Ben Franklin said the only thing in life that’s certain is death and taxes. While cryptocurrencies wouldn’t be created for another 240 years, the same remains true today. If you have income from crypto, the tax man wants his chunk. Fortunately for you, we have compiled a list of the best crypto tax software to make the process as painless as possible. Yay…Taxes 🙄

It’s one thing to say, “you need to pay your taxes,” but a whole other process to actually do it, and many are left wondering where to start and how to proceed. With crypto, it isn’t easy. Moreover, collecting information on all of your trades and compiling them in your tax returns can be a daunting task.

Fret not, my fellow hodlers; as in this post, I will give you some info that should hopefully help you on your journey and give you seven crypto tax tools & software that could help simplify this process.

If you are eager for more tax tools, Guy also happens to have a video on his top picks for useful tax tools:

Before diving in, let’s take a look at some taxation regulations.

Global Crypto Tax Treatment

If you’re in the U.S., the U.K., Japan, Canada, Australia, or many European countries, then crypto taxation is something you need to take seriously. These are some of the countries that already have tax regulations in place, and they expect their citizens to pay those taxes reliably.

Many of these countries are now also working with exchanges and chain analytic companies in order to track transactions, so if you think the tax man doesn’t know about the Bitcoin you sold this year, news flash, they definitely do. Big brother is always watching. If you buy or sell crypto on a major exchange, it is best to assume that the government is likely going to know about it.

Here’s a table that shows how cryptocurrencies are classified by these countries, and what taxes citizens are required to pay:

| Country | How Crypto is Classified | Type of Tax Paid |

| United States | Property | Crypto income and capital gains |

| Australia | Property | Crypto income and capital gains |

| Japan | Miscellaneous income | Crypto income and capital gains |

| United Kingdom | Chargeable asset | Crypto income and capital gains |

| Canada | Commodity | Crypto income and capital gains |

There are many useful tools for calculating crypto taxation regardless of your location to help simplify the calculating and filing process.

Also, note that the capital gains tax is for the event of selling crypto assets. Crypto can also be taxed as income or business income if you are actively trading, staking, receiving airdrops, renting NFTs, lending etc.

There are so many ways to earn crypto income, many of which are taxed differently, so it may be a good idea to seek advice from a tax professional as it can be confusing. Here are just some of the different crypto-related activities that are subject to taxation in many countries:

- Selling for fiat at a profit or loss- take advantage of writing off those capital losses people! They can offset the tax paid on gains.

- Exchanging digital assets on a DEX or centralized exchange- Yup, this one is a bummer. Swapping an altcoin for some Bitcoin can also trigger a tax event.

- Receiving airdrops- Yup, apparently this is “income.”

- Sale of NFTs- This can trigger capital gains, or income tax depending on the nature of the income.

- Earning income from Blockchain and P2E games.

- Staking income.

- Providing liquidity or yield farming- Any APY earned may be considered income.

- Using CeFi lending platforms like Nexo, an exchange, or DeFi lending protocols like Compound Finance or Aave.

- Crypto mining.

- Using crypto debit cards.

- Earning rental/advertisement income from digital land or renting NFTs.

- Providing a service and getting paid in crypto.

Much of the software in this article works for any number of countries. Users can import data from crypto exchanges or sync the software directly to their exchanges, wallets, DEXs, and DeFi protocols for automated ease. Good tax software can also auto-populate information, filling the appropriate tax forms so you don’t even need to know which number to plug in where. Think of these tools like TurboTax, but for cryptocurrency activity.

Once you’ve collected all your crypto records by exporting activity history from an exchange/platform then uploaded the files into the tax software, or allowed the automated integration to do the heavy lifting and gather all the info for you, you can:

- Hand it to your accountant so they can figure it out and file it on your behalf.

- Use one of these crypto tax tools and file your taxes yourself.

- Allow one of the tools like Cryptotrader.tax, (rebranded now as CoinLedger) or CoinTracking to auto-fill tax forms to file yourself, or utilize their team of tax professionals who can help you file, or file on your behalf.

Some crypto transactions aren’t taxable though, and it’s good to know what these are so you don’t inadvertently end up paying too much in taxes. Examples include charitable donations and transferring crypto between wallets.

In the U.S., tax authorities have stated that even if a return is accepted now, it is open to audit from the IRS, and taxpayers could be asked to file an amended return years later and pay back taxes.

Top Free Crypto Tax Software: Top 7 Crypto Tax Tools

Crypto tax software can identify which transactions are taxable and which aren’t, saving you from making that determination yourself.

It does this through a series of questions and by analyzing crypto transaction events. The tax tools will also try to help lower your tax bill by using capital loss deductions if you’ve had losses on your crypto trading and investing activities.

One thing that we noticed when testing out the tax tools mentioned on this list is that not all tax tools are created equally. They also have their own strengths and weaknesses in different areas. These are the platforms that we found to be the most solid all-around with full functioning utility needed to meet the needs of most crypto users.

So, in no particular order, here are the top 7 tools available to traders and investors to help you with your crypto tax software comparison.

CryptoTrader.Tax (Now called CoinLedger)

Just so we are on the same page, CryptoTrader.Tax rebranded to CoinLedger in 2022. As CryptoTrader.Tax has a fantastic reputation and is an excellent platform, I wanted to point out that it is still the same great company, just with a shiny new name.

While some of the crypto tax software later in this article can seem a bit complicated, that isn’t the case with CoinLedger. According to the website, CoinLedger will let you finish your crypto taxes “within minutes.”

The tool supports integrations and imports from over 350 different exchanges, 181 DeFi platforms, nine wallets including MetaMask, Trust Wallet, and Exodus, and covers cryptocurrencies and NFTs. This makes it simple to import your trades and easily calculate gains and losses for the entire year, covering things like simple swaps, and actions undertaken on supported DeFi protocols like Aave, Uniswap, Compound, Pancake Swap and more. It really doesn’t get much easier.

There are plenty of other useful features baked into the platform which make it a very straightforward method for anyone to calculate their tax liability from their cryptocurrency activities. One of these features is the automation of all the crypto tax reports and forms needed when filing.

By using CoinLedger throughout the year, traders can keep an eye on their profits and losses, and their tax liability.

The CoinLedger team has put together this handy YouTube video on How CoinLedger Works if you want a visual walkthrough that puts all the bits and bobs together.

