No, Your Blockchain Startup Doesn’t Need a $20 Million ICO

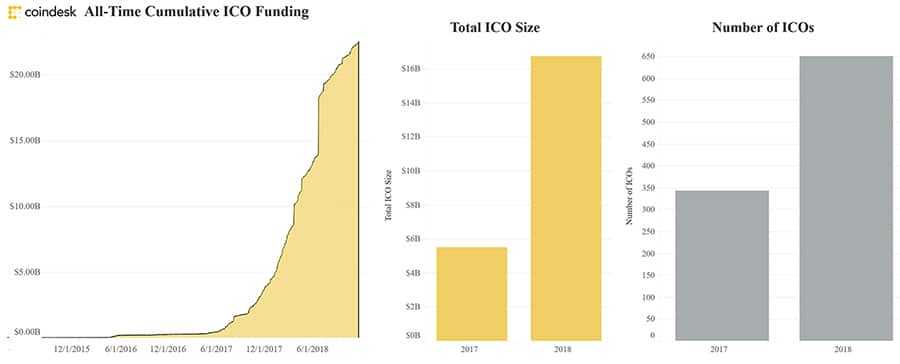

Twenty billion dollars...

That’s the amount raised by initial coin offerings (ICOs). In under two years, no less. It’s a golden period during which companies that ran successful ICOs raised, on average, $23.9 million. Not bad for seed funding – just ask any founder who’s ever gone hand out to investors.

On the surface, all this money may seem like a blessing. Think of the new offices, top tier talent, and deep marketing budgets.

But more money isn’t necessarily a good thing when it comes to startups. Especially when the team behind the startup is little more than a whitepaper, website and a vision, and lacks experience managing funds and scaling a company.

In this post, I’ll look at the perils of too much funding too soon. I should know. It’s what almost cost me my previous startup.

ICO Mania

Since J.R. Willet conceived ICOs in 2012, around 800 companies have successfully deployed the model to bring in $20 billion at an average of $23.9 million. It’s been a heady time, no doubt. Money flowed, crypto wallets bulged.

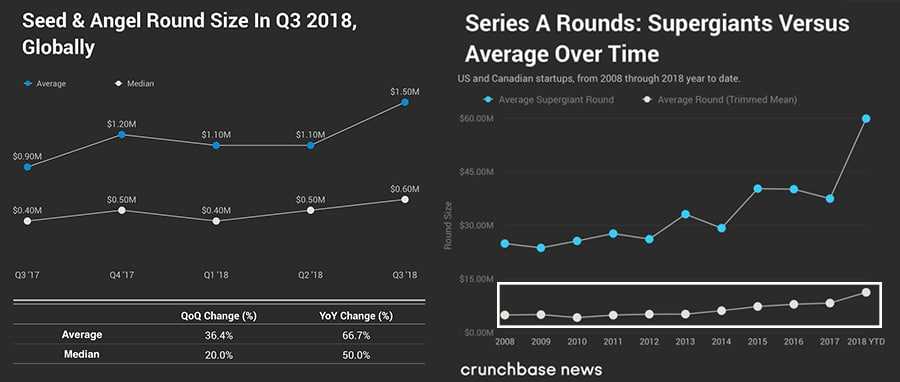

Now, compare these numbers to the traditional VC funding world. A world I’ve lived for the past 10 years as a CEO in Silicon Valley. In the mainstream tech industry, the average seed funding for a startup is $1.5 million and the average Series A raise is $11.3 million.

If we consider ICOs somewhere in between seed and Series A rounds – ignoring their uniqueness and peculiarities – they raise on average almost 16 times more than the former and two times the latter.

You Need More Than Facebook, Uber and Amazon Did? Right…

To get even more specific in the comparison between mainstream VC and ICO funding, it’s valuable to look at the fundraising histories of some of the most successful tech companies of our time.

To get going, Facebook took on $500k seed funding, on its way to a $400 billion-plus market cap. Uber, now being valued at $120 billion, took $200k of founder seed plus $1.2m in angel pre-series A. Amazon, at times the most valuable company in the world, took just $1 million in seed funding.

Compare these modest figures with the astronomical amounts being raked in by ICOs and it’s easy to see something doesn’t add up.

Yes, there are huge, sometimes crazy figures and valuations thrown around in the VC world ($100 million juicer, anyone?) but these commonly have some connection with reality and company performance. Where most ICOs do not. Instead, hype, promise and FOMO are the guiding investment principles. And this is where much of the problem lies.

But We Need The Money...

I hear different reasons all the time on why ICOs need more money than their traditional counterparts. Some of these are valid. Expensive blockchain developers and nascent technology, for instance.

