LTO Network Review: Hybrid Blockchain For Data Sharing

The LTO Network is a trustless blockchain focus on creating connections and collaborations between businesses.

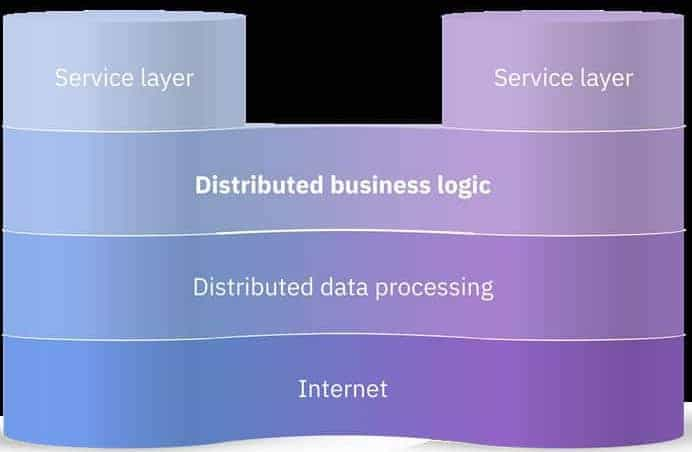

There is a public layer that acts as an immutable digital notary, and a private layer that features process automation and data sharing.

With this hybrid approach the LTO Network has become the first blockchain that is data privacy and GDPR compliant. It is also highly scalable, making it ready for mainstream adoption right now.

History

As a blockchain project the LTO Network has a pretty long history, although it didn’t actually start out as a blockchain project. The project began in the Netherlands in 2014 as a tech startup focused on company incorporation, and within a year it grew to account for roughly 10% of the Dutch market.

The team behind the company soon saw that workflow automation was a huge need in the marketplace and they began delivering centralized software solutions in 2015 to many large European corporations.

They soon began to find that the efficiencies of automation were only present when the software remained insular. As soon as collaboration with another company, or even another department within the same company, became necessary any efficiencies disappeared. This is the well known “silo effect” and it prevents companies from reaching the next level of efficiency despite business process automation.

To help solve this problem LTO Network turned to blockchain technology as they saw it as a way to maintain efficiencies without compromising the data security of firms. Since 2017 LTO Network has been focused on using blockchain technology to improve workflow automation for B2B clients.

Tokenomics Encourages Staking

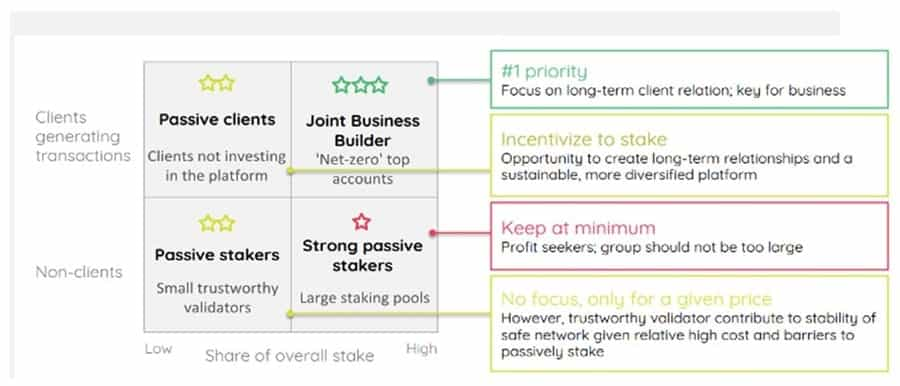

The LTO Network has four categories of staking validators in its system. The team has said they are trying to achieve “token distribution in the maturity phase of ~80% held by participants.” These are the Passive Clients and Joint Business Builders in the diagram below:

The primary blockchain network usage of the LTO Network is by its corporate clients. These clients are all encouraged to hold LTO tokens, which incentivizes them to help care for the functionality and stability of the overall network. In turn that helps to attract even more clients, creating a virtuous circle. Plus a higher staking ration improves security by making attacks on the network more costly.

