CoinTracking Review 2024: The Ultimate Crypto Tax Solution!

CoinTracking is one of the industry leaders when it comes to crypto tax reporting and portfolio management. With both free and cost-effective options available, CoinTracking is second to none when it comes to transaction detail, classification, and accuracy. Secondary verification checks lead to enhanced confidence and compliant reporting. Direct tax reporting support for 13 countries and over 100 countries supported for general tax preparation leads to CoinTracking being a fantastic tool worth checking out. The free version is a great tool that offers full tax reporting capabilities for casual crypto traders and hodlers with under 200 transactions or for anyone wanting an incredibly powerful portfolio tracker

I hate to be the one to burst anyone’s bubble here, but gone are the days of the “Wild West” of crypto, where users could make astronomical gains with the tax authorities being none the wiser.

The cat is out of the bag and everybody knows about the life-changing wealth potential of digital assets, especially the government who wants their cut. Unless you want to risk Uncle Sam coming around to hit you with a tax fine, or worse, it’s probably a good idea to pay your taxes. But hey, here at the Bureau, we aren’t tax advisors and we certainly aren’t your parents, so we aren’t going to tell you what to do, but we are going to be good crypto hodlers ourselves and pay our tax bill!

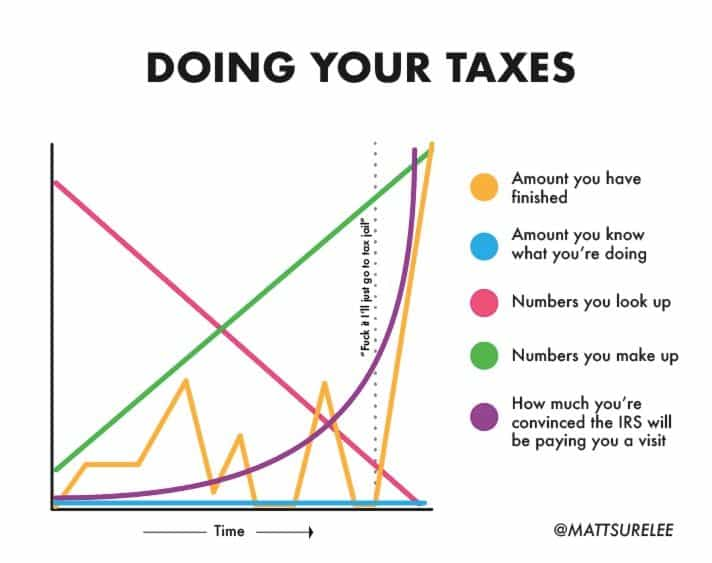

One of the primary reasons crypto and tax have become such a contentious issue isn’t just because of the libertarian ideals that many crypto adopters hold dear or the quasi-anarchist groups that also seek solace in digital assets, but is, in fact, because of the complexities involved in digital assets. It is an entirely new asset class generating income in ways never before possible, meaning the current crypto income-generating framework does not always fit into the traditional taxation definitions. It is a classic case of a square peg into a round hole.

This was a major issue, especially in the early days of crypto. One of our writers here at CB told us of their nightmare story of going through four different accountants to try and deal with their crypto tax situation. Three accountants provided wildly different and conflicting information and the fourth account simply said they had no idea and they should find another accountant. When the accountants can’t even figure it out, good luck to the average crypto trader.

Fortunately, now there are some incredibly convenient crypto tax tools that no crypto holder should live without! Unless you are one of the few who are fortunate enough to live in a crypto tax-free country, using a crypto tax tool like CoinTracking will not only save you hours of time, but also help ensure your tax report is accurate and compliant, and can even save you money by identifying capital losses and tax lost harvesting opportunities!

In today’s CoinTracking review, we are going to be covering the pros and cons of CoinTracking, the key features and benefits, and any areas for improvement. By the end of this review, we hope you will have a better idea of whether or not CoinTracking is the right crypto tax solution for you.

Why Crypto Tax Software is Essential

As the crypto landscape expands, so does the complexity of managing and reporting taxes on these assets. There are different aspects to take into consideration, not just around the nature of the assets themselves, but also your personal situation. Crypto assets can be taxed as personal income, property, business income, capital gains, and often even a mixture of more than one category.

Here is the TL;DR on why utilizing crypto tax software is crucial:

Accuracy and Compliance: Crypto tax software automates the process of tracking and calculating gains, losses, and taxable events. This ensures accuracy and compliance with the tax laws of your jurisdiction.

Time and Effort Savings: Manual tracking and calculation of crypto transactions is time-consuming and prone to errors. Crypto tax software streamlines the process, saving significant time and effort.

Portfolio Optimization: By gaining insights into your portfolio's performance and taxable events, you can optimize your investment strategy, improve tax efficiency, and make informed decisions.

Audit Support: Crypto tax software generates comprehensive reports that serve as audit trails, providing evidence of your transactions and calculations in the event of an audit.

Someone who actively trades crypto can be taxed differently than someone who just holds it, and then we get into the realm of staking, airdrops, renting NFTs, lending crypto etc. I don’t envy the person who has to explain to their accountant that they made $32 on HarryPotterObamaSonic10Inu token or the person who earns 0.32% lending on Tulip Protocol, or how about the guy who sold Smooth Love Potion to buy a house in the Philippines?

Here’s a really fun one: what happens if you buy $100 worth of Ethereum, use a bridge to convert $20 to a Layer 2, pay $10 in ETH gas fees, make a capital loss on the L2 token you bridged but you stake the L2 to earn an APY, then liquid stake half of the remaining $80 worth of ETH on a platform like Lido, use the stETH to take out a loan, default on the loan and lose it. The price of your remaining Ethereum goes up but what about the portion of your initial investment that went to gas fees? You lost your stETH, the dollar value of your L2 went down but the number of tokens went up due to staking and you received an airdrop for using the L2 worth hundreds of dollars, which magically showed up in your wallet out of thin air.

-Have fun dealing with that, Mr Tax Man.

Scenarios like the one above are not uncommon for DeFi users, there are entire threads on Reddit from frustrated users trying to navigate the crypto tax waters. This is probably the primary reason tax software is so important, for convenience, accuracy, and let’s face it, sanity and to avoid the fears of going to tax jail. Active DeFi users are often looking at thousands, if not tens of thousands of transactions per year, and keeping track of those manually is a nearly impossible Herculean task.

The brilliant thing about tax software tools is that they can integrate directly with your wallets and exchanges, automatically recording and sorting every one of your transactions. If syncing isn’t an option, users can also mass export their transactions as a .csv file and import thousands of transactions into a tax software, which will do all the heavy lifting.

Crypto users are also often uncertain about what type of transaction will trigger a taxable event, which is why it's best to let the tax software figure it out. During the 2021 bull market when crypto debit cards were popular, shockwaves of fear spread throughout the market as it was inferred that crypto transactions should count as taxable events. I don’t know about you, but I certainly don’t keep track of every time I use my card to buy a cup of coffee.

Here are some of the other types of crypto transactions to consider. Note that many of these will depend on your jurisdiction:

- Selling for fiat at a profit or loss- Selling into stablecoins can also be considered the same as fiat in some countries, but not in others.

- Exchanging digital assets- Swapping an altcoin for some Bitcoin can also trigger a tax event.

- Receiving Airdrops- This can apparently be taxed as “income” or capital gains when you sell. What about all those unwanted NFTs that get airdropped into our wallets from scammers?

- Sale of NFTs- This can trigger capital gains, or income tax depending on the nature of the income.

- Earning Income from Blockchain and P2E games- You may have to pay tax on every loot box you open. Harsh. Instead of tracking this manually and ruining the game, let tax software figure it out.

- Staking Income

- Providing Liquidity or Yield Farming- Any APY earned may be considered income.

- Using CeFi lending platforms like Nexo, an exchange, or DeFi lending protocols like Compound Finance or Aave.

- Crypto mining.

- Earning rental/advertisement income from digital land or renting NFTs.

- Providing a service and getting paid in crypto.

Crypto tax softwares work in most countries and the good ones are even compliant with taxation reporting standards and can auto-populate tax forms in preparation for filing. Talk about making things as easy as possible.

For some tips and tricks on how to save some Sats come tax time, be sure to check out Guy's video on the subject below:

And with that bit of background, we segue into one of the best tax software solutions on the market.

CoinTracking Overview

CoinTracking is a leading crypto portfolio tracker and tax calculator that has gained immense popularity among cryptocurrency investors, traders, and tax professionals. Its extensive range of features and user-friendly interface make it an essential tool for anyone involved in the crypto space.

CoinTracking was founded in 2012 and launched its product in 2013, which is practically ancient in crypto terms. The platform has seen consistent growth, with nearly 1.5 million users, 25k businesses, and over 2,000 corporate clients signing up for the platform.

In this industry, crypto-centric companies boom and bust at a higher rate than traditional established industries, so anytime we see a company that has survived and thrived through multiple bear markets and regulatory uncertainties is always a vote of confidence in our books.

CoinTracking is suitable for both retail traders and crypto companies, which is great, as many crypto companies are also personal crypto traders, so the ability to find one company to handle both company and personal crypto is a huge bonus.

