The single largest resource on earth is, believe it or not, humans. It's through the sheer amount of human labour that humans created the seven wonders of the world. Just look at the Sphinx in Egypt or the Great Wall in China. What lies behind the architectural splendours are the hours, days, months and years of backbreaking work by humans.

Nowadays, human labour, together with the assistance of machines, drives this world forward (or maybe backward, as some might think). While most of us have the good fortune never to be involved in the kind of backbreaking work our ancestors did, our presence and the actions taken to ensure our survival continues to be a source of energy and power to many things we create, including blockchains.

In this article, we explore how blockchains utilise us as a source of power for their existence, security and future. In exchange for what we offer, we get a reward, which we can use as we please. Sounds like a fair exchange, right? If you're interested to know more, read on!

What is Staking?

I think we are all familiar with how bank deposits work. You deposit your cash into the bank to earn interest. What you make in interest is more of what you put in, which is dollars (or whatever your local currency is called).

Staking is very similar to deposits, but there are fundamental differences. Look up the word "staking" in an online dictionary, and you'll see the following definitions:

- To risk an amount of money.

- To hold up and support something by fastening it to stakes.

Let's see if we can apply the definitions above to the bank deposit example.

While some risk is involved in putting your money in the bank, that risk has been hugely mitigated with government protection (up to a certain amount). So, are you supporting something with your deposits?

Well, in the good old days before fractional reserves, I would say, yeah, your deposits will be someone's capital in the form of a loan from the bank. Nowadays, I'm not even sure if banks even need our money to make loans. Just look at the interest rates you get from deposits!

And that's pretty much where the similarities end.

In crypto staking, you purchase tokens of the network you're interested in and either support the network directly as a validator or by lending your tokens to validators. Whichever way you decide, you will earn some rewards in the end. Staking earnings can be withdrawn for other usage or rolled back in to compound future gains.

The concept of staking is intricately tied to the concept of Proof of Stake. Staking cryptocurrencies is a way to earn yield while supporting the blockchain network. The more validators are involved, the more secure the network will be because it will be more difficult for bad actors to disrupt the workings of the blockchain.

It's also good to know that "staking" has been appropriated to mean, in essence, "give me your tokens, and I'll give you more tokens plus some extra benefits". In many DeFi protocols, users are encouraged to obtain and then stake the protocol's native token to earn more yield, but it does nothing towards supporting a blockchain. ApeCoin, Curve protocol, and PancakeSwap are just some examples where token holders are encouraged to park the protocol's native token, APE, CRV, and CAKE, back into the protocol in exchange for voting power and the chance to earn more tokens. APE and CRV are applications on the Ethereum blockchain, while CAKE is on the Binance Smart Chain. They have nothing to do with securing the Ethereum blockchain or the Binance Smart Chain and are purely for earning yield.

This article focuses on crypto staking as a means of securing the blockchain, not so much on the yield-generating part, which is a worthy topic on its own for another day.

How does Proof of Stake Consensus Work?

As you may know, distributed ledger underpins blockchain technology. Blockchain records are immutable because hundreds of copies of the ledger are spread worldwide and maintained by people. What incentivises them to do so? Tokens! How do they get the tokens? Ah well, here's where it gets interesting.

In the Proof-of-Stake consensus mechanism, aka PoS, each person or entity maintaining their copy of the ledger is known as a validator. The number of tokens they hold or stake qualifies someone to be a validator. Most protocols have a minimum threshold that needs to be met. For example, to be an ETH validator, you need 32 ETH.

Once you are a validator, you get the chance to add a block of transactions to the blockchain and earn tokens as a reward. The algorithm randomly chooses a validator. The chosen validator needs to review the transactions submitted by others to ensure they are legitimate before adding them to the blockchain.

The reason why validators need to have tokens staked is that if they are bad actors, their tokens will get confiscated, giving them an incentive to do things properly and not try to cause trouble or muck up other people's work.

Compared to Proof-of-Work, aka PoW, or the "Teacher, I'm the first person to finish my homework!" version, PoS is a lot more energy-efficient, requires less expensive infrastructure to run a node, and in most cases, are more scalable.

What can I Stake?

Nowadays, a lot of protocols operate on the PoS model. Each protocol has its native token used as the de facto currency in its ecosystem. These tokens are used to pay gas fees and as a medium of exchange for some items denominated by it. Obtaining these tokens is usually done through some centralised entity, be it an exchange or an organisation selling crypto.

These entities are the way to swap your cash for crypto. Many of them have KYC requirements as the companies are regulated by governments to prevent wrongdoing such as money laundering (although we all know where the real money laundering happens).

Here are some points to consider when choosing where to buy what could be your first crypto:

- Types of payments accepted - credit card and bank transfers are the most common.

- Fees - how much does it cost to make a purchase?

- Liquidity - how easily available is it for them to sell me the token I want? This affects the price of what I will be paying for the token.

