Review of HCash (HC): The Latest Cross Platform Cryptocurrency

HCash is a cross-platform project that is being designed to allow for transfers between blockchains and between blockchains and blockless cryptocurrencies.

It is unique among cryptocurrencies in that it claims to have already solved the quantum resistance issue. It will also provide support for smart contracts, DAO governance and private transactions.

In this Hcash review, I will take a closer look at what HCash is and what it’s meant to achieve. I’ll also take some time to explore criticisms of the project. It should be a good introduction to HCash.

Let's dive in!

HCash Overview

After performing an ICO in June 2017 the value of HCash climbed quickly, and by November 2017 HCash (HSR) had the 14th highest market cap of any coin. The HSR token continued climbing, hitting an all-time high of $37.33 on December 20, 2017.

Since then the token price has slid steadily lower, and as of August 7, 2018 it is at $5.20. With the launch of a new main chain on Aug 7 we could see price pop higher in the coming days and weeks.

HCash hasn’t been without controversy. Some are believers and continue to promote the benefits of transactions between blockchains being promised by the HCash team, but others feel that the technological challenge is too great and fell the HSR token is overvalued.

The HCash team itself is based in both Australia and China. They do have an impressive group of support and advisory, but the core development team remains unknown. This makes it impossible to know what experience and strengths the team brings to the project.

I also found it disturbing that last year the CEO of HCash was one Dallas Brooks, who was described as “a qualified, highly sought after expert in financial and investment strategy”, but this year the CEO is Adam Geri.

I found no mention of when this switch took place, or why it took place. Furthermore, I found it strange that Dallas Brooks background is as a financial literacy television show host. There are no prior positions for him on LinkedIn, and no mention of any connection with HCash.

Hcash Brings Chains Together

Cryptocurrencies such as Bitcoin and Ethereum, and many others work on a blockchain. They use some form of mining to create blocks that hold transaction ledgers. The downside is that there’s no way for the Bitcoin blockchain to communicate with the Ethereum blockchain. To transfer value between the two an exchange service is needed. And with literally thousands of blockchains already created this problem keeps growing.

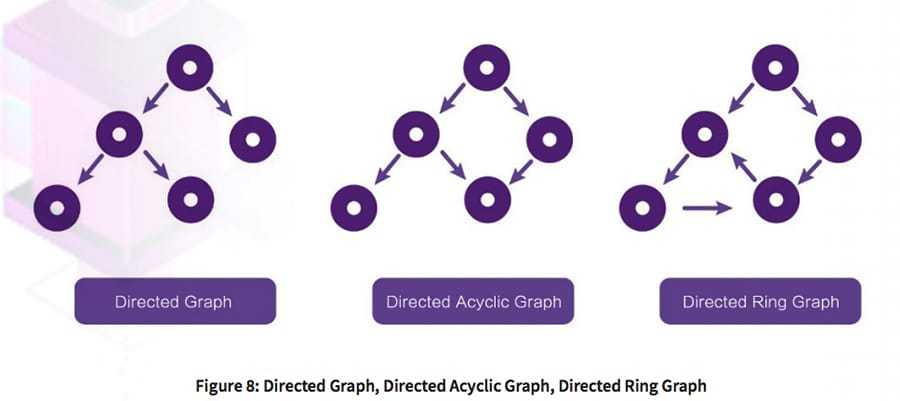

Making the issue even more complex are newer cryptocurrencies like Byteball and IOTA that don’t even use blockchain technology. Instead, these newer cryptocurrencies use directed acyclic graph (DAG) technology to create a mesh of transactions that verify each other.

Avoiding exchange service is certainly a worthy goal, since exchanges can be slow, expensive and centralized. Really little better than the traditional banks that Bitcoin was made to free us from. So, currently anytime you need to switch from cryptocurrencies you’ll find yourself stuck using an exchange that is little different from the slow, expensive, centralized banking institutions.

The HCash solution to this is to work as a side chain for blockchain and DAG currencies. It will do this by creating two concurrent networks: one blockchain based and a second DAG based network. These two networks will work together to create interoperability between blockchains and cryptocurrencies.

It’s important to note that the current main net release does not include a DAG network, and based on the yellow paper recently released by HCash it seems like it will be some time before they’re able to implement DAG technology.

Public & Private Addresses

Because HCash is planning on being a side chain for many cryptocurrencies, including ones that are privacy-centric, it also needs to implement privacy features itself. To achieve the necessary privacy HCash is implementing zero-knowledge proofs, which have already been proven by the ZCash blockchain.

Zero-knowledge proofs effectively mask the identity of both sender and receiver by using advanced cryptography to verify transactions while keeping transaction information private from miners. This results in blocks that do not include personally identifiable information.

The launch of the main net does not include privacy yet, and the yellow paper says that the team will aim “To develop an iteration of ZCASH’s zero-knowledge proof protocol”. Developing a solution that works across so many network connections is expected to be incredibly difficult, so we can only wait to see how well the HCash development tackles the privacy issue.

Quantum Resistance

One fear of the cryptocurrency community has revolved around the eventual creation of quantum computing. Quantum computing would far exceed the processing power of today’s computers, and could put blockchain technology at serious risk.

