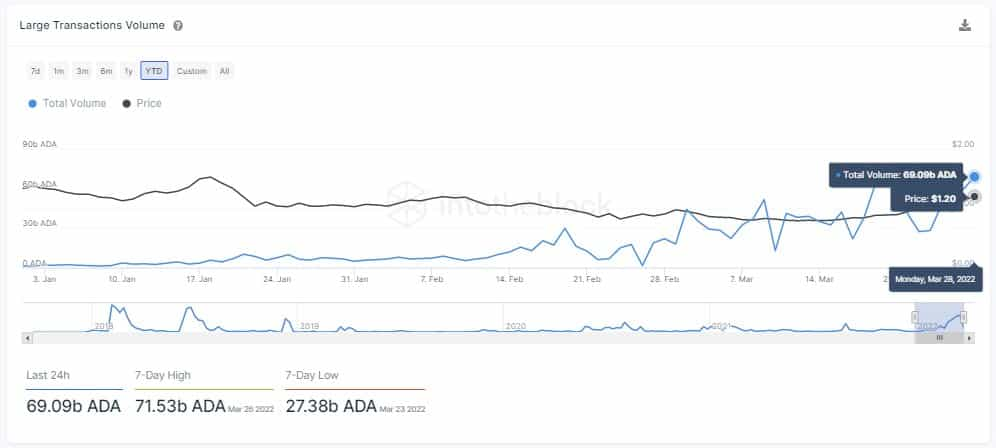

As ADA holds the $1 range, Cardano is welcoming an increased demand from large players according to blockchain intelligence company IntoTheBlock.

“Cardano is experiencing increasing institutional demand

The volume of on-chain transactions >$100k has increased by 50x just in 2022

Yesterday, a total of 69.09b $ADA were moved in these large transactions, representing 99% of the total on-chain volume.”

Cardano’s big numbers cast a tall shadow over the same stat from the beginning of the year, when only 1.35 billion ADA in volume were traded on January 1st. It’s a 51x increase and represents one of the highest levels in the past 3 years.

Charles Hoskinson’s Ethereum challenger is seeing the increased demand at the same time that multiple Cardano DApps are beginning to roll out and the new Cardano-based non-fungible token (NFT) marketplace AdaSwap is up and running.

AdaSwap aims to be a major decentralized exchange (DEX) on the Cardano chain. It attracted a slew of high-profile investors, including iAngels. Shima Capital, Pluto Digital, GBV Capital, Stardust Capital, Efficient Frontier, Finova Capital, Banter Capital and Coti.

Actress, producer, and “Wonder Woman” star Gal Gadot and her husband Jaron Varsano also participated in the seed round.

Image via Shutterstock

Image via Shutterstock

“Many NFT platforms suffer from poor curation, with hundreds of copycats impersonating famous NFT collections such as the Bored Ape Yacht Club. This can be misleading and cause confusion for users. Add to that, most NFT marketplaces today are boasting high gas fees from the Ethereum Chain while DAFT enjoys very low gas fees from the Cardano chain. There’s also a lack of decentralization on existing NFT marketplaces, meaning that their users have no control over which collections are listed,” AdaSwap explains.

Yesterday, SEC-regulated digital asset management firm Waves Financial announced a new fund to support decentralized finance (DeFi) on Cardano. Starting with an initial $100 million, the fund, called the ADA Yield Fund, is designed to provide liquidity to new DeFi platforms launched on the Cardano ecosystem.

“We’re thrilled to continue breaking ground in the field of cryptocurrency through the creation of innovative new funds, and today we are launching what we believe is the first pure liquidity provisioning fund in crypto,” said David Siemer, CEO of Wave Financial. “Our new fund will support the new decentralized exchanges, lending protocols, and stablecoin issuers building on Cardano. Each of these decentralized applications adds to the strong foundation of the Cardano blockchain as it realizes a fully functional and diverse ecosystem.”

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.