NEO Climbs as Concerns Raised, many Claim FUD

This was a really strong weekend for NEO (Antshares). The "Chinese Ethereum" had some really strong performance over the weekend as the price rallied on news and speculation.

As NEO was rising over the weekend, there was some criticism that was levelled at it from someone on Github. These were interesting to read and made some valid points that some may consider "warning signs".

However, there were many in the community who claimed that these were nothing more than FUD. In a well thought out post by NEO insider Malcolm Lerider. He did a good job of dispelling a great deal of the concerns.

Below we will take a look at the individual criticisms and how Malcolm addressed them.

NEO is too Centralised

The GitHub author claims that the network is really centralised because there are only "13 validating nodes". He further went on to claim that these have to be whitelisted and approved by the developers. The notion of developers selecting the nodes is indeed a concern for many who believe in decentralization.

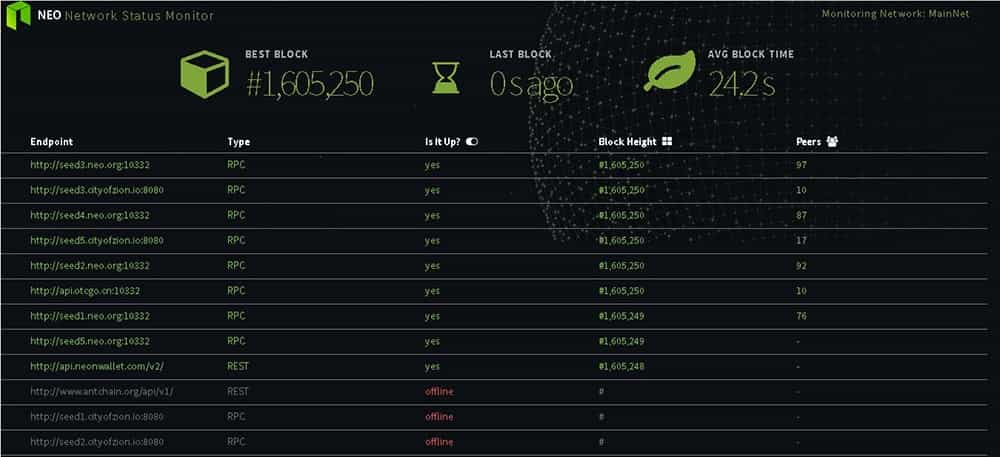

The individual also posted an image with these 13 nodes. From the image, it appeared as if all of these 13 NEO nodes were down. This may have created an impression that these NEO nodes are not operating at all.

While Malcolm agrees that NEO is quite centralised, the 7 validating nodes are there for specific reasons. This was described in the white paper for NEO.

Moreover, these nodes are not whitelisted by the developers but they are voted in by the community of NEO holders. This means that although there are a limited number of consensus nodes, they are choosing in a democratic fashion by the community.

With regards to the picture that was shared, the writer may have been intentionally misleading. As Malcolm pointed out, if you refreshed the page on the site he referred, one can see that the nodes appear inactive. However, give it a few seconds to load and they are online.

Image via cityofzion

Malcolm pointed out that there was "100%" uptime since the launch of the MainNet.

NEO's Blockchain Dissappeared

The author went on to talk about the outage on the NEO blockchain in October. He claimed that because of only 13 validating nodes, the entire Blockchain was unable to be viewed. This may have worried certain people as the outage lasted for a few hours.

He also went on to claim that the reason given for the outage was not sufficient. He said that the "manual checks" behind the shutdown had something to do with the 15m movement of tokens.

Malcolm was quick to dismiss this. He stated that at no time did the Blockchain go dark. He also delicately broke down how the unlocking of the 15m NEO was done and how the tokens will be returned to another address.

Another thing that was left out by the author of the Github article was that detailed response that the NEO team wrote in response to the event.

