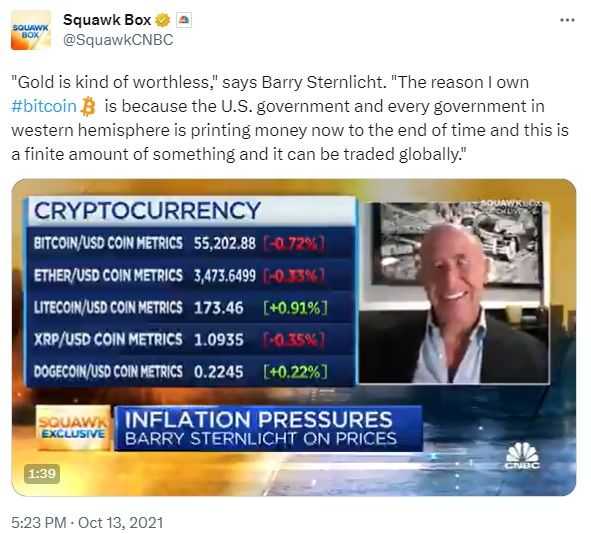

Billionaire Owns Bitcoin and Ethereum, Says ‘Gold is Kinda Worthless’

Billionaire and real estate mogul Barry Sternlicht says he owns both Bitcoin and Ethereum for multiple reasons, and he also disagrees with JPMorgan CEO Jamie Dimon who said he thought BTC was "worthless."

Speaking with CNBC, Sternlicht says that gold is arguably just as "worthless" as Bitcoin in that it only has a few but mostly trivial industrial use cases. He likes BTC sitting in his portfolio as a hedge against endless money printing by most governments.

"For me and I think Novogratz has come on your show and talked about it, it's a diversification and I think what Jamie Dimon talked about, gold is kind of worthless too and silver, I mean they have some industrial uses but they're minor. It's a store of value and the reason I own Bitcoin is because the US government and every government in the western hemisphere is printing money now to the end of time. And this is a finite amount of something, and it can be traded globally and people have fiat currencies whether it's in Nigeria... or Bolivia or wherever, you can move into something that the world has accepted as a substitute for gold."

Sternlicht, who has nearly $100 billion in assets under management at Starwood Capital, says that he thinks Bitcoin doesn't really serve that much of a purpose other than a store of value, but Ethereum serves an entire ecosystem of other coins and blockchain-based technologies.

"Since it's 18 million float of 21, I think Bitcoin... It's the biggest, it's a dumb coin, it has no real purpose other than a store of value, and it's a little crazily volatile. So Ether, which is right below it, I own some of that, that's a programmable Bitcoin, and then there are tons of other coins that are built off of that system... I've become very interested in the blockchain technology as a whole. The digital ledger is going to change everything, we're probably in inning one of the internet..."

Sternlicht's sentiments on Bitcoin and the crypto space have been echoed by other billionaires as of late. Chamath Palihapitya, CEO of Social Capital, recently said Bitcoin had effectively replaced gold, and that he thought owning multiple cryptocurrencies was a good hedge against medium-term inflation. Mark Cuban, long-time crypto bull and owner of the Dallas Mavericks, recently told CNBC that as an investment, Etheruem has the most upside potential and that Bitcoin is "better gold than gold."

Elon Musk, Mike Novogratz, Michael Saylor, Kevin O'Leary... The list of pro-crypto billionaires goes on and continues to grow. With that said, there are still many billionaires who haven't come around.

Larry Fink has been in charge of the biggest asset management on the planet for 33 years, and while he believes in the potential of blockchain technology and digitized currencies, the BlackRock CEO still admits he's in the "Jamie Dimon camp" when it comes to Bitcoin and crypto.

And of course, the Oracle of Omaha, Warren Buffett, is not a proponent of cryptocurrencies. Earlier this year he said he doesn't own any crypto, "and never will."

"Cryptocurrencies basically have no value, and they don't produce any so you can look at your little ledger item for the next 20 years and it says you've got X of this cryptocurrency or that, it doesn't reproduce, it doesn't deliver, it can't mail you a check, it can't do anything, and what you hope is that somebody else comes along and pays you more money for it later on, but then that person's got the problem. In terms of value, zero."

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.