Since multiple blockchain networks have existed in Web3, users have paved paths to transport monetary value from one chain to another. Legacy networks, even many built today, do not support the ability to canonically move assets in and out of their systems, making cross-chain interoperability one of blockchain technology's most commonly cited limitations.

In this piece, we will traverse the evolution of cross-chain interoperability in Web3. As we enter the fourth Bitcoin halving cycle, Web3 has grown into a myriad of blockchain ecosystems constantly exchanging value and information. We will explore the journey of cross-chain communication from slow and clunky atomic swaps to seamless cross-chain swaps that are fast, economical, and secure.

In its infancy, cross-chain navigation involved hefty due diligence from the users. One had first to find the optimum bridge protocol that supported source and destination networks, ensure there was enough gas on the source chain to fund the transactions, and also, on the destination chain address, to be able to use the bridged tokens. Bridge protocols could only support a handful of assets and chains, not to mention dealing with synthetic versions of crypto assets that were targets of frequent attacks and de-pegging events.

With innovations in this niche, the industry is heading toward cross-chain path abstraction. With new interoperability protocols in the market, the users simply specify their intent (desired cross-chain transaction) and leave the rest for the protocol to figure out. This piece will illuminate pathways for users learning to navigate the multi-faceted blockchain landscape.

Part I: Evolution of Cross-Chain Interoperability

Cross-chain interoperability has emerged as a critical solution in the blockchain realm, addressing fundamental issues and propelling the industry forward. It tackles liquidity fragmentation by allowing seamless asset transfers between disparate blockchains, thus unlocking liquidity and enhancing market efficiency.

Interoperability drives innovation and collaboration by enabling different networks to communicate and build together, fostering a more integrated ecosystem. This integration paves the way for better user experience and choice, providing users with a diverse range of services and assets across platforms. Moreover, it enhances connectivity and network efficiency, breaking down barriers between chains and creating a more robust, interconnected blockchain landscape. Ultimately, cross-chain interoperability is not just a technical advancement; it's a catalyst for a more unified, innovative, and user-centric blockchain universe.

Early Attempts and Challenges

In the initial phase of blockchain development, networks were isolated, functioning as siloed systems with their own rules and limitations. This isolation led to significant challenges, primarily in liquidity and information flow. Centralized exchanges emerged as early solutions, offering a platform for users to trade between different cryptocurrencies. However, these exchanges acted as custodians, introducing risks like hacking and fraud, and were often regulatory targets.

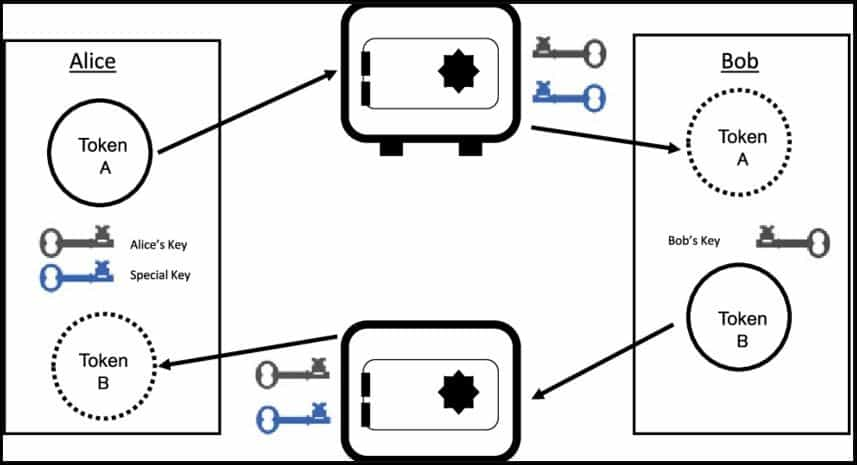

Then came simple atomic swaps, a decentralized alternative allowing direct peer-to-peer exchanges between blockchain assets. While revolutionary, atomic swaps were complex and limited by the need for compatible networks and the willingness of users to participate in direct trades. Both centralized exchanges and atomic swaps faced inherent limitations: they were often cumbersome, lacked general scalability, and did not fully solve the interoperability issue.

