HTX Review 2024: Exchange with DEEP Liquidity

In November 2023, Justin Sun said on X (formerly Twitter) that HTX and Heco Cross-Chain Bridge were hacked. As a result, deposits and withdrawals were temporarily suspended, but he said HTX will make affected hot wallets whole again. While Sun didn't say how much was lost, Web3 blockchain security firm Cyvers said a “suspicious address” received around $85 million from Heco.

We recommend users considering HTX do their own due diligence before they decide to sign up.

HTX is a cryptocurrency exchange that offers deep liquidity for popular spot and derivatives trading pairs. It features a wide selection of trading products and has its native cryptocurrency, Huobi Token (HT), which can be used to pay for trading fees at a discount.

The search for the best crypto exchange to meet your trading needs can be difficult. With over 400 different cryptocurrency exchanges available, many specializing in different areas, the search for the perfect exchange can be like trying to find a needle in a haystack. Fortunately, here at the Coin Bureau, we conduct in-depth research on many of the largest exchanges to help narrow your search. That is exactly what this HTX (Previously Huobi) review aims to do, help you determine if this exchange is right for you.

This HTX exchange review will cover the pros and cons, key features, a bit of the history and background of the platform, and we will provide a summary and how it compares to other exchanges. Let’s crack on!

Note: Users located in the US and UK are not supported.

HTX Summary:

| Headquarters: | Seychelles |

| Year Established: | 2013 |

| Regulation: | Unregulated Huobi Global holds the following licenses: Digital Asset Trading License-Ministry of Finance of Thailand Compliance license- Japan Virtual Currency Exchange Digital Trading License- Gibraltar Financial Services Commission Hong Kong Asset Management 4/9 License- SFC |

| Spot Cryptocurrencies Listed: | 500+ |

| Native Token | Huobi Token (HT) |

| Maker/Taker Fees: | Lowest: 0/0.0218%

Highest: -1.0 BPS/ 0.2% |

| Security: | Very High |

| Beginner-Friendly: | No |

| KYC/AML Verification: | Not needed for limited functionality

KYC will be needed for higher trading and withdrawal requirements |

| Fiat Currency Support | USD, GBP, EUR, RUB, UAH, KZT |

| Deposit/Withdraw Methods: | Crypto, Credit/Debit card, Bank transfer, AdvCash, Banxa, Apple Pay, Poli/PayID/BPAY, iDEAL, Faster Payments, SEPA/Sofort, Interac |

Review: What is Huobi Global? (HTX Rebrand)

Huobi Global announced a rebrand to HTX in September 2023 to celebrate their 10-year milestone. According to the announcement, 'H' stands for Huobi, 'T' represents TRON, showing their commitment to the Tron blockchain, and 'X' stands for the exchange.

HTX is one of the top ten largest cryptocurrency trading exchanges in the world, currently sitting at the #10 spot according to Coin Market Cap in terms of trading volume. HTX was founded in 2013 by Leon Li and Du Jun. Before Huobi, Li was a computer engineer at Oracle, while Jun founded two other highly successful companies: Golden Finance, and Node Capital.

HTX Exchange has a very strong presence in the Asian markets and was originally based in China. After increasing regulatory crackdowns, HTX relocated to the Republic of Seychelles. HTX has physical locations in South Korea, Japan, Hong Kong, Singapore, and even opened an office in the United States in 2018, but had to close due to regulatory reasons. An interview between HTX co-founder Du Jun and CNBC explained that they are working towards re-entering the US market as soon as they can get the proper licensing in place.

HTX is available to residents of most countries, with the exception of Japan and the United States, though Japanese users can access Huobi Japan, and Korean users can enjoy Huobi Korea. Huobi is fighting for the same market share as Binance, KuCoin, and OKX, providing a robust trading platform with a plethora of tradable markets, attracting a demographic of serious and experienced traders.

We will take a look at the exchange itself later on in this review, this next part will cover the key features that Huobi Global/HTX has to offer above and beyond the trading exchange itself.

If you want to see how HTX stacks up against other crypto exchanges, feel free to check out our Top Exchanges article where we break down the best exchanges in different categories to help you find the right one to fit your needs.

HTX Exchange Key Features

The key features and strengths of the HTX Exchange are the Finance/Earn features, the trading mobile app, and trading options, each of which will be covered below.

HTX Margin Trading

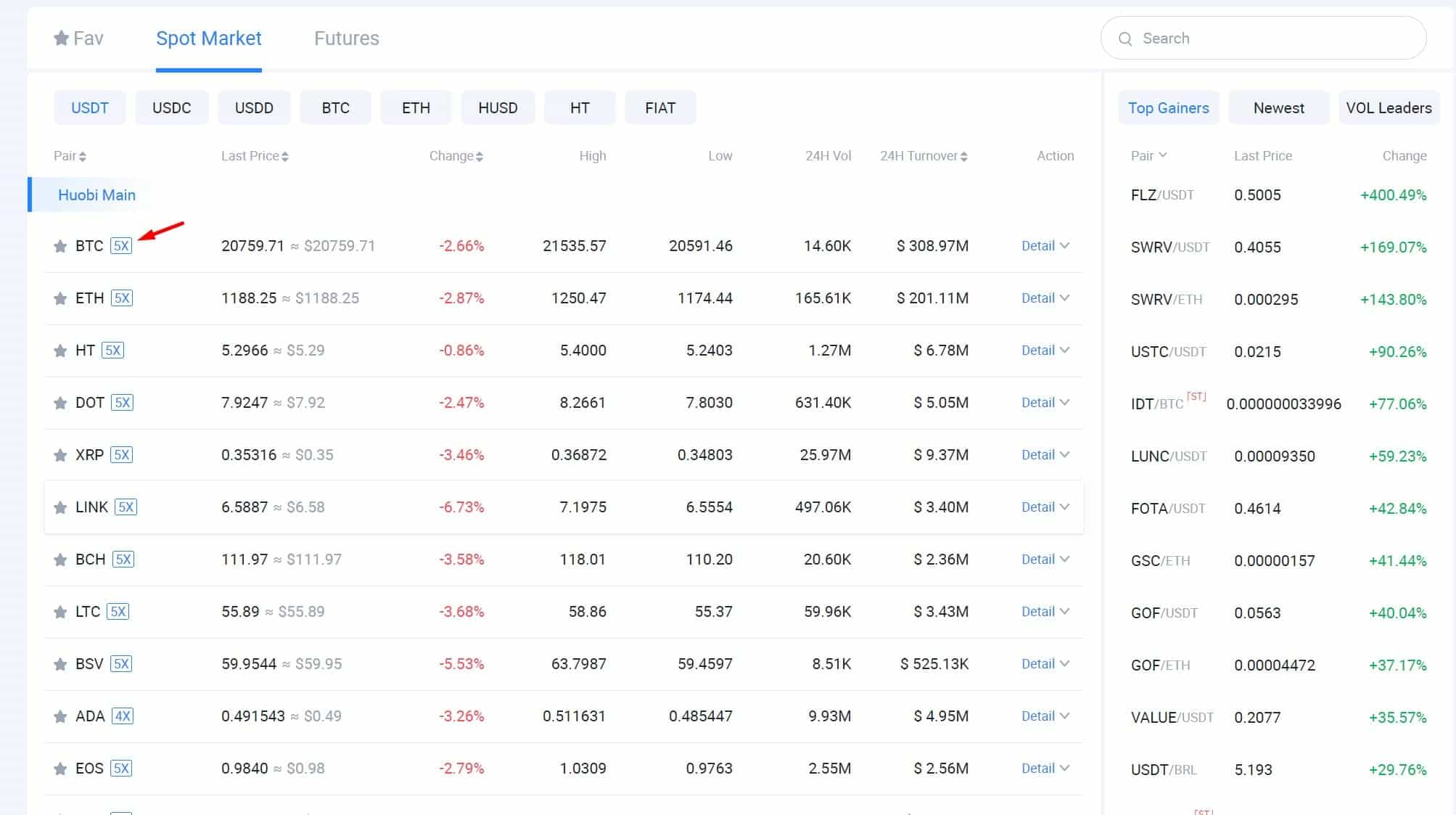

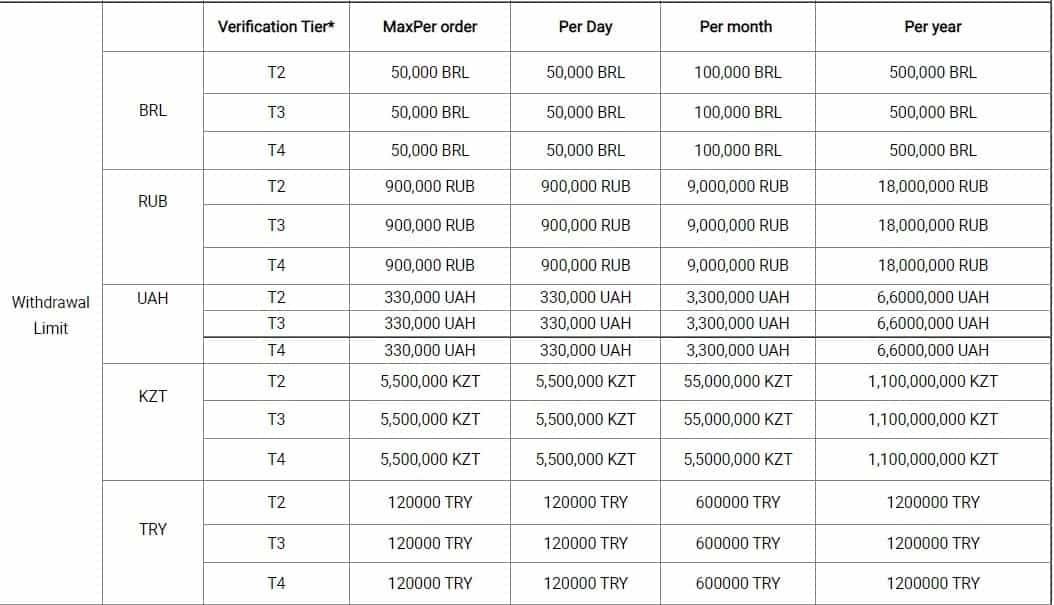

One of the biggest attractions to HTX trading is the fact that traders can access leveraged trading of up to 5x for spot markets on over 80 tokens. Tokens that are available for leveraged trading on the spot market can be identified by the number shown in a blue box and the letter ‘x’ beside the token as seen below:

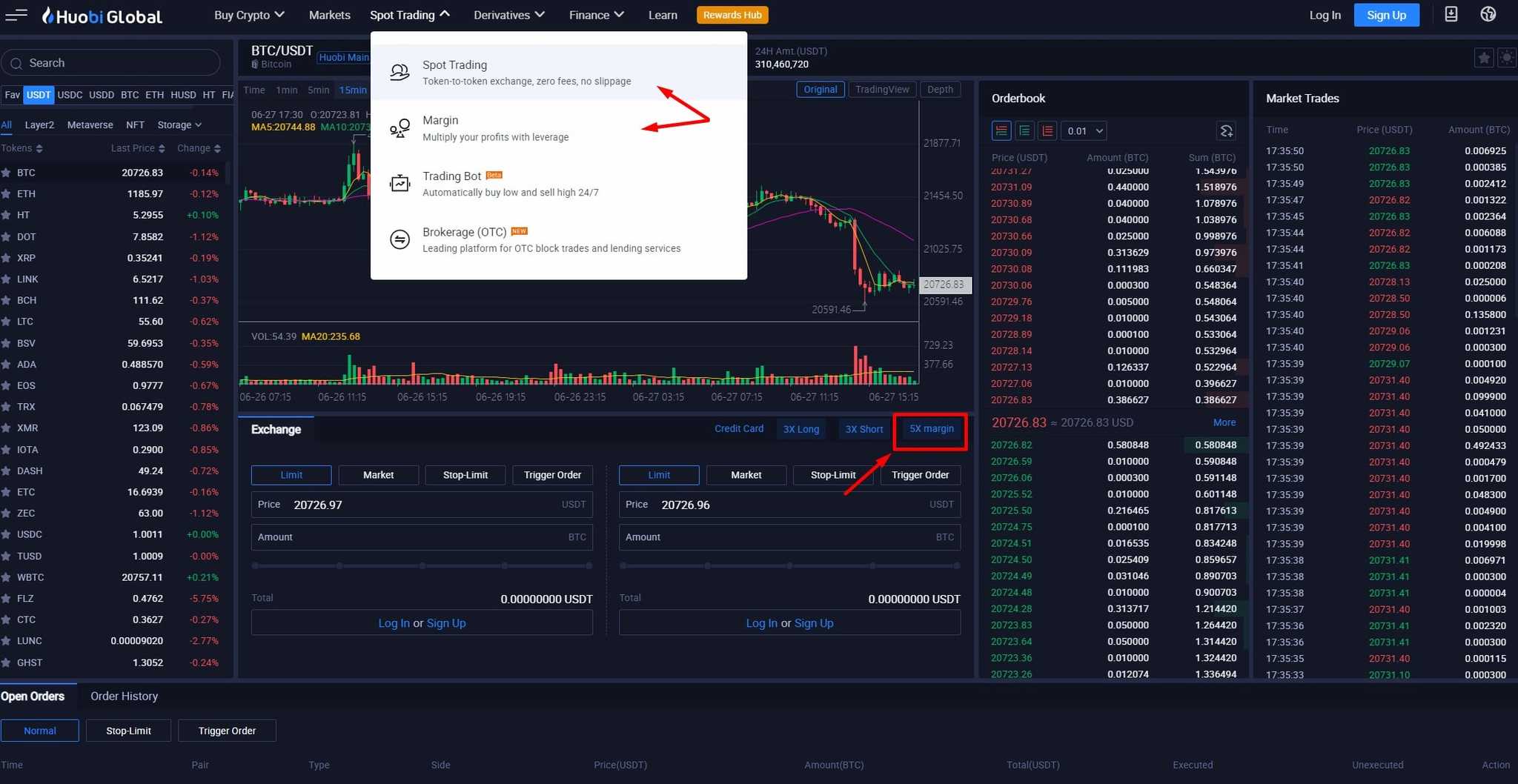

From the trading screen, traders will need to flip between Spot and Margin sections to bounce back and forth between leveraged and non-leveraged tokens, this can be done in two different ways as shown by the red arrows below:

