Republic Protocol (REN) Review: Decentralised Dark Pool Trading

The Republic Protocol (REN) is a project that has garnered a great deal of interest recently. They are building a decentralised dark pool for cross-chain cryptocurrency trading.

While that may be a mouthful, this project could have the potential to completely change the way investors think about OTC trading and cryptocurrency exchanges in general.

In this review, we will take an in-depth look into the republic protocol. We will give you what you need to know about the technology, partnerships, roadmap and the potential for wider adoption and use-cases of the REN token.

What is The Republic Protocol?

The Republic Protocol is a decentralised and open-source dark pool protocol that will allow traders to place orders in a completely private and secure manner.

The Republic Protocol will facilitate the exchange of Ethereum, ERC20 tokens and Bitcoin through this distributed dark pool. Using multi-party computation, they will be able to develop a matching engine that will cross these orders on the decentralised order book.

Then, once these orders have been matched, the protocol will use cross chain atomic swaps to exchange the assets in question. They will also use economic incentives to make sure that the trades are executed effectively.

There are a number of benefits that the Republic Protocol will have not only over centralised exchanges but also over a number of the Decentralised Exchanges (DEXs) that we see coming to market.

Before we delve into the technology, we need a brief primer on dark pools...

What is a Dark Pool?

A "dark pool" is an OTC marketplace where institutional investors can get anonymous execution of large block orders of shares. Unlike traditional exchanges, these orders are not available to the general public and as such provide anonymity.

The private institutions that operate these dark pools are mostly investment banks and other market makers. These are great avenues for institutional money managers to get their large block orders executed at reasonable prices.

So, why do investors need the dark pools?

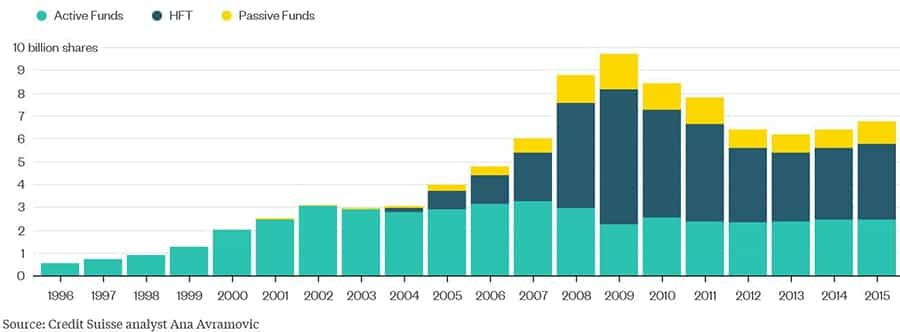

High Frequency Trading Firms

High Frequency Trading Firms (HFTs) are well known on Wall Street for being ruthless number crunchers who rely on lightning quick algorithms to get better prices than those slower than them.

As the markets have become so sophisticated, being a mere Nano second faster than your competition means that you will be able to take home the bacon (juicy spreads). HFTs make a great deal of their money from deciphering what the large institutional money managers are doing.

One of the ways in which they do this is by pulling data from the public order books and running them through their machine learning systems. If they get sense that a large institution is buying a large block of shares, they will "position" themselves accordingly.

The HFTs have become so good at this in recent years that the large money managers have been looking for alternative methods to execute their sizable block trades. When the investment banks offered them a solution in a dark pool, they jumped at it with open arms (read "order books").

Crypto Dark Pools

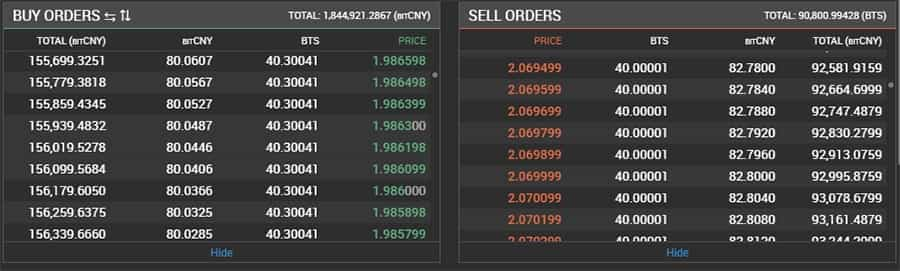

While the HFT firms may not be as active in the cryptocurrency markets, the risk posed by open order books is just as severe. When you place a large order on an exchange, the whole market can see this. They can infer large positions that someone is trying to take.