The early landscape was marked by these fragmented solutions, each with its own challenges, paving the way for more sophisticated and integrated approaches to cross-chain interoperability.

Challenges in Early Attempts:

- Centralized exchanges are at risk of hacks, frauds, and heat from regulatory bodies.

- To use CEXs, one must go through the privacy-violating KYC processes.

- Atomic swaps require technical knowledge and compatible network conditions, limiting their accessibility and scalability.

- Atomic swaps are a P2P transaction that can only be executed with the participating parties online simultaneously.

The Advent of Cross-Chain Bridges

Cross-chain bridges emerged as a pivotal innovation in blockchain technology, addressing the need for secure and efficient asset transfers between distinct networks. These bridges act as intermediaries, enabling communication and transactions between chains that operate independently.

Among the first were lock and mint bridges, which lock assets on one chain and mint a corresponding asset on the other. This method effectively bypasses the limitations of direct swaps by using a two-step process to ensure value is transferred securely (Harmony, WBTC). Liquidity networks were developed to pool resources and facilitate more significant, more efficient transfers across chains (Hop Protocol, Connext, and Celer). Hash locks, part of the HTLC mechanism, provide a secure way to ensure that both parties in a swap fulfil their obligations before the assets are released.

Addressing Challenges:

- Centralized Exchanges (CEXs): Unlike CEXs, these decentralized bridges reduced reliance on trust in a single entity, mitigating the risk of hacks, fraud, data leaks and general third-party risks.

- Atomic Swaps: Bridges offered a more streamlined and user-friendly approach compared to the technically complex and less scalable atomic swaps. They also solved liquidity issues by creating more stable and reliable methods for asset transfer.

Limitations:

- Reliance on External Validators: Some bridges depend on third-party validators, introducing potential points of centralization and security vulnerabilities.

- Smart Contract Risks: The complex nature of bridge contracts can lead to vulnerabilities, potentially risking user funds if exploited. Bridge hacks have led to some of the most severe exploits in crypto.

- Liquidity Concerns: Early bridges often struggled with providing sufficient liquidity, leading to slippage and less efficient trades.

- Integration Complexity: Bridging diverse blockchains involves intricate technical challenges, making it difficult to create universal solutions.

Cross-chain bridges represented a significant advancement in interoperability, offering more efficient solutions than their predecessors. Despite their limitations, they laid the groundwork for the sophisticated technologies that followed, continually pushing the boundaries of what's possible in cross-chain communication.