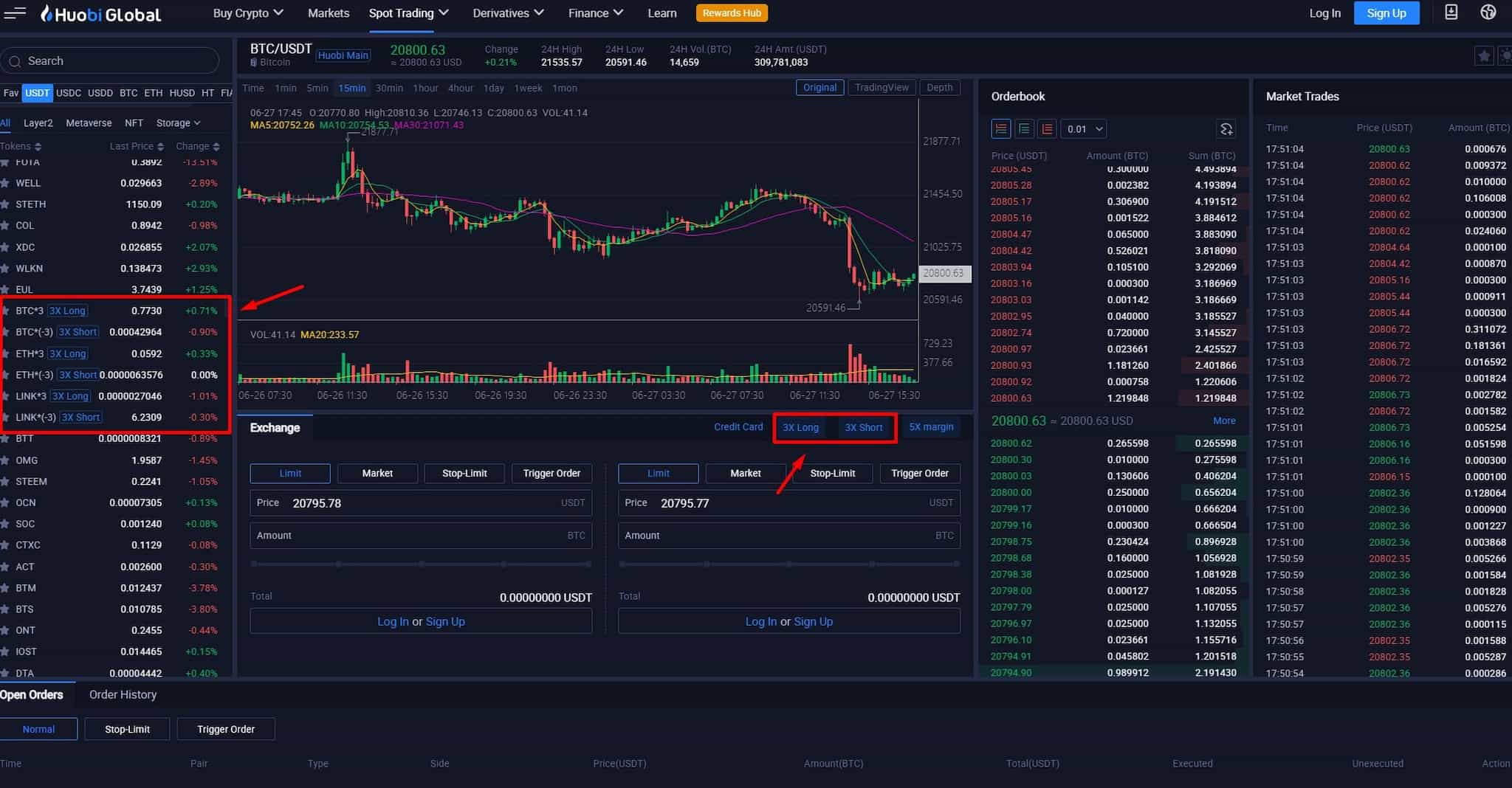

Traders can also select leveraged tokens similar to the leveraged token products available on Bybit, Binance, and KuCoin. HTX refers to these as Exchange Traded Products (ETPs).

HTX Leveraged Exchange Traded Products

HTX offers Leveraged Tokens with 3x leverage built directly into the underlying asset, which can be accessed directly from the main trading screen in two locations:

Each ETP product is a basket of margin positions, the assets available to trade are Bitcoin, Ethereum, and Chainlink. They have the ticker symbols:

- BTC*3- for 3x leverage long Bitcoin

- BTC*(-3)- for 3x leverage short Bitcoin

- ETH*3- for 3x leverage long Ethereum

- ETH*(-3)- for 3x leverage short Ethereum

- LINK*3- for 3x leverage long on Chainlink

- LINK*(-3)- for 3x leverage short on Chainlink

These leveraged instruments have become popular for traders as they trade on the spot market and are less risky and complex than trading with leverage. It is an easier and safer way for traders to gain access to leverage which can help magnify profits (and losses). There are no liquidation risks associated with trading leveraged ETPs.

HTX Futures Trading

As for derivatives trading, traders can trade the following derivatives products:

- Traditional Futures

- Perpetual Swaps

- Coin-Margined Futures

- USDT-Margined Futures

- Options

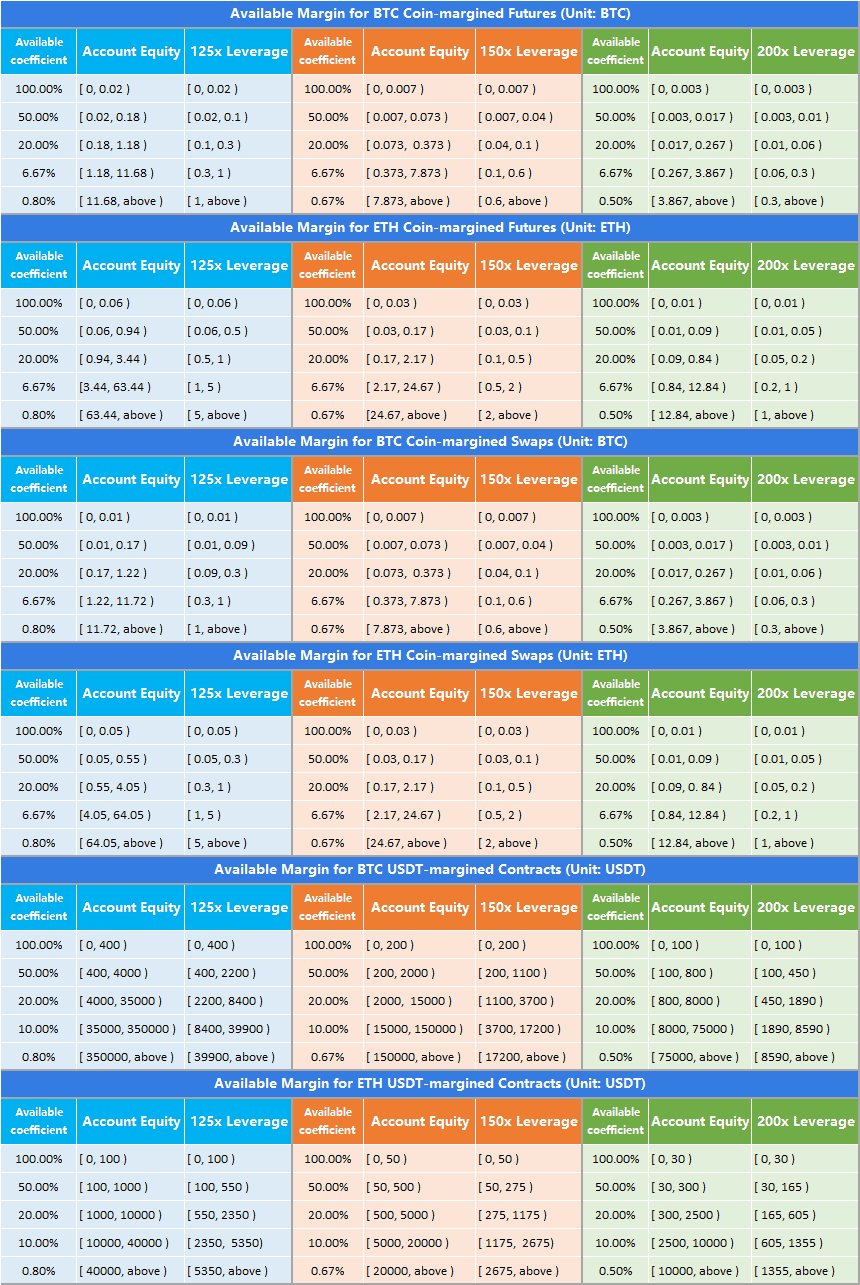

Traders can access up to 200x leverage on certain derivatives products and Coin-margined futures. Margin availability on futures contracts follows a tiered structure as you can see below:

Contract trading is open on a 24-hour round-the-clock basis and is only interrupted at the settlement time at 16:00 GMT+8 every day. Trading types can be divided into opening and closing positions, and further divided into longs and shorts.

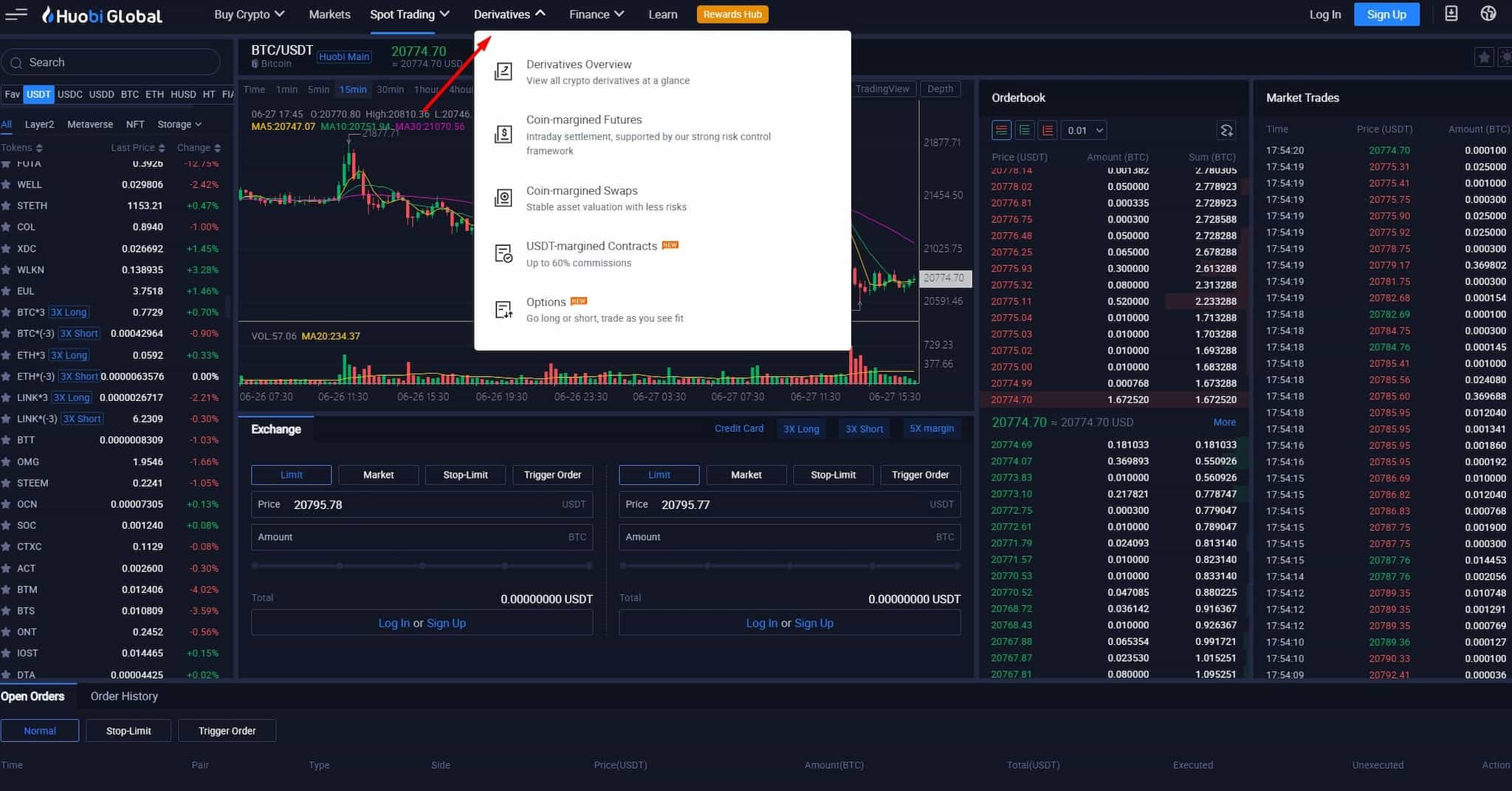

The Futures trading platform looks similar to the Spot platform and can be accessed conveniently by simply locating the Derivatives section, then choosing your market of choice:

From there, traders will be able to access the powerful Futures trading interface which has the following areas:

When it comes to the charts, there are three different options to meet the needs of most traders. The available charting interfaces are as follows:

Standard chart- Limited features and functionality, with few options for indicators. There is the 5, 10, and 30-day moving averages on the chart, with a volume indicator on the bottom that includes a 20-day moving average. Time frames available are 1 minute to 1 month, there are no options to use any sort of drawing tools or additional indicators.