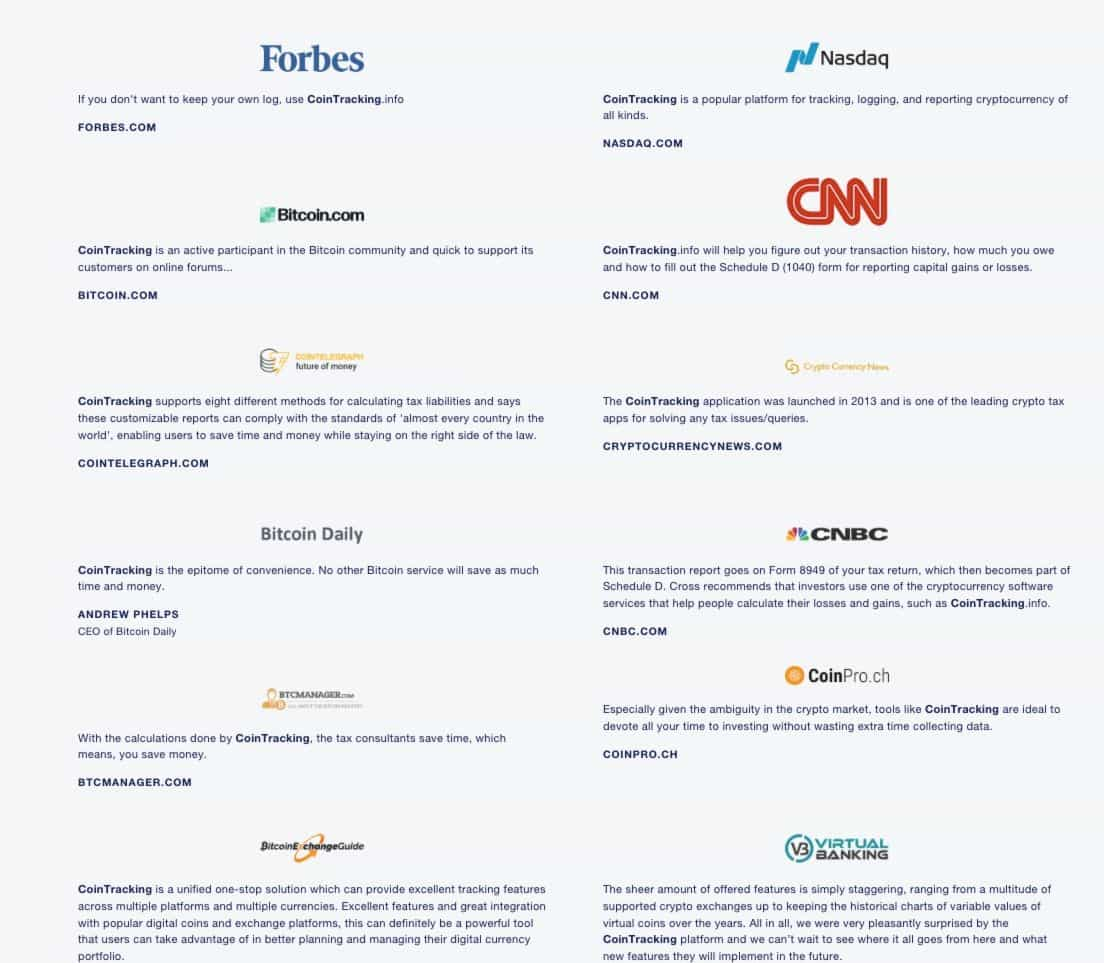

Another feather in the cap of CoinTracking is they haven’t only got our attention as a solid tax software solution here at the Coin Bureau, but many industry leaders trust the software provided by CoinTracking to ensure their tax reporting is compliant and accurate.

It’s also worth highlighting the importance of education, guides, and tutorials, especially when it comes to something as important as taxes. Not many companies take the time and effort to create educational content and guides, but CoinTracking has a great blog and video tutorials that walk users through each step of the process so you can hit the ground running and know what you are doing from day one of platform signup.

Now we will cover some of the key features and benefits of CoinTracking.

Key Features

Trade Tracking

CoinTracking supports seamless integration with over 300 exchanges and wallets and over 27,500 digital assets, allowing users to effortlessly import their transaction history. Trades can be imported either completely automatically thanks to the support of APIs, or users can manually mass import via CSV, or enter transactions individually.

It doesn’t matter if you are trading coins, tokens, NFTs, or dabbling in DeFi, mining, airdrops, futures trading, earning interest, using margin, etc. CoinTracking can pretty much track whatever you can throw at it.

Tax Reporting

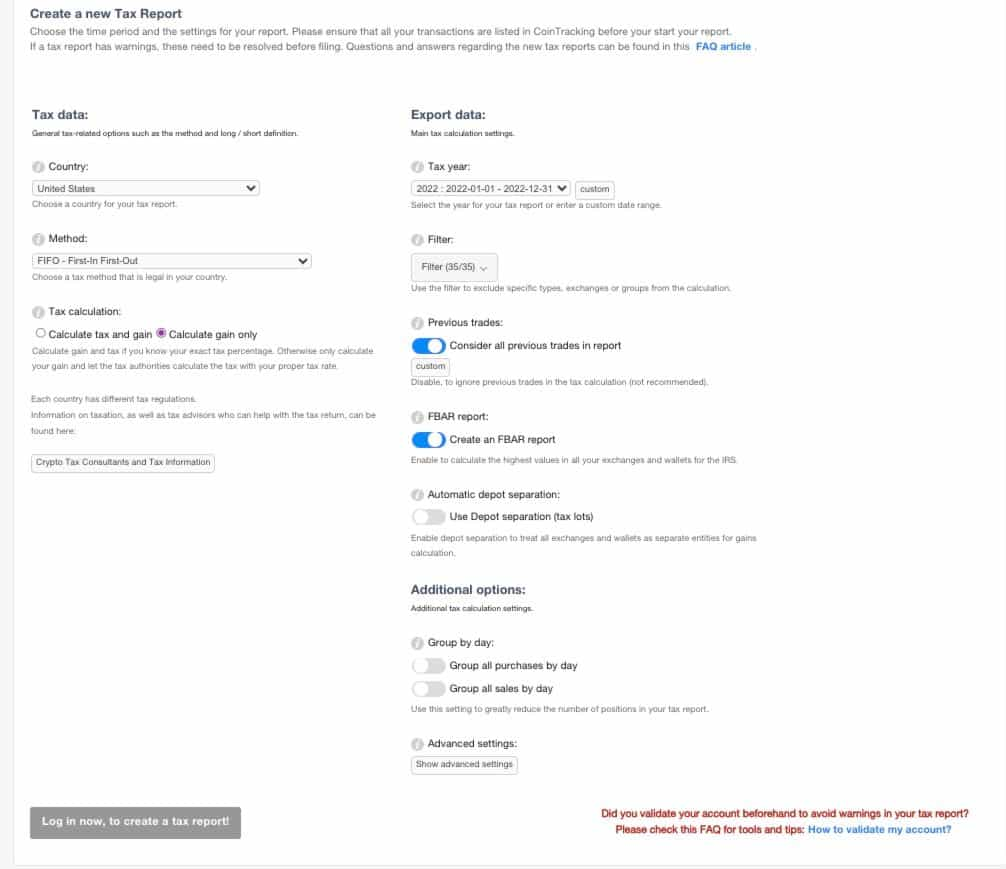

With support for over 100 countries, CoinTracking offers comprehensive tax reporting that covers 14 different tax methods such as FIFO, LIFO, AVCO, HIFO, LIFO, and more, making them among the most competitive in this category. The platform generates tax reports tailored to the specific requirements of each jurisdiction, simplifying the tax filing process

In the United States, CoinTracking can help populate Form 1040, Form 8949, Schedule D, Schedule 1, Form 1099-NEC and 1099-MISC. If you are a US-based user and unsure when the above forms are required, CoinTracking has this fantastic Guide to Crypto Tax in the US, which covers things like trading, mining, airdrops, hard forks, spending, and more, while providing the correct forms for each scenario.

In the UK, CoinTracking is compliant with the HMRC tax standards and provides a Guide to Crypto Taxes in the UK.

For Canadians, CoinTracking is compliant with the filing standards set out by the Canadian Revenue Agency and users can select the ACB (Adjusted Cost Base) method. They offer this great Guide to Crypto Taxes in Canada.

Obviously, we cannot cover all of the hundred-plus countries supported, but it is good to know that CoinTracking does support country-specific tax reports for the USA, Germany, Canada, the UK, Austria, Finland, Denmark, New Zealand, Belgium, India, Spain and Italy. Outside of these countries, users can use the general tax reporting function, which is adequate to hand over to an accountant or for those who file their own tax returns.

I would recommend navigating to cointracking.info/tax and selecting your country of residence to see if CoinTracking is suitable for residents of your country.

When it comes to tax reporting, users are able to select different views of their tax data by using the filters or hitting the “show advanced settings” button to find info such as capital gains, income, gifts and donations, lost and stolen coins and closing positions.

With these tax reports, users can either use them to file their own tax returns or give these reports to their accountants or tax professionals who do taxes on their behalf. CoinTracking also has direct integrations with TurboTax, TaxACT, Drake, and Wiso Steuer, making tax preparation reporting even easier.

If you don’t have a crypto-savvy accountant or don’t feel like doing your own taxes, another thing we like about CoinTracking is that if this all makes about as much sense as Egyptian hieroglyphs, CoinTracking has also partnered with hundreds of tax consultants who are familiar with CoinTracking that users can reach out to. They even offer full-service packages, which we will cover later on.

From what we have seen with multiple crypto tax software providers, CoinTracking provides one of the most seamless and easiest-to-use tax platforms. It isn’t just the tax filing that is useful, but the plethora of additional benefits users get at no cost such as in-depth analytics and reporting tools that we will cover in the next section. But pound for pound, CoinTracking is a very powerful tool that is suitable for any crypto user whether you pay taxes, want in-depth analytics into your portfolio, or both, which is why we featured CoinTracking as one of our picks in our Best Tax Tools article.