Protocol Level Interoperability

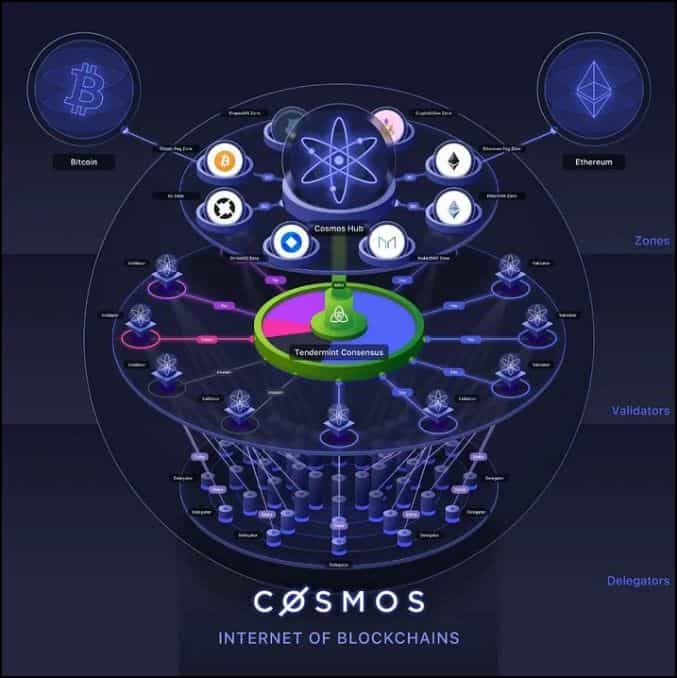

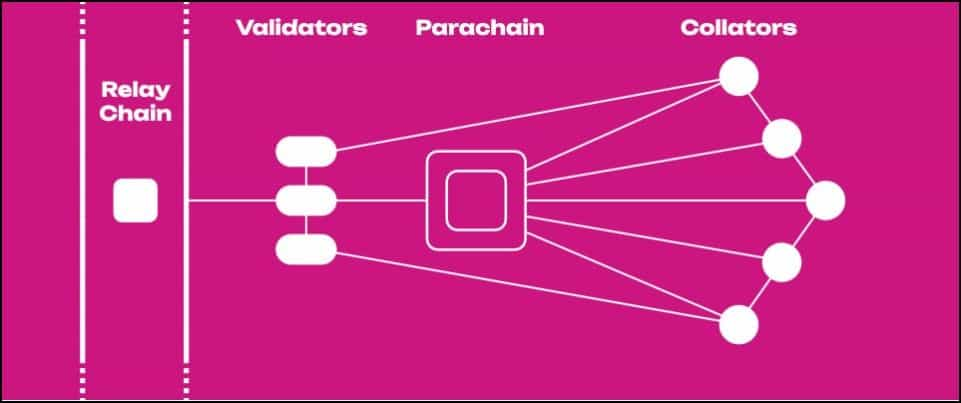

The evolution of blockchain interoperability reached a pivotal point with the introduction of protocol-level solutions like Cosmos' Inter-Blockchain Communication (IBC) and Polkadot's parachain framework. These technologies were designed to provide a more standardized and scalable approach to cross-chain interactions.

Cosmos' IBC: IBC is a protocol that allows independent blockchains to communicate and transfer assets and data among each other. It's akin to creating a standardized language for blockchains, enabling them to understand and interact without centralized intermediaries.

Polkadot's Parachain Framework: Polkadot uses a central relay chain in which various blockchains (parachains) can connect. This architecture allows for specialized blockchains to operate individually while benefiting from the security and interoperability of the central chain.

These solutions significantly broadened the scope and usability of cross-chain interactions by offering:

- Standardized Communication: They provided a universal set of rules for blockchains to interact, greatly simplifying the process of cross-chain transactions.

- Enhanced Security and Decentralization: By reducing reliance on external validators and central points of failure, these protocols enhanced the security and trustlessness of cross-chain activities.

- Improved Liquidity and Efficiency: By enabling broader participation and more direct paths between chains, they addressed liquidity concerns and reduced slippage in cross-chain transactions.

- Simplified Integration: With a standardized protocol, integrating different blockchains became more straightforward, lowering the barriers to entry for new networks.

Limitations:

- Closed Systems: These protocols often work best within their ecosystem, limiting interactions with external blockchain networks.

- Limited Coin Support: They may not support all types of assets, especially those from blockchains with significantly different structures or consensus mechanisms.

- Complex Governance: The decision-making process for upgrades and changes can be complex and slow, particularly as the number of participants grows.

- Scalability Concerns: Maintaining efficiency and speed can become challenging as the number of chains and transactions increases.

Despite these limitations, protocol-level interoperability solutions like IBC and Polkadot's parachain framework represent a significant advance, offering a more robust, secure, and user-friendly approach to inter-blockchain communication. They set the stage for a future where blockchains can operate both independently and as part of a larger, interconnected network.

Challenges and Unsolved Issues

As the blockchain landscape evolved, so did the complexity and demands of its users. Despite significant advancements, several challenges and unsolved issues persisted, laying the groundwork for the next wave of innovation in cross-chain technologies. These challenges provided a bird's eye view of the needs propelling new developments:

- Gas Efficiency: Cross-chain transactions were notoriously gas-inefficient, often requiring users to spend significantly on transaction fees. The necessity to procure separate gas tokens for the destination chain also compounded the issue, leading to a poor user experience and higher costs.