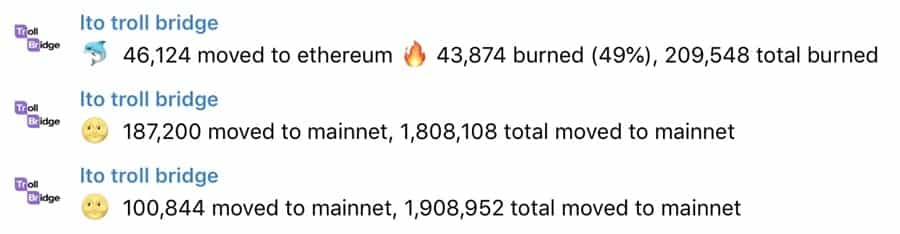

LTO has even incorporated the encouragement to staking right within the design of the network. They have implemented a feature known as a “troll bridge” which is in essence a way to tax users when they convert between the native mainnet staking token and the ERC-20 liquidity token that’s used for trading and speculation. The initial purpose of this bridge was a way to prevent the early adopters from selling their tokens, although the network has now grown to a size that the troll bridge is no longer truly relevant.

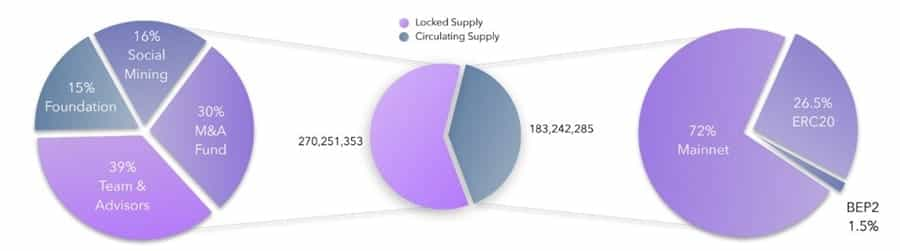

This has been highlighted by the project itself as they burned 50 million tokens in June 2020, while also locking up an additional 81 million tokens to be used for Mergers & Acquisitions sometime in 2021 or beyond. “We do not rely on sales proceeds to continue the operations and network growth, so we have committed to a long-term lockup, to strengthen the community trust in the project.”

Use-case Driven Design

Unlike some other blockchain projects that were created as a solution to hypothetical problems, the LTO Network blockchain was created to solve some very specific real-world problems. It was structured with the needs of its corporate clients in mind.

By creating such a hybrid blockchain the LTO Network has been able to find a way to bring together the corporate and blockchain communities. With a public blockchain that’s run by staking and is GDPR compliant, and a private chain that emphasizes transparency and efficiency, the LTO Network best serves the needs of all users.

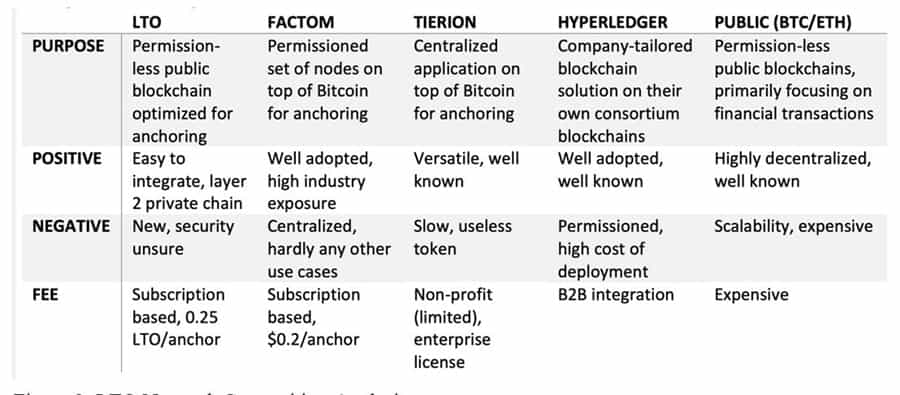

There could be some who feel that the anchoring functions could be done on another public blockchain, but this isn’t the case since the LTO public chain also provides a governance function. Stakers are able to vote and make decisions that affect the network, such as the transactions cost. There are other blockchains that serve as Proof of Evidence like LTO and you can see how they compare with LTO in the table below:

Strong Go-to Market Strategy

The LTO Network is somewhat different from other blockchain projects in that they have a strong business strategy and marketing plan. They are essentially focused on two primary features: integrating the existing products to build connections, and developing their own products that can help their clients realize the benefits of blockchain technology without suffering any negative impact from decentralization.

