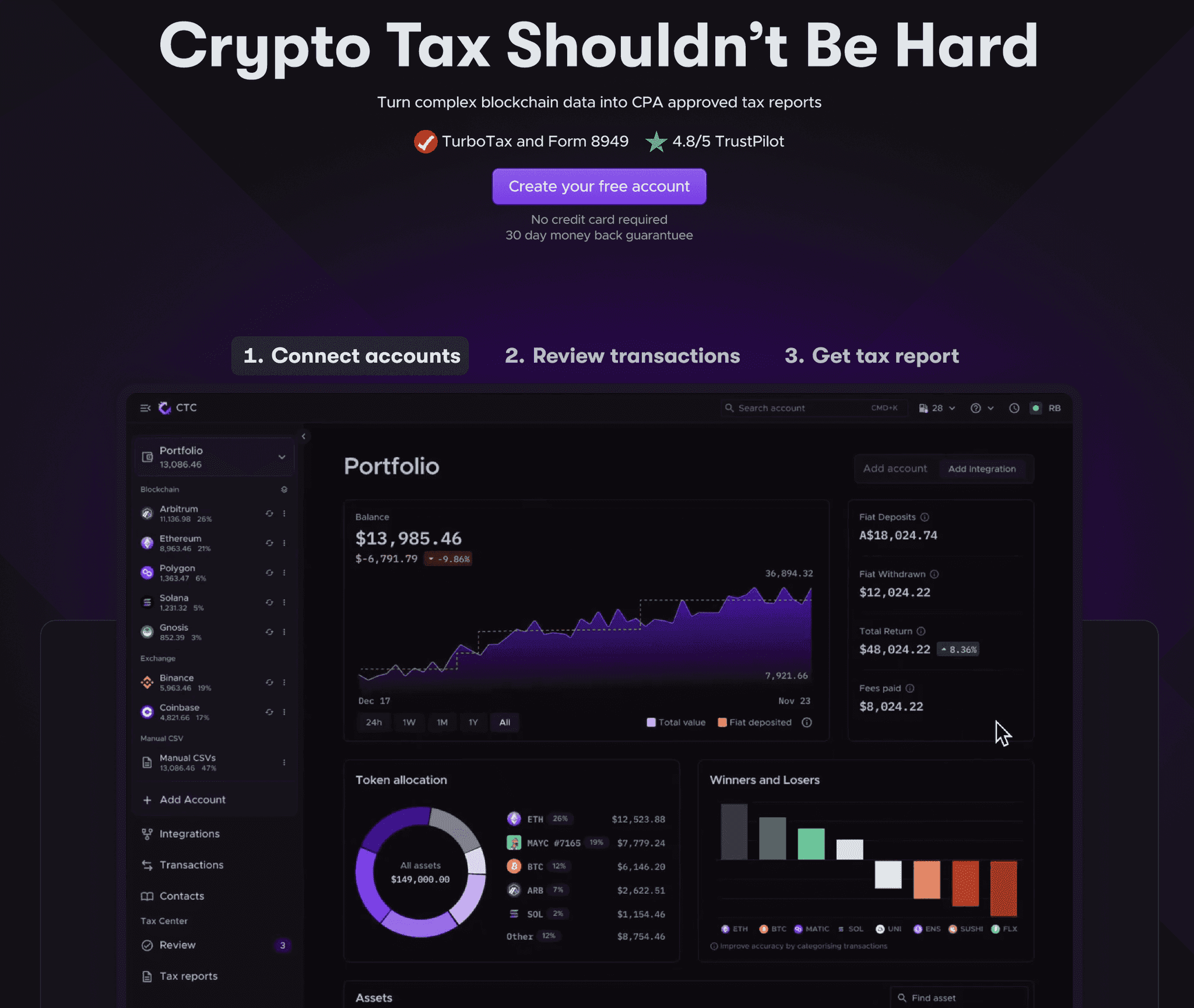

Crypto Tax Calculator Review 2024: Crypto Tax Streamlined!

Crypto Tax Calculator provides a comprehensive solution to handle cryptocurrency taxes, accommodating a wide array of digital currencies, exchanges, wallets, and DeFi operations. Its standout features are the seamless importation of transaction data and AI-powered automated transaction categorization which significantly simplifies the tax reporting procedure for cryptocurrency investors and traders. Crypto Tax Calculator not only boasts an excellent UX/UI but also employs one of the most effective approaches for importing, categorizing, and editing transaction data.

Cryptocurrency, blockchain, and Web3 are at the forefront of innovation, a true crossroads giving us a glimpse into an exciting future brimming with the ethos of decentralization, a fairer monetary system, the end of totalitarianist tech giants selling, controlling, and manipulating our data, and true sovereignty whether it comes to our finances, identity, or creative control.

Whether you are facilitating payments peer to peer without greedy middlemen bankers taking a cut, tracking supply chain logistics more accurately than ever before, taking true ownership over your finances, identity and data, zipping around the galaxy in a crypto game like Star Atlas, or discovering virtual worlds in a place like Decentraland or the Sandbox, this “Web3 thing” is truly awe-inspiring and exciting.

But with all that sunshine, rainbows, and excitement, there is still the unfortunate reality of taxes. Oh yeah, that old chestnut. 🙄

Sorry, my friends, but there is no escaping, and it is nobody’s favourite topic. With this new digital frontier comes the infiltration of new tax liabilities as Web3 will see taxable events triggered for things like gaming, data ownership, DAO participation, DeFi usage, etc.

But fret not, because there are now time-saving (I would argue life-saving) innovative tax software tools like Crypto Tax Calculator that have come onto the scene, making the lives of crypto traders and Web3 adventurers immeasurably easier. Not all heroes wear capes; some of them create automated tax tools, and we salute them for it.

Crypto Tax Calculator Features and Benefits:

- Broad Coverage: Supports a wide range of cryptocurrencies, NFTs, DeFi, and DEX trading activities.

- Automatic Import: Integrates with numerous exchanges and wallets for easy transaction import.

- Tax Optimization: Provides tax-loss harvesting tools to optimize tax outcomes.

