Exploring the Frontier: The Top Crypto Narratives of 2024

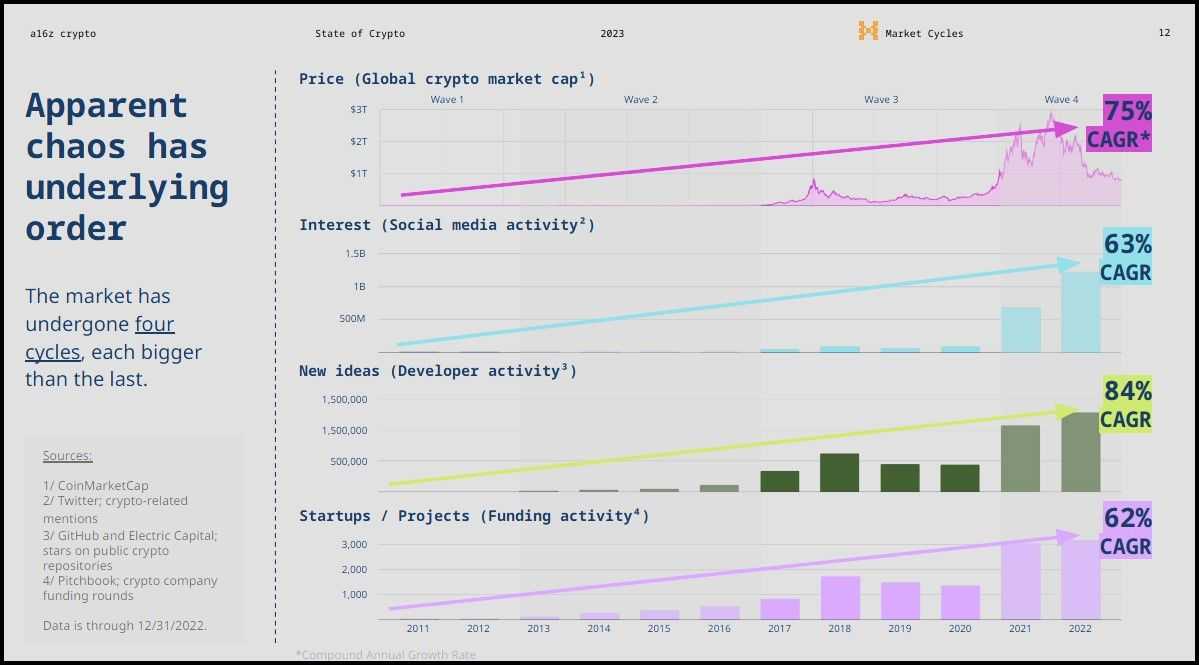

The article explores the various narratives that are shaping the cryptocurrency landscape in 2024. It highlights the revival of the cryptocurrency sector, emphasizing its resilience and evolving nature. The growing global interest in cryptocurrencies is supported by a significant increase in fresh ideas, the proliferation of startups, and expanding user bases.

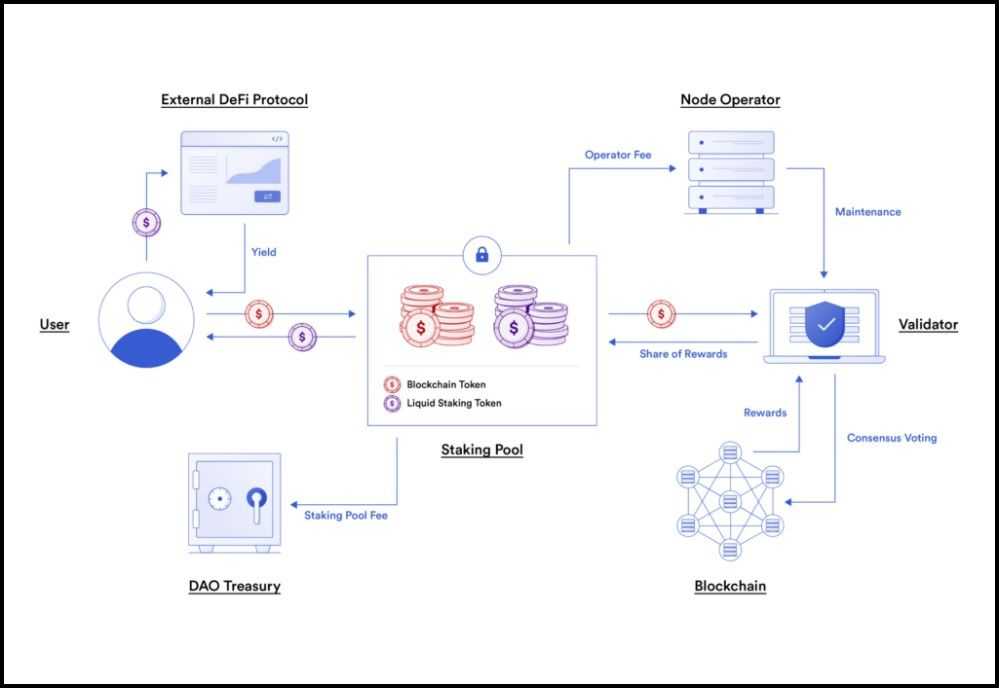

The first narrative discussed is liquid staking tokens, which address the liquidity constraints faced by participants in the traditional staking model. Liquid staking tokens allow stakers to maintain liquidity while their assets are staked, thus maximizing operational efficiency and financial opportunities within the blockchain ecosystem. However, this approach also comes with risks such as smart contract vulnerabilities and market volatility.

