Covesting Review: Complete Platform Overview

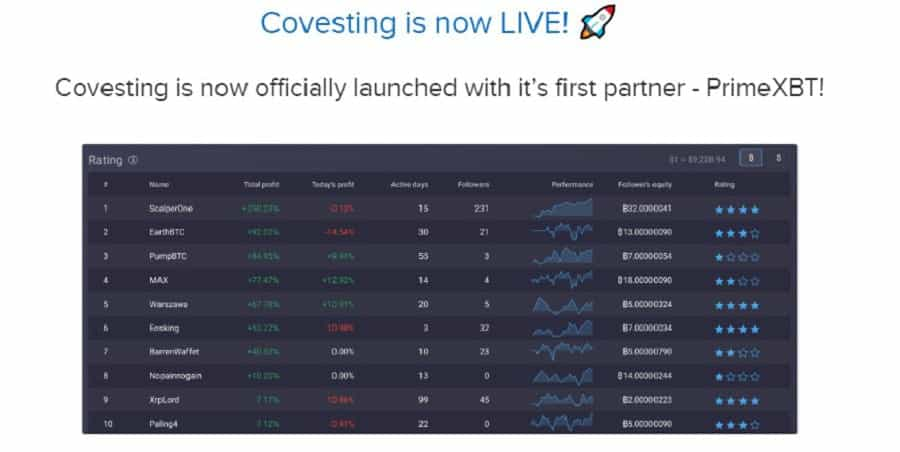

For those of you who have used PrimeXBT in recent months, you have probably noticed a new tab titled ‘Covesting’ at the top of your dashboard (once you have logged in, of course).

For those of you who were curious enough to click on it, congratulations! You are some of the first to see one of the most powerful cryptocurrency tools in action, and if you went as far as to use this tool, you are an early adopter.

The Covesting Module, which became available to all PrimeXBT users on August 17th of this year, gives you the ability to trade cryptocurrency AFK (away from keyboard). How you ask?

By allowing professional cryptocurrency traders to do it for you while you sit back, relax, and let the money roll in. If you want to see exactly how to do this in PrimeXBT, check out our other article. This article will focus on the Covesting platform itself and its promising COV cryptocurrency token.

What is Covesting?

Covesting is a company which builds trading tools. Their aforementioned Covesting Module allows you to copy the trades of some of the best cryptocurrency traders.

They have also recently launched the beta version of their fully licensed, legally compliant, and secure Covesting platform containing an arsenal of features including copy trading (more on this later). The Covesting Module will also eventually be available on other exchanges (which have not yet been named).

Is Covesting legit?

Covesting is a company registered in Gibraltar and is a fully licensed Distributed Ledger Technology Services Provider. In fact, their adherence to doing things by the book is part of why it has taken so long for their first public product, the Covesting Module, to become available to the public. The project faced a number of regulatory hurdles since its announcement in 2017 which have finally been traversed.

Is Covesting safe?

Covesting’s obsession with abiding by the rules is on par with their dedication to user security. For starters, all web traffic on the Covesting platform is SSL encrypted (https). They have also partnered with companies such as Cloudfare to protect against DDoS attacks. User passwords are cryptographically hashed, and 2FA is also available for login and withdrawal of funds.

Additionally, roughly 95% of cryptocurrency funds on the Covesting platform are kept in multi-signature cold wallets which requires the coordination of multiple employees around the world to access. All hot wallets are generated and secured by Microsoft’s Azure Key Vault. Any fiat currency assets are spread across multiple bank accounts, with separate accounts for user funds and Covesting’s operations.

A brief history of Covesting

Covesting was founded by a veteran Lithuanian trader named Dmitrij Pruglo, who is also Covesting’s publicly active CEO. Pruglo has over 12 years of experience trading “whatever moves” at some of the largest Lithuanian and Danish financial institutions and banks.

Shortly after becoming a licensed financial advisor, he started his own holdings company and began experimenting with real estate investing and became obsessed with cryptocurrency trading in 2015.

Pruglo realized that peer-to-peer platforms such as Airbnb and Uber are the future of many services in the global economy. Noticing that similar services existed in legacy financial markets for trading wherein investors could pay traders to trade their assets on their behalf, Pruglo decided to create Covesting.

