Future of Crypto: Analyzing Adoption, Regulation and AI

Cryptocurrencies, born out of the Great Recession, have become an established investment class. They envision a decentralized future where financial transactions occur seamlessly across borders, free from traditional banking institutions. However, regulatory authorities have expressed concerns about issues such as money laundering and investor protection. The future of cryptocurrencies is uncertain, with questions about sustainability and regulatory implications. Technological advancements, such as blockchain interoperability and artificial intelligence, are expected to shape the future of cryptocurrencies. The key challenges developers are working on include security, user experience, and utility. Governments and regulatory bodies are expected to respond to the growing influence of cryptocurrencies through integration within existing regulatory frameworks. The most pressing challenges faced by the cryptocurrency industry, excluding regulation, include security vulnerabilities and a shortage of qualified developers. Potential game-changers on the horizon include layer 2 solutions and cross-chain tools. The future of cryptocurrencies lies in finding a balance between innovation and regulation, addressing security issues, and improving the user experience. Mass adoption may be driven by the emergence of a killer application or compelling use case that motivates people to embrace cryptocurrencies.

Cryptocurrencies, born out of the Great Recession, have become an established investment class. They envision a decentralized future where financial transactions occur seamlessly across borders, free from traditional banking institutions. However, regulatory authorities have expressed concerns about issues such as money laundering and investor protection. The future of cryptocurrencies is uncertain, with questions about sustainability and regulatory implications. Technological advancements, such as blockchain interoperability and artificial intelligence, are expected to shape the future of cryptocurrencies. The key challenges developers are working on include security, user experience, and utility. Governments and regulatory bodies are expected to respond to the growing influence of cryptocurrencies through integration within existing regulatory frameworks. The most pressing challenges faced by the cryptocurrency industry, excluding regulation, include security vulnerabilities and a shortage of qualified developers. Potential game-changers on the horizon include layer 2 solutions and cross-chain tools. The future of cryptocurrencies lies in finding a balance between innovation and regulation, addressing security issues, and improving the user experience. Mass adoption may be driven by the emergence of a killer application or compelling use case that motivates people to embrace cryptocurrencies.

A product of The Great Recession, cryptocurrencies have cemented their place as a bonafide investment class. What started with the elusive Satoshi Nakamoto's Bitcoin whitepaper has today culminated in the explosive growth of a multi-trillion-dollar global market.

The cryptocurrency movement envisions a decentralized future, where people have greater autonomy over their finances and transactions occur seamlessly across borders and barriers — all free from the constraints of traditional banking institutions. This vision propelled the rise of blockchain technology, which underpins the decentralized architecture of cryptocurrencies and promises transparency, security and efficiency in financial transactions.

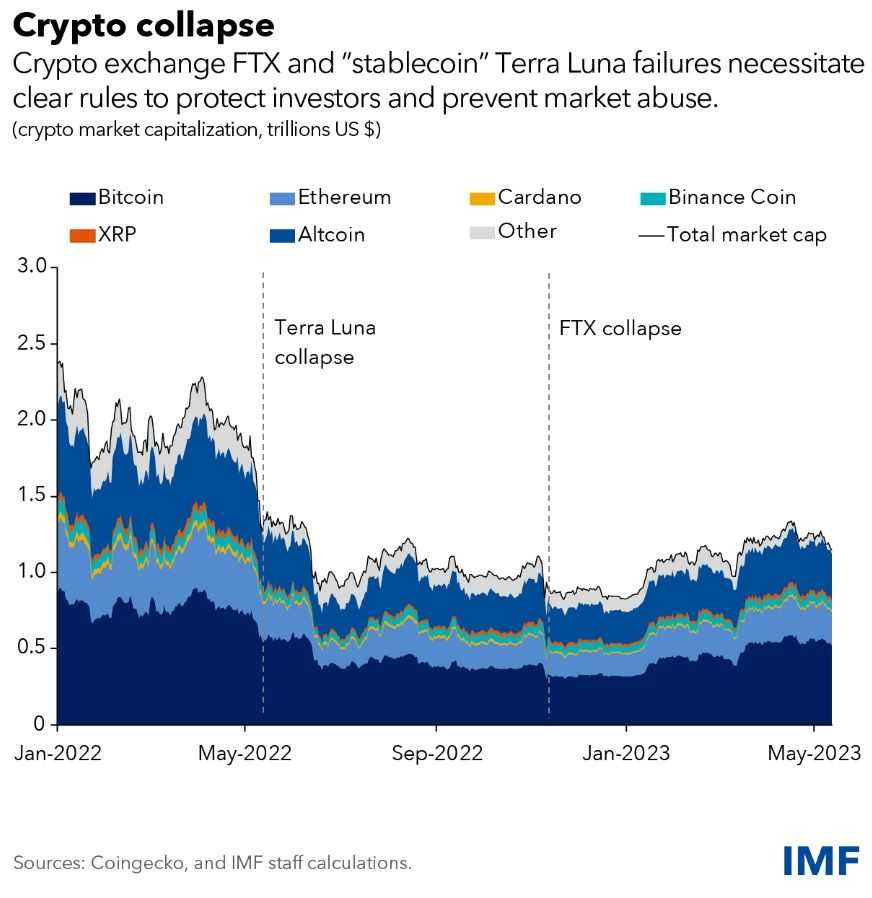

Alongside the promise of decentralization, however, cryptocurrencies have also garnered scrutiny from regulatory authorities and policymakers worldwide. Concerns ranging from money laundering and terrorist financing to market manipulation and investor protection have promoted calls for greater control of the crypto market. Crypto has always had a love-hate relationship with regulation as policymakers always seem to have to play catch up with the industry's innovation, which moves at warp speed.

Yet, amidst the current euphoria of astronomical price surges, questions linger about the sustainability and regulatory implications of the crypto ecosystem. Will cryptocurrencies pave the way for a utopian financial future where borderless, instantaneous, and low-fee transactions are the norm? Or will the spectre of regulatory intervention continue to cast a shadow, posing challenges to innovation and adoption? What about artificial intelligence, now a sector with over $26 billion within blockchain?

In this exploration, we will gaze into the crystal ball to discern the future of crypto. Our goal here is not to draw conclusions as to whether the future holds promise or uncertainty, but to shed light on the possibilities and pitfalls that lie ahead for this still nascent sector.

What is The Future of Crypto?

In this section, we delve into predictions and forecasts from industry experts to gain insights into what the future might hold for cryptocurrencies.

We asked our experts five questions:

- What are the most significant technological advancements expected to shape the future of cryptocurrencies?

- What are the key challenges that developers are currently working to address in the cryptocurrency space?

- How do you anticipate governments and regulatory bodies responding to the growing influence of cryptocurrencies?

- What are the most pressing challenges the cryptocurrency industry might face in the future excluding regulation?

- Are there any potential game-changers on the horizon that could significantly alter the trajectory of cryptocurrencies?