The second narrative is restaking, which redefines the mechanics of blockchain security and token economics. Restaking involves new blockchain networks delegating their economic security to a specialized security layer. This approach streamlines security, lowers barriers to entry, and incentivizes new participants to join the ecosystem.

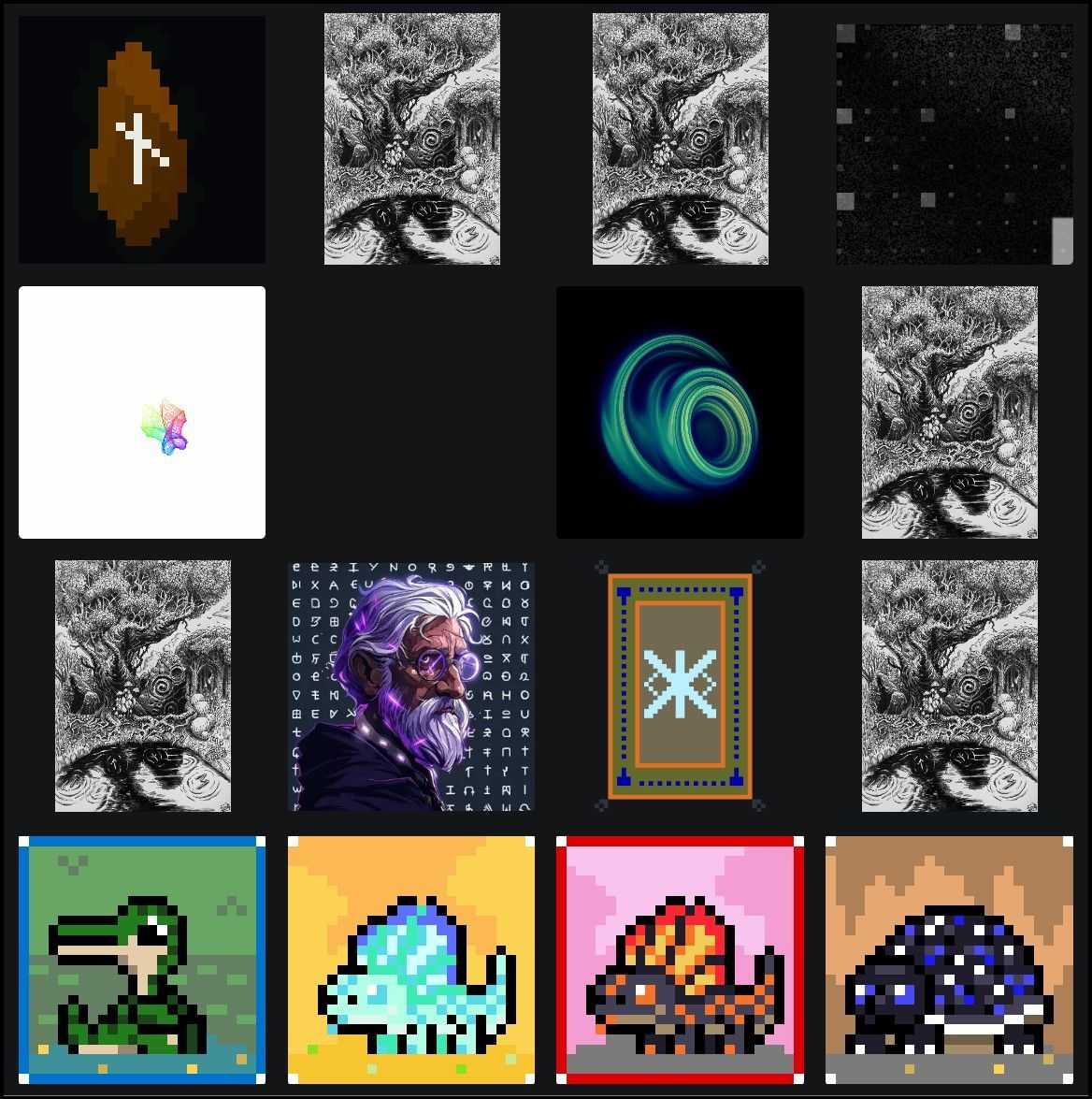

The article also discusses BRC20 tokens, which bring a new layer of utility to the Bitcoin blockchain by inscribing JSON files onto individual satoshis. These tokens enhance the versatility and use cases of Bitcoin by enabling direct peer-to-peer transfers, facilitating Bitcoin-based DeFi applications, and tokenizing real-world assets.