Depth Chart- The depth chart is a great tool to show traders the differences in buying and selling sentiment. It is a graphical representation of the buy and sell orders for a specific asset at various prices and looks like this:

TradingView- This will likely be the most common option and is easily accessible without having to leave the HTX trading interface which is very convenient.

For those of you who don’t know, TradingView is one of the best charting platforms around, and the most widely used on the planet. Major exchanges such as OKX, Binance, Kraken, and KuCoin have also integrated TradingView into their platforms. It supports nearly every function a trader can imagine, allowing access to hundreds of tools and indicators, making it perfect for technical analysis traders.

Night Owls 🦉: If you prefer a darker UI, the little sunshine icon at the top right of the screen will swap between an eye-blinding, sunburn-inducing glaring bright white screen, and the darker UI which I prefer that is showcased in this review.

One more thing to note about the platform is although it is pretty intuitive, there are no panels/widgets that you can move around. This means that, unlike other platforms, the layout cannot be customised.

Order Forms

You do have some customisation options around your orders on the HTX platforms. Firstly, you can either choose whether you would like to open your long or close your trade.

As for order types, HTX offers a lot of advanced trading options that should be enough to suit any style and level of trader. The following order types are available:

Limit order- Trader specifies the price and quantity of the order. The limit order specifies the highest price that users are willing to buy or the lowest price that they are willing to sell. The limit order can choose three effective mechanisms, "Post only", "FOK (Fill Or Kill)", "IOC (Immediate Or Cancel)"; when no effective mechanism is selected, the limit order defaults to "always valid".

Trigger order- Traders can select the trigger price and its order price and quantity in advance. When the market's price reaches the trigger price, the system will place an order based on the order price and quantity set in advance (ie, limit order).

BBO(Best Bid Offer) order- If the user selects BBO to place an order, the user only enters the order quantity, and cannot enter the order price. The system will read the current latest opponent's price at the moment of receiving this order and place a limit order for this price.

The Optimal Top N BBO Price Order- Traders can place orders based on BBO price, which can be placed faster and get filled immediately only by selecting desired price level among “top 5 optimal BBO price”, “top 10 optimal BBO price” or “top 20 optimal BBO price” and enter contract quantity. The Optimal Top N BBO Price Order function is available for both opening and closing positions in both limit order and trigger order, enabling faster transactions.

Flash close- Flash Close is a function that would help users to place orders with top 30 optimal prices based on the BBO price orders. In other words, users could close positions with top 30 optimal BBO prices as fast as possible. However, if there are positions left not closing, the unfilled parts will convert to Limit Order automatically. The close prices of Flash Close are predictable, avoiding the losses caused by unfilled orders when market moves violently.

You will also notice on the order form that you have the option to “cross margin”. The same digital currency asset of your account will be used as margin of all the open positions of that digital currency.

For example, if you open one position of BTC contracts, then all the BTC in your account will be the margin of that position, and if you open several positions of BTC contracts, then all the BTC in your account will be the margin shared by these open positions. The profits and losses of positions of one digital currency can be mutually offset.

Warning ⚠️: If you are going to be placing a trade, make sure that you always leave an adequate stop in place. This will protect your downside risk

Double Warning ⚠️⚠️: I wouldn’t be a very good crypto educator if I did not strongly warn about the dangers of using high leverage. Leverage is a tool best used by professional and experienced traders. Be sure to thoroughly educate yourself on the risks of leverage before diving in.

One more really handy tool that you have at your disposal is the position calculator. This will allow you to calculate all of your most important levels prior to the trade. This includes liquidation, potential profit and margin requirements.

HTX Trading Bot

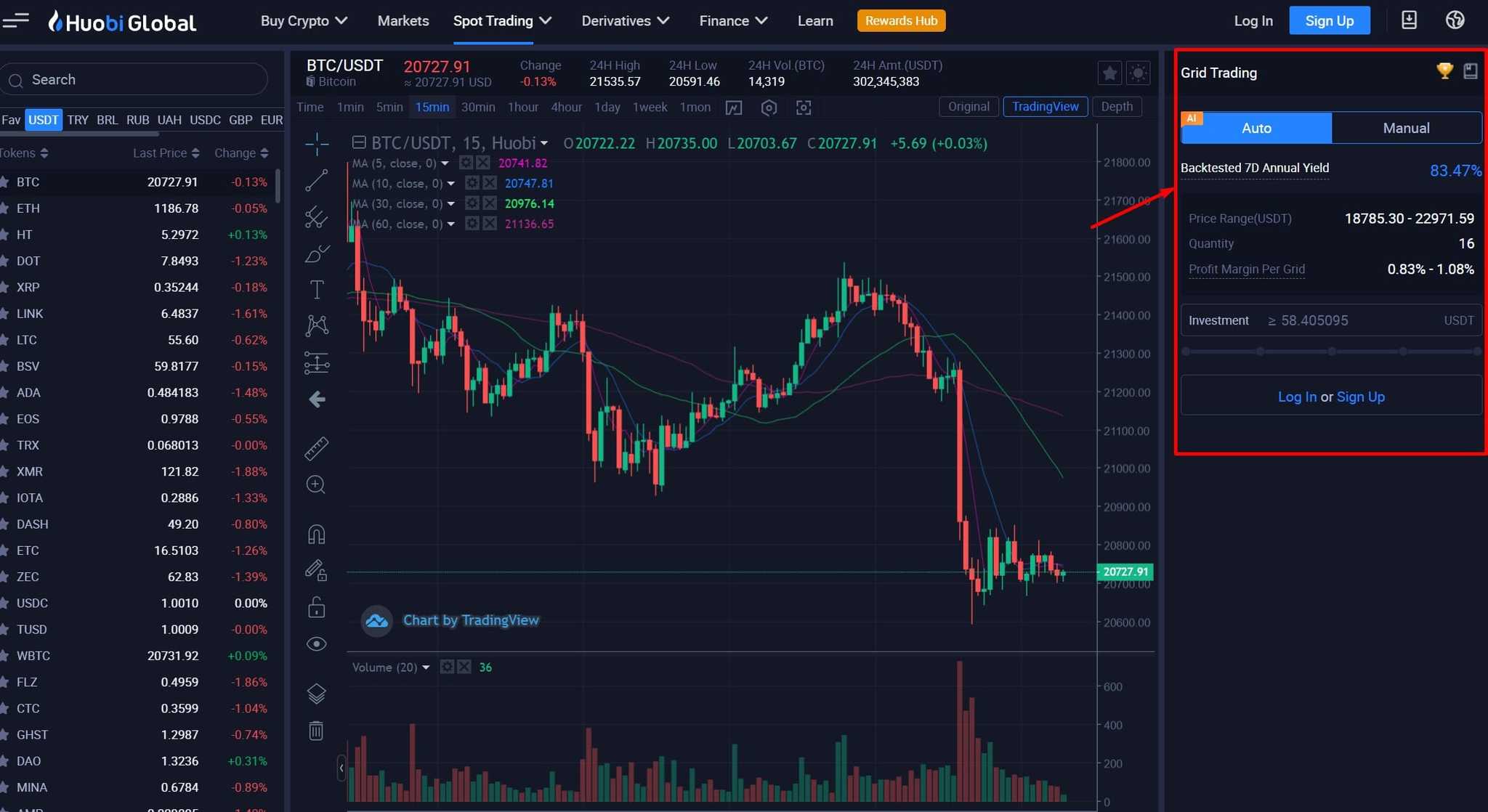

While KuCoin remains the top platform for trading bots being integrated directly into the trading platform, HTX is making strides in this area and offers a grid trading bot that can be accessed directly from the main platform page. Here is a look at the trading bot screen:

Setting up a bot is easy, all a trader needs to do is set the price low and high where they will allow the bot to trade within, and set the number of grids within the price range, which will affect the profit per grid.

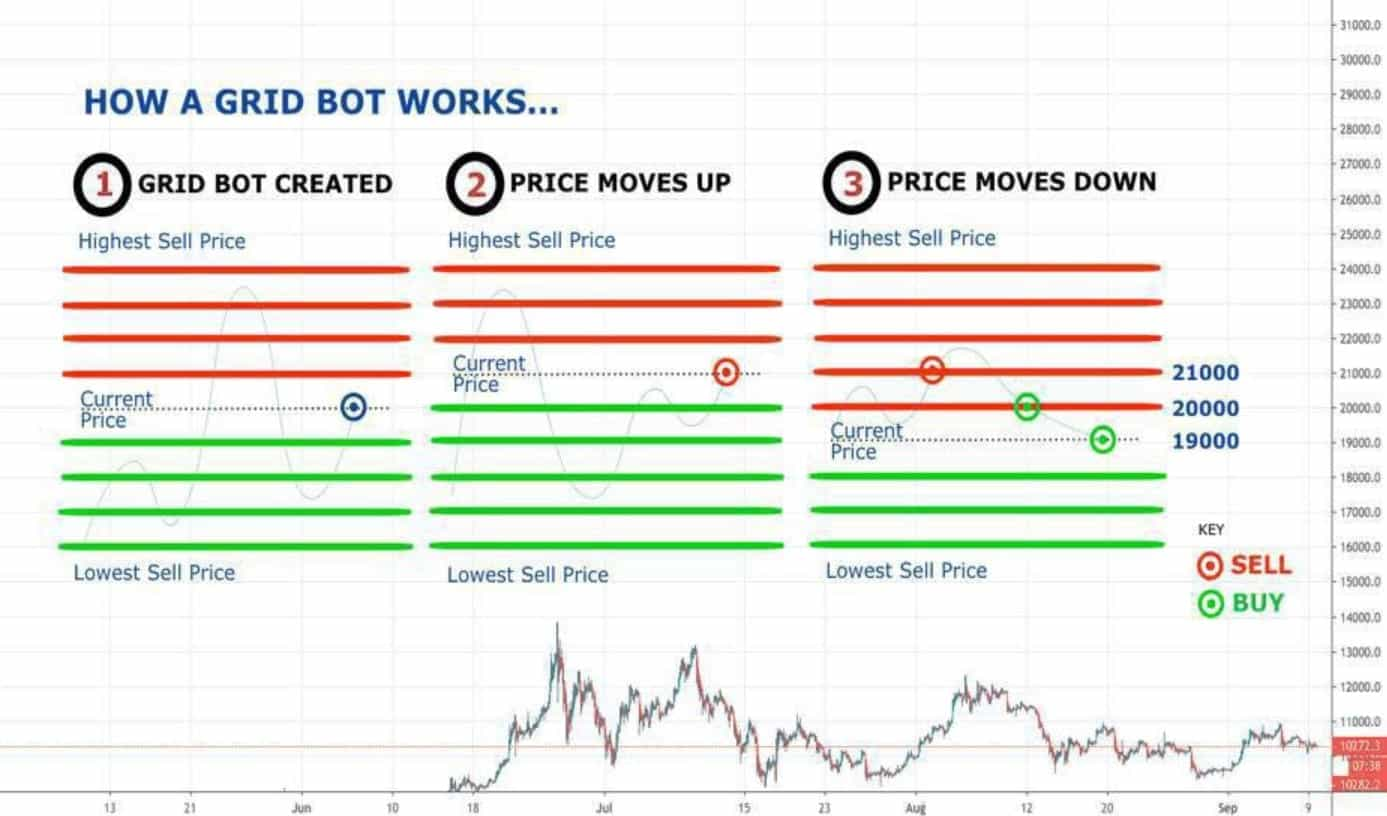

Here is a great visual from Coinmonks showing how grid trading works, and what the bot will be doing:

HTX also supports Websocket and Rest APIs for traders who want to use trading bots from other sources or code their own.

You can find the HTX Grid Trading User Guide to learn more about the grid trading bot.

