We humans have feelings and we’re programmed to respond to them in certain ways. If we’re scared and feel that we might be in danger then your brain will tell you to run and flee. On the contrary, if we’re happy doing something, then we’re bound to do it again. Furthermore, if we’re jealous, then doing the same thing the person that made us jealous did is on our bucket list. These are just a few examples of what 99% of us feel in certain situations and it’s simply because of our human nature.

Now because we truly are this predictable it might result in opportunities if we can ourselves avoid these programmed solutions and also see when others are acting according to them. Often times people buy into some asset, whether it be cryptos or stocks, with hopes of becoming rich. We believe in this because others have made a fortune from doing so. We’re jealous of the person who bought $8000 worth of Shiba Inu a year ago and is now sitting on over $5 billion, we want that too. Then when we do get lucky and make some money, we feel a wave of happiness like never before. This makes us confident and we might purchase the next potential asset or maybe add some more of the previous one. However, when the price starts to plummet all the feelings of happiness are overtaken by fear and panic. Our brains tell us to sell and get the f*** out of there. So, we sell the holdings just to discover that we perfectly managed to buy at the top and sell at the bottom. Just like we planned it, right?

Are We Truly This Predictable?

The introduction is a simplification of some aspects of human psychology but I think you’re lying if you say that the example above doesn’t sound familiar. I would be lying if I didn’t say that buying some Dogecoin, Shiba Inu, or even Floki Inu hasn't crossed my mind. Although I know that all these meme coins are huge risks with no fundamental value, I’m still surprised by the urge to buy when reading about the previously mentioned billionaire Shiba investor. I know that buying those types of assets goes completely against my investing thesis but sometimes feelings can override that, and I also know is that I’m not alone in these feelings. Why I know others also feel the same way is because:

- I’ve seen it first-hand. Friends buying into shit coins in hopes of becoming billionaires.

- Look at what happened to many small meme coins when one of the big memes pumped. Loads of retail investors went looking for the next big thing.

Can't keep count how many times I've heard people wanting to buy into these meme coins. And yes, that's always after a 100x pump.

Can't keep count how many times I've heard people wanting to buy into these meme coins. And yes, that's always after a 100x pump. Another example where irrational thinking sometimes takes over is when positive news of a certain project comes out. Often times people flood the project and buy like crazy, especially if it includes some famous companies or people, until they take a second look and realize that either the project itself isn’t that good or maybe the news isn’t that great after all. If you haven’t felt these feelings I’m surprised.

However, by looking at the charts I can prove to you that many others do have these feelings. One notable example is from the price action of Flow. When Flow announced a partnership with Google (a big famous company) on 14th of September, 2021 the price rallied from roughly $20 to a high of 23.75$. However, the price after that started to gradually decline only to hit the same price where it started in a couple of days. The decline continued, and the price of Flow is currently at just under $14. I’m not saying that the recent price action is necessarily linked to the news announcement but at least the price action immediately after the top was caused by people who quickly realized that while Flow might do great things it certainly isn’t the greatest investment due to its aggressive vesting schedule. I do want to point out that I’m not saying that all news events are overreacted to, I’m just saying that you have to be careful not to let emotions take over.

Here you can see the price chart of Flow zoomed in on the above mentioned example. Image via CoinMarketCap.

Here you can see the price chart of Flow zoomed in on the above mentioned example. Image via CoinMarketCap. So yes, I would say that we’re extremely predictable creatures. A further example of this is from technical analysis. Have you ever really thought about why technical analysis can work and what it’s based on? Well, many patterns are based on human behavior in certain situations, often caused by our emotions. We tend to respond certainly to different price actions and that’s the basis for many technical analysis indicators and patterns. I’m sure you’ve heard of FOMO (fear of missing out). This is something whales take advantage of when they want to sell. They push the price up to attract newcomers who are afraid of missing out on all the gains. Then once those newcomers enter the whales start dumping their holdings and before even realizing what has happened the retail investor has a return of negative 25% while the whales successfully dumped their holdings to these retail investors at the peak. This is partly what the Wyckoff method is about, and I suggest you watch Guy’s video on it or read this article about it.