- User-friendliness of UI - how easy is it to make a purchase without help?

- APY in case I want to stake with them - how much can I make if I decide to park my tokens with them?

It's also worth noting that in many cases, APY is highly correlated with the lock-up period of the tokens. These vary anywhere between 7 to 120 days. The longer you are willing to lock up your tokens, the higher the APY. Where you decide to stake it can also affect what you could be getting. For now, it's enough to know that the estimated APY can be one point of reference for you to consider when deciding what to buy. Later in the article, we will discuss where to stake them, which will have a greater influence on the rate you can potentially get.

In selecting the best place to buy specific crypto, some companies may have a slight advantage over others, usually in the form of APY. However, while we make recommendations on where to buy, the differences between the entities are often minimal.

Staking is like planting trees. Water it and watch it grow.

Staking is like planting trees. Water it and watch it grow.If you're interested in putting some of your cash to good use and contribute towards the health of the crypto industry in general, here's a nice big list for you to pick from. These blockchains act as the foundation of crypto, in some ways. The healthier they are, the better it is for everyone in crypto.

Quick note: Since the article was published, Kraken had a settlement with the SEC, resulting in the end of staking services for US customers.

| Crypto | Staking Market Cap | Total Market Cap | Staking Ratio | Estimated APY | Best Exchange to Buy |

|---|---|---|---|---|---|

| Ethereum (ETH) | $26,322,375,530 | $237,849,744,108.46 | 10.87% | 4.06% | Kraken |

| Solana (SOL) | $18,543,227,721 | $16,091,868,071.81 | 75.83% | 5.61% | Binance |

| Cardano (ADA) | $13,657,312,830 | $18,740,516,235.20 | 70.43% | 3.88% | KuCoin |

| Avalanche (AVAX) | $7,698,070,760 | $8,215,310,542.72 | 65.05% | 8.57% | Crypto.com |

| BNB Chain (BNB) | $6,025,441,565 | $51,742,618,881.26 | 83.72% | 4.84% | Binance |

| Polkadot (DOT) | $5,678,555,490 | $10,220,604,117.13 | 52.02% | 13.94% | Crypto.com |

| Tron (TRX) | $2,942,075,867 | $6,389,378,459.26 | 45.79% | 3.5% | Kraken |

| Cosmos (ATOM) | $2,283,813,623 | $3,322,137,679.95 | 65.48% | 17.82% | Kraken |

| NEAR Protocol (NEAR) | $2,381,273,796 | $4,183,020,303.51 | 39.39% | 10.57% | Binance |

| Internet Computer (ICP) | $2,889,133,729 | $1,986,807,793.77 | 75.57% | 8% | Binance |

| Polygon (MATIC) | $2,545,434,516 | $7,209,754,706.72 | 32.47% | 3.65% | Kraken |

| Flow (FLOW) | $2,049,258,842 | $2,888,407,302.02 | 53.34% | 8.31% | Kraken |

| Tezos (XTZ) | $1,252,016,714 | $1,624,167,347.34 | 74.63% | 2.76% | Binance |

| Algorand (ALGO) | $2,236,455,836 | $2,477,439,243.61 | 84.7% | 7.43% | Crypto.com |

| Elrond (eGLD) | $823,149,483 | $1,402,804,358.67 | 58.42% | 10.3% | Binance |

| Cronos (CRO) | $595,505,483 | $3,819,094,223.41 | 15.48% | 14.75% | Crypto.com |

| Mina (MINA) | $809,990,954 | $510,229,892.82 | 99.14% | 11.46% | Kraken |

| Curve DAO Token (CRV) | $772,848,604 | $529,532,012 | 108.49% | 0.72% | Swissborg |

| Axie Infinity (AXS) | $545,641,506 | $1,655,839,175.94 | 23.36% | 62.38% | Binance |

| Eos (EOS) | $459,607,254 | $1,287,418,938.41 | 3.54% | 33.27% | Binance |

| Kusama (KSM) | $381,631,577 | $517,056,537.19 | 52.21% | 13.54% | Kraken |

| The Graph (GRT) | $373,360,687 | $1,002,648,634.64 | 26.08% | 128.15% | Binance |

| Fantom | $482,975,931 | $781,057,930.54 | 49.89% | 4.3% | KuCoin |

Source: stakingrewards.com

How to Choose a Staking Coin

With so many blockchains out there, all clamouring for your support, how do you know which one to choose? Well, let's take some of the following into consideration:

Project-related Factors

- Mission/purpose - does what they do align with what you believe in or support?

- People - Who is the team? What have they done previously? Why do this project? Any VC backers (this is a double-edged sword depending on your viewpoints on VC participation)? The number of validators? Community support strength?

- Quality - how long has it been around? Any negative news surrounding it (You'd need to be able to tell the actual news from FUD)? Were audits done?

Token-related Factors

- Stakers vs everyone else - how many holders are also stakers? Strength of its staking community?