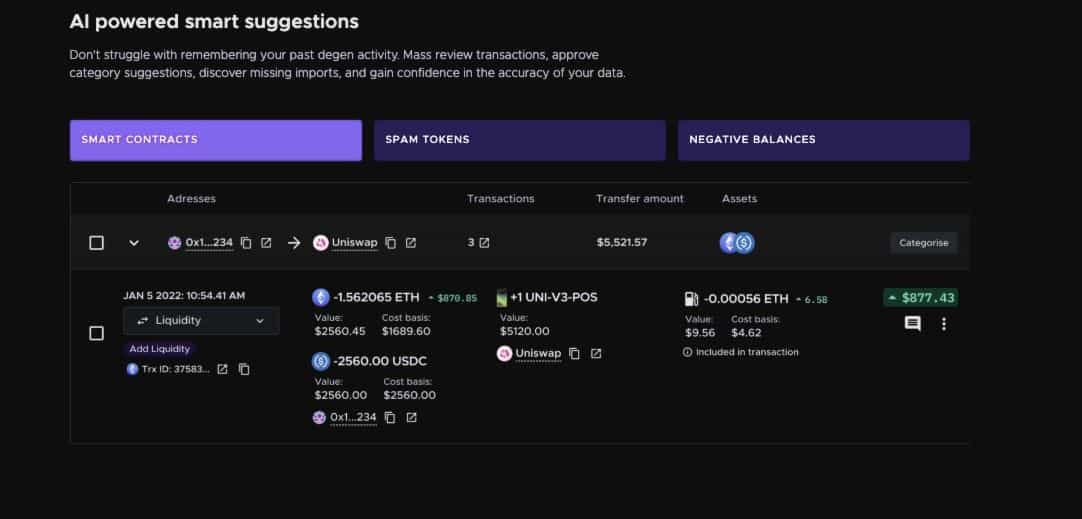

- AI-Powered Assistance: Utilizes AI for smart transaction categorization and spam detection.

- Customizable Reports: Offers personalized and comprehensive tax reports.

- User-Friendly Interface: Designed for simplicity, suitable for both beginners and experts.

- Global Compliance: Adheres to tax regulations in multiple countries.

- Expert Support: Access to professional tax advice and customer support.

- User-Friendly Interface: Designed for ease of use, catering to both beginners and seasoned crypto enthusiasts.

- Trusted by Experts: Backed by Coinbase Ventures and trusted by certified tax professionals

- Automatic Categorization: Makes importing transactions easy

Crypto Tax Calculator: Summary

Crypto Tax Calculator offers a robust solution for managing cryptocurrency taxes, supporting an extensive range of digital currencies, exchanges, wallets, and DeFi operations. Its key feature is the effortless importing of transaction data, streamlining the tax reporting process for crypto investors and traders. We found Crypto Tax Calculator to not only have a fantastic UX/UI, but also has one of the most efficient methods of importing, categorizing, and editing transaction data out of many of the crypto tax tools we’ve tested and reviewed. It is clear why Coinbase chose Crypto Tax Calculator as their crypto tax tool of choice and why it is trusted by enterprises and tax professionals around the world.

Now, let’s get into the Crypto Tax Calculator review.

Overview of Crypto Tax Calculator

In 2018, Shane and Tim Brunette co-founded Crypto Tax Calculator in Sydney, Australia, and it has since established itself as a significant player in the cryptocurrency tax software industry.

There is no denying that crypto tax is a dry subject, and the crypto tax industry is filled with software tools that look about as exciting as the command prompt window that came installed on the Windows 95 operating system. One of the first things that stood out with Crypto Tax Calculator was the eye-candy design and layout of the website. Whoever is in charge of user interface and user experience over at Crypto Tax Calculator deserves serious kudos as the platform offers the most sleek and aesthetically pleasing tax software we’ve used.

Okay, so yeah... Crypto Tax Calculator looks amazing and provides a fantastic interface, but who cares? It’s taxes; after all, it doesn’t need to be exciting. Does it work?

Well… Yes, it works very well, and before you go on thinking that the nice design is a moot point, there is a good chance that you will be spending quite a bit of time staring at your tax tool of choice, so why not make it as pleasant as possible? Nobody wants to spend hours staring at a black-and-white wall of text. Anyway, sorry, we got distracted by pretty things. Back to the overview!

Crypto Tax Calculator has also been praised for its comprehensive functionality, simplifying the complex process of crypto tax classifications, categorizations, and calculations. It's designed to cater to a wide range of users, from individual investors to professional accountants, enabling them to track and organize their crypto activities across numerous exchanges and blockchains with ease.

The platform stands out for its ability to handle a diverse array of transaction types, including standard trading, mining, staking, airdrops, and even transactions involving NFTs and DeFi. This wide-ranging support is particularly beneficial given the fast-paced and varied nature of the crypto market.

Crypto Tax Calculator's strength lies in its meticulous categorization of transactions, which it achieves by leveraging AI and sifting through data from multiple sources. It automatically categorizes transactions wherever possible, calculating capital gains, losses, and income along the way, while also highlighting areas that may require manual input. This ensures accuracy and completeness in tax reporting, which is essential for compliance with tax regulations.

Moreover, the tool's integration capabilities are noteworthy. It can import data from hundreds of exchanges and wallets, streamlining the tax calculation process. This is a necessity for users who manage their crypto across multiple platforms and wallets. The software also offers error checking to identify potential data gaps, further enhancing its reliability.

After using a handful of crypto tax software tools, Crypto Tax Calculator significantly reduces the time and effort traditionally associated with crypto tax reporting thanks to its API integrations, auto-categorization, error reconciliation, and the ability to mass edit imported data.

That last point on mass editing data is worth elaborating on as we’ve used tax tools that only support editing transactions by exporting via spreadsheet, fixing the spreadsheet, re-importing the spreadsheet, then having more errors flagged then having to repeat the process. The process is seriously time-consuming, and it sucks, especially for DeFi users who wrack up thousands of transactions. Crypto Tax Calculator’s ability to mass edit from directly within the platform is a utility that significantly improves the crypto tax experience and reduces hours, if not days of frustration.

Crypto Tax Calculator generates detailed, easy-to-understand reports that can be directly used for tax filing or shared with accountants. If you are really stuck up the creek without a paddle, Crypto Tax Calculator can also provide you with consultation and advisory services from their network of accountants to help ensure your tax obligations are met with accuracy.

In summary, Crypto Tax Calculator is more than just a tax calculation tool; it's a comprehensive solution for crypto investors and professionals seeking to navigate the complexities of cryptocurrency taxation with confidence and ease.