Warning ⚠️: Over 90% of inexperienced traders who use automated trading bots lose money. It is important to understand that no automated trading strategy can be successfully deployed in all market conditions. Trading bots are static and rule-based, while markets are dynamic, volatile and unpredictable. Professional traders have different strategies to deploy for different market conditions, and no one strategy, like the one followed by a trading bot, can be consistently profitable in all market conditions.

Similar to using leverage, trading bots are tools best used by experienced traders who know the appropriate market conditions in which to run a bot and have already developed profitable trading strategies. Be sure to check out our article on Automated Trading Bots to learn more.

If you are interested in exploring trading bots further, I recommend checking out 3Commas, you can learn about them in our Trading Bots article. Feel free to take advantage of our 3Commas sign-up link, which gets you a 3-day free trial and a 50% discount if you choose to sign up.

HTX Finance

One of HTX's strengths is their plethora of additional earn and finance features which provide users with plenty of ways to earn an income from their hodl stash.

HTX Staking

One of the easiest and safest ways for users to earn enticing APYs is to simply stake funds on the platform.

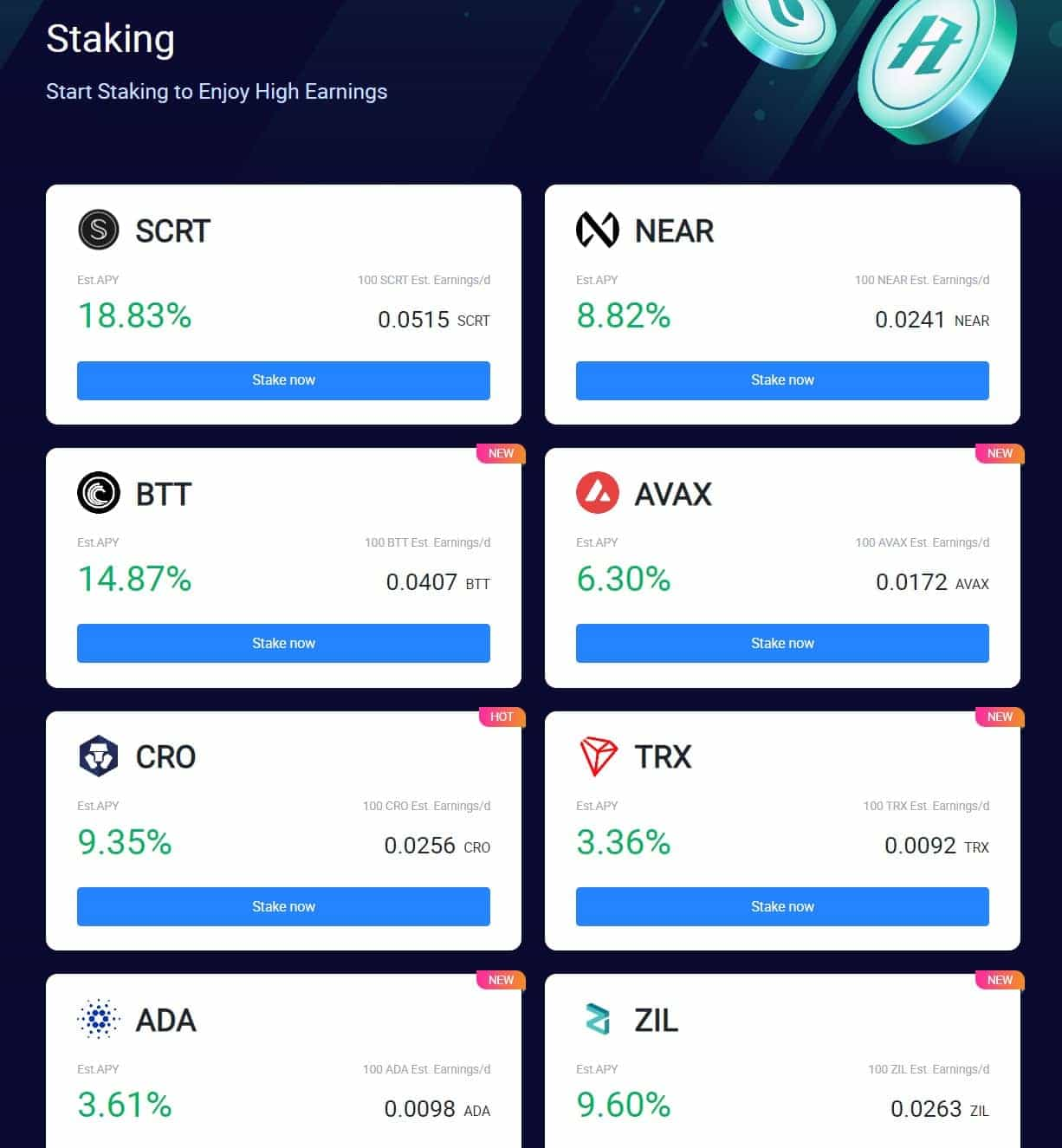

HTX offers staking on 13 different assets, with APYs ranging from 3.3% to an impressive 20%, here is a look at the staking page:

Assets available to stake are SCRT, NEAR, BTT, AVAX, CRO, TRX, ADA, ZIL, ELF, LUNC, XPRT, SOL, and CSPR.

Note that when I mention that staking is one of the safest ways to earn APY, keep in mind that there is still a risk of keeping your funds on any centralized exchange or lending platform. Be sure to check out why we recommend crypto self-custody for ultimate safety and security.

HTX Primepool

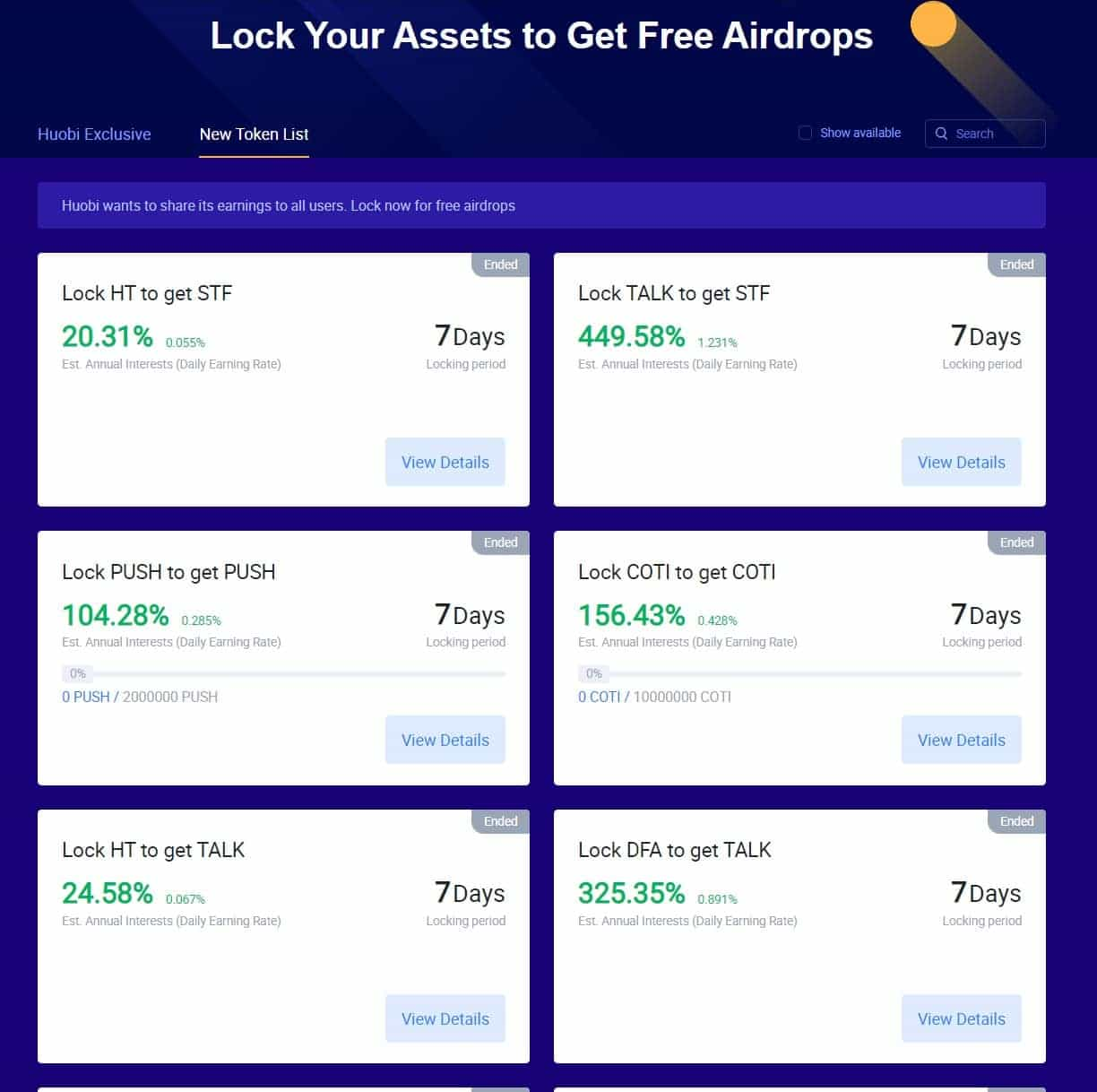

Primepool is a unique feature on the platform that allows users to lock their assets to get free airdrops

I think this is a great feature because, well, who doesn’t love passively earning crypto rewards?

I am a fan of earning DeFi airdrops as well, but, for anyone who has participated in those knows what a pain it can be to try and find upcoming airdrops, ignore the hundreds of them that are scams and rug-pulls, then jump through all the complex hoops to qualify. HTX provides a refreshing alternative for crypto users to get involved with airdrops who don’t want to navigate the complicated and often dangerous world of DeFi.

To get involved, users simply need to navigate to the HTX Primepool page or "new token" section in the app, look for an airdrop event that interests them, and lock up the associated funds to receive the airdrop token. The lockup duration ranges from 7 to 365 days, and the locked tokens can be anything from Bitcoin to Huobi’s HT token. Here are the rules associated with the Primepool:

- Tokens can be locked and unlocked at any point during the campaign

- During the event, daily snapshots of the locked tokens will be taken to determine how many rewards will be earned by the user

- All locked tokens will be automatically unlocked in the user’s exchange account after the campaign ends

My only criticism about this feature, along with the platform in general is a pretty big one. While I think this is a great feature, it is pretty useless if they never actually deploy the product. What I mean is that it has not been very active at all. At the time of writing, there have only been 11 events, all of which ended in 2021. There have been no events this year and when I asked support if this feature is being discontinued or why there have been no events, I was simply instructed to keep an eye on the Primepool platform for future announcements.

What I mean about a criticism against the platform, in general, is that the mobile app is significantly more built out and useful than the web platform. While the Primepool feature on the web platform is as dead quiet as my father-in-law when I awkwardly try and crack a joke at the dinner table, the mobile app has features and events it refers to as “new listings,” and “candy drops” that appear to be similar to the Primepool, yet far more active with current events going on.

I will cover more about the app later on in the app section, but I would recommend accessing these features in the app and not the web platform to get the most out of it.