- Unlock periods and minimums - what is the minimum required, and how long do you need to stake it for?

- Rewards - what can you get and why?

Based on the factors above, try ordering them by the level of importance that works for you. This would help greatly in making decisions when many other things are equal or similar.

As a starting point, here is a brief description of the projects mentioned in the chart above. We hope that you will be able to draw up an initial interest list. Click on the headers to find out more about the projects you're keen on. Our rating for the project will also be based on the factors discussed.

Blockchain projects

Ethereum (ETH)

APY: 4.06%

Where to Stake: Kraken (custodial), Lido, Rocketpool (can get liquidity in the form of stEth or rETH).

Where to Buy: Kraken

Ethereum, conceived by Vitalik Buterin, is the blockchain known for popularising the usage of smart contracts and bringing it to a wider audience. Ethereum used to share the PoW consensus mechanism used by Bitcoin but moved to the Proof-of-Stake concept, known as The Merge, in 2022, allowing for Ethereum staking. One needs 32 ETH minimum to become a validator for the network. ETH tokens are used to pay for gas fees, and it is one of the most widely-used cryptocurrencies after Bitcoin due to the popularity of NFTs and DeFi, denominated mostly in ETH.

Coinbureau rating: 9/10

Solana (SOL)

APY: 5.61%

Where to Stake: Solflare (non-custodial), Marinade Finance (obtain mSOL for liquidity), Binance (custodial)

Where to Buy: Binance

Commonly known as an "ETH Killer", the Solana blockchain is one of the fastest blockchains in the crypto space, with 1000 - 2000 transactions per second (TPS). It is a healthy ecosystem with loads of dApps created on the blockchain. However, it has suffered criticism for being too centralised, with VCs having a significant say in the project. It is also known for outages that have happened a bit too frequently for critics' liking. While there is no rigid minimum on the number of SOL tokens, voting to participate in the consensus may require up to 1.1 SOL per day. SOL is used as the native currency on the blockchain. Its thriving NFT marketplace Magic Eden also helps boost the token's popularity.

Coin Bureau rating: 7/10

Cardano (ADA)

APY: 3.88%

Where to Stake: Kraken, Yoroi wallet

Where to Buy: KuCoin

This blockchain has been around since 2015, founded by Charles Hoskinson, one of the Ethereum cohort in its early days. Despite being one of the earliest blockchains, its peer-review approach takes things much slower than most. Like Solana, there is no minimum to get started as a validator. One interesting point is that the staking pools are capped. Once saturation level is reached, you will be advised to move to another pool to continue obtaining rewards. Currently, it has one of the highest amounts of staked tokens among other PoS blockchains. ADA is the native currency of the Cardano ecosystem.

Coin Bureau rating: 8/10

Avalanche (AVAX)

APY: 8.57%

Where to Stake: Ledger (non-custodial) / Crypto.com, Binance (custodial)

Where to Buy: Crypto.com

Billing itself as the fastest blockchain in crypto, Avalanche is a decentralised and programmable smart contracts platform for building dApps. The throughput for the chain is around 4500 tps and has thousands of validators. It features three chains in its infrastructure, one of which, Platform Chain (P-Chain), is where the staking and validating occur. 2000 AVAX is required to become a validator with a minimum lock-up period of 2 weeks and a maximum period of 1 year. AVAX is the native currency of the blockchain.

Coin Bureau rating: 7/10

BNB Chain (BNB)

APY: 4.84%

Where to Stake: Binance, PancakeSwap (DeX)

Where to Buy: Binance

The Binance Chain (BEP2) is the settlement layer blockchain created by Binance. The chain uses a copy of the Ethereum source code to get started and has since undergone its own development. Later, the Binance Smart Chain (BEP20) was created to be the chain that executes smart contracts, enabling dApps to be built on it. Binance is the first exchange to operate its own blockchain. Needless to say, these are centralised to the hilt. However, it enjoys a certain level of popularity due to the low fees and huge selection of dApps available. BNB is the native currency of the blockchain. BEP20 is its version of the ERC20 tokens. BNB can also be staked/swapped in various DeFi protocols with other BEP20 tokens based on the blockchain.

Coin Bureau rating: 8/10

Polkadot (DOT)

APY: 13.94%

Where to Stake: Polkadot.js wallet (non-custodial), Crypto.com (custodial)

Where to Buy: Crypto.com

Positioning itself as the "layer 0" of blockchains, Polkadot's mission is to be the underlying security layer for blockchains built in its ecosystem. Its focus is on providing the best infrastructure capability to other blockchain operators. It pioneered the concept of parachain auction slots. A total of 100 slots are available for blockchains to bid for in an auction. Success in winning the slot means gaining access to Polkadot for the security end. These blockchains are free to expend resources to do what they're good at. DOT tokens are staked by these projects to gain the slot. Once successful, these tokens are locked for up to 96 weeks.