It was to be a copy-trading platform which would let users copy the trades of professional cryptocurrency traders in a non-custodial manner (without actually giving their crypto to the traders). The Covesting whitepaper was released in late 2017.

Pruglo is obsessed with making sure that Covesting as a company and Covesting as a product has all the required certifications and meet all the regulations necessary to operate legally and securely.

He even noted in an interview that Covesting will never use a third-party KYC service for its users simply due to security and privacy concerns. This is also why the Covesting platform leverages the Ethereum blockchain; to make all gains from copy-trading transparent and publicly verifiable.

What is the COV Token?

COV is an ERC-20 token on the Ethereum blockchain used on the Covesting platform. As the platform’s native utility token, it serves multiple functions. The first is to pay for trading fees and receive a discount for doing so. COV tokens used to pay for trading fees are burned.

The second is as reward – all profits made from copy trading will be paid in COV tokens, making profits publicly viewable on Etherscan. The third is to reduce the platform fees for each profitable trade (more on this later).

Although not available at the time of writing, Pruglo has noted that COV tokens will also be used for staking on the platform to receive various benefits. One of these benefits will be the ability to use third-party algorithmic trading tools on the Covesting platform.

While the COV token was initially intended to be exclusive to Covesting’s exchange, it listed on multiple exchanges shortly after its launch. COV will also be available on all cryptocurrency exchanges which integrate its Covesting Module.

It is important to note that since the Covesting platform has yet to launch in its alpha version, it is unknown exactly how many of these use-cases for COV will remain, and what others may be added.

The page about the COV token on the Covesting website has not yet defined the terms for token burning at the time of writing. All those noted here were mentioned in interviews, Q&As, FAQ, and/or the Covesting whitepaper.

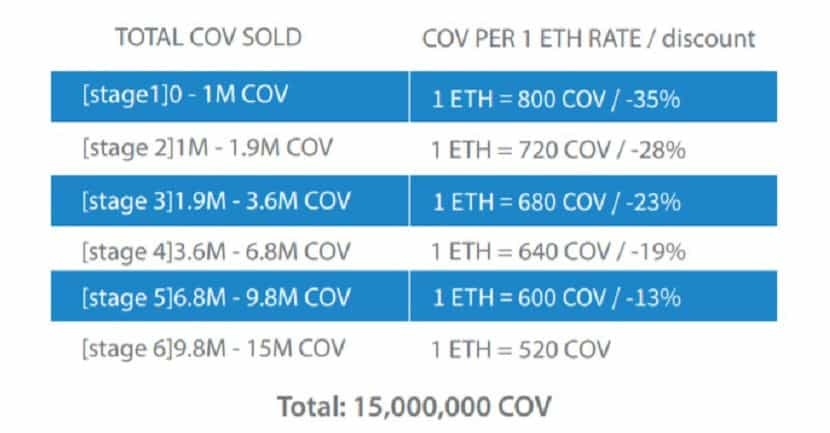

COV Token ICO

While the numbers are a bit hard to pin down, the Covesting Whitepaper states that 1.5 million tokens were allocated for a pre-ICO which took place in October 2017 and raised around 600 000$USD at around 0.40$USD per token.

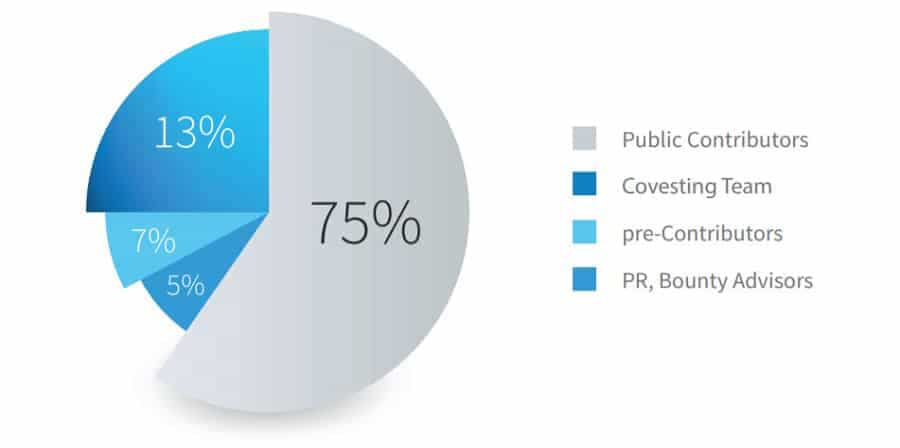

The initial coin offering for the COV token took place in November and December of 2017. An additional 15 million tokens were sold at an estimated price of 0.60$USD per token, yielding another estimated 8.5 million USD in funding.

