What is Dash Cryptocurrency

When it comes to cryptocurrencies, one of the original benefits that many people had touted was that it was decentralized. There was not one person or entity that controlled it. The network was spread out across a whole host of nodes and the development was done in an open source nature.

Even though decentralised networks are seen as a way to remove control from centralised forces, it does come with quite a few drawbacks. This has been on display recently with the Bitcoin network. It is the perfect example of where theory and practice play out.

The notion behind Bitcoin was that it would be governed by all of the nodes. The idea was that all important decisions about development of the network would be based on the entire community. The result has been a long and extended internal battle about the best way to grow the network and scale transactions.

As the Bitcoin debate has raged and different people have tried to serve their own interests, the congestion on the network and the cost with which transactions are taking place has continued to grow. We have also had quite a few hardforks and chain splits in the Bitcoin network.

Moreover, there has constantly been the worry that although Bitcoin is "decentralised", the miners who control a majority of the mining power can eventually get to a stage where they can overpower the majority of the network with a 51% attack.

How Dash Tries to Solve This

Dash has tried to solve this problem with the creation of two tier networks or a "2-tier node" system. On this system we have the capability for a decentralised voting system. This exists on the blockchain network and only those participants that have invested 1,000 Dash into the process can participate in it.

Dash has tried to solve this problem with the creation of two tier networks or a "2-tier node" system. On this system we have the capability for a decentralised voting system. This exists on the blockchain network and only those participants that have invested 1,000 Dash into the process can participate in it.

One of the main reasons that there is this voting system is that those parties that have staked the tokens can take part in decisions about how the monthly funding system works. This decentralised monthly funding system is built into the protocol and comes from no one person or entity.

This pool of monthly funding can be used for any purpose that participants see fit. It is always going to be available and hence the Dash organisation does not have to rely on external funding. It is governance of shared funds by the majority and for the majority.

If you would like to work on a project on the Dash network that you think will benefit the ecosystem in the long run then all you need to do is convince other participants to "vote" for your project. If it has the most votes then the Dash protocol is automatically designed to allocate the funds to the address that you have given for the project.

Obviously, those projects will need to be completely transparent and will need to be really convincing in order to get other participants to believe that it is worthy of the funding.

The monthly funds for the project also come from newly created blocks. This means that they are still limited by the defined inflation growth on the network. There are a number of different use cases for the funds but typically it will be for core development, wallets and software development.

Exponential Funding

The genius behind this funding pool for development is that as the value of the currency goes up, so too does the value in the pool. This will mean that there will be more funds available for developing the system, making it more in demand and hence increasing the price further.

This cycle of funding, demand and increasing price creates a positive incentive for the development team and those voting on the network. It encourages them to think about solutions that will improve the protocol by speeding up the network and hence further increasing demand. The result is an exponential cycle that creates value.

It also discourages any sort of bad actors to try and exploit the system for their own gain. If they did something that were to undermine the trust in the dash protocol then this would mean that their 1,000 Dash that they had invested would be at risk of decreasing in value. This also runs contrary to most centralised systems of governance where decisions made by those at the top could benefit themselves at the expense of others.

Private and Fast Transactions

Apart from the protocols which handle self funding on the network, the main goal of Dash is to function effectively as a digital cash (hence the name). Moreover, it was essential for the mass adoption of Dash that the transactions can be completed quickly and at relatively lower costs. Similarly, the Dash protocol wanted to try and incorporate the optionality to anonymise the transactions.

The Dash network is able to do this with two innovations, Instant X and Darksend Mixing

Instant X Transactions

The main goal of Instant X transactions is to solve something that is well known in Bitcoin, full blocks. When there are full blocks on the network the block confirmation time will increase. Similarly, when you have congestion on the Bitcoin network then it becomes impractical to send really small transactions.

However, Instant X transactions are able to process up to 8 confirmations in a matter of seconds. Instant X makes use of the second tier "masternode" voting protocol to provide instant consensus on the network. Given that these transactions can be cleared in such a short period of time, it is a great solution for point of sale transactions.

For example, assume that you wanted to buy a cup of coffee. You could send the Dash immediately and the vendor would receive it in seconds. They could then decide what Fiat currency they would like to receive it in at the store or to keep it in Dash. This means that they can hedge out any volatility and uncertainty in the price right there in the store.

Darksend Mixing

No doubt the choice of the name for these types of transactions does make it sound nefarious and more for the realm of the darknet. This is indeed unfortunate because it is not only those with bad intentions who would like to hide the information about their transactions. There are many people who would not like their transaction history to publically available. Indeed, if someone with bad intentions knows the size of your wallet then you do become a prime target.