Traders can get started for free with the platform. The free version allows users to import all of their transaction history, view their net capital gains and losses with the crypto tax calculator, and track their portfolio. Payment is only required when users want to download and view their full crypto tax report. CoinLedger is also in the process of launching a portfolio-tracking tool so users can track profit and loss, the holding period of current assets, and much more.

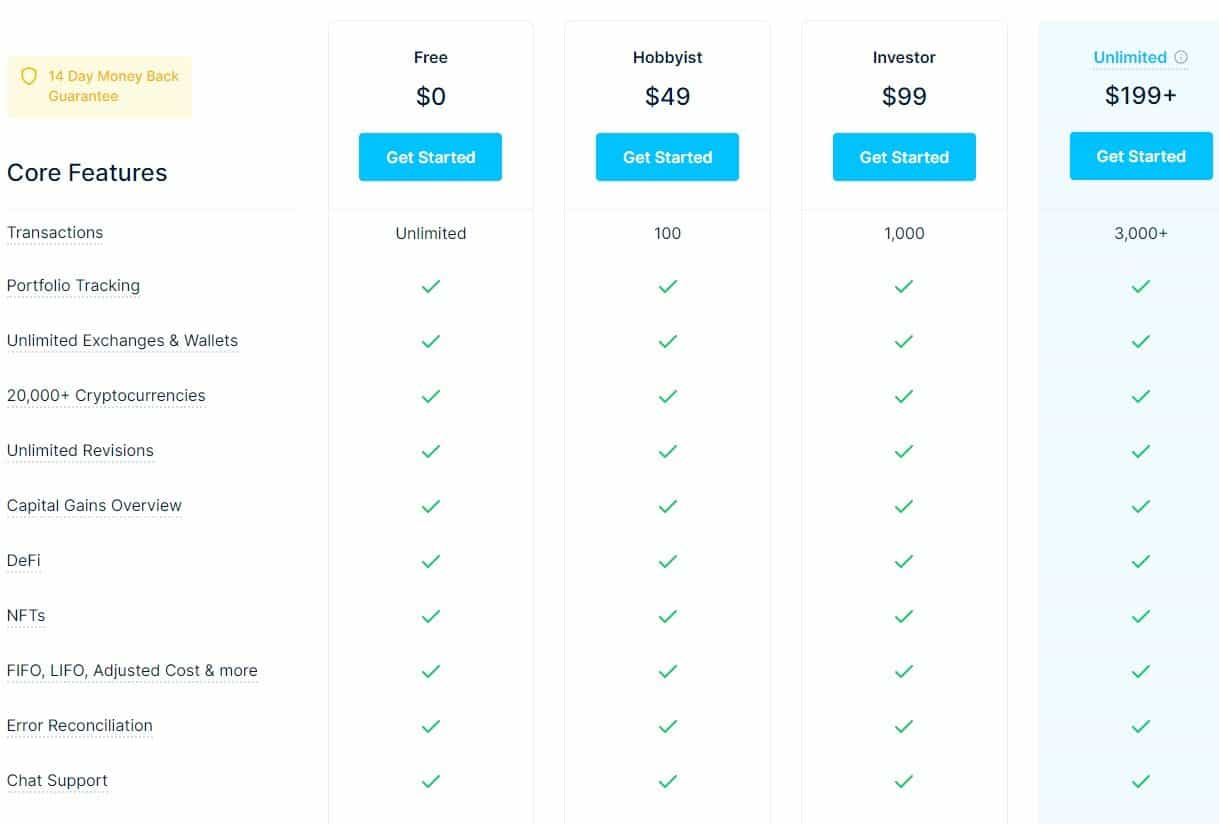

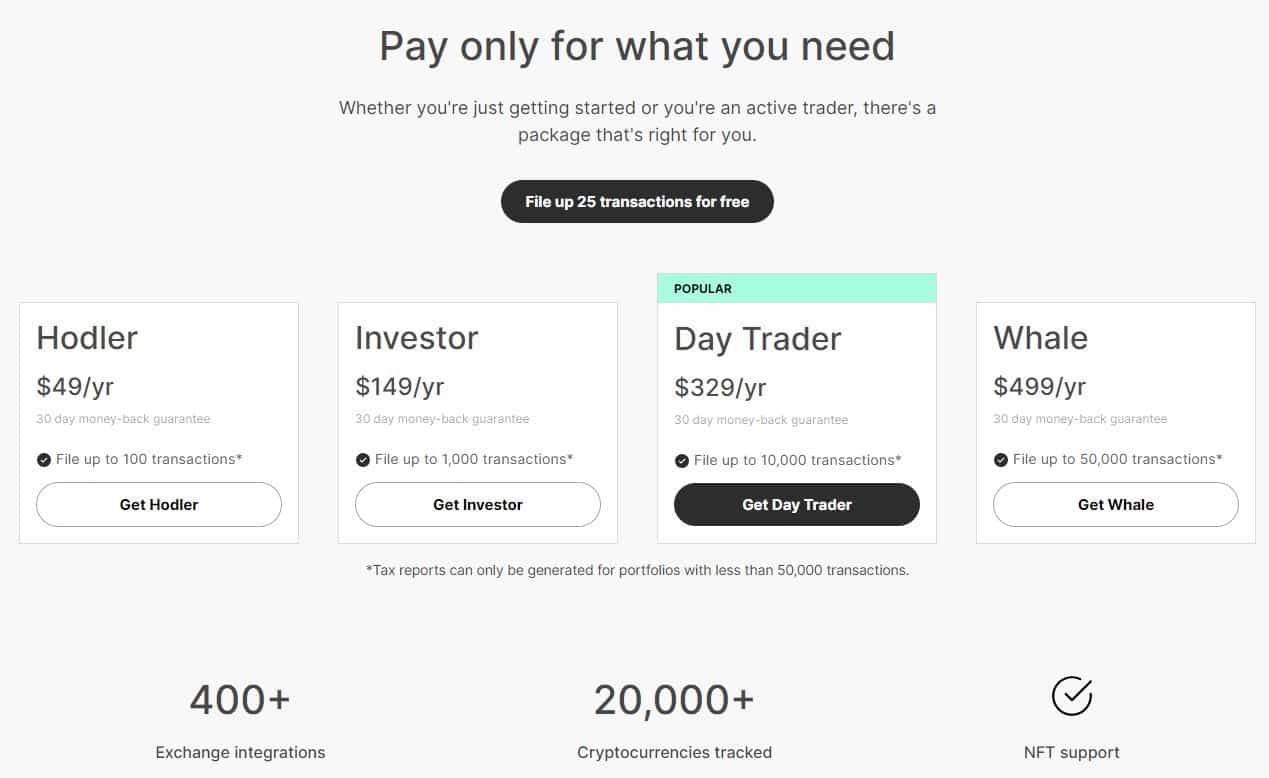

Above the free version, the fees depend on how many transactions you’ve made over the course of the calendar year and are as follows:

- Hobbyist $49

- Investor: $99

- Unlimited $199: Unlimited transactions. If you exceed 3,000 transactions, you can purchases additional transactions.