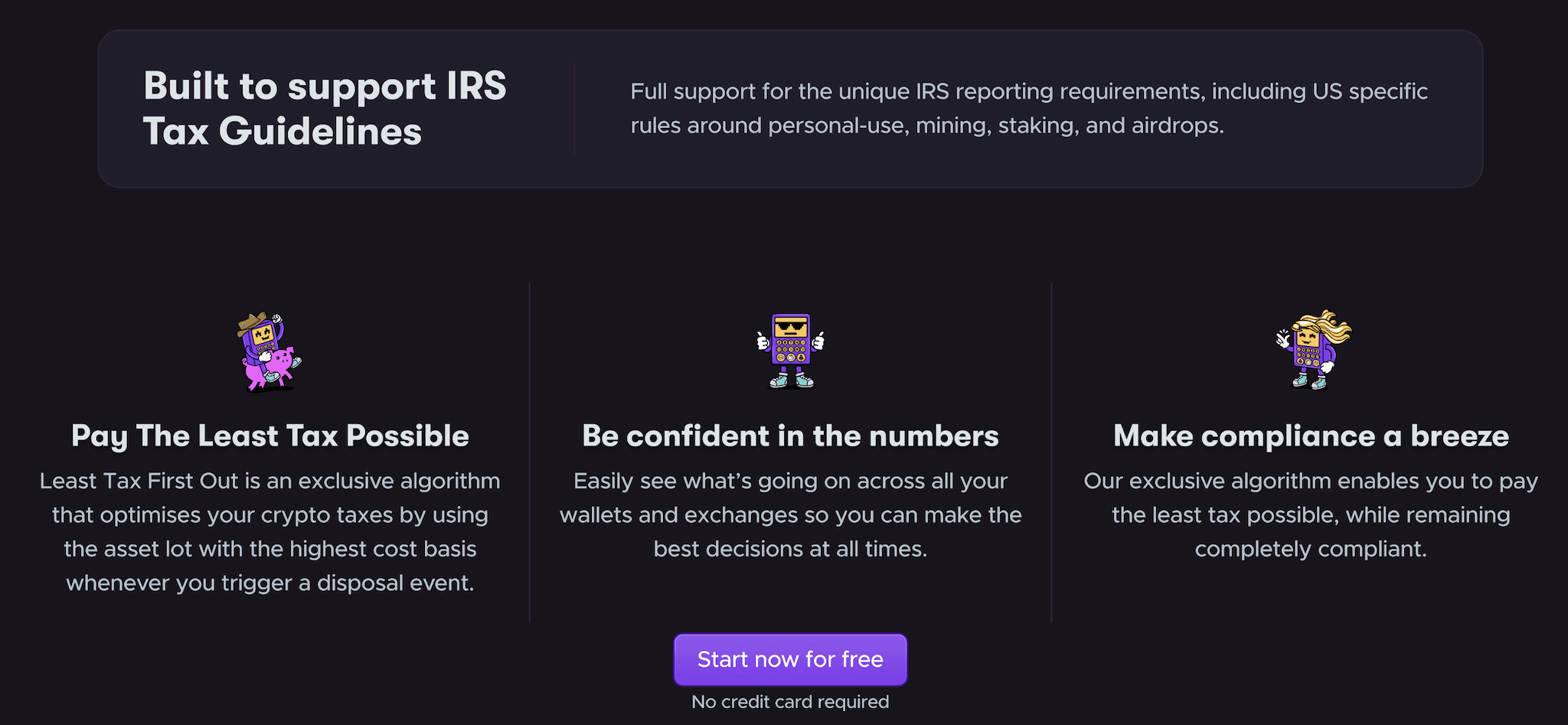

Importance of Accurate Crypto Tax Reporting

As the cryptocurrency realm grows, the intricacies of handling and documenting taxes related to these assets also increase. Various factors need consideration, extending beyond the characteristics of the assets to encompass your individual circumstances. Taxation of crypto assets can involve categorization under personal income, property, business income, capital gains, and sometimes a combination of multiple categories.

Here are some of the ways using a tax tool can help:

Precision and Adherence: Cryptocurrency tax software automates the tracking and computation of gains, losses, and taxable events, ensuring precise calculations and compliance with the tax regulations in your jurisdiction. Crypto transactions can often be more complicated than simply buying and selling as well. When we look at factors such as cross-chain swaps, bridging, gas fees, and smart-contract execution, what looks like a single transaction on the surface can, in reality, be a multiple-step process. Using a crypto tax tool identifies these complex transactions on-chain and summarizes the amounts, a feat that is very difficult to do manually.

Here is one of my all-time favourite memes about taxes and pretty much sums up why everyone should be using a crypto tax tool to ensure accuracy and compliance.

Time and Effort Efficiency: Manual tracking and the calculation of cryptocurrency transactions are time-intensive and prone to errors. Crypto tax software simplifies the process, leading to substantial time and effort savings.

Enhanced Portfolio Management: By gaining insights into your portfolio's performance and taxable events, you can refine your investment strategy, enhance tax efficiency, and make well-informed decisions.

Audit Assistance: Crypto tax software produces comprehensive reports that serve as audit trails, offering documentation of your transactions and calculations in case of an audit.

If you’re still not sold on the importance of using crypto tax software, let's dive into a fascinating scenario:

You buy $100 worth of Ethereum, use a bridge to convert $20 to a Layer 2, pay $10 in ETH gas fees, incur a capital loss on the L2 token you bridged. However, you stake the L2 to earn an APY, then liquid stake half of the remaining $80 worth of ETH on a platform like Lido, use the stETH to take out a loan, default on the loan, and lose it. Meanwhile, the price of your remaining Ethereum increases. But what happens to the portion of your initial investment that went into gas fees? You've lost your stETH, and witnessed the dollar value of your L2 decrease, yet the number of tokens increased due to staking. To add to the complexity, you receive an airdrop for using the L2, suddenly finding hundreds of dollars magically appearing in your wallet out of thin air.

Good luck explaining that to your accountant or figuring out the tax implications manually. I wasn’t kidding when I said crypto tax tools are life-saving (an exaggeration for effect, of course). As someone who has always done their own taxes manually and figured I would do the same with crypto, I quickly realized that automated tax tools are not only a convenience, but a necessity.

