DODO Exchange Review: Proactive Market Making DEX

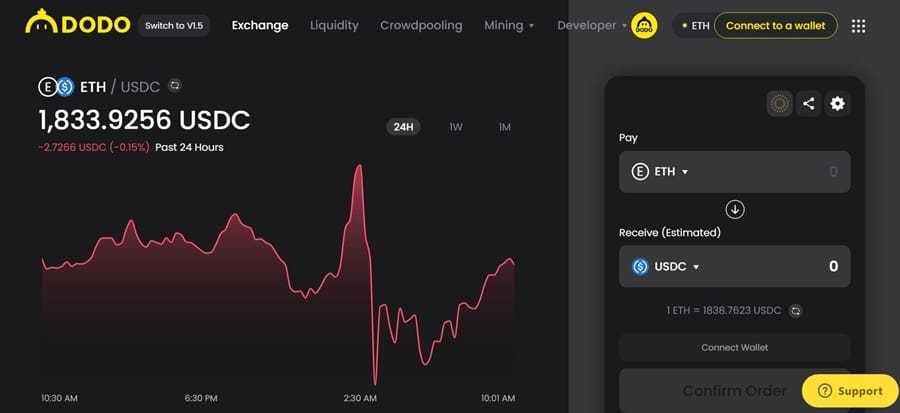

Dodo is a leading decentralized exchange (DEX) platform that revolutionizes token trading with its innovative market-making algorithm. With its user-friendly interface, Dodo offers a seamless trading experience for users, ensuring fast and secure transactions on the Ethereum blockchain.

Decentralized exchanges keep popping up , but so far none have been able to overtake Uniswap as the top decentralized exchange. Which is a shame, because Uniswap is certainly not perfect. If there were an exchange that could rectify the problems that Uniswap has rather than copying them, maybe we would see some evolution in the space.

Well now that’s a distinct possibility as the DODO Exchange is looking to take market share from Uniswap by actually improving on its problems. It’s doing that be attempting to eradicate impermanent loss, and improve liquidity by using a unique market making algorithm.

That unique new market maker algorithm has been coined Proactive Market Maker (PMM) by the folks at DODO Exchange. It is meant to replace the Automated Market maker (AMM) model that’s used by Uniswap and most other decentralized exchanges. The PMM model is capable of responding to liquidity constraints in real time, as well as adapting to changing market conditions.

DODO Exchange Overview

DODO is created on the Ethereum network and it appears to be the next generation exchange when it comes to on-chain liquidity providing (LP). When you compare PMM side-by-side with AMM it is clear that an improvement has been made to a first generation attempt at creating a decentralized exchange.

The second generation LP tech is here, creating on-chain, contract-fillable liquidity for all users. With DODO Exchange there is always sufficient liquidity for every trade, just like you’d traditionally find in centralized exchanges. This benefits users by creating an exchange with very little slippage, as well as mechanisms that reduce impermanent loss to the minimum possible.

The remainder of this review will discuss the details around DODO, but first we’ll start off with some background that will help to highlight where DODO is making the most impactful changes and how it will improve the decentralized exchange ecosystem with its novel PMM technology.

AMM-Based Decentralized Exchanges

We will use Uniswap as the model for AMM-based decentralized exchanges throughout this review, although we do understand that many others exist. For example, Kyber, Curve, and Bancor all use the same AMM model in creating an exchange.

An examination of Uniswap will give us a basic understanding of how automated market making works, but more importantly we will see the shortfalls inherent in the design of AMMs. All include impermanent loss risks, slippage, and the use of arbitrageurs to create a functioning decentralized exchange. DODO is looking to improve on this by minimizing both impermanent loss and slippage, while doing away with the need for arbitrageurs to make their PMM model work.

AMMs are seen as superior to centralized exchanges because they do away with control over the exchange by a single entity. This should even the playing field for everyone involved in the markets. The AMM is different from centralized exchanges in a number of ways, but the most prominent is the way in which they price the tokens listed on the exchange.

