Theta Token is taking the blockchain to video streaming, seeking to decentralize video streaming and video on demand.

Their vision is to provide high quality video streams without the buffering issues often seen today. In addition, they plan on utilizing bandwidth and storage from users to reduce the cost of video streaming while also improving the quality.

However, with such strong competition, does it have what it takes?

In this Theta Token review, we will take an in-depth look at the project including the team, technology, unique selling points and prospects for the THETA token.

Theta Token Overview

We already know that internet users have a huge appetite for video and video streaming services. That’s been proven by the popularity of YouTube, Twitch, Live.ly and the video streaming additions to Facebook and Twitter, as well as the increasingly popular Tik Tok.

In fact, networking hardware company Cisco estimates that over two-thirds of today’s internet bandwidth is taken up by video streaming. That amount is expected to increase to 82% over the next 18-24 months.

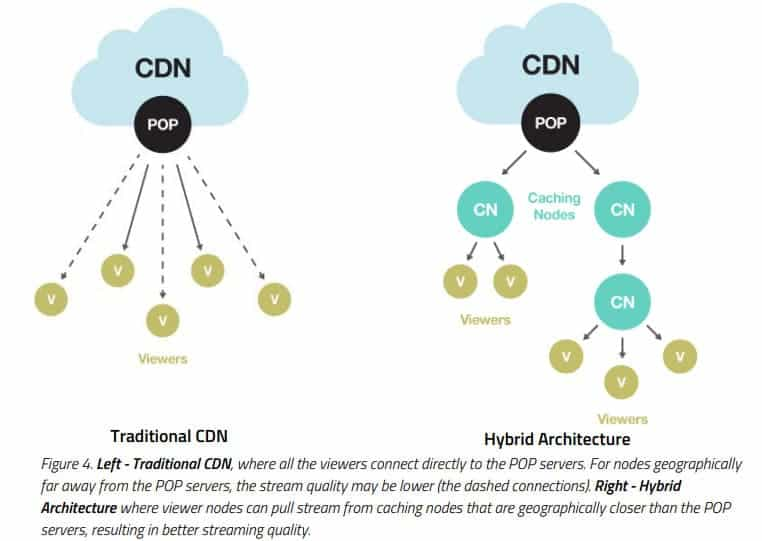

While that’s all well and good, today’s video streaming is not perfect. Many video streams suffer from what is known as “last-mile” delivery problems. The Content Delivery Networks have created an infrastructure where large datacenters provide streaming services for specific geographic areas.

However, streams are only as good as the infrastructure that feeds into the actual users homes, and this can sometimes be slow and cause frequent lag, rebuffering and choppy streams.

Traditional CDN Network vs. Theta Token "Hybrid" solution. Source: White Paper

Theta Token’s team has come up with a solution to the “last-mile” problem using decentralized blockchain technology. That has led to the world’s very first Decentralized Streaming Network (DSN). Not only that, but in September 2020 Theta Labs received the first ever decentralized streaming patent covering “Methods and Systems for a Decentralized Data Streaming and Delivery Network.”

In this blockchain network users are incentivized to share their unused memory and bandwidth to improve the overall network. This leads to better overall performance for everyone, all across the globe. According to the Theta labs founder, Mitch Liu

At its core, Theta is enabling users to share their idle bandwidth and computing resources to mine Theta tokens and in turn cache and relay video streams to others in the network

Technology behind Theta Token

The Theta blockchain network is secured by a Proof-of-Stake consensus mechanism, which is far less demanding computationally, and has a higher transaction throughput when compared with Proof-of-Work protocols. By using PoS as the consensus mechanism it’s possible to have many different devices acting as viewers and caching nodes.