Coin Bureau rating: 8/10

Tron (TRX)

APY: 3.5%

Where to Stake: Ledger (non-custodial), Kraken (custodial)

Where to Buy: Kraken

Tron is a blockchain aimed at decentralising the creation and distribution of content, drawing upon the pain points well-known in social media platforms. By removing intermediaries, artists and content creators can promote and sell their content via a secure peer-to-peer platform. This network also features a number of crypto assets used on its blockchain, including BTT, JST and a TRC20 version of USDT. With low fees and fast transaction speeds (up to 2000 per second), USDT (TRC20) is the most popular option for users using stablecoins. 27 Super Candidate Representatives, selected by TRX holders, get to add blocks to the blockchain. You can start with 1 TRX to become a node and be voted a Super Candidate, or add 9,999 TRX to become one.

Coin Bureau rating: 6/10

Cosmos (ATOM)

APY: 17.82%

Where to Stake: Ledger, Keplr (non-custodial), Kraken (custodial)

Where to Buy: Kraken

Billing itself as "the Internet of Blockchains", Cosmos has a similar structure to Polkadot in being a kind of layer 0 blockchain. The Cosmos SDK is a tool used to create blockchains used by many projects such as Secret Network, a privacy-based blockchain, Terra etc. Some of these projects join the Cosmos Hub, where they can interoperate. ATOM is the currency used by these blockchains when interacting with the Cosmos ecosystem. If staking with a validator, please note that the unbonding process takes up to 3 weeks. During this time, the tokens may be slashed if the validator acts in an undue manner.

Coin Bureau rating: 8/10

NEAR Protocol (NEAR)

APY: 10.57%

Where to Stake: Ledger (non-custodial), Binance (custodial)

Where to Buy: Binance

The NEAR protocol allows developers to build decentralised apps without worrying about the cost and complexity of running the blockchain. Built using Adaptive Proof-of-Stake (APoS), it is secure and scalable. In addition to being used for paying gas fees, the NEAR token can also be used in the governance process. Currently, there are only 100 validators on the network. Therefore, the cost of becoming one is based on the 100th seat with a minimum of 67,000 NEAR tokens.

Coin Bureau rating: 6/10

Internet Computer (ICP)

APY: 8%

Where to Stake: Network Nervous System wallet (NNS) (non-custodial), Binance (custodial)

Where to Buy: Binance

The central idea of ICP is to build a decentralised version of Google or Amazon Cloud, made possible by having hundreds of independent data centers join together to form an alternative. Originally known as Dfinity, the ICP network can run all the applications accessible by traditional Internet standards such as DNS (Domain Name Server). The ICP token is used for governance, as payment for network fees and for rewards. Staking directly on the platform via an NNS wallet, developed by Dfinity, can take anywhere from 6 weeks to a maximum of 8 years.

Coin Bureau rating: 6/10

Polygon (MATIC)

APY: 3.86%

Where to Stake: Metamask (non-custodial), Kraken (custodial)

Where to Buy: Kraken

Polygon is a Layer 2 blockchain on top of the Ethereum network. It was created to resolve Ethereum's scalability issue, allowing for faster transactions and (much) cheaper gas fees on the Ethereum network. One of the most significant developments in the network is the launch of zkEVM (zero-knowledge Ethereum Virtual Machine). This technology allows EVMs to generate zero-knowledge proofs to ensure the security of transactions. Another big piece of news concerning Polygon is its inclusion in the Disney Accelerator program. It is one of 6 companies selected to develop AR, AI, and NFT experiences. MATIC is the native token of the network and is currently one of the top staked tokens in the industry.

Coin Bureau rating: 8/10

Flow (FLOW)

APY: 8.31%

Where to Stake: Ledger, P2P Validator (non-custodial), Kraken (custodial)

Where to Buy: Kraken

Flow is a blockchain purposely built to support NFTS and large-scale crypto games. Created by Dapper Labs, Flow is home to the NBA Top Shots NFT series. It is also known for supporting more alternative NFT artists in its NFT marketplace known as Viv3. Dapper has aggressively scored partnerships with well-known brands such as Dr Seuss, CNN, UFC, Samsung and Warner Music Group. Expect to see NFTs released by them appearing in the Flow blockchain. Stake FLOW by delegating them to a node. You can expect a weekly payout due to an epoch being one week long. Node operators collect an 8% fee.

Coin Bureau rating: 7/10

Tezos (XTZ)

APY: 2.76%

Where to Stake: Ledger, Guarda (non-custodial), Binance (custodial)

Where to Buy: Binance

The main defining feature for Tezos compared to other blockchain projects was the avoidance of a hard fork if any changes were to occur to the blockchain. These changes, voted on by the XTZ token holders, can instead be upgraded using a self-amending ledger system. In other words, it's the blockchain that can upgrade itself. The process of validating the network is known as baking, with a minimum of 8000 XTZ in a roll.