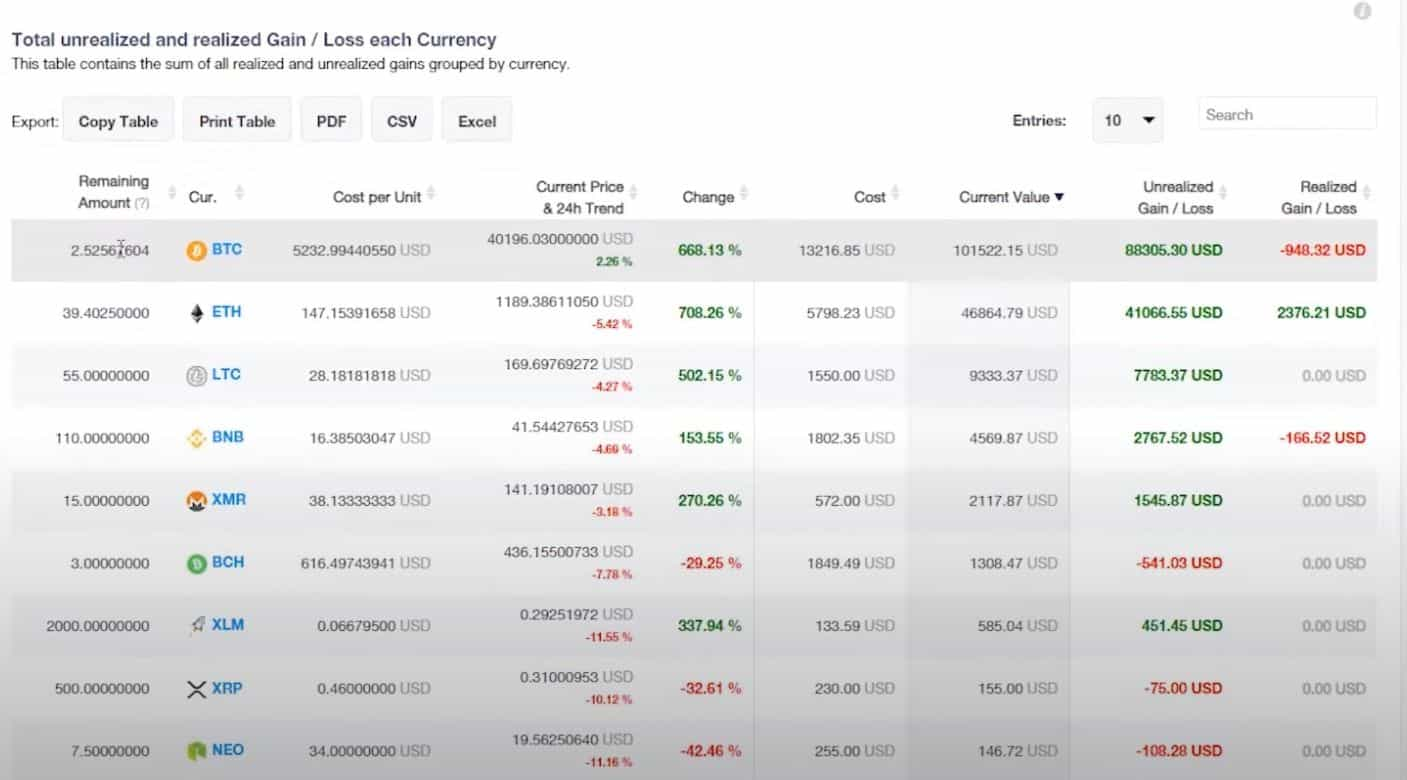

Realized and Unrealized Gains & Capital Losses

Unrealized gains and capital losses are important to distinguish. When it comes to tax time, there is a good chance that many of the coins in our portfolio are down or we sold at a loss. Being able to offset capital losses could mean the difference between being in overall net profit or net loss. CoinTracking automatically identifies and calculates this for users.

CoinTracking provides an in-depth analysis of both realized and unrealized gains, enabling users to assess the performance of their investments accurately. This information is crucial for tax calculations and portfolio management.

Data Visualization and Analysis

CoinTracking presents users with dozens of interactive charts and graphs that help visualize trade history, portfolio composition, and performance over time. These visualizations aid in identifying trends, patterns, and opportunities for improved decision-making, as well as organizing taxable information.

Some of the charts and reports available fall under the following categories:

- Trades

- Historical Balance and Trade Statistics- Shows historical data for all coins

- Trade List- This shows the entire transaction list.

- Trade Prices- A table that shows all transactions and prices at the time of transaction.

- Trading Fees- Shows all your accumulated fees associated with trading history.

- Number of Trades- Total number of trades and transactions grouped by exchange and dated.

- Double-Entry/Ledger List- A list of all transactions including deposits, withdrawals and fees, split according to debit and credit.

- Balance

- Current Balance- Shows the current balance of all crypto you own.

- Daily Balance- The value of the amount of crypto grouped by day, week, or month. This is useful for time-stamped historical analysis.

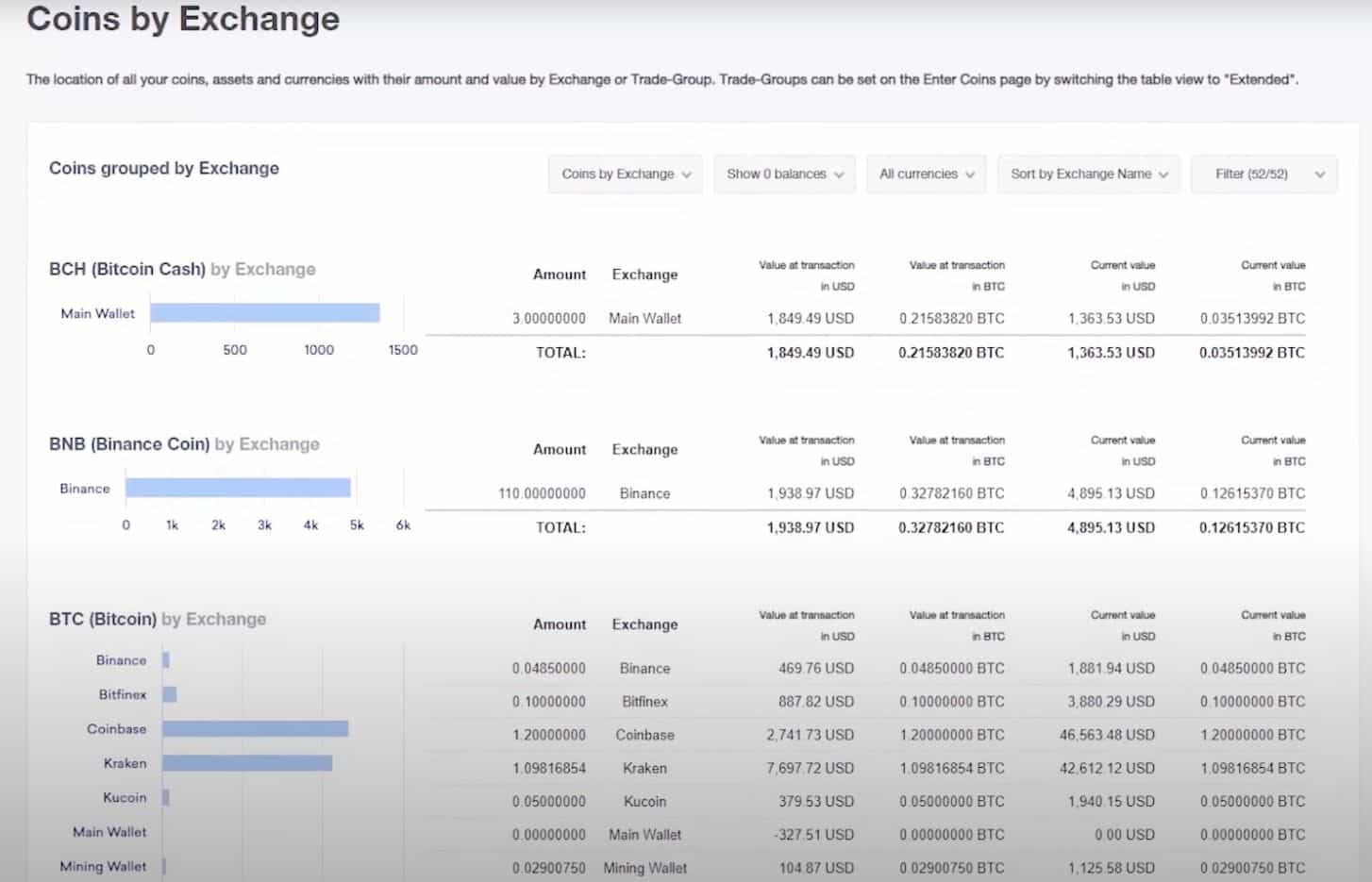

- Balance by Exchange- Shows all current holdings grouped by exchange, transaction type or trade group.

- API Live Data Check- Provides your current amount of coins and currencies for all API-connected exchanges.

- Balance by Currency

- Coins by Exchange

- Gains

- Realized and Unrealized Gains- Current and historical realized and unrealized profit and loss calculation.

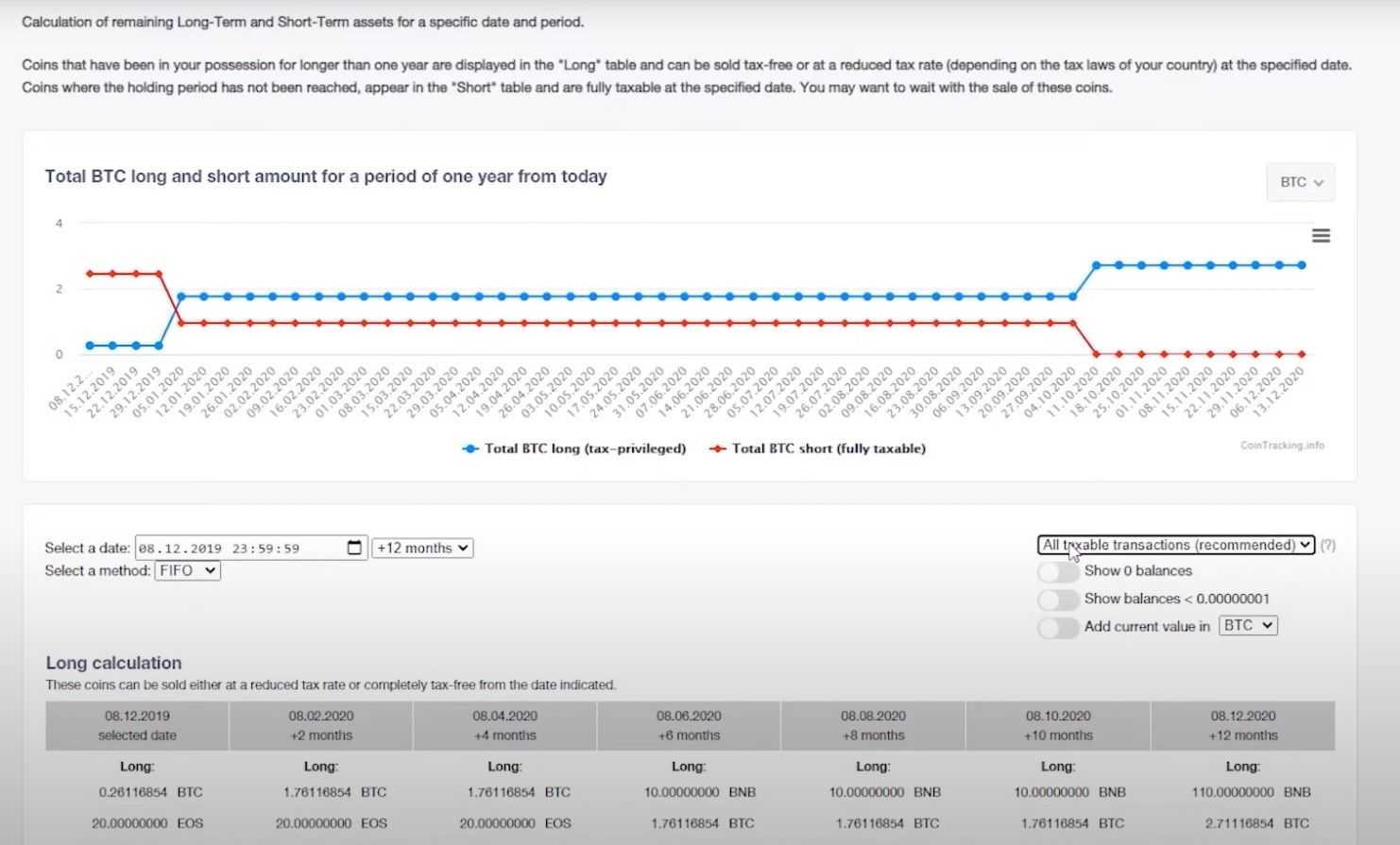

- Tax-Privileged Coins (Short and Long)-Displays your coins' individual holding period to show which and how many can be sold at a reduced rate of taxation.

