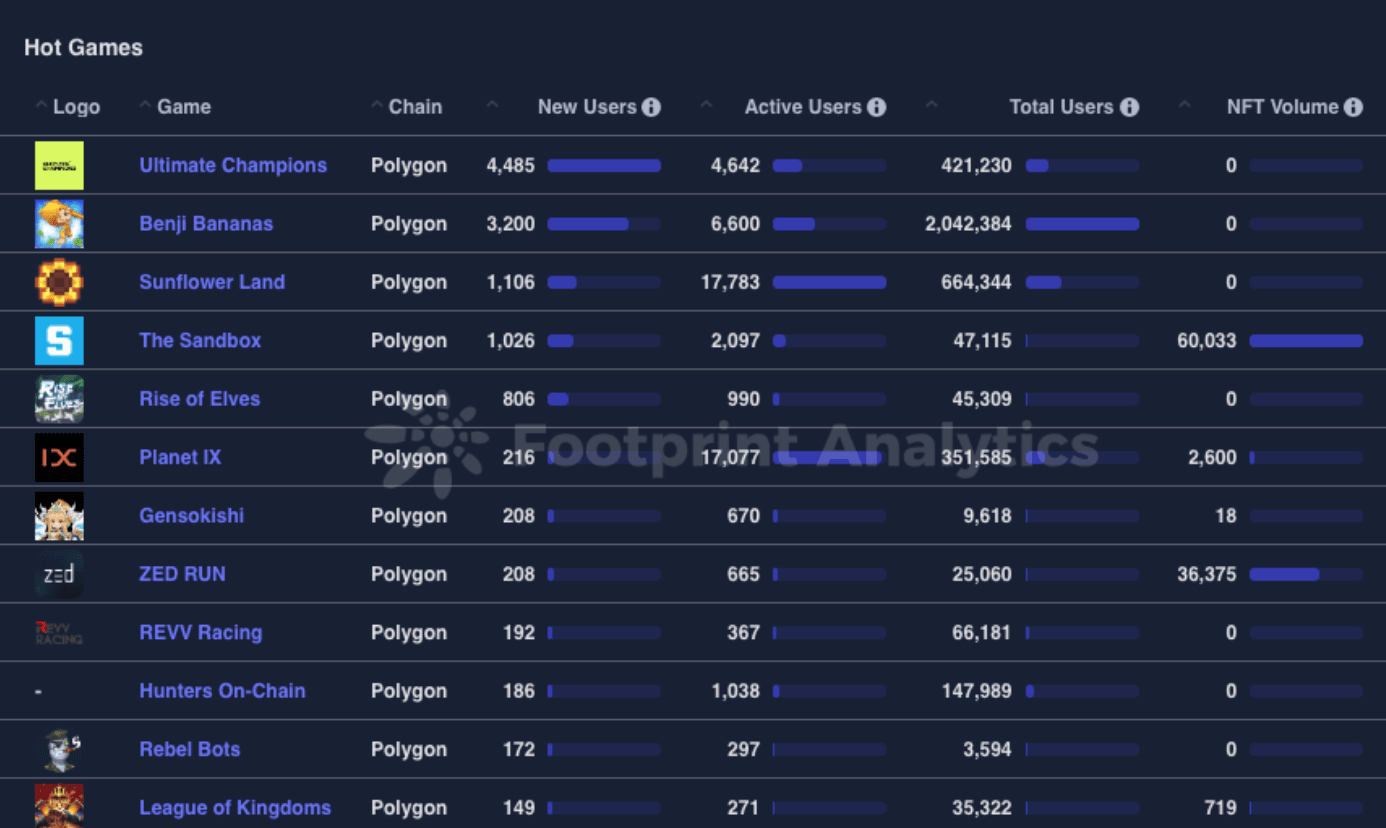

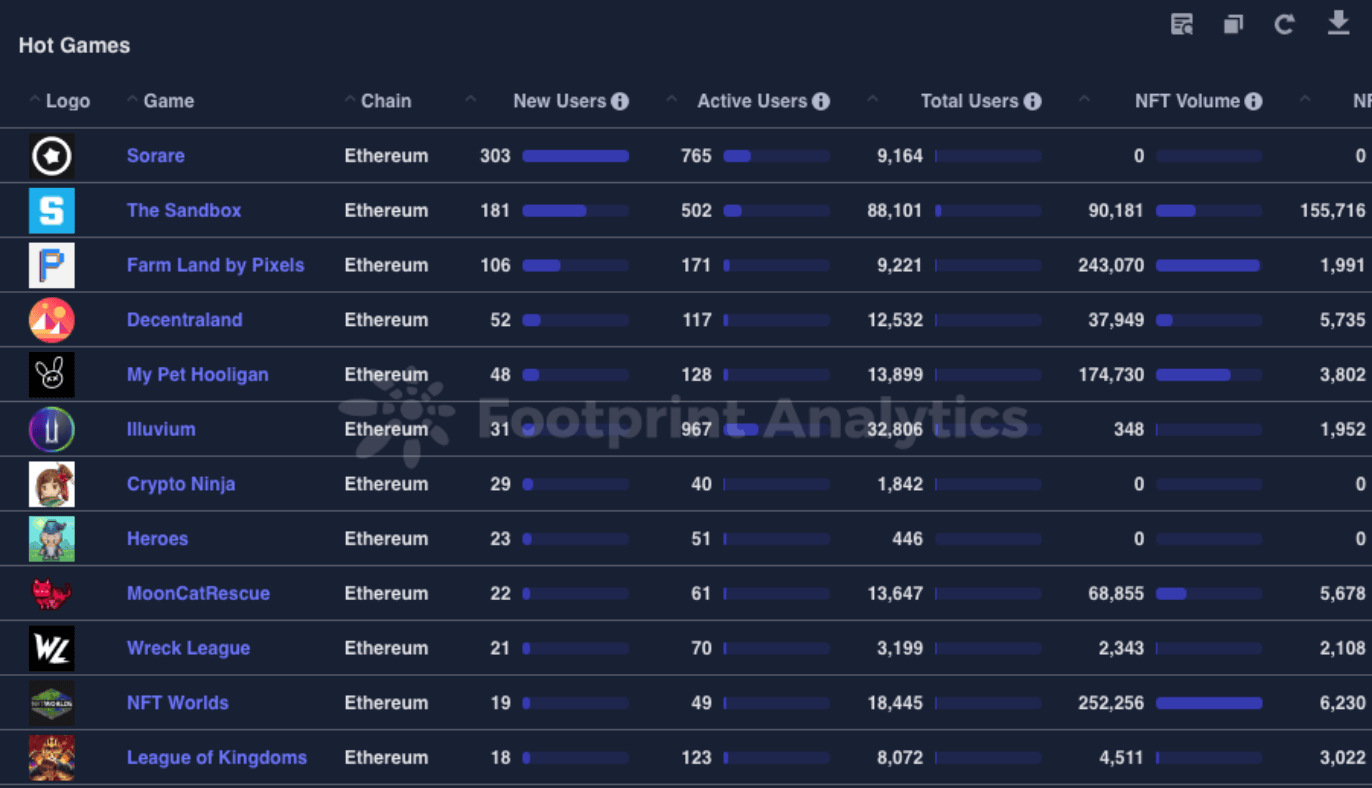

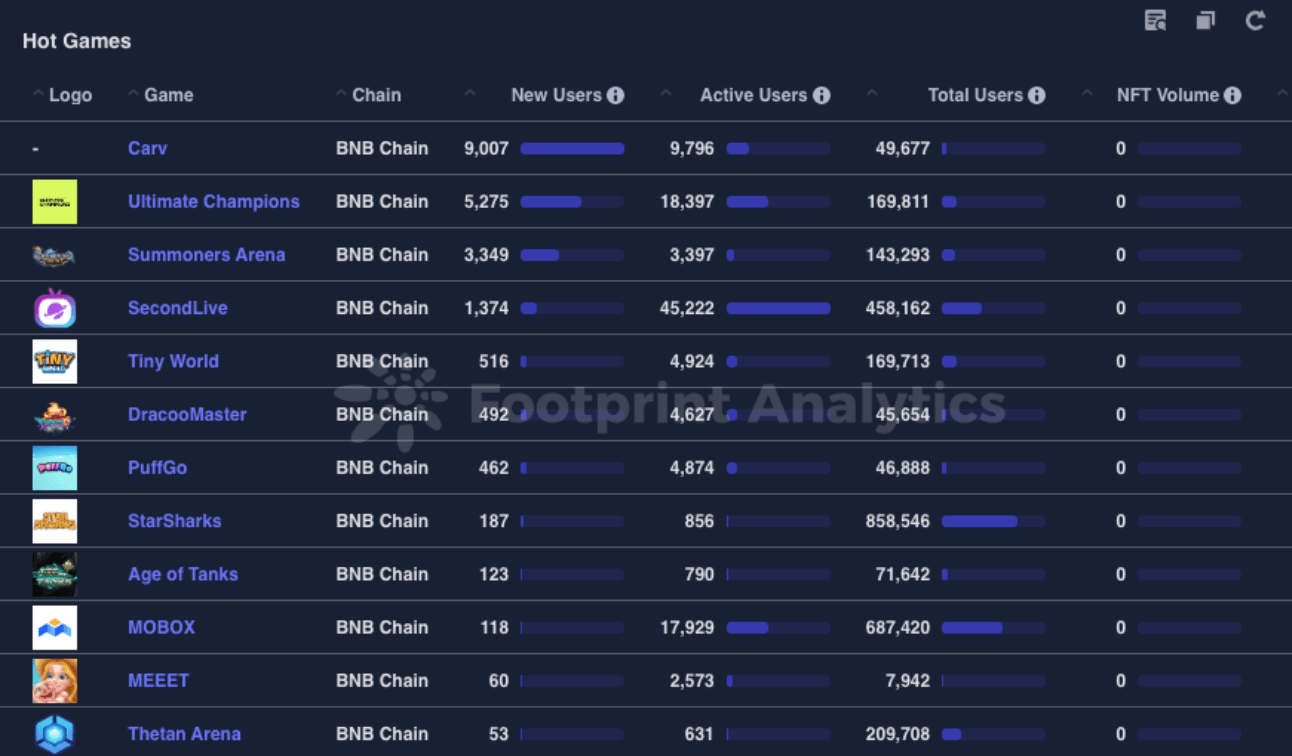

The following three graphs compare gaming activity on Ethereum, BNB, and Polygon. Polygon stands out as the dominant chain for gaming, where games like Ultimate Champions, Benji Bananas, and Sunflower Land have a staggering number of users. It is likely that gaming's future will shift to other L1s or L2 solutions, and cease completely on Ethereum due to high costs and fees for users.

In conclusion, the gaming and NFT markets are witnessing growth and are poised to remain influential in both the crypto space and the broader internet culture.

Despite not yet achieving mainstream participation, crypto gaming tokens offer substantial growth potential, especially for early entrants. GameFi demonstrates impressive market capitalization, and gaming projects continue to feature heavily in the blockchain space. As we look to the future, the market leaders from the last bull run still hold sway, but changes may occur. Keeping an eye on this space, particularly on Polygon, where gaming and NFTs are thriving, is advisable as the landscape continues to evolve.

DeFi, L1s & L2s

News

- Circle teases IPO.

- The Dubai International Financial Centre has approved Ripple's XRP and TON, expanding the list of crypto allowed within its special economic zone to five, including Bitcoin, Ethereum, and Litecoin.

- Meme tokens associated with Musk's new ChatGPT competitor, Grok, have started appearing on various blockchains.

- Nansen 2 is coming soon.