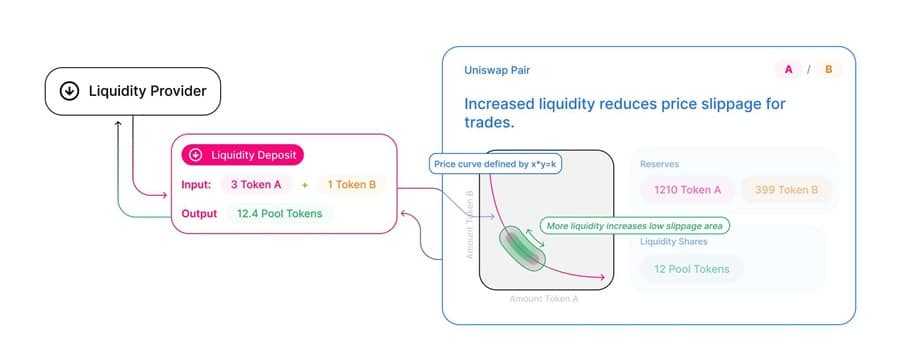

In centralized exchanges the exchanges search for a counterparty for each trade, thus setting the price based on the counterparty’s asking price. The AMM replaces counterparties with a smart contract that stores a pool of tokens. This is where the liquidity for the exchange comes from. And these tokens are provided by users, often the same users who are trading on the exchange.

Users are given an incentive for placing their tokens in the liquidity pools in the form of yield on their provided assets. So on Uniswap the 0.3% trading fee is distributed among the liquidity providers as a way to help keep the platform going by creating an incentive for liquidity providers.

It should also be mentioned that there are different varieties of AMM. In the case of Uniswap the variety used is a Constant Product Market Maker (CPMM). The CPMM model gets its name from the constant product of its price algorithm. Rather than using supply and demand to determine the price of listed assets, as most orderbook-based exchanges do, Uniswap uses the equation x*y=k.

In this equation both “X” and “Y” represent the supply in a given token pool on the platform. As traders buy and sell “X” and “Y” the price of each changes to keep “K” as a constant.

This design has become very popular and in fairness it has helped to inspire a wide range of new ideas in decentralized markets and exchanges. And the model created by Uniswap has made it possible for anyone to provide liquidity for any ERC-20 token at all. Unlike the centralized exchanges, there are no gatekeepers who decide what tokens can and cannot be listed for trade.

While this is all great for decentralized exchanges and trading, it doesn’t come without its faults, the primary of which are impermanent loss risks and slippage.

AMM Design Flaws in Detail

Let’s look at the design flaws in the typical AMM more closely so we can then compare how the design of DODO Exchange overcomes these flaws for an improved decentralized exchange.

AMM Slippage

Slippage is the difference between the price agreed to in the purchase of sale of an asset and the actual price the transaction is executed at. Slippage is most noticeable during periods of high market volatility, and can be quite extreme. Cryptocurrency trading has the problem of slippage increased further by the relatively slow execution times caused by the use of blockchain technology.

A lack of liquidity will also contribute to slippage. With assets that are illiquid a large trade can cause that asset to soar or plunge in instants.

Uniswap has been able to minimize slippage in smaller trades, which are the majority of the trades being handled on the platform, however large trades can still see massive slippage in some cases. To help traders manage the risk of slippage Uniswap offers a number of tools that help to better gauge potential slippage of any trade.

So it is clear that Uniswap is making a tradeoff in providing liquidity for every market, even those that would otherwise by extremely illiquid. While these illiquid markets are now available to traders, the exchange is likely keeping the large traders who could have an outsized impact on the illiquid coins away due to the threat of extreme slippage on large trades.