Coin Bureau rating: 6/10

Algorand (ALGO)

APY: 7.43%

Where to Stake: Ledger, Pera wallet (non-custodial), Binance (custodial)

Where to Buy: Crypto.com

Algorand was created to solve the blockchain trilemma of security, scalability and decentralisation. It uses the Pure Proof-of-Stake consensus mechanism, where only two-thirds of a consensus from the validators for transactions to be approved and processed. Chainalysis, a well-known data analytics company used to monitor on-chain activity, has partnered with Algorand to offer its services on their blockchain. A minimum of 1 ALGO is needed to participate in node activity.

Note that in 2022, Algorand staking changed to include governance with additional governance rewards being rewarded for stakers who commit their ALGO for 3 months.

Algorand is one of the most advanced and promising layer one protocols ever created. You can learn more about it in our Algorand review.

Coin Bureau rating: 7/10

Elrond (eGLD)

APY: 10.3%

Where to Stake: Elrond wallet (non-custodial), Binance (custodial)

Where to Buy: Binance

Elrond is one of the blockchain projects offering a way to resolve Ethereum's scalability issue. What differentiates it from the rest of the pack is its technology called Adaptive State Sharding and Secure Proof-of-Stake. Instead of a single chain, the network is made up of shards that broadcast processed transactions onto the metachain. Every 24 hours, nodes that validate transactions get reshuffled into new shards, like musical chairs, preventing collusion amongst the nodes. Each node requires a minimum of 2500 EGLD staked in the network.

Coin Bureau rating: 6/10

Cronos (CRO)

APY: 14.75%

Where to Stake: Crypto.org DeFi wallet (non-custodial), Crypto.com exchange (custodial)

Where to Buy: Crypto.com

Cronos is a blockchain built by Crypto.com, a centralised exchange platform that aims to copy the Binance playbook. The blockchain was created using the Cosmos SDK and is compatible with both Cosmos and Ethereum. It's also the first EVM on the Cosmos chain. This means that Ethereum-based applications can work on the Cosmos network. This is not to be confused with the Crypto.org blockchain, also by Crypto.com but is a settlement layer chain. Cronos is the one with the smart contract capability. This setup is similar to Binance's Binance Chain (BEP2) and Binance Smart Chain (BEP20).

The CRO token is the native token powering the blockchain. It is also used by Crypto.com for fees discount on its trading platform, earning more when lending it on the platform, and receiving higher cashback CRO rewards for those who are also Crypto.com cardholders.

Coin Bureau rating: 8/10

Mina (MINA)

APY: 11.46%

Where to Stake: Auro wallet (non-custodial), Kraken (custodial)

Where to Buy: Kraken

Mina protocol was designed to address the problem of blockchain storage. As the size of the blockchain grows, it becomes harder for anyone to be a validator as the amount of space required to store the ledgers are ever-increasing. With this protocol, even handheld devices like smartphones can participate in becoming a full node operator as the protocol only requires a few KB of data.

Coin Bureau rating: 6/10

Curve DAO Token (CRV)

APY: 0.72%

Where to Stake: Curve DAO platform, Convex Finance (get cvxCRV for liquidity)

Where to Buy: Swissborg

Curve DAO is the native token of Curve Finance, a decentralised exchange known for providing liquidity through varieties of stablecoins. Liquidity providers get CRV, which is staked to obtain veCRV. These are the voting tokens coveted by many DeFi protocols because the token holders can vote on extra CRV rewards for the liquidity pools in addition to the yield earned. Unfortunately, the lock-up period can be up to 4 years, which is a long time not to have access to the tokens. Other DeFi protocols, such as Convex Finance, entice holders to stake with them and give them cvxCRV tokens that can be used to participate in other DeFi protocols, thus unlocking the liquidity of the staked tokens.

Coin Bureau rating: 7/10

Axie Infinity (AXS)

APY: 62.38%

Where to Stake: Ronin wallet (non-custodial), Binance (custodial)

Where to Buy: Binance

Axie Infinity, built on the Ethereum network, is the first blockchain game to transform the gaming NFT arena in the crypto verse successfully. Users buy an NFT called an Axie, which can be trained and developed to fight other Axies in battles, gaining rewards that can be used to trade for cash later. Its popularity was instrumental in firing the first shot announcing the arrival of the play-to-earn movement. The movement's success also spawned other xxx-to-earn schemes such as Move-to-earn, Wear-to-earn etc. AXS is the in-game currency used that can be exchanged for ETH. It is also the governance token for the ecosystem.

Coin Bureau rating: 5/10

Eos (EOS)

APY: 33.27%

Where to Stake: InfStones (non-custodial), KuCoin, Binance (custodial)

Where to Buy: Binance

What makes EOS stand out from the other blockchains is its goal to have an operating systems-style of a blockchain, making it easier for developers to build their dApps on the chain. EOS.io is the core operating system that controls the EOS blockchain using the Delegated Proof-of-Stake (DPos) consensus mechanism. This involves a bunch of "official" Block Producers voted by token holders and another group on standby in case any official ones aren't online or up to some funny business. Currently, no minimum number of EOS tokens is required to be a block producer.

