Decred Explained: Everything you Need to Know about the Project

Decred, which was launched in February 2016, aims to be an open, and progressive self funding cryptocurrency that is based on community governance.

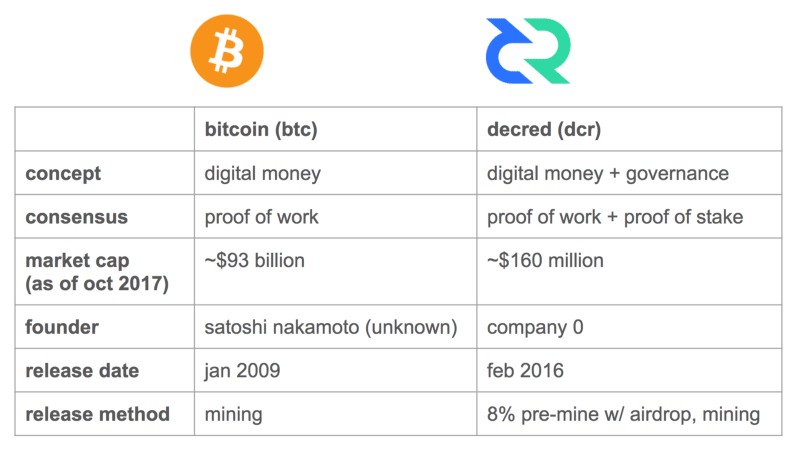

One of the most interesting aspects of the Decred cryptocurrency is how it tries to combine the notion of digital money like Bitcoin with some sort of decentralised governance. This is done through the use of different mining protocols.

Including some form of governance in protocols where the participants can vote is something that has been adopted by a number of cryptocurrencies recently. These are viewed as some of the most effective ways to avoid the disagreements we have had recently with the SegWit2X hard fork debacle the most recent example.

There have also been some other interesting developments with the Decred coin (DCR) over the past few months. Yet, before we dig into the latest news at Decred, let’s take a look at the fundamentals of the project.

What is Decred?

Decred launched the mainnet in February 2016 with the aim of creating a coin that truly embodied the decentralised ecosystem that Bitcoin was supposed to be.

This often sounds like a bit of cliche when a coin claims that they represent the true purpose of Bitcoin. However, they do have a point when it comes to the mining centralization of Bitcoin. Currently, Bitcoin is mined with through Proof-of-Work algorithms.

This basically means that the miners will try and crack complicated mathematical algorithms called hash functions using brute force computing. Some miners have been able to develop specific machines called Application Specific Integrated Circuits (ASICs).

These ASICs are able to mine Bitcoin much more efficiently through an exploitation of the SHA256 hashing algorithm. This means that those miners who have these machines are able to outcompete the other smaller miners. This leads to large and centralised mining pools.

Decred is able to counter this through a hybrid mining system that we will cover below. There are a few other unique differences between Decred and Bitcoin which include the manner in which they were released and the hashing function.

Another interesting feature that Decred has is the ability to make transactions expire after a certain period of time has passed. The user can input the expiration time that they would like prior to signing the transaction.

If the transaction has not been included after a certain number of blocks then it will automatically be rejected post that block height. This is great as it allows transactions to be cancelled if there are significant delays on the network.

Hyrbid PoS and PoW Mining

The Decred cryptocurrency uses a combination of a Proof-of-Work (PoW) and Proof-of-Stake (PoS) mining algorithm. Unlike with the PoW mining, there is no calculations or "Work" that is required in order to mine under PoS.

Decred still uses PoW mining in order to verify the transactions. However, in order to restrict mining by ASICs, the hashing algorithm used by Decred is the "blake" algorithm. This helps limit hashing power centralisation.

All that is required in a PoS model is that the participants in the network stake a certain amount of coins in order to act as the verifying nodes for the consensus algorithm. These nodes will confirm the transactions without calculating sums.

In terms of the breakdown of the rewards, 60% of the newly generated coins in Decred will go to the PoW miners, 30% will go to those that have staked the coins while the remaining 10% will go towards a development subsidy.

With Bitcoin, all of the rewards from mining the coins will go to the miner and there will be no funds left to future development of the Bitcoin protocol. We have seen this recently as work done to address Bitcoin scaling concerns has been limited.

With Decred, the developers will get paid for their work on the proposals that have been laid out in the community. This will also have to be approved by the community before the funds are released.