AMM Impermanent Loss

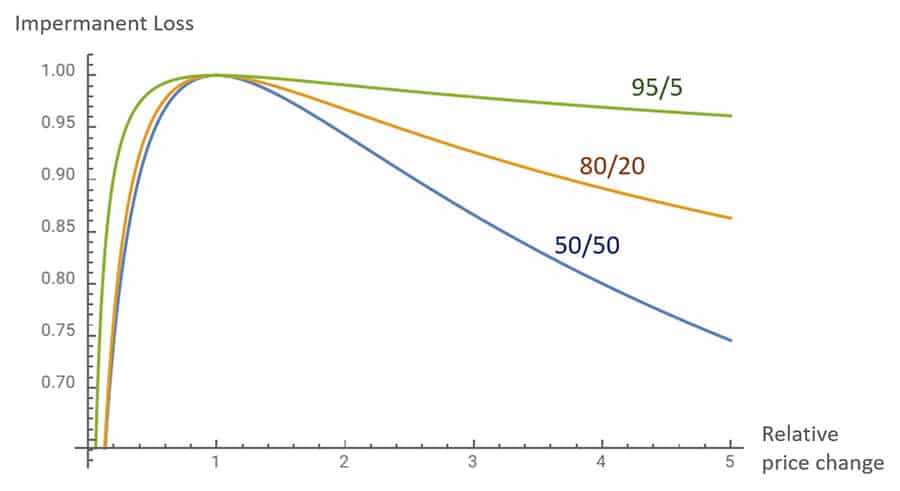

A second, and more complicated issue that Uniswap and other AMMs face is the issue of impermanent loss.

One way to avoid this is to have prices on the exchange provided by a third party oracle, such as Chainlink (although this brings its own issues). Uniswap does not use price oracles, but instead relies on the internal algorithm mentioned above for its pricing. Because of this the prices on Uniswap can vary widely from the prices available for the same asset on other platforms.

For example, if the price of a token rises or falls by 10% on the centralized exchanges that change in price might not be immediately realized on Uniswap or other AMMs. This creates a period of time in which arbitrageurs can take advantage of this price difference to make a profit.

Arbitrage is thus very common on Uniswap as traders come to either buy cheap assets or to sell expensive ones and make a profit. This type of behavior wouldn’t normally be a problem, until you add in the liquidity pools of Uniswap. Because the liquidity pools cannot block this type of arbitrage activity they can at times experience extreme losses in the form of impermanent loss.

You see, users need to stake their assets in the liquidity pools on Uniswap to earn their fees. However during periods of volatility and large price changes where arbitrageurs become involved the amount of staked assets in the liquidity pools changes to keep the value of “K” constant.

This means that rather than simply holding the appreciating token in a wallet and enjoying the 10% price hike users of the liquidity pools at Uniswap can find that their tokens have been arbitraged away.

For a more in-depth explanation of impermanent loss you can head over to this post about Growth, another DeFi platform trying to eliminate impermanent loss, where we explain impermanent loss in greater detail.