- Binance has unveiled Binance Messenger, believed to be a chat application, now available on the Apple Store.

- Kraken plan to launch their own L2.

- Evmos is ceasing operation on Cosmos.

- Crypto funds extend their streak, accumulating $767M over six weeks, with ether experiencing its most substantial inflow since August 2022.

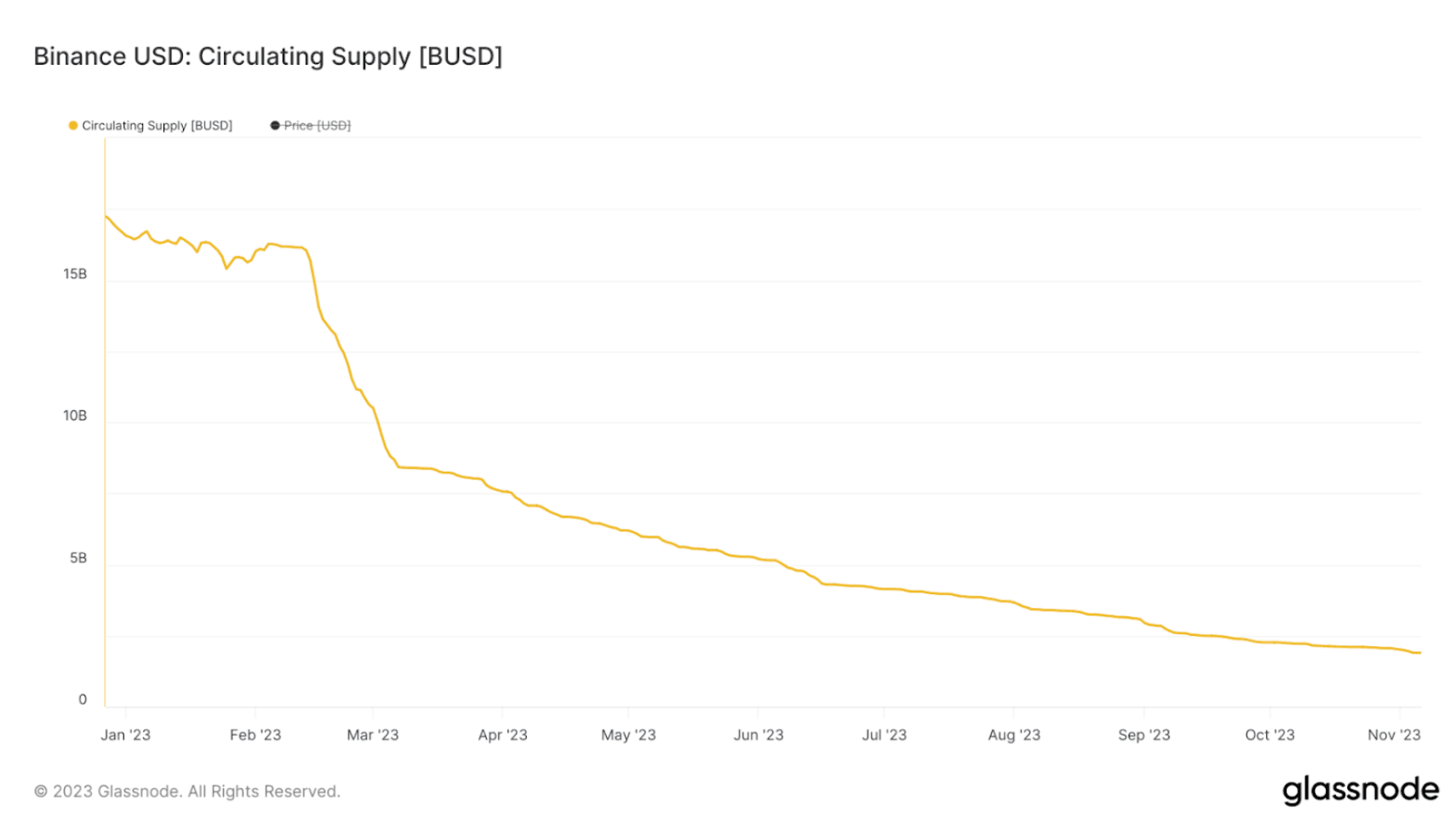

- BUSD supply has sharply declined by over 90%: Dropping from nearly 23 billion to around 1.88 billion, signaling a significant loss in market share and demand for BUSD in favor of other stablecoins like USDT, USDC, and DAI.