The COV token has a maximum supply of 20 million and is a deflationary asset (because it can be burned to pay for trading and platform fees on Covesting). Of the remaining 3.5 million tokens which were not sold during the pre-ICO and ICO, 2.5 million have been allocated to the founders of the project, and the remaining 1 million COV will be used to pay advisors and any extra PR for the project.

The 9.1 million USD raised from funding was/will be allocated as follows: 40% for research and development of the Covesting platform, 25% for marketing and user acquisition, 30% for B2B partnerships and associated operational expenses, and 5% for legal and compliance fees. Pruglo noted in a Q&A that these funds would be more than enough to sustain operations for a few years.

COV Token Price Analysis

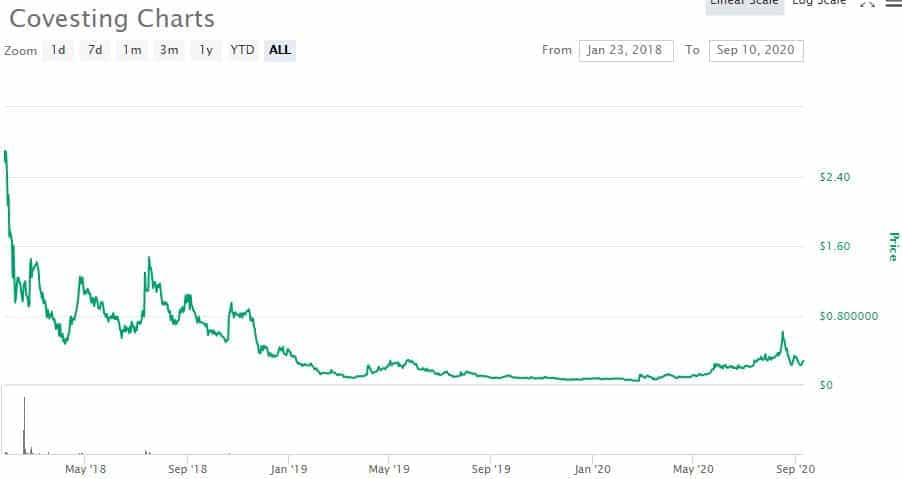

When COV hit the open cryptocurrency markets in January of 2018, it was trading at a price of nearly 3$USD. Unfortunately, this was the COV token’s all time high and its price was in a gradual decline until it hit a staggering low of less than half a cent USD in February of this year.

However, the announcement of the launch of the Covesting Module on PrimeXBT pulled the token back from the brink, and it has since been in an uptrend, recently recovering to roughly 0.30$USD, still only about half of its ICO price.

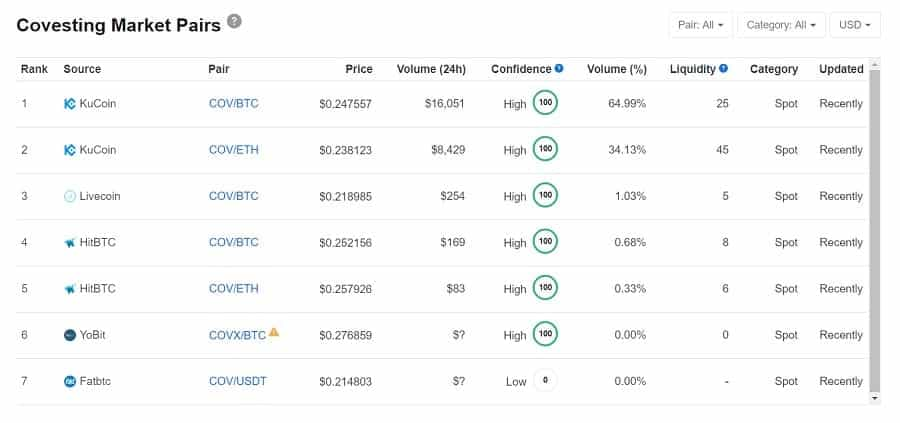

COV Exchange Listings

If you are looking to get your hands on some COV tokens, you are going to have a bad time. Your options are limited to the Covesting platform, KuCoin and HitBTC, with the latter of the three having a questionable track record.