This will happen both on centralised exchanges and on decentralised exchanges such as Bitshares et al. As long as the order books are public, other traders, exchanges and crypto whales can position themselves ahead of your order.

Even if you decide to buy your cryptocurrency in the OTC market, other traders can still monitor movements. This is because of the very public nature of the blockchain. You will no doubt have seen a lot of the news that surrounds movements in the wallets of large Bitcoin addresses.

However, with a dark pool, your orders are hidden from sight.

What is even more compelling behind the Republic Protocol Dark pool is that you do not have to rely on the honesty of the pool operator. You do not have to trust some investment bank or market maker to have your best interest at heart when executing your orders.

The Republic Protocol dark pool is completely private and decentralised. All orders are hidden and through the use of advanced cryptography no one (not even a pool operator) has any market color on your orders.

How Republic Protocol Works

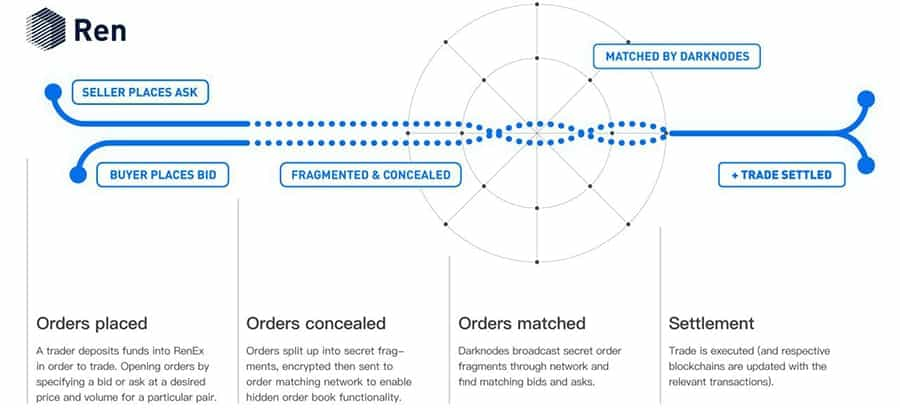

The underlying purpose of the Republic protocol is to develop a decentralised network of nodes that can effectively match orders without really knowing anything about the orders in question. This is where the need for advanced cryptographic techniques come in.

They make use of the Shamir Secret Sharing Scheme which will break down the orders into a collection of order fragments. These will then be distributed throughout the network so that they cannot be easily recombined.

In order to make sure that these fragments cannot be constructed they will use an Ethereum smart contract called then "Registrar". This will organise the nodes in the network such that construction of the order fragments on the nodes is not possible.

Each of the nodes on the network can use two opposing order fragments and then co-operate with other nodes that hold the remaining fragments. These separate nodes will then conduct a series of computations to determine whether these orders do indeed match.

Using a random scaling factor, the Republic Protocol is able to prevent any of the nodes from reconstructing the original orders based on what they know about the fragments. The protocol also makes use of Zero Knowledge Proofs on the computation through a smart contract called the "Judge".

Now that two orders have been matched the Republic Protocol has to facilitate the exchange of the two assets. Given that these will be across chains, an Atomic swap is used. These will be initiated over the Republic Swarm Network which is a P2P network.

Traders do not have to be connected to the network in order for it to be matched and the orders will remain secure until this occurs. When they are matched then some information about the order will obviously be revealed to the matching parties. Yet, the total liquidity on the network cannot be reliably estimated by anyone.

REN Tokens

The native token on the Republic Protocol are the REN tokens. These are ERC20 utility tokens and will be used within the Republic Protocol to incentivize nodes to perform the order matching process.

Hence, the REN token will be used in order to facilitate this exchange on the network. It will also be used to pay "bonds" the registrar. There will be a total supply of 1 Billion REN.

Network Order Fees

On the trader side, the REN tokens will be used in order to pay for the transactions. Once this REN enters the ecosystem it will be used by the nodes in order to run the computations required to match the orders.

If the order expires before the transaction can be matched then the order fee will be refunded to the trader. However, if the order has been matched then any node that has participated in the decentralised computation will receive a portion of the rewards which will be evenly split.