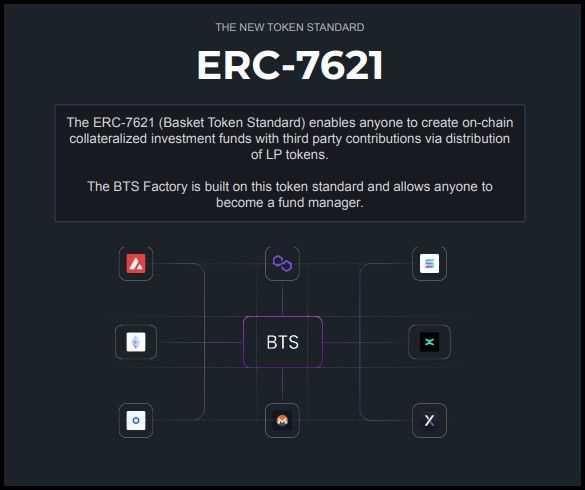

The ERC7621 token standard, developed by the Alvara Protocol, allows the creation and management of on-chain multi-token asset portfolios and investment baskets. It offers a framework for deploying the Basket Token Standard on the Ethereum blockchain, allowing the creation of tokens that include various underlying ERC20 tokens.

The article also explores the rise of dedicated data availability layers, which provide a shared infrastructure for new blockchain networks to subscribe to, reducing startup and operational costs. These layers optimize resource usage, enhance decentralization, and serve as a foundation for application-specific chains.

Decentralized Physical Infrastructure Networks (DePINs) leverage blockchain technology to innovate in sectors like data storage, energy, and connectivity. Projects in this space, such as The Graph Protocol, Theta Network, and Arweave, enhance service efficiency and accessibility by leveraging blockchain's transparency and decentralization.

Decentralized Science (DeSci) aims to transform scientific research collaboration and publication by leveraging blockchain's transparency, immutability, and decentralization. DeSci fosters open collaboration, democratizes access to scientific data, and introduces innovative funding models such as decentralized autonomous organizations.

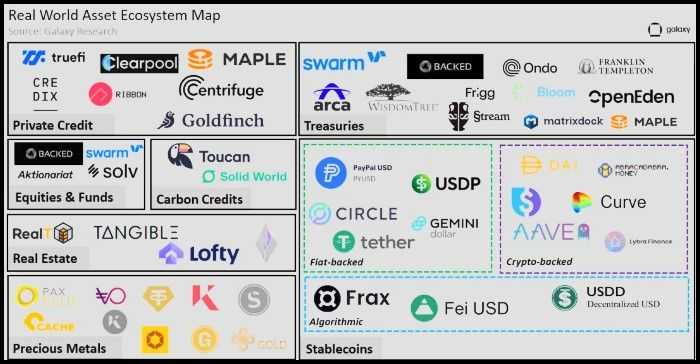

Finally, the tokenization of real-world assets (RWAs) is discussed as a growing niche within the crypto space. RWAs bring traditional assets onto the blockchain, enhancing liquidity, accessibility, and efficiency. Projects like ONDO, Polymesh, and MANTRA are leading in the tokenization of assets.

In conclusion, the crypto sector in 2024 is characterized by resilience, innovation, and maturation. The narratives discussed in the article signify a move towards a more interconnected, accessible, and efficient digital future. However, the nascent nature of many of these innovations and the evolving regulatory landscape pose challenges that need to be navigated.

The article explores the various narratives that are shaping the cryptocurrency landscape in 2024. It highlights the revival of the cryptocurrency sector, emphasizing its resilience and evolving nature. The growing global interest in cryptocurrencies is supported by a significant increase in fresh ideas, the proliferation of startups, and expanding user bases.

The first narrative discussed is liquid staking tokens, which address the liquidity constraints faced by participants in the traditional staking model. Liquid staking tokens allow stakers to maintain liquidity while their assets are staked, thus maximizing operational efficiency and financial opportunities within the blockchain ecosystem. However, this approach also comes with risks such as smart contract vulnerabilities and market volatility.

The second narrative is restaking, which redefines the mechanics of blockchain security and token economics. Restaking involves new blockchain networks delegating their economic security to a specialized security layer. This approach streamlines security, lowers barriers to entry, and incentivizes new participants to join the ecosystem.

The article also discusses BRC20 tokens, which bring a new layer of utility to the Bitcoin blockchain by inscribing JSON files onto individual satoshis. These tokens enhance the versatility and use cases of Bitcoin by enabling direct peer-to-peer transfers, facilitating Bitcoin-based DeFi applications, and tokenizing real-world assets.