Technological Advancements

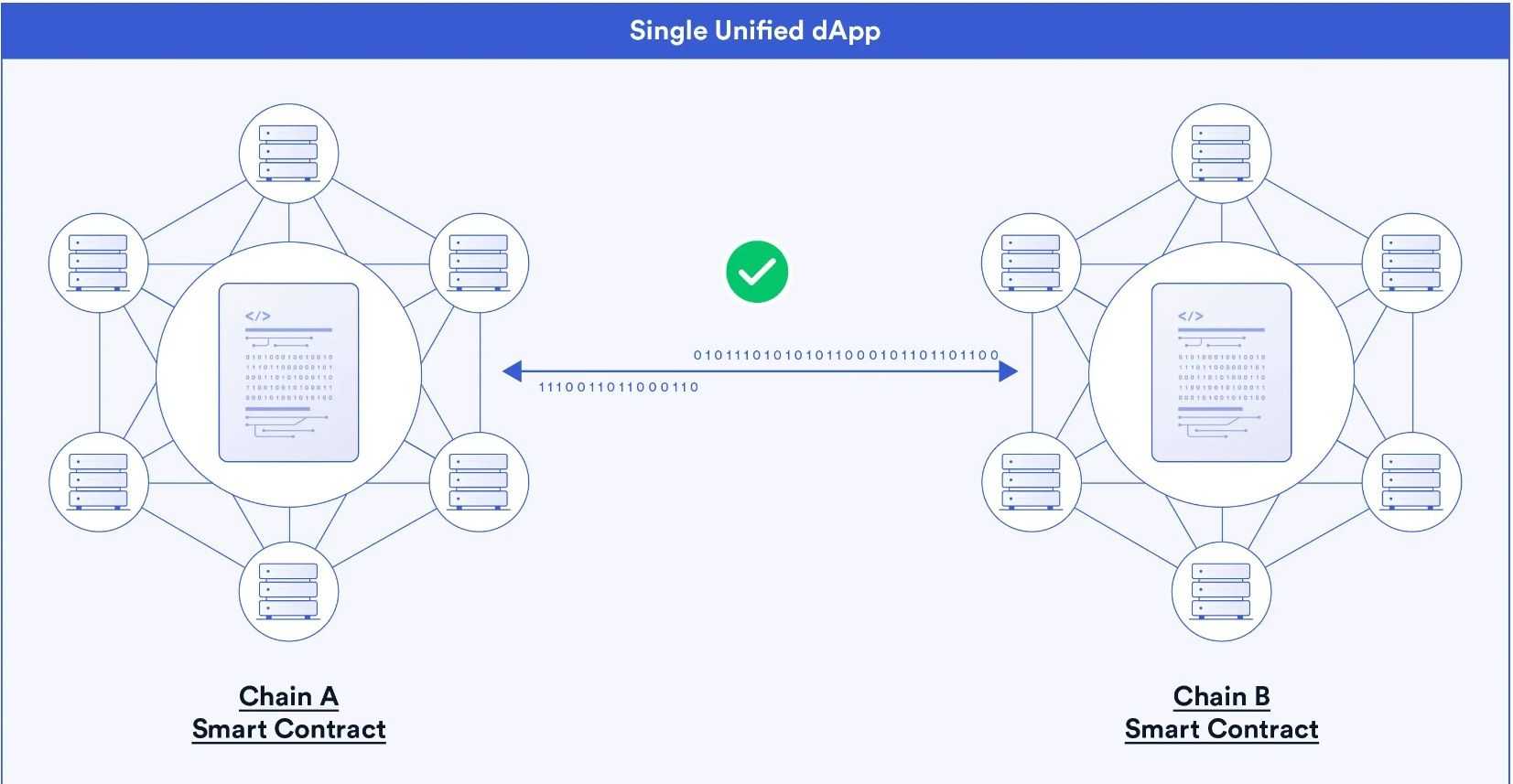

Becky Sarwate, head of communications at CEX.IO, asserts that blockchain interoperability is the most significant technological advancement expected to shape the future of cryptocurrencies. While the quest for greater interoperability remains a significant challenge, it also represents the industry's "white whale." Achieving interoperability would not only facilitate seamless transacting between different protocols but could also herald a new era of harmony in the digital economy, she told The Coin Bureau.

With a dizzying number of blockchain networks, interoperability has become crucial for enabling efficient transactions and interactions across different ecosystems, especially in industries like finance where various blockchain platforms are utilized. It offers several benefits:

- Scalability: Interoperability allows leveraging different chains for their respective strengths, addressing the blockchain trilemma and enhancing overall performance.

- New Use Cases: Interoperability unlocks diverse business models and revenue opportunities, such as decentralized finance (DeFi), asset tokenization, digital currencies, gaming, and supply chain management.

- Higher Adoption: This is crypto's endgame — onboarding billions of people. Interoperability, connected decentralized apps (DApps) and more chain support will lead to a simplified user experience.

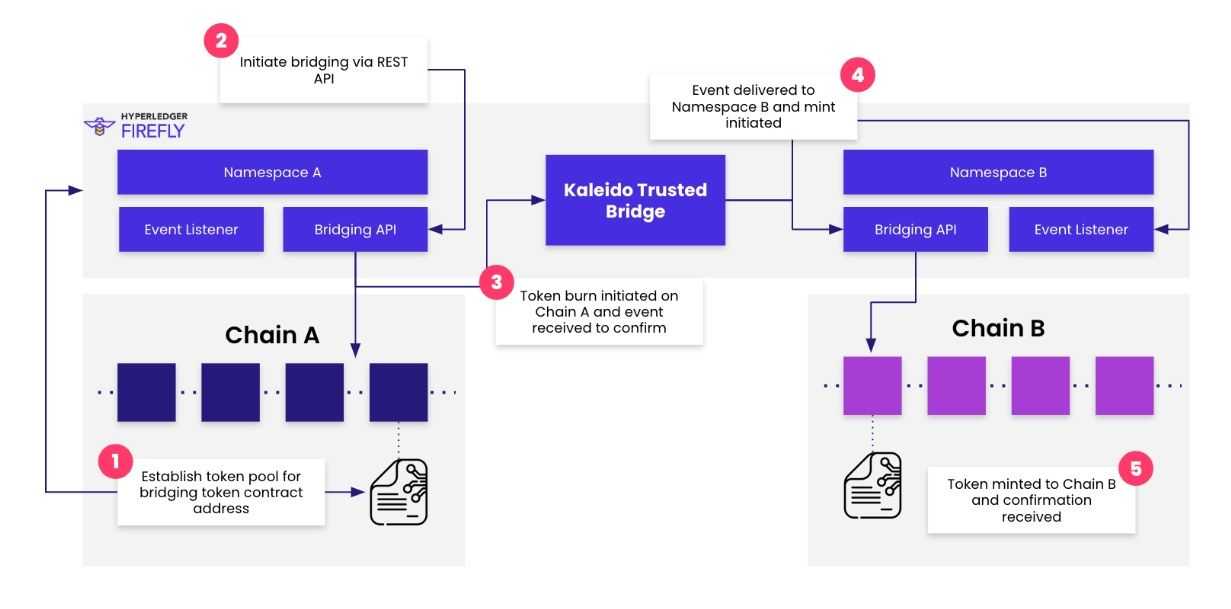

There are various types of blockchain interoperability solutions:

- Token Swaps: Involves trading tokens between different blockchains, facilitated by atomic swap protocols or cross-chain automated market makers (AMMs) with separate liquidity pools.