- Roll Forward/Audit Report- Provides the detailed asset data that is required for financial statements, tax reporting, and period closing.

- Trade Analysis- Coin pair analysis shows the average purchase and sales price along with the break-even price and profit or loss.

- Average Purchase Price- Calculates the average purchase price for all coins as well as purchases or sales.

- Checks

- Missing Transactions- This acts as a double check, searching your data for missing deposits or withdrawals.

- Duplicate Transactions- Checks to ensure there are no duplicated transactions.

- Validate Transactions- This check validates transactions for earnings and errors.

- Charts and Trends

- Coin Trends- A pricelist of the digital currencies available on the market with market cap and order volume.

- Coin Charts- Historical price chart for all digital currencies, similar to what is found on CoinMarketCap or CoinGecko.

- Coin Price Calculator- Conversion of all digital currencies, assets, and tokens at the current or historical price.

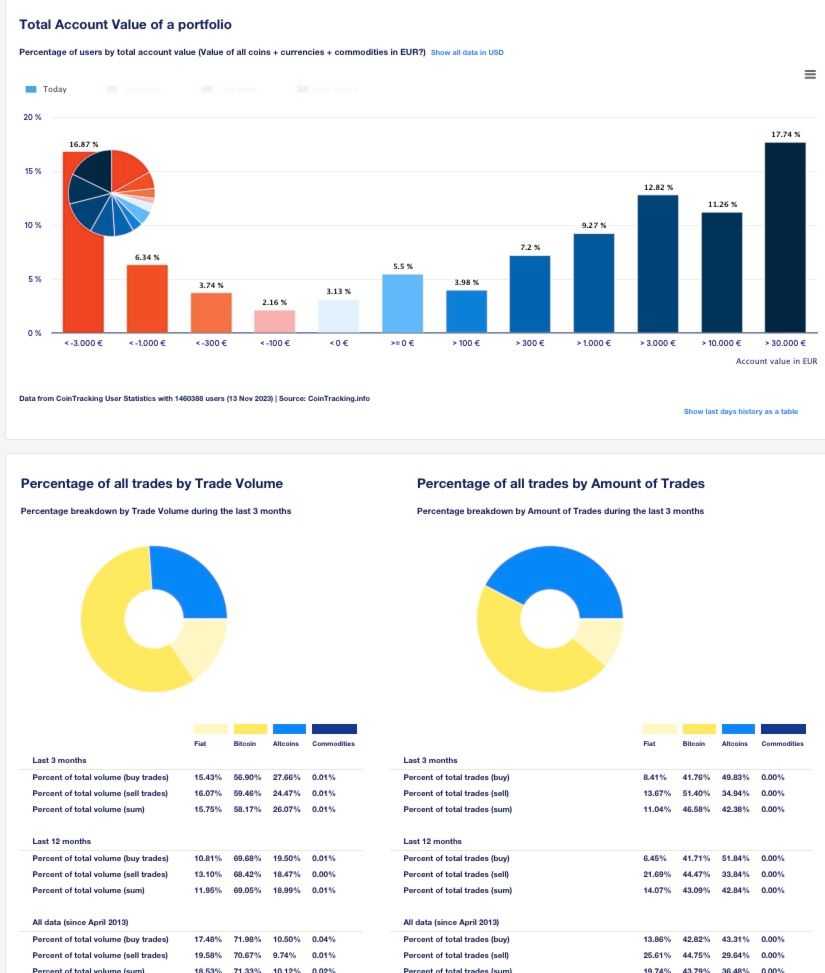

- User Statistics- Average portfolio and trading statistics based on the aggregated data of all CoinTracking users.

- Bitcoin Analysis- Experimental analysis of Bitcoin using EMAs and search engine trends.