In terms of total coin supplies, both Bitcoin and Decred have a limited amount of coins that are set at 21 million. This means that the mining difficulty will be adjusted in a similar way to that of Bitcoin such that no more than 21 million coins can ever be mined.

Voting with Decred

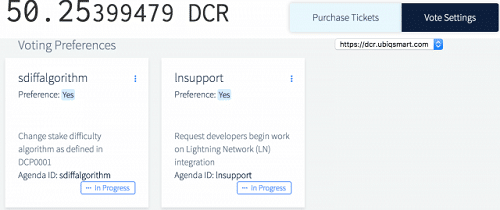

The PoS model also lends itself well beyond just the validating transactions. Those users that have staked their coins also have the benefit of being participants in any community based decisions around development.

An example of a change that was suggested for voting recently was the implementation of numerous privacy coin protocols. The team at Decred wanted include some of the anonymity features that coins like Monero had. You can see an overview of current voting here.

In other words, these users will be given voting rights to the most important development decisions that shape the technology going forward. The voting will work with users buying "tickets". These tickets will cost a certain amount of DCR.

Although you will be "paying" for these tickets, the DCR will be refundable to the holder. This means that you will still gain if the price of DCR increases. This is staking your coins to the voting which will take place within 28 days.

The proposals for future developments will be laid out and the ticket holders will have the chance to vote on these suggestions. Once you have completed your vote, you will have your DCR given back to you after 256 blocks have passed. You will then receive the ticket price back as well as the PoS reward.

Benefits for Governance

The benefit of this approach to voting is that those that have a direct stake in the price of the coin are the ones who will vote on the future of it. Hence, incentives are aligned as these users will make voting decisions which are likely to advance the price of DCR.

Many may be wondering how this is different from the Dash governance model which makes use of masternodes. Although they are both voting systems, in order to become a Masternode at Dash, you need to stake 1,000 DASH.

At the current price of DASH, this will require the user to stake over $500,000 to vote. This automatically limits a great deal of people from being able to participate in the process. It could centralise decision making to only a few large whales.

Moreover, the way in which the Decred protocol is coded, the changes that are eventually decided upon will automatically be implemented. This is unlike other voting ecosystems that will gather the votes and then implement the changes separately.

Decred Contractor Model

Given the way that the new coins are distributed throughout the community, there will always be 10% that will be set aside for development costs. This will be used in order to pay for "contractors" who work on the protocol.

This makes it different from Bitcoin that relies on the work of developers for free. Developers will get a direct stake in the cryptocurrency they are working on which also aligns the incentives. It also allows the ecosystem to be upheld by some of the smartest developers in the world.

There are currently 14 active developers at Decred and many of them are Bitcoin developers who worked on BTCsuite. They have received a great deal of praise from a number of influential voices in the community including Charlie Lee, Riccardo Spagni and Jimmy Song.

Lightning Network and Atomic Swaps

Decred is also ahead in terms of implementations of some of latest technology in the cryptocurrency space. For example, given that they work closely with the LN developers, Lightning Network support has already been included.

This will allow for off-chain payment channels to be set up between two different Decred users and will allow them to transact much more efficiently. Many also view the lightning network as the most effective solution to Bitcoin scaling.

Decred was also one the first few cryptocurrencies to complete an on-chain atomic swap. The Decred / Litecoin atmoic swap was completed in September last year and was hailed by many in the community including Charlie Lee.

Atomic swaps essentially allow two users who have different cryptocurrencies to swap these coins in a decentralised fashion over the counter (OTC). This cuts out the need for large centralised exchanges that often charge high fees.

Future of Decred

There has not been too much publicity thrown at Decred recently but this is most likely because they have prioritised development over PR. There are great deal of Altcoins that spend large amounts of money on marketing in lieu of other more important functions.

The PoS voting system will also greatly impact future developments as important decisions are taken in a decentralised and democratic nature. Users will mostly vote for those improvements that increase the value of DCR.

Whether Decred can ever really be a strong alternative to Bitcoin is not certain. As off-chain scaling is being greatly improved on the Bitcoin chain, there is more hope that transaction backlogs will be cleared and fees will drop.

However, the added benefit of Hodling Decred is that if you stake your coins for voting, you could earn a return from it. The only hope for a return on Bitcoin is through pure price appreciation.

We will keep a keen eye on the latest news that comes from the Decred team.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.