- Token Bridges: Enable the movement of assets across blockchains through different mechanisms

- Contract Calls: Smart contracts on one blockchain calling functions deployed on another blockchain, possibly based on data from the source blockchain.

- Programmable Token Bridges: Combining token bridging with arbitrary messaging, allowing for richer cross-chain functionality within a single transaction, such as staking, swapping, or depositing tokens into smart contracts on the destination chain.

However, Sarwate argues that such a development would primarily resonate with active crypto users, doing little to engage the general public. Instead, she suggests exploring how blockchain technologies can transform traditional sectors as a means to generate broader interest.

Not only could this help non-engaged participants become crypto-curious, but additional vectors have the potential to rebrand crypto as more than a speculative instrument.

Sarwate also emphasized the importance of highlighting the broader utility afforded by interoperability. By showcasing blockchain's potential beyond trading, she contends that crypto can shed its niche status and gain wider acceptance.

However, there are a few roadblocks the industry must overcome in order to achieve interoperability:

- Security Concerns: Interconnected blockchains could amplify the impact of vulnerabilities, as issues in one blockchain may affect others. Smart contract vulnerabilities might propagate across interconnected networks, posing security risks.

- Compliance and Regulatory Issues: Cross-chain transactions may raise compliance concerns due to conflicting regulations in different jurisdictions, complicating regulatory adherence.

- Lack of Standardization: The current lack of standardization in interoperability solutions may lead to incompatibility and fragmentation between blockchain networks, hindering seamless communication and data exchange.

- Performance Issues: Increased complexity and communication between interconnected networks could result in performance issues, potentially reducing transaction speeds and increasing costs.

By balancing technical advancements with practical applications, the industry can navigate towards a more inclusive future in the digital economy, Sarwate concluded.

Artificial Intelligence

Joe Lackner, founder of Coin Interest Rate, a website that tracks crypto interest rates, reasons that AI holds immense potential to revolutionize both the user experience and the development of cryptocurrencies. AI technologies could play a pivotal role in identifying fraudulent tokens and simplifying complex concepts such as wallet transactions and smart contracts, he told The Coin Bureau.

The combined utilization of blockchain and artificial intelligence (AI) offers a synergistic approach to addressing various challenges and unlocking new opportunities across different domains:

- Authenticity and Trust: Blockchain's immutable ledger provides transparency into the origins and integrity of data used by AI systems, addressing concerns related to explainable AI. This transparency fosters trust in the data and recommendations provided by AI algorithms, enhancing overall data integrity and credibility.

- Augmentation of Intelligence: AI's ability to analyze and interpret vast amounts of data is complemented by blockchain's capability to securely store and distribute this data. By leveraging blockchain technology, AI can access a wealth of information both within and outside organizational boundaries, enabling deeper insights and more informed decision-making. This collaboration facilitates scalability and fosters a transparent and trustworthy data ecosystem.

- Automation of Processes: The integration of AI, automation, and blockchain streamlines business processes, particularly those involving multiple parties. Smart contracts embedded with AI models can automate complex actions such as product recalls, transactions, dispute resolution, and logistical decisions. This automation reduces friction, enhances speed, and improves efficiency, ultimately delivering value across interconnected networks.

Blockchain is increasingly being recognized as a crucial tool in safeguarding against misuse of AI in the business world. By leveraging blockchain's decentralized and transparent nature, companies can protect valuable intellectual property (IP) used to train AI chatbots while also opening up new revenue streams.

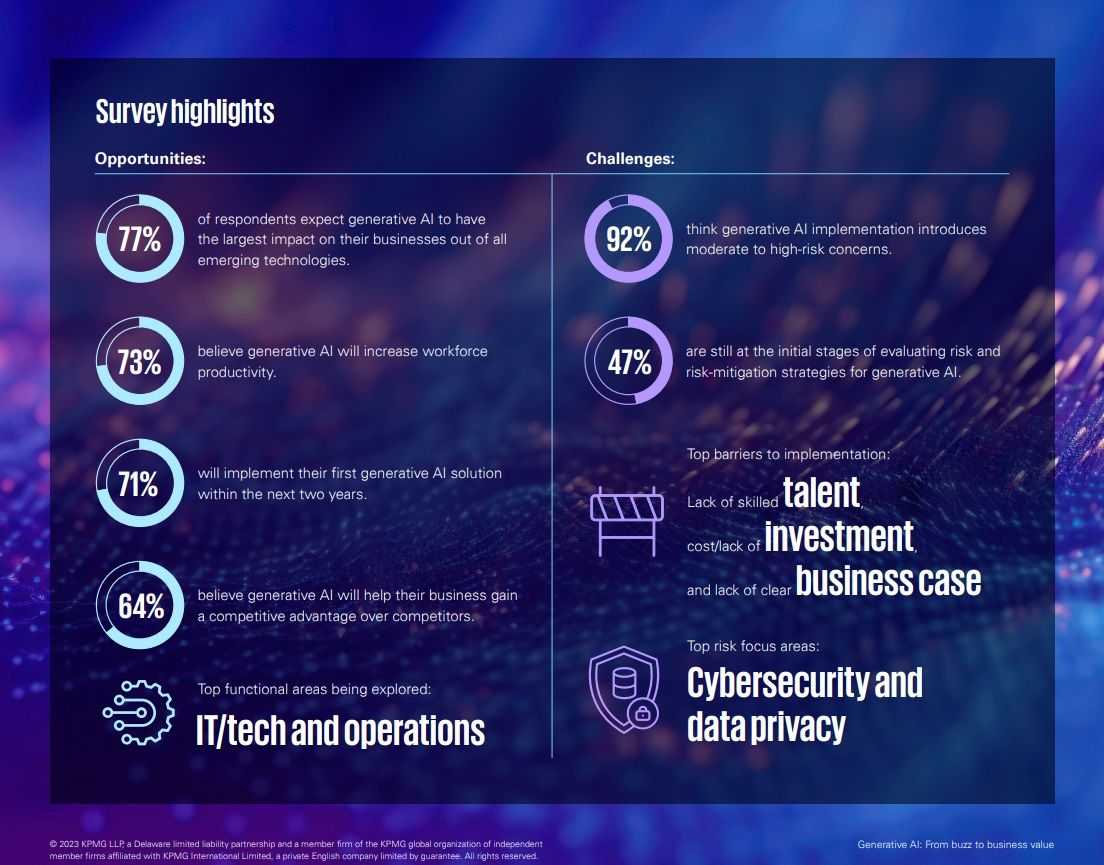

Here are key benefits outlined in a survey by KPMG:

- Accurate Identity and Verification: Blockchain's decentralized identity and verification capabilities ensure the authenticity and ownership of IP used in training AI chatbots, preventing unauthorized use.