Full-Service Tax Reporting

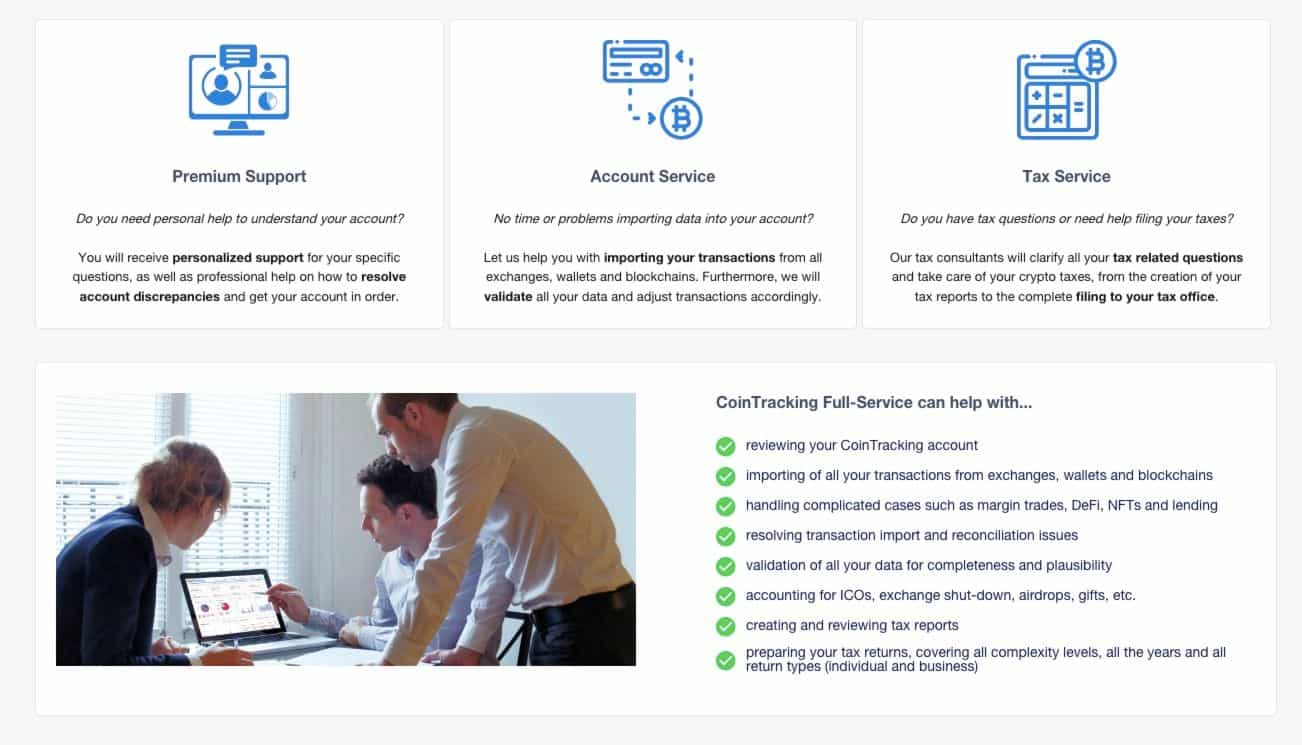

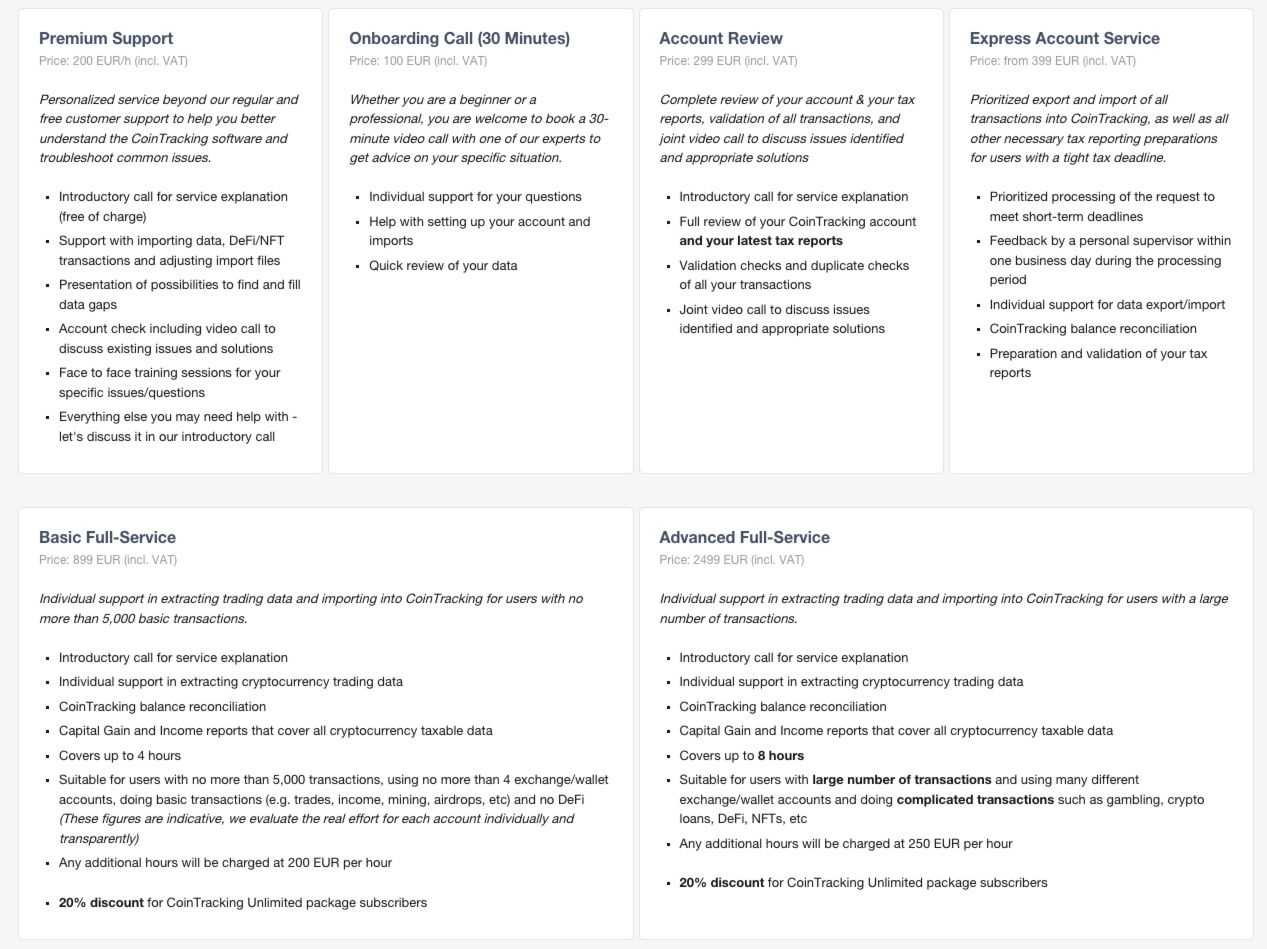

For anyone who can’t be bothered with the pain points involved with taxes, CoinTracking also offers an end-to-end tax solution where users receive professional assistance when it comes to managing and filing crypto taxes

This “white-glove” full-service solution is ideal as the CoinTracking team can do all the heavy lifting such as importing transactions, validating data, and categorizing transactions, which can help give users not only peace of mind as the CoinTracking team are professionals, but they also take care of the most time-consuming aspects of tax filing.

CoinTracking has in-house qualified tax consultants and experts who are there to ensure users remain compliant and accurate with all matters of crypto tax reporting. Utilizing the full-service package also ensures that users have access to premium support 24/7 and direct access to tax professionals who are able to handle all of their tax-related queries.

CoinTracking Security

CoinTracking prioritizes the security and privacy of user data, as any reputable platform should.

All CoinTracking servers are located within the European Union, meaning sensitive user data is GDPR compliant. CoinTracking is also ISO/IEC 27001:2017 certified, which involves independent auditing of all CoinTracking processes, reports, encryption methods and support/management processes.

To achieve this certification, successful audits had to be passed for:

- User data encryption

- SSL encryption

- Compliance with all data protection regulations

- Management and full process audits (external and internal)

- IT and infrastructure audits (external and internal)

- API audits

Users also have the ability to register with CoinTracking completely anonymously if they should choose, though CoinTracking will not be able to help with things like password resets if users don’t sign up with their email address at least. It is also good security hygiene for users to enable 2FA on their accounts.

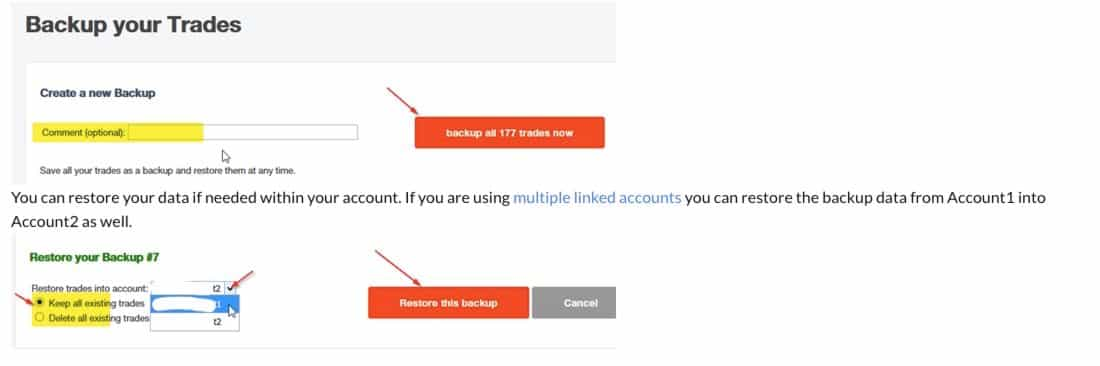

All API keys are encrypted and allow read-only access, meaning that data from exchanges can be read only without any added functionality such as trading or withdrawing. Another great security feature that we have only seen with CoinTracking is that users can also create free backups of their data and restore them at any time.

CoinTracking Exchange Support

CoinTracking offers a multitude of ways to import exchange trading data, making it one of the more versatile platforms out there.

The most convenient method will be via API synchronization. The API feature allows your exchange of choice to integrate directly with CoinTracking and update your trading information in real-time and automatically. Some of the most notable supported exchanges include but are not limited to:

- Binance

- Bitfinex

- Bitget

- Bitpanda

- BitMEX

- Bitstamp

- Coinbase

- Crypto.com

- Gemini

- Huobi (HTX)

- Kraken

- KuCoin

- OKX

If your exchange is not supported, another popular method of importing data is through the use of CSV files, Excel, or the built-in exchange importer. Most exchanges allow users to export their entire trade history via a CSV file which will appear in a spreadsheet. Users can easily import that into CoinTracking and it will automatically sort and categorize your transactions.

Users also have the option to manually input transaction history as well.

CoinTracking Wallet Support

Similar to exchanges, some wallets are supported via direct API integration. Some of these wallets include:

- BitBox

- Bitcoin Core Client

- Blockchain.com Wallet

- Electrum

- Exodus

- GateHub

- Ledger

- MyCelium

- Trezor

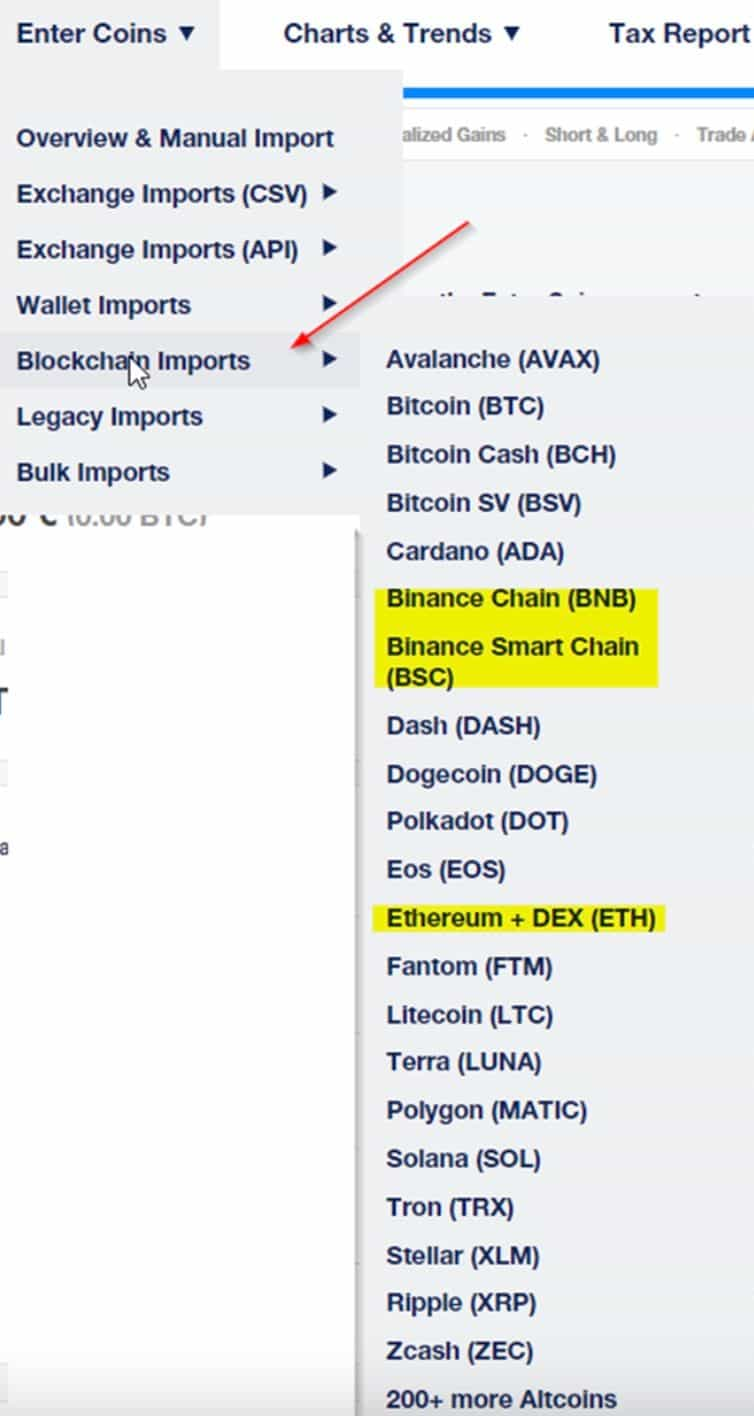

It is great to see hardware wallet leaders Ledger and Trezor in here and some notable software wallets like Exodus and some old-school wallets like Bitcoin Core Client. If you don’t see your wallet listed here, no sweat, CoinTracking does support blockchain-specific individual wallets for the likes of Avalanche, Solana, Matic, and more. Here is an image showing the wallets and blockchains supported:

This means that regardless of whether you use Trust Wallet, MetaMask, or pretty much any wallet running on the over 220 networks supported, you’ll be able to import that address into CoinTracking. Here’s a look at the blockchain import process that you can use if your wallet is not supported:

CoinTracking makes the process quite simple, you can see how easy it is for yourself by checking out their MetaMask or Trust Wallet import guide.

One of the features we found quite useful was the bulk transactions editing capability. On some other crypto tax software tools, we found the process of having to edit transactions one by one to be very time-consuming and painstaking, so being able to bulk edit was a time-saver.

It isn’t until you go down the rabbit hole of crypto tax software that you start to realize small nuances that actually make a big difference. For anyone considering using any tax tool, I would opt for one that supports daily syncs, preferably for free. CoinTracking will automatically sync your transactions to keep your information up to date in real time, removing much of the manual continuous labour needed with some of the other tools out there.