DeFi users often find themselves in complex scenarios, leading to frustration and confusion about crypto taxes. The sheer volume of transactions, especially for active users, makes manual tracking an almost impossible task. Tax software is crucial for convenience, accuracy, and peace of mind, sparing users from the dread of potential tax issues.

These tools seamlessly integrate with wallets and exchanges, automatically recording and categorizing transactions. Even without syncing options, users can effortlessly import transactions via a .csv file, letting the software handle the heavy lifting.

Given the uncertainty around taxable events, relying on tax software to determine them is wise. For instance, during the 2021 bull market, concerns arose about crypto debit card transactions possibly triggering taxable events. This highlights the challenge of tracking every transaction, such as using a crypto card for a simple coffee purchase.

Here are a few examples of various crypto transactions that may come with tax implications, depending on jurisdiction:

- Selling for fiat or stablecoins

- Exchanging digital assets

- Receiving Airdrops

- Sale of NFTs

- Earning from Blockchain and P2E games

- Staking Income

- Providing Liquidity or Yield Farming

- Using CeFi lending platforms

- Crypto mining

- Earning rental/advertisement income from digital assets

- Providing services and getting paid in crypto

Quality crypto tax software is widely applicable and compliant with reporting standards, even auto-populating tax forms for easier filing. Now, let's delve into one of the top tax software solutions in the market.

If you are interested in tax tips to save some Sats, check out Guy's video on the subject:

If you want to skip on taxes altogether (legally, of course) you can check out our Top Crypto-Tax Free Countries article. If relocating isn't an option, read on.

Features of Crypto Tax Calculator

User Interface and Accessibility

We’ve already mentioned that the platform is visually appealing and well-designed. The design incorporates minimalism for easy navigation and is clean and intuitive.

One of our favourite aspects is that it walks you through a simple 4-step sequential process, and each stage can be done at different times so you are not overwhelmed and can come back to it later. Crypto Tax Calculator is one of the easiest platforms we’ve used and requires the least amount of manual effort or having to deal with multiple exports and re-importing of data for classification, categorization, and error reconciliation purposes.

The only thing I can say would be nice is a little more direction during the transaction review process. Some suggestions for reconciling transaction information would be helpful as we had hundreds of transactions flagged dating back to 2020. My experience went something like this:

Crypto Tax Calculator: Hey, remember that ETH transaction for $3.27 on October 2nd, 2020?

Me: No? What about it?

Crypto Tax Calculator: Well, there’s something wrong with it.

Me: Okay… What’s wrong with it, and what should I do?

Crypto Tax Calculator: …

Me:…?

I guess I can’t expect too much as I am essentially asking a software to give me tax advice, but being directed to some common problems or common ways to reconcile the issues would be appreciated. This also isn’t a complaint specific to this software but pretty much all tax software functions in a similar manner.

I should also point out the above scenario happened when loading 4+ years of tax data into the platform at one time with tens of thousands of transactions to sort. Proper procedure from responsible hodlers would be using a tax tool from day 1 and frequently checking in to make sure synchronized transactions are categorized and error-free while your recent transactions are fresh in your memory. So this is more user fault and not the software, but know that the sooner in your crypto journey you adopt a tax tool, the easier your life will be

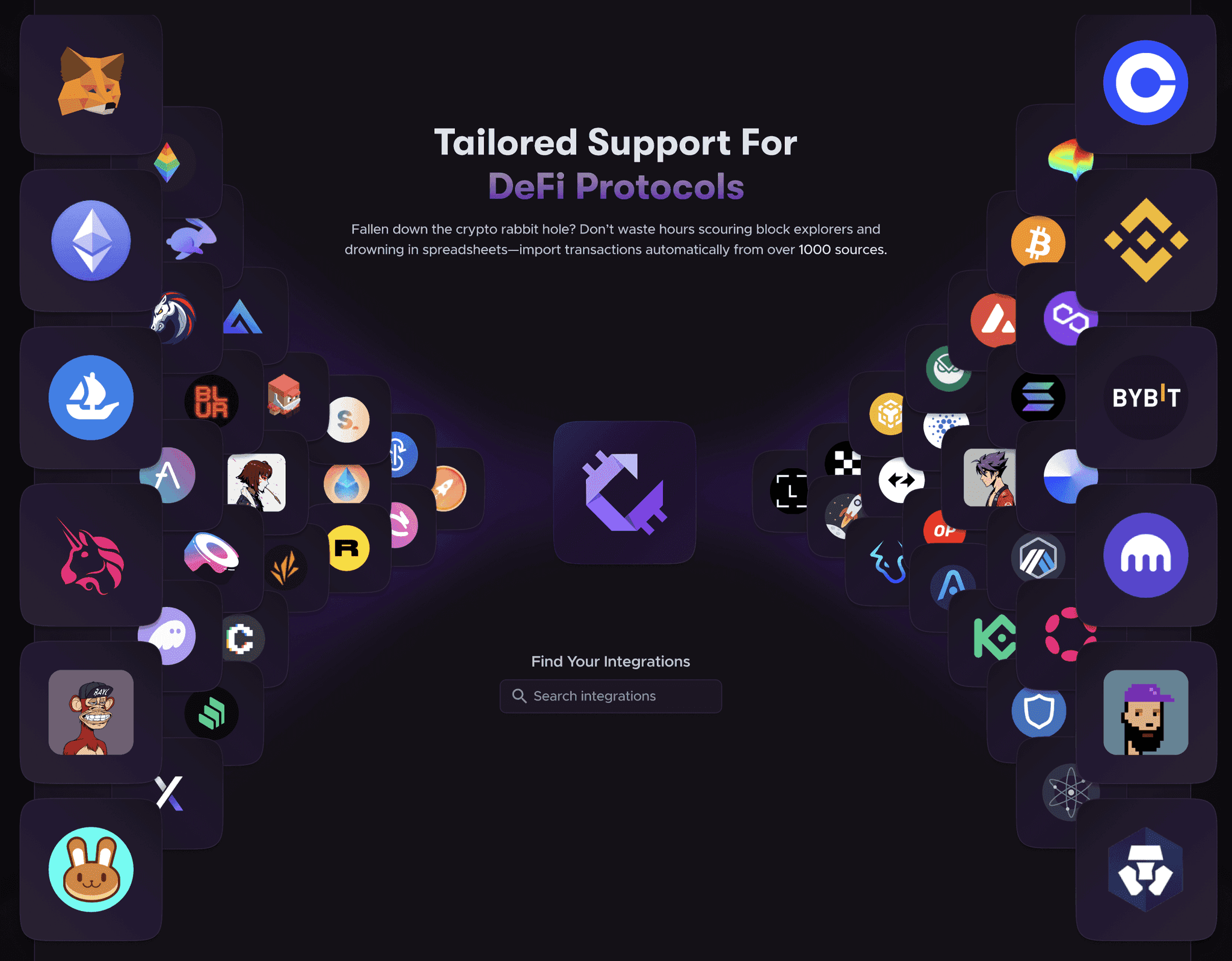

Integration with Cryptocurrency Exchanges and Wallets

Crypto Tax Calculator supports 827 protocols across 150+ chains either via direct API integration or CSV importers.