How to Take Advantage of This

There’s a lot of ways to take advantage of sentiment analysis, both for long-term and short-term investors. We all know that cryptocurrencies have extremely strong cycles which can result in huge gains if you find a way to buy at the bottom and sell at the top. Even for long term hodlers it’s a good idea to do some analysis and sometimes trim your exposure to the markets in order to then buy the dip. To do this, to measure the interest/feelings towards cryptocurrencies, there are many tools.

Make profit of other people's emotions.

Make profit of other people's emotions. First, we have the Fear & Greed Index which you can find from this link. As you can read from their own introduction it measures people’s emotions and sentiment. If you scroll further down the page and look at the 1-year chart you see how the numbers fluctuate. Then if we compare those to Bitcoin’s chart, we do see that longer periods of high values in the Fear & Greed Index tend to cause a correction. However, you might also be criticizing the indicator since it most definitely isn’t perfect, which is why you might want to combine it with other forms of sentiment analysis in order to get a more complete picture. I’m going to list a few methods and tools to use when doing sentiment analysis, both for long-term investors and short-term investors.

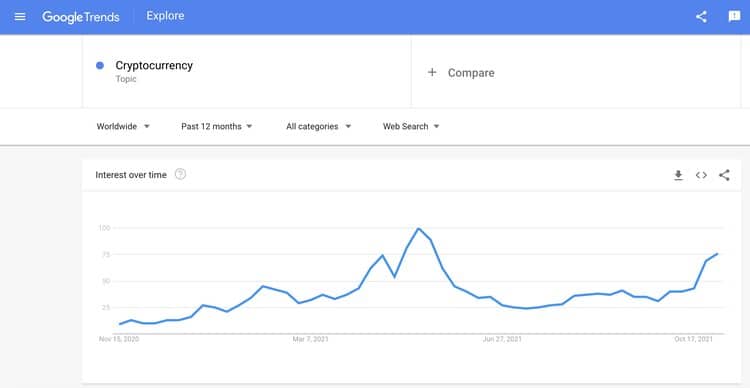

Google Trends

To continue with something for our long-term hodlers to spot the top with you can use Google trends. This service provides you the traffic to certain keywords, for example Bitcoin or Cryptocurrency. How you can use this to your advantage is by assessing when the traffic is starting to hit its peak. Guy on Coin Bureau’s YouTube channel often refers to this tactic as a good way to spot the top. He actually has a whole video on how to spot the top, check it out here. That’s because when the search volumes surge it often means retail investors are piling in due to FOMO. Perhaps they heard their friend bragging about gains made with Bitcoin and other cryptocurrencies, which causes them to buy regardless of the price, they just want to make money.

Here's a look for the keyword cryptocurrency. As you can see we're already quite high. Image via Google Trends.

Here's a look for the keyword cryptocurrency. As you can see we're already quite high. Image via Google Trends. Another way of “manually” doing this same thing is just by listening. I’m sure many of you have friends or family who are completely uninterested in cryptocurrencies. If these people start talking about cryptos and potentially buying into them, it might be time for you to sell your coins to them. Now you might be wondering why you should be exiting when masses are flooding into the market and that’s because those who enter are newbies while those who exit are often big whales and institutions. There’s a saying of this originating from the stock market and applied to Bitcoin it would go something like this, “When your cab driver starts talking about Bitcoin, it’s time to sell”.

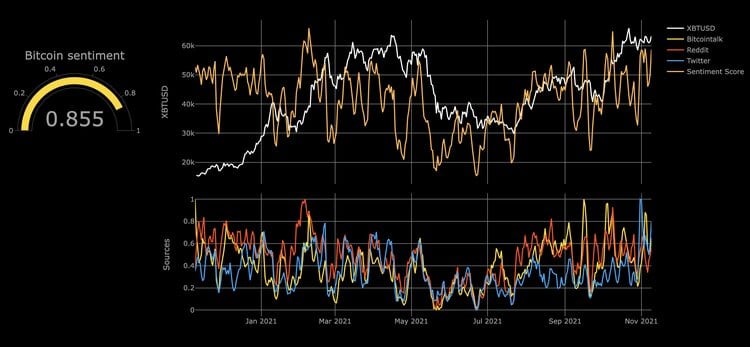

Bitcoin Bull & Bear Index

A common way to measure sentiment around something in today's digital world is by looking at social media sites, and that’s exactly what this indicator does. This indicator found on Augemento.ai gathers data from social media sites to form a score of 0 to 1 based on how positive the content out there is. This indicator includes data from Reddit, Twitter and the BitcoinTalk forum.

