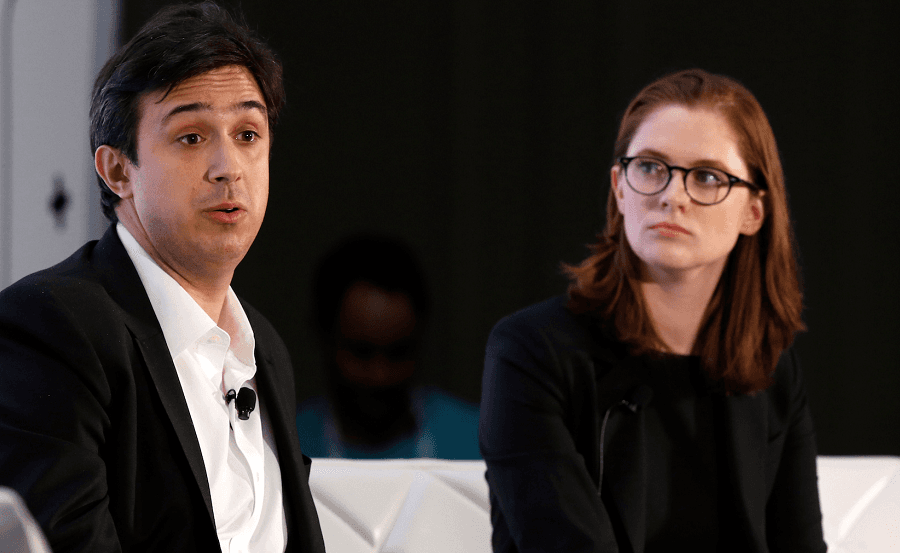

Tezos was co-founded by husband and wife team Arthur and Kathleen Breitman, and the Swiss based couple began developing the project in 2014 when the project's white paper was first published.

The duo appeared well placed to lead such an innovative project with Arthur serving as a vice president for Morgan Stanley between 2013 and 2016, and Kathleen boasting two years with professional services firm Accenture on her resume.

Tezos was an ambitious project that intended to bring forward a self-amending crypto ledger technology that would increase security and trust whilst improving on the existing Bitcoin and Ethereum networks.

The team behind the project also saw themselves as providing the world with a superior alternative to Ethereum and were quite upfront about their prospects. Arthur Breitman felt that the mechanics utilized by Tezos would act as a kind of "rule of law" and prevent the shortcomings that led to The DAO hack and Ethereum blockchain split last year.

Essentially, Tezos tackles the issue of governance and development within a decentralized network made up of different actors who may not share the same incentives and goals. As a result, the behaviour of the people behind the project has something of an ironic twist to it.

The ICO

The Tezos ICO began on July 1 and ran for a period of 13 days, with the ICO taking the form of an uncapped crowdsale, meaning that there was no limit on the total amount of tokens sold or donations received. At the end of the crowdsale the project had amassed around 65,627 BTC and 361,122 ETH.

The Tezos ICO began on July 1 and ran for a period of 13 days, with the ICO taking the form of an uncapped crowdsale, meaning that there was no limit on the total amount of tokens sold or donations received. At the end of the crowdsale the project had amassed around 65,627 BTC and 361,122 ETH.

This was worth an approximate $232 million which saw the blockchain project break records and surpass the crowdsale total previously set by Bancor. The euphoria felt at holding such a successful token sale would soon wear off with the founders becoming embroiled in a messy dispute.

The Infighting

Tezos is owned by DLS (Dynamic Ledger Solutions), a company owned by the Breitmans and a number of venture capital partners. The blockchain project is also supported by the Tezos Foundation, which acts as an independent, non-profit organization that seeks to ensure best practice and allow for the holistic development of the entire project.

Over the past few months there has been an increasing amount of discord between the Breitmans and Johann Gevers, the head of the Swiss foundation with both parties engaging in a public display of mudslinging. The couple have called for Gevers to resign from its board as they feel he exercises undue control of the financial resources at his disposal.

Gevers has responded by asserting that “the Breitmans have attempted to bypass the Swiss legal structure and take over control of the foundation, and have acted destructively, causing months of delays in the Tezos project.”

The foundation manages the $232 million raised in the Tezos crowdsale and must be independent under Swiss law. This dispute has resulted in a delay of the release of the Tezos token with the futures market for the tokens plummeting by around 75% since news of the dispute became public.

The Impact

The immediate impact of this public fall-out has been a significant increase in the level of scrutiny around the entire project. It has since become clear that the Tezos legal structure involves the foundation paying to acquire the company controlled by the Breitmans, and then spending the bulk of the ICO money to develop and promote the platform.

This arrangement has led to some questioning whether Tezos’s plans fit within the bounds of the Swiss legal system’s definition of a foundation and the lack of transparency around this issue coupled with delays that will see the token release put off until February 2018 have left investors with few options.

In the past few days, a class action has been filed in the district court in California on behalf of investors by attorney James Taylor-Copeland. The lawsuit names the Breitmans and Gevers, Dynamic Ledger Solutions, the Tezos Foundation, and also Strange Brew Strategies, the public relations firm that promoted the project leading up to its ICO as defendants.

The suit alleges that Tezos violated US Securities Law by selling unregistered securities, committing securities fraud, false advertising and unfair competition by misleading investors regarding the nature of the company.

The class action includes an estimated 30,000 people who bought “Tezzies” and seeks to allow them to rescind their purchases and other damages and we can expect that this lawsuit is just the first of many.

The ICO market is often described as the Wild West and the resolution of this dispute will have far-reaching implications for future ICOs. The high profile nature of the Tezos project failure will completely eradicate investor confidence in the sector and the authorities are also poised to step in and inevitably provide governance and regulation.

This could lead to a rapid decline in the previously booming ICO market.

The Insights

The ownership structure used by the Breitmans was always going to be problematic, and the fact that Tezos is owned by DLS which the couple own alongside their venture capital partners surely led to the decision to give the group a pre discount months before the ICO in September 2016 and then again during the main sale with 8.5% going the Breitmans and billionaire Tim Draper.

The ownership structure used by the Breitmans was always going to be problematic, and the fact that Tezos is owned by DLS which the couple own alongside their venture capital partners surely led to the decision to give the group a pre discount months before the ICO in September 2016 and then again during the main sale with 8.5% going the Breitmans and billionaire Tim Draper.

These pre sales and pre ICO discounts are becoming more prevalent but actually work against retail investors with the bigger and institutional investors “dumping” their heavily discounted tokens on the market and ruining the prospects for regular investors. The Tezos fiasco has shed more light on the backroom workings of many ICOs and improvements in disclosure practices are needed across the board in order to maintain investor confidence.

The token sale has also come under renewed scrutiny as investors start to question the wisdom of holding an uncapped ICO. The lack of a cap means that the tokens are more likely to fail as the secondary market has been destroyed. Any investors unable to take part in the crowdsale could still buy the tokens in the market which would help maintain the tokens market value, stimulate some positive price action, and therefore reward the early retail investors.

Token sales should be set up to benefit the project and retail investors and not a select group of early investors as is often the case. It’s clear that blockchain projects need to get back to basics and investors need to become savvier and steer clear of the razzle-dazzle ICOs whilst also guarding their value as financial supporters.

It seems that the days of the high profile, record breaking ICO have come to an end. Investors will surely begin to focus on tightly run, highly transparent, small cap projects that come to the table with more to offer than a white paper and grand promises.