- Proper Attribution and Royalties: Transforming IP into non-fungible tokens (NFTs) with smart contracts on a blockchain enables companies to specify usage rights, attribution requirements, and royalty payments.

- Protection Against Infringement: Storing IP on a blockchain reduces the risk of infringing on others' IP by allowing companies to compare their content with existing records and avoid potential legal disputes.

- Legal Certainty: Blockchain helps address legal uncertainties surrounding AI by establishing transparent and traceable records of content ownership, copyright protection, and liability.

- Data Privacy and Compliance: Incorporating blockchain ensures compliance with data protection regulations and demonstrates responsible use of AI, particularly concerning data privacy when training AI models on publicly available data.

However, like AI itself, blockchain is not a standalone solution but rather part of a broader framework that encompasses both technology and human-centric considerations. Organizations face significant tasks ahead in adopting and enforcing responsible AI frameworks, which necessitate a holistic approach integrating people, processes, and technology. This involves ensuring data integrity, statistical validity and model accuracy — the top three concerns identified by executives in the KPMG survey.

Mass Adoption

Vladimir Smerkis, co-founder of crypto trading app Blum, said that while significant progress has been made since the inception of the cryptocurrency market, complexities remain a barrier for the mass audience, except for those using centralized exchanges.

Mass adoption is a sticky topic in the crypto realm.

While virtually every project aims to onboard a billion people to crypto, the complexity keeps many would-be users at bay. The industry is actively trying to devise ways of making the blockchain aspect invisible to the Average Joe. One solution is chain abstraction.

Chain abstraction simplifies the complexities of blockchain technology into more understandable layers. By abstracting these layers, blockchain technology becomes more accessible to developers, users, and stakeholders without requiring deep technical knowledge. This accessibility, proponents hope, will foster mainstream adoption and facilitate the development of intuitive DApps.

NEAR Protocol is one project working on chain abstraction. It envisions a world where navigating the Web3 landscape feels as seamless as strolling through a well-organized city. Chain abstraction will simplify the user experience by removing the need to worry about which blockchain they're on or how to navigate between networks.

Another solution aimed at lowering the barrier to entry is account abstraction, which allows users to utilize smart contracts as their accounts instead of the traditional Externally Owned Accounts (EOAs). EOAs, controlled by external private keys, are the default account model in many blockchain networks and they require a deep understanding of blockchain mechanics to be used safely, potentially acting as a barrier for some users.

“Initiatives like account abstraction and gasless transactions across networks are only starting to emerge and have yet to be fully integrated at scale.” - Vladimir Smerkis

Simplifying the User Experience

Ulyana Skladchikova, head of product at EVM explorer Blockscout, highlights several developments aimed at streamlining user experiences and enhancing transaction speeds to rival centralized services like Visa in the near term.

Skladchikova points out that account abstraction is poised to revolutionize the onboarding process for new users by allowing them to create cryptocurrency wallets using familiar methods such as email and passwords. Additionally, subsidized user fees are expected to alleviate friction points encountered during the initial onboarding process into the crypto world.

Skladchikova notes that scaling efforts, such as the introduction of EIP-4844 (proto-danksharding) for Ethereum and the emergence of new Layer 2 solutions on Bitcoin, will unlock programmability and new use cases, attracting a wave of new users to the ecosystem.

“Decentralized social platforms will also play a large role in shaping the future of cryptocurrencies, as DeFi applications can be directly embedded and enable payments, trading, and other activities through these community-owned platforms.” - Ulyana Skladchikova

Key Challenges For Developers

Sarwate, the head of comms at CEX.IO, said that security remains a formidable challenge for both developers and participants.

Indeed, just as the industry has matured, bad actors have devised sophisticated techniques to target blockchains. Here's what a blockchain breach might look like:

- Blockchain Ecosystem Vulnerabilities: Small networks are more susceptible to attacks. Sybil attacks involve a bad actor gaining control of multiple nodes. 51% attacks target Proof-of-Work blockchains, allowing control over the majority of the mining power and enabling double-spending.

- Centralization Risks: Despite aiming for decentralization, factors like mining pools can centralize control, posing vulnerabilities. Additionally, reliance on centralized cloud infrastructure, such as Amazon Web Services, can introduce risks if targeted, leading to increased centralization and vulnerability to attacks.

- Blockchain Network Congestion: Insufficient validators can cause delays and increased fees, potentially leading to downtime and instability, eroding confidence in network resiliency.

Despite significant technological advancements in the crypto sphere, fraud continues to pose a pervasive threat, often dominating industry discussions and media coverage. Sarwate points out that high-profile cases, like the recent sentencing of Sam Bankman-Fried, not only tarnish crypto's public image but also serve as constant reminders of the risks involved, potentially dissuading potential participants from entering the crypto realm.

According to Immunefi, the crypto industry lost $336.3 million in the first quarter of 2024. Of the total, $321.6 million was lost to hacks and $14.7 million was lost to fraud. By comparison, hackers and fraudsters stole $437.5 million in the first quarter of 2023.

In addition to network-level attacks, there are also attacks on infrastructure and users:

- Popular Software Attacks: Target wallets and software, such as the exploit on the Solana mobile wallet Slope.

- Centralized Exchange Hacks: Cryptocurrency exchanges, like Binance and HTX, have been targets for hackers.

- Malware: Infects users' computers to steal wallet keys or perform unauthorized transactions.

- Phishing Attacks: Exploit individuals by tricking them into divulging sensitive information through bogus websites or messages.

- SIM Swap Attacks: Gain control over accounts linked to a user's phone number by swapping SIM card details.

- Social Engineering Scams: Convince individuals to send cryptocurrency or reveal private keys under false pretenses.

- User Error: Risks include losing private keys, revealing them accidentally, or sending assets to the wrong address.

Sarwate argues that the core issue at hand is trust. While digital asset technology promises to transcend traditional financial systems, building trust is paramount. She poses a critical question:

How can crypto combine the peace of mind offered by financial institutions, with the mobility and freedom of a peer-to-peer network?

She suggests that self-custodial wallets offer users greater control over assets but acknowledges that more must be done to create a user-friendly transacting environment.

A critical piece of this puzzle is doing more to eradicate the latitude bad actors have to exploit network weaknesses and knowledge gaps in first-time users. If the industry can’t remedy this problem on its own, such mounting outcomes will inevitably induce regulators and elected officials to intervene, as is increasingly the case.

Complexity of Use and Data Availability

Blockscout's Skladchikova highlights several key issues that developers are currently addressing to enhance usability and sustainability within the industry.

