What is Tether (USDT)? Overview of the Controversial Stablecoin

There’s a certain irony in Tether...

It’s a stable coin that, at any moment, could snap. Cryptocurrency traders need stability. Hell, everyone needs a bit of stability -- especially those of us in all things Bitcoin and blockchain.

Traditionally we would look for stability in Fiat currencies like USD or EURO. However, not all exchanges offer trading in fiat pairs. The requirements of KYC, AML, and other laws necessary for an exchange to pair crypto with stable fiat is simply too daunting for many exchanges and impossible for small ones.

But traders need a stable store of value. Riding altcoin waves is challenging as it is without the worry of your main coin (be it BTC, ETH, etc) also rising and falling while you plan your next trade.

But where there’s a will...there’s a way.

Stable Coins, a Staple Need

We need stability. In the crypto world, where the big boss (Bitcoin) can rise and fall by 20% in a single day -- we need a stable, safe haven. The reasons are threefold:

Use as a Currency

Whether traveling, sending payments across borders, or even waiting for transactions across the blockchain to confirm -- we need a measure of stability in a currency.

A stable coin will ensure that the value of the money you send to someone will be the same when it arrives. Traders and investors are particularly interested in this.

Trading

Myriad crypto traders out there are trying to drive a lambo one day. They’re trying to accomplish this by swapping one coin for another, trading (hopefully up) until they squeeze the leather steering wheel of their dream car.

In the meantime, however, they need a safe garage to park their current whip. It would be disappointing, to say the least, if they had worked their way up to a Maserati -- only to see it transform into a Ford Pinto. By parking their wealth, meager as it may be, in a stable coin during ‘nontrading hours’ they are able to keep it safe.

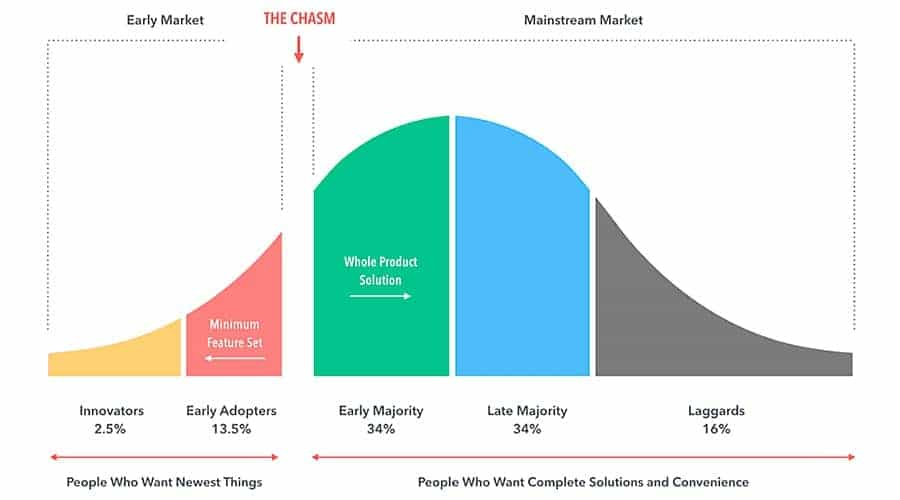

Mass Adoption The "Holy Grail" of Crypto

Forbes mentions that once the public sees that cryptocurrencies can be stable, then they will be far more eager to use them -- as currencies. Since Bitcoin’s beginnings, the dream of anarchists and enthusiasts alike has been mass adoption: a world of financial freedom where we are in control of our own money.

Perhaps stable coins could lead us to this beacon of hope. After all, the public has not adopted Bitcoin en masse because they know it isn’t stable. The average Joe doesn’t want to buy a beer for 0.02 bitcoin one day and then the next day buy the same beer for 2 bitcoin. But a stable coin would hold its value and provide the same security as fiat, thus ushering in mass adoption.

What is Tether?