There is no Activity on the NEO Github

The critic then went on to discuss the lack of activity on the NEO github pages. He claimed that the last update was over 16 days ago and the last three updates appeared to not be "substantial" enough. He made that claim that a Github that is not active is a sign of an "abandoned" project.

There were many people who took issue with this statement. Some of the defences were that the NEO team may not use Github that often as they are indeed Chinese based.

However, according to Malcolm there is a really important reason for this. The repository that he was looking at was the live project that has been deployed. There would be something alarming to see many changes in the code in the MainNet.

Malcolm also went on to explain the role of forks in the development of NEO. Since the inception of NEO, there have been 5 times as many forks as there were for the Bitcoin blockchain. Indeed, with other projects that may not have so many forks their Github may have more information.

Malcolm also opened the door to being more activite on the main Github page but this would have to come with important reasons. Merely claiming that lack of activity was concerning is not good enough of a reason in Malcolm's eyes.

Limited Smart Contracts on NEO Blockchain

The "investor warning" author also took issue with the fact that there were only 6 smart contracts currently on the NEO blockchain. He claimed that a 2 year old smart contract system with a $3bn market cap could not reliably have only 6 contracts on their blockchain.

What the author failed to disclose however, is when smart contracts officially became deployable. According to Malcolm, they were only launched in August of this year. These smart contract deployments also come at a cost 500 GAS on the MainNet.

If one was to take a look at the number of smart contracts currently available on the testnet, there are hundreds of projects in development. Malcolm claims that the GAS fee is used precisely in order to prevent the deployment of poor smart contracts.

Malcolm urged the author to take a look at the smart contracts on the MainNet in a few months and use that as the best comparison.

Heavily Concentrated in the "West"

The author also made the claim that there was relatively no interest from the Eastern markets in NEO. He gave an example of the trading volume in NEO which seemed to be mostly on Binance or the Bittrex Exchange. He was trying to make the claim that for a Chinese project, there was very little "Asian" demand.

Malcolm was able to lay this aside quite effectively. He claimed that no one knows the trader profile in exchanges such as Bittrex and Binance. It would be incorrect to characterize them as "western". There may be a great deal of Asian traders on this exchange and no one can make a statement about the perceived users.

Scammy ICOs and dApps

The author also went on to claim that NEO somehow "attracts" scammy ICOs. He discussed a project called "AdEx" that he raised a number of concerns about. He also took issue with one of the other ICOs called Red Pulse and went over his rationale.

Although he may indeed have clear points about the ICOs in question, an open source blockchain cannot be held responsible for the actions of a company that would like to raise an ICO off of it.

Malcolm countered the assertion that NEO somehow "attracts" bad ICOs. Due to the fact that it costs 500 GAS to deploy a contract on the MainNet, it acts as a major disincentive for scammy ICOs. If they really wanted to raise funds in the quickest and most effective way possible they would use a blockchain with less GAS requirements.

"Announcements of Announcements"

Lastly, the author did not like the idea that the team at NEO would claim that they were about to release some news. He had the view that these were “frowned upon" practices in the cryptocurrency community and that certain projects had already ceased the practice.

Malcolm rightly pointed out that NEO wanted to keep the community up to date with important announcements. It was indeed quite an eventful weekend for the project as Ontology launched and the NEON whitepaper was about to be released. It may have informed the community of helpful information.

Is This all Just FUD?

Whether a critique by someone is merely "FUD" is hard to tell. When someone brings forward legitimate concerns that they may have with a project, it should not be labelled as FUD.

However, it is equally important to not be disingenuous with the concerns that are raised. It is also really encouraging when members of the project take the time to address the concerns head on. Moreover, Malcolm has claimed that he is more than willing to address any other concerns that the author had.

Healthy conversation in the cryptocurrency community is encouraged, yet people's incentives should be clear. The author takes tips in Ether, QTUM and WAVEs.

One can only wonder which projects he is backing...

Featured Image via Fotolia

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.