The complexity of blockchain technology is a significant barrier to entry, particularly with the influx of new chains and applications, Skladchikova said. In a survey by NerdWallet, 68% of Americans said they didn't fully understand the concept and how it works. Alarmingly, 37% of current crypto investors said the same thing.

To overcome this hurdle, developers are focusing on creating multichain applications that streamline fund movement and tracking across different chains, thus simplifying the user experience.

In terms of security, Skladchikova emphasizes the need for tools that promote transparency, such as smart contract verification tools, to mitigate risks. Additionally, innovations in wallet technology, such as password recovery features, are helping users safeguard their assets and recover lost funds.

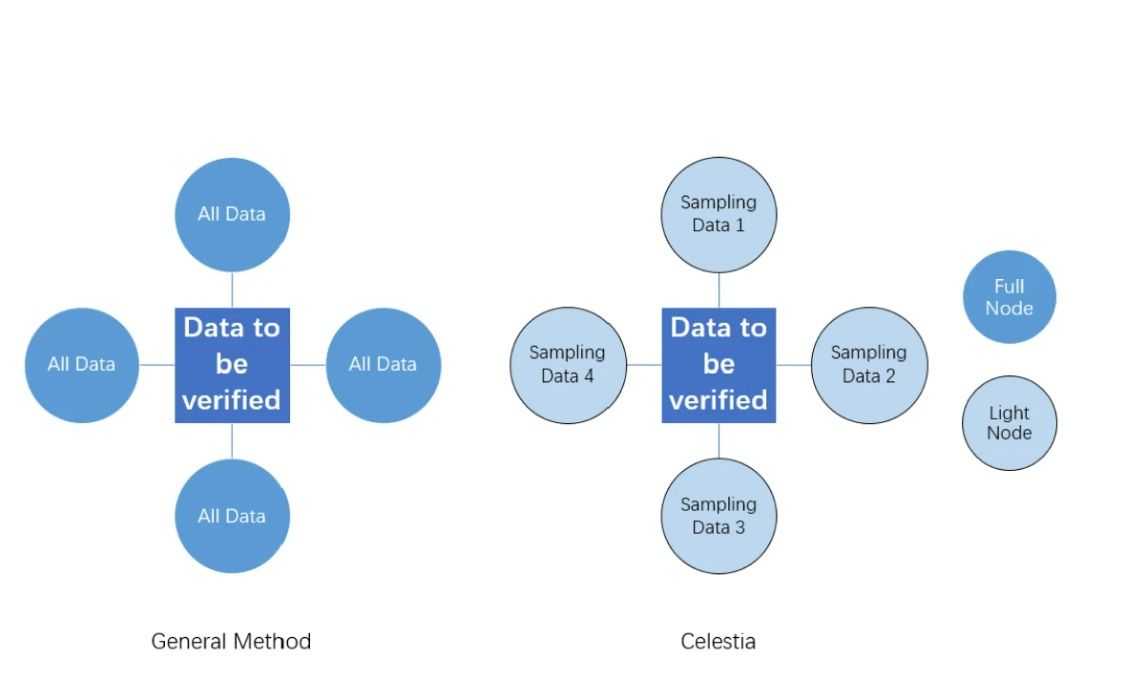

Data availability is another challenge facing developers.

The concept of data availability in cryptocurrency ensures that all participants in the network have access to the necessary data to verify transactions. This is particularly crucial in decentralized platforms like Ethereum, where each node independently confirms transactions without relying on trust from other nodes. In simpler blockchain configurations, every full node downloads and verifies the entire transaction dataset to uphold the network's integrity.

So, what's the problem?

When not running a full node, ensuring the accuracy of transaction data becomes essential. This is particularly relevant when considering the expansion of block size limits, which can lead to increased costs for running full nodes and a shift towards using less secure light nodes. To address this, light clients require fraud-proof mechanisms to verify block data effectively.

Layer 2 scaling solutions, like rollups, aim to improve blockchain scalability by handling transaction data off-chain. In optimistic rollups, sidechain users rely on fraud proofs to identify invalid transactions, while zero-knowledge (ZK) rollups utilize cryptographic proofs for data validation. These mechanisms help maintain data integrity and security, even when using lighter nodes or off-chain processing methods.

Skladchikova highlights efforts by DA providers like Celestia and Avail to streamline data confirmation and ensure efficient scaling of chains, particularly with the integration of new Layer 2 solutions.

Lastly, Skladchikova points out the importance of creating appropriate incentives and economic models to attract and retain users.

“We’ve seen many different airdrop models designed to reward real users deployed with varying degrees of success. Points programs are the latest variation of this. Designing systems that are fair and effective for user retention is an ongoing challenge." - Ulyana Skladchikova

Regulation

There's a consensus among regulators around the world: The crypto industry has to be regulated.

In 2023, the IMF made the following policy recommendations:

- Maintaining Robust Domestic Institutions: The defence against cryptocurrencies replacing sovereign currencies lies in maintaining strong domestic institutions. Transparent and coherent monetary policy frameworks are essential for effectively addressing the challenges posed by crypto assets.

- Avoiding Official Currency Status for Cryptocurrencies: To protect national sovereignty, it's crucial not to grant crypto assets official currency or legal tender status. According to the IMF, doing so could lead to fiscal risks, threaten financial stability, and potentially result in rapid inflation.

- Integrating Crypto Assets within Existing Regulatory Regimes: Policymakers should integrate cryptocurrencies within existing regimes and rules governing capital flows to address volatility effectively. This integration will help ensure stability and minimize disruptions caused by capital flows associated with crypto assets.

- Clarifying Tax Treatment of Cryptocurrencies: Tax policies should provide unambiguous treatment of crypto assets, and compliance efforts should be strengthened. Specific regulations are needed to clarify the tax treatment of cryptocurrencies, including value-added taxes and levies on income or wealth.

The EU implemented the Markets in Crypto-Assets (MiCA) regulatory framework in June 2023 to regulate crypto-asset markets, focusing particularly on stablecoins. MiCA imposes strict transparency, governance, and prudential rules to enhance citizens' protection, financial stability, innovation, and financial inclusion.

Also in 2023, Hong Kong and Singapore emerged as frontrunners in crypto regulation within Asia, attracting numerous global crypto firms to establish a presence in both regions. Elsewhere in Asia, Japan, South Korea and Taiwan also put in place crypto-specific regulations and guidelines.

“While there’s some debate around the direction regulation should take, there’s no question that greater oversight is needed to protect participants from others, as well as themselves” - Becky Sarwate

One notable country missing is the U.S. where four agencies — the SEC, the Department of Justice, the Commodity Futures Trading Commission and the Treasury Department's Financial Crimes Enforcement Network — police the sector at their whim amid a lack of clear regulatory guidelines.

In 2023, the U.S. was the most active enforcer of penalties and legal action against crypto companies.

According to Sarwate, these regulatory actions are driven by the need to safeguard both traditional financial institutions and individual investors from the potential exploitation of vulnerable systems.

Blum's Smerkis notes a tightening regulatory landscape, evident through an increase in inquiries, lawsuits, and fines targeting non-compliant platforms.