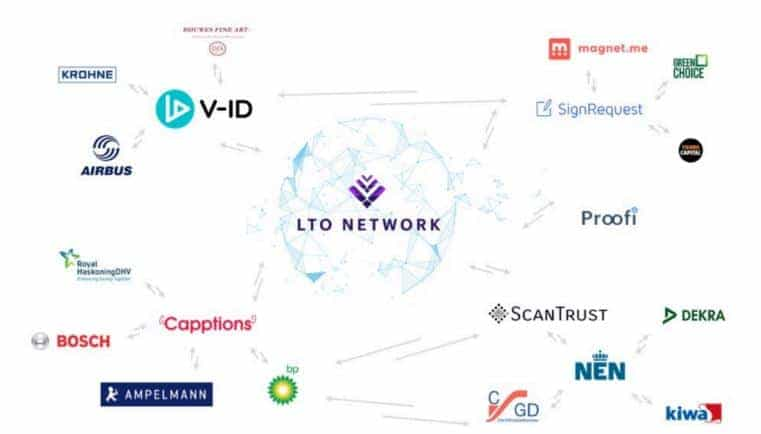

The first feature is definitely gaining traction as LTO brings more big-name organizations into its fold. You can see all the projects going on that take advantage of the LTO anchoring solution by visiting their website. Some of the partners include IBM, The Hague University, and the Dutch Blockchain Coalition.

The latter feature is already beginning to gain traction through the implementation of the company’s FillTheDoc product. The team also expects to see great adoption of the other two products in development: Proofi and LetsFlow.

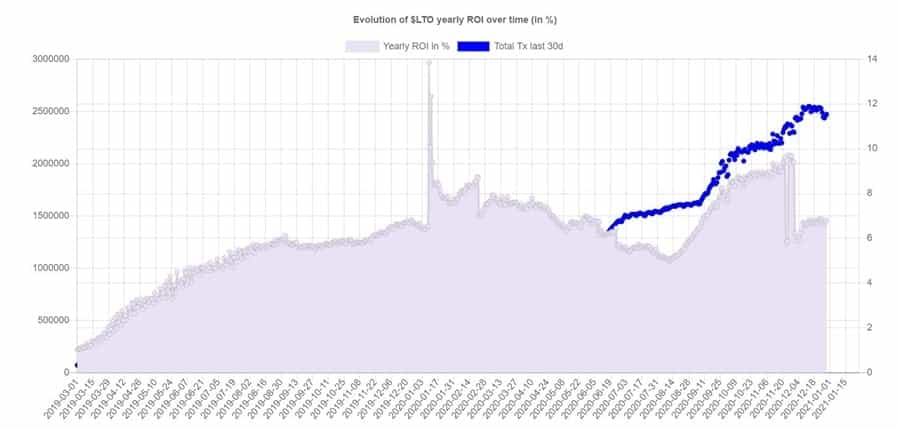

Number of Transactions and Yield

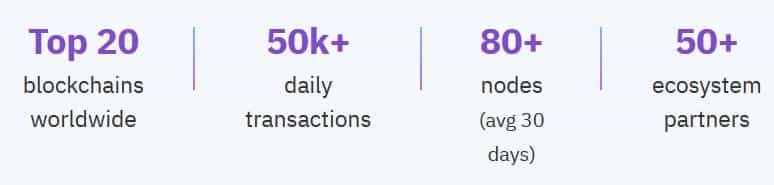

LTO Networks is also notable as being one of the 20 largest blockchains in terms of blockchain activity. This isn’t a sudden surge in activity either. The blockchain has seen a steady growth in transaction activity, with the number of transactions on chain doubling over the past year. That’s occurred even after a dip in anchoring from clients during the start of the COVID-19 pandemic in March 2020.