Most justifications, however, just further illustrate how backwards things are in the blockchain world. Often, huge budgets are not being spent on product development or on customer acquisition but, rather, on things like high-priced exchange listings and exorbitant pay-to-play media.

Where to spend the money is the bigger picture here. The idea that capping spending in certain areas drives focus where it really matters.

An example of this is legendary investor Peter Thiel’s policy on startup CEO salaries. Thiel insists that the CEO of companies he invests in is paid less than $150,000. This, he believes, keeps CEOs focused on building and making company equity worth more.

Where’s the Utility?

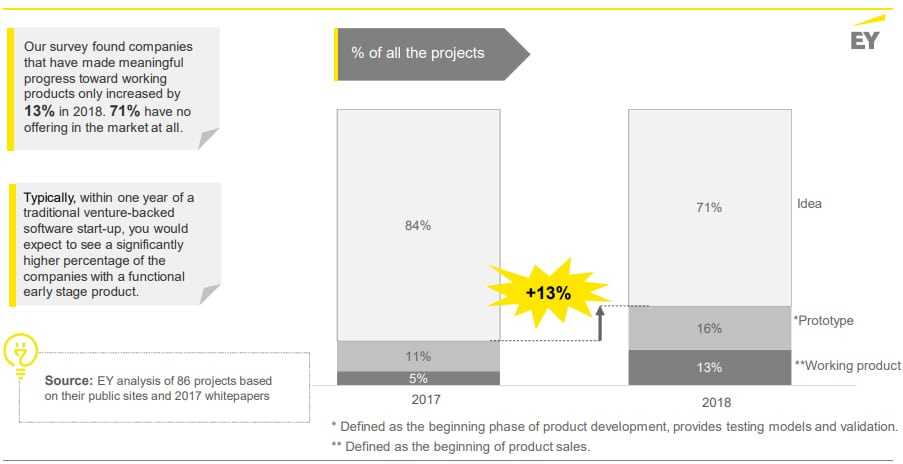

Let’s put it starkly: few ICO companies that filled their pockets had, at the time of their raise, demonstrated utility, let alone a working product -- even if only an MVP. For some, it wouldn’t be hard to argue against the need for blockchain and decentralization altogether.

Ernst & Young reports 71% of ICO projects lack a working product or a prototype. It’s also been revealed only one in 10 digital tokens issued in ICOs has a utility following their sale. This no-utility phenomenon has created a strange paradox where “the hottest ICOs are the ones that have done the least amount of work”.

It’s a rare event that a VC will invest $20 million-plus in an idea that’s not left paper. And unheard of that this first up funding would reach the $100 million levels some ICOs rake in.

Sure, some of this lack of development can be put down to the emergent stage of blockchain technology. But that’s only an explanation at scale. For the ambitions of most blockchain startups, there’s nothing standing in the way of an MVP or some semblance of utility. Certainly not the need for $20 million, anyway.

This combination of outsized funding and a lack of working product is a dangerous combination.

I’ll explain why...

The Perils of Too Much Too Soon

Even in the mainstream VC world, the track record of companies that raise huge amounts of money as their first round is not good. As Y-Combinator President Sam Altman says: “The culture gets messed up".

Some notable examples are Color and Clinkle.

Color, a photo-sharing app, raised a first round of $41 million in 2011 without a single user, biting the dust a year later without a product ever materializing.

It was a similar tale for Clinkle. The startup raised $25 million in 2012 with no product – the largest seed round in Silicon Valley at the time. Clinkle eventually released a stripped back product two years later, and were out of business not long later.

You’ll Spend What You’ve Got

Color and Clinkle are two examples that should be cautionary to those seeking ICO riches. They’re part of the startup truism that you will spend what you raise in the same time frames regardless of what you raise.

Contractors, more staff, events, lavish offices, they all become within reach. But it doesn’t make them necessary. They become temptations that can make raising millions early on counterproductive.

With money to burn, it’s easy to drift away from the tried and tested "Lean Startup” theory. A method that makes startups more resourceful and instills the ability to build, measure and learn without over-investment which can be blinding.

Many of the founders entrusted with the multimillion-dollar ICOs bounties have never had to manage this kind of money. Often simply developers and engineers, financial control and treasury management are forgotten amidst lines of code.

At times, it’s like giving a teenager the keys to a Ferrari: it’ll be a fast, wild ride but there’s a good chance it’ll end in a wreck.

How Do I Know? I’m a Founder Who Took Too Much…

I founded my first company Humanity.com (formerly ShiftPlanning.com) in 2009.

As a startup, we incrementally took on funding. A seed of $150,000 to start. Then $200,000 as traction grew. Before eventually raising $3 million over the next three years in gradually increasing amounts on as-needed basis.

Then it came. An investment of $9 million. Triple what we had received to date.

