Payment processing companies play an important in facilitating secure financial transactions across various industries.

These companies serve as intermediaries between merchants and consumers aka you, enabling seamless transfer of funds while ensuring adherence to security protocols. As the backbone of the modern payments ecosystem, payment processors streamline transactions and mitigate risks.

With digital currencies fast becoming viable alternatives to traditional fiat currencies, there was a need for a crypto payments processor. Enter BitPay. By allowing merchants to accept payments in cryptocurrencies such as Bitcoin and Ethereum, BitPay seeks to capitalize on the growing demand for digital payment solutions.

In this BitPay review, we'll touch on everything you need to know about this crypto payments processor.

BitPay Review Summary:

Founded in 2011 and based in Atlanta, Georgia, Bitpay is a blockchain payment processing company that provides mobile checkout services to companies looking to accept crypto payments.

The Key Features of BitPay Are:

- BitPay Wallet

- BitPay Card

- In-built Coinbase integration to buy and sell crypto

- Support for 16 cryptocurrencies

- Multi wallet support

- Crypto conversion

What is BitPay?

Bitpay is a blockchain payment processing company. It was founded in 2011 to provide mobile checkout services to companies looking to accept crypto payments.

As of November 2011, the company had onboarded only about 100 merchants. By October 2012, however, that number had swelled to 1,100, and a whopping 10,000 by September 2013. Today, Bitpay is the leading crypto payment processor, having processed 60,204 transactions in the last 30 days and 334,486 crypto transactions over the past six months.

For business, BitPay protects from the price fluctuations of Bitcoin and other cryptocurrencies. Businesses receive the full amount they charge in dollars or euros, minus a transaction fee. Bitpay may have started as a company to process Bitcoin payments, but it has branched out to now help merchants accept several other cryptocurrencies.

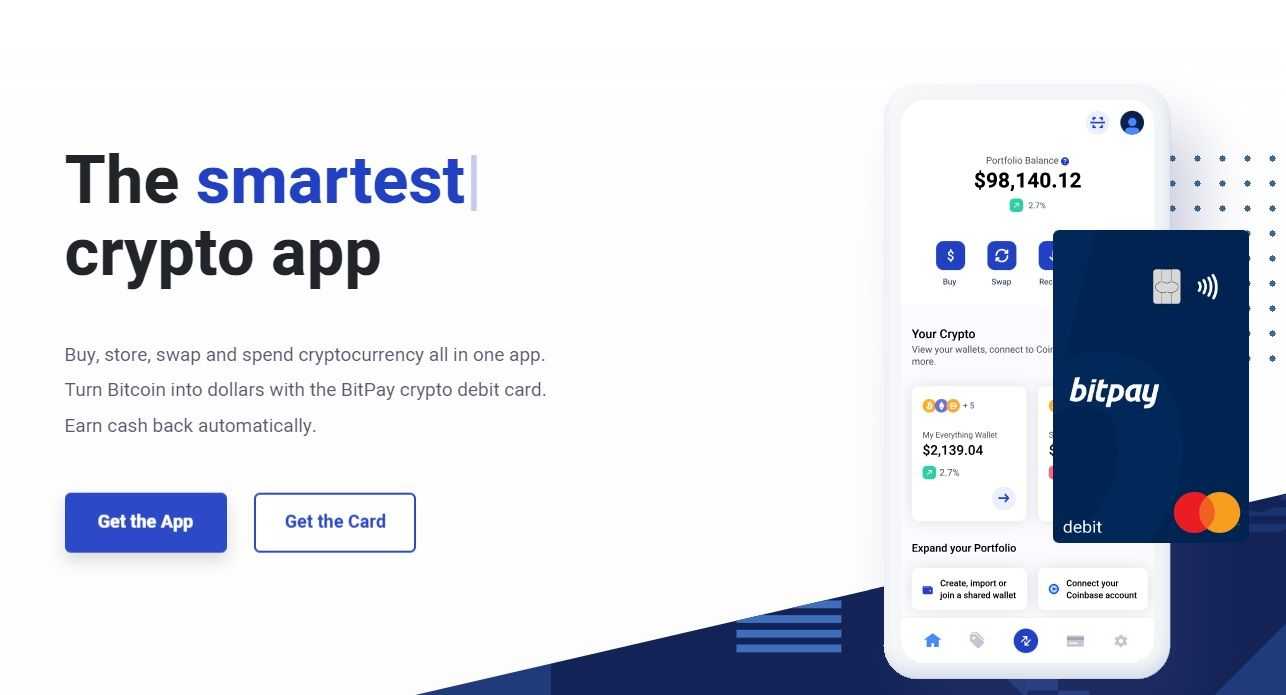

BitPay lets individuals buy over 16 cryptocurrencies. In addition to the blue chips, you can purchase meme coins like ApeCoin and Shiba Inu, and stablecoins such as USD Coin, Tether and Binance USD. But where do you park these coins? In the Bitpay Wallet, a non-custodial crypto wallet where only you have access to your private keys and assets.