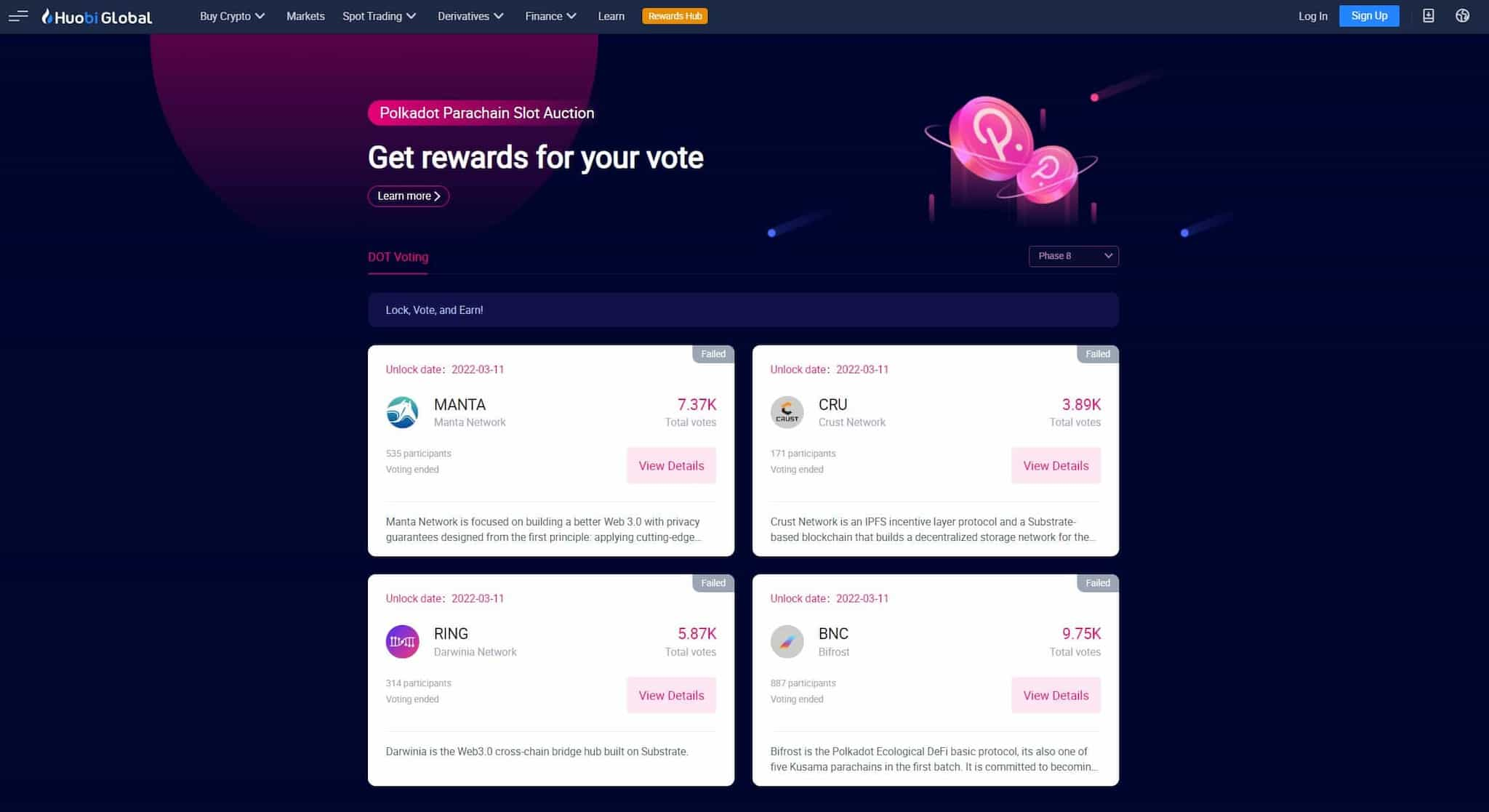

HTX Polkadot Slot Auctions

HTX supports Polkadot parachain auctions, along with Kraken and KuCoin. I think this feature is amazing, a huge driver attracting fans of the Polkadot ecosystem. Polkadot is an exciting project with huge potential, but it is quite complex and confusing to navigate, leaving many crypto users at a loss with no idea how to get involved with the DOT auction process.

HTX has found a way to simplify the process for platform users, allowing them to participate in parachain slot auctions without the technical know-how needed to navigate the complex Polkadot DeFi environment.

If you are just hearing about Polkadot parachain auctions for the first time, or want to learn more, check out Guy’s Ultimate 101 Guide to Polkadot Auctions:

HTX users who want to participate in the Polkadot slot auctions will need to perform KYC, and cannot be registered in Japan, Cuba, Iran, Mainland China, Hong Kong (China), Macau (China), North Korea, Sudan, Syria, the United States, and its overseas territories (American Samoa, Guam, Northern Mariana Islands, Puerto Rico, and the United States Virgin Islands), Canada, and Singapore.

Here are the rules to get involved in the slot auctions:

- DOT tokens will be temporarily locked after voting, and be unavailable for withdrawal, trades, and staking until unlocked.

- If the project you vote for fails to win the bid, HTX will unlock your DOT tokens and send them to your Exchange account once the auction result is confirmed.

- If the project you vote for wins the bid, your DOT tokens will be locked until the lease term expires.

- Voters can get rewards based on their locked amount of DOT and reward distribution rules shown on the locking page.

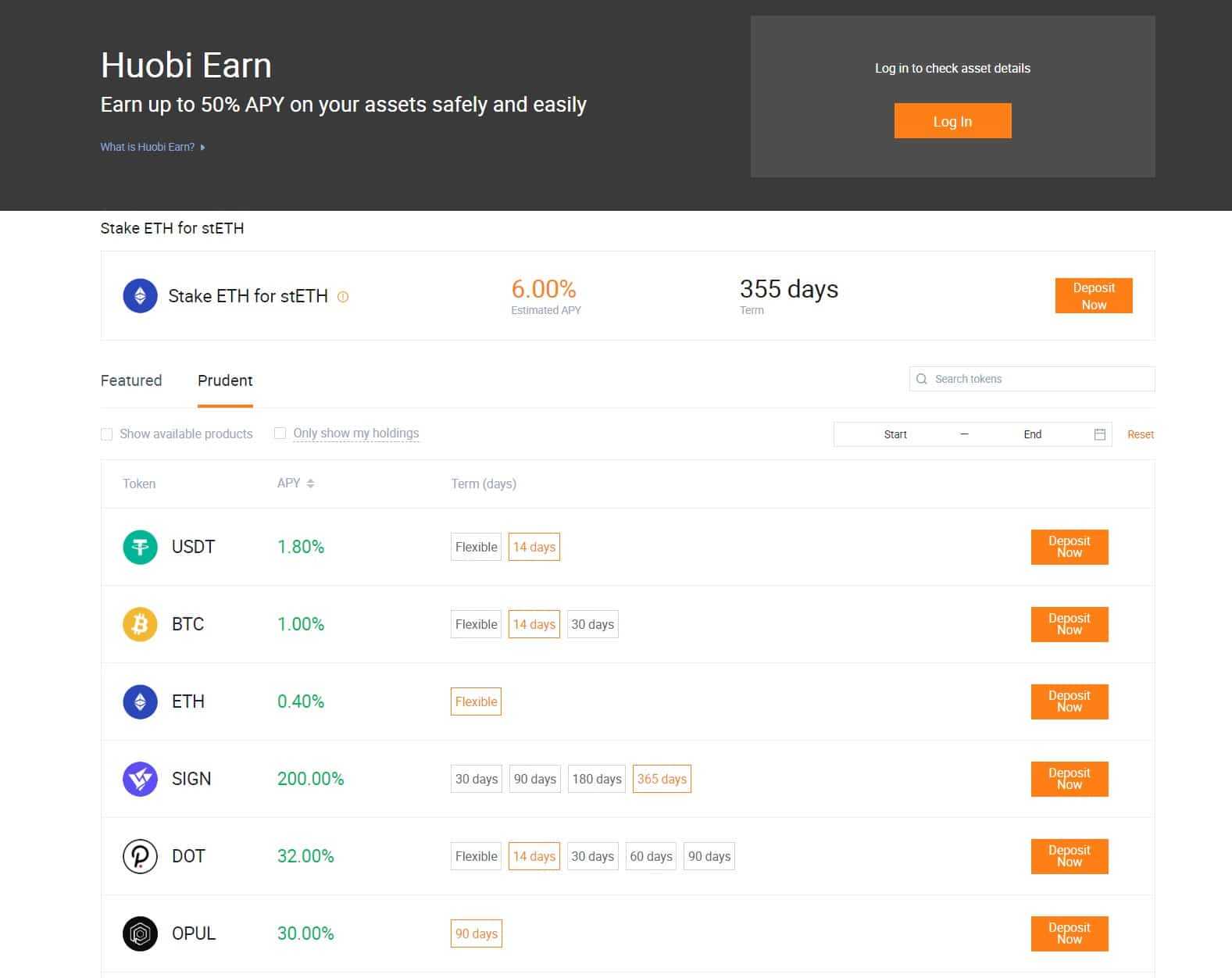

HTX Earn

HTX Earn features a variety of investment and wealth management products to provide users with a plethora of ways to earn passive income on their holdings. This is another one of Huobi’s strengths, is the sheer number of Earn products available.

There are currently 39 assets available to be locked up in either a flexible term, or 14-day, 30-day, 90-day, 180-day, or 365-day terms with APY ranging from 0.4% to 200%.

While the HTX Earn section is getting better all the time, if passive income is the most important factor for you in determining the best exchange choice, Binance currently rules the roost offering the most Earn products on the widest selection of tokens.

Crypto Loans

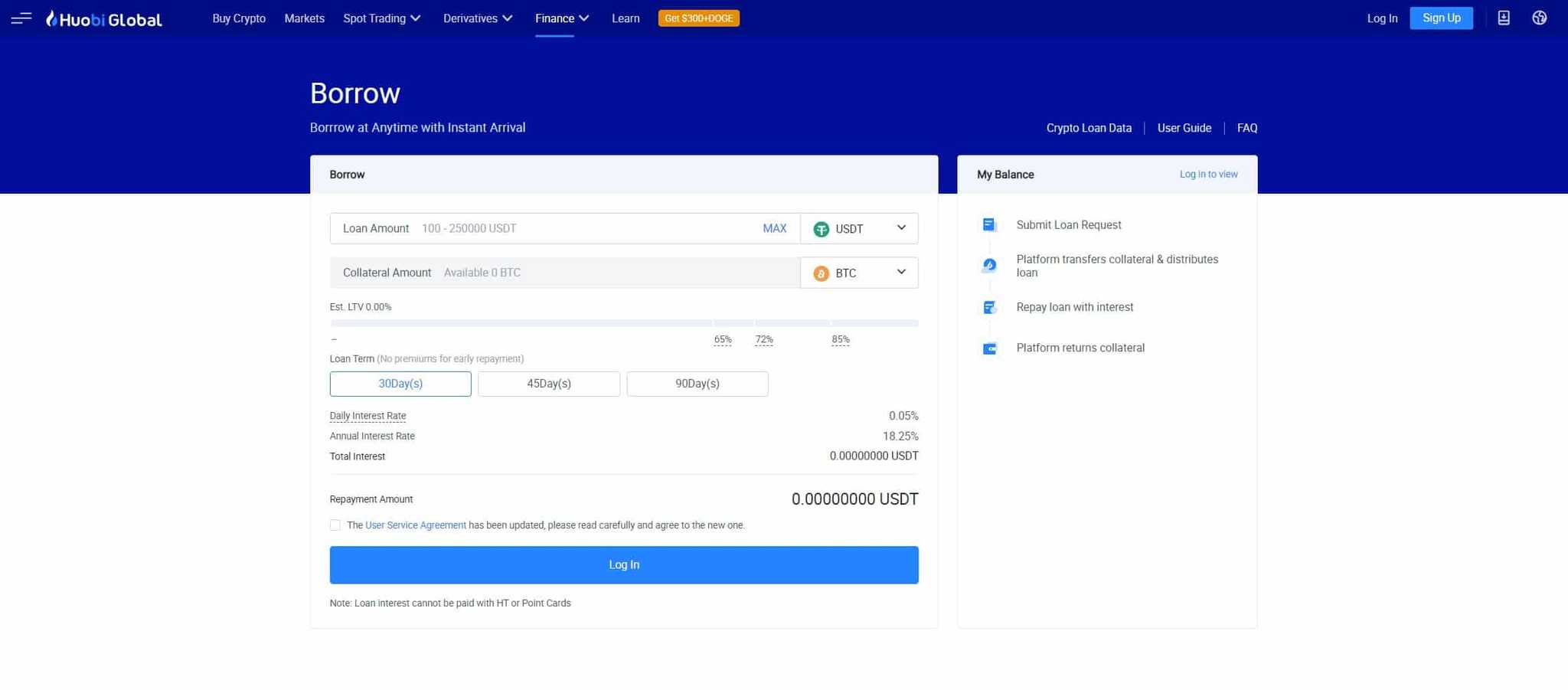

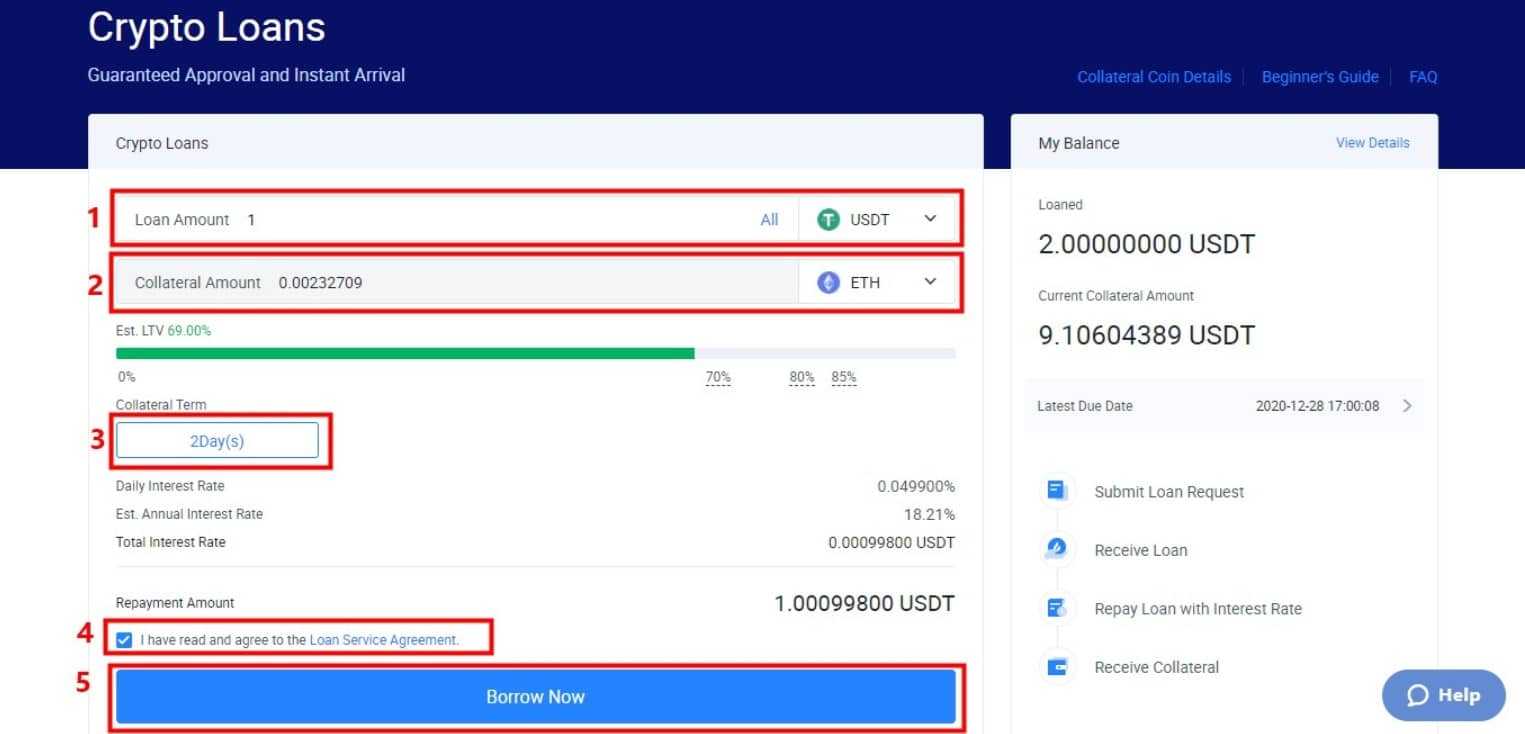

HTX users can also take out crypto loans once they pass KYC verification.