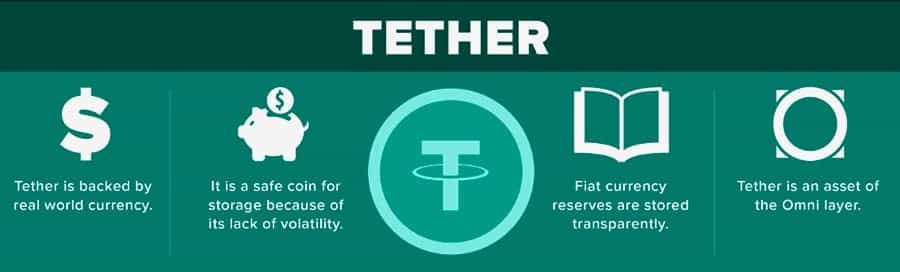

Tether, or as it’s known by its ticker “USDT” is one of the very first stable coins. Each Tether token (USDT) is supposed to be “tethered” to one U.S. Dollar -- and thus offer a stable spot for traders to park their money when exiting a trade in BTC, ETH, or other paired cryptocurrencies.

USDT, or Tether Limited, was conceived of in January 2012. Back then the whitepaper referred to it as Mastercoin. The name changed to Realcoin when it was published in 2014. And in January 2015 it was launched as Tether by Bitfinex -- one of the biggest behemoths in the crypto exchange business.

According to Coinmarketcap -- it’s currently the 7th most traded coin -- and by far the most traded stable coin. No surprise, either, since it is offered by dozens of the absolute largest exchanges as well as myriad middle sized exchanges.

Thanks to this, investors and traders can send USDT between exchanges, between themselves, and of course trade between crypto pairs with more ease. USDT With this type of momentum, it continues its dominance -- despite several concerning ‘hiccups’ in recent years...

But How Does Tether Work?

Author David Gerard was quoted by the Wall Street Journal saying:

Tether is sort of the central bank of crypto trading ... [yet] they don't conduct themselves like you'd expect a responsible, sensible financial institution to do.

Much like a central bank, Tether prints its coins. It then sells these coins. In theory, anyone who owns an amount of Tether can send it to Tether Limited and receive the equivalent in cash. Tethers exist on blockchains using the Omni Protocol -- a protocol specifically developed for Tether Limited.

These protocols consist of open source software (on Github) that uses blockchain tech to issue and redeem these specific Tether coins. Tether limited further claims that USDT is “100% backed by actual fiat currency assets in our reserve account.”

And once someone agrees to Tether Limited’s ‘terms of service’ they then can redeem Tethers at a conversion rate of 1 tether USDT equals 1 USD.

The ironic thing, however, is that even though you can theoretically redeem your USDT for cold hard USD -- you cannot do so if you are a U.S. citizen. As of January 2018, Tether Limited “has decided to stop serving U.S. individual and corporate customers … unless they are Eligible Contract Participants (“ECP”).”

This is, as you might imagine, somewhat concerning. A central bank, especially one printing the equivalent to the world’s most stable currency, would be under a great deal of suspicion if it only printed money for use by other companies -- but didn’t accept it at their own branch.

It’s as if you could spend money buying groceries, paying for gas, and going to the movies -- but if you tried to deposit it at your bank they wouldn’t let you.

Situations like these warrant further investigation ...

Who is Behind Tether?

Tether Limited is run by 3 individuals: Jean-Louis van der Velde, Giancarlo Devasini, and Stuart Hoegner. The company is based in Hong Kong.

As we learned earlier, Tether was originally conceived of and named Mastercoin and Realcoin. It originally struggled to take off, like many other coins. However, starting from January 2017 and continuing for the next year and a half, the number of tethers printed by ‘the central bank of Tether’ grew from $10 million USD to nearly $2.8 billion USD.

Further research shows that in February 2018 Tether accounted for about 10% of bitcoin trading volume. By the end of summer 2018 it accounted for nearly 80% of bitcoin volume around the world.

Recently, Jean-Louis van der Velde, the longtime CEO of Tether, stepped down and handed over the reins to Chief Technology Officer Paolo Ardoino. The change takes effect in December, and Ardoino will continue as CTO. Ardoino will continue in his roles as CTO for Bitfinex and chief strategy officer for Holepunch. Van der Velde will transition to an advisory role for Tether while retaining his position as CEO for Bitfinex.