To make matters worse, the trading volume across all exchanges is so low (around 30 000$USD in 24 hours) that it does not even register as a candle on CoinMarketCap. As such, you might find yourself paying a little extra to scrape some COV tokens from the shallow order books on these exchanges.

COV cryptocurrency wallets

If you manage to snag some COV, you will be delighted to find that storing this cryptocurrency is incredibly simple. Since COV is an ERC-20 token, you can store it on just about any cryptocurrency wallet which supports Ethereum based assets.

The list is long and it includes Trezor and Ledger hardware wallets, the Exodus Wallet, and Atomic Wallet (which are available on both desktop and mobile).

Covesting Roadmap

Although Covesting has been relatively slow in its progress, it has more or less been right on schedule according to its roadmap.

A few months after its ICO in late 2017, the tokens were listed for public trading on KuCoin and HitBTC. The majority of Covesting’s roadmap focused around relentlessly testing its trading platform and its features (especially copy trading) and acquiring the necessary licensing to make it legal.

In May of 2018, Covesting joined the Enterprise Ethereum Alliance. As one of the world’s largest blockchain initiatives, the EEA consists of over 50 companies inside and outside of cryptocurrency, some of which are also on the list of the Fortune 500. Members include Microsoft, Intel, J.P. Morgan, Accenture, Tendermint, and Consensys.

Watching Covesting’s earlier content on their YouTube Channel reveals an enthusiastic Dmitrij Pruglo who had clear-cut, no B.S. answers to every question asked about the project in multiple Q&As. However, as we all know, the 2017-2018 bull market did not last. Many of the products which were under development such as the Covesting mobile app seem to have been left unfinished (for now).

On the bright side, Covesting’s recent integration with PrimeXBT marks a paradigm shift for the project. Pruglo initially envisioned that cryptocurrency exchanges would make use of Covesting’s invaluable copy trading feature, and it seems that vision is finally becoming a reality. Although Pruglo has been discreet when it comes to partnerships, it seems that the adoption of the Covesting Module is well on its way.

Covesting platform tutorial

While the alpha version of the Covesting exchange platform has not yet launched, it is publicly available for beta testing. To access it, you will first need to create an account. The process for this is quite standard: email, password, confirm email, and you are ready to roll (ish).

As noted at the beginning of this article, if you would like to know how to use the Covesting Module in PrimeXBT, please refer to the Covesting Module section in this article.