Crypto Loans can be obtained by collateralizing your crypto on the platform and borrowing other crypto assets. The following funds can be borrowed:

- USDC

- HUSD

- BTC

- ETH

Collateral can be put up in the same assets as the ones mentioned above, with the addition of HT and HPT.

When taking out a loan, users will select the loan amount, and the collateral amount, which will calculate the loan-to-value ratio (LTV). This, along with the term, will determine the annual interest rate.

Crypto loans come with their own set of risks such as liquidation risks/margin calls, and users need to be careful to keep an eye on their LTV during downside volatility as margin calls can happen fast. Be sure to understand the risks associated with crypto loans and how to make repayments and re-collateralize your position before deciding to take out a crypto loan.

Huobi Chat

Huobi Chat is a social media app on IOS and Android for cryptocurrency enthusiasts. It was created and tailored to meet the needs of the crypto space, including crypto communities, e-commerce, and provides an all-inclusive platform for sharing trends and information within the crypto community.

To incentivize more users to the social platform, Huobi launched the Huobi Chat Token (HCT) which can be earned by actively participating in the app. The website states that there are tens of thousands of users on the app, but according to Google Play, the app only has 1k+ downloads.

There are direct install links on the website, so there could be a lot more users than what Google Play shows, but the fact that I could not find much about this app online leads me to believe there may not be tens of thousands of users on it. I was also not able to find any information about the HCT token.

The app provides the following benefits:

- Instant messaging, supporting text, voice, pictures, videos, and calls.

- Group chats of up to a million people and private chats.

- Multi-dimensional recommendations for popular projects. Categories for interesting new projects and developments.

- Information, learning, content aggregation, social chatting and recommendations about blockchain all in one place.

Normally for these reviews, I would always use the service myself before reviewing it. Unfortunately, this app was unavailable for my device, and for security reasons, I do not install files directly on my mobile from websites. All the information about Huobi chat was taken from Google and the Huotalk website.

HECO Chain

HTX is dedicated to more than just providing a place for cryptocurrency trading. Similar to how Binance and Crypto.com have created their own blockchain networks, HTX has done something similar with their HECO Chain.

HECO Chain uses an HPOS consensus mechanism which allows for a TPS of 500+, with block out time as low as 3S. It is a decentralized, energy-efficient public blockchain that has lower fees than Ethereum and supports cross-chain asset transmissions of multiple mainstream currencies.

HECO Chain supports RPC interface of all Ethereum and related SDK assets, seamlessly connecting the Ethereum Chain to HECO. Usage of the HECO Chain has seen some impressive growth, with already over $1b in core assets total value locked on the network.

According to DeFi Llama, HECO Chain is currently the 22nd largest network in TVL, sitting just below Elrond and above MoonBeam, with over 35 projects currently deployed or building on HECO.

Huobi Capital and DeFi Labs

One thing I really like seeing from major exchanges is the contribution to the greater crypto industry. Most of the major exchanges invest heavily in the expansion of the crypto industry, support and promote new projects, and provide an education for the crypto community and the regulators who try and make heads or tails of this new frontier.

HTX is no different in this regard and has launched two ambitious projects that deserve a quick shout-out here.

Huobi Capital is the investment branch of Huobi Group, and they focus on providing incubation and VC services for blockchain-related projects.

The firm’s investment philosophy is to find daring, innovative and charismatic leaders to invest in, and help them reach their full potential. Countless fantastic projects would never be able to see their work come to light if it wasn’t for VC funding, this is a crucial service that is needed for new projects to flourish.

The other project is Huobi DeFi Labs. This is the platform that conducts DeFi research, investment/incubation, and ecosystem building. They are dedicated to building a new financial system that collaborates with the global crypto and DeFi community for the future. Sounds ambitious!

Huobi DeFi Labs primarily invests in projects focused on lending, DEXs, derivatives, and more.

HTX App

The most common way that HTX traders access the trading interface is via the web platform, but all the other features are more accessible on mobile. The HTX trading platform can also be downloaded for Windows and Mac, with the mobile application supported on IOS and Android.

I found the version that could be downloaded to PC was faster and more responsive than the web-based platform, but the differences were negligible, though it is nice to have an option for traders who prefer to have a downloadable trading platform directly on their computer.

As far as the mobile apps go, the HTX app is one of the highest-rated among the major crypto trading apps, receiving an impressive 4.8 out of 5 with over 77k reviews on Google Play, and an even more impressive 5 out of 5 on the App Store on over 3k reviews. The app has over 5 million downloads across both platforms.

The app is a very well-designed and intuitive mobile trading app with fantastic UI/UX and usability. Navigating the app is a breeze, and users can use the app to trade on the go, buy and sell crypto, and access the plethora of earn features supported by HTX. HTX is the only crypto trading platform that I have seen where I would say the mobile app is a must for users to get the most of out of the exchange, and not just a convenience as is the case with other crypto platforms.

On top of buying, selling, earning, and trading, users of the app can also access:

- Live news feed

- Markets and charting data

- Trading bots

- Access HTX NFTs

- Access more airdrop and earn events and features

HTX is the first crypto exchange I have come across that looks like the team is going for a mobile-first approach. The mobile app is far more usable and feature-filled than the web trading platform, which to me seems backwards. Compared to the mobile app, the web platform feels like a product that is half-finished.

Trading is best performed on a computer setup with multiple screens, multiple tabs, tools and applications open for multi-tasking which is why you don’t see professional traders using a mobile device as their primary trading tool. I can't say that I am overly impressed to see that HTX put all their effort into the mobile app while neglecting the web platform. Don't get me wrong, the app is incredible, but a move like this will likely attract inexperienced retail traders who will degen into trades Wall Street Bets style having no clue what they are doing while driving away serious traders.

Maybe I am just getting old, but making a crypto exchange mobile-first seems counterintuitive to me. I guess the Huobi team are trying to reach a wider market as the world is becoming more mobile, but I would recommend sticking to the web or desktop platform for trading, and using the mobile to access the other features.

Pro Tip: Never search for crypto apps directly in an app store due to multiple fake app download links from scammers nearly indistinguishable from the real app. Always hit the download or redirect link directly from the company website.

HTX Learn

I really appreciate platforms that put effort into crypto education and HTX does a decent job here. Education is the key to mass adoption, and the crypto industry can be a weedy jungle to try and traverse.

HTX offers multiple instructional videos and articles that are well-presented and easy enough for people to follow along with and understand.

In the Learn section, those who want to learn about trading, or just beef up their general crypto knowledge can digest educational content such as:

- What is digital asset trading?

- How to open trades

- Leverage

- Margin Mechanism

- Spot & Contract Trading

HTX Fees

HTX fees are quite low among the major exchanges for trading fees and fiat deposits via bank transfers, while fees for crypto purchases with card are average. Let's break down the different fees:

HTX Deposit and Withdrawal Fees

When depositing funds on HTX, crypto deposits are free and fiat wire transfers will have the following fees:

EUR- 0.15% + 1 EUR for SEPA bank transfers, 2.9% + 0.1% for Skrill

GBP -0.15% + 1 GBP fee for Faster Payments network

USD - 0% for domestic wire transfer, Swift, and Silvergate Exchange Network (SEN) transfers

RUB- 0% for Advcash

UAH-1.5% for card 0% for Advcash

KZT- 0% for Advcash

TRY- 0% Bank transfer and Advcash

BRL- 0% for Bank transfer

VND- 2.3% for E-wllet balance, QR Code, or Bank Transfer (NganLuong)

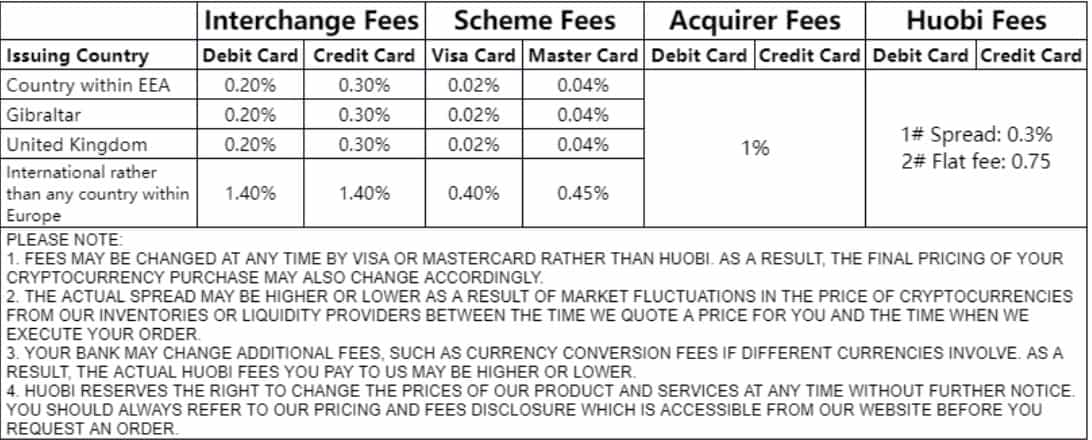

Card purchases will have the following fees applied:

Fiat withdrawals are not supported for any currency other than USD and TRY, and the minimum USD withdrawal needs to be $1,000. USD withdrawals can only be done through a Stcoins API Key, you can learn more about the process in HTX’s How to Withdraw USD guide.

Crypto withdrawals have variable fees depending on the crypto asset being withdrawn, those fees can be found on the HTX Crypto Withdrawals Fees page.

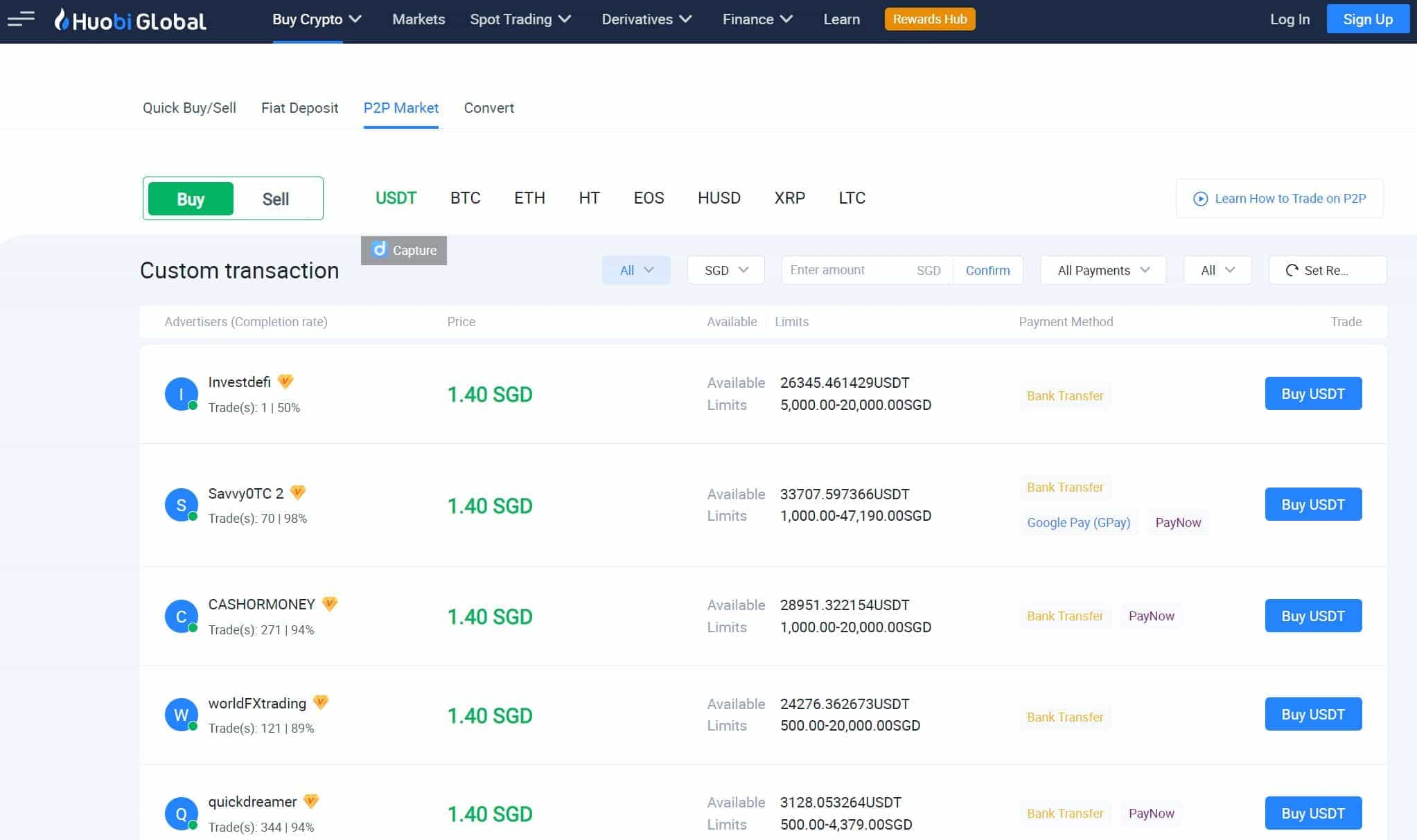

One of the most fee-friendly features on HTX is the peer-to-peer (p2p) marketplace where traders can convert fiat to crypto and vice versa for 0 fees.

