What is Tomochain? Complete Beginners Guide to TOMO Token

Tomochain (TOMO) is a project that is trying to help scale the Ethereum blockchain - no doubt a pressing concern in the face of previous network bloat.

Indeed, scaling has been foremost in the minds of Ethereum developers ever since the Crypto Kitties slowdown of late 2017. There have been a number of projects which have recently launched that are trying to tackle this - each with their own unique solution.

So, how is Tomochain's solution any different?

In this Tomochain review, I will give you what you need to know about the project. I will also take a look at the use cases and long term potential of the TOMO tokens.

TomoChain Overview

Besides attempting to solve the known scalability issues with the Ethereum blockchain, TomoChain is also aiming to solve interoperability issues as well.

Scalability covers a number of related issues which include network congestion, long wait time for transaction validation, and the high transaction fees that come along with these issues. Interoperability refers to the ability for Ethereum to link with other blockchains to provide cross chain interaction.

Both of these are crucial since to realize its disruptive potential blockchains will need to work at scale, and they will need to have a way to work together. One of the major functions of blockchains that stand to forever change the financial systems of the world is the way they move and record funds between accounts.

Unfortunately, even major blockchain projects like Ethereum can only process 15 transactions per second. Compare that with Visa or Mastercard, where up to 6,000 transactions per second is doable.

TomoChain is seeking to solve the scalability problem through sharding and a stake voting solution. That has led to a Tomo blockchain that provides up to 5,000 transactions per second, 2 second transaction times, and low transaction fees for users. Once sharding is achieved the development team claims TomoChain can reach 20,000 to 30,000 transactions per second.

The TomoChain Mainnet

TomoChain released its mainnet back in December 2018 and it came with a large number of changes. The changes included the move to an independent chain, the addition of masternodes and the addition of Proof-of-Stake Voting (POSV).

The switch to masternodes made TOMO a mintable currency rather than a minable currency. The masternodes, of which there are currently 150, are used to create and verify blocks and are compensated for doing so with minted TOMO.

The compensation for the first two years will be 250 TOMO per epoch (which is 900 blocks), split between the masternodes based on the number of blocks signed.

After those first two years, the block reward will be split between the masternode owner (40%), all those who voted for the masternode (50%) and the TomoChain Foundation (10%).

Over the first eight years, there is a fixed supply of 100 million TOMO and after the first eight years, another 17 million TOMO will be available for block rewards. The council of masternodes is also able to vote to increase the total supply by up to 1 million TOMO each year.

In comparison with Ethereum, the TOMO fees are just 1% of those charged for Ethereum transactions, and the TomoChain has 2-second transactions versus 15-second transactions for Ethereum.

Additionally, TomoChain can already reach 2,000 transactions per second and when sharding is introduced that should increase to at least 20,000 transactions per second. Ethereum only processes 15 transactions per second currently.

About TomoChain Masternodes

I’ve mentioned the masternodes before, and they are a crucial part of the TomoChain ecosystem. At their most basic level, they are nothing more than servers contributing computing power to the network to sign blocks. For performing this service the masternode receives TOMO as a reward.

TomoChain uses a maximum of 150 masternodes and these 150 masternodes use POSV to reach consensus. There are a number of requirements that go into running a TomoChain masternode.

- To become a masternode candidate you must first deposit 50,000 TOMO. Candidates are allowed to resign, but the TOMO remains locked for 1,296,000 blocks (30 days) after the resignation.

- Once you’ve become a candidate the next step to becoming a masternode is to be in the top 150 voted candidates in an epoch.

- If chosen as a masternode you receive TOMO rewards in proportion to the number of signed blocks. Masternodes are also planned to receive fees from the TomoX decentralized exchange.

Owning a masternode not only guarantees rewards from the TomoChain, but it is also the best way to support the network.

While on the subject of the masternodes it will be good to also discuss the Proof-of-Stake Voting (POSV) consensus model. This is a feature that is unique to TomoChain and sets the project apart. It not only allows the blockchain to function as EVM-compatible, but it also allows for the nearly instant transaction times, and for the entire masternode architecture.

With POSV the stakeholders are able to vote for the 150 masternodes they want to participate in block creation. This means even though the block creation aspect is centralized, the masternodes themselves can easily be voted out if they aren’t representing the interests of the stakeholders.

And after the first two years, the stakeholders can also receive block rewards if the masternode they voted for wins and becomes a validating node.

TomoChain Governance

Governance is a big deal for decentralized networks, and there are many different approaches to making it work. Some have claimed that a masternode network is the best way to govern a blockchain network, and the wider the network of masternodes, the better.

TomoChain not only includes a network of masternodes, but it also allows the stakeholders to vote for the masternodes and elect those they wish to become validating nodes.

This goes counter to the popular Proof-of-Work consensus mechanism, which rewards those who have the most raw computing power, leading to centralized mining cartels and monopolies. The decentralized nature of the masternode architecture allows everyone to benefit from being part of the network, not just those who are able to afford powerful hardware.