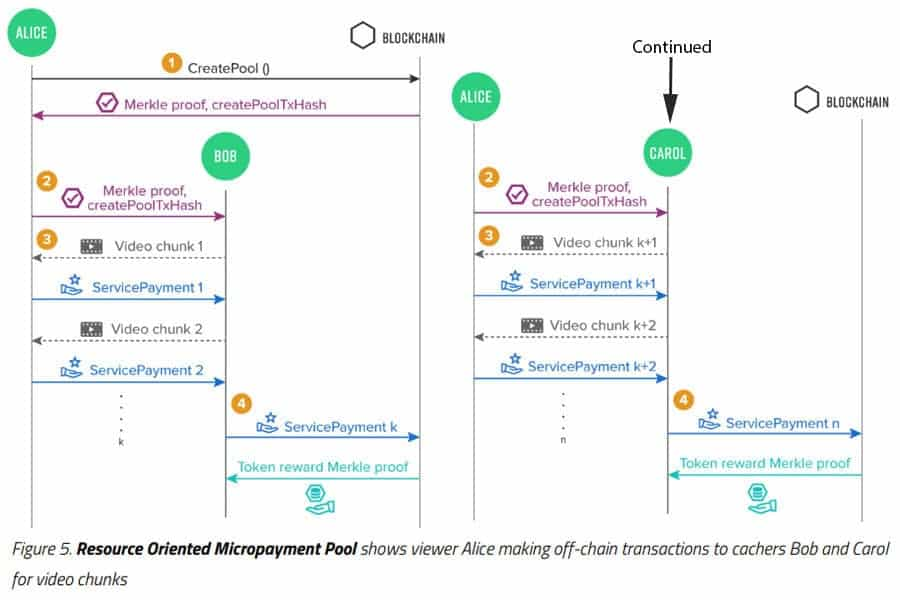

You might wonder how Theta Token is handling the issues of scalability in blockchain and video streaming. They have developed a Resource Oriented Micropayment Pool to solve scalability issues. In addition, they are implementing something called Proof-of-Engagement to track the delivery of video segments.

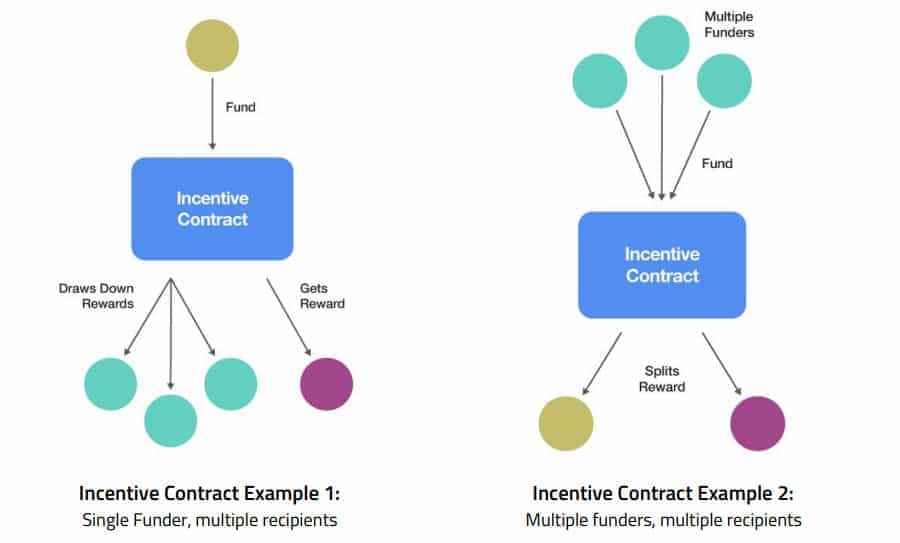

The distribution and collection of rewards on the platform is handled by Smart Streaming Contracts, which are a specific type of smart contracts on the Theta Token blockchain.

Here are more detailed explanations of these new concepts:

Resource-Oriented Micropayment Pool

The Resource Oriented Micropayment Pool was created by Theta Token specifically to create off-chain payment pools that users can for off-chain withdrawals. They have been designed to be resistant to double spending and also offer more flexibility than other off-chain solutions.

If a double spend is attempted it is detected by the validators on the Theta Network. One use case for the Resource Oriented Micropayment Pool is to allow for payments to multiple caching nodes without using on-chain transactions.

The major benefit of using this solution is that it allows for much greater scalability by keeping many micro-transactions off the blockchain.

Proof-of-Engagement

As you might guess from the name, this is a protocol that proves viewers have actually watched a live video. It’s a means of providing transparency for advertisers, as well as being a means for users to earn Theta tokens in return for their engagement.

The Proof-of-Engagement protocol is necessary to create a reliable measure of video stream engagement and a trustworthy way for viewers and advertisers to measure their video stream engagement.

