Comprehensive Guide to PoS Mining: What You Need to Know

Mining in cryptocurrency is the process of securing and verifying transactions (called blocks) along the blockchain. Cryptocurrency mining (also called crypto mining) helps to maintain network security by ensuring that only valid blocks are recorded on the digital ledger.

Participants in a mining process get rewarded for dedicating their resources and time to solving computational algorithms.

Cryptocurrency mining can be done in either Proof of Work (PoW) or Proof of Stake (PoS) consensus, depending on the coin.

In this guide to PoS mining, we will examine what Proof of Stake is, how it works and which coins currently use this method.

What’s Proof-of-Stake?

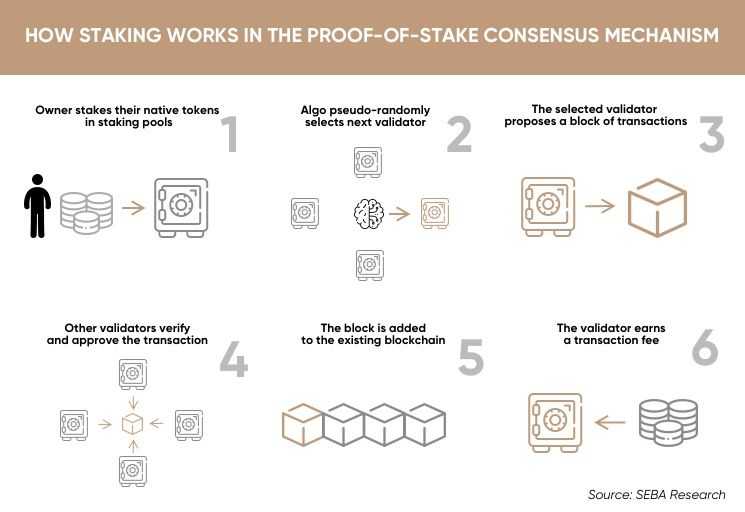

Proof of Stake is a consensus algorithm whereby new blocks are secured by validators before being added to the blockchain. In the proof of stake mining algorithm, a person (node) can participate in the mining process by “staking” a given amount of their coins to be allowed to validate a new transaction.

The PoS is a deterministic concept that simply states that an individual is only able to mine or validate new blocks equivalent to the number of coins they possess in their staking account.

It implies that the more coins you have, the higher your mining power, i.e., the more coins you have in your wallet, the more transactions you can validate, collecting transaction fees as your reward.

How does Proof-of-Stake work?

When you hold a given amount of coins in your wallet for staking, your computer qualifies to be a node. For a node to be chosen as one of the stakers, they need to have deposited a certain amount of coins in a bound wallet.

The chosen validators then stake the required amount of coins using the special staking wallets. The node will forge or create new blocks proportional to the number of coins in their wallets.

Different coins use a variety of PoS systems, but they all work the same by helping verify transactions and secure the network. Validators get rewarded with a share of the transaction fees collected per block.

What about Proof of Stake Pooling?

It is possible to pool funds to participate in staking and earn profits from coins that have very high staking amounts. There are two ways to do this. You can give your coins to another user who will stake and then share profits with you.

This, of course, should be done with a reliable person known to you. The other method is to join a staking pool. Here you get to join some of the biggest holders.

Benefits of a PoS consensus system

- The proof of Stake consensus mechanism doesn’t require specialized and expensive hardware to run. You only need an internet connection and a functional computer setup.

- Anyone with enough coins to stake can validate transactions on the network.

- Investments in a PoS system do not depreciate with time like what happens to ASICs and other mining hardware. A validator’s initial stake can only be affected by price fluctuations and trading rates.

- Proof of Stake is more energy efficient and environmentally friendly than Proof of Work regarding power consumption.

- Reduced threat of 51% attack.

Although the PoS consensus algorithm indeed does sound great, there is one disadvantage and that is that decentralization is not fully possible.

This is because staking can still be monopolized by a few of the nodes on the network. Those that have the most coins can effectively control most of the mining.

Most Profitable POS Coins

When you invest in a Proof-of-Stake coin, you have the added benefit of not only the possible appreciation in the value of the coin but also of the returns on possible staking.

But which are the best PoS coins to invest in currently? Below are a few you may want to consider.

Ethereum

Ethereum started off as a PoW blockchain, but that changed in September 2022 when an upgrade that came to be known as “the Merge” saw the blockchain move to a PoS consensus.

According to figures from the Ethereum Foundation, the Merge made Ethereum 99% more energy-efficient.

BNB

The Binance Smart Chain fuses elements of a PoS model with proof of authority.

Anyone can become a candidate for the validator. To become part of the selection process of validators, the nodes have to stake their BNB. Validators can self-delegate (self-bound) BNB to themselves and can also receive delegations from any other BNB holders. The minimum amount for self-delegation is 2,000 BNB (roughly $430,000).

Cardano

Cardano is built on the PoS consensus protocol Ouroboros, and it is the first blockchain consensus protocol to be developed through peer-reviewed research.

At the heart of the protocol are stake pools, reliable server nodes run by a stake pool operator to which ADA holders can delegate their stake. Stake pools are used to ensure that everyone can participate in the protocol, regardless of technical experience or availability to keep a node running. These stake pools focus on maintenance and hold the combined stake of various stakeholders in a single entity.

Polkadot

Polkadot uses Nominated Proof-of-Stake as its mechanism for selecting the validator set. It is designed with the roles of validators and nominators, to maximize chain security.

A variation of the PoS consensus mechanism, nominated PoS allows token holders to nominate validators to represent them in the block validation process. It aims to be more democratic and more fair.

Avalanche

The Avalanche blockchain uses a PoS consensus mechanism to provide Sybil protection to the blockchain. This PoS system gives tens of thousands of validators a say in the system, ensuring that the network remains resistant to attacks, robust, and reliable.

Summary

Cryptocurrency mining is one way of getting crypto coins into circulation. Proof-of-stake is similar to POW in this respect. However, as decentralization and cheaper transactions become more important, the use of PoS could help by cutting hardware costs and electricity needs.

Frequently Asked Questions

Proof of Stake is a consensus algorithm in which participants validate transactions and create new blocks on a blockchain based on the number of coins they hold and are willing to "stake" as collateral.

Unlike PoW, which requires miners to solve complex mathematical puzzles using computational power, PoS relies on participants staking their coins to validate transactions, making it more energy-efficient.

Participants in PoS earn rewards by staking their coins and validating transactions. They receive a share of transaction fees and, in some cases, newly minted coins as a reward for their contribution to the network.

Yes, as long as you hold a certain amount of the cryptocurrency supported by PoS, you can participate in staking and earn rewards. The minimum staking requirement varies for each cryptocurrency.

Risks include the potential centralization of mining power among large stakeholders, security vulnerabilities, and the influence of wealth on decision-making within the network. Market fluctuations also impact the value of staked coins.

Several cryptocurrencies have adopted PoS, including Ethereum, Cardano, Polkadot, Avalanche, and Binance Coin (BNB), among others.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.