The ERC7621 token standard, developed by the Alvara Protocol, allows the creation and management of on-chain multi-token asset portfolios and investment baskets. It offers a framework for deploying the Basket Token Standard on the Ethereum blockchain, allowing the creation of tokens that include various underlying ERC20 tokens.

The article also explores the rise of dedicated data availability layers, which provide a shared infrastructure for new blockchain networks to subscribe to, reducing startup and operational costs. These layers optimize resource usage, enhance decentralization, and serve as a foundation for application-specific chains.

Decentralized Physical Infrastructure Networks (DePINs) leverage blockchain technology to innovate in sectors like data storage, energy, and connectivity. Projects in this space, such as The Graph Protocol, Theta Network, and Arweave, enhance service efficiency and accessibility by leveraging blockchain's transparency and decentralization.

Decentralized Science (DeSci) aims to transform scientific research collaboration and publication by leveraging blockchain's transparency, immutability, and decentralization. DeSci fosters open collaboration, democratizes access to scientific data, and introduces innovative funding models such as decentralized autonomous organizations.

Finally, the tokenization of real-world assets (RWAs) is discussed as a growing niche within the crypto space. RWAs bring traditional assets onto the blockchain, enhancing liquidity, accessibility, and efficiency. Projects like ONDO, Polymesh, and MANTRA are leading in the tokenization of assets.

In conclusion, the crypto sector in 2024 is characterized by resilience, innovation, and maturation. The narratives discussed in the article signify a move towards a more interconnected, accessible, and efficient digital future. However, the nascent nature of many of these innovations and the evolving regulatory landscape pose challenges that need to be navigated.

As 2024 unfolds, the cryptocurrency sector is making a trailblazing comeback, richly rewarding those who weathered the storm of the latest bear market. This resurgence is not just a rebound in value; it's a testament to the resilience and evolving nature of the crypto ecosystem. Investors, enthusiasts, and innovators who remained steadfast are now at the forefront of a reinvigorated space, witnessing the birth of groundbreaking ideas and the blossoming of crypto's potential into tangible, innovative applications that extend far beyond mere speculative assets.

A compelling infographic from a16z's State of Crypto Report 2023 supports this vibrant revival, illustrating the burgeoning global interest in cryptocurrency. It's not just the price that's climbing; the influx of fresh ideas, the proliferation of startups, and the expanding user base are all soaring with a compound annual growth rate (CAGR) between 63% and 84% since 2012. This robust growth narrative underscores the crypto sector's dynamic evolution, highlighting its ability to bounce back and push the boundaries of what's possible, ushering in a new era of innovation and opportunity.

This piece delves into some of the most compelling new narratives shaping the crypto landscape in 2024. From the transformative potential of decentralized finance (DeFi) to the pioneering strides in tokenizing real-world assets, the breadth of innovation is staggering. Yet, as we explore these frontiers, it's crucial to approach with a discerning eye. Many of these concepts, while promising, are still nascent, with their real-world applications yet to be fully realized and tested. Moreover, the ever-evolving regulatory environment poses additional complexity and potential headwinds.

As we embark on this exploration of the top crypto narratives, it's essential to remain vigilant, recognizing the boundless possibilities while being mindful of the uncertainties and challenges that lie ahead.

Liquid Staking Tokens: Reshaping Staking Dynamics

In the traditional staking model, participants lock up their assets to support network operations, facing liquidity constraints as a trade-off for earning rewards. Liquid staking emerges as a game-changing innovation, addressing this fundamental issue by enabling stakers to maintain liquidity while their assets are staked. This approach is increasingly in demand as it harmonizes the benefits of staking with the flexibility of liquid assets, allowing participants to maximize their operational efficiency and financial opportunities within the blockchain ecosystem.

Benefits and Risks of Liquid Staking

Liquid staking introduces several benefits that enhance the staking experience:

- Enhanced Liquidity: Stakers receive liquid tokens representing their staked assets, enabling them to utilize them in various DeFi applications without relinquishing their staking rewards.

- Increased Participation: Liquid staking encourages broader participation in network security by lowering the barriers to entry and enhancing decentralization.

- Flexibility and Efficiency: Participants can react swiftly to market changes, employing their liquid tokens in trading, lending, or borrowing, thus optimizing their asset utility.

However, these advantages come with associated risks:

- Smart Contract Vulnerabilities: The reliance on smart contracts introduces a layer of risk, where flaws or exploits could lead to loss of funds.

- Market Volatility: The value of liquid tokens can fluctuate, introducing a market risk component that doesn't typically exist in traditional staking.

- Complexity and Interdependence: Integrating various DeFi protocols increases complexity and interdependence, potentially escalating systemic risk in the blockchain ecosystem.

Prominent Liquid Staking Projects:

Several notable projects are at the forefront of the liquid staking movement, significantly influencing the Web3 landscape:

- Lido: As a leading player in liquid staking, Lido offers solutions across multiple blockchains, facilitating staking without locking up assets, thus enhancing liquidity and participation.