Blue Chip and Majors Overview

- $ARK: Up by 107%, ARK has more than doubled in value, showcasing a remarkable growth spurt in the market.

- $CAKE: PancakeSwap's token, CAKE, experienced significant growth due to new features and strategic moves like Binance’s CAKE Perpetual Contract and a Position Manager that enhances yield farming, incentivizing early adoption with increased rewards.

- $SUSHI: SUSHI has seen a 55% rise, suggesting a healthy appetite for this asset among traders after its renewed gameplan for the protocol.

- $TON: TON's value has increased by 52%, crossing the halfway mark to doubling its value.

Degen Corner

- The 19th Gitcoin Grants program is now open for participation. If you plan on contributing, aim for amounts that are $5-$10 or more. This has led to users being airdropped in the past.

- $WEMIX has seen a 105% increase over the past 7 days has been attributed to its comprehensive ecosystem, partnerships, and the integration of blockchain in gaming to create a more engaging experience.

- The early admission of $MEME to Binance, carrying a substantial initial market capitalization of $1.6B, has elicited a varied reaction from the market.

- $BITCOIN, $MOG, $JOE, $SPX, and Smurf Cat: These coins are currently in a consolidation phase, and it's an open question whether they will continue the momentum they have recently shown.

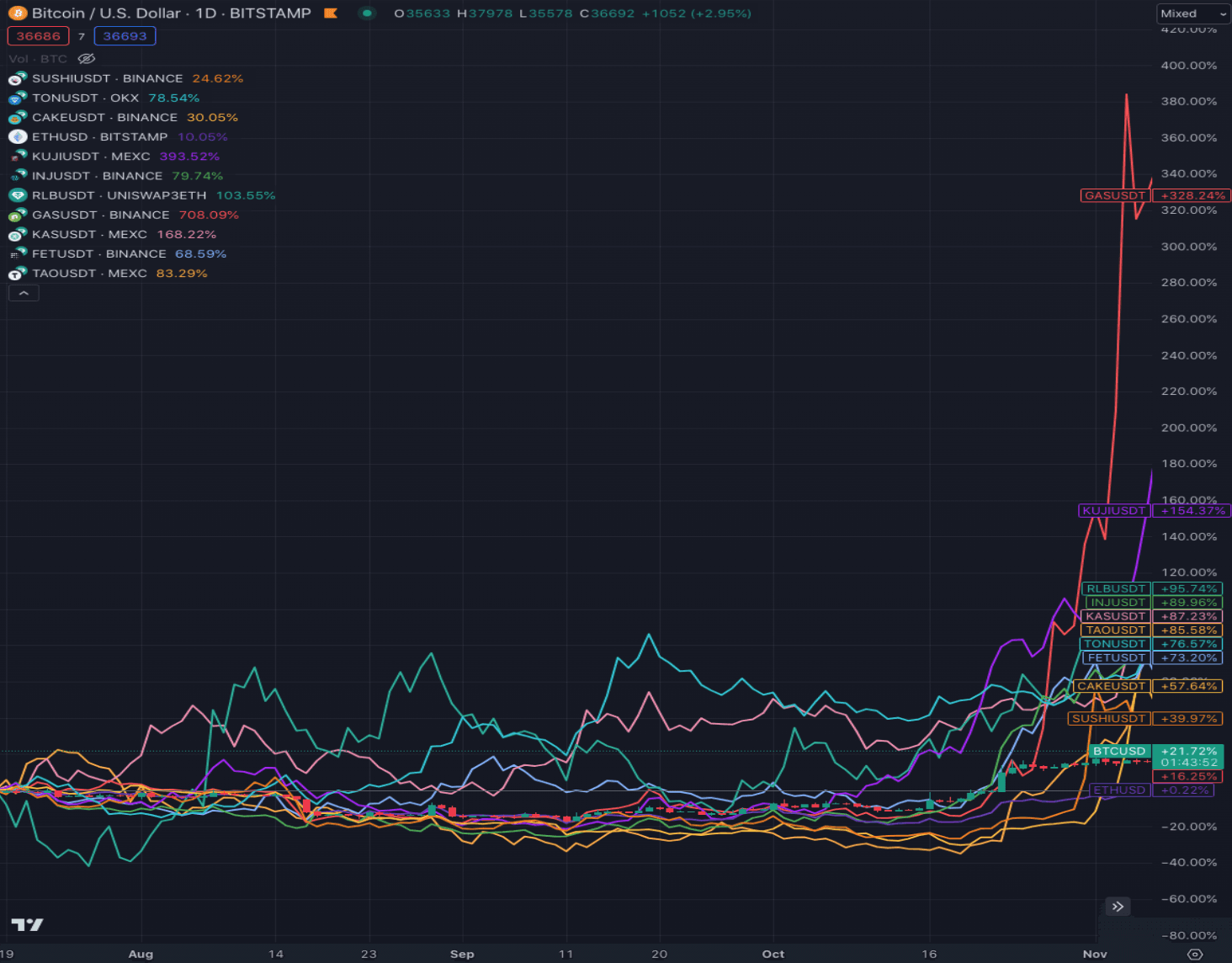

- $GAS has seen an extraordinary sevenfold increase in its price within a fortnight, marking it as one of the most actively traded crypto recently in the current market.

NFTs & Gaming

News

- Magic Eden is partnering with Yuga Labs to create an Ethereum NFT marketplace committed to enforcing creator royalties, launching by year-end. This move follows Yuga Labs' plan to sever ties with OpenSea due to its shift towards a royalty-free model, causing a decline in revenue.

