Cryptocurrency Markets Bleed Out With End of Year Sell-Off

With the massive gains the cryptocurrency space has been seeing since November, many in the community have been joking that "Christmas came early this year."

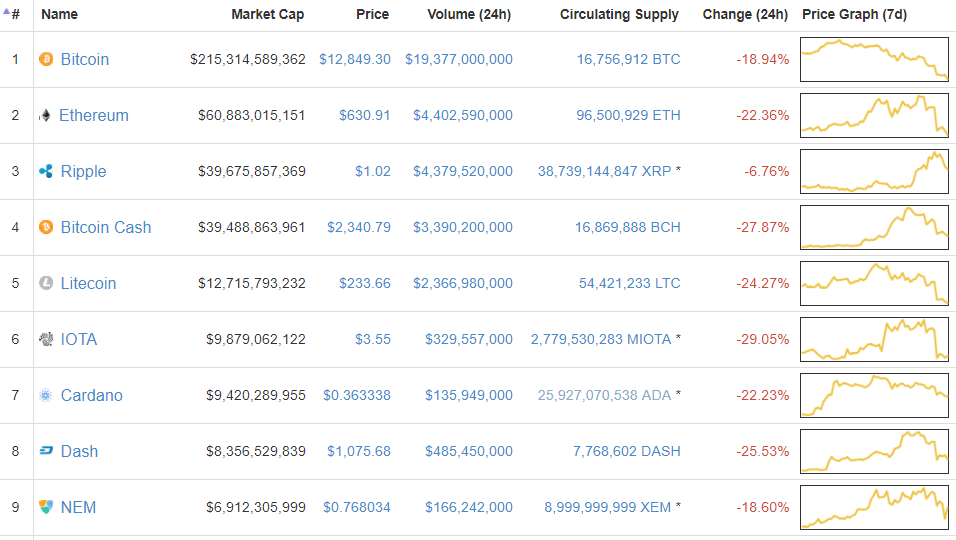

But that doesn't necessarily seem to be the case any more, as traders the world over are awaking to a major crypto bleed out, with most of the cryptocurrencies in the top 100 by market capitalization down by at least 20 percent.

The market has tanked today - Image via CoinMarketCap

The market has tanked today - Image via CoinMarketCap

Most of us figured such a retracement was just around the corner, as what goes up must come down. But, just like having a bucket of cold water dumped over your head, it can take your breath away for a few seconds regardless if you know it's coming.

So what gives? Is there anything driving this acute downtrend?

Well, to start off, we can rule out any kind of dreadful regulatory developments, e.g. the United States' Congress banning crypto ownership in America or something titanic of that sort.

In fact, there's been major adoption news in the past 24 hours, with Goldman Sachs announcing the launch of its own crypto trading desk. So these drastic price movements don't seem to be news-driven as is common. Instead, they appear clearly market-driven.

And the ways this price slump could've materialized is manifold.

First, you have to wonder if "weak hands" are getting shaken out, as it were. This line of thought is perhaps the dominant theory on the cryptocurrency forums as I've been perusing over them this morning.

"Weak hands," as in new investors who bought near the top (bitcoin at $19,000 or ether near $870, for example) who couldn't stomach an acute five or 10 percent retracement. So when the newcomers sell-off, it can trigger a panic sell that avalanches into a 30 percent retracement like we've just seen with the bitcoin price at press time.

Another viable theory? Institutional funds have entered the market, and now they're using their power and know-how to drive cryptocurrency prices down, particularly bitcoin's price. The idea behind this contention is that these hedge funds are shorting BTC through bitcoin futures.

To this end, Ross Norman, CEO of bullion firm Sharps Pixley Ltd., just told Bloomberg that “Bitcoin’s been heavily driven by retail investors, but there’ll be some aggressive funds looking for the right opportunity to hammer this thing lower.”

A much more speculative theory that's getting some traction is that perhaps Roger Ver -- owner of Bitcoin.com and ardent Bitcoin Cash (BCH) supporter -- just launched a massive +5,000 BTC sell order on Bitfinex. There doesn't appear to be any direct proof of this angle yet, but Ver would certainly have the bitcoin riches to launch such a massive sell-off.

But what should be remembered is that it wasn't even a month ago that BTC hit the $10,000 price point for the first time in its history. Relatively speaking, Bitcoin is still sitting higher than it has in any previous month. That's still incredible.

So there's no cause for pure madness just yet. These kinds of retracements are par for the course in the premature crypto space.

And while some are calling this one of crypto's "biggest tests" yet, you get the sense they haven't been around for long. Because today's bleed out is nothing like the crashes of yore. We'll all just have to see what happens next.

Featured Image via Yahoo Finance

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.