Here is a look at the features included in the different plans:

The paid versions include integrations with the following tax software:

- TurboTax Online and Desktop

- TaxACT

- H&R Block Desktop

- TaxSlayer

The tax reports that can be generated are as follows:

- IRS Form 8949

- International Tax Reports

- Income Report

- Capital Gains Report

- Audit Trail Report

- Tax Loss Harvesting

CoinLedger supports tax reporting for several countries, including the U.S., Canada, New Zealand, Germany, Japan and Australia. The U.K. is noticeably missing.

This is a crypto tax solution that makes it simple to manage your taxes at a reasonable price. Plus, it will reduce or eliminate much of the stress associated with crypto taxes and provide reliable and accurate tax reports.

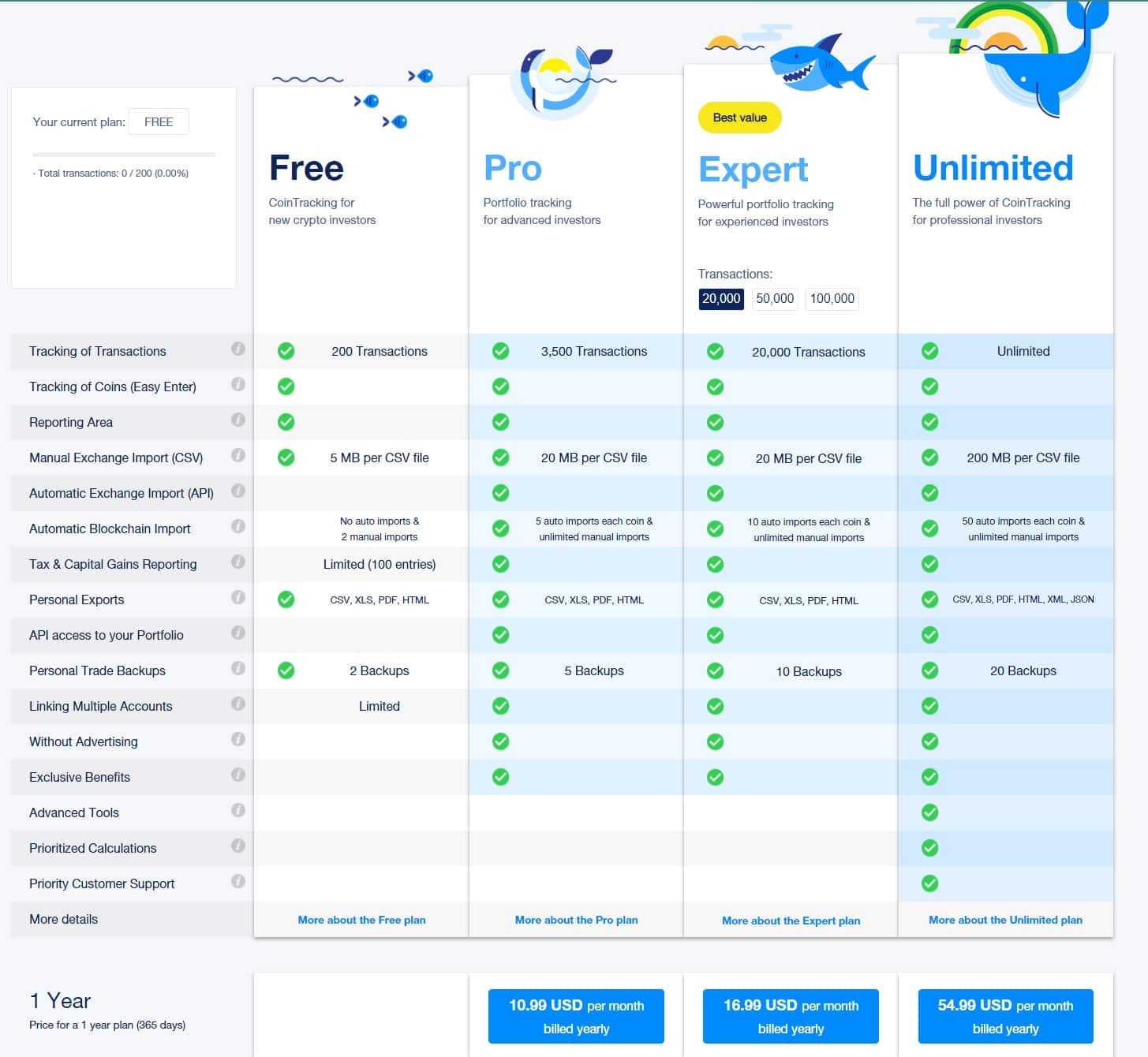

CoinTracking

CoinTracking calls itself the leader in cryptocurrency reporting and tracking, and with over 1.4 million clients, including more than 25,000 corporate clients and CPAs, they might not be wrong. We recently did a deep dive into CoinTracking and can say that we were surprised and delighted with how robust and comprehensive this tax tool really is, making it clear why it is trusted by so many tax professionals, firms, and retail users, including some members here at Coin Bureau HQ.

CoinTracking is particularly detailed, and users will know exactly how their portfolio is performing, how diversified they are, and what their tax burden is going to be throughout the year. We found that along with CoinTracking being a great tax tool, it also offers one of the most powerful portfolio tracking tools we've used, and the best part, at no additional cost. The reporting and analytics section of CoinTracking is second to none.

CoinTracking has a web-based solution that allows for the easy connection to exchanges via an API, or through CSV files. This allows CoinTracking to display the complete trading history of a user and determine profits, losses, and taxes owed in real-time. Final reports can be generated in a number of formats, including CSV, PDF, XLS, XML, and JSON.

The platform aggregates all of the transactions made through the connected accounts, showing exactly what was sent or received, and the exact trades made over the course of the year. CoinTracking can help with:

- Personal analysis: 25 customizable crypto reports to show things like profit/loss, audit reports, realized/unrealized gains etc.

- Easy imports from 110+ exchanges, automatic import and direct syncs.