- Rocket Pool: Targeting Ethereum, Rocket Pool provides decentralized, trustless staking services, promoting accessibility and network health.

These projects, among others, are pioneering a shift towards a more fluid, dynamic, and inclusive staking environment, fostering a robust Web3 ecosystem where participants can engage more freely, securely, and profitably. As liquid staking continues to evolve, it is poised to redefine the staking paradigms, offering a compelling blend of security, liquidity, and opportunity that aligns with the foundational principles of decentralization and user empowerment in the blockchain domain.

Restaking Revolution: The New Paradigm in Crypto Earnings

A groundbreaking concept known as restaking redefines the mechanics of blockchain security and token economics. Restaking is a sophisticated mechanism where new blockchain networks delegate their economic security to a robust, specialized security layer. This is achieved by amassing liquid staking tokens and allocating them to a staking layer, thereby ensuring enhanced protection and efficiency.

The "re" in restaking signifies a layered commitment: resources are initially staked to secure a primary protocol like Ethereum and subsequently allocated to another, benefiting both layers. This innovative approach streamlines security and fosters a more interconnected and cooperative blockchain ecosystem.

Impact of Restaking on the Crypto Economy

Restaking is a game-changer for the crypto economy, particularly for emerging layer 1 networks. By eliminating the need for these networks to recruit validators and accumulate staking resources independently, restaking significantly lowers the barrier to entry and operational overheads. This model promotes a more efficient use of resources, as staking assets are leveraged across multiple protocols, enhancing the overall security and vitality of the Web3 space.

Moreover, the additional revenue streams generated through restaking incentivize new participants to join the ecosystem. This influx of stakeholders contributes to a more secure, robust, and decentralized Web3 environment, underscoring the transformative potential of restaking.

How to Participate in Restaking

Engaging in restaking requires a strategic approach and a keen understanding of the underlying platforms and mechanisms. Potential participants should start by familiarizing themselves with platforms like EigenLayer and EtherFi, which are at the forefront of the restaking movement.

The general steps involve acquiring liquid staking tokens (LSTs) from platforms like Lido Finance and pledging these assets to the chosen restaking layer. By adhering to this process, individuals and entities can contribute to the security and efficiency of multiple blockchain networks while also tapping into new avenues for earning and participation in the digital asset space.

BRC-20 Tokens: Making Bitcoin Smarter

BRC-20 tokens represent a significant innovation, bringing a new layer of utility to the Bitcoin blockchain. Unlike traditional satoshis, which serve as the basic units of Bitcoin, BRC-20 tokens introduce a novel concept by inscribing JSON files onto individual satoshis. This process is akin to attaching a unique digital note to each satoshi, imbuing them with distinct properties and identities. These inscriptions can detail various attributes, including the token's name, ticker, and total supply, transforming ordinary satoshis into multifaceted digital assets.

BRC 20s vs. ERC 20s: A Comparative Overview

The creation of BRC-20 (like Ordinals) tokens diverges significantly from the established ERC-20 standard on the Ethereum blockchain. While ERC-20 tokens leverage smart contracts to introduce new assets with attributes independent of Ether, BRC-20s utilize a method of inscriptions. To create BRC-20 tokens, one must deposit a specific amount of Bitcoin into the ordinals registry. This deposited Bitcoin then serves as the backbone for the BRC-20 tokens, with the token supply mirroring the deposited amount.

An intriguing aspect of BRC-20 tokens is their operational framework, which allows them to run parallel to the main Bitcoin blockchain. Consequently, transactions can be validated on Bitcoin's network while simultaneously being denied on the BRC-20 protocol if they fail to align with the predefined inscribed conditions.

Advantages of BRC-20 tokens include their simplicity and the robust security inherited from Bitcoin's blockchain. However, they are not without limitations. The absence of smart contract functionality curtails their versatility, and their interoperability with other blockchain systems is relatively constrained.

Future Prospects of BRC 20 Tokens

Looking ahead, BRC-20 tokens are poised to usher in a new era of possibilities on the Bitcoin network. From enabling direct peer-to-peer transfers to facilitating the creation of Bitcoin-based DeFi applications and tokenizing real-world assets like gold and real estate, BRC-20s could significantly broaden Bitcoin's use cases, heralding a new chapter in its storied evolution.

ERC 7621: Basket Token Standards

ERC-7621 is a new token standard developed by the Alvara Protocol. It is designed to create and manage on-chain multi-token asset portfolios and investment baskets. It offers a framework for deploying the Basket Token Standard on the Ethereum blockchain. A single BTS token can encapsulate an arbitrary composition of ERC-20 tokens, facilitating on-chain fund management akin to mutual funds in traditional finance.

Key Features and Innovations

- Basket Token Standard (BTS): A revolutionary approach allowing the creation of tokens that include various underlying ERC20 tokens.

- Transferability and Liquidity: By integrating with the ERC721 standard for ownership representation, BTS becomes transferable, enhancing liquidity and management rights.