The BitPay Card lets you spend your crypto like fiat currency. The Mastercard-branded card is currently not accepting new applications; otherwise, it's only available in the U.S. Users have the option to link various cryptocurrency wallets within the BitPay app, including Metamask, Trezor, Ledger and Trust Wallet, among many others.

Since its establishment in 2011, BitPay has facilitated over $5 billion in transactions. Both small businesses and major corporations opt for BitPay as their crypto payment processor. With BitPay, businesses can seamlessly accept crypto payments without exposure to risk or volatility. Its processing service is compatible with nearly all wallets.

Who Founded BitPay?

Stephen Pair and Tony Gallippi co-founded BitPay. Pair now serves as CEO, while Gallippi is executive chairman.

Chief Marketing Officer Bill Zielke, COO Jim Lester, CFO Jagruti Solanki and Chief Technology Officer Justin Langston make up the rest of the management team.

BitPay Review: Features

Here are some of BitPay's top features.

BitPay Wallet

Custodial wallets, like the ones hosted by centralized crypto exchanges, may be convenient but there are several pitfalls associated with them:

- Security Risks: Custodial wallets increase the risk of hacking.

- Dependency on Service Providers: Users have limited control over their funds since they rely on the custodial wallet provider's infrastructure and policies.

- Centralization: Custodial wallets centralize control over funds, contradicting the decentralized ethos of cryptocurrencies.

- Limited Access: Custodial wallet providers may impose restrictions on fund access, such as withdrawal limits or transaction monitoring.

- Counterparty Risk: Users face the risk of the custodial wallet provider going bankrupt, being hacked, or engaging in fraudulent activities, resulting in potential loss of funds.

None of the above applies to the Bitpay Wallet, however, because it is a non-custodial wallet.

BitPay enhances security with optional multi-signature functionality, offering an additional layer of protection for your crypto wallet. A multi-signature wallet necessitates multiple signatures to authorize a transaction, safeguarding your assets from potential threats such as theft, operating system vulnerabilities and security flaws.

For more reading pleasures, check out our guide on how to keep your crypto safe.

Assets can be transferred from any wallet or purchased directly within the BitPay Wallet app. BitPay collaborates with Simplex, Changelly, and 1inch to streamline buying and swapping processes. You can purchase cryptocurrencies using credit and debit cards without exiting the app.

BitPay Card

The BitPay Card functions similarly to a standard debit card. However, rather than drawing funds from a traditional bank account, you can load funds from either the BitPay Wallet app or your Coinbase account.

Once your card is funded, it's ready for use virtually anywhere. Whether shopping in-store or online, you can use your BitPay crypto debit card. If you require cash, you can use it at any compatible ATM. Additionally, you can add funds, freeze your card, and monitor transactions directly from the BitPay app.

It's important to note that the Bitpay Card is not a crypto credit card. Instead, it operates as a prepaid debit card. Users can fund the BitPay card through their chosen wallet within the BitPay app. Both virtual and physical versions of the BitPay Card are available to customers.

Once your BitPay Card order has been completed, you will get immediate access to the virtual card. The virtual card comes with its own distinctive 16-digit number and mirrors the balance of your physical card. Stored within your BitPay App, the virtual card ensures secure access to your funds. The virtual card provides immediate spending capabilities even before you've received your physical card.

Unfortunately, Bitpay Card is not currently taking on any new customers as the company looks to revamp the program. Also, the card is available to U.S. residents only, meaning if you're a resident of another country, you can't get your hands on the Bitpay Card ... when it restarts accepting applications, that is!

Also, check out our ranking of the best crypto debit cards.

BitPay Browser Extension

BitPay's browser extension opens up a world of possibilities for cryptocurrency users, allowing them to transact at numerous leading brands across various industries. With this extension, users can enjoy the convenience of spending their crypto holdings without the need for complex conversions or transfers.

Whether you're shopping for electronics, clothing, travel essentials, or even ordering food delivery, BitPay's browser extension provides access to a vast network of merchants who accept cryptocurrency payments. From well-known retailers to niche boutiques, the extension connects users to a diverse range of brands, ensuring that they can use their digital assets to purchase a wide array of products and services.

The extension enhances the shopping experience by providing a streamlined checkout process, enabling users to complete transactions with just a few clicks. BitPay currently supports the U.S., Canada, Brazil, Japan, India, the U.K., EU countries and sites that serve global customers.

BitPay Merchant Directory

Got all this crypto and looking to find out merchants accepting crypto payments? The BitPay Merchant Directory has got you covered.