While such measures serve to weed out bad actors, Smerkis points out that regulatory frameworks often tend towards restrictive measures, particularly in certain jurisdictions where unfriendly legislation pushes users into operating in a murky, cross-border zone.

"Effective regulation should not only prioritize safety and transparency but also establish operational conditions conducive to businesses and enterprises. Notably, the crypto industry boasts exceptional transparency, affording several advantages over traditional banking systems." - Vladimir Smerkis

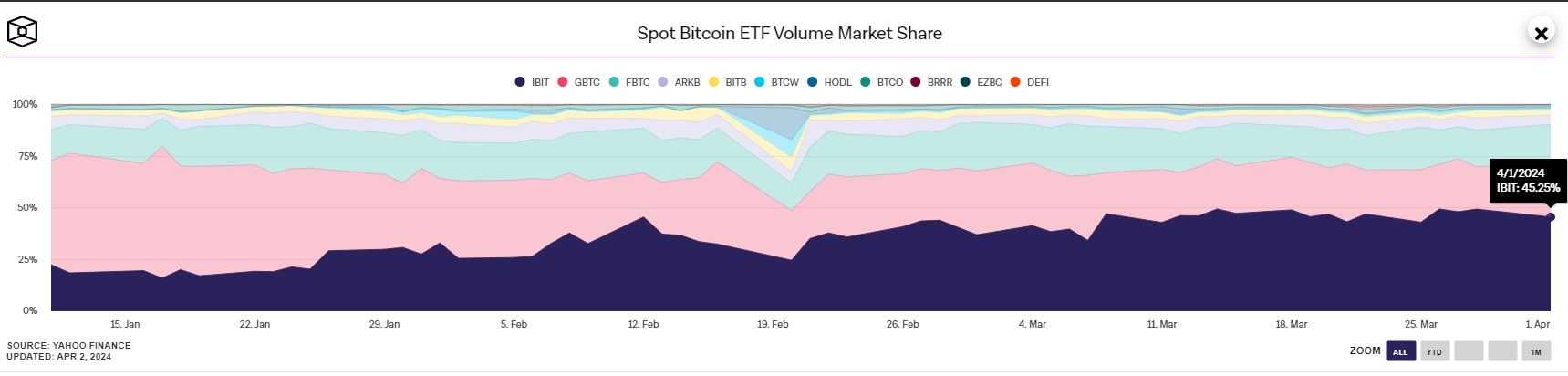

Mojmir Racak, head of business development at Blockscout, predicts that "DeFi regulation is inevitable" in the long term.

With prominent entities like BlackRock now actively involved in the space, possessing significant resources and legal teams, Racak anticipates that they will expedite the regulatory process to safeguard their interests. For reference, BlackRock holds a mammoth 45.25% market share of the Bitcoin spot ETF market.

“Defined regulations should help other institutional, retail, and individual users enter the space.” - Mojmir Racak

Future Challenges

Security will continue to be a challenge for the crypto industry down the line, according to Sarwate. For Bitcoin specifically, environmental concerns will continue to be a topic of interest.

Sarwate points out that the pursuit of discovering new BTC has led some mining facilities to resort to coal-fired power, raising concerns about environmental sustainability. With the upcoming halving event exacerbating the challenges for miners to break even, there is an added economic incentive to opt for cheaper but environmentally damaging energy resources like coal.

Much has been said about Bitcoin's environmental impact.

According to a study published in the Earth's Future journal, the global Bitcoin mining network consumed 173.42 Terawatt hours of electricity during the 2020–2021 period. This means that if Bitcoin were a country, its energy consumption would have ranked 27th in the world.

Those in the opposing camp point out studies that show how the banking industry consumes more energy than Bitcoin.

Sarwate suggests that to address this issue and set a forward-looking precedent for the industry, the Bitcoin community could consider adopting a less energy-intensive protocol, drawing inspiration from Ethereum's approach.

User Experience and Utility

Coin Interest Rate's Lackner identified several pressing challenges beyond regulation that the sector must address.

One significant challenge lies in user experience (UX) and utility. Lackner emphasizes that tasks such as using, buying, trading, and managing tax liabilities for users remain daunting. While new functionalities like account abstraction hold promise for enhancing user safety and preventing losses, the overall experience needs to become more seamless, secure, and user-friendly.

He also echoed Sarwate's comments on security, noting the prevalence of scams, spam and phishing within the crypto space. He highlighted the need for additional tools to mitigate these risks, as they often deter non-technical users from participating due to the perceived outweighing of risks over benefits.

Regarding utility, Lackner advocates for interest and staking rewards as essential incentives for crypto users to view their investments as long-term assets.

"However, we saw far too many CeFi platforms like Celsius Network implode from bad internal actors and third-party risk, so there's obviously a lot of work needed here as well." - Joe Lackner

Consolidation and Shortage of Developers

Blockscout's Racak predicts a period of reckoning and consolidation amidst the proliferation of new Layer 2 chains.

Racak said that many of these chains may struggle to maintain ongoing usage and will face three possible outcomes:

- Finding a specific niche

- Being acquired by larger chains seeking to expand their user base

- Fading into obscurity

A more pressing concern, however, is a shortage of qualified developers entering the blockchain and cryptocurrency space, Racak said. According to a Developer Report, the number of net blockchain developers fell 24% in 2023 over the previous year. Developers who have been in crypto for over two years are at an all-time high, however, after growing at 52% annualized for the past five years.

While web3 was once a fertile ground for developers, recent advancements in AI have attracted much of the new top talent, according to Racak. Funding shortages during the previous bear market resulted in many developers losing their jobs and transitioning to other industries, he noted.

“In addition, the L2 issue above is creating a lot of segmentation where developers choose an ecosystem and learn all of the tools of that ecosystem, making it difficult to move between different chains. Standardized tooling across ecosystems will help alleviate some of these issues.” - Mojmir Racak