- Fungible BTS LP Tokens: These are ERC-7621's LP tokens, representing stakes in the basket and usable across various DeFi applications, enhancing their utility beyond traditional fund stakes.

- Dynamic Contributions and Withdrawals: The protocol allows for the minting and burning of LP tokens with each contribution or withdrawal, aligning with fund dynamics.

- Management Fees and Rebalancing: ERC-7621 enables automated management fee allocation and facilitates portfolio adjustments, streamlining fund management.

Alvara Protocol: Harnessing ERC-7621

Alvara Protocol capitalizes on the ERC-7621 standard, offering a decentralized framework for creating and managing investment funds on the blockchain. With a fund Factory and Marketplace, Alvara enhances visibility and performance tracking of BTS, supported by its native ALVA and veALVA tokens, which drive ecosystem engagement and governance. This protocol democratizes fund management, ensuring an accessible and efficient meritocratic environment.

Note: ERC-7621 is an experimental token standard that hasn’t been officially proposed as an Ethereum Improvement Proposal. As such, it has not been scrutinized by the Ethereum community, so readers who plan to explore this new standard must tread diligently.

ERC-404: Semi-Fungible Tokens

ERC-404 is another experimental token standard developed independently by Pandora Labs. Ethereum supports the ERC-20 standards for creating fungible tokens and the ERC-721 standards for NFTs. Pandora Labs merged these concepts to create semi-fungible tokens, a solution quite like fractional NFTs.

The idea of semi-fungible tokens has been floating in Web3 for almost as long as NFTs have been around. The idea dictates a situation requiring on-chain co-ownership of NFTs. Where a standard NFT token can have only one canonical owner at a time, ERC-404 defines a standard that preserves the “non-fungibility” of NFTs and the liquidity of ERC-20 tokens.

How ERC-404 Works:

ERC-404 tokens are both divisible and unique. When a newly minted ERC-404 token represents a virtual asset's ownership, the whole unit within a single address will mint the NFT in your wallet. That address can then sell a fraction of that token. Once the ERC-404 is fractionalized, the protocol burns the NFT. When an address collects enough fractions of a particular ERC-404 token to form a whole again, the protocol mints back the NFT in the associated address.

The Potential of ERC-404 Tokens

Pandora’s innovation has many potential applications that expand the utility of NFTs. For starters, one may use a fractionalized NFT as a liquidity source to power liquidity pools or own a basket of NFTs in a diversified portfolio instead of buying entire units of NFTs individually.

However, users must understand that ERC-404 is experimental and not a standard Ethereum Improvement Proposal. Pandora is developing it independently, and the Ethereum developer community has not vetted it. Therefore, this innovation has the potential for bugs and exploits and could be prone to development bottlenecks.

General Data Availability Layers: Frontiers of Modularity

Data availability is crucial as it ensures that sufficient transaction data is accessible during the consensus process. This accessibility is vital for validators or nodes to verify the validity of transactions within a proposed block. Data availability is fundamental to maintaining chain liveness, a state where the network continues to agree on the sequence of transactions and guarantees that invalid transactions are consistently identified and rejected.

However, creating a dedicated data availability (DA) layer is a resource-intensive endeavour. It demands significant hardware capabilities and staking requirements to ensure robustness and security. To mitigate these challenges, the blockchain industry is witnessing the rise of general-purpose DA layers. These layers offer a shared infrastructure that new or emerging blockchain networks can simply "subscribe" to, alleviating the need for each chain to establish its own costly data availability solutions.

Prominent Data Availability Solutions

- Celestia: A pioneering solution in this space, Celestia offers a modular blockchain network, decoupling data availability from consensus, which allows for scalable and flexible blockchain designs.

- EigenDA: EigenDA provides a unique approach to data availability by using liquid staking tokens, enhancing the efficiency of blockchain networks.

- Polygon Avail: As part of the Polygon suite, Avail is designed to serve as a robust and decentralized data availability layer, supporting a variety of blockchain architectures and enhancing their performance and security.

Benefits of Dedicated DA Layers

The advent of dedicated DA layers brings multiple advantages to the blockchain ecosystem:

- Reduced Overheads for New Chains: By leveraging existing DA layers, new blockchain projects can significantly lower their startup and operational costs.

- Efficient Utilization of Resources: Dedicated DA layers optimize resource usage across the ecosystem, preventing redundancy and promoting eco-friendly blockchain operations.

- Enhanced Decentralization: With accessible DA services, smaller chains can achieve levels of security and decentralization that would otherwise be unattainable.

- Foundation for Appchains: These layers facilitate the development of application-specific chains or "Appchains," enabling tailored blockchain solutions that meet unique requirements without compromising on data integrity or availability.

In essence, dedicated data availability layers are transforming the blockchain landscape, offering a foundational infrastructure that supports the growth and diversification of the Web3 ecosystem. They stand as a testament to blockchain technology's ongoing evolution and maturation, paving the way for more resilient, scalable, and application-centric networks.