And even though there are only 150 masternodes as validators, it doesn’t mean these 150 have supreme power. Quite the opposite since they can be voted out every 900 epochs, and there is always a tight race for the winning masternode spots.

To remain as a part of the masternode network the server needs to show activity and stability. If the masternode is inactive, or constantly dropping off the network, it is soon be replaced by a more stable and reliable masternode. The TomoChain network evolves quickly, and moves fast and fluid, just like the blockchain itself.

In the PoW system, miners invest in hardware and are separate from the network since they are able to switch mining to any PoW coin they like. In the TomoChain network, the masternodes are invested in the tokens, and this makes them an inseparable part of the network.

The TomoChain Team

The TomoChain team consists of 30 members and most are located in Singapore, although the project also keeps offices in Vietnam and Japan. The CEO of TomoChain is Long Vuong, and in addition to being one of the founders at TomoChain, he was also previously the project lead of the successful NEM blockchain project.

There are three other co-founders in addition to Long Vuong. The second co-founder and CFO of the project is Le Ho, who has over 10 years in the investment and finance industries. She was previously Senior Investment Manager at BVIM and a former Director of the Investment Banking Division at HSC securities company.

Next is Son Nguyen, the CTO of the project and an experienced and accomplished technical leader, former Director of Engineering, founder of the Blockchain Developer group with more than 800 active members. Finally, there is Tung Hoang, who is the Product Manager of Tomo Wallet. He is also an experienced FullStack Developer & Smart Contract Developer.

In addition to the founding group, there is a dedicated, talented and experienced group of developers who have made the project a success so far.

The TOMO Token

The TOMO ICO was held in March 2018, and while the public sale was scheduled for a 20 day period, it ended in just 1 day as the team quickly met their hardcap of $8.5 million. TOMO was created as an ERC-20 token but transitioned to a native token on a 1:1 basis when the mainnet went live in December 2018.

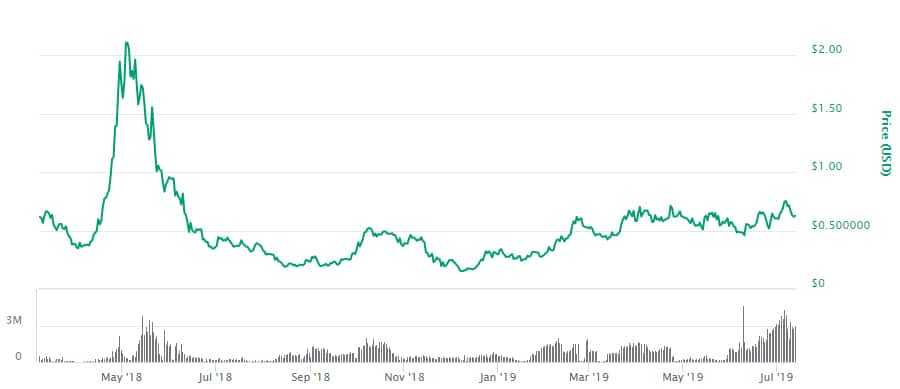

Tokens were sold at $0.25 during the ICO. By the time the token was listed and trading on an exchange it was already above $0.60, despite 2018 being such a bad year for cryptocurrency markets.

The market weakness led to a drop over the next month to $0.40 and then the token took off. From early April through May it rallied, remaining above $1 for all of May after hitting an all-time high of $2.30 on April 29, 2018. The token then declined alongside the broader market for the remainder of 2018, hitting its all-time low of $0.146134 on December 8, 2018.

Since then the token has made a solid recovery and is trading at $0.618541 as of July 12, 2019. That’s a nice gain for the initial investors and pretty much right where the token was when it began trading.

TOMO Trading & Wallets

TOMO is listed on a handful of exchanges, with by far the greatest volume trading on Hotbit. It is also on the Binance DEX, KuCoin, OceanEx, and BitForex.

Hotbit has over 85% of all of the volume in the open market. This could present a challenge when it comes to key exchange risk. If ever there was an issue on Hotbit, liquidity would sink dramatically.

Having said that, there are reasonable daily turnover levels on HotBit for TOMO. This means that you would be able to execute most normal sized orders with no price slippage.

Once you have your TOMO tokens, you will probably want to move them off of the exchange. We all know the risks that come from centralised exchange hacks. Moreover, Hotbit is not really on our list of the most reputable exchanges.

For storing TOMO you have just a few choices. There is a mobile wallet released by TomoChain, and you can also use mobile TrustWallet as it supports TOMO. The Ledger hardware wallet also supports TOMO. And it appears you are still able to use MyEtherWallet for storing TOMO.

Tomochain Development

Nothing speaks volumes more about the state of a project like the amount of work that they are doing on their protocol and technology.

This can, of course, be hard to ascertain. Yet, one of the best rules of thumb that I use is to look at their public code repositories. This can give you a direct indication of code commits and hence development.