DODOs Solution to the AMM Problem

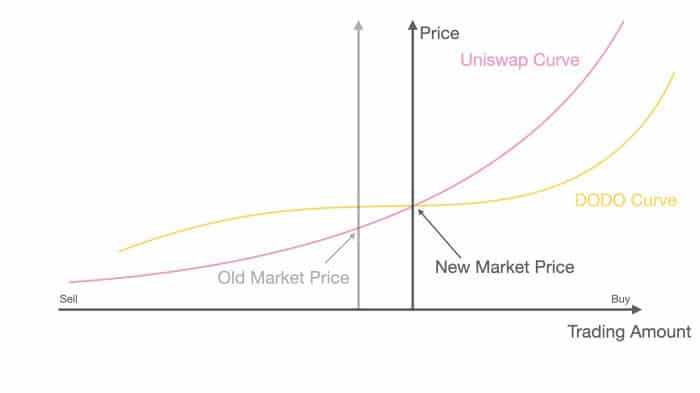

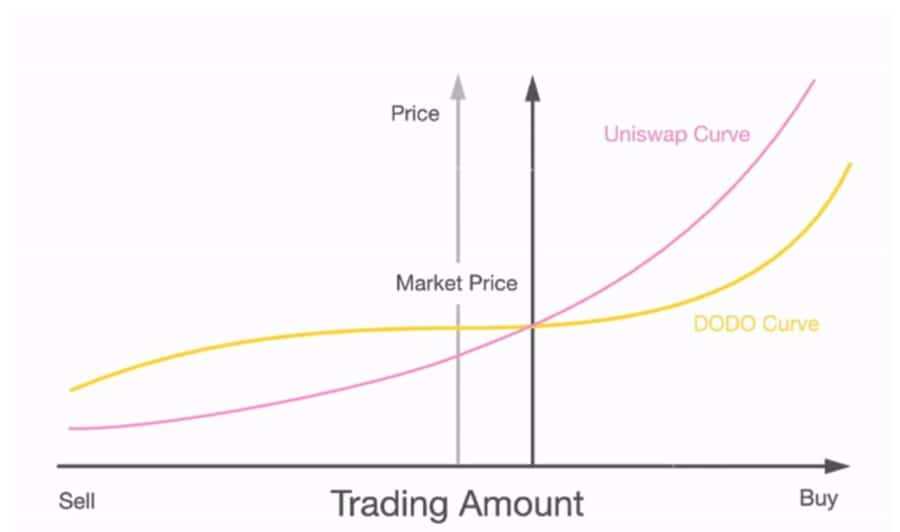

DODO’s Proactive Market Maker solution uses off-chain price oracles to provide real-time, accurate pricing information about each asset on the platform. It then uses the data provided by the oracle to calculate an ideal market price. Once an ideal market price is determined DODO can sell liquidity tokens for the quote token based on the curve shown below.

This model decreases the liquidity away from the market price very rapidly, removing the arbitrage opportunities and providing a more efficient exchange system when compared with AMM exchanges.

The PMM model used by DODO encourages only the arbitrage trading that helps to ensure the exchange price matches that of the market price. This in itself might not be unique, but the PMM is unique in that it shifts the price curve and that helps it achieve an efficient liquidity structure.

In fact, the method has proven to be superior to that used by AMMs as it not only provides enough liquidity for an unlimited number of trading pairs, it also benefits liquidity providers at the same time. In short, the PMM system effectively mitigates impermanent loss risks, thus making the act of providing liquidity on DODO a less risky activity when compared with Uniswap and other AMMs.

The PMM system takes advantage of the flaws known to exist in traditional orderbook-based and AMM exchanges. These flaws being that they are either dependent on human input to function, they are too expensive, or they are unable to provide the necessary liquidity at all times. The PMM was designed as an algorithmic market maker, but it functions as if on steroids, providing on-chain contract-fillable liquidity for every asset pair without exception.

How DODO Exchange Works

Now that we’ve gotten all the background information out of the way it’s time to take a deep dive into DODO itself and see what’s under the hood.

What sets DODO apart from other DEXs is that it offers decentralized on-chain asset trading, but provides its users with order execution that’s comparable with the centralized exchanges and trading platforms. As is the case with other DEXs arbitrageurs and liquidity providers continue to play a significant and crucial role in the DODO ecosystem, but the team claims to have eliminated impermanent loss risk for all intents and purposes.

And in a welcome upgrade from the AMM model, with DODO’s PMM model liquidity providers are not required to provide both sides of the trading pair when adding liquidity. With DODO it is completely fine for the LPs to add just a single asset to any of the liquidity pools and begin earning fees.

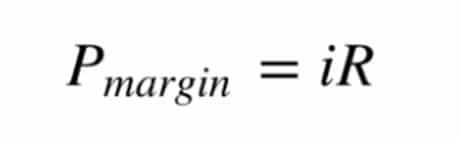

It can achieve all of these things simply by altering the AMM algorithm with its own unique Proactive Market Maker algorithm that switches the x*y=k equation used by Uniswap with the following algorithm:

In the equation above the symbol “i” represents the market price of an asset, and “R” represents the risk factor. Understanding “R” is the key to understanding how DODO incentivizes high liquidity at accurate prices.

DODO uses the price feeds from Chainlink oracles to establish the value of “I” in this equation. The partnership with Chainlink was forged in August 2020. The provided real-time market data gives DODO a baseling to work from, allowing the algorithm to avoid any massive discrepancies in its price versus the actual market price of the assets. The “R” factor will also change as capital for each particular asset accumulates in the liquidity pool, recognizing the fact that greater liquidity also provides lower risk.

According to the team at DODO the result of this is:

Depending on the liquidity in the capital pool, PMM changes the parameter R in real-time to fine-tune P, the market price on DODO, in order to maximize fund utilization.

The result of this is that liquidity for the asset is shifted to the price of that asset based on the Chainlink data. That means the real-time price data provided by Chainlink creates a baseline for the exchange prices, however this does have the downside of placing a large amount of trust in the Chainlink data being provided to the system.