- Price Slippage and Front Running: In the decentralized finance landscape, price slippage and front-running became prevalent issues. As users initiated transactions, the time delay and visibility allowed others to manipulate the market, leading to less favorable prices for the original transactor.

- No Practical Cross-Chain Trading: While users could move assets across chains, these transactions were typically executed one-to-one. This method was inefficient and not suited for dynamic or practical trading needs, where a more fluid and integrated market mechanism was necessary.

- Complexity and Fragmentation: The landscape was cluttered with many bridges and decentralized exchanges (DEXs), each with its protocols and interfaces. Users found navigating this fragmented ecosystem challenging and time-consuming, especially when performing cross-chain swaps.

- Security Concerns: As more bridges and protocols emerged, so did the attack vectors. Ensuring the security of cross-chain transactions remained a persistent and evolving challenge.

These challenges underscored the need for more advanced solutions. They set the stage for Part 2 of this exploration, where we delve into how new technologies like UniswapX, Socket Protocol, and Jumper Exchange aim to address these issues, offering more efficient, secure, and user-friendly cross-chain interactions. As we transition, it's clear that while the foundations laid by early technologies were crucial, the journey toward a seamless, interconnected blockchain ecosystem is ongoing and ever-evolving.

Part II: New Cross-Chain Swap Technologies

As we venture into the fourth halving cycle and beyond, the landscape of Web3 is rapidly evolving, with cross-chain interoperability at its core. This new phase is marked by a collective drive to enhance user experience, focusing on path abstraction and simplifying the complex nature of cross-chain trades. The ethos of the latest interoperability solutions is to minimize the technical barriers and procedural steps that users face, embodying a shift toward intuitive and efficient blockchain interactions.

This transition is crucial as it reflects the growing need for a more inclusive and streamlined Web3 environment where the technology's complexity doesn't hinder its adoption and utility. In an era where digital interactions are increasingly interconnected, these advancements in cross-chain solutions are not just improvements but necessities, ensuring that the decentralized web remains accessible and practical for a broader audience.

UniswapX

UniswapX is a new, permissionless protocol introduced by Uniswap Labs, designed to enhance on-chain trading by aggregating liquidity from various sources, including Automated Market Makers (AMMs) and other on-chain and off-chain venues. It utilizes a Dutch auction-based system for trading, aiming to provide users with better prices, gas-free swapping, protection against Maximal Extractable Value (MEV), and no cost for failed transactions. The protocol is set to revolutionize how swaps are conducted by making them more efficient and user-friendly.

Gas Efficiency:

One of the critical benefits UniswapX brings is enhanced gas efficiency. By moving towards a system where users express trades as intents, the need for individual transaction approvals and executions is reduced. With this system, users can potentially save on gas fees, as their intents are batched and handled by third-party entities known as 'Fillers.' These Fillers compete in a Dutch auction to fill swaps at the best price, further optimizing the process.

Eliminating Front-running:

UniswapX's design significantly mitigates the front-running issue. Traditional AMMs are susceptible to MEV strategies like sandwich attacks, where traders capitalize on pending transactions in a block. UniswapX's auction-based model and the competitive nature of Fillers ensure that users are less vulnerable to such exploitative practices. Any positive slippage is returned to the swappers in the form of price improvement, ensuring that users are protected from front-running and benefit from any favorable price movements.

Upcoming Cross-Chain Swaps Feature:

Looking ahead, UniswapX plans to expand into cross-chain swaps, combining swapping and bridging into one seamless action. This development will enable swappers to exchange between chains in seconds and choose which assets they receive on the destination chain rather than a bridge-specific token. This feature is poised to significantly change the cross-chain swaps landscape by making the process faster, more efficient, and user-centric.

Overall, UniswapX represents a significant advancement in decentralized trading, addressing many of the limitations and inefficiencies of previous systems. By offering better prices, reducing gas costs, protecting against MEV, and preparing to facilitate seamless cross-chain swaps, UniswapX is well-positioned to become a key player in the future of on-chain trading and cross-chain interoperability.