Note that KYC verification needs to be done to use the P2P marketplace.

HTX Trading Fees

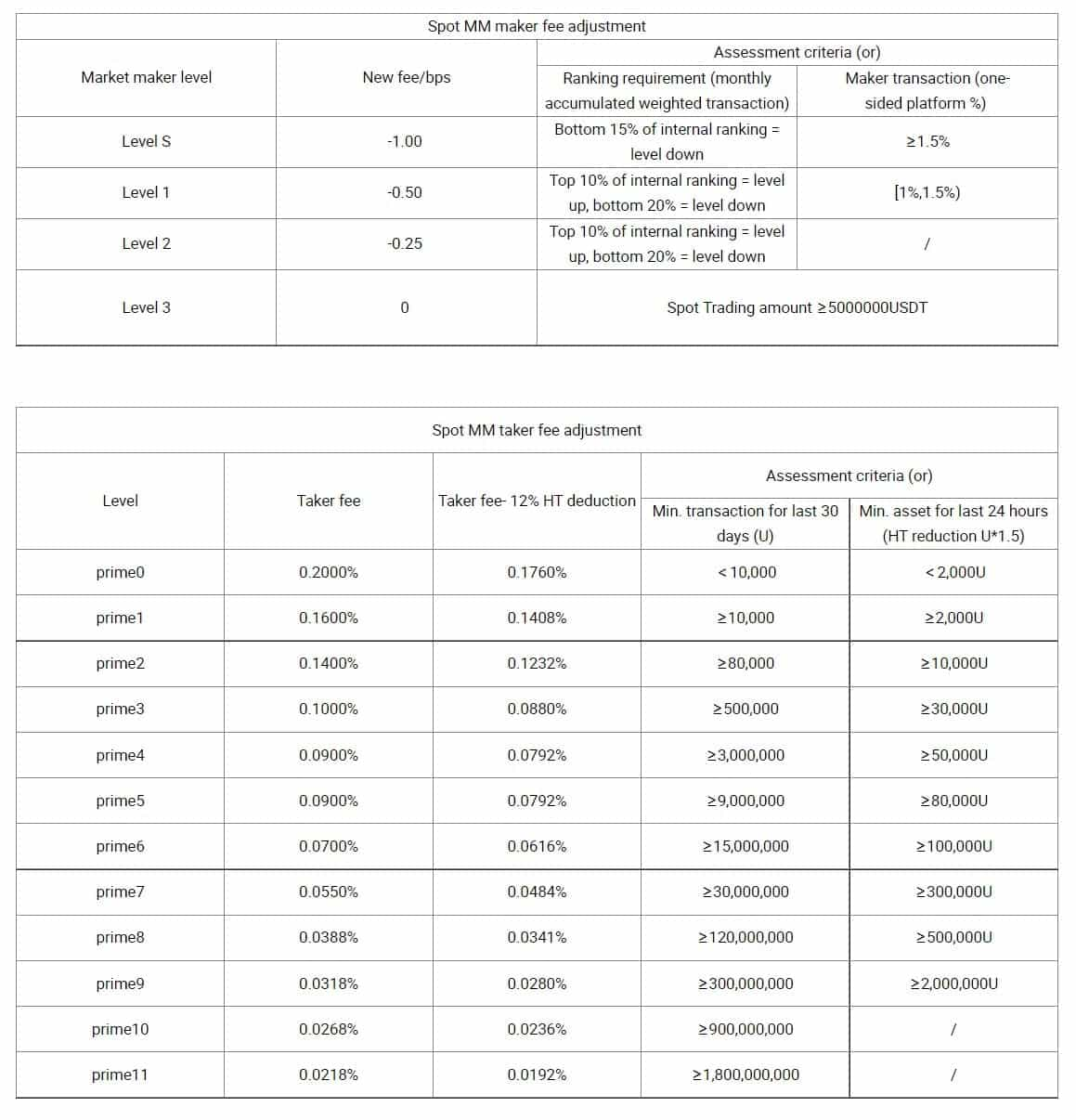

HTX has a tiered fee structure similar to OKX, Binance and KuCoin. Trading fees are dependent on volume and the more Huobi Tokens are held by the customer, the greater the fee discount. If the trader has less than 10 HT, they will be charged a basic rate of 0.2% per trade. Here is a look at the fee table for maker and taker fees:

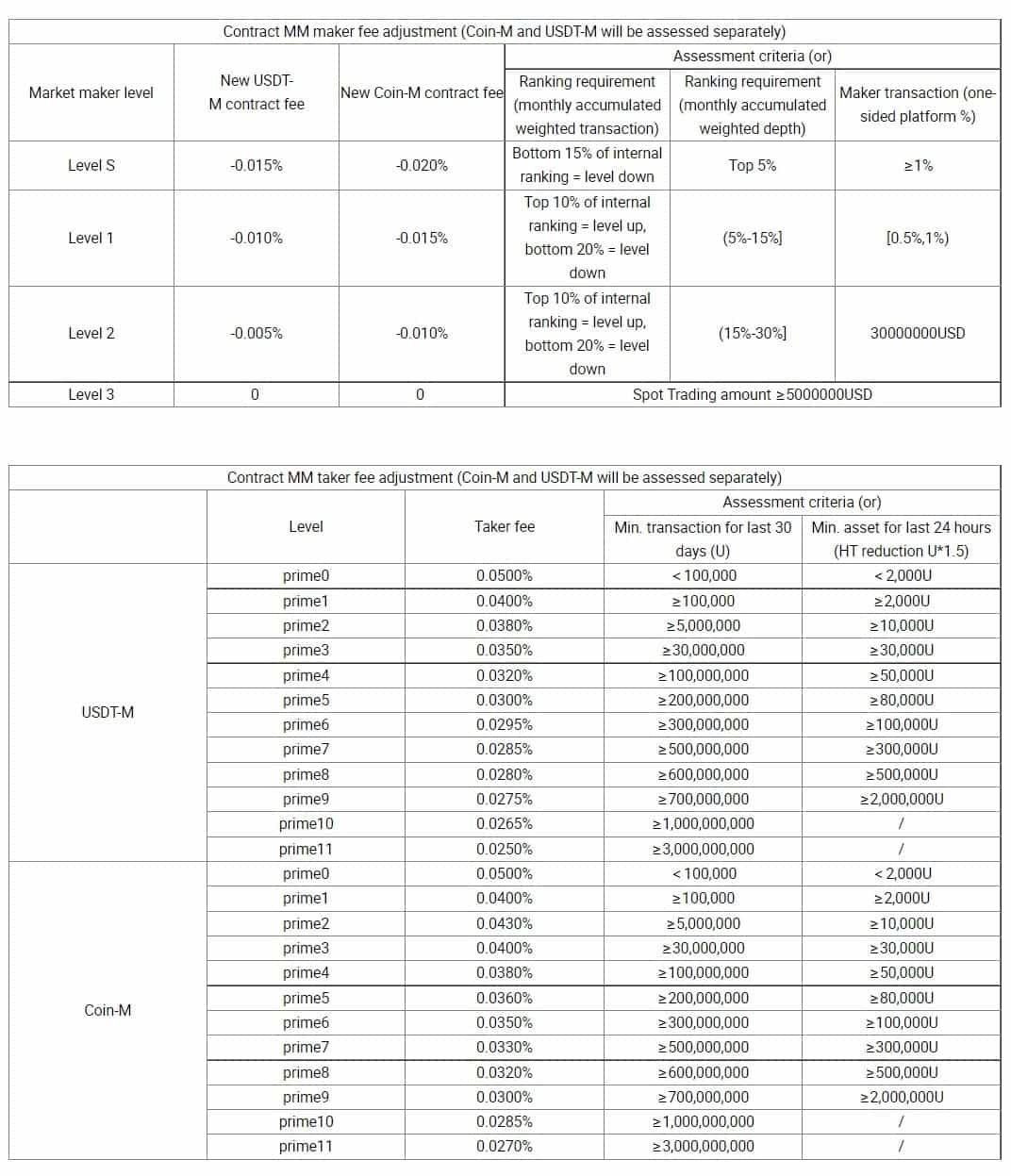

Here is a look at the fees for trading on the derivatives platform:

Derivatives trading fees are quite competitive on HTX, so traders don't need to be worried about being nickel and dimed there.

HTX KYC and Account Verification

HTX is one of the few major exchanges left that allows for any level of trading with no KYC necessary for limited trading functionality. Users can deposit up to $1,000 without verification and withdrawals are restricted to 0.006 BTC in 24 hours.

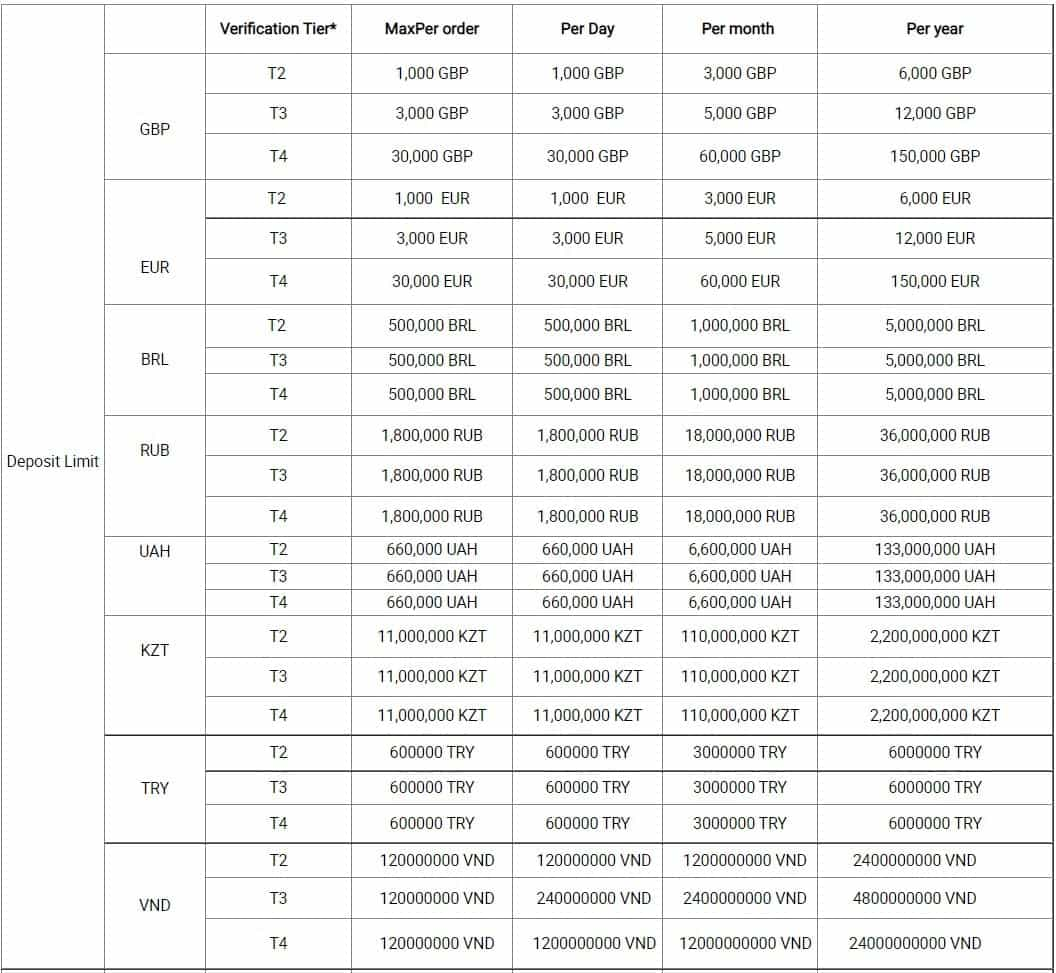

For higher deposit thresholds, here is a table showing the deposit limits per account verification tier:

Here are the withdrawal limits for the different verification levels:

The verification requirements for each tier are as follows:

Tier 1 (unverified)- Email address

Tier 2- Personal info, ID Verification

Tier 3- State the purpose for trading, who you trade on behalf of, estimated daily and monthly trading volume, source of funds, monthly income, employment status

Tier 4- upload verification documents such as residential proof of address and source of funds.