- Tax declaration for over 100 countries supported for filing capital gains, income, mining, business operations tax and more.

- Tax Advice- A team of tax advisors to help with tax queries and perform tax reviews.

We found CoinTracking to have among the best country and fiat support, including the most robust network of tax professionals available in 75 countries for users to contact.

The platform also shows the historical coin prices at the time the trades were made and has over 12 years of data on more than 26,000 coins.

CoinTracking has positioned itself to be suitable for individual hodlers, traders, institutions, and companies. Like the other mentions on this list, users can enjoy limited functions for free, or choose one of the paid plans as you can see here:

For pricing, we found CoinTracking to offer the most value out of the competition for their free plan and the best-priced option for users with between 1,000 to 3,500 transactions. This platform also becomes the best-priced option (by quite a significant margin) for anyone who needs to import over 100k transactions or anyone needing unlimited transaction support.

One of the requirements for any platform to make it in this article is that they have to have positive reviews and a good reputation, and CoinTracking is no exception. These guys have some raving reviews from the likes of Forbes, Nasdaq, CNN, Bitcoin.com, CNBC, plus ourselves here at the Bureau and more, so users can sleep well at night knowing their taxes are being done accurately with CoinTracking.

If you want to learn more about why this tax software tool won us over, be sure to check out our in-depth CoinTracking review! CoinTracking also offers a full-service crypto tax solution where they offer start-to-finish tax services.

👉 Sign up for CoinTracking and Enjoy 10% Off For Life!

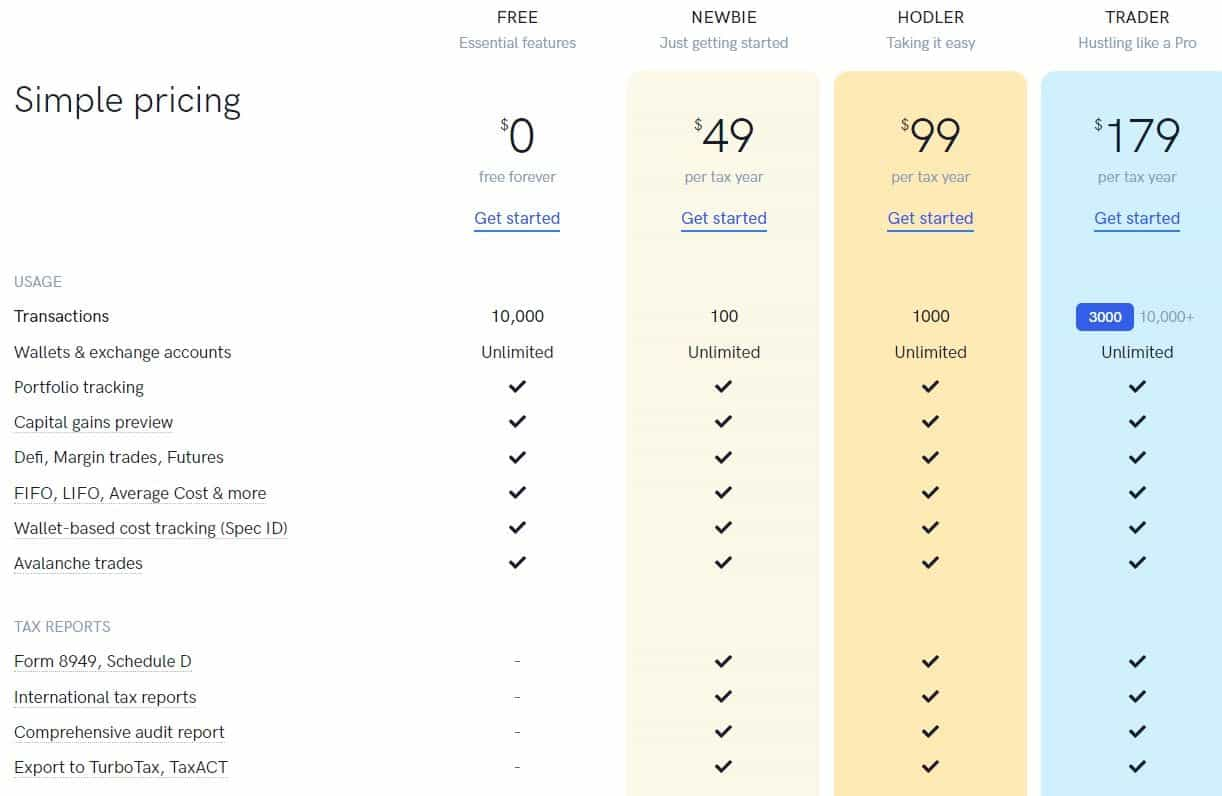

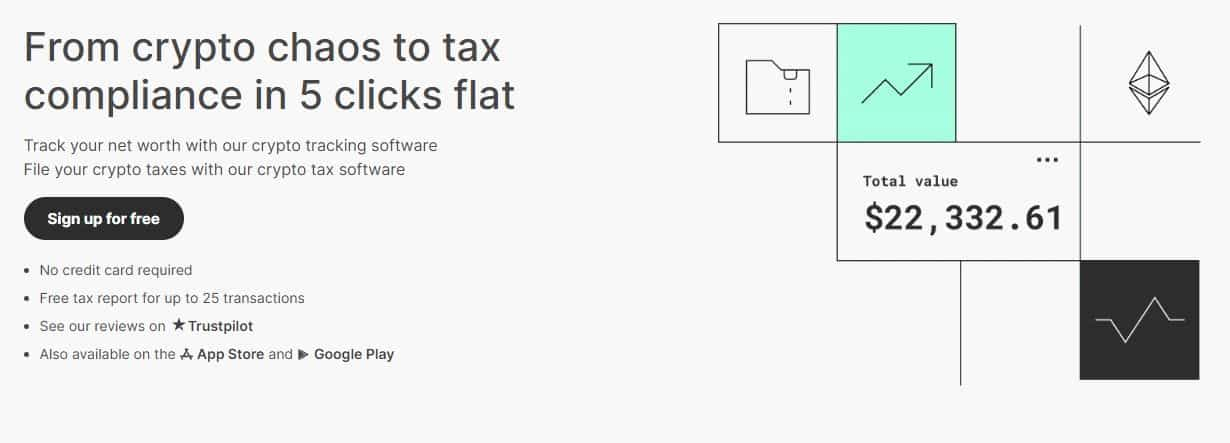

Koinly

Koinly combines crypto accounting and tax all in one software package. It supports tax reporting for over 20 countries, including the U.S., Australia, and Canada.