Pro Tip: Crypto tax tools often use terminology like “We Support thousands of platforms and protocols” as a marketing ploy, but over the past year we have had the chance to nerd out and test multiple tax tools and we have learned to take statements like this with a massive pinch of salt.

For starters, some tax software will say something like “We support 40,000 assets”, and then another tax platform will say “We support the Ethereum ecosystem” which is essentially the same thing. Don’t let the numbers on the homepage fool you. When deciding on a tax tool, it helps to do your research and manually search the exchanges, wallets, blockchains, and tokens that you use to make sure they are directly supported. That is one thing to bear in mind, but it gets worse.

Some tax tools will say they support x number of exchanges. What they really mean is they will give you a CSV template to download where you can manually enter your crypto transactions and upload them. Avoid this at all costs, it is a serious time waster. Especially if you use multiple platforms, exchanges and wallets. The downloaded transaction history CSV file you get from your exchange will likely not be in the same format as the template provided by the tax tool, so unless you are a spreadsheet professional, you are looking at hours, if not days, of manual work inputting the data.

I am happy to report that the above negative criticisms do not apply to Crypto Tax Calculator. We appreciate the transparency of the platform and how easily they make it to find this specific information, unlike some of those other tax tools that shall not be named.

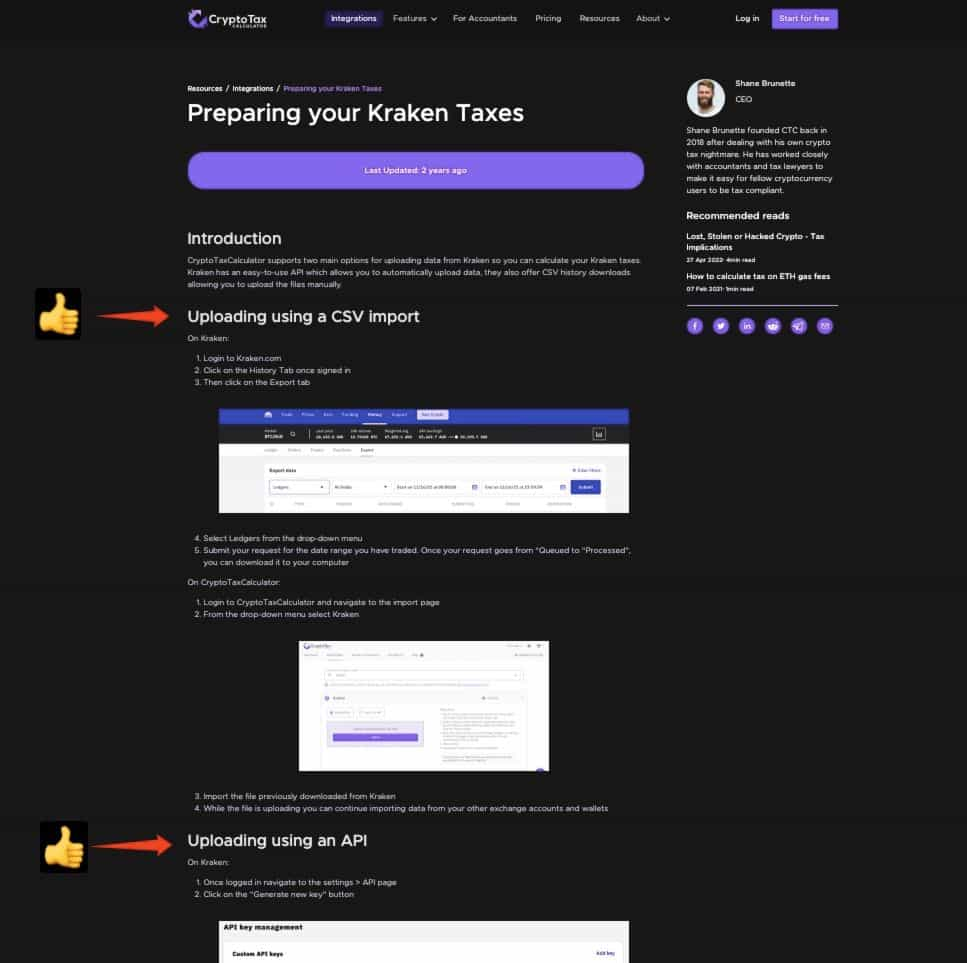

So, the key takeaway here is to find a tax tool that either directly connects to your most widely used platforms via APY or one that supports direct CSV import. Your sanity will thank you for it. Crypto Tax Calculator has an area directly on the homepage where you can search for your platforms of choice.

Simply search for the wallets, blockchains, and exchanges you use the most and look for the terms: CSV Import, and/or API and you are golden.

Crypto Tax Calculator supports:

- 600+ API Integrations

- 161 exchanges

- 265 wallets/blockchains

- 2,390 DeFi platforms/protocols

From the platforms we’ve tested, Crypto Tax Calculator is among the best for asset support, making it a good choice for those who venture into the obscure world of lesser-known wallets and DeFi platforms.

I will quickly highlight some notable exclusions. Crypto Tax Calculator does not support the Tezos, Stacks or HBAR networks on-chain (CSV import only), NEAR protocol, Filecoin, or ICP.

Real-time Portfolio Tracking

Any tax tool worth its salt should also feature a portfolio tracking tool. The portfolio tracking capabilities on Crypto Tax Calculator are quite basic, but they get the job done.

While I do enjoy the aesthetics of the portfolio tracker and it gives you all the information you need, such as:

- Balance- Shows the current market value of all your assets.

- Cost Base- Shows the total cost basis of your assets

- Unrealized Gains- Reflects your current unrealized profit or loss.