- The Simpsons recently aired an episode that humorously targeted NFTs, but prior to this satirical take, the show had released two NFTs for fans to buy and trade, showcasing the growing presence of NFTs in popular culture.

- Jokerace have introduced NFT allowlists.

- Vertu's CEO presented the Metavertu II as a luxury crypto phone that serves as a "passport to the Web3 world."

- OpenSea Pro is now live on Polygon.

- Rarible introduce RaribleX.

- Yuga Labs co-founder spends $1.5M on NFTs in recent days.

Degen Corner

- Fusionist, a web3 gaming firm, is gearing up for its second beta test scheduled for November 22 on the Steam platform. This time, the test will be extended to accommodate 3,000 participants. In May 2022, Fusionist successfully raised $6.6M during its seed round, with leading contributions from Binance Labs and FunPlus. Be sure to try to participate.

- The Phantom Galaxies platform has opened its mint for the third class of Avatars and Starfighters, available without gatekeeping or whitelists. Users can mint NFTs using ASTRAFER tokens.

- Try out the new creator dashboard on Sudoswap.

- Pixels have migrated to Ronin. Play and mint NFT pets and earn $BERRY.

- The Machines Arena has launched Beta Season 2, offering character skins, an in-game store, a new game mode, and more. The update includes bugfixes, free bundles for players, and Halloween-themed outfits in the in-game store.

NFT-related tokens: the current market leaders in terms of volume, market cap, and token price are still made up of projects that were at the center of the last bull run. It will be interesting to see if this changes in the coming cycle. Another important note is that tokens such as $MANA and $SAND still continue to be traded despite the metaverse narrative largely fading. Currently, Polygon seems to be developing the most exciting ecosystem for gaming and NFT-related projects, and the user base is reflecting this.

This is just a preview, be sure to check out the full version of this report here!

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.