DePIN: Decentralized Physical Infrastructure Networks

Decentralized Physical Infrastructure Networks (DePIN) represent a groundbreaking movement in the crypto space, marrying blockchain technology with real-world physical infrastructure. DePIN projects leverage blockchain's decentralization and tokenization to innovate in sectors like data storage, energy, and connectivity, transforming how physical services are provided and managed. Notable examples like The Graph Protocol, Theta Network, and Arweave illustrate DePIN's potential, showcasing how blockchain can extend its utility beyond the digital realm to influence tangible, real-world infrastructure.

- The Graph Protocol uses blockchain to index and query data from networks, effectively creating a decentralized service for information retrieval.

- Theta Network decentralizes video streaming, distributing bandwidth among users, thus improving the quality and reach of streaming services.

- Arweave offers a novel data storage solution, allowing information to be stored permanently on a decentralized network.

These initiatives exemplify how DePIN is redefining infrastructure, leveraging crowd-sourced contributions to enhance service efficiency and accessibility.

Advantages of DePIN over Traditional Systems

DePIN offers numerous advantages over conventional infrastructure models:

- Decentralization: By distributing control and ownership, DePIN ensures that no single entity can monopolize the service, fostering a more democratic infrastructure ecosystem.

- Transparency: Blockchain's inherent transparency allows all network participants to view and verify transactions and operational processes.

- Incentivization: DePIN uses cryptocurrency rewards to motivate participation, ensuring that infrastructure is maintained and enhanced by a self-sustaining community.

- Accessibility: Lowering entry barriers, DePIN enables a broader range of participants to contribute to and benefit from physical infrastructure services.d

Challenges With DePIN

Despite its potential, DePIN faces several challenges:

- Integration with Physical Infrastructure: Bridging digital blockchain systems with physical infrastructure requires innovative solutions and robust middleware to ensure seamless operation.

- Scalability: As these networks grow, ensuring that they can scale effectively while maintaining service quality and network security is crucial.

- Regulatory Compliance: Navigating the regulatory landscape, especially in sectors like energy and transport, is vital for DePIN's adoption and success.

In conclusion, DePIN is poised to transform physical infrastructure, making it more decentralized, transparent, and user-centric. By addressing the associated challenges with innovative and collaborative approaches, DePIN can significantly impact various sectors, ushering in a new era of blockchain-integrated physical services.

Check out Guy's coverage of DePIN on YouTube:

Decentralized Science: Revolutionizing Research and Innovation

Decentralized Science, or DeSci, is an innovative movement leveraging blockchain technology to transform the landscape of scientific research, collaboration, and publication. DeSci addresses several persistent issues in traditional science, such as data inaccessibility, lack of transparency in research funding and publication processes, and the monopolization of knowledge by a few gatekeeping institutions. Using blockchain's inherent transparency, immutability, and decentralized nature, DeSci fosters open collaboration, democratizes access to scientific data, and streamlines funding mechanisms.

DeSci's Role in Data Sharing, Research Publishing and Funding

DeSci revolutionizes data sharing by enabling a transparent, immutable record of scientific data, facilitating peer verification, and encouraging collaborative research efforts across borders. DeSci challenges the traditional publication model in research publishing by offering decentralized platforms where research can be published without undue gatekeeping, ensuring faster dissemination and recognition of scientific findings.

Furthermore, DeSci introduces innovative funding models, such as decentralized autonomous organizations (DAOs), that allow community members to fund research projects they believe in directly. This model accelerates funding processes and democratizes the decision-making process, aligning research incentives with community interests rather than those of a select few.

Notable Projects in DeSci

- VitaDAO: VitaDAO focuses on funding longevity research. By leveraging blockchain technology, it allows community members to have a say in the research projects they fund, fostering a direct connection between researchers and the public.

- Athena DAO: Specializing in biomedical research, Athena DAO utilizes blockchain to facilitate funding and collaboration in the medical research field, ensuring that findings are shared widely and transparently.

- Vallet DAO: Vallet DAO is another prominent player in the DeSci space, aiming to decentralize the funding and publication processes in scientific research, making it more accessible and efficient.

In conclusion, DeSci is set to redefine scientific research and publishing paradigms, breaking down barriers to information access, ensuring greater transparency, and promoting a more inclusive, collaborative approach to scientific inquiry. Through projects like VitaDAO, Athena DAO and Vallet DAO, DeSci is not just a concept but a growing reality, with the potential to significantly impact how scientific research is conducted and shared globally.

Tokenized Real World Assets (RWAs)

Real World Assets (RWAs) tokenization is a burgeoning niche within the crypto space in 2024, gaining momentum for its innovative approach to merging the tangible and digital realms. RWAs are blockchain tokens that represent ownership or stakes in physical and traditional financial assets. This sector is expanding rapidly, with various projects tokenizing an array of assets, including cash, commodities, real estate, and more, thereby bringing these assets onto the blockchain for enhanced liquidity, accessibility, and efficiency.

