Review of Bitshares (BTS): The Original Decentralised Exchange

BitShares is a blockchain-based distributed autonomous community that has developed and maintained the codebase for the BitShares Blockchain, one of the most advanced blockchain platforms for running decentralized FinTech. Their innovative Blockchain as Organization (BaO) architecture integrates financial technologies into efficient and transparent financial ecosystems.

Bitshares (BTS) was launched back in July 2014 as one of the first decentralized cryptocurrency exchanges. It also serves as an open source financial platform, as you’ll see later in this article.

One of the primary problems being solved by Bitshares is the risk that is inherent in centralized exchanges. That doesn’t just mean traditional exchanges, but also the centralized cryptocurrency exchanges, which have proven to be unsecure as seen by the famous Mt. Gox hack and the more recent Coincheck hack.

There have been numerous other smaller hacks as well, and this has led to the loss of funds for scores of users, simply because they had to place their trust in a centralized third party provider.

Bitshares seeks to eliminate the potential for loss through hacking by decentralizing, making it very difficult to compromise the exchange since the data is not being stored in one central location.

Bitshares Origins

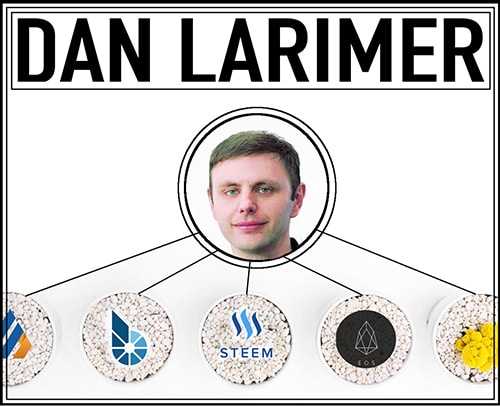

Bitshares was conceived of by Dan Larimer, who is also the co-founder of Steemit and EOS, as well as being the current CTO of EOS. He initially brought the Bitshares project to life with Charles Hoskinson, who himself is the co-founder of Ethereum and Cardano.

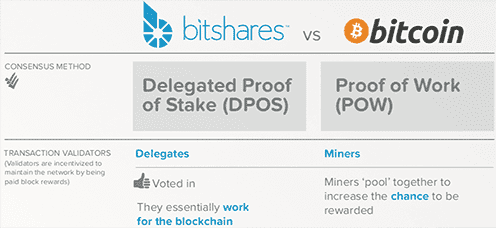

Larimer want to build Bitshares because he thought that proof of work mining was flawed due to network centralization. To get around this he came up with the Bitshares concept, and a new consensus algorithm which he called Delegated Proof of Stake (DPoS). This consensus algorithm is not just more efficient, but it also gives Bitshares greater network speed and flexibility.

How Bitshares Works

Unlike centralized exchanges that now require fairly extensive personal information from their users, Bitshares is quick and easy when it comes to account creation. There’s no need to provide them with detailed personal information.

In fact, there’s no need to provide them with any information. This makes Bitshares very attractive to those who are privacy conscious, and it also keeps the platform more secure, since user data is never stored on the network, and especially not on any centralized servers.

In addition to the added security, you’ll find that some of the volatility is removed from cryptocurrency exchange when you’re using Bitshares. This is because the exchange uses something they call SmartCoins as a stable coin. This use shows one of the main differences of Bitshares when compared with many other cryptocurrencies.

Rather than trying to be a peer-to-peer currency, Bitshares was created to be an exchange system with tokens tied to real-world assets. This is similar to the Polymath or Bytom projects, but it’s already functioning for years.

Bitshares users can stabilize any of their holdings by converting to stable cryptocurrency assets which are pegged to fiat currency. Note that there’s no need to actually convert the cryptocurrency to fiat, thus maintaining the users anonymity. In addition to the Bitshares blockchain and exchange, there is also a Bitshares token.

This can be converted to other crypto assets, such as the BitUSD, which is pegged to the U.S. dollar at a rate of 1:1. This keeps the value stable at all times, protecting users from volatility, and it also serves to keep assets on the blockchain.

Another amazing feature of Bitshares is is scalability and ability to process transactions. Bitshares is based on an open-source blockchain implementation known as Graphene which acts as a consensus mechanism. Other projects using Graphene include Steemit, and it is claimed to be able to handle 100,000 transactions per second. That’s more than Visa and Mastercard handle, combined.

You can also get a multi-currency wallet from Bitshares, which is available for desktop, web and mobile (Android only). Based on Google Play reviews the mobile version is somewhat buggy, but the desktop and web versions work well, with no significant issues being reported.

Delegated Proof of Stake (DPoS) and Governance in Bitshares

One of the main problems with proof of work consensus is that it is extremely resource intensive, and many have said this will not be sustainable long term. Another issue is the centralization that occurs with proof of work protocols. With the rise of ASIC mining chips, new miners have effectively been shut out of the ecosystem, leaving mining in the hands of an increasingly small number of miners or organizations.

This brought rise to the notion of Delegated Proof of Stake. In the traditional Proof of Stake implementation users are rewarded for holding coins with additional coins. In Delegated Proof of Stake we see the same mechanism, but it also adds a governance layer where users are permitted to delegate their stake to others.