These aren’t just generic files being generated either, Koinly was developed in close collaboration with tax firms around the world and is trusted by CPAs worldwide. The platform provides reports such as Form 8949 and Schedule D in pdf format that users can submit directly to their tax authorities.

Koinly supports:

- Over 23,000 cryptocurrencies

- Over 170 blockchains

- Over 400 exchanges

- Over 100 wallets

- Over 30 crypto services

I really like that Koinly approaches users’ personal crypto holdings from a 360-degree view, more than just from a tax perspective. Customers can use it to keep track of their crypto portfolio, watch how it changes over time, and generate some lovely graphs so they know exactly how their crypto portfolio is performing. While there are certainly other portfolio-tracking tools, Koinly shines by offering both portfolio tracking and tools to monitor and reduce taxes.

Koinly has a feature that matches transfers between exchanges and your own wallets, which helps avoid unnecessary taxes. It also has a smart error-handling system that warns when there are discrepancies in the data or when there might be inaccuracies in the tax report. They also have a crypto tax guide to help users get the most out of the platform.

Koinly also has a lot to offer users for free and is one of the most powerful tools for those thrifty penny pinchers. Here is a look at the pricing plans that compare the free plan to the Trader plan:

Koinly is a great platform and with the feature-packed free version, you’ve got nothing to lose by taking advantage of the service and deciding if the extra paid features are worth your hard-earned Satoshi’s. If you want to learn more about Koinly and why it is one of our top picks, you can learn more about it in our Koinly Deep-Dive Review.

👉 Sign up for Koinly and find out why this is a community favourite among crypto traders!

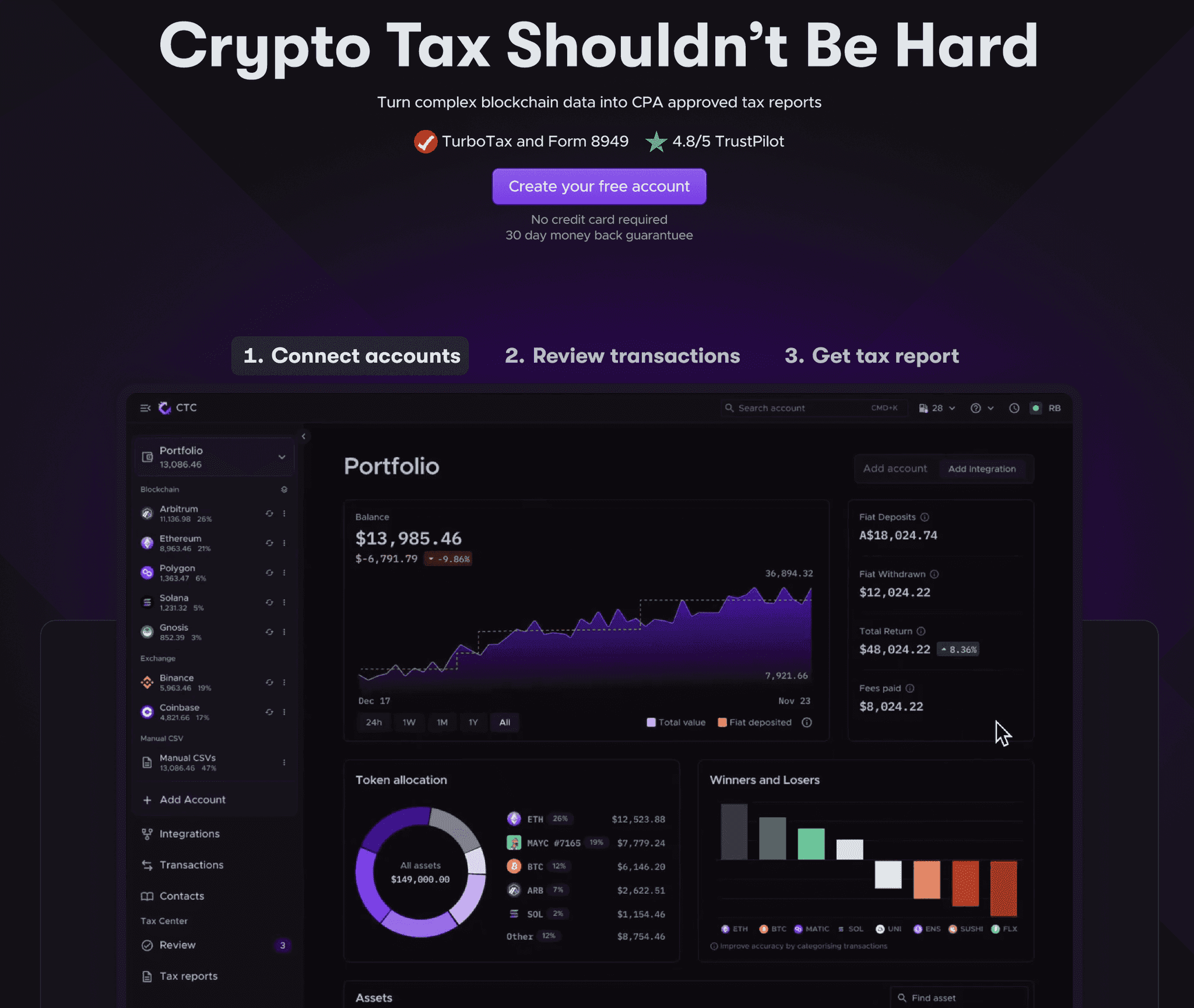

Crypto Tax Calculator

Crypto Tax Calculator is another tax software tool that we recently had the pleasure of performing an in-depth review on and were again, pleasantly surprised. Over the years, we have spent a lot of time testing and reviewing multiple crypto tax tools and it isn't often that one comes along that we truly enjoy using and it ends up being adopted by some members here at the Coin Bureau.

Crypto Tax Calculator is one of those platforms, we were immediately impressed with the beautiful design and layout of this tool. It is not only aesthetically pleasing (more so than any boring old tax tool really needs to be) but the design is extremely well laid out and easy to use. It is the most streamlined tax tool we've used and we found Crypto Tax Calculator to not only be the easiest of all mentions on this list, but is also the fastest to get your transactions imported, sorted, and reconciled.