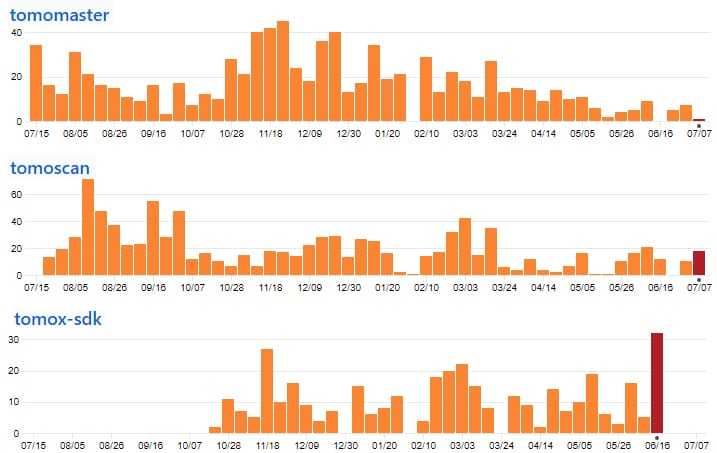

I jumped into the Tomochain GitHub to get a better look at their coding activity. In the below image we have the code commits to the top three most active pinned repositories.

As you can see, the team has been very active pushing out code. It is also worth noting that there are a further 66 other repositories in their GitHub with varying levels of activity - impressive stuff.

Indeed, this is more activity than I have seen on most other projects which are at a similar stage in their development. Perhaps this rapid pace of development will make sense when viewed in context of the broader project roadmap.

Tomochain Roadmap

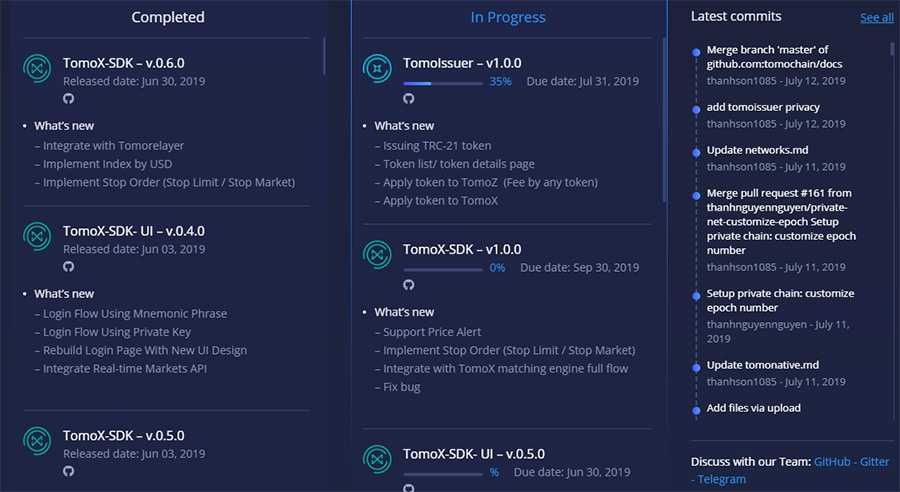

Tomochain has a pretty comprehensive roadmap page that gives their users a running update on the progress of particular development milestones.

They also pull in the latest GitHub commits that we have been talking about above. Taking a look below, you can see the list of completed milestones on the left as well as those that are in progress on the right.

Indeed this is just a snapshot and you can scroll down on their roadmap page to see exactly how much they have completed and are currently working on.

Some of the most important things that are currently being worked on by the team include the following:

- Tomox V0.1: This is the decentralised exchange protocol that is being worked on by the team. This will be the first alpha release and will feature a full-flow decentralized orderbook and matching engine execution. It will also be integrating with TomoDex and TomoRelayer. This is currently at 80% completion and is due for release in the next few weeks.

- Tomomaster v2.0.0: They also plan to release an update to their graphical UI for the masternode voting / governance. This has not been started yet as progress is still at 0%.

- TomoX SDK v1.0.0: This is the Software Development kit that will allow developers to build on top of their decentralised exchange. Work has not been started yet.

- TomoIssuer v1.0.0: This is the "Fee by any tokens" Registration DApp. Some of the newest features include issuing TRC-21 tokens, apply to token list and apply token to TomoZ.

So, as you can see quite a bit to look forward to over the coming year from the Tomochain developers. If you want to keep abreast with their latest updates then you can follow their official blog.

Conclusion

TomoChain has had a successful run so far, and the mainnet launch was both successful and impressive. The team seems to have a clear vision and direction, which should lead them into the future.

The recovery in the value of the TOMO token is also impressive when you consider that the 2019 rally so far has been primarily a Bitcoin rally, and many altcoins have struggled to keep up. That recovery has also come without TOMO being listed on any of the top exchanges other than KuCoin.

The real success for this blockchain will be when they implement sharding. If they can accomplish that quickly they should easily put themselves in the forefront of the blockchain revolution.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.