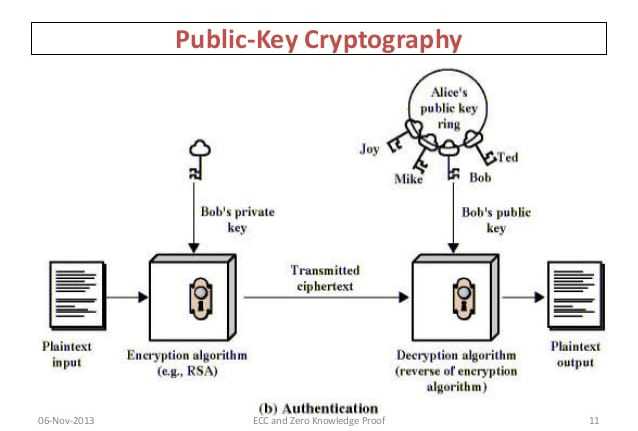

The cryptography used in blockchain technology relies on a link between private and public keys. This is how people can send money to a known address, but any spending can only be authorized by the person who holds the private key.

It’s currently nearly impossible for an attacker to compute the private key from the public key. In fact, it has been estimated that on a 128-bit cipher it would take 10.79 quintillion years to discover a private key from the public key. However, it has also been estimated that a quantum computer could crack the same cypher within 6 months.

Experts agree that it will likely be some time before quantum computing becomes a reality, but the HCash team is ready for it today. They’ve already built quantum resistance into their code, and are one of the first to implement anti-quantum technology. HCASH incorporates two of the most popular post-quantum signature schemes, BLISS [DDLL13] and MSS/LMS [BDH11, LM95]. This ensures that quantum computers, when they’re developed, won’t gain undue influence over Hcash’s network.

DAO governance via Hybrid PoW & PoS

The most common consensus mechanisms being used by blockchains are Proof of Work (PoW) and Proof of Stake (PoS). With PoW blocks are created by miners who use computing power to solve cryptographic puzzles. The miners that solves the problem and creates the block receives a reward for doing so.

In a PoS consensus mechanism the system will take into account all the addresses that hold the cryptocurrency, and then based on the stake, or size of holdings, the network semi-randomly chooses an address to verify the new block. I say semi-randomly because the more coins you hold, the more likely it is you’ll be chosen to verify a block.

After the verifier compiles and seals the block the rest of the network inspects it to ensure it is honest. If it is the verifier receives a small reward. If the block is fraudulent the verifier loses all their coins on that blockchain.

In the case of HCash, they are proposing a hybrid PoW/PoS system to increase user engagement and improve computing power efficiency. The PoW component incentivizes miners to provide computing power, while the PoS component keeps other users engaged and incentivized to hold coins.

The intent is to use this hybrid system to enable voting and create a decentralized autonomous organization (DAO) to govern the HCash network.

The voting power of each user will be determined by a combination of their stake and the computing power they are contributing to the network. There is an interesting counterbalance in using both PoW and PoS and several potential benefits. The idea to use this system came about from the Decred blockchain, of which HCash is a fork.

Criticisms of HCash

Once HCash climbed into the top 20 on Coinmarketcap it came under intense scrutiny, and there were several very vocal opponents of the project. In one Reddit thread a user went as far as to call HCash a scam coin that has no purpose other than to make money for the founders and advisors, and that the team had no intention of ever delivering the technology described in their white paper.

In fact, the white paper itself faced criticisms from the community for being too generic. Some said it did nothing but describe existing technologies and their problems, without answering how those technologies would be improved and implemented in the HCash network.

A further criticism was the HCash wasn’t under active development, and in fact the last GitHub commit is from September 20, 2017. Since the main net launched on August 7, 2018 it’s obvious that the project simply isn’t being developed as open source, which is another issue.

Finally, it’s usual for new projects and cryptocurrencies that climb so high on Coinmarketcap to be the subject of intense debate on online forums. That hasn’t been the case with HCash at all. The subreddit for the project is very quiet, and there’s no activity in other online forums either. And speaking of online venues, it is odd that the development team have no active profiles on any of the major social media platforms.

The HCash Token

Until very recently the token for HCash was HShares (HSR), which has been declining in price since December 2017, and was at $5.20 on August 7, 2018, when HCash launched their main net. Several days earlier the team announced the conversion of the testnet HSR tokens to the main net HC token. These tokens will be converted 1:1. Once the parallel HyperExchange chain is launched there will be a utility token called HX for that chain, with 1 HC worth 100 HX.

Trade volume on Bithumb increased dramatically after the news of conversion to the new HC coin and the launch of the main net, but at this time it’s hard to say where price might go as most exchanges have halted deposits, withdrawals and trading HSR for the time being after HCash made the announcement:

All HSR tokens generated from PoS or PoW activities after block height 938,888 will be irredeemable (non-swappable).

You can buy HSR tokens currently on exchanges such as Bithump, Binance and the Huobi exchange.

Conclusion

In reading through the HCash yellow paper the project has a very promising vision of the future, but to my mind an uncertain vision of how to get there.

The launch of the main net for the project is certainly a promising move in the right direction, but there remain many elements and features that remain missing with little concrete evidence of how the development team will solve the problems of the technologies they are attempting to modify for their use.

It’s an extremely ambitious project, but one that has been fraught with questions and concerns. As of August 2018 few of these questions have been addressed, let alone answered.

I’ll presume the project is progressing acceptably based on the launch of the main net, but I think further proof is needed before the project is seen as a solid one.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.