Potential Game Changers

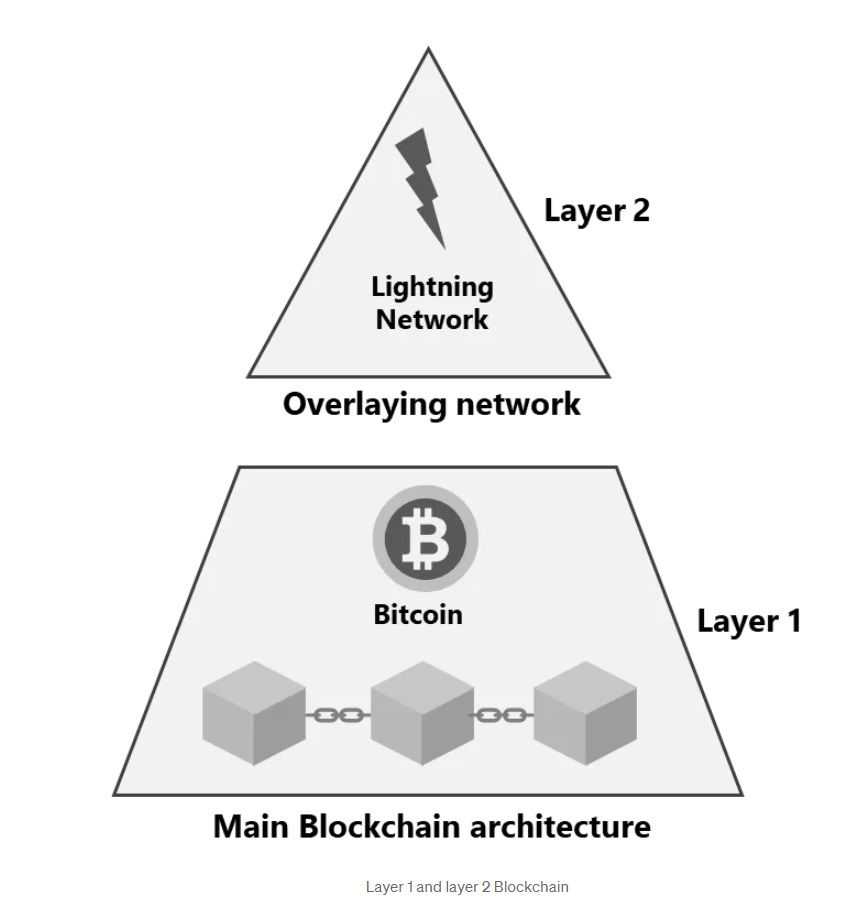

Sarwate identified Layer-2 solutions as potential game-changers on the horizon that could significantly alter the trajectory of cryptocurrencies.

Imagine a highway where each car represents a transaction on the blockchain, and the highway itself is the main blockchain. As more cars join the highway, congestion increases, leading to slower speeds and delays in reaching their destinations.

Now, let's introduce a Layer-2 solution. In our analogy, think of it as adding express lanes or toll roads alongside the main highway. These express lanes operate separately from the main highway but still connect to it at key points.

Here's how it works: when a driver wants to reach their destination quickly, they have the option to use the express lanes instead of the main highway. These express lanes have fewer cars and smoother traffic flow compared to the main highway, allowing drivers to bypass congestion and reach their destination faster.

Similarly, in the context of blockchain, a layer 2 solution operates parallel to the main blockchain but processes transactions off-chain. Users can choose to utilize the layer 2 solution for faster and cheaper transactions, avoiding congestion on the main blockchain. Transactions processed on the layer 2 solution are settled on the main blockchain, similar to how drivers on express lanes eventually merge back onto the main highway.

Here are the main types of Layer 2 solutions and their examples:

- State Channels: Allow multiple parties to conduct transactions off-chain, reducing congestion and fees. Example: Lightning Network for Bitcoin.

- Sidechains: Separate blockchains linked to the main chain, facilitating asset transfer between chains. Example: Liquid Network for Bitcoin.

- Optimistic Roll-ups: Enable smart contract execution off-chain with Ethereum Layer 1 security. Examples: Arbitrum and Optimism for Ethereum.

- Zero-Knowledge Rollups (ZK-rollups): Use Zero Knowledge Proofs to verify transaction validity off-chain, enhancing privacy. Examples: Starknet, Polygon ZK EVM, and ZKSync.

Sarwate highlighted various methods that networks employ to bolster interoperability. Notably, she pointed out that Ethereum recently entered a new phase where L2 engagement surpassed base network activity for the first time.

"A shift of this magnitude shows a clear trend of where the industry is headed, and the types of services capturing participant attention."

As projects continue to evolve to accommodate greater capacity and throughput, she observes the possibility of users consolidating around dominant networks. However, Sarwate acknowledges a robust contingent within the space that remains attracted to emerging opportunities.

"But short of a major breakthrough in clean energy production, the refinement of network architecture is the focal point many projects are striving toward." - Becky Sarwate

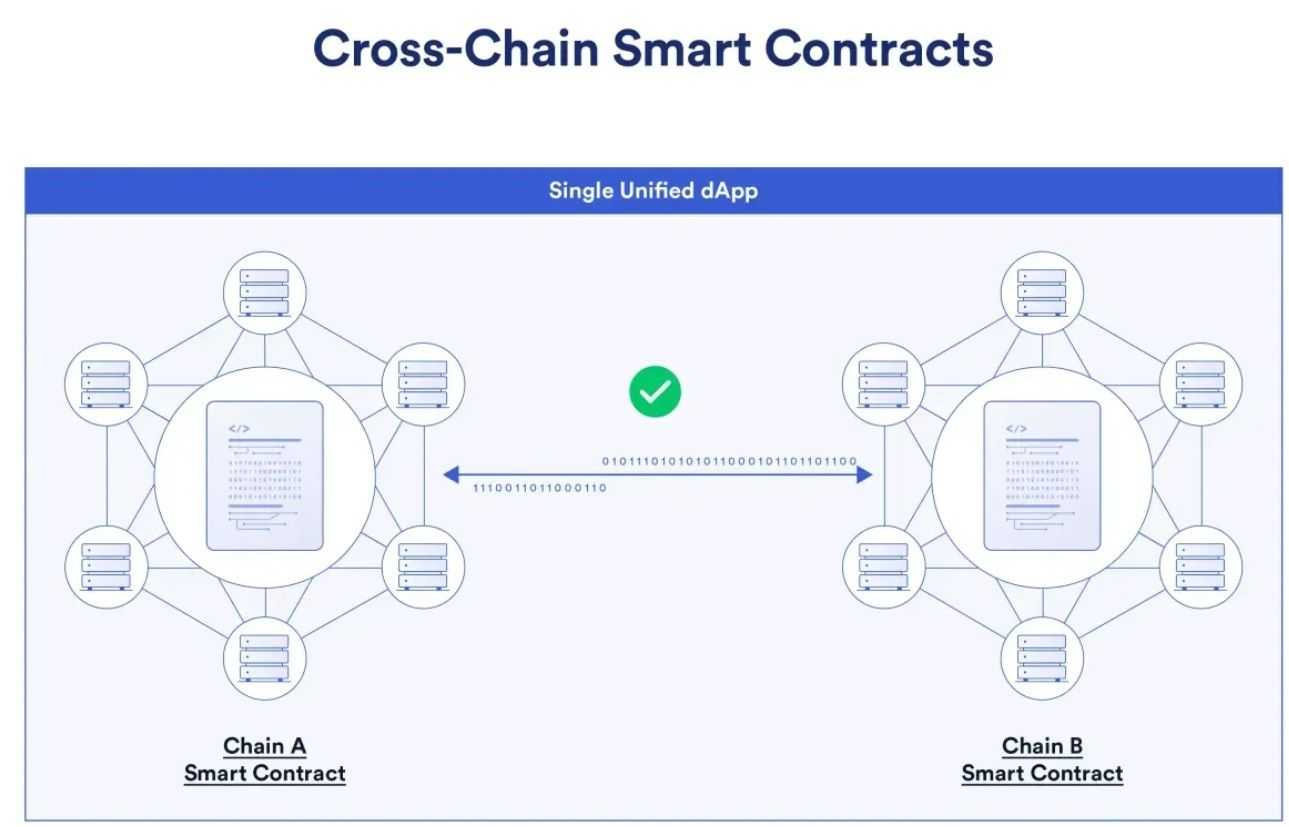

Cross-Chain

Smerkis said cross-chain tools revolutionizing the gaming industry and creating novel opportunities that leverage the Bitcoin blockchain's foundation.