If there is ever a situation where the Chainlink nodes fail, or are compromised in some way it is possible that DODO would receive incorrect information, and base its market prices on that incorrect data. This could lead to significant losses for the liquidity providers in the DODO system.

DODO Core Features

Obviously DODO has the basic trading, staking and pooling features you would expect from such an arrangement, but it also has three very unique features not found elsewhere.

The DODO Vending Machine

The DODO Vending Machine allows anyone with a wallet to create a liquidity market using DODO’s PMM technology to create a bonding curve for the provisioned tokens Just provide tokens, define the pricing curve desired, and the DODO Vending Machine will create a liquidity market for the asset, decentralized and non-custodial, but accessible to everyone.

What’s even better is that this is a fully permissionless process, meaning anyone with a wallet can build trading venues on DODO without having to worry about censorship and interference from the platform itself (unlike Robinhood). A more detailed explanation can be found here.

DODO Private Pool

This is similar to the DODO Vending Machine, but with more options for professional market makers who have special requirements that can’t be satisfied by the DODO Vending Machine. The DODO Private Pool gives market makers the ability to do the following:

- Make one-sided deposits/withdrawals (DVM requires two-sided liquidity provision/removal).

- Change the pricing curve at any time (DVM’s pricing curve cannot be modified after creation).

- Have liquidity everywhere in the price range from zero to infinity.

This provides several benefits for market makers, taking advantage of the configurability and flexibility of DODO’s PMM model.

- Avoiding downside risk.

- Active price discovery.

- Constant price market.

- Reversion to traditional AMM model.

With these characteristics users are able to leverage the advanced pool configuration options and be their own market makers. With these parameters, countless permutations are possible and makers can ply their trade on DODO to their heart’s content. DODO gives market makers ample freedom to devise and manage their tailor-made liquidity solutions on-chain. More details about the DODO Private Pool can be found here.

DODO NFT Vault

The DODO NFT Vault is a price discovery and liquidity protocol for non-standard assets. It allows users to create new NFTs or use existing NFTs and pledge them into the DODO NFT Vault. The NFTs can be kept unique or they can be fractionalized which divides the NFTs in the Vault into many pieces with fungible tokens issued to represent them.

Once the Vault is established a liquidity pool for the NFT can be created to establish a flexible and efficient market to trade these pieces. This is powered by DODO's Proactive Market Maker algorithm. Through DODO's SmartTrade and liquidity aggregation service, the pieces can be traded with any tokens at the best price. Learn more about the DODO NFT Vault here.

The DODO Team

DODO was created by a trio of experienced blockchain professionals, each with deep knowledge of various aspects of blockchain technology and exchange function.

Mingda Lei is the CEO and one of the co-founders of DODO. He was the architect behind the PMM model used by DODO. He was previously a core developer at DDEX, a margin trading platform, and is a PhD dropout from Peking University.

Qi Wang is the COO at DODO. He is a software developer and founded DOS Network, a layer two oracle service based in China. Wang worked for companies like Oracle and Pure Storage as a software developer before venturing into crypto.

Diane Dai is the Chief Marketing Officer at DODO and the third co-founder of the platform. She is very active on WeChat, running a number of channels, including the subscription-based “DeFi Labs” channel.

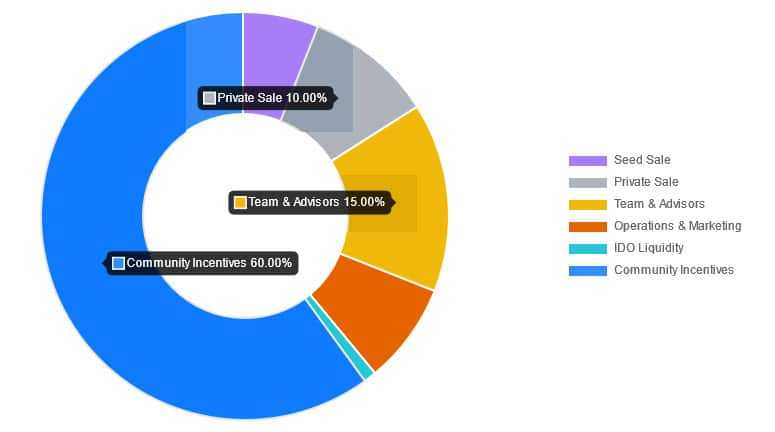

The DODO Token

The DODO token is an ERC-20 token and is the native governance token for the platform and is also used for incentivizing liquidity provisioning on the platform. There is a total supply of 1 billion tokens, with just over 100 million DODO tokens in the circulating supply. There were 40 million tokens sold in a seed round at $0.01 each, and later there was a private sale with 100 million tokens offered at $0.05 each.