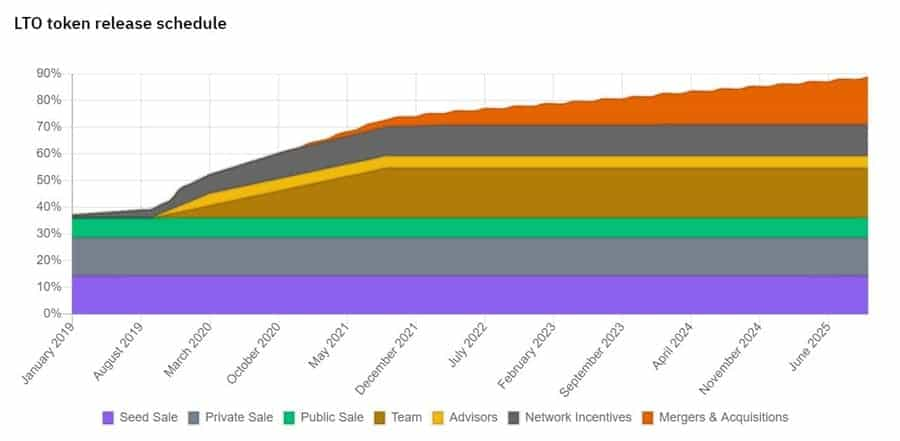

The yield on staking also remains acceptable, despite an aggressive token release schedule that is causing some inflation in the early days of the project. A closer look at LTO’s transparency report reveals this token release schedule.

In looking at the token release schedule we can see that 68% of the tokens have been released, and over the next four years the remaining 130 million tokens will be released, mostly for Mergers & Acquisitions.

Currently there are 273 million tokens in circulation which means if the remaining 130 million tokens are all released it will create over 50% inflation, which could theoretically devalue the token by 50% over the coming four years.

LTO Network Products

LTO currently has one product that is fully released and two others that are in closed beta testing. The fully released product is called FillTheDoc and the other two products are Proofi and LetsFlow. Below are brief explanations of what each product does:

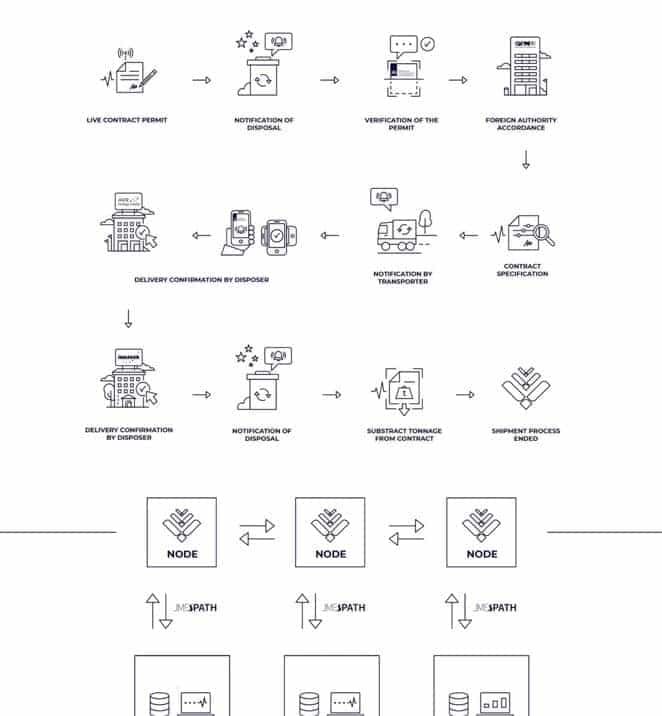

- FillTheDoc – FillTheDoc provides contract automation that is far more advanced and secure than any centralized solution. The system is capable of retrieving data from multiple systems to include in one or more legal contracts. All of the data included in the contracts is then securely anchored on the LTO Network, making it immutable.

- Proofi – Proofi is a digital signature solution that can be used to prevent online fraud during online communications. It was planned to be released in February 2020, but that release was delayed and as of January 2021 the product remains in closed beta. Once it is fully released it is planned to integrate its usage with popular social media tools and other online systems.

- LetsFlow – This is possibly the most complex of the platforms being built by the LTO Network. Meant to be similar to Zapier for the blockchain ecosystem it can be used to create both decentralized and centralized workflows. LetsFlow was originally planned for March 2020, but as of January 2021 it has yet to be released and there’s been no update to the release date.

Blockchain and Network Data

The LTO Network allows anyone to become a node operator and participate in the network, which is a permissionless private network that operated on a hybrid blockchain.