Smart Streaming Contracts

Smart Streaming Contracts are type of smart contract or incentive contract used to help facilitate reward distribution and collection.

There are a number of use cases for Smart Streaming Contracts, including:

- Advertisers rewarding streamers and viewers;

- Viewers gifting rewards to streamers;

- Gift contracts for multiple streamers;

- Premium or paid video content;

- Subscriptions to streamers content or to Decentralized Content Networks;

- Cachers can share rewards with viewers and content streamers.

The Smart Streaming Contracts were designed to be executed by validators, which means the original person or entity who funds the contract doesn’t need to be involved with distributions or validations.

Currently these Smart Streaming contracts are being tested on the Testnet, but is expected that they will deploy on the mainnet in early 2021 with the release of the THETA mainnet 3.0. Once Smart Streaming Contracts go live on the mainnet Theta will also implement TFUEL staking and burning.

Theta Token Network

The THETA tokens were launched in December of 2017 and were issued as ERC-20 tokens. Once the blockchain launches (est. late 2018) these ERC-20 tokens were exchanged for native tokens at a 1:1 ratio.

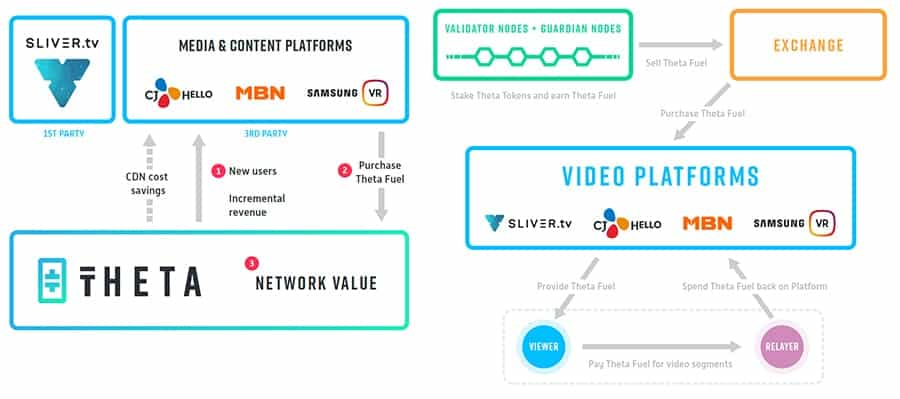

These tokens were also an early part of the SLIVER.tv platform and are used to reward viewers, streamers and those who share their resources (memory/bandwidth) with the Theta Network.

In fact the mainnet did not launch until March 12, 2019, which was a few months late, but the launch went well, with no issues. In addition to swapping the ERC-20 THETA tokens, users also received an airdrop of the Theta Fuel (TFUEL) tokens.

Following that intial launch, v 2.0 of the mainnet went live in May 2020. At that time Theta introduced Guardian nodes, a revolutionary, two layer consensus mechanism to complement Enterprise validators run by a premiere set of global partners including Google, Samsung, Binance, Blockchain.com, and Gumi.

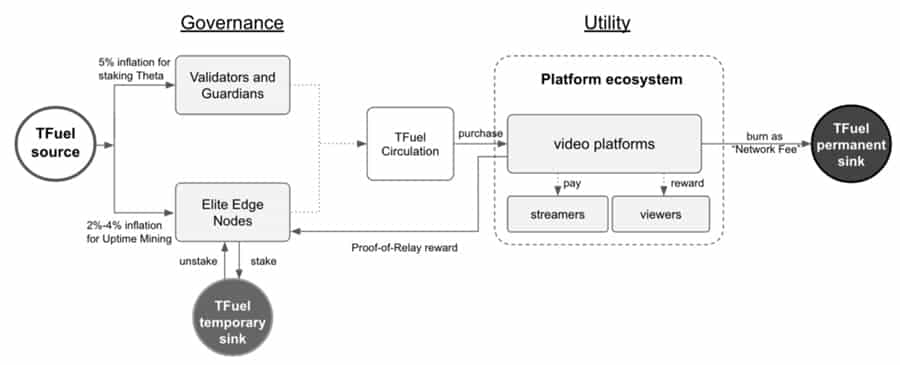

Theta