This fee is not fixed and orders will compete with each other in terms of the amount of order fees that they pay. Those that pay the highest fees for the transaction will be favoured by the matching nodes.

Hence, the only piece of differentiating information that each node will see for the order is the fee that is attached to it. In the case of a successful order match there will be two payments that will be processed from either side of the order.

Network Bond

Given that the Republic Protocol is a distributed network, there is always the risk of a Sybil attack where one entity is able to get a control of the majority of the nodes. If they do this, they will receive most of the order fragments which they could try and construct the order flow.

In order to prevent this, the protocol requires that traders and nodes must submit a certain amount of REN as "bond" before they can access the network. This will be held in the Registrar smart contract and as such can be queried at anytime by anyone.

Once the traders and the nodes have left the network these bonds will be refunded. The amount of the bond is not fixed but is subject to a globally defined minimum threshold. Those that submit a higher bond can place more parallel open orders.

This bond will then be on the line during verification. This will be used as an incentive in the verification process. If either of the nodes (Provers) or the group of traders (Challengers) are proved to have been acting dishonestly in the computation then they will lose their bond.

REN ICO & Price Performance

The Republic Protocol completed an ICO in January and February of 2018. On the 28th of Jan they sold 56.6% of their total supply in a private sale. Those who contributed were able to get 18,025 REN for 1 ETH.

This means that in this private sale round of their raise they were able to raise about $28m and the token holders bought in at a price of about $0.0513 per REN token. There were a great deal of well known cryptocurrency investment funds that partook in this.

The Republic Protocol also held a larger public crowd sale after that on the 2nd of February where they raised a further $4.8m selling an additional 8.6% of the total supply.

When REN was first released onto the exchanges it was trading well above the ICO price and reached an ATH of $0.142 in May of 2018. Unfortunately, the token has followed the rest of the market lower and has fallen below the ICO price.

Currently, REN is available on 9 different exchanges but is only really active on two of them. Indeed, over 88% of the volume currently is being traded on the Binance Exchange where REN was only just recently listed.

Given that the REN token is an ERC20 token, you can store it on any ERC20 compatible wallet.

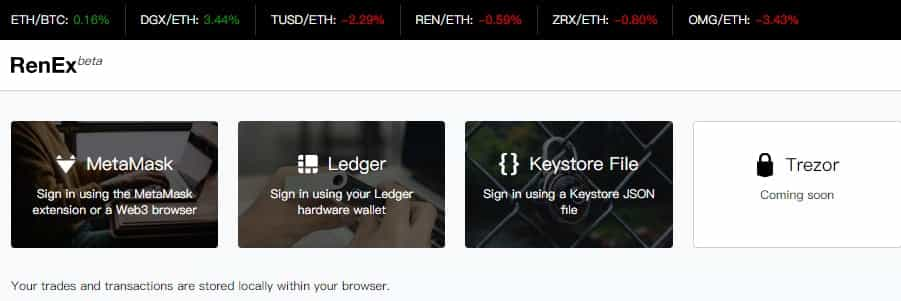

RenEx Mainnet

The first dark pool that the Republic Protocol launched was their RenEx Dark Pool main net which was released in Beta back in September. They opened it up to traders on this date and they could officially start placing their orders.

Given that the mainnet is still in Beta, the team controls 24 of the Darknodes on the network. They control this to make sure that the network is well tested before they start handing the Darknodes over to the community.

They have announced that come January 2019, they will be opening up Darknodes for limited community participation. As more Darknodes are brought online by the broader ecosystem the Republic Network team will reduce those that are controlled by them.

Currently, on the RenEx network the fees to place an order are set at a flat rate of 0.2% per trade. 80% of this cumulative fee of 0.4% will be given to the node operators. 20% of the remaining REN tokens will be kept to incentivise liquidity on the platform through the use of market making rebates.

When the project eventually does release the Darknodes to the broader community then they plan to set the bond at 100,000 REN. This implies that with a total supply of 1 billion REN that there will be 10,000 Darknodes.

Team, Advisors & Partnerships

The team behind the republic protocol has quite a few years of experience in software development and financial markets. For example, the CEO is Taiyang Zhang who has previously worked as a software engineer and as a manager at a Quantitative investment fund.