HTX Security

HTX adheres to strict security compliance and follows industry best practices. They hold client funds in a multi-signature cold wallet and keep a 20,000 BTC Security Reserve Fund that was set up to reimburse funds in the event of security accidents, providing users with peace of mind of knowing they have a good chance of being reimbursed for any lost funds.

Fortunately, HTX has never had to deploy the Security Fund as they are one of the few exchanges that have never fallen victim to a successful hack, along with SwissBorg and Kraken.

HTX keeps funds offline in a cold storage environment, with multi-factor encryption and 24/7 platform monitoring. From the user side, HTX traders have peace of mind of being able to access the following account security features:

- Minimum password requirements

- 2FA

- Whitelist withdrawal addresses

- Trading password

- Anti-phishing code

- Account Freeze option

Cryptocurrencies Available on HTX

HTX has an impressive selection of over 500 different cryptocurrencies, including the majors such as Bitcoin, Ethereum, Ripple, Litecoin, Cardano, Solana, etc. while also being a good place for the altcoin gem hunter.

HTX offers more crypto assets than the likes of Coinbase and Kraken, but less than Binance, OKX, and KuCoin.

HTX Exchange Platform Design and Usability

The HTX exchange is well laid out and designed with convenience in mind, while still providing a feature-packed platform that is easy to navigate around. The mobile app is especially robust while still maintaining an intuitive layout and an enjoyable user experience.

Of course, beginners will need to familiarize themselves with the basic concepts pertaining to trading so they will understand the different areas of the platform and the terms that they will encounter, but for experienced traders, the platform is very functional.

I like that there are a couple of different options to access things like the leveraged tokens and the way that spot and derivatives trading happens on different interfaces. The fact that traders can choose between the three different types of charts is also a plus, providing plenty of choices needed to meet the requirements of most crypto traders.

Outside of the trading terminal, the site is very beginner-friendly and easy to navigate for those looking to access the P2P, Buy, Finance, and Learn sections.

Deposits and Withdrawals at HTX

Crypto Deposits and Withdrawals are supported on HTX, fiat withdrawals are not supported with the exception of USD through an Stcoins API key and TRY can be withdrawn via AdvCash. The following deposit methods are supported:

USD- Purchase crypto via card, Bank transfer/ABA, SWIFT, SEN fiat deposits

EUR- Purchase crypto via card, Bank Transfer/SEPA fiat deposits

GBP- Purchase crypto via card, Bank Transfer/ Faster Payments fiat deposits

BRL- Bank transfer (PIX)

RUB- Bank card, Bank Transfer, AdvCash

UAH- Bank card, AdvCash

KZT- AdvCash

INR- Buy USDT via UPI/Bank Transfer

TRY- AdvCash

List of supported currencies that can be used to purchase crypto with a debit/credit card: BGN, CHF, CZK, DKK, EUR, GBP, HRK, HUF, MDL, MKD, NOK, PLN, RON, SEK, TRY, UAH, HKD, AUD, NZD, KZT, THB, PHP and USD.

HTX Token (HT) Uses and Performance

The HT token is an Ethereum-based token that can be used to decrease trading fees, receive crypto rewards, trade for other crypto assets, access the different HTX Finance features, and even used to vote on exchange decisions.

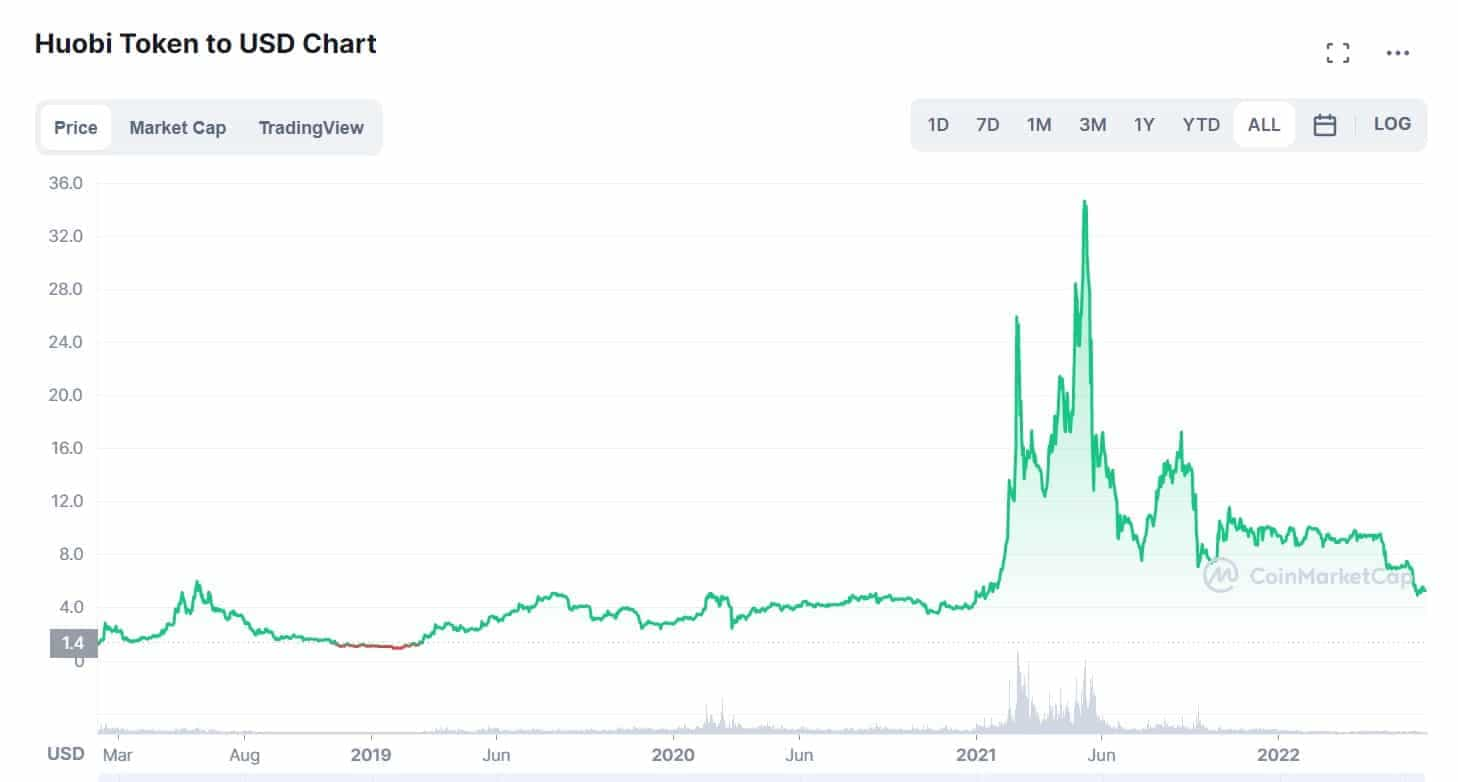

The HT token launched at around $1.20 in 2018 and has seen fairly steady price appreciation up until the 2021 bull run where it shot up to an all-time high of just above $34 in May, that is approximately a 2,733% gain, holy smokes!

Exchange tokens did exceptionally well during the euphoria stage of the 2021 bull run, but like the broader crypto market, the HT token has seen a significant drop in price. HT has dropped 84% down to its current price of $5.21, experiencing a worse depreciation than many competitors’ exchange tokens, while still holding a higher price than it was trading at prior to 2021.

Investors who hold the HT token are bullish on the HTX exchange and believe the use cases and demand drivers for the token make it worth holding, and that the token will continue to appreciate in value, in correlation with the future success of the platform.

HTX Customer Support

HTX offers support via live chat and an email ticket system, both of which are pretty good in terms of response time. I tested out their support for this review and each time I accessed the live chat I was connected to someone in less than five minutes, and their email support responded in under 10 hours, so not bad on those fronts at all.

To speak to an agent, you will first need to ask a question which will prompt articles to auto-populate and ask if they answered your question. Simply hit “unsolved” under the article and a live agent will be with you soon.

In terms of the quality of support, this could use quite a bit of work. When reaching out to the chat agents for answers, they seemed less than willing to help, as if they consistently had a case of the Mondays. I had to be persistent and prod them, asking the same question two or three times with different wordings and from different angles before receiving a complete answer.

The email responses I received were not adequate either, the first email response didn’t even address my question, so I had to reply and let them know that my question was still unresolved. The follow-up email still did not answer my question.

My question was asking for a list of licenses and regulations held by HTX Global, and some insight into where they legally operate, this was the response:

“With the principle of globalization, professionalism, compliance, and diversification, Huobi Group is dedicated to providing safe and trustworthy Internet of Value (IoV) services to its tens of millions of users in more than 100 countries and regions.”

Not very helpful, nearly as bad as the support I experienced at KuCoin. Seriously, check out the support section in this KuCoin review for a customer support story so terrible it's almost legendary.

While the response time at HTX was good, they were unable to give me proper answers about their licensing situation or simple answers about fees with regards to fiat deposits and USD withdrawals, and could not answer if they were discontinuing Primepool or why there have been no events this year on the web platform.

If customer support is important to you, I would recommend checking out SwissBorg or Kraken, they have the best support I’ve experienced in crypto.

HTX Top Benefits Reviewed

HTX is a robust trading platform with deep liquidity and a nice selection of tradeable markets and additional earn features. Designed as a professional trading platform, it fulfils that role quite well, which is why HTX Global trading is enjoyed by millions of traders worldwide.

What Can Be Improved

The obvious downside is the lack of fiat withdrawal support. Traders on HTX need to withdraw crypto to another exchange to use as a fiat offramp if they wish to avoid the complex USD withdrawal system.

HTX could do more to build out its earn section as well, with the Primepool running more events too. If HTX wants to compete with the likes of Binance and KuCoin, they will need to increase their earn feature products and offerings as they are falling behind the competition.

I also really don’t like that the web platform is being neglected as the team prioritizes the mobile app. Crypto platforms via web and mobile app should compliment one another, not have one completely dominate the other, and the web interface shouldn’t feel like an abandoned, forgotten part of the exchange.

HTX Review Closing Thoughts

HTX remains one of the largest cryptocurrency exchange platforms, enjoyed by millions of users worldwide. They do have a decent number of tradeable assets, a well-built-out earn section, a professional-grade trading interface, and one of the best crypto exchange mobile apps on the market.

HTX has become very popular in the Asian markets and for those looking for limited KYC-free trading. As HTX is ranked #10 in terms of the largest and most popular crypto exchanges, I could not find any defining strengths that would entice a trader to choose HTX over many of the higher-ranked exchanges.

I do feel that there are better, cheaper, and safer options out there in terms of regulated exchanges. Many of the top exchanges offer more in terms of tradeable markets, daily crypto use cases, and ways to convert crypto to cash and withdrawal. While there is nothing bad about HTX, it is above average and a decent exchange, but I would be sticking with the exchanges in the top 5 personally.

You can learn more about Binance in our Binance review.

Frequently Asked Questions

As far as security goes, HTX is incredibly safe. Their robust security protocols have not been breached once in the 9 years the platform has been in operation, and Huobi has a well-funded reserve fund to reimburse traders should the need arise.

The fact that HTX is an unregulated exchange is a red flag for many investors and traders. Many crypto users will opt for regulated exchanges like Crypto.com, Binance, Kraken or SwissBorg as they feel regulated exchanges are safer. I agree with this sentiment.

No, HTX is not available to users located in the US, though they are working on acquiring the proper licensing. I recommend Kraken for US-based traders.

It is my opinion, and the opinion of the greater crypto community, as OKX is the more popular and widely adopted exchange, that HTX is not better than OKX. OKX is superior for the following reasons:

- OKX offers more tradeable assets and markets

- OKX is a more feature-packed exchange, offering more products and features outside of just crypto trading

- OKX has deeper liquidity

- You can learn more about OKX in our OKX Review.

It is my opinion, and the opinion of the greater crypto community, that HTX is not better than Binance, as Binance is the largest exchange in the world, and has the largest user base. Binance is better than Huobi Global for the following reasons:

- Binance is regulated in multiple jurisdictions

- Binance has lower fees

- Binance offers more Earn products and features

- Binance has more tradeable assets and markets

- Binance has more “all-around” crypto features making it the better platform for daily crypto use.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.