Nigerian Central Bank Warns of Cryptocurrency "Risks". Ironic?

In a country that is synonymous with internet and mail scams, it is quite surprising to see that the Nigerian Deposit Insurance Corporation (NDIC) has warned its citizens about the danger of trading cryptocurrencies.

Indeed it is also quite ironic that Nigerians should be warned about the risks of cryptocurrency volatility while the risks of losing money to an infamous Nigerian 419 scam are almost certain.

The Original Phishers

There is no doubt a great deal of phishing activity these days as hackers try to steal login credentials for online exchanges.

They have made use of increasingly sophisticated methods from making fake apps on the app store to altering UTF URL structure to fool users as to the identity of the site.

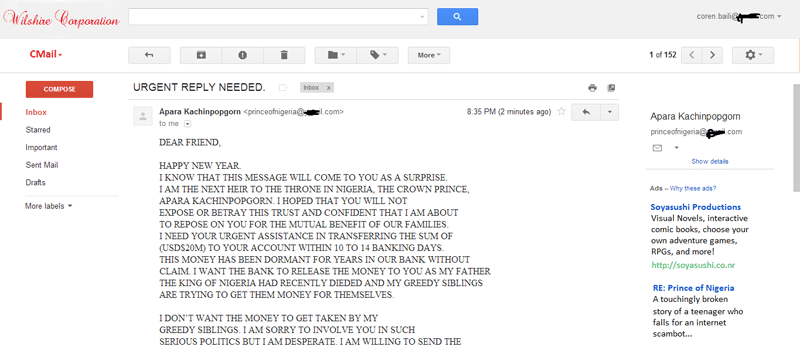

However, phishing for important information of people started in an extremely low tech way in the west African country. People would receive unsolicited emails or mails from the scammers purporting to be a "Nigerian Prince".

The goal of the mail was to goad the victim into handing over sensitive financial information such as bank account, identifying information etc. Once this was captured, they would use it for illicit purposes.

The Wonder Bank

The comments came from a workshop that was held by the NDIC. The director at the NDIC said that citizens should be careful when dealing with cryptocurrencies as there are potentially "negative consequences".

He also said that the NDIC could not insure the stability of any cryptocurrency that was not issued by the Nigerian Central Bank. He went further by stating that a committee was established to make sure those that did engage in crypto trading were not exposed to the unnecessary risks.

Although restricting traders from engaging with cryptocurrencies may be overkill, there is reason for the government to worry about proven scams. One of them was the so called "wonder bank".

The modus operandi of the scheme seems to have the hallmarks of a ponzi with unrealistic promises of returns. He also claimed that a great deal of people have lost their life savings with the scam.

Yet, it seems as if the director was not able to appropriately discern between legitimate cryptocurrencies and a pyramid scheme. He said:

Also the emerging trend of investing in digital currencies popularly known as Bitcoin is equally dangerous because just like wonder bank, the digital currencies are not licensed by the CBN and therefore not insured by the NDIC

Responsible Regulations

If the Nigerian authorities are legitimately concerned about the impacts of scams on the victims, then this is a welcome change. However, instead of targeting established names like Bitcoin, they should also focus on the email scams emanating from within their borders.

Yet in today's crypto age, the Nigerian Prince scam is a lesser threat.

Sophisticated hackers and state backed cyber threats are lurking on the wild west of the web. A simple spam email with badly written English is the least of crypto holder’s worries.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.