He is joined by Loong Wang at the CTO position. Loon has worked as a software developer at Neucode and has also spent a number of years as a researcher and Tutor at the Australian National University. His specialty is in distributed and high performance computing.

On the advisor side, they have some pretty seasoned investors and project developers on board:

- Dorjee Sun: CEO, Perlin Network

- Loi Luu: CEO, KyberNetwork

- John Ng Pangilinan: Partner, Signum Capital

- Prabhakar Reddy: Investor, Accell Partners

- Anup Malani: Economics, University of Chicago

In terms of token distribution to the team and the advisors, they have been allocated 99m REN. These will start being released in February of 2019 and will vest every 4 months until February 2020. This means that they are incentivised for the medium term.

The team has also been active in terms of partnerships. For example, in September of 2018 they partnered with Wyre. Wyre is a blockchain international remittance company which will provide the Republic Protocol with KYC integration and liquidity.

They have also partnered with TrueUSD as the stablecoin of choice which will be integrated with RenEx. Lastly, the team has also partnered with BitGo, the Kyber network and many others to start Wrapped Bitcoin (WBTC).

Development & Roadmap

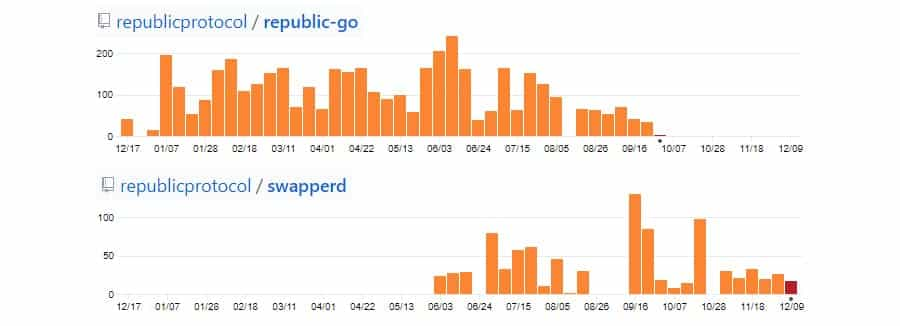

When it comes to development, the Republic protocol team seems to be quite active. One of the best ways to get an idea of the work that is being done is to take a look at their GitHub repositories.

Over the past 12 months the team has submitted thousands of commits to over 25 different repositories. Below you can see the activity for the top 2 repositories over the past year.

In fact, if we were to take a look at this activity in the context of the other top cryptocurrency projects we can see that they are ranked number 6 in terms of total commits over the past 12 months coming in just behind development on EOS.

This development has taken place at a time when the Republic Protocol was just about to launch their mainnet which could explain the massive spike in activity. It seems as if this may continue into 2019 given the number of milestones in their roadmap.

This was well laid out in a recent medium post. Here are some of the most important things to look out for in 2019:

- Early Q1 2019: Support for BTC-to-ERC20 trading pairs after the streamlining of atomic swaps.

- Early Q2 2019: Introduction of a new dynamic fee model which will allow for market maker rebates. Support for midpoint orders will be added and they will also release dark liquidity integration.

- Late Q2 2019: The team hopes to provide support to third-party dark pools beyond RenEx. They also plan to release a number of tools, SDKs and tutorials in order to help these third party developers.

Apart from work that they are carrying out on development, the team is also quite active in their community engagement. They regularly keep people updated about project announcements on their blog.

They have also recently started their REN ambassadors and community building initiative. This will allow members of the community to bring awareness to the project in return for some offers from the Republic Protocol team.

Conclusion

The Republic Protocol is quite an interesting project that could change the way that we think about trading digital assets. Not only have they created a Decentralised Exchange but they have also developed one that keeps orders completely private.

Cryptocurrency traders will be able to place large block orders without the fear of anyone knowing what they are doing with their assets and which way they are positioned in the market. This will become even more important as more of the HFT firms start engaging in crypto trading.

While REN tokens have fallen in price recently, this is more a factor of the current market conditions than something specific to the project. They have been very busy developing the protocol and have launched their Mainnet Beta on time.

It will be interesting to see how the RenEx exchange testing goes. If the Darknode roll-out goes according to plan and they are able to meet their roadmap milestones, 2019 could be an exciting year.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.