BitPay highlights 250 retailers that accept cryptocurrency as a form of payment. Adorn yourself with jewellery, dive into the world of gaming, upgrade your ride, and stay ahead of the curve with the latest gadgets — all available for purchase with cryptocurrencies.

During checkout, opt for BitPay as your payment option. Following this, you'll be prompted to authenticate your wallet details. You can finalize the transaction just as you would with any other payment method.

Even if your preferred store doesn't currently support crypto payments directly, you can still leverage digital currencies for shopping. You can purchase gift cards through the BitPay app or extension to access a diverse range of brands.

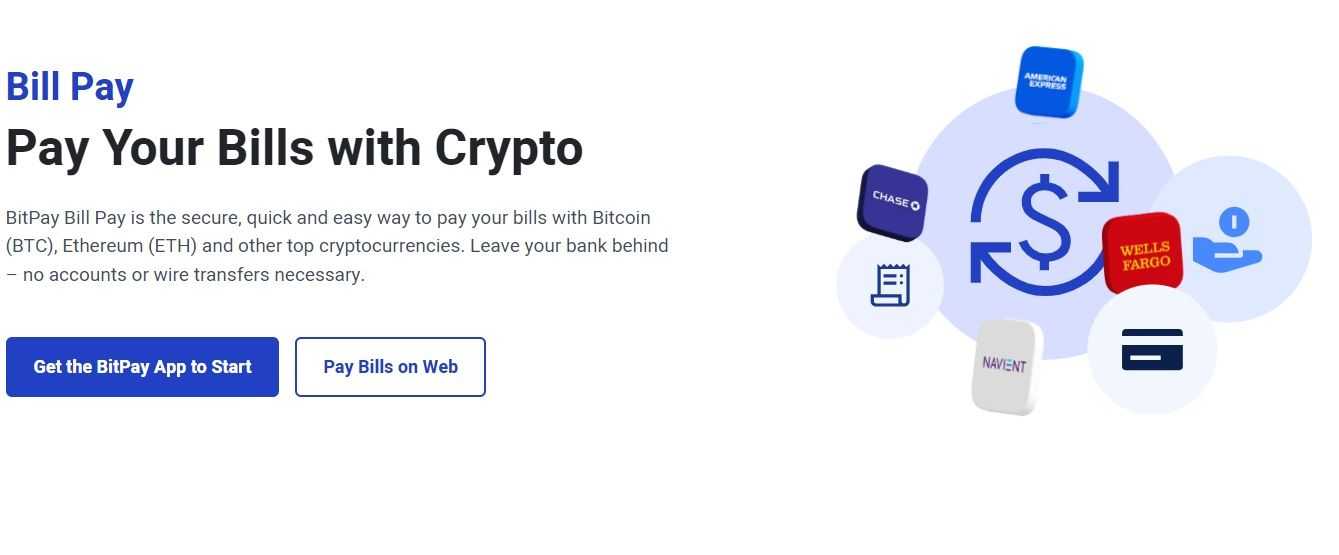

Pay Bills

Say goodbye to traditional banking hassles and wire transfers!

Whether it's credit cards, mortgages, or any other bills, you can settle them directly from your crypto wallet. BitPay streamlines the process by automatically identifying and organizing all your bills in one place, connecting them to your crypto wallet.

Here's how it works: First, BitPay locates and consolidates all your bills for easy access. Then, you can choose your preferred cryptocurrency for payment from your wallet. Finally, with just a tap, you can make payments within seconds and receive instant confirmation within the app.

If you prefer to use a different wallet app to pay your bills, simply log in to bitpay.com and access the Bill Pay tab. After connecting your bills, an invoice will be created, allowing you to make payments using your alternative wallet app.

BitPay for Business

Here are a few highlights of BitPay's offering for its business customer base.

- No Need to Handle Cryptocurrency: Receive settlements in cash without ever having to directly handle cryptocurrency.

- Eliminate Fraud Chargebacks: Enjoy the security of irreversible crypto payments, eliminating the risk of fraudulent chargebacks.

- Compatibility with Any Wallet: BitPay supports over 100 different crypto wallets and continues to expand its compatibility.

- Wide Range of Supported Coins: Choose from over 16 different cryptocurrencies, including Lightning Network payments.

- Access to a Broad Audience: Reach hundreds of millions of potential customers through various channels.

- Competitive Fees: Benefit from lower transaction fees compared to traditional credit card transactions.

- Global Accessibility: Instantly access 229 countries and territories worldwide.

BitPay Fees

BitPay does not directly buy or sell cryptocurrency. So, if you want to sell your cryptocurrency (cash your funds out), you need to do it with a third party. If you're buying and selling crypto via BitPay, you'll be charged miner fees, which is crypto given to incentivize miners (and their operators) to confirm transactions.