It would be nice to see the portfolio tracker provide more in-depth analysis and insights, such as the one on offer by CoinTracking that also covers things like trade statistics, balance by exchange, balance by wallet, daily balance over time, tax-privileged positions, time held, average purchase price, etc. But for the average user, the portfolio tracker that comes with a Crypto Tax Calculator account is sufficient.

DeFi Support

Crypto Tax Calculator offers comprehensive DeFi support, not only for the blue-chip DeFi protocols such as Aave and Compound, but even some surprisingly small and lesser known ones, making this a fantastic platform for DeFi enthusiasts.

One of the strengths is the cross-chain capabilities of Crypto Tax Calculator. I was more than pleasantly surprised to find when I added my Ethereum address for a wallet, the platform automatically detected and imported my EVM-compatible addresses for other networks like Avalanche, Polygon, Arbitrum, Optimism etc. For airdrop hunters or those who like to participate in different ecosystems, this turned out to be a massive time saver as it saves needing to repeat the process for every address on each network supported in your wallet of choice.

Crypto Tax Calculator also has robust transaction-type support. It is crazy in this day in age to know that there are crypto tax tools out there that only support three transaction types: Buy, Sell, Trade. That may be fine for some users, but not many of us. Crypto Tax Calculator has you covered for things like airdrops, staking, lending, liquidity providing, borrowing, fees, royalties, mining, chain splits, burns and more.

One specific strength of this platform that isn’t industry standard is that the blockchain integrations don’t stop at the blockchain level, but can also register transactions with smart-contracts and categorize them accordingly. This is massively helpful for users who interact with liquidity pools and DeFi applications.

The integration of artificial intelligence into the platform also aims to make categorizing and identifying trades a breeze.

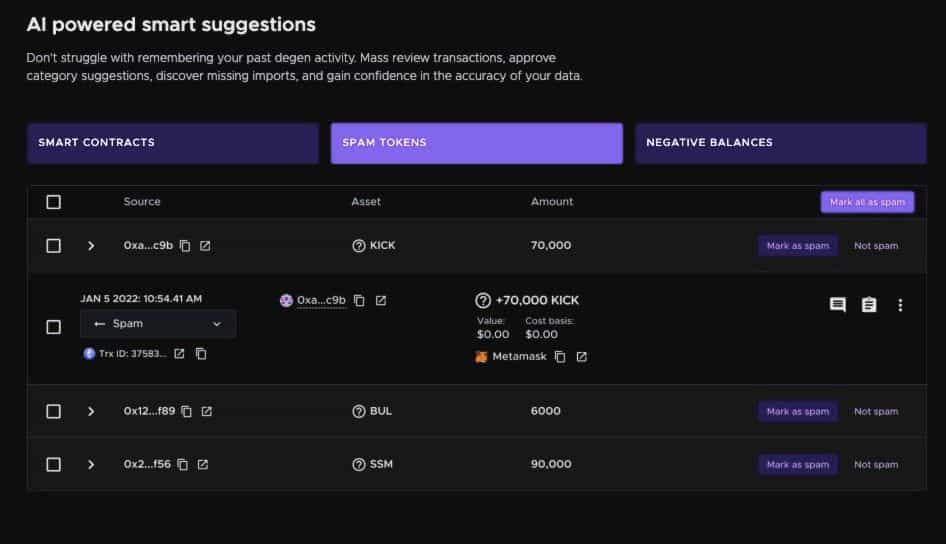

Very few crypto tax tools I’ve come across also allow you to mark transactions as spam. I don’t know who needs to hear this, but those dozens of NFTs that say you’ve just won a million dollars worth of Arbitrum and the 10,000 coins that magically appear in your wallet that are not worth anything should not be interacted with! Crypto Tax Calculator is great at identifying these as spam and categorizing them appropriately.

NFT Support

Crypto Tax Calculator also stands out as a leader when it comes to NFT support, supporting NFTs on more networks than most competitors including:

- Ethereum

- Solana

- Polygon

- Avalanche

- Cardano

- Arbitrum

As for NFT transactions, the platform supports integrations with NFT marketplaces and can handle transactions such as minting, buying, selling, and trading. Then for NFT creators, the platform can also help manage sales income and royalties with revenue tracking support.

Tax Reports

Crypto Tax Calculator allows users to create and export detailed tax reports that breakdown capital gains and income that you can share with your accountant or file yourself.

Conveniently, when you set up an account, you will choose your country and the default tax settings will be compliant with the tax authorities in your jurisdiction. In the US, for example, Crypto Tax Calculator generates tax reports that are compliant with the IRS with forms 8949 and 1040.

For inventory methods, the following are supported:

- First in First Out

- Last in First Out

- Highest in First Out

- Average Cost

- Most Tax Effective

The platform also allows you to generate reports for previous tax years at no additional cost, something not offered with every tax software.

Tax reports can be generated in CSV files or PDF, and in the United States, users can export directly to popular tax software platforms such as TurboTax for easy filing.

The following report types are available for download:

- Report Summary

- Capital Gains Report

- Income Report

- Derivative Trading Report

- Transactions Report

- Inventory Report

- Miscellaneous Expense Report

- Trading Stock Report

For Accountants

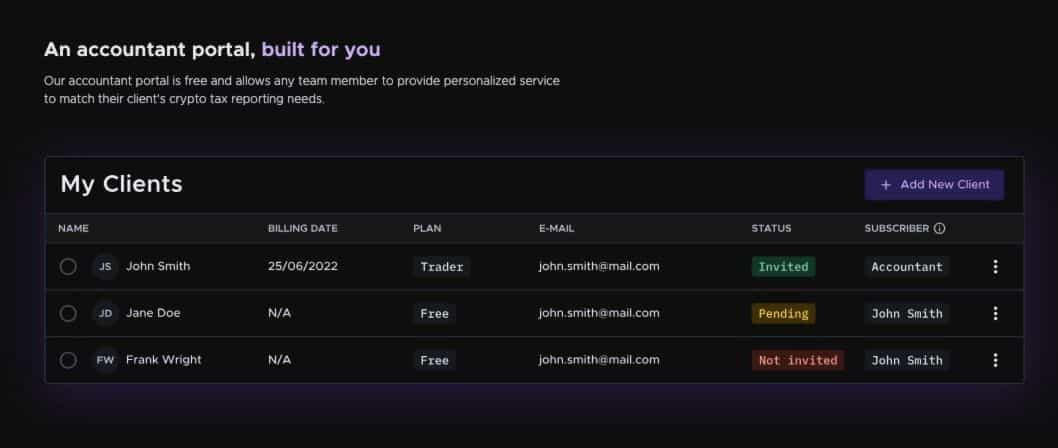

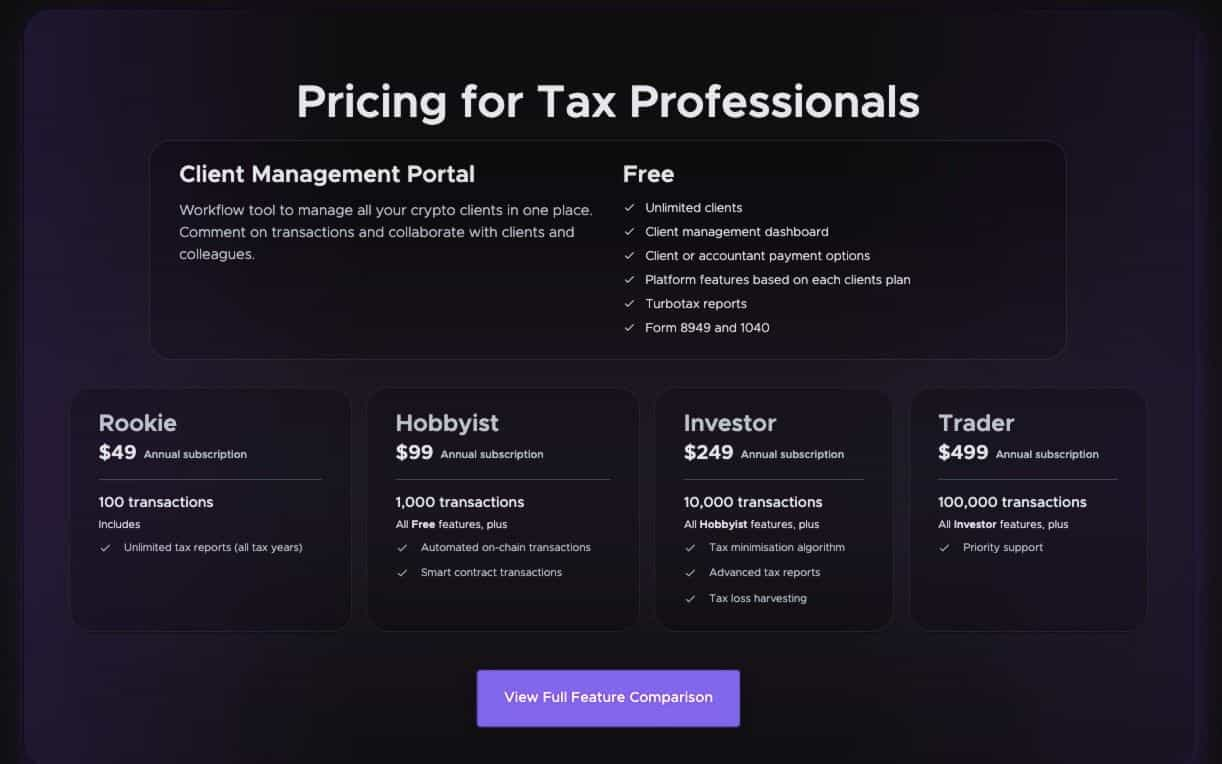

Certified accountants need accurate and compliant tax tools to manage their client’s taxation needs and Crypto Tax Calculator has plenty to offer not just individuals, but accountants and businesses as well.

The platform offers an accountant portal for no additional cost and allows accountants to manage their clients and provide personalized tax services for their book of business.

The tax software meticulously addresses intricate tax situations, including DeFi loans, NFTs, DEX transactions, gas fees, leveraged trading, mining, staking rewards, and more, ensuring that regardless of the complexity of a client's trading history, the tax accounting software provided by Crypto Tax Calculator will be able to help.

Here is a look at the pricing model for tax professionals:

Country Support

Crypto Tax Calculator has solid country support, with general reports available to users in over 100 countries and specific tax reports and advice available for 22 countries, including:

- USA

- Canada

- Australia

- Japan

- New Zealand

- Singapore

- Austria

- Belgium

- Germany

- Finland

- France

- Greece

- Ireland

- Italy

- Netherlands

- Norway

- Portugal

- Spain

- Sweden

- Switzerland

- United Kingdom

- South Africa

Customer Support

I was pleased and, albeit, quite surprised to find that customer support was very good on Crypto Tax Calculator. The reason I mention that I was surprised is that customer support is notorious for being terrible in the crypto industry, with major companies like Coinbase and Binance even failing to provide adequate support more often than not.

Crypto Tax Calculator offers support via live chat, accessed by a widget available on each page of the platform, meaning that help is never far away. I tested the chat function for the purpose of this review and found an agent got back to me within 1-3 hours each time. Not only was the response time fast, but the quality was great! There is nothing worse than waiting forever for a response, only to have the agent not address the issue or concern. It is good to see the support staff at Crypto Tax Calculator are both friendly and knowledgeable.

The team can also be emailed at [email protected], but I didn’t test the email response as the chat support was plenty suitable. There is also phone support for those who subscribe to the premium plan.

For the do-it-yourself type, Crypto Tax Calculator also offers a robust resource area, blog, and help center where users can find plenty of information for everything tax-related and very helpful guides such as the US Crypto Tax Guide and NFT Tax Guide