Another nuanced feature that we haven’t seen with other tools is the ability to create backups. This is often considered an afterthought, but really shouldn’t be. Compiling years of tax data is no small task, especially for tax professionals who manage the accounts of multiple clients. Imagine what a nightmare it would be if your tax tool of choice went bust or a glitch resulted in losing years of tax data. This may not only result in tens of hours worth of lost work but even get you in hot water with tax authorities as many countries require users to keep tax documents for a period of ten years.

We were very surprised to find that CoinTracking is not only one of the only platforms that offers backups but even includes them for free! I would say this is a must-have feature for anyone handling the taxes on behalf of clients.

CoinTracking Price

The cost of CoinTracking is tiered and dependent on the needs of the user. The free version is great for casual crypto traders and is capable of supporting users who have up to 200 transactions. The free version allows users to access the direct and bulk CSV importers and provides access to the portfolio tracking features. Note that the direct API integration is only available for paid users, so transactions will need to be input manually or imported for the free plan.

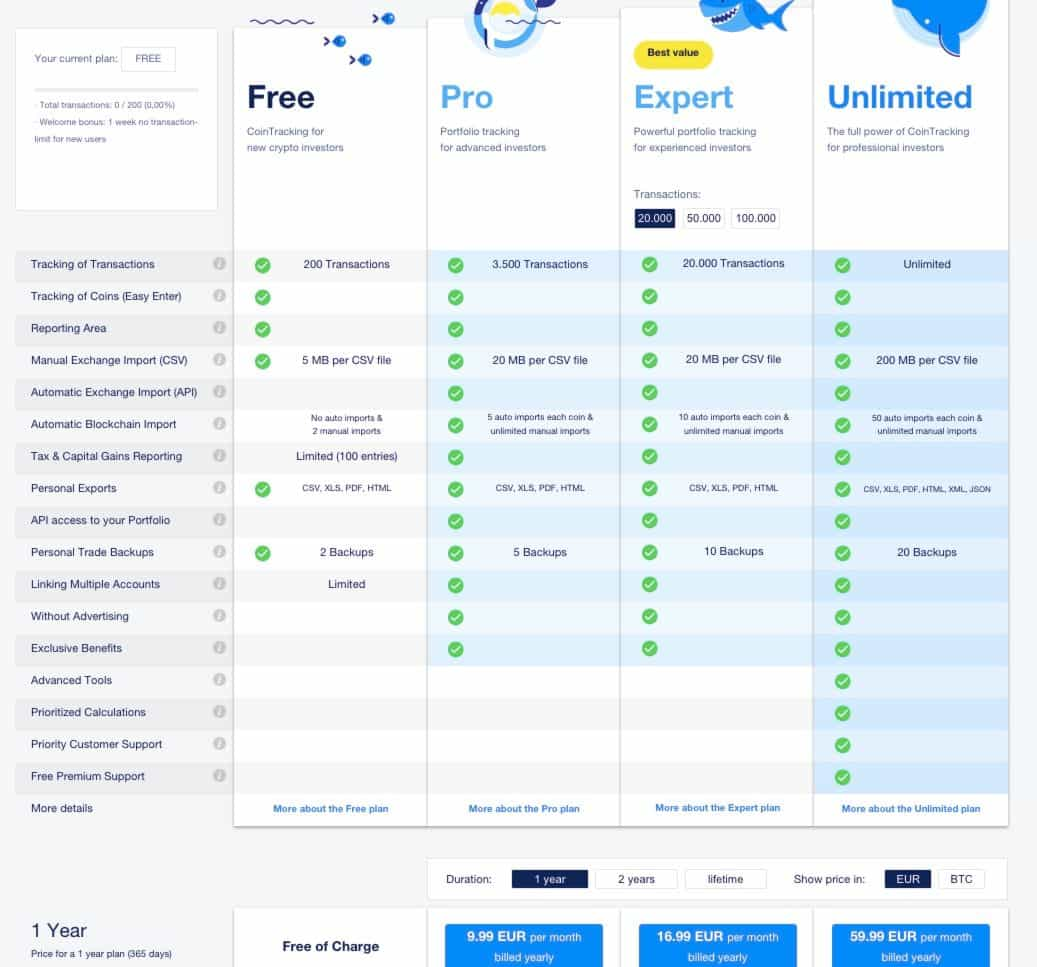

The Pro feature will likely be the one that is best suited for the majority of users as it can track up to 3,500 transactions, support 20MBs of CSV files for imports and more. That comes in at 9.99 per month and then the Expert and Unlimited versions will be best suited for businesses and tax professionals. Here is a breakdown of what is included with each account level:

Users can enjoy a steep discount in price if they select a 2-year package. For those who want to avoid recurring billing payments, users can reach out to the CoinTracking team for a one-time lifetime payment option and corporate customers can inquire about account-based pricing models and sub-accounts that can scale with the business.

Payment can be made using a credit card, PayPal, or bank transfer, or users can also pay in crypto, which is pretty cool. Bitcoin and 50 altcoins are supported for payment, users can enjoy a 5% discount if choose to pay in that sweet digital gold. Well played, CoinTracking, that is one way to stack them sats.😎

We provide a cost comparison a little further on, but compared to major competitors, we found CoinTracking to be not only the most friendly in terms of fees, but actually provide the best value for cost AND they are very generous with transaction count. CoinTracking is the only platform we found to be scalable in terms of cost for firms with over 100k transactions, they also don’t charge for sub-accounts or for previous tax years like many of the platforms out there.

👉 Try CoinTracking for Free or Enjoy a 10% Discount on Paid Plans!

CoinTracking Support

CoinTracking has solid customer support for both the “do-it-yourself” type and those who like to reach out for support 24/7. CoinTracking has support members answering support tickets around the globe to do their best to get back to customers within 4 hours, regardless of their time zone. It would be nice to see chat support enabled, but the ticket system works well, with no glaring complaints from customers suffering from long response times.

Regular customer support can be reached on the CoinTracking Support page, then for those who opted in for full service can reach out to the Full-Service Support Desk.

Customers can take a crack at accessing the Knowledge base for DIY, tutorials, and guides, and the YouTube video guides can be found below:

- CoinTracking Reports - Video Guide

- CoinTracking Import - Video Guide

- CoinTracking How-To - Video Guide

- CoinTracking Community Videos

CoinTracking App

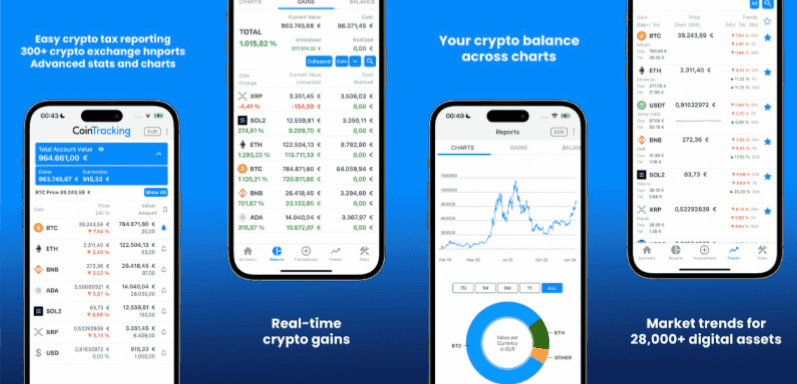

The CoinTracking mobile app is great for those users who use the portfolio tracking feature. Of course, you probably aren’t going to use the app for tax reporting purposes when trying to import CSV files and export reports for your accountant, the web version is better for that, but the CoinTracking app is brilliant for keeping an eye on all your balances and token performance in one place.

The app offers live data for more than 28,000 coins and assets and allows users to track their gains and balances directly from their phones. There is also a great widget feature allowing users to check out the markets at a glance.

The app is available on both IOS and Android and has fantastic reviews across both app stores. The app has a 4.3-star rating on Google Play and 4.7 on the App Store. What’s more telling is the 4.6-star review on ProvenExpert with over 11k reviews. That is a lot of satisfied users.

To point out where it has lost some points appears to be from Android users who mention the app consistently signing them out when they close the app, leading them to need to sign back in daily, so nothing deal-breaking.

We found the app to function without issue and were pleased with it. It was really useful to be able to access in-depth portfolio insights on the go, though if we are being picky, we found that the interface could use a more “modern” look.

CoinTracking vs Competitors

There are a few prominent players in the crypto tax software space and it can be hard to choose the one that is right for you, so we will provide some info here to help make that task easier.

Here we will highlight the areas where CoinTracking outperforms some of its peers, and, of course, also cover the areas where CoinTracking doesn’t quite match up with the other Titans in the industry.