Looking at this too the sentiment seems to be quite high. Image via Augmento.io.

Looking at this too the sentiment seems to be quite high. Image via Augmento.io. Now, looking at the picture above you can see that it’s not perfect by any means. However, as with every form of analysis you can’t rely on just one. It can’t be denied that this indicator does have a way of indicating certain price movements and when you take a closer look you might recognize that often the sentiment turns negative before the price starts falling. This can partly be explained by the previously mentioned newbies piling into the market at the top.

CryptoRadar

Another simple to use and easy to interpret sentiment analysis tool is CryptoRadar by Bison. This analyses Tweets on Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Uniswap, and Chainlink. Again, this is a simple tool so don’t except too much of it. However, when you combine a few of these easy tools you’ll get a good overview of the mood surrounding the whole space.

Here's a look at Cryptoradar. Image via Bison

Here's a look at Cryptoradar. Image via Bison How you interpret the radar is by looking at where the logo is situated. The more to the right the better, indicating more tweets about the project.

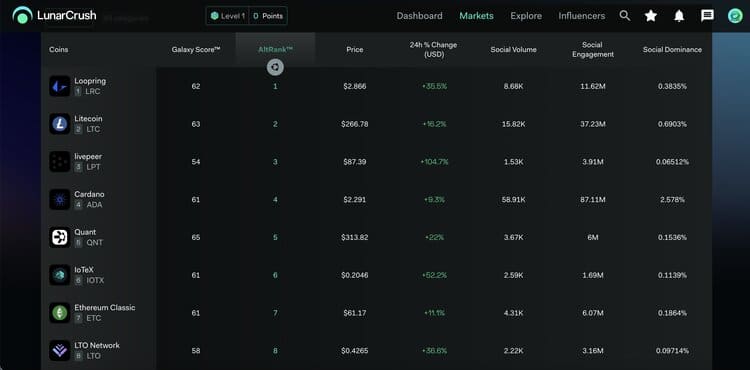

LunarCrush

The above-mentioned methods were heavily concentrated on Bitcoin and also quite simple. LunarCrush is a complete platform supporting sentiment analysis on a wide range of altcoins, over 2000 in fact. The way LunarCrush works is by analyzing activity on social media sites to then give them their custom scores, Galaxy Score and AltRank.

AltRank measures 4 different things:

- Market volume – based on reputable exchanges

- Social volume – volume from unique sites

- Percent change versus Bitcoin – is it outperforming Bitcoin

- Social score – total social volume

Based on these four criteria a crypto gets a ranking where 1 is the best. How you can use this data is by looking at coins with a gradually increasing ranking. Simply picking number 1 isn’t the best choice since the recent price action plays such a huge role, which means if a crypto spikes for a short while it will briefly also push up the AltRank, however, that doesn’t mean it’s sustainable.

Cryptos sorted by Alrank. Image via LunarCrush.

Cryptos sorted by Alrank. Image via LunarCrush. Galaxy Score is also derived from 4 different measures:

- Price score – calculated from a moving average

- Social score – based on bullish and bearish social updates

- Social impact – based on social volume/interaction/impact

- Correlation rank – an algorithm determines how much the price correlates with social sentiment

While the Galaxy Score also includes the price action it’s less impacted by that since it’s calculated using a moving average. Therefore, the Galaxy Score better measures the social sentiment which is why it’s something worth keeping an eye on. The Galaxy Score gives a value of 0 to 100 where 100 is the best.

Cryptos sorted by Galaxy Score. Image via Lunarcrush.

Cryptos sorted by Galaxy Score. Image via Lunarcrush. When using LunarCrush I would focus on the Galaxy Score since I think it gives a better opportunity to find good altcoins before they moon. Also, on top of both the AltRank and Galaxy Score LunarCrush offers more, such as the amount of social engagement, social media posts, influencer tracking, and much more. You can even earn LunarCrush’s native token LUNR for using the service. And hey, almost forgot, LunarCrush is completely free, you just have to make an account. However, to get access to more data you need to purchase LUNR tokens.