What makes this tool so powerful in terms of speed and effectiveness is the artificial intelligence that helps automatically sort and categorize transactions. Another plus is Crypto Tax Trader supports mass import and editing within the platform, as opposed to some tools that require exporting transaction history via spreadsheet, editing, then re-importing, which is a pain. This tool can also help save hours as it automatically detects other blockchains associated with wallets during the import process so users do not need to repeat steps. The platform also features a portfolio tracker and has good customer support.

Here is quick overview of the highlights:

- Mass support for exchanges, wallets, blockchains, DeFi and NFTs

- AI-powered smart categorization, spam detection, and importing can be automatic

- Tax compliant in multiple jurisdictions

- Multi-language support

- No additional charge for previous tax years

- Suitable for Tax Professionals with dedicated client portal

It wasn't just us that were impressed by Crypto Tax Calculator either, Coinbase has chosen Crypto Tax Calculator as their partner of choice and offers seamless integration for Coinbase users.

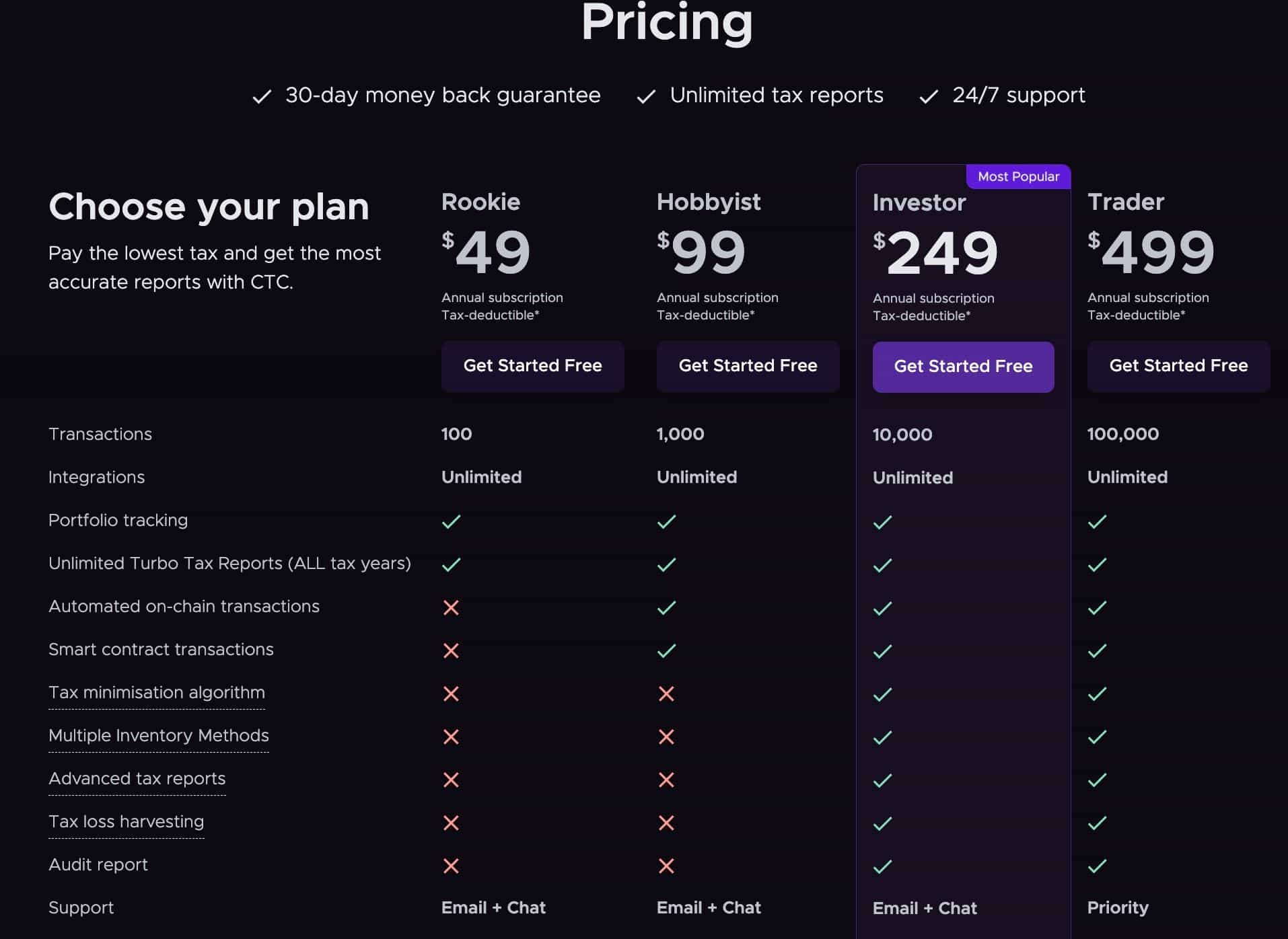

With regard to pricing, the lowest price starts at $49 for the rookie plan which supports up to 100 transactions and scales from there.

We barely scratched the surface here of what this crypto tax software is capable of, we recommend checking out our Crypto Tax Calculator review.

👉 If you're already sold, feel free to sign up and use our Crypto Tax Calculator discount code for an exclusive 20% off for life!