At the time, we had millions in revenue, growing consistently month-on-month, great unit economics and a solid foundational team. But, to borrow from Sam Altman, it made our culture a mess.

We became less agile. The funds blinded us in many places. We made bigger bets and let them run for longer even if they were losers. Finding ways to be scrappy turned into finding ways to spend.

In short, our team and processes weren’t truly ready to scale in line with the $9 million windfall.

Basically we – and by that, as the CEO, I mean me – let the funds change our culture and move us away from what made us great in the first place.

Even though we were a living company with thousands of customers, strong growth and revenue – not just a whitepaper and a vision – too much funding hampered us at the time. We needed money to grow the company; but only an amount actually fit for our needs.

This critical fundraising and financial management balance is what faces many ICOs. And with an average of $23 million, less traction and experience, the stakes are even higher. That’s why when to take funding is just as important as how much.

The Timing’s Gotta Be Right

Taking funding can be opportune for many reasons. It can draw funding away from competitors, allow you to raise when times are good, and permit you to make proactive moves or bets. But all these reasons become moot unless your team is truly ready for the funding.

At Humanity, we corrected our culture and reigned in our spending. Now, after 10 years in business, the company has more than one million users and is in the offices of companies like Lyft, CNN and Nike. But this experience – along with the state of the ICO landscape – has been telling for my blockchain startup WorkChain.io.

When it comes to raising funds, it can be hard to resist. Whether it’s the outstretched arm of a VC with a check in hand, or millions of dollars from a crowd of thousands of crypto fanatics.

I’ve come to learn that it’s about raising the right amount at the right time. Taking on only what your company truly needs and is ready for – which takes a mix of acumen and honest assessment. Because, even defining “real” needs, in the context of lofty, world-changing visions can in of itself be a challenge.

Is the Market Even Ready?

Blockchain companies, particularly those who’ve walked the ICO path, have another timing question to ask themselves. Is the market even ready for what they’re building?

As Salil Deshpande, managing director at Bain Capital Ventures, points out:

Full decentralization is happening a lot slower than we think. A lot of these projects are too early to market, and they’ve already spent too much because they’re getting the timing wrong

It’s a tricky balance. But also a strong sign for all of us in the blockchain industry to put the focus squarely on the technology, utility and mainstream adoption, because throwing more money at $25,000 YouTube reviews is not going to help the market mature.

In fact, we are only handicapping ourselves and the industry with wild ICOs and overspending in an inflated market. The result of which has been 86% of ICOs losing value and 10% of funds raised disappearing altogether.

This unchecked ICO climate is hurting the next wave of projects -- and blockchain itself -- who will find it increasingly harder to access capital as trust diminishes.

Why Less is More

So why are we doing things differently at WorkChain.io? In part because of my experience with my previous company. In part because of the fate of the 1000 of ICO companies already dead, or burning through ICO funds.

We’ve built a working product with $250,000 in seed funding. Some suggested we were foolish -- and still do -- to not capitalize on the ICO gold rush when we started in early 2017. But we chose to put product first. An approach that has us selected as a blockchain TechCrunch ‘Top at Disrupt.

I don’t say this out of self-congratulation. Instead, to make a point: for 99% of blockchain projects it doesn’t take $20 million to build a working product.

And the money we’ll take on from here? It’ll be based on company needs as we grow and enter the next stage of business. And it will be realistic. Even by mainstream VC terms.

Selling Future Revenue

By selling tokens via an ICO with promised future utility, companies are also effectively pre-selling future revenue, giving a service for free later.

What will this mean for future cash flow and viability?

That’s something all ICO companies need to think through. Reaping bucket loads of cash up front is all well and good. But will your token model be able to sustain itself based on what you’ve promised with tokens already distributed?

Regardless of the amount of funding raised in an ICO, eventually it will run out. Research shows startup burn rate tends to happen even faster in the blockchain world.

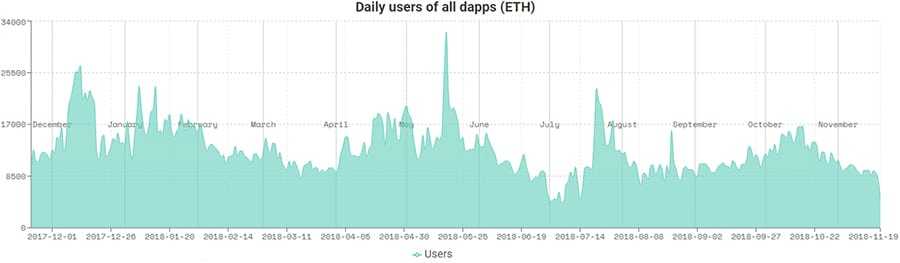

As Salil Deshpande said, decentralization happening more slowly than expected. Dapp usage hovers around 15,000 monthly active users for top apps (compared to 270 million for centralized). This makes runway and burn rate an even trickier equation for us in the blockchain space. Again, timing is everything.