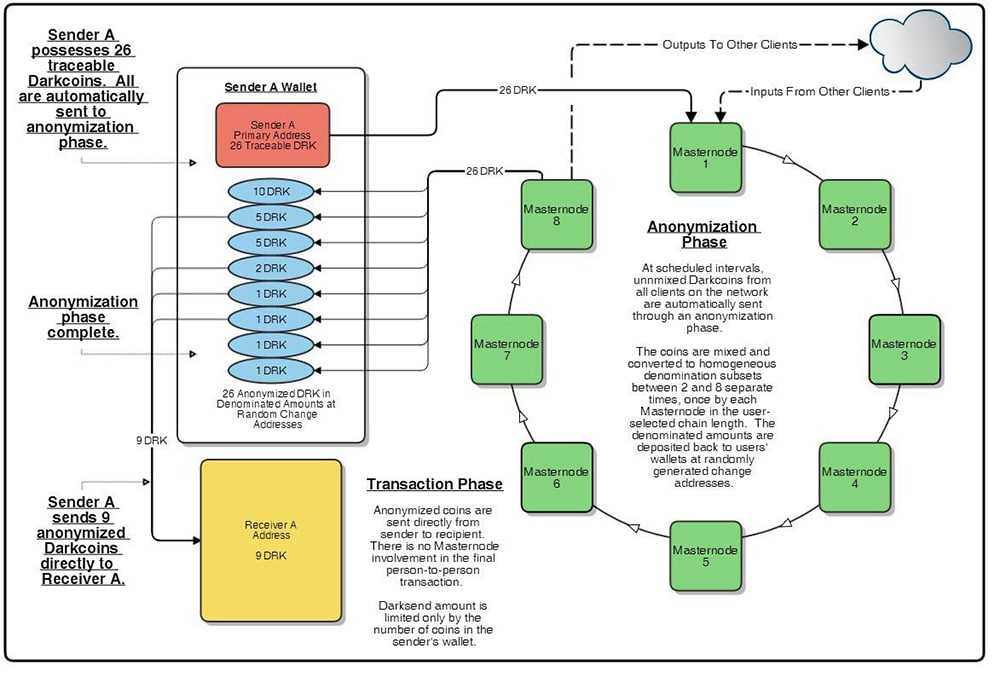

The Darksend mixing on Dash mixing does just that, it mixes your coins on the blockchain. You can elect to split a larger payment up so that it appears as though it was a collection of smaller payments. It is important to point out that this is not entirely a private cryptocurrency such as Zcash or Monero.

However, when someone does an analysis of the transactions on the Dash blockchain all that they will see is a mixture of smaller coins flowing into your wallet. They cannot see how much coins you own and have been spent. Exactly how the Darksend transactions work is presented in the below image. These were developed when Dash was originally called "Darkcoin". Its name was changed for obvious reasons.

Dash Two Tiered Node System

The only way that the Dash system can function according to this decentralised self-funding protocol is through the use of a two tier node system. The second tier or the "Masternode" network is what allows Dash to include all of these innovations.

- First Tier: This is the tier that most replicates that of Bitcoin and other blockchains. On this tier there is no ability to vote and will operate much as a normal cryptocurrency wallet. However, within this tier is functionality such as Instant X transactions and Darksend mixing. These have been embedded in the Dash network and have been well established advantages on this first tier.

- Second Tier: The second tier is known as the "Masternodes". These are the client wallets that contain the 1,000 Dash in that address and these have been locked as collateral. These will allow the contributor to vote on the decisions of the network. There are many plans afoot for the Masternode network but it is currently being used with great affect for the Darksend mixing and Instant X which we discussed above. These Masternodes are also able to vote on important decisions that affect the budget of the Dash project as well as where those self-generated funds are sent. Apart from being able to take part in important decisions for the network, you will also be give a distribution of Dash for the amount that you have staked. At the time of writing this reward is currently 12% ROI.

Interesting Dash Projects

Given that Dash can be allocated to any projects that could benefit the network, there are already some really interesting developments under the go. One of them is Dash Evolution which is a protocol that is built on top of the second tier network.

Dash evolution will also include social infrastructure where usernames can be registered, instant messaging used with friend’s lists as well as instant address generation with in client payment requests. The main aim of it will be to make payments through Dash easy and accessible even to those who are not necessarily technologically savvy.

Points of Concern

Although Dash does sound like it is a strong competitor to Bitcoin, there are a number of people who don't see it that way. This may indeed be why the amount of transactions on the Dash Network is still currently quite limited. There are also not enough merchants who will accept Dash as a means of payment.

One of the most contentious points may be the whole idea of the masternodes to begin with. Currently, they are in the hands of a small group of people who are not known to many users. This brings back the fears of a centralised body which is the reason why Bitcoin was able to flourish.

Moreover, there is now another digital currency that aims to become the de-facto digital means of payment and that is Bitcoin cash. Bitcoin cash is a result of the split in the chain of Bitoin back in August of 2017 when a group of developers wanted to upgrade to a coin that would provide for larger block sizes. Hence, users have a coin that has all of the benefits of a decentralised cryptocurrency without the full blocks that were plaguing Bitcoin

Where to Buy & Store DASH

If you have decided that you would like to buy some DASH then you will have to head on over to one of the exchanges where it is listed. Given the popularity of DASH, there are are number of different exchanges where you can buy them. Some of the most popular include the likes of Binance, BitHump and Bittrex.

These exchanges will require you to first purchase some other cryptocurrency and send it to them in order to exchange for DASH. However, you could use an exchange such as Kraken which is a "Fiat Gateway". This means that you can send them your fiat currency and purchase DASH directly with these funds.

Once you have your DASH, you will want to find a secure place to store it. Leaving a large amount of coins on an exchange is not a wise move given the risks that are posed by such events as large exchange hacks or corporate malfeasance. You are perhaps best suited to get yourself a hardware wallet and keep your coinsin an offline environment. We have covered an extensive list of some of the best DASH wallets to securely store your coins.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.