Crypto Tax Calculator Price

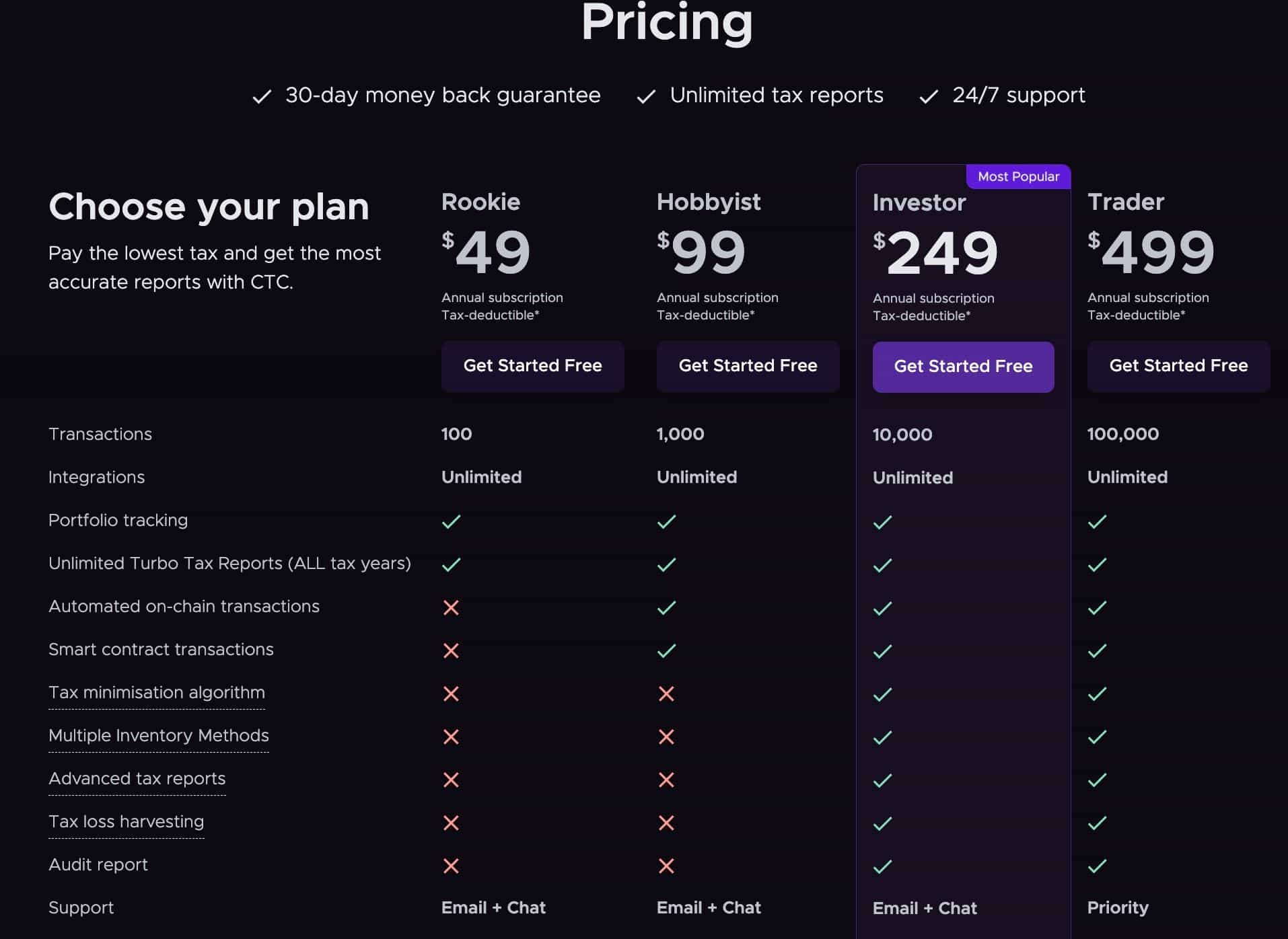

Crypto Tax Calculator offers a free-forever plan that allows users to import their transactions, utilize the smart suggestion and auto-categorization features and the portfolio tracker, but users who want to generate tax reports are going to have to pony up some cash and subscribe to an annual plan.

The plans range from $49 for up to 100 transactions to $499 for the Trader plan which supports up to 100k transactions.

Crypto Tax Calculator offers a 30-day money-back guarantee.

Pro Tip: The purchase price can be tax deductible 🤓

If you have more than 100k transactions, I recommend CoinTracking as they are, by a large margin, the lowest-priced option for users with 100k+ transactions from the platforms we’ve tested and reviewed.

If you are someone like me who spends hours of research checking out dozens of options before committing, allow me to do my best here to save you some time if you are trying to decide on the best crypto tax software for you.

Koinly and Crypto Tax Calculator are two of my favourites for sheer ease of use, making them great for the average person. I would have to give Crypto Tax Calculator the edge over Koinly for its smart categorization engine, mass import and edit options, and auto-detection features. After testing about 10 crypto tax platforms, Crypto Tax Calculator is definitely the quickest and easiest I’ve used, and with comprehensive support for transaction types, it is suitable for those knee-deep in the strange world of DeFi. This platform is also well suited for tax professionals thanks to the clients’ area where users can manage their business.

For power users or those who really want to nerd out and get into the granular details with a magnifying glass and fine-toothed comb, CoinTracking is my other top pick. I personally use both Crypto Tax Calculator and CoinTracking (definitely overkill, but I like the double-check). CoinTracking offers the best analytical and portfolio tools built into a crypto tax software I’ve seen, but it can feel quite advanced and sluggish compared to Crypto Tax Calculator.

Closing Thoughts

Not all crypto tax software is created equally, and we have tested some pretty terrible ones that I wouldn’t recommend to my worst enemy.

I was very impressed with Crypto Tax Calculator. While I wouldn’t go as far as saying I enjoyed my experience using it… As crypto tax and sorting transactions are about as exciting as watching paint dry, I did enjoy using the platform more than any other tax tool I’ve used. This was simply due to the efficiency of it. Thanks to the robust API integrations and CSV import options, the AI-enabled smart classification, categorization, error reconciliation, and auto-detection of other networks, the process was very streamlined, knocking literal hours off the time the same process takes with other tax tools.

It is also well-designed and beautifully displayed, adding some flair to the normally boring tax process.

The only areas I would like to see improved would be added functionality to the portfolio tracker, there is more that could be done here to enhance its functionality with more insights and analytics. Also, with a portfolio tracker, it's nice to have a mobile app for those of us who like to keep an eye on their portfolios on the go.

Overall, Crypto Tax Calculator is a solid tax software. It is clear to see why they have become the trusted tax tool of choice for Coinbase and tax professionals around the world. It is definitely worth testing out the free version and If you are impressed, be sure to snag a 20% discount using our Sign up link!

Disclaimer: This is a paid review, yet the opinions and viewpoints expressed by the writer are their own and were not influenced by the project team. The inclusion of this content on the Coin Bureau platform should not be interpreted as an endorsement or recommendation of the project or product being discussed. The Coin Bureau assumes no responsibility for any actions taken by readers based on the information provided within this article.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.