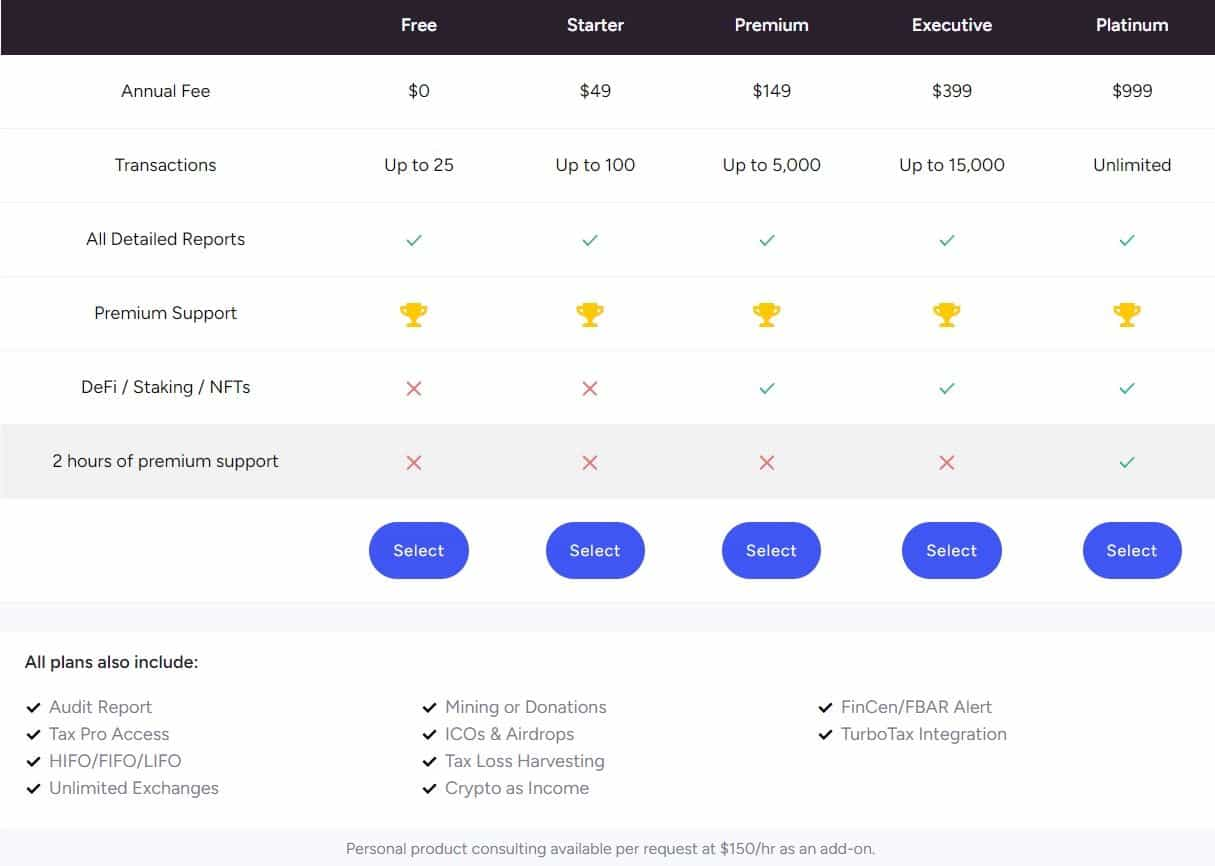

TokenTax

TokexTax bills itself as a crypto tax software and full-service accounting firm.

TokenTax’s first iteration was created by co-founder Alex Miles in 2017. In its early days, data was imported from Coinbase. Soon after, Zac McClure joined as co-founder. In 2019, the company acquired Crypto CPAs. Today, TokenTax calculates cryptocurrency taxes and provides tax and accounting services for thousands of crypto investors. TokenTax is an official Turbo Tax partner.

TokenTax syncs with all your wallets and accounts, eliminating manual data entry and letting you see and analyze all of your data in one place. It has support for DeFi and NFT as well as margin and futures trading. The company's tax reports include:

- FIFO, LIFO, Minimization, and average cost tax liability calculations

- Tax loss harvesting dashboard

- Mining and staking income reports

- Ethereum gas fee reports

- Custom enterprise reports

There are also all the tax forms you can think of.

With TokenTax you can choose to file the tax yourself, but the company also offers advanced reconciliation services from crypto-savvy tax professionals. There are four plans to choose from depending on the complexity of your trading level.

- Basic: The entry-level tier supports up to 500 transactions and Coinbase and Coinbase Pro API only. It costs $65 per tax year.

- Premium: The next in line is suited for investors operating across exchanges and platforms. This tier supports 5,000 transactions, DeFi and NFT, and every centralized exchange. The per-tax year cost is $199.

- Pro: We're in the big leagues now! For investors with high trade volume across exchanges and platforms (up to 20,000 transactions), this tier may be more suitable. It's priced at $1,599 per tax year.

- VIP: Let TokeTax do the heavy lifting! The priciest tier is geared toward advanced investors who want expertly prepared tax returns. This tier includes two 30-minute consultations with tax experts as well as a review of any IRS inquiries. It costs a whopping $2,999 per tax year.

Accointing.com

Accointing is a popular tax accounting solution that was acquired by a Glassnode, a crypto market intelligence platform in 2022, and then sold again to Blockpit in 2023.

Accointing claims to be an all-in-one solution that covers everything crypto and tax-related, helping from Bitcoin to DeFi and NFTs. It has a user-friendly interface, and in many cases, you’ll be able to get your crypto-tax information together in just a few clicks of your mouse.

One of the most powerful features is the portfolio management tool that comes with Accointing. Users can drill down to view the state of their portfolio within a specific timeframe, historical and current performance. Related to this is the Holding Period Assistant dashboard, which will look at when you added cryptocurrencies to your portfolio and then make tax-strategy recommendations such as tax-loss harvesting based on your holdings and holding period.

When it comes to crypto taxes, Accointing has you covered. The Tax Review feature automatically goes through all the steps required to calculate a user’s tax burden accurately. It will even generate reports based on different cost accounting methods, allowing customers to choose the best for their situation easily. It also allows users to mark off transactions as airdrop, hard fork, gift, or payment to ensure they are being taxed appropriately.

All of this is made possible by the import function of Accointing. The data import software included in the Accointing package makes it super easy to upload everything from wallets and exchanges via CSV or API integration. Once a user has linked all their wallets and exchange accounts, it’s as easy as clicking a button for Accointing to pull in all the data and begin its tax calculation magic.

Accointing's API currently supports:

- 27 exchanges

- 38 wallets

- 31 blockchains

It also offers manual support for several other exchanges and wallets.

Accointing is one of the best options on our list for those who prefer free services. Users with up to 25 transactions per year get access to the platform for no cost.

However, if you have more than 25 transactions, you’ll need to purchase one of the following plans:

Accointing is a very powerful and user-friendly tool for tracking your portfolio and generating tax reports. Both features will save you time and quite possibly a good bit of money.

Accointing has plenty of fantastic reviews and was featured in Yahoo Finance, Bloomberg and Seeking Alpha as it is a great tax tool that you can’t go wrong with.

