Buy The Rumor, Sell The News? Crypto Markets Eagerly Await Bitcoin ETF Launch

Many traders prefer not to join a crowded trade, or a trade that's too "obvious." That school of thought is circulating as the first Bitcoin exchange-traded fund (ETF) goes live today, with a lot of analysts suggesting that it's a classic "buy the rumor, sell the news" situation.

Jim Cramer of CNBC's Mad Money admitted that he was taking some chips off the table ahead of the ETF rollout, selling a portion of his Ethereum (ETH) to de-risk.

“Cryptocurrencies, they’ve become unstoppable, and even as someone who likes them, I think they’ve become the definition of rank speculation, and rank is bad. You could argue they're roaring because people want insurance against inflation, but I think they're roaring because the crypto ETF is launching tomorrow and people want in ahead of time. If I'm right, then tomorrow very well could be the peak for crypto, and that's why I've sold off one eighth of my Ethereum position today. Obviously I'd sell it all if I had any confidence it was the top, but I don't..."

Image via Shutterstock

Image via Shutterstock

In their latest Blockchain letter, Dan Morehead of crypto asset management giant Pantera Capital says that while he remains bullish on Bitcoin, the hype around the ETF launch is a bit of a déjà vu from previous times. The longtime crypto veteran said he would be taking some profits this time around.

"All during 2017, the markets were rallying with the mantra ‘When the CME lists bitcoin futures, we’re GOING TO THE MOON!!!’

The markets did rally – 2,440% until **the very day** futures listed. That was the top. One of those -83% bear markets started that day.

We recently repeated that cycle. The whole industry reveled in Coinbase’s upcoming direct listing. The bitcoin market was up 822% coming into the day of the listing. Bitcoin peaked at $64,863 that day and a -53% bear market started."

Mark Yusko of Morgan Creek Digital also had a similar outlook, telling CNBC that Bitcoin was already overbought, and that a sell-the-news scenario was in play for the ETF rollout.

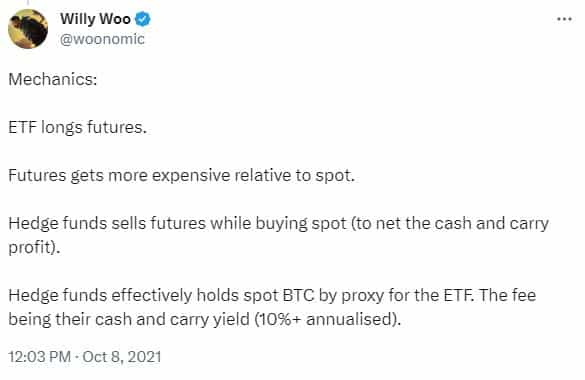

Many anaylsts, especially those in the crypto space, are less than impressed with the ProShares ETF, which will be based on futures rather than the spot price of Bitcoin. As on-chain analyst Willy Woo said earlier this month, the ETF will be an “expensive way to hold BTC.”

But with so many analysts expecting a dip following the ETF launch, perhaps that idea has now become the crowded trade they were trying to avoid in the first place. One pseudonymous trader popular on Twitter named "Light" says that the ETF is more of a buy-the-rumor, buy-the-news situation instead.

"shorted CME launch in 17, shorted Coinbase listing in 2021

take it from my experience, it's not a sell the news event when a large part of the market is worried it may be a sell the news event"

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.