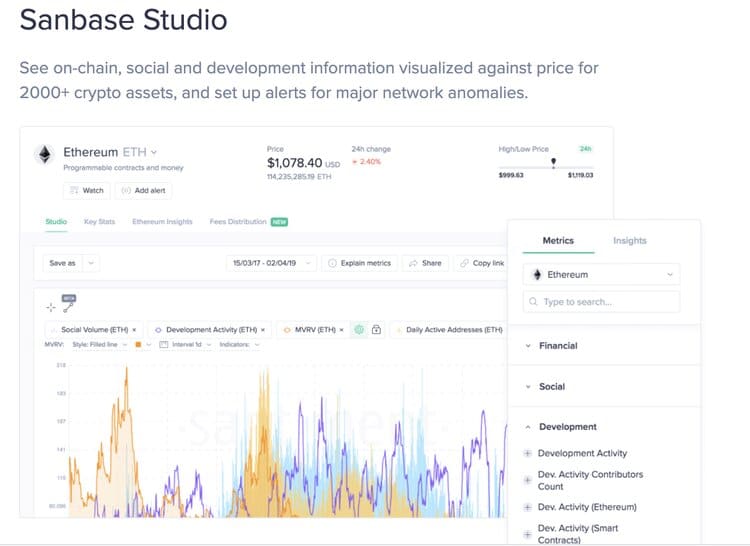

Santiment

Just like LunarCrush Santiment is a complete platform with a wide range of different analytics and metrics. What differentiates these two is that Santiment doesn’t have any of their own proprietary scores or rankings, but rather they’re just a tool for “raw” data. This data includes social data, price data, and even on-chain data.

Take a look at Sanbase Studio, as you can see they offer much more than just sentiment analysis. Image via Santiment.

Take a look at Sanbase Studio, as you can see they offer much more than just sentiment analysis. Image via Santiment. When using Santiment for research you’ll be using their Sanbase, that’s where you’ll find everything. On top of that they provide an API service for developers. What I like about Sanbase is their charting where you can compare price charts with social volume. On top of that you can do keyword scanning similar to what Google Trends allows you to do. When it comes to pricing, you’ll get everything for free except for the most recent data. Therefore, if you want to use it for short-term trading, you’re going to have to purchase the Pro plan for $49 a month.

CryptoMood

This is another complete platform and there were a few reasons why I wanted to bring it up. However, first I have to say that while there is a free plan available, you’ll have to pay $4.50 a month if you truly want to get some advantages out of it. So, if you’re not looking to pay anything you can skip to the conclusion.

Maybe I should too download and try the app, the price isn't that bad, and I like checking crypto stuff on the go whenever I have time. Image via CryptoMood

Maybe I should too download and try the app, the price isn't that bad, and I like checking crypto stuff on the go whenever I have time. Image via CryptoMood The reasons I wanted to bring up CryptoMood are their mobile app and their huge database. So, if you’re someone who prefers to do everything on their phone or likes to check cryptos and do some analysis whenever you have time then CryptoMood is for you. I haven’t myself used the application but from what I’ve read it seems like the real deal. They use a huge database looking at data from over 50,000 sources, and they even have a partnership with Santiment. On top of that, I see a great benefit in using their news aggregator to read yourself and determine the mood in recent news. And to make it easy for you, you don’t have to read whole articles since they provide summaries.

Conclusion

We are all influenced by emotions and that’s natural. It’s also something which is necessary to keep the markets going. Yes, sometimes emotions cause extreme market moves which might seem intimidating. However, as Guy likes to point out, you need to look at the bigger picture, both when the price goes up and especially when the price goes down.

You need to analyze whether price movements truly are reasonable or is it just some FOMO or FUD. When you see that big drop, you don’t have to think it’s the end of the world. Look at the long-term sentiment around the project or market, what has happened. Is it a short drop from which we’ll likely keep going up? Did we really see the top? Simply find the answers and then make sound decisions on whether it is an overreaction and a great time to buy the dip. And the same goes the other way around. When you see a big pump on some positive news take some time to truly analyze what happened and see if it could really start a greater trend shift or is it just people not knowing what they’re doing and buying out of FOMO. You don’t want to be the guy buying at the top and selling at the bottom.

And hopefully after reading this guide you won't be that guy.