The is partnership has no doubt been quite fruitful for both companies. Yet when one person is behind two titanic entities in the industry … certain temptations arise.

Tether Pros and Cons

Whether you decide to use Tether as your stablecoin of choice will depend on your personal preferences and risk tolerance. You will also need to consider the specific pros / cons of the stablecoin.

Let's take a look at these in a bit more depth.

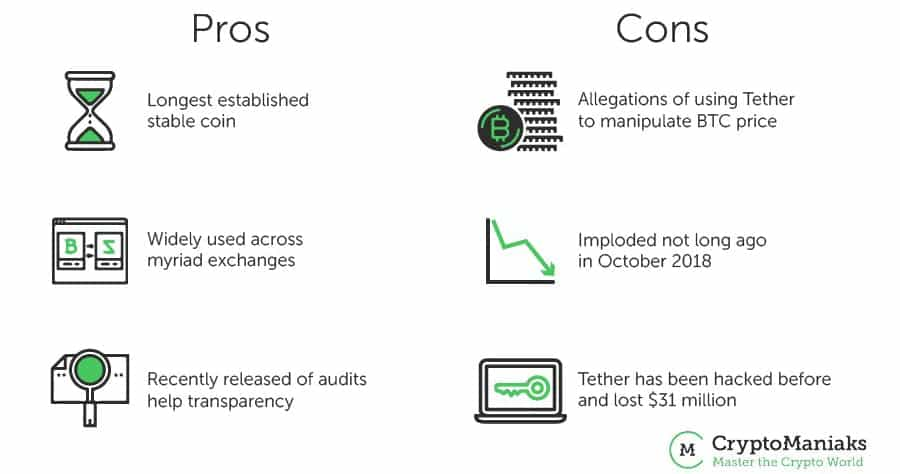

Pros

- Longest established stable coin: Say what you will but there’s something to be said for experience. Plenty of businesses enjoy running ads and posting placards that read “Established 1955” or “Family run since 1920” or “50 years of excellence.” People find comfort and security in a business with roots. After all, if something’s broke -- why fix it? And what better business to advertise its length than a stable coin. Tether has weathered a couple boom and bust cycles. Its struggled past a few hacks. Its proven itself, basically, as a harbor through the storms.

- Widely used across myriad exchanges: A benefit of its long history and top connections is the viral extent to which USDT is spreading. USDT is available across mega and medium exchanges alike, even certain small ones. This gives traders of all experience levels a familiar foothold, a good garage, to park their savings in during the volatile boom and bust cycles of crypto.

- Recently released of audits help transparency: Tether Limited continues to grow and develop as a company. Due to several loud voices decrying the company last year for its lack of transparency, difficult customer service, and overall customer neglect -- Tether seems to have taken steps towards rebuilding the trust of its customers. One of the newest features is the periodic release of its accounts. By doing this the company aims to show that, in fact, each USDT is backed by a real USD in their accounts.

Cons

- Allegations of using Tether to manipulate BTC price: The fact that the CEO of Tether is the same man running Bitfinex has led many to wonder if there may be any collusion going on. One particularly zealous investigative journalist seems to have uncovered evidence “showing a single entity wash trading 24,000 BTC, or at the time over 20% of all of the Bitcoins held on Bitfinex.” This is no small chunk of loose change. Neither is it the work of one bored trader. Such a setup requires incredible capital and connections. The roots of this problem also affect tens of thousands of people. When volume and price are artificially manipulated like this … the entire market suffers.

- Imploded in October 2018: The most ironic thing about Tether coin is its tenuous grasp on being a stable coin. Its value proposition is simple: trust us to keep your money stable. Yet in October 2018 a fresh round of deeply concerning accusations cropped up: USDT’s were not backed back USDs, no banks would partner with Tether, and more. This culminated in a virtual ‘run on the bank.’ Traders and normal long term HODLers began selling off their USDT’s for Bitcoin. The price of this ‘stable’ coin quickly plummeted to 0.88 cents on the dollar.

- Tether has been hacked before and lost $31 million: Though it’s true that myriad exchanges have been hacked for tens of millions of dollars -- the problem with Tether being hacked is that, once again, its value proposition is undermined. When a company sells itself as providing stability, safety, and accountability -- the last thing its customers want to hear is that their accounts were hacked and their hard earned money stolen. Unfortunately, Tether has been hacked a few times.

