Bitfinex to Suspend Trading in Chain Splits Tokens

Today, Bitfinex has announced that they would suspend the trading of all Bitcoin Chain Split Tokens (CSTs). Below is the tweet that made it clear:

These CSTs were futures contracts that Bitfinex made available to traders so that they could bet on the outcome and price of any future splits in the Bitcoin network. They were due for expiry today.

Hence, those who have contracts which are still valuable such as the Bitcoin Core (BCC) and Bitcoin BTC (BT1) will be credited the value of these tokens in Bitcoin.

Given that the Bitcoin unlimited and Bitcoin Segwit 2X hardforks will expire worthless, they will be removed from the user accounts.

Community Upset

Although this may sound like quite a routine task for a futures provider to undertake, many in the community were not happy with the announcement. Particularly, they did not like the idea that the failed fork futures would be terminated.

Indeed, Bitfinex has not created the most trusting environment as an exchange with the numerous rumours regarding Tether and other exchange withdrawal problems. Yet, futures are legal contracts.

Many traders think that the futures contracts that they had entered into particularly on the SegWit2X fork may still have some value. This on the belief that the SegWit2X fork may still be in the works.

Many users responded to the Bitfinex tweet with disbelief and anger as they realised that their future tokens would now be worth nothing by the end of the day.

Unfortunately, the rumours that the 2X fork may still go ahead were proven to be unsubstantiated. The proposed development team had not making any headway.

Futures Contracts Expire

Although the users may have had hopes as to the resurrection of the splits, Futures contracts are time dependent bets on the future price of an asset.

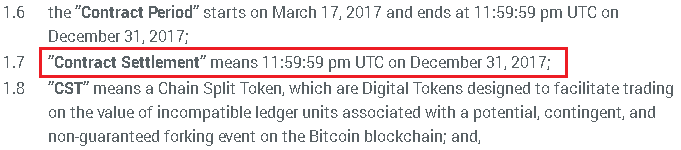

In this case, the contracts were due to expire on the 31st of December 2017. Given that there are still no tokens for either of the Chain splits, the bet would have expired worthless.

Hence, only those that bet on the future price of BCC or BT1 will now have any pay-out from these tokens.

It is also clearly stated in the Bitfinex terms of service that these Futures contracts would expire at the end of this year. Below is an extract from their T&Cs that outline these futures contracts.

This was picked up by a number of users and pointed out in reply to some of those who were calling out Bitfinex.

Cursory Lessons

As traders, when you enter a futures contract you are entering a bet on the future price of an asset. Futures are inherently risky as they are in traditional financial markets.

With cryptocurrencies such as Bitcoin Futures, they can be that much more volatile and risky. Yet taking a bet on the price of an asset that has not even been created has so many unknowns.

In future, traders should carefully consider their chances of a chain split actually occurring and make sure that they only invest as much as they are willing to lose.

Featured Image via Fotolia

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.