Seed investor tokens will be locked 1 year after token issuance, and then linearly vested over nest 2 years and private investor tokens will be locked 6 month after token issuance, and then linearly vested over next 1 year per Ethereum Block.

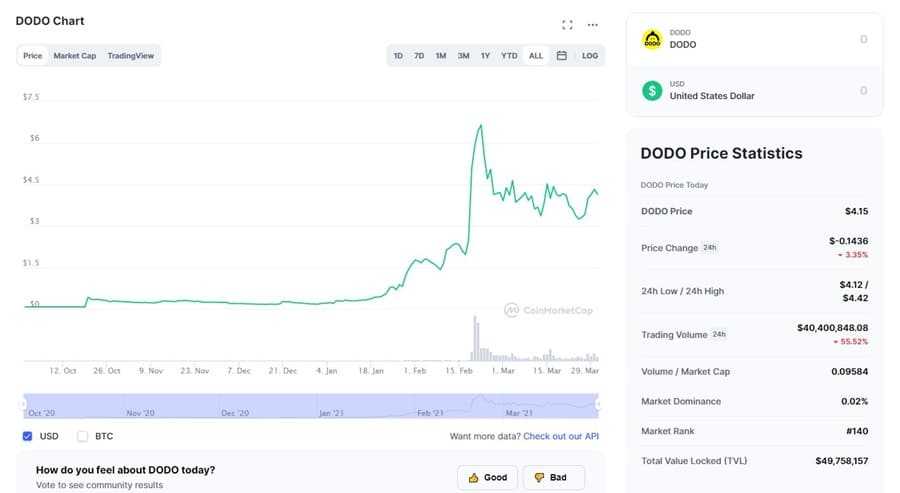

More recently DODO also moved to the Binance Smart Chain, giving it dual chain functionality. That led to it being listed in Binance Launchpad in a farming round that ended March 4, 2021. That farming round resulted in a pool of 641,710.8000 DODO that were farmed by staking BNB tokens. There was also a BETH pool with 320,855.4 DODO in rewards and a BUSD pool with 106,951.8 DODO in rewards.

These tokens are time-locked to prevent token dumping in the protocol's early stages. While it seems like a large portion of tokens were allocated to sales, it is essential to consider the sizeable total supply.

DODO tokens have participated in the 2021 rally in cryptocurrencies, hitting an all-time high of $8.51 on February 20, 2021. Since then the price has declined by over 50% and as of March 30, 2021 the DODO token is trading at $4.15. Given the volatile nature of the crypto markets and smaller tokens like DODO (it is ranked #140 in terms of market cap) it is impossible to predict if the value of the token will hold at its current value, rise again to take on the all-time high, or decline to lower levels.

With the launch of DODO v2 the DODO token has also been given two additional important utilities in addition to its governance function. It can now also be used for trading fee discounts on the exchange and for crowdpooling and IDO allocations.