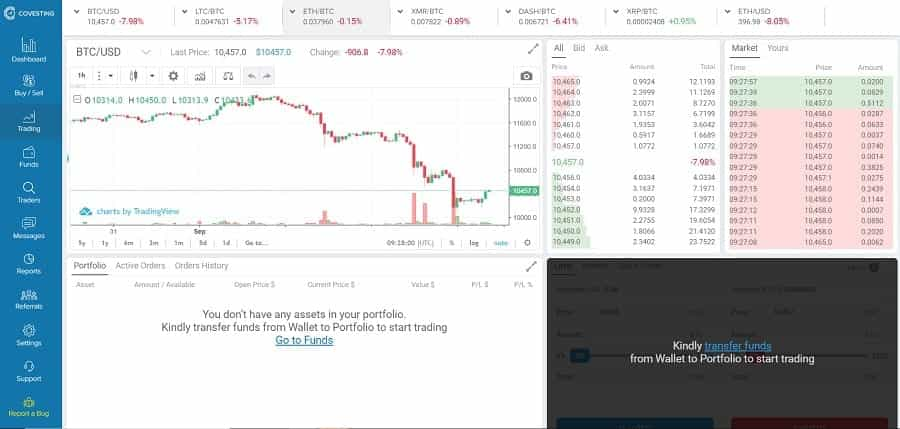

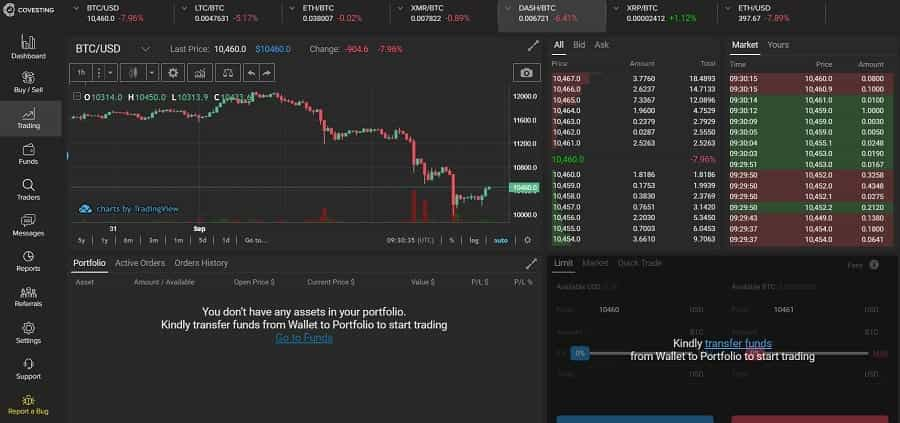

The Covesting platform features an extremely user-friendly interface. Features include a Dashboard where you can track your portfolio, an instant fiat-crypto (and vice versa) payment gateway, and a classic TradingView spot exchange.

There is also an intuitive Funds tab to view your crypto and fiat wallet balances, a directory of active cryptocurrency traders available for copy trading and the ability to message other users on the platform. You will also find a useful tool to generate various financial reports, referral incentives, user settings (including a seamless light and dark theme), and multiple customer support options.

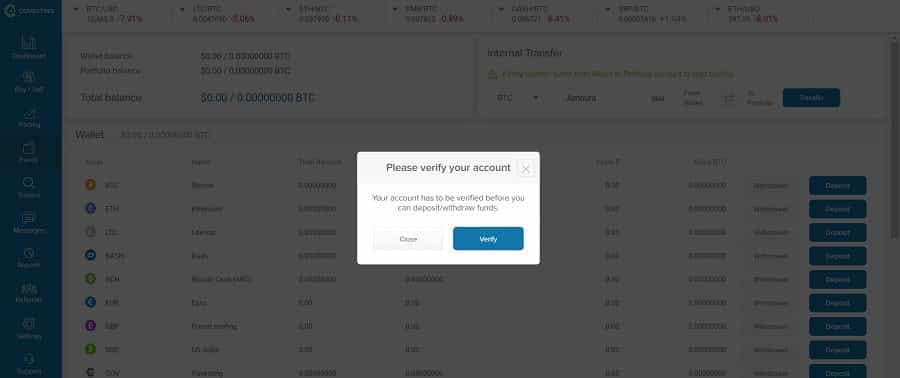

Covesting KYC requirements

To deposit or withdraw funds on Covesting you will need to submit some Know Your Customer (KYC) documentation. This can be either a passport or national ID. You will also need to state your address and provide a valid document confirming that address. According to the Covesting Help Center, it can take anywhere from 1-5 business to get verified. One you have confirmed your identity, you are now actually ready to roll!

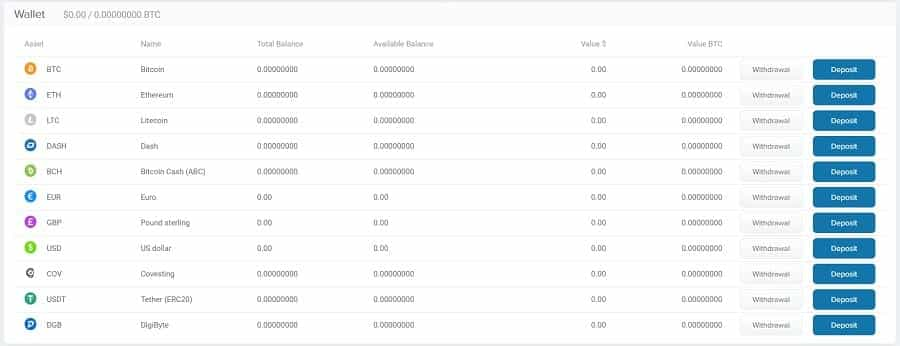

Cryptocurrencies on Covesting

The Covesting platform currently offers 8 cryptocurrencies for trading: Bitcoin, Ethereum, Litecoin, Dash, Bitcoin Cash, Tether, Digibyte, and the Covesting token. Supported fiat currencies include Euros, British Pounds, and US dollars. All cryptocurrencies are tradeable against fiat currencies and Bitcoin, with a few being tradeable against Ethereum.

