Bitcoin is down over 40% from its all-time highs following hints from the Federal Reserve that it may raise interest rates to combat surging inflation.

According to the Fed’s minutes from its December meeting, “expectations for a reduction in policy accommodation shifted forward notably” among participants, and that rate hikes may end up coming sooner than expected.

The minutes stated:

“Participants generally noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.

Some participants also noted that it could be appropriate to begin to reduce the size of the Federal Reserve’s balance sheet relatively soon after beginning to raise the federal funds rate. Some participants judged that a less accommodative future stance of policy would likely be warranted and that the Committee should convey a strong commitment to address elevated inflation pressures.”

As co-founder and former CEO of BitMEX Arthur Hayes put it, “the money printer ain't going BRRR” anymore.

Based on the likelihood of rising interest rates hurting future cash flows, Hayes says the Fed’s policy is a “setup for a severe washout,” adding that he thinks speculators and investors will end up having to dump “or severely reduce their crypto holdings.”

“I do not doubt that the faithful diamond hands will continue to accumulate as prices plummet. However, in the very short term, this dry powder will not be able to prevent a calamitous fall in prices at the margin.”

Image via Shutterstock

Image via Shutterstock

On the flip side, some analysts point out that markets tend to have a delayed reaction to Fed rate hikes, and that an imminent crash of the crypto and stock bull market may not be a reality for quite some time after the initial raising of rates.

As veteran crypto analyst Jordan Lindsay of JCL Capital says,

"Raising rates and quantitative tightening do not cause a stock market crash for some time.

Last round it took 4 and 2 years respectively. That’s four years after rate hike cycle began and two after QT [quantitative tightening]...

Expect volatility around time of hike but markets to continue risk on for some time afterwards.”

If Lindsay is correct, a rate hike in 2022 may not negate the possibility of a cycle peak in the springtime that many other analysts have been projecting for a long time. However, for the time being, Bitcoin is still in a downtrend and most altcoins are well over 50% down from their highs.

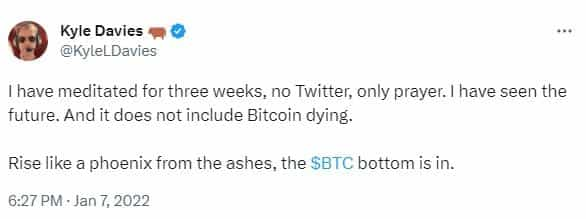

Kyle Davies, co-founder of billion-dollar crypto hedge fund Three Arrows Capital, is also laid back as Bitcoin threatens to break $40,000.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.