Jumper Exchange

Jumper Exchange is a multi-chain DEX and bridge aggregator platform powered by LI.FI. It is designed as a cross-chain swap platform that connects various chains, bridges, and decentralized exchanges (DEXs) to provide users with the most efficient and cost-effective routes for their cross-chain transactions.

Web3 is scattered across several layer 1 and layer 2 networks with EVM and non-EVM execution environments. Various bridge protocols connect these blockchain networks, each offering a selection of cross-chain token bridges. Blockchain networks also house chain-native DEXs that facilitate intra-blockchain token swaps. Therefore, if a user wishes to swap a particular token for another residing in a foreign network, they typically look for a path involving cross-chain bridging and DEX swaps on both sides.

A wide selection of available networks, tokens, and bridges significantly complicates devising an optimal path. The sheer amount of due diligence in navigating across chains equates to a terrible user experience.

The picture above illustrates how complicated it can get to swap MATIC (now POL) tokens to AVAX. The Jumper Exchange pushes all such convoluted steps behind the curtain and presents a clean interface to the user.

Jumper Exchange users specify the desired swap, source, and target chains. The exchange consolidates over 20 blockchains, 30 DEXs, and over 15 bridges. It finds the most optimal path for the user within its network, abstracting the need to browse the numerous cross-chain paths possible for any swap action.

In summary, Jumper Exchange functions as a comprehensive solution for users looking to navigate the complex landscape of cross-chain transactions. By aggregating multiple chains, bridges, and DEXs, and providing a user-friendly interface, it simplifies the process of finding the most efficient and secure routes for cross-chain swaps and transfers.