Coin Bureau rating: 7/10

Kusama (KSM)

APY: 13.54%

Where to Stake: Polkadot.js wallet (non-custodial), Kraken (custodial)

Where to Buy: Kraken

Starting as a clone of sorts of Polkadot, Kusama is the canary network for Polkadot. Innovative dApps and ideas are first put to the test in this live sandbox to get real-world feedback. Once the revisions have been made, the stabilised version of the dApp will be launched on Polkadot, where more emphasis is put on security instead of speed. Many parachain projects launched on the Polkadot ecosystem follow the live/canary setup. KSM is the native currency for securing the network and paying transaction fees. 50 KSM is needed to be included in the Thousand Validator programme. Otherwise, 1KSM is enough to get started as a validator.

Coin Bureau rating: 6/10

The Graph (GRT)

APY: 128.15%

Where to Stake: Metamask (non-custodial), Binance (custodial)

Where to Buy: Binance

First conceived to be a kind of Google of blockchain data for users, The Graph is a blockchain project that aggregates and analyses the data collected from blockchains and stores them in indices known as Subgraphs. This information is provided to applications querying the network. Indexers and delegators are the ones providing this service on the network. Curators are developers who assess the quality of the subgraphs and submit those they believe are good to the network, together with GRT tokens to support the submission. Being an Indexer needs 100k GRT to start with, no minimum for Curators, and delegators are the ones who park their tokens with Indexers.

Coin Bureau rating: 7/10

Fantom (FTM)

APY: 4.3%

Where to Stake: Metamask (via Stader - non-custodial), KuCoin, Binance (custodial)

Where to Buy: KuCoin

Fantom is one of the blockchain networks from the "ETH Killer" class that aims to resolve Ethereum's scalability problem. It uses a mechanism known as the Lachesis protocol to secure its network. The mainnet, known as Opera, is EVM-compatible, thus making it possible to interact with Ethereum. It also integrated with the Binance Chain, thus expanding its users through cross-traffic with both chains. FTM is the native token used on the Opera mainnet to power the ecosystem. There are also ERC20 and BEP20 versions of the token on their respective chains. 500,000 FTM are required to be a validator, but you can participate in the staking for much less.

Coin Bureau rating: 7/10

How to Choose a Staking Provider

Now that you've chosen what to buy and where to buy it, the next most important thing to consider is who to stake them with. The first thing to consider is how much responsibility you want to bear for the security of your funds. There are two options available for consideration.

Custodial staking

The user is in charge of their funds at all times. You interact with a platform, most likely a DeFi protocol that offers staking services; connect your Web3 or cold wallet to the platform and stake through them. While you temporarily may not have access to your funds during this period, they still belong to you 100%.

Non-custodial staking

The user has relinquished ownership of the funds to the platform they're staking. This option primarily concerns a centralised entity like an exchange, for example. To participate in the entity's staking activity, the user must deposit funds. If anything were to happen to the entity, the funds would effectively be lost.

If you are prone to forgetting things, the second option might be better because once you've picked a solid platform, you can pretty much set and almost forget. On the other hand, if you prefer to have 100% control at all times, the first option is a no-brainer.

Regardless of which option you go for, the following points are all things to consider when picking a staking platform:

Security

What kind of security measures do they have in place? How often are the entity/smart contracts audited? Have there been any hacks in the past? How long has the platform been around? Since everything in crypto moves at a blazingly-fast pace, longevity matters. Platforms that withstood the test of time are better equipped to face new challenges ahead, of which there will be many.

People

What kind of reputation does the platform's founder have in the industry? Have they been involved in previous projects, or is this a new venture? How did the previous projects fare if involved previously?

Platform's Reputation

What does the crypto community think about this platform? Aside from the platform's official social channels, general forums like Twitter or Reddit are also good places to find out. If there are any reviews of the platform, study those reviews. Gauge the feedback on the review websites to see the mix of people posting a review. Only good or bad or both?

All that Glitters is not Gold

This is especially true when it comes to high APY yields, especially the ridiculously-high ones. Let's think about this: Why is someone offering high yields? Because they want your tokens, whether it's the staking provider or the network offering the yield. Why do they want the tokens? To secure the network, yes, but they may also want the money for something else, like reinvestment etc. If it's a rugpull project, they'd want to accumulate as many tokens as possible before they scoot and run. So this is also something to keep in mind.

Pay attention to the T&Cs

Frequently, it's easy to stake, but there might be a few hurdles to overcome when unstaking. This is because there are things like a cooling-down period where your funds might be in limbo because they're not staked but not fully in your possession yet. Other things to note could be the minimum amount to stake and, of course, how rewards are calculated. Reading the fine print here will undoubtedly save you a lot of unnecessary anxiety in the future.