Even the minority of companies with a working product can be ahead of their time and risk running out of funds before organic token or revenue economics kick in. There’s a lot to think about which is made even more difficult if you’re a first-time founder thinking about it.

It’s About Credibility

So why does it matter? Why not just say, “good on ‘em” and let ICO companies enjoy their millions? Because we’re not just talking in isolation here. It’s about the soul of the blockchain industry. Its reputation, credibility and long-term health.

Realistic fundraising – and the proper management of it – is what the blockchain industry needs to mature. It’s a real barrier to reaching its indisputable potential, shaking the skepticism, and being taken seriously outside the crypto bubble. It’s bigger than any one blockchain company – mine or yours.

Don’t get me wrong, plenty of well-managed companies raise ICOs and it has its rightful place. But even they’d admit there’s a stigma attached to ICOs. Its a product of the avalanche of companies who have failed and those who took the money and ran.

Transparency Matters

Technologically, blockchain breeds transparency. It’s one of its most pivotal traits. But, the irony is, too often the companies behind the technology lack transparency when it comes to ICO funds.

Fabian Vogelsteller, one of the developers credited with the formalizing the ERC-20 token code that birthed ICOs, has gone as far as to propose a reversible ICO or “RICO”. An idea he believes will bring much-needed transparency. A RICO would allow token investors to take back their funds at any stage in that project's lifespan.

Decentralized autonomous organizations (DAO), with their hard-coded rules, are another approach to adding transparency.

RICO and DAO are positive steps. There are also signs of steps being taken at the company level too. A great example is Aragon’s ‘Transparency Framework’ which provides transparency of funds, development and governance.

Rethinking ICOs

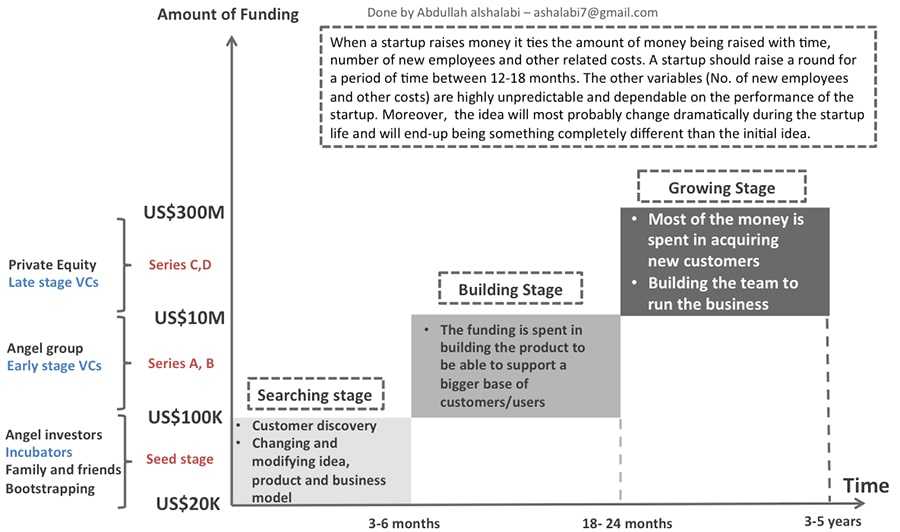

This transparency and oversight can be taken further. The ICO model needs to take a leaf out of the VC playbook, shifting to a model of staged rounds that are linked to progress. Away from the “give it to us all up front and we’ll see if we can pull it off” model to one based on progress.

As milestones are met and team capabilities are demonstrated more funding can be sought. Like a Series A, B, C and so on.

Like the tech startup world, those who fail to execute will die out, without sucking huge upfront investment out of the blockchain ecosystem. This would raise the bar in an organic way: projects that deliver more will attract more.

All This Comes From A Massive Blockchain Advocate…

Everything I say here today comes from someone who, like many others, sees the incredible potential for blockchain. More than anything, I want is to ensure its progress, perception and adoption isn’t hindered by outsized ICOs, spurned funds, and an army of scorned investors.

There are positive signs we’re trending toward maturity and realism.

Research shows blockchain projects with an MVP raised eight times more than those only at the idea stage with little more than a whitepaper and a basic team in the first part of 2018.

Blockchain companies are also increasingly migrating to more traditional, equity fundraising. CryptoKitties raising $15 million, for instance.

So why does your blockchain startup need a $20 million ICO?

The answer: it most likely doesn’t. And you could be better off with (much) less.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.