It is worth noting that the spot exchange seems to indicate that there are more cryptocurrencies available for trading than can be deposited or withdrawn, including Tron, Monero, and Tezos (XTZ). Furthermore, for the time being volume appears to be quite low on the Covesting platform.

That being said, there also appears to be very frequent trading, albeit in smaller denominations than you would see on some other cryptocurrency exchanges. Liquidity will improve as the platform’s user base grows.

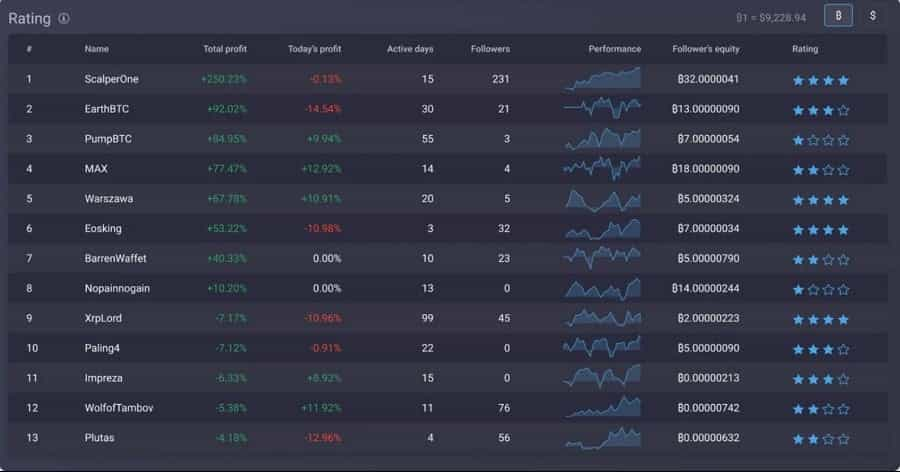

Traders on Covesting

As with the Covesting Module, the Covesting platform lets you automatically copy and execute the trades of professional cryptocurrency traders. Likewise, you are able to see how much profit each trader has made over a given time period.

This time period is important to note, since a trader which has been around longer and has a 200% profit over that time frame will probably be more reliable than a trader who has a 200% profit but has been on the platform for a couple of days.

If you are a cryptocurrency trader, the copy trading feature on the Covesting platform and Covesting Module give you the chance to showcase your talents and get a little extra bang for your buck (the fees section explains how).

Although you will also need to provide KYC documentation, the Covesting platform lets you set a publicly viewable username in lieu of your real information as a trader and/or investor on the platform. Note: investors who copy traders can only allocate funds to them using the COV token.

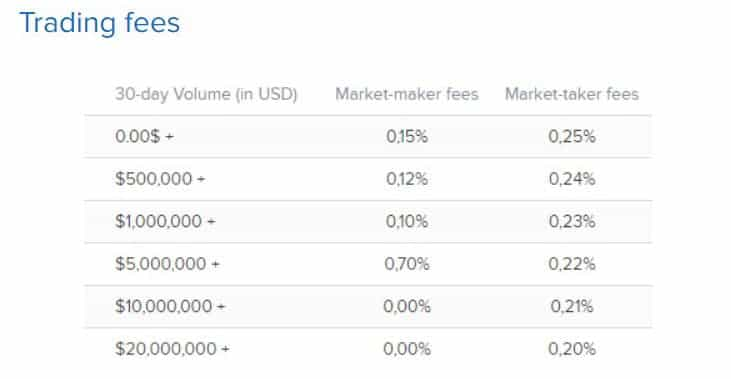

Fees on the Covesting exchange

There are three types of fees on the Covesting exchange: trading fees, copy trading fees, and deposit and withdrawal fees. The trading fee schedule is based on your 30-day trading volume and heavily favors market makers, as seen in the image above.

Copy trading fees are super straightforward and are as follows: 2% entry fee (when you start following a trader), 10% platform fee (10% of the profits you made, taken when you unfollow a trader), and a 18% trader fee (18% of the profits from trading your assets). If you do the simple math, you keep 72% of copy trading profits.