Benefits of Crypto Staking

Crypto projects are heavily reliant on the network effect. The more users using it, the better it is for everyone. The same reasoning goes for having as many validators as possible to secure the blockchain. When you stake with a validator, you are contributing toward the security of the blockchain, which is a great contribution by itself. Plus, you can make money doing it, so it's a win-win situation for everyone.

It's also an excellent way to diversify your investment portfolio. If you have mainly stocks, bonds and some assets, having a bit of it in crypto in the form of staking is a good hedge. If things go terrible, you didn't lose much, but at least you tried. If things go well, you could stand to gain a tidy sum. You can get started with a small amount of money, so the entry barrier is relatively low.

Staking cryptocurrencies also gives you some skin in the game, at least when it comes to the crypto universe. From doing your own research to selecting a protocol to stake with and then keeping up with the news and developments of the protocol, it ceases to be just news that doesn't concern you to the news you're interested in. This is how I define "having skin in the game". To truly see what kind of fruit is borne, it should involve a longer timeframe, like a year or more.

Risks of Crypto Staking

Where money is concerned, care should always be exercised. The risks involved in crypto staking are the total of the dangers of each touchpoint in the crypto staking process. These include the blockchain project itself (is this a viable project?), the validators or entities you stake with (how secure are they with your funds?), the method of custody you choose, and how the tokens are stored.

Another risk factor is the token itself. While it is locked up, you have no access to it. During this period, the token's price may fall to the point where it's much less than what you paid for it in the first place. If this is money you don't need in a hurry, this shouldn't matter. Otherwise, you might not be able to sell them in time. When this happens, I like to think of it as forced savings if it's something you can afford.

Some pertinent questions include:

- If I buy the tokens of this project, will the price go to zero one day? The answer for this should be as far away from zero as possible.

- If I stake with this validator, will the validator be a bad actor and have all the funds confiscated? If I stake with this platform and anything happens to it, will I lose all my money? The answer to these questions should be at least "not likely/highly unlikely".

Where to Stake

Staking pools

I think of these as a kind of crowdfunding service initiated by the validators. Aside from needing to collect the minimum number of tokens to be one, the more tokens the validators hold, the higher their chances are of being able to add transactions to the blockchain and collect rewards. If you join one of these pools, you will be able to get a share of the reward, usually proportional to your contribution to the pool total. Interaction with these pools typically requires that you have your own wallets, so it is mainly custodial.

Centralised Exchanges

These are off-the-bat non-custodial options. You are required to entrust your tokens to them, thereby relinquishing ownership of them in exchange for taking care of everything on their end and sharing the rewards with you. There might also be a bit of a time lag between the rewards being distributed on the blockchain and them crediting your account with the rewards.