Alternatives

Fear not. As long as their are lambos (and dreams of lambos) there will be garages (and stable coins). The cryptocurrency sphere is expanding, fast as ever. Even though prices have been plummeting, people’s entrepreneurial spirits and passion for blockchain have been increasing. Alternative stable coins now exist. We have our choice of garage:

- True USD: A project led by TrustToken, a team of people experienced in blockchain and cryptography. They do not have a central entity like Tether but rather put trust in a group of third-party firms to secure the 1-to-1 peg of TUSD to USD. TUSD price has remained stable to within 0.02 cents on the dollar.

- USDC: The USDC stablecoin is issued by the Centre Consortium. This a collaboration between Circle financial and Coinbase, both big names in the blockchain and cryptocurrency space. They use a mechanism of numerous projects on one network to secure the peg. Each project and firm in the network is required to maintain its own reserves. Additionally, these reserves must be made transparently public.

- DAI: DAI is the first decentralized stable coin that was launched by the MakerDao team. They require their users to buy and collateralize an equivalent amount of Ethereum to keep their peg stable. Users can also stake their coins and thus be incentivized to earn or sell based on price action.

- GUSD: The Gemini Dollar (GUSD) is issued by the well known Gemini exchange. Like Tether, this is a fully Fiat backed stablecoin with US dollars in accounts. However, unlike Tether, through its holdings at State Street bank it has retained a pass-through insurance product to provide FDIC insurance within specific limits.

- PAX: The PAX token is issued by Paxos Standard, a New York based trust company. It is also backed by US dollars in a bank account but is also regulated and approved by the New York State Department of Financial services. They are of the view that as a qualified custodian trust company they can offer greater protections to the holders.

All of these stable coins have their own unique features, benefits and disadvantages. But taking into account the allegations that were made against Tether, and since stable coins aren’t going to increase in value over time, it’s not recommended to hold USDT for a long time -- it’s actually one of the 25 common mistakes cryptocurrency investors make according to CryptoManiaks.

After all, “an ounce of prevention is worth a pound of cure,” as Benjamin Franklin would say. Identifying and avoiding mistakes clears your path to the right choice. And the right garage makes all the difference.

Buying USDT and Other Stable Coins

USDT is in the top 10 cryptocurrencies by Market Capitalization. It is by far the most popular stable coin and is quite liquid on a number of exchanges. For example, you can buy it at HitBTC, HTX and Binance.

This is USDT’s biggest strength. All the other alternative stable coins are on smaller exchanges, though they can certainly still be purchased. After all, it’s good to diversify your portfolio, even when it comes to stable coins.

For example, you can register at Binance and Buy USDT and USDC and Digix. The benefit of Binance is their plethora of altcoins. Due to this they need several stable coins. By signing up you can pick and choose your garage. Heck, you can even park in all three.

You can also use Coinbase in order to buy USDC. This is a mammoth exchange and is one of the biggest in the USD and abroad. Since USDT does not allow American citizens to use Tether, the next best option is USDC, available at Coinbase.

Why not use both USDC and USDT?

By registering at HitBTC, you will have opportunities to store your wealth in both USDT, USDC, and myriad altcoins.

Conclusion

The crypto world needs a stable coin. Crypto traders need a stable coin to park their wealth. Cross border crypto transfers need a stable coin to ensure correct value transfer. Regular people could also benefit from a stable coin (especially people living in countries such as Venezuela where their fiat currency is itself imploding.) In truth, everyone in blockchain, from beginners to experts, would greatly benefit from stable coins -- when they prove to be one of the catalysts for mass adoption.

That said, Tether (USDT) may not be the best solution. It’s been hacked, manipulated, and centralized.

Alternatives exist: True USD and USDC (used by Coinbase), which maintain stability through reserves; DAI and AAA Reserve which maintain stability through nontraditional means. Yet these projects are untested as of yet. Perhaps, then, the solution is to keep experimenting with these new stable coins.

Now, which brave soul will step up first?

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.