You can find out more in our guide to crypto network fees.

BitPay Card Fees

There are a few fees to be mindful of. For one, you will pay the BitPay network cost and/or wallet miner fee depending on the cryptocurrency you are paying with.

There are no transaction fees for using the card to pay in the U.S. When travelling outside of America, you will be on the hook for a 3% fee to cover the cost of currency conversion. There is also a $2.50 fee for ATM or cash-back withdrawals inside and outside of the U.S.

In addition, if there are 90 days of no transactions, you'll have to pay a dormancy fee of $5.00. It's important to note that your card balance will not become negative because of dormancy fees. For example, if you have $2.00 in your BitPay card account and you incur the dormancy fee, your account will only be debited $2.00, and not the full $5.00. On top of that, if you do decide to load funds onto the card again, you will not be charged the balance of the dormancy fee.

Business Customers Fees

Business customers incur fees based on their monthly transaction amounts.

For transactions totalling less than $500,000 per month, a fee of 2% plus a fixed 25¢ fee will apply. Transactions falling within the range of $500,000 to $999,999 monthly will be subject to a 1.5% fee. For customers with monthly transaction amounts of $1 million or more, the fee will be 1%.

It's important to mention that certain high-risk industries may face higher fee rates.

BitPay Security

To enhance security and prevent fraud, buyers receiving refunds of any amount are required to sign up for the personal dashboard. This process only entails providing an email address and does not necessitate identity verification beyond this.

Typically, for payments equal to or exceeding $3,000 or refunds of $1,000 or more, users must undergo additional verification by acquiring a BitPay ID. In Europe, a one-time identity verification is mandatory for purchases exceeding 1,000 euros. Business users who wish to make payments or receive refunds within these thresholds must complete ID verification as individuals.

It's important to note that verification requirements may vary by region, and in some cases, buyers may need to sign up for a BitPay ID for purchases of any value, depending on local laws and regulations.

The verification process involves providing identity verification information such as a Social Security Number for U.S. residents or a passport number for non-US residents, along with submitting a picture of an approved photo ID and a selfie.

BitPay utilizes Onfido for BitPay Dashboard ID verification, leveraging Onfido's identity verification services. When users undergo verification, Onfido collects specific information, such as an image of the user's identity document and a picture or video of their face. Onfido then verifies the authenticity of the identity document and compares the facial features in the photo or video with those in the document's photo.

BitPay Review: Closing Thoughts

With its headquarters in Atlanta, Georgia, BitPay offers a comprehensive suite of services designed to cater to the diverse needs of its users. Users benefit from features such as multi-wallet support, crypto conversion, and optional multi-signature security, ensuring the protection and accessibility of their funds.

The BitPay Card further extends the utility of cryptocurrencies by allowing users to spend their digital assets like fiat currency. Accepted anywhere Mastercard is, the BitPay Card offers flexibility and convenience for everyday transactions, whether shopping in-store or online, and provides users with the ability to withdraw cash from compatible ATMs.

However, it's essential for users to be mindful of potential fees associated with BitPay's services, including transaction fees, currency conversion fees, and dormancy fees for the BitPay Card. Additionally, compliance with identity verification requirements, especially for larger transactions or refunds, may vary depending on geographical location and regulatory guidelines.

Overall, BitPay presents a compelling option for those seeking to embrace the future of digital payments with cryptocurrencies.

Frequently Asked Questions

BitPay is a blockchain payment processing company founded in 2011. It specializes in providing services that allow businesses to accept cryptocurrency payments, making transactions easier and more accessible. BitPay offers solutions for both merchants and individuals, including payment processing services, a digital wallet, and a prepaid debit card.

BitPay employs various security measures to protect users' funds and personal information. These include optional multi-signature security, encryption protocols, and compliance with industry standards. However, like any financial service provider, BitPay is not immune to risks, and users should exercise caution and follow best practices for securing their accounts and funds.

Yes, BitPay may require Know Your Customer (KYC) verification for certain transactions or account activities. Depending on factors such as geographical location, transaction amounts, and regulatory requirements, users may be asked to provide personal information and documentation to verify their identity. KYC verification helps BitPay comply with anti-money laundering (AML) regulations and mitigate fraud and security risks.

The BitPay Wallet is a digital wallet application provided by BitPay. It allows users to securely store, send, and receive various cryptocurrencies, including Bitcoin, Ethereum, Bitcoin Cash, and more. The BitPay Wallet also supports features such as multi-wallet support, crypto conversion, and integration with the BitPay Card for spending crypto like fiat currency. Users can access the BitPay Wallet via mobile devices or web browsers, providing convenient access to their funds wherever they go.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.