How Asset Tokenization Works

Asset tokenization involves converting the rights to an asset into a digital token on a blockchain. The process starts with verifying and valuing the asset, followed by creating a digital representation (a token) that reflects ownership or a claim on the asset's value. These tokens can then be bought, sold, or traded on digital platforms, allowing for fractional ownership and broader access to investment opportunities that were previously less accessible due to high entry barriers or illiquidity.

Benefits of RWAs

- Accessibility and Inclusivity: Tokenization democratizes access to investment opportunities, allowing more people to invest in high-value assets through fractional ownership.

- Liquidity: Tokenizing real-world assets enhances their liquidity, making it easier to trade these assets without the need for a traditional intermediary.

- Transparency and Efficiency: Blockchain technology ensures transparency, enabling a clear view of the asset's ownership and transaction history, thereby reducing fraud and speeding up transactions.

Risks of RWAs

- Regulatory Uncertainty: The tokenization of real-world assets navigates a complex regulatory landscape where clarity and compliance are still evolving.

- Market Risk: The value of tokens can be volatile, influenced by both the underlying asset's performance and the broader crypto market dynamics.

- Operational Risks: The process involves various stakeholders, including legal entities, custodians, and token issuers, whose operational integrity is crucial for the asset's tokenization and ongoing management.

Projects Building in the RWA Sector

- ONDO: ONDO focuses on democratizing access to financial assets, offering a platform for fractionalizing and investing in a diversified portfolio of real-world assets through blockchain technology.

- Polymesh: Designed as a blockchain specifically for regulated assets, Polymesh facilitates compliance, providing a framework for issuing and managing securities on the blockchain.

- MANTRA: MANTRA operates in the DeFi space, extending its offerings to include the tokenization of real-world assets, aiming to bridge the gap between traditional finance and DeFi.

In conclusion, tokenizing real-world assets represents a significant leap forward in blending the physical and digital worlds, offering myriad benefits while posing unique challenges.

Closing Thoughts

As we traverse the dynamic landscape of cryptocurrency in 2024, it's clear that the sector is not just rebounding; it's evolving, diversifying, and maturing. The resurgence is underpinned by a wave of innovation extending the boundaries of what's possible within the blockchain and crypto realms. From the liquidity-enhancing mechanisms of Liquid Staking Tokens to the groundbreaking integration of blockchain with the physical world via Decentralized Physical Infrastructure Networks, each narrative we've explored signifies a step toward a more interconnected, efficient, and accessible digital future.

The advent of tokenized Real World Assets heralds a new era where traditional asset markets and blockchain technology converge, offering unprecedented investment and asset management opportunities. Meanwhile, Decentralized Science (DeSci) is poised to revolutionize the very foundations of scientific research and publication, fostering a more collaborative, transparent, and inclusive global research community.

Yet, as we marvel at these advancements, it's crucial to approach this new frontier with a balanced perspective. The nascent nature of many of these innovations means they are still being tested in the crucible of real-world application and market acceptance. Moreover, the regulatory landscape continues to evolve, posing potential challenges and shaping the trajectory of these emerging sectors.

The crypto space in 2024 is a testament to the resilience and relentless innovation of the blockchain community. As we navigate this promising yet unpredictable journey, staying informed, adaptable, and discerning will be key to leveraging the opportunities and navigating the challenges of this new digital age. The future of crypto is unfolding before us, rich with potential and brimming with possibilities waiting to be seized.

Frequently Asked Questions

Liquid Staking Tokens (LSTs) are revolutionizing how investors interact with staking mechanisms by providing liquidity to otherwise locked assets. This innovation allows participants to earn staking rewards while retaining the ability to use their staked assets in various DeFi applications. LSTs enhance market efficiency, encourage broader participation in network security, and foster a more vibrant and fluid DeFi ecosystem.

DePINs integrate with blockchain to decentralize and democratize the management of physical infrastructure. These networks maintain a transparent, immutable ledger of transactions and operational data through blockchain, enabling decentralized decision-making and resource allocation. This integration allows for real-time tracking, automated payments in cryptocurrency, and a permissionless system where any provider with the necessary resources can participate.

Tokenizing real-world assets offers numerous benefits, including increased liquidity, accessibility, and transparency. It opens up investment opportunities to a broader audience by allowing fractional ownership and easier trading of assets that are typically illiquid or difficult to divide. Additionally, blockchain technology ensures a transparent record of ownership and transactions, enhancing trust and efficiency in the market.

Projects in the RWA sector face challenges such as regulatory compliance, ensuring the accurate representation and valuation of tokenized assets, and maintaining a secure and transparent blockchain infrastructure. They must navigate complex legal landscapes, establish trust with users, and develop mechanisms to ensure that the digital tokens accurately reflect the underlying physical or financial assets. These challenges require innovative solutions and adapting to evolving regulatory and market conditions.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.