Cross-chain solutions involve validating the state of the source blockchain and relaying transactions to the destination blockchain, both crucial for completing cross-chain interactions. Cross-chain bridges facilitate token transfers between blockchains by locking or burning tokens on the source chain and unlocking or minting them on the destination chain.

While cross-chain bridges focus on token transfers, programmable token bridges enable more complex interactions like swapping and staking in the same transaction. Additionally, arbitrary data messaging protocols support generalized cross-chain functionality, facilitating the development of diverse applications such as decentralized exchanges, money markets, NFTs, games, and more.

"Furthermore, there's a fresh perspective on NFTs, including those integrated into new networks." - Vladimir Smerkis

What About Adoption?

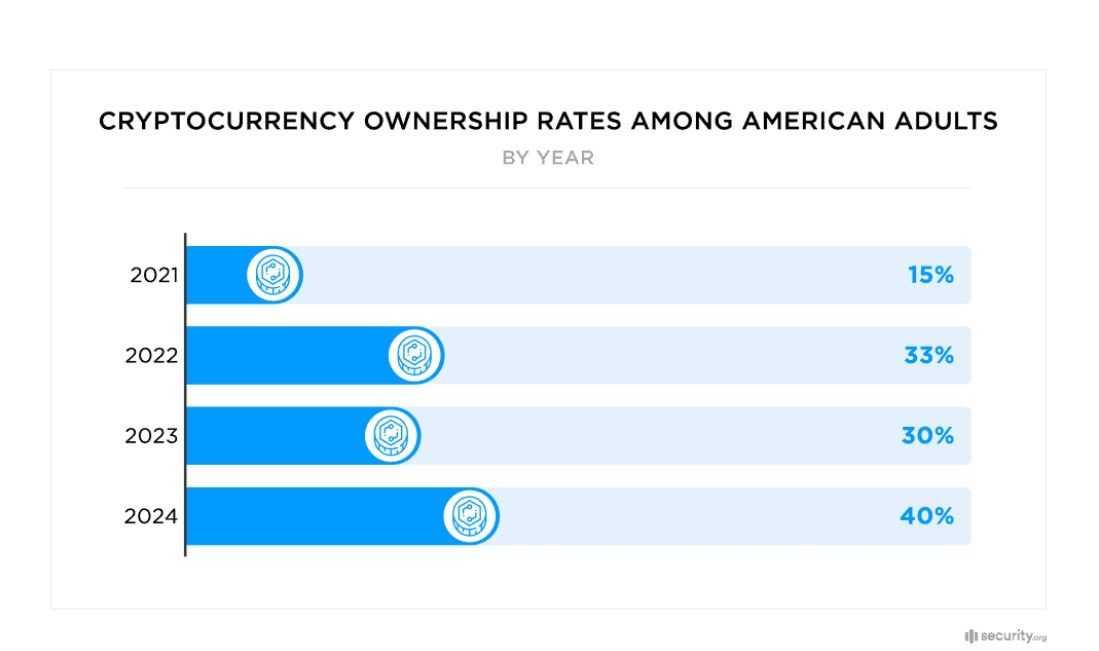

According to Chainalysis, worldwide grassroots crypto adoption is down, but that in lower-middle-income countries is on the up. Security.org says awareness and ownership rates have increased — 40% of American adults now own crypto, up from 30% in 2023.

The ideals crypto is grounded in can perhaps be summarized in two words: decentralized empowerment.

Cryptocurrencies may have been founded on the principles of self-sovereignty but most crypto entrants today have only one thing in mind: Making money fast. It's why there are so many meme coins and rug pulls. It's why the industry is rampant with scams and frauds. The allure of speculative gains in an era of economic disparity is too tempting for a generation seeking quick wealth.

Perhaps, the industry needs to double down on this to drive adoption. While speculative platforms offer fast gains, they also pose risks and challenges. However, beyond speculation, crypto presents opportunities to reshape finance through DeFi, democratizing access to assets and enhancing financial flexibility. The focus should be on designing transparent and non-exploitative mechanisms to harness these speculative interests.

Racak suggests that the mass adoption of Web3 may hinge on the emergence of a "killer application" or a compelling use case. He brought up universal basic income or another innovative concept that could motivate people to embrace Web3. Drawing parallels to rapid adoption seen in other contexts, such as play-to-earn games in the Philippines, Racak envisions a scenario where a new use case could propel global adoption, attracting hundreds of millions of new users within a short timeframe.

The Future of Crypto: Closing Thoughts

The future of crypto is filled with promise and potential. The insights from experts paint a picture of a sector that is evolving, with significant potential for reshaping the global financial landscape, yet facing hurdles that must be overcome.

Technological advancements, particularly in blockchain interoperability and artificial intelligence, are set to play a pivotal role in enhancing the functionality, security, and user experience of cryptocurrencies. The regulatory landscape for cryptocurrencies remains a complex and evolving area.

Despite these challenges, the potential for cryptocurrencies to drive a more decentralized, efficient, and inclusive financial system remains undiminished. The path forward requires balancing innovation with regulation, addressing security vulnerabilities, and continually striving to enhance the user experience.

Frequently Asked Questions

Blockchain interoperability and artificial intelligence (AI) are significant advancements. Interoperability facilitates seamless transactions across different blockchain protocols, while AI can enhance security, user experience, and the development of cryptocurrencies.

Developers are tackling issues related to security, scalability, and user experience. Security remains a top concern due to sophisticated attacks and scams. Scalability is crucial for handling increased transaction volumes without compromising speed or cost. Enhancing user experience involves simplifying interactions with blockchain technology for mainstream adoption.

Layer-2 solutions, which aim to improve scalability and reduce transaction costs, and cross-chain technologies that enable interoperability between different blockchains, are seen as potential game-changers. Additionally, the integration of AI could revolutionize various aspects of cryptocurrency usage and development.

Blockchain interoperability refers to the ability of different blockchain systems to communicate and transact with each other seamlessly. It is crucial for creating a unified and efficient ecosystem that supports diverse applications and services, enhancing user experience and enabling broader adoption of blockchain technology.

AI can impact the sector by improving security through fraud detection, simplifying complex processes like smart contracts and wallet transactions, and enhancing decision-making through data analysis. It represents a synergistic approach to addressing challenges and unlocking new opportunities within the cryptocurrency space.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.