Price

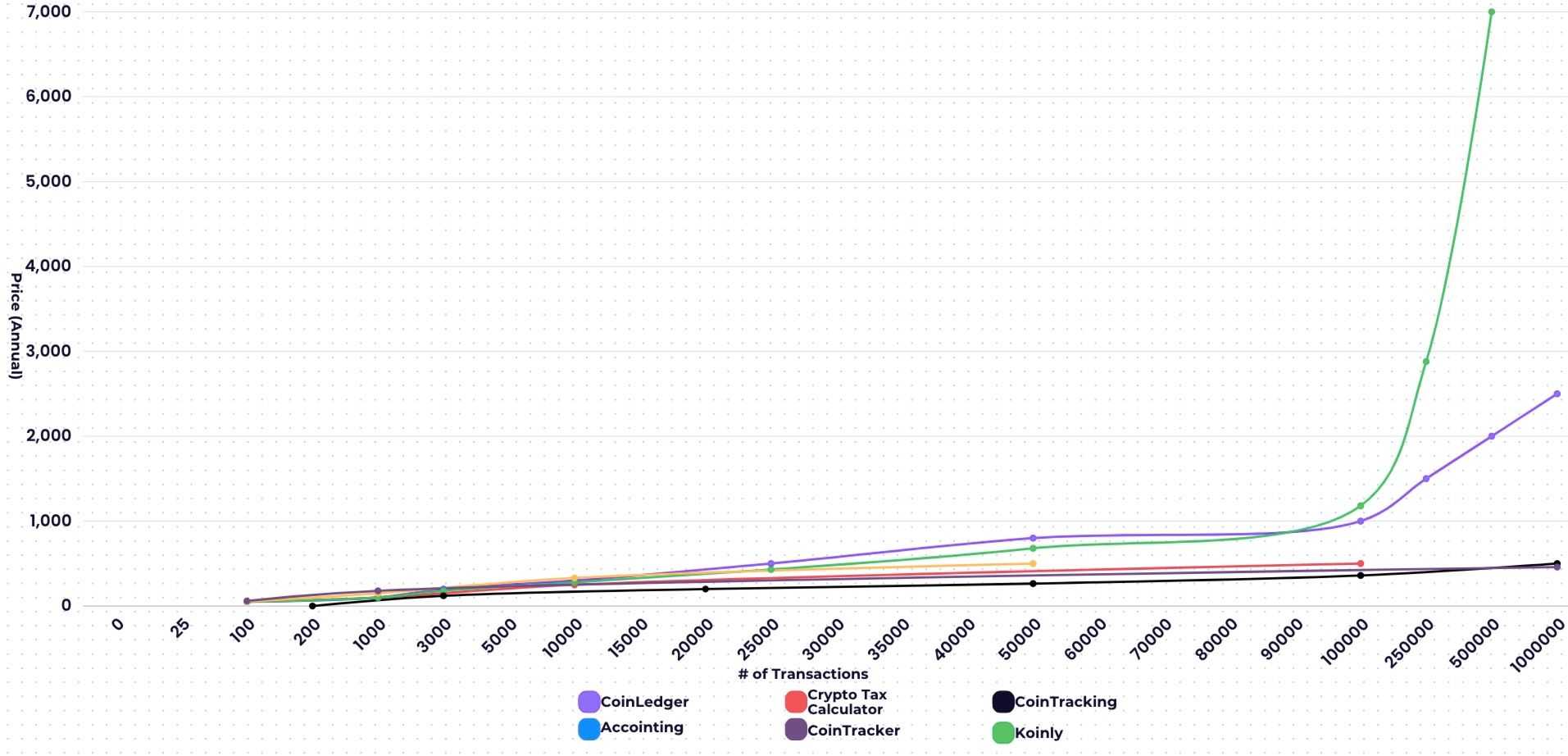

Perhaps cost is one of the most important considerations and the best place to start. CoinTracking allows up to 200 transactions for free and is among the leading platforms from a price-performance ratio, as in, you get a great “bang for your buck” with the Pro plan. If you are a casual crypto trader/hodler, I would opt for free plans such as the one provided by CoinTracking. CoinTracking is the only leading tax software we know of that offers a one-time lifetime payment option as well as free reporting capabilities on the free plan

| Free Plan? | Charge For Previous Years? | Free Portfolio Tracker? | Mid-Tier annual cost for active users | Unlimited Plan Available? | Free Backups? | |

| CoinTracking | Yes | No | Yes- analytics & reports | $120 3,500 Txn | Yes | Yes |

| Accointing | Limited | Yes | Yes- analytics only | $149 1,000 Txn | No | No |

| Koinly | Yes | Yes | Yes- analytics & summaries | $99 1,000 Txn | No | No |

| Crypto Tax Calculator | Limited | No | Basic analytics | $99 1,000 Txn | No | No |

| CoinLedger | Yes | Yes | Yes- analytics only | $99 1,000 Txn | No | No |

| CoinTracker | Yes | Yes | Yes- analytics only | $179 1,000 Txn | Yes | No |

Something notable worth pointing out with the pricing plans is that CoinTracking has a “sweet spot” pricing of $120 for 3,500 transactions. Most other companies offer a low $99 entry price for up to 1,000 transactions but the next pricing plan will jump significantly.

Our observations from the table and graph above highlight CoinTracking as the best-priced option, especially for users with between 1k to 3.5k transactions.

The plans are comparable from there until the 20k transaction mark and then CoinTracking and CoinTracker become significantly more favourable from a price perspective. The steep price increases from Koinly and CoinLedger are quite surprising. Koinly charges $10 per 1,000 transactions on top of their most expensive pro plan which rings in at $280, so if you have more than 10,000 transactions Koinly becomes very expensive very fast. CoinLedger isn’t the easiest on the pocketbook either and Accointing (recently acquired by Blockpit) doesn’t support over 50k transactions while Crypto Tax Calculator tops out at 100k transactions.

CoinTracking also has the most tier pricing spots available with users being able to select 20k, 50k, 100k, or unlimited transactions, meaning users can get closer to paying for what they actually use. CoinTracking and CoinTraker are also the only mentions on the list that offer unlimited for users who don’t want to worry about transaction count.

And if you think that transaction numbers over 10k don’t apply to you, many users find themselves shocked when they realize how many transactions they actually rack up. We found quite a few complaints from users on other platforms after discovering that some staking coins earn daily interest payouts and some DeFi transactions can actually count as multiple as coins are routed via different avenues, so for users who are heavily into DeFi, trading, and staking on multiple wallets for multiple coins, users found themselves paying quite a bit more than they bargained for as they easily shot over 10k transactions. This especially becomes more prevalent for users who need to include transactions from previous years.

For users looking for free plans, CoinTracking, CoinTracker, Koinly and CoinLedger offer free plans that provide value, the limited free plans on Crypto Tax Calculator and Accointing appear to be more suited to just give users an idea of what the platform can do, but clearly state that users will need to pay for basic functionality. CoinTracking and CoinTracker also allow users to download tax forms on the free plan, adding to their competitiveness

With regard to having to pay for previous years, Koinly and CoinLedger operate on a per-tax-year basis, so if you sign up in 2024 for a year plan but want to do your 2023 taxes, you will be charged extra. CoinTracking and Crypto Tax Calculator get a nod here as when you pay for the year, you can use their services for whatever tax years you'd like.

Portfolio tracker is another aspect worth diving into as most of them offer a free portfolio tracker, but not all are created equal. CoinTracking and Koinly definitely take the win in this category as their utility covers more than just observing your portfolio. CoinTracking gives users the option to generate useful reports and dive into in-depth analytics with their portfolio tracker at no cost and Koinly gives users the ability to see tax summations so they can track what their tax liabilities are likely to be. The others simply provide basics like portfolio balance, P&L, etc.

Supported Countries

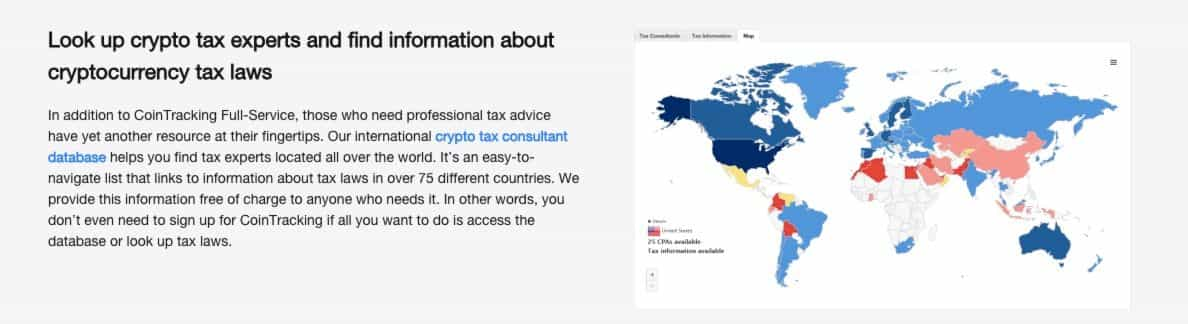

Country support is another important consideration as some tax software companies are US-only or have limited country support. CoinTracking also ranks well here against competitors, supporting 100+ countries and featuring country-specific reports for 12 nations.

| Country-Specific Reports | Total Countries Supported | Nation-Specific Tax Advice Available | |

| CoinTracking | 12 | 100+ | 75 Countries |

| CoinTracker | 4 | 100+ | 4 Countries |

| Koinly | 10 | 100+ | 26 Countries |

| Crypto Tax Calculator | 4 | 22 | 22 Countries |

| CoinLedger | 4 | 16 | 8 Countries |

CoinTracking does well in this category, providing country-specific reports for 12 countries and blows the competition out of the water when it comes to their global network of tax professionals. The fact that they can put you in contact with tax professionals in 75 countries who are familiar with crypto tax laws and the CoinTracking platform is seriously impressive.

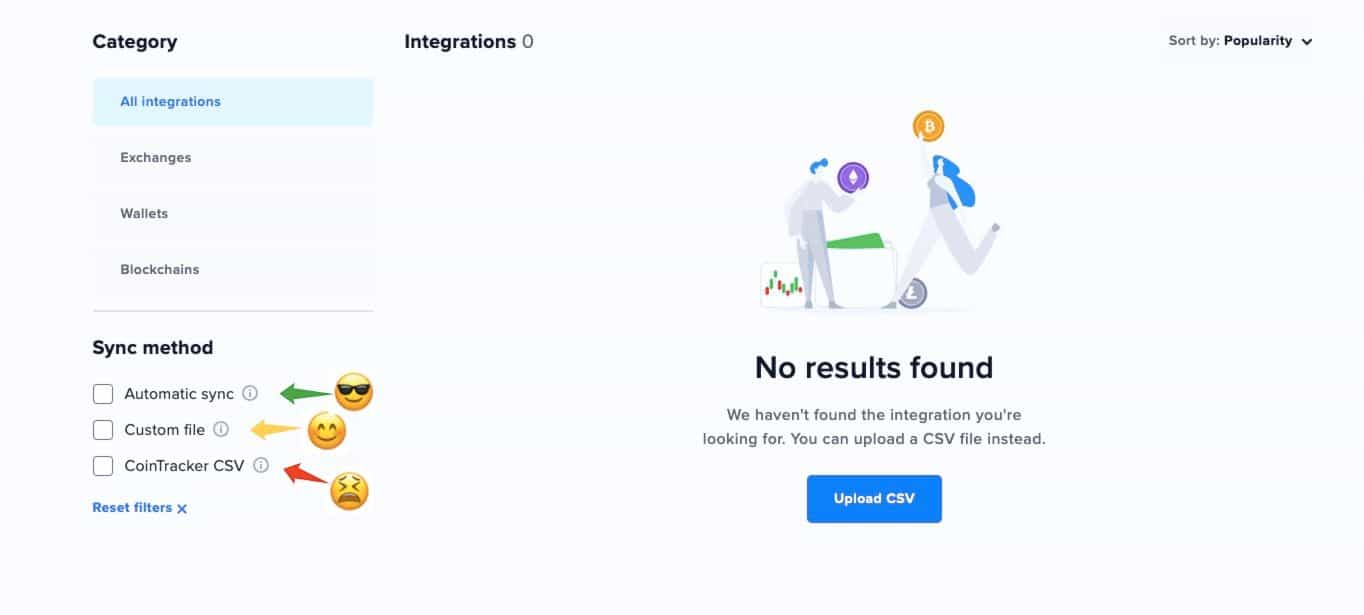

Import Options

Import options are something that is worth taking into consideration, particularly for users who use a wide variety of exchanges, wallets, and protocols. CoinTracking doesn’t win the gold when it comes to API integrations, however, with 86 CSV importers supported, 56 API integrations, 30 legacy data importers, and 200+ blockchain integrations supported, it’s unlikely that the majority of crypto users would need scope outside of this.