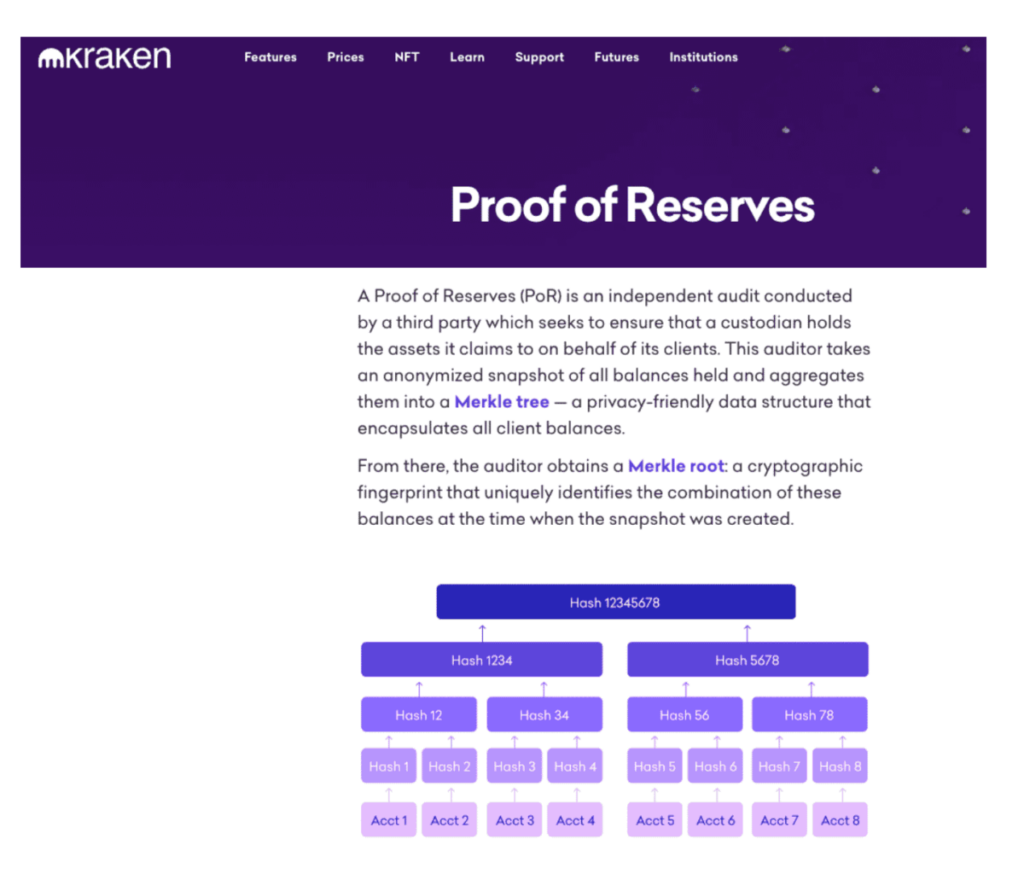

The first thing to consider is security. From that point of view alone, it is worth considering major exchanges that are highly incentivised to do a good job in ensuring the safety of funds. One of these exchanges, Kraken, has taken funds security to a different level than other exchanges by introducing the Proof-of-Reserves concept to selected tokens. It is a pity that they are unable to offer their staking services to US clients due to a recent settlement with the SEC in Feb 2023.

This involves an independent audit done by a third party that verifies the funds held by the exchange are, in fact, there. You can find out more about this from their website. It was first applied towards Bitcoin and Ethereum held in the exchange in December last year. Since then, Kraken has extended it to include USDT, USDC, XRP, ADA and DOT.

Proof that your tokens are safe with the exchange. Image via Kraken

Proof that your tokens are safe with the exchange. Image via KrakenStaking-as-a-Service

There's a lot of work involved in being a validator. For example, you need to ensure you have 100% uptime, not do things that cause your tokens to be slashed, and there's usually a level of technicality involved that would baffle most of the general public who is not IT-savvy. However, there is a lot of capital out there waiting to be put to work, so staking-as-a-service became a matter-of-course development in the crypto revolution.

In a nutshell, it is an organisation offering to help you get into the staking game without worrying about the technicalities of being a validator. Centralised exchanges are an example of Staking as-a-Service (SaaS), but other organisations are also offering these services. Not all SaaS are custodial. There are non-custodial ones too. In the chart below, we will look at a few of them to give you an idea of what's out there. Note that with the non-custodial ones, you would likely be asked to get a wallet compatible with the network you want to stake in. Feel free to refer to the wallets mentioned above in the asset description section.

Staked value (30-day) | Users (30-day) | Custody Type | Top Asset | Fees |

| P2P Validator | $446.51 million | 18,000 | Non-custodial | SOL, ATOM |

| Stakefish | $796.83 million | 86,142 | Non-custodial | ATOM, SOL |

| Chorus One | $274.39 million | 42.029 | Non-custodial | ATOM, MINA |

| Staking Facilities | $294.29 million | 4,658 | Non-custodial | SOL, ATOM |

| Launchnodes | $1.76 million | NA | Non-custodial | ETH |

| HashQuark | $274.14 million | 2,197 | Non-custodial | BNB, MATIC |

| Stakin | $411.02 million | 31,425 | Non-custodial | MATIC, SOL |

| All Nodes | $1.78 billion | 90,912 | Non-custodial | AVAX, MATIC |

| Binance Staking | $1.8 billion | 107,000 | Custodial | ADA, ETH |

| InfStones | $1.76 billion | 33,106 | Non-Custodial | ETH, EOS |

| Kraken | $1.78 billion | 1,282 | Custodial | ETH, SOL |

| Everstake | $1.2 billion | 582,000 | Non-custodial | SOL, ATOM |

| Staked | $884.01 million | 20,861 | Non-custodial | ETH, TRX |

| Swissborg | $327.93 million | 229,000 | Custodial | ETH, BNB |

| Guarda Wallet | $520.42 million | 6,433 | Non-custodial | ETH, TRX |

| MathWallet | $217.98 million | 222 | Non-custodial | BNB, ATOM |

| RockX | $43.57 million | 1,292 | Non-custodial | ATOM |

Conclusion

By now, having made it to the end of this article, I hope you have at least a general idea of what is staking, its importance to the crypto industry and how you can play a role in helping its growth. Perhaps you might even have a small list tucked at the back of a notebook or pocket as to which ones you'd like to burrow in further. Some of the questions provided are food for thought, and it's perfectly ok to take your time answering them or that your answers change as you continue to evaluate which blockchain you want to support.

Each of the protocols listed has its merits in the crypto industry, so they are all worth some consideration. Good luck on your exciting journey to becoming part of the burgeoning community of stakers supporting the industry!

Disclaimer: I stake SOL, DOT, KSM on Kraken and ADA on Yoroi.