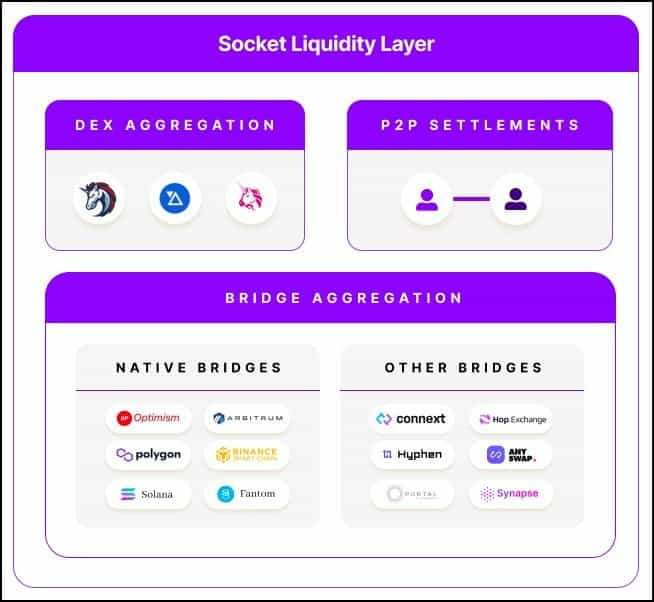

Socket Protocol

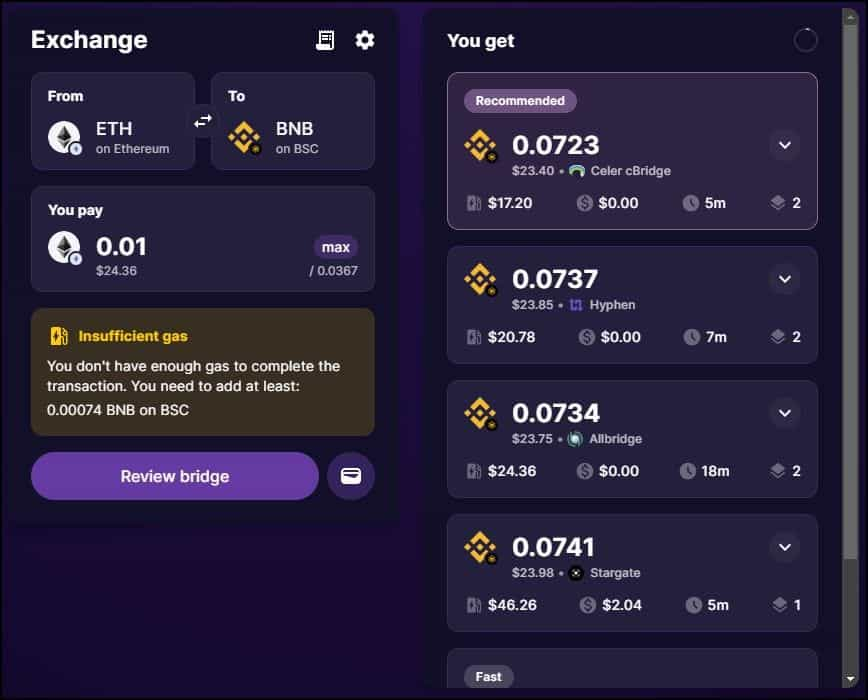

Like the Jumper Exchange, Socket powers a cross-chain interoperability platform called Bungee Exchange that facilitates asset transfers and swaps across different blockchain networks. It aggregates various bridges and decentralized exchanges (DEXs) and presents them under a unified interface for cross-chain interactions.

Refuel

Refuel is a centralized gas provision solution. One of the major bottlenecks with cross-chain interactions is where the users bridge a particular asset to another chain but do not hold sufficient gas tokens on the target chain to interact with the bridged assets. Socket integrates Refuel within the bridge flow to send target chain gas tokens with the bridged assets, improving user experience phenomenally.

Part II Conclusion

These new interoperability projects represent a significant stride in the evolution of cross-chain swaps. By abstracting the complexity and offering a more streamlined experience, they cater to the growing demand for more user-friendly blockchain interactions. Their focus on optimized routing and broad liquidity access addresses critical issues like cost efficiency and market impact. As the blockchain space grows and diversifies, solutions like UniswapX, Jumper, and Socket play a vital role in knitting together disparate networks, fostering a more interconnected and accessible digital ecosystem.

Parting Thoughts

The journey of cross-chain interoperability has been transformative, evolving from the early days of simple atomic swaps and centralized exchanges to today's advanced, user-centric solutions. We've witnessed a remarkable transition from isolated and cumbersome processes to sophisticated, seamless technologies that prioritize efficiency, security, and user experience. This progression reflects the relentless drive for innovation within the blockchain community, a testament to its commitment to overcoming barriers and enhancing connectivity.

The importance of continued innovation in this space cannot be understated. As the digital landscape becomes increasingly complex and interconnected, the need for robust, versatile, and accessible cross-chain solutions will only grow. The advancements we see today lay the groundwork for a future where blockchain interoperability is not just a feature, but a fundamental characteristic of the digital world.

Looking ahead, these continuous innovations promise to refine and redefine the possibilities of blockchain technology. With each new development, we move closer to a fully integrated and interoperable ecosystem where the seamless exchange of information and value across diverse networks is a reality. The future of blockchain interoperability, shaped by these advancements, holds the potential for a more unified, efficient, and inclusive digital world.

Frequently Asked Questions

New interoperability protocols feature advanced routing for optimal transaction paths, enhanced security mechanisms, and the ability to seamlessly connect multiple blockchains. They prioritize user-friendly interfaces, reduce transaction costs, and increase transaction speeds, significantly improving the overall efficiency and experience of cross-chain interactions.

UniswapX offers features like gasless transactions, auction-based trading, and protection against maximal extractable value (MEV). It emphasizes user-centric design with improved routing for best price discovery and is expanding to enable seamless, permissionless trading across various blockchains.

A simple user experience is essential to promote cross-chain communication as it lowers technical barriers, making the complex process of interacting with multiple blockchains accessible to a broader audience. By demystifying the intricacies of cross-chain transactions, it encourages wider adoption and fosters a more inclusive environment. A streamlined experience helps users confidently navigate the ecosystem, thereby accelerating the integration and practical use of diverse blockchain technologies in everyday applications.

Efficient cross-chain communication is difficult due to the diverse architecture, consensus mechanisms, and security protocols of different blockchains. Coordinating these varied systems to work seamlessly together presents technical and governance challenges, requiring complex solutions to ensure security, interoperability, and performance.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.