To make your tax life as easy as possible, don’t overlook the importance of bulk importing, especially if you gather all your transaction history in one go once per year at tax time and do not keep records updated. A bulk importer will be your best friend here and surprisingly, not every crypto tax software supports this. CoinTracking supports bulk CSV/XLS imports which can also include NFTs. Not only does CoinTracking support bulk imports, but it also supports the ability to bulk edit imported transactions. This may not seem like a big deal, but we will get into why that is important in the following paragraph.

| Bulk Imports | Edit Import Results? | Blockchains Supported | |

| CoinTracking | Yes | Yes- Within the platform | 200+ |

| CoinTracker | Limited- Manually formatted CSV files need to fit Coin Tracker Template | No- Import files need to be formatted/edited before import | 32 |

| Koinly | Yes (Only on the paid versions) | No-results need to be exported via CSV file, then edited and re-imported | 170+ |

| Crypto Tax Calculator | Yes | Yes | 300 |

| CoinLedger | Yes | Yes | 41 |

With bulk imports, it is important to be able to edit the import results as sometimes the transactions are not imported or categorized correctly. Many platforms do not allow users to edit this information, while others may only support the tagging of transactions. If you are an infrequent crypto user who only uses major centralized exchanges that have API integrations, you may not need to worry about this, but most crypto users will find themselves needing to use the manual transaction import feature from time to time.

This can be quite a large pain point with platforms such as Koinly and CoinTracker. Our experience using this function with Koinly was frustrating as we had to manually export all transactions into a spreadsheet, edit them in the spreadsheet, re-upload them, have them flagged again as having issues in Koinly’s system, export them again, fix them, upload them, then repeat the process, which took a long time and was less fun than listening to your mother in law talk about her recent vacation to wherever.

The process gets even worse when direct CSV imports are not supported as spreadsheets need to be formatted to fit the platform’s spreadsheet template before they get uploaded. If you have thousands of transactions, you may as well be asked to scale Mount Everest.

Pro Tip! (This is a big one, thank me later)

Regardless of the tax software, there are three main ways of getting your data on the platform:

Direct API Integration- The Best. (Automation for the win!)

Custom/CSV Importer- The terminology changes between platforms, but this means the format of the CSV file export from the exchange or platform can be uploaded directly to the crypto tax tool. This is also very convenient and straightforward.

Excel Import/Custom Import- Again, the terminology can change drastically from platform to platform but this third option is for if you need to add exchange or trading history in a CSV file that is not directly supported.

This last option sucks, big time, I would rather try and fight the three headed dog Cerberus that guards the gates of the underworld than have this as my primary import method. This step involves downloading the supported spreadsheet format from the tax software and copying your entire transaction history from the trade history spreadsheet into the tax tool template. This may not seem that bad, but if we are talking about hundreds or thousands of transactions, if everything is formatted differently, no thanks!

So, the tip is to identify your primary exchange and wallets and find the tax tool that supports your platforms of choice either via API integration or CSV upload support. Aint nobody got time for mix and matching spreadsheets manually.

Bonus Pro Tip!

Just because Platform A advertises 400 API integrations and Platform B advertises 100 integrations, don’t let their marketing gymnastics fool you!

While conducting this review, we learned about some of the devious marketing tactics some platforms use. Let me give you an example.

Platform A states: “We support a bazillion wallets and tokens!” 🥳

Platform B states: “We support Ethereum”

Some new users may think “Wow! A bazillion wallets AND tokens? Platform A must be better!” Though this can essentially mean the same thing. Like everything, the devil is in the details. Search for your specific exchange, blockchains, and tokens specifically and don’t fall for the headline claims.

One of the best parts about working at the Coin Bureau is that we get to spend countless painstaking hours diving into all these different platforms and writing about them so our readers can save innumerable hours learning from our research and findings.

Before researching for this article, I didn’t even know what I didn’t know about crypto tax tools. I thought they all functioned more or less the same way, then I spent dozens of hours diving into all these different platforms. I have to say that when it came to importing, CoinTracking and Crypto Tax Calculator took the win here… Big time, and not just for convenience, accuracy, and time saving, but for the very sake of sanity…If you have thousands of trades and upload transaction history via CSV file, not being able to bulk import and bulk edit WITHIN the tax platform is going to make you want to fling your laptop out a tenth-storey window and beg the tax cops to take you to tax jail as that would be easier than dealing with tax software that doesn’t support those features.

Transaction Types

If you are someone who dabbles in multiple layers of crypto, transaction-type support is also important. Some of the weaker platforms only support buy and sell transactions. Look for platforms that support things like buying, selling, receiving, sending, airdrops, bridge in transactions, cashback, chain split, collateral withdrawals, gifts, staking, spam, adding liquidity, bridge out, interest, loan, mining and more. CoinTracking supports 47 types of transactions, placing them among the top, so they should have you covered regardless of your crypto habits.

| Number of Transaction Types Supported | |

| CoinTracking | 47 |

| CoinTracker | 19 |

| Koinly | 24 |

| Crypto Tax Calculator | 41 |

| Coin Ledger | 21 |

Where transaction type support is important is for anyone who dabbles in DeFi, provides liquidity or hunts for airdrops. There is no point in using a crypto tax tool that can’t recognize and catetorize your crazy DeFi degen habits.

For cryptocurrency support, CoinTracking is in the middle of the pack, supporting over 26k digital assets, and for fiat support, they are among the best, supporting 36 fiat currencies. Many platforms only support the major fiat currencies or USD.

There is no point in creating a table here as the companies market asset support differently, some saying that they support tens of thousands of cryptocurrencies and then the other company may simply state that they support a blockchain, which is essentially the same thing. All the mentions in this article have mass cryptocurrency support with CoinTracking and Crypto Tax Calculator winning when it comes to blockchain support, 200 and 300 hundred respectively and also have the best fiat support at over 15 fiat currencies.

The final strengths we enjoy with CoinTracking are the Missing Transactions, Duplicate Transactions, and Validate Transactions checks. This provides users with fantastic peace of mind and a tool that can double-check transactions for accuracy is a nice benefit. CoinTracking is also one of the very few platforms that offer free backups of your data as well so you don’t lose all that information should the platform go down or you make a mistake.

In almost every category measured, CoinTracking either takes the win or is among the top performers. When you average out the strengths and weaknesses across multiple categories, CoinTracking and Crypto Tax Calculator are superior in most regards with CoinTracking edging out a win for us, thanks to their top-of-the-industry reporting and analytics and their price cannot be beaten for the services on offer.

This may sound quite pedantic, but the only thing we didn’t like so much about CoinTracking was that the user interface wasn’t as beautifully designed as some of the others on the market so it lacks a bit of eye candy. Compared to the other platforms CoinTracking looks about as exciting as a dentist’s office, but hey, it’s tax reporting after all, and not meant to be sexy. In their defence, it appears that they were busy building out the most advanced functionality and all-encompassing tax tool, going for power over aesthetics, and certainly cannot be faulted too much for that. I’d rather have a tax tool that works than one that looks pretty.

We found the data quality to be second to none and the wide-ranging utility for the cost makes CoinTracking the most robust tax tool we’ve tested. It is especially easy to see why CoinTracking has been one of the top picks for institutions and tax professionals as well.

If you want some more in-depth comparisons, CoinTracking has compiled the following comparison articles:

CoinTracking Review: Closing Thoughts

In conclusion, managing and reporting taxes on cryptocurrency investments can be an overwhelming task. That's where CoinTracking comes to the rescue with its comprehensive features, user-friendly interface, free and cost-effective versions, and commitment to accuracy. Whether you're a seasoned crypto pro or just dipping your toes into the digital currency world, CoinTracking is a must-have tool for simplifying tax reporting, optimizing your portfolio, and gaining valuable insights into your trading habits and crypto investments.

CoinTracking can handle just about any nitty-gritty complex transaction details you can throw at it and the automation is a real lifesaver. Of all the tax software tools we’ve reviewed, CoinTracking is the most detail-oriented when it comes to raw data and has more accuracy checks in place than the competition. Coupled with the fact the CoinTracking payroll also includes certified tax professionals, the platform is business-friendly in terms of cost-effective scalability, and there are full-service options as well as 24/7 customer support, CoinTracking is certainly a platform worth keeping on your radar and is, at the very least, worth trying out commitment free!

If you are impressed with the platform, also be sure to snag a 10% discount using our Sign up link!

Disclaimer: This is a paid review, yet the opinions and viewpoints expressed by the writer are their own and were not influenced by the project team. The inclusion of this content on the Coin Bureau platform should not be interpreted as an endorsement or recommendation of the project or product being discussed. The Coin Bureau assumes no responsibility for any actions taken by readers based on the information provided within this article.

Frequently Asked Questions

CoinTracking is a cryptocurrency tracking and tax reporting software that supports users in monitoring their trades with an in-depth portfolio tracker and generating tax reports. CoinTracking is one of the most popular and powerful crypto tax tools on the market.

CoinTracking helps users track all their transactions in real-time, calculate their coins' overall value, realized and unrealized gains, profits, and losses, and generate tax reports. It also supports more than 100 countries and offers live chat support, a Youtube Channel for guidance, and a FAQ section with answers to commonly asked questions

Yes, CoinTracking offers professional support for complex tax issues. You can seek help from the experts of the CoinTracking Full-Service team for account-specific questions or complex tax matters. They can assist you with setting up profiles for clients, reconciling data, and addressing any other complex tax-related queries

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.