This allows for the election of Witnesses, who serve to verify transactions, create blocks, and broadcast those blocks to the network. Witnesses are rewarded for their service with additional Bitshares from the reserves pool.

In this system, 1 Bitshare is equal to 1 vote. With most users holding marginal amounts of Bitshares, the voting process can be considered burdensome. Most users wouldn’t even bother to use their votes. This led to the rise of proxy voting, whereby votes can be delegated to others.

This speeds the governance process greatly, and while the group of Witnesses is centralized, it is a temporary centralization, since any Witness can be voted out at any time, maintaining the core decentralization of Bitshares.

Bitshares Decentralized Exchange (DEX)

In the traditional exchange the exchange accepts fiat payments and issues IOUs to users, creating counterparty risk. In addition, they also act as the clearinghouse for orders, maintaining the order book to facilitate buying and selling. This centralized system of order management creates unnecessary security risks that decentralized exchanges such as Bitshares look to avoid.

Thanks to the decentralized nature of Bitshares there is no central point of failure. The decentralization also removes the counterparty risk that occurs when the exchanges are handling all the order matching functions. Even in centralized cryptocurrency exchanges we’ve seen what can happen with centralization, including mismanagement of keys that can lead to security breaches and the loss of hundreds of millions of dollars worth of assets.

Bitshares, and OpenLedger, which works on the Bitshares blockchain, operate as trustless gateways to exchange assets, with that exchange being recorded on the blockchain. The gateway goes out to buy the coin and then transfers it to your wallet. They don’t hold it for you like a centralized exchange would.

This keeps you in control of your private keys, and is more secure than allowing an exchange to keep control of your keys. As is often said in cryptocurrency circles – “If you don’t hold the keys, you don’t own the coins.”

Decentralization provides other benefits as well. It can level the playing field for traders by eliminating the ability for bad actors to conduct the type of nonsense that is often seen on Wall Street and other traditional exchanges and markets. In those systems the rich and powerful insiders are able to place their infrastructure in such a way that they get the fastest execution of orders.

They also use complex trading algorithms that can front run markets, or they will use hidden orders to manipulate trade volumes and pricing. All of these shenanigans work to shut out the retail trader, but are not possible on a decentralized blockchain exchange like Bitshares.

Because Bitshares was created with the ability for users to create their own digital assets you can trade any number of digital derivatives with Bitshares. Stocks, bonds, commodities, and even other cryptocurrencies can be created as derivatives and can be traded against any other digital asset, so you could trade gold against bitUSD, or crude against ETH.

The possibilities are endless.

Stable coins are a hot topic in cryptocurrencies, but Bitshares already has that issue solved with their SmartCoins. The SmartCoins allow for the creation of the bitUSD, which is pegged to the U.S. dollar in a 1:1 ratio. 1 bitUSD can always be redeemed for $1 worth of Bitshares, and each bitUSD is backed 200% by Bitshares.

Witnesses maintain the price parity of the bitUSD. This single feature allows for options and collateralized shorts to be created, opening up the possibility for Bitshares to take some of the trading from the $1 quadrillion derivatives markets.

Perhaps best of all for many cryptocurrency enthusiasts is the freedom gained by using Bitshares. There are no personal information requirements, and you can avoid all the KYC and AML requirements, as well as skirting extensive paperwork and tax reporting requirements.

Additionally, there are no trading limits imposed on you by the Bitshares DEX. Trade any amount, at any time, and from any where in the world. There are no deposit or withdrawal limits since there is no account approval process or tiers based on the amount of personal information you’ve given away.

You’ll also find that Bitshares is one of the cheapest trading options available, with fees amounting to just a few pennies if you’re using SmartCoin pairs. Fees are subject to change, but since they are set by shareholder approval it isn’t likely that they would rise substantially.

Bitshares (BTS) Token

The BTS token is traded most heavily on the Bitshares platform, but is also heavily traded on ZB.com and Huobi's exchange as it is quite popular among Chinese traders due to the privacy features. You can also purchase on Binance.com and Poloniex.

The token itself has seen some volatility over the past six months, jumping to $0.40 in June 2017 and again in early May 2018. It saw its all-time high in January 2018 when it nearly reached $0.90 per token. As of May 16, 2018 it has retreated to $0.24 and has traded as low as 0.129 in 2018.

This volatility is not necessarily bad as it shows there is still interest in the coin, and as of May 2018 it remains the 36th largest coin by market cap with a market cap of $643 million.

Conclusion

As you can see, there are an large number of benefits that come from decentralized exchanges, which will likely make them the choice for the future. With Bitshares being one of the first ever created it does have a solid first mover advantage.

That said, they haven’t made the best of that advantage. The Bitshares Asset Exchange currently sees just $7 million in daily volume, with most of that coming from China. The exchange isn’t very user friendly, and is more suited to advanced traders, and there has been little done in the way of marketing.

Bitshares could be a leader in decentralized exchanges, but someone will need to lead that charge forward, and with creator Dan Larimer having moved on to the EOS project, there’s no telling who that might be.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.