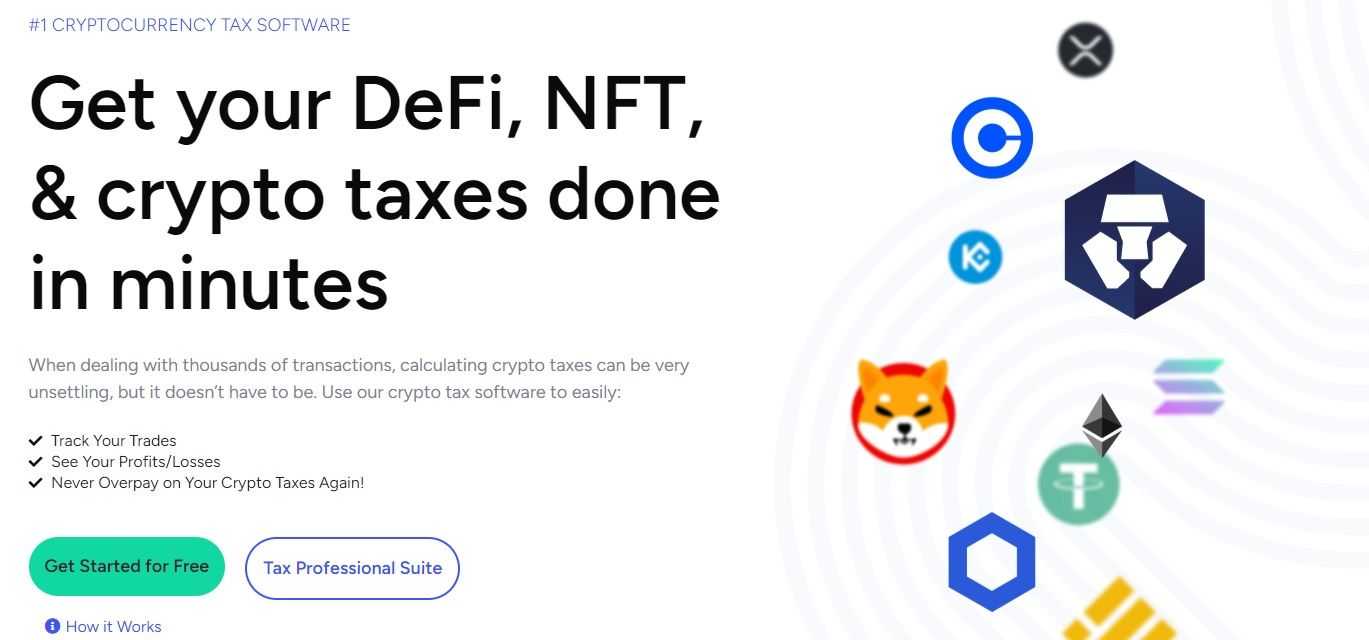

ZenLedger

ZenLedger is a simple and effective platform for calculating cryptocurrency, DeFi and NFT-related taxes. Those who use TurboTax may want to consider using ZenLedger crypto tax services for their digital assets as it seamlessly integrates with the platform.

ZenLedger is another mention on this list that has received pretty significant funding through a couple of funding events. In 2021, ZenLedger raised $6 million in a Series A funding round led by Bloccelerate and saw investment from Mark Cuban’s Radical Ventures, among many others. Then in 2022, the company raised $15 million in Series B funding.

ZenLedger has received positive reviews and was featured in the Wall Street Journal, Bloomberg, Coindesk, Forbes and more. ZenLedger supports the following:

- 400+ Exchanges

- 50+ Blockchains

- 100+ DeFi and NFT protocols

ZenLedger will quickly import transaction history from supported exchanges and will automatically use the data to fill in the required information in tax documents. This includes capital gains, donations, closing statements, profit and loss statements, and income from cryptocurrencies.

All of the reports and documents created by ZenLedger are IRS-friendly. That means they can all be submitted directly or used in conjunction with other tax reporting solutions. As a result, ZenLedger works perfectly for all levels of crypto enthusiasts.

Pricing for the different ZenLedger plans is as follows:

Those who want their crypto taxes done with minimal effort can also use ZenLedger to access tax professionals who can prepare and file a tax return on a customer’s behalf. This add-on will cost $150 per hour.

I would say that ZenLedger would be my top pick for US-based hodlers due to the IRS-friendly nature of the platform and seamless integration with TurboTax. You can’t go wrong with this one.

Additional Thoughts

If you are someone who finds taxes a royal pain and would rather avoid them altogether (legally, of course), have you considered moving to a country that doesn't tax crypto? You can find some options in our article on Crypto Tax-Friendly Countries.

If you are seeking more information on whether relocating is right for you, feel free to book a call with our friends from Offshore Citizen to plan and execute your move legally with as little hassle as possible. They help with residency permits, bank accounts, company structures, etc.

Free Crypto Tax Software: Conclusion

Calculating crypto taxes can be a delightful, stress-free, and fun way to spend a weekend — said nobody ever.

I am afraid that for those of us not fortunate enough to live in one of the top crypto tax-friendly jurisdictions, crypto taxes are just a part of life.

Fortunately, these solutions can make the burden of calculating and filing your taxes an absolute breeze and provide crypto enthusiasts with peace of mind knowing that they are filing their taxes accurately.

Best of all, with the landscape surrounding cryptocurrency taxation continually changing and new tax laws popping up and evolving faster than the Fed can print money, these platforms will keep in front of those changes and help their users remain compliant with the latest tax laws in their respective countries.

Using one of the seven solutions above will ensure the correct information is being collected and reported to tax agencies and could help users avoid penalties or fines. Keeping track of tax information for digital assets can be challenging, but these crypto tax tools make it far more manageable.

Frequently Asked Questions

Each jurisdiction has separate tax laws for digital assets, many of which are changing quickly. In most jurisdictions, the sale of crypto assets is taxed as capital gains and active trading can sometimes be taxed as income. Be sure to check with an accountant in your country to understand the crypto tax laws in your jurisdiction.

Tax rates on crypto will depend on whether it is being taxed as capital gains, interest, or income. Some countries have decided not to tax crypto on any assets held for longer than 1 year, but many countries have chosen to tax digital assets differently, so be sure to check with a local accountant. Crypto tax can also depend on your income level as many countries tax their residents a certain percentage depending on their annual salary level. Many of the mentions on this list have paid full service tools, or a basic free crypto tax calculator to help gauge a tax estimate.

The only way to legally avoid paying taxes on crypto is to relocate to a country that does not tax crypto. Check out our article on Top Tax Friendly Crypto Countries to learn which countries have favourable crypto tax treatment. It is not advisable to try and hide crypto taxes as many exchanges now enforce KYC and have agreements with local tax authorities.

Yes, in many jurisdictions, losses on crypto assets can offset capital gains, similar to stocks and other investable assets.

Koinly is often our top pick for the best crypto tax software, as they service both simple and complex crypto tax situations and are available in most countries. It is also beginner-friendly and good value for money. Some of us here at the Bureau use Koinly and find it is the best crypto tax tracker for our needs.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.