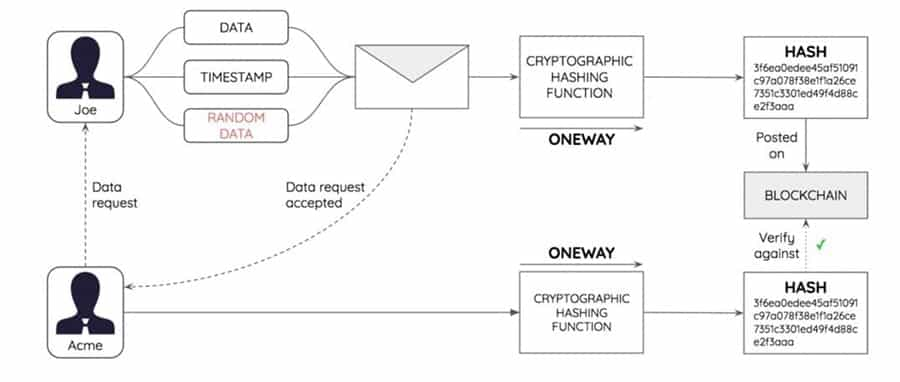

That hybrid nature becomes clear as only the hashes are shared with all the nodes on the public network, while and data is shared on a peer-to-peer basis between individual nodes. This allows businesses to benefit from the immutability of blockchain technology while still maintaining their data privacy.

Permissions on a Permissionless Network

Due to the hybrid nature of the blockchain there are no authoritative nodes or network-wide permissions that have been created. Instead the Live Contract specifies the read and write privileges of all participants. Each network participant is able to subscribe to a Live Contract through a specific node. Only that node receives the data that is associated with the contract.

Private Event Chains

An event chain is a hash of related events. On the private layer of the LTO blockchain are a number of event chains, in fact there is one for each Live Contract. So rather than arranging transactions in a block like most other blockchains, the LTO Network directly adds events to the appropriate event chain and then broadcasts the event to the nodes of all the participants.

Live Contracts

Each event chain has its genesis in the creation of a Live Contract. And each Live Contract begins with an initial set of participants, plus the rules and logic of the collaboration between the participants. This is defined as a workflow process and is modeled as a finite state machine to make it understandable to both humans and machines.

It is also possible for Live Contracts to contain off-chain instructions in order to describe the entire collaboration agreement. In most cases these will be modeled in such a way that one party executes and another validates. For example, the executing party might submit a bank payment and add an event for this. The validating party will look at their bank account balance and submit a validating event when the money is received.

Private Layer Consensus

The LTO Network has no majority consensus included to resolve conflicts. It was designed this way due to the potential for bias and the small number of participants associated with any Live Contract. In the private layer all participants are considered equal and there is no authoritative participant.

To reach consensus each event is anchored to the public layer by writing a hash. In this manner the order of the events can also be noted based on the order of transactions being anchored to the public chain.

Linked Data

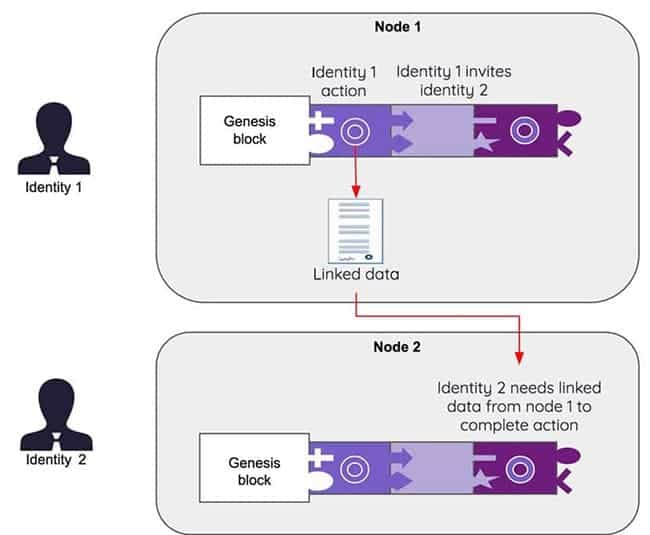

There are some design features that were necessary for compliance with privacy regulations. For example, the inclusion of a single ad-hoc chain for each process allows information to be erased as required by privacy regulations. At the same time sharing all of the data related with a process with all the participants does not meet privacy regulation requirements.