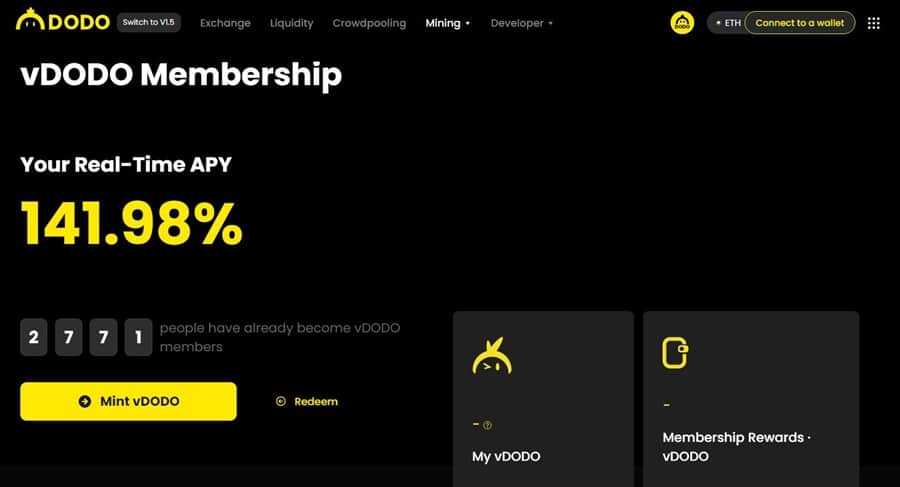

In addition, a new non-transferable vDODO token has been created to serve as proof of membership in the DODO loyalty program. vDODO can be minted at a rate of 1 vDODO = 100 DODO. vDODO is a token that serves as a user’s proof of membership in DODO’s loyalty program. Benefits for vDODO token holders include but are not limited to the following:

- Governance rights:holders can create and vote on proposals. 1 vDODO = 100 votes

- Crowdpooling and IDO allocations

- Trading fee discounts

- Dividends paid out from trading fees (exclusive to vDODO token holders):A proportion of the trading fees accrued on the platform will be distributed to vDODO holders.

- vDODO membership rewards (exclusive to vDODO token holders):DODO reward tokens will be distributed to vDODO holders every block.

DODO v2

The impermanent loss suffered in Uniswap liquidity pools ends up as a permanent loss all too often. Other AMMs are a turnoff for traders due to the massive slippage that can occur with larger orders. These two factors are what make DODO such an innovation in the decentralized exchange space. With the advent of DODO v2, launched February 22, the platform is entering its next phase of development.

DODOs innovation that allows it to set market prices without simply balancing liquidity around a constant formula has worked so far to offer better terms for traders and liquidity providers. Traders are able to better avoid slippage and LPs can deposit just one token rather than a pair, thus avoiding the risk of impermanent loss.

One of the concerns around the platform is that without sufficient trading volume the LPs could still face losses if the total fees earned for providing liquidity are too low. LPs need the trading volume to increase consistently for them to generate steady profits.

The DODO team is addressing this in DODO v2 by adding some incentives for traders, and for pool creators and liquidity providers. The team understands that token incentives are an effective way to acquire and appeal to new users. The DODO team has designed the following token incentive programs for DODO users.

Trading Mining on DODO

With the implementation of DODO v2 traders are now able to mine DODO tokens when they make trades on the DODO exchange. There is a mining pool prize created that receives 3 DODO for each block mined. If a trader has “Trading Mining” turned on in the platform when executing trades they receive 1% of the tokens in the prize pool after successfully completing a trade.

In addition, there will be tokens labeled as “Hot Tokens” in the exchange, and when trading these tokens traders receive triple the mining reward of 3% of the prize pool. The designation of Hot Tokens will be made through a combination of an aggregation of the trending sections in third party data providers, voting by DODO community members, and by the decision of the DODO team.

Combiner Harvest

Combiner Harvest mining is an incentive program that was added for pool creators and liquidity providers as of DODO v2. The Combiner Harvesting program is a way to give DODO users access to promising blockchain programs that are willing to form a collaboration with DODO. These collaborations will result in the vetting of programs and the creation of liquidity pools around the vetted projects.

Conclusion

There’s no question that the DODO exchange has improved the trading experience on decentralized exchanges. It has also decreased the risks faced by liquidity providers. The use of Proactive Market Maker technology has guaranteed more stable asset pricing, and more efficient liquidity, even for lightly traded tokens.

The offered services are unique and growing. The addition of crowdpooling, IDO allocations, trader mining, NFT vaults, the DODO Vending Machine, and private liquidity pools have all contributed to a stronger platform with increased trading volumes. This in turn maintains stability for the platform and makes it even more attractive to traders and liquidity providers.

Furthermore the trading interface is fast and uncluttered. Anyone with any trading experience should be able to quickly understand how to trade, stake, or provide liquidity on DODO.

In short, DODO seems to have solved the problem of impermanent loss for liquidity providers and the issue of slippage for traders by creating a platform that uses Proactive Market Maker technology to create efficient real-time liquidity for any token.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.