Deposit and withdrawal fees on Covesting vary depending on the asset. Fiat currencies, specifically British Pounds and Euros, can only be transferred on and off the Covesting platform via wire transfer. Transferring funds to the exchange does not cost anything, but you will pay a handsome 50 GBP or 50 EUR fee when withdrawing GBP or EUR funds, respectively.

There are no deposit fees for cryptocurrencies but do take note of minimum deposit amounts. Minimum withdrawal amounts also vary depending on the cryptocurrency in question.

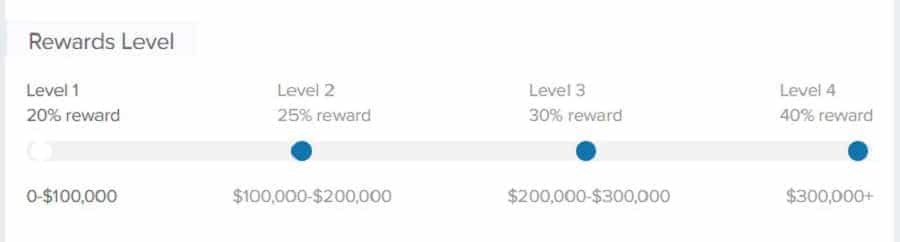

Covesting Referral Program

If you want to earn some extra Bitcoin with Covesting, you can do so by referring your friends to the platform using the referral link that is automatically generated for you in the Referrals tab. Covesting even provides you with a free marketing kit to help you spread the word about the perks of their platform! The more people you refer, the more of their trading fees you get.

Here is how it works: it all depends on how much your referrals trade in a 30-day period. If all the people you referred trade less than 100 000$USD in a month, you will earn 20% of their trading fees. This increases by 10% for every 100 000$USD they trade, up to 40%. That being said, Covesting notes in the referral rules that you can get access to some “special conditions” if your referrals trade more than 400 000$USD in a 30-day period.

Covesting Customer Support

When it comes to customer support, the Covesting platform gives you three options: Live Chat, a fillable General Enquiries form, and an extensive FAQ page called the Covesting Help Center. The Live Chat is not really a live chat but is instead a fillable email template form.

The General Enquiries form is exactly what you would expect. The FAQ page provides some legitimately useful information to help confused users navigate the Covesting platform. Unfortunately, some of the information there seems to be out of date.

Our Opinion of Covesting

The Covesting platform is absolutely incredible. It is extremely user-friendly it is fast, it is sleek, and it is not crammed with extra information which is unrelated to trading (which seems increasingly common among large exchanges these days).

You can also methodically track your portfolio in an intuitive manner, you can print financial reports (which will come in very handy when tax season rolls around). Most importantly, you can automatically copy the trades of proven cryptocurrency trading veterans!

The most impressive thing about Covesting is you can tell that a lot of work has gone into building their products. Everything is, for lack of a better expression, as it should be when it comes to cryptocurrency trading platforms.

The debut of the Covesting Module on PrimeXBT is further proof that the Covesting team can deliver incredibly valuable tools to a market which is starving for them. Hopefully their CEO Dmitrij Pruglo can finally pat himself on the back for a job that was seriously well done.

Now for a few downsides. First, there is not much trading volume on the Covesting platform. While this will improve once the platform is officially released, it may be a while before it becomes useable enough for serious trading.

Second, much of the documentation about the Covesting platform appears to be out of date or incorrect. This can make it difficult for new users (or prospective ones) to understand how everything works. It also does not help that there are many features which have been mentioned there but not released, such as algorithmic trading.

Third, the COV token. It is hard to see how a token with a relatively low max supply will be used efficiently as a utility token in the Covesting ecosystem. Nevermind the low trading volume – it arguably be more concerning if the token was being actively traded.

The COV token is also tied to something which is slowly becoming a thing of the past: exchange fees. As noted by Binance CEO Changpeng Zhao in a recent interview, the cryptocurrency exchange market is a race to 0 fees. What happens to the COV token when that happens?

Concerns aside, Covesting has brought a level of transparency and user-friendliness which remains incredibly rare in the cryptocurrency space. They have created functioning products and promising proof of concepts which are guaranteed to shake up the cryptocurrency space, and could bring an avalanche of users rushing in to take advantage of copy trading and all the other legitimately useful features that Covesting has to offer.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.