This gave rise to linked data, which allows some data to be excluded from any private event chain. Instead only the hash of the event is shared with all the participants. The participant node that actually owns the data is assigned the role of controller, and all of the other nodes are assigned the role of data processor.

In this system a data processor is permitted to request a copy of any linked data. If the workflow state indicates that the data processor is completing a task that requires the requested data it will be provided. This provision is made under very specific terms, and these are logged in order to comply with privacy regulations.

Public Blockchain Data Anchoring & Consensus

The public layer of the hybrid blockchain acts as a digital notary for hashes. The LTO Network is able to acknowledge network transactions within 2 seconds, making the anchoring of data on a public blockchain a viable solution that will scale for businesses.

Consensus on this public layer is done via Leased Proof-of-Stake in which the entire community works together to secure the network and is then rewarded by sharing the fees generated by the organization.

This Leasing PoS mechanism allows anyone to participate in staking without the need to run their own node. In the future there are plans to migrate the consensus mechanism to Leased Proof-of-Importance, which will help to mitigate the risk of centralization in the network.

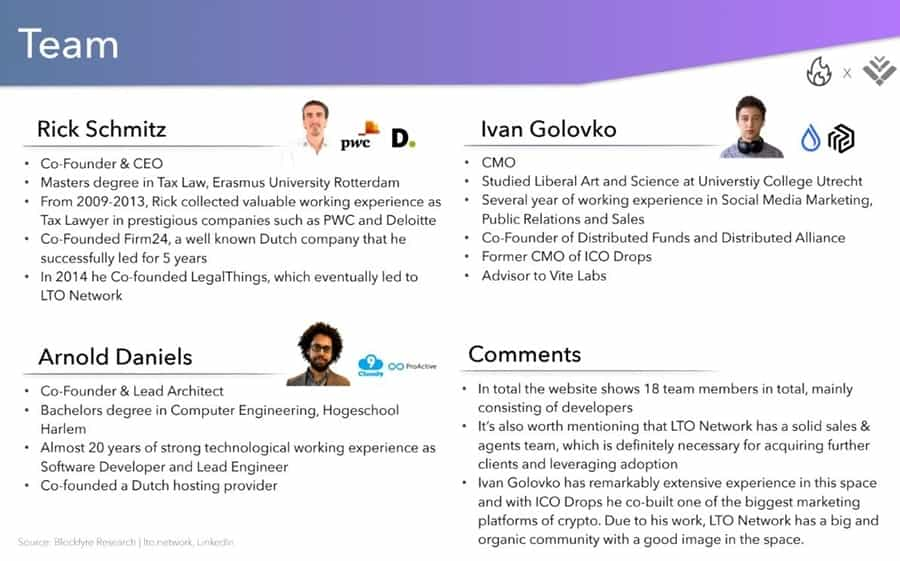

LTO Network Team

The LTO Network came about as a collaboration between the founders of LegalThings, a Dutch contract solution in real estate, and Firm24, a Dutch business registration company. Tying these two together is the current CEO of the LTO Network, Rick Schmitz. He was a co-founder of both LegalThings and Firm24, and prior to joining the two in the LTO Network he worked in Mergers & Acquisitions for Deloitte and PwC.

Joining in the co-founding of LTO is current CFO Martijn Migchelsen, who was also a co-founder of Firm24. Migchelsen met Schmitz when working in corporate finance at PwC.

Sven Stam is the CTO of the LTO Network and has a master’s degree in artificial intelligence and 15 years experience in the industry.

And finally there is Arnold Daniels, who is another co-founder of LTO and the Lead Architect of the project. He is also the only founding member who did not come from LegalThings or Firm24. Instead he is an open source software developer for Jasny, and prior to that founded the hosting company Helder Hosting, which was acquired by VIP Internet in 2011 and discontinued as a brand in 2016.

The LTO Token

Over the years the LTO Network has had several rounds of seed funding that have increased the token supply. December 2017 was the first seed round, and LTO raised $1.4 million from early private investors. The following year in December 2018 LTO held another private sale, raising an additional $1.7 million.

That was followed a month later in January 2019 by a crowd sale that was left open for just 60 hours. That crowd sale saw an additional $990,000 raised, with 50% of the crowd sale tokens remaining unsold and subsequently being burned. During these sale rounds the private sale and seed investors received the mainnet LTO tokens, which are not tradeable, while the crowd sale participants received the ERC-20 tokens that are tradeable and are meant primarily for speculation.

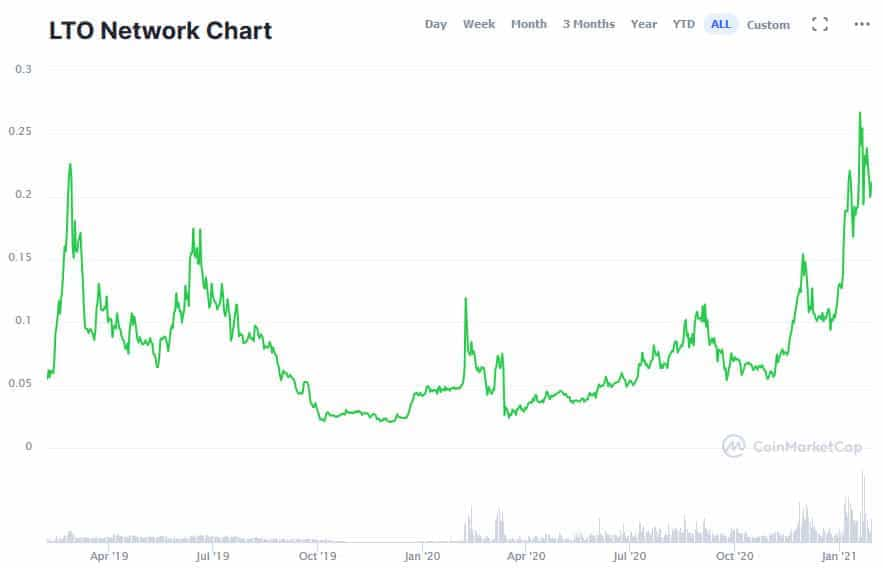

Since launching for trading in February 2019 the LTO token has seen many ups and downs, as illustrated by the price chart below.

Over the nearly two years of trading the token has seen an all-time low of $0.01969 on December 2, 2019 and an all-time high of $0.2722 on January 19, 2021. Just a week after hitting the all-time high the token is trading at $0.2000, which further highlights the volatile nature of the token.

LTO Network Pros

After reading this far you can probably tell there are some definite advantages to the LTO Network. One of these is the fact that unlike so many other blockchain projects with tokens, this one has an actual legitimate business model to draw on. In addition to that the direction and ambitions of the project are realistic.

The team is not trying to tackle something like revolutionizing the medical industry, but has more modest goals. And finally, the transparency of the project is quite welcome in an industry where it can often be difficult to dig out the details. LTO posts regular financial reports, and even lets the community know the addresses where assets are being held. Good or bad, everything is made fully transparent by the team.

LTO Network Cons

Of course all is not good with the project and perhaps the most troubling thing is questioning whether or not this is a project that actually needs to be decentralized. Exchanges are one example of centralized entities that have been extremely successful in the blockchain space. The same could be true of LTO if they were openly centralized.

Another real potential problem is the issuance of the ERC-20 LTO tokens simply to have a tradeable asset versus the staking asset. This could certainly flag the ERC-20 LTO token as a security at the SEC, and the resulting measures taken against the LTO Network would be anything but good. In fact, the whole process of having three different tokens (native, ERC-20, and BEP-2) is somewhat confusing and perhaps unnecessary.

Conclusion

Overall the LTO Network looks like a very good project. It is well targeted and well designed. Plus the transparency of the project makes it far more approachable when compared with many other blockchain projects.

The systems and products are quite straightforward and easy to understand, which is also welcome. It should make it easier for the LTO team to gain adoption too since the concepts will be far easier to explain to prospective clients.

As an outsider looking in there’s little to complain about. It does seem like the leadership of the project will be crucial, and the success or failure of the project could hinge on how well led it is.

If the team can continue adding new clients to the platform it is the type of thing that is self-fulfilling. It needs more clients to look good, and the more clients it gets the easier it becomes to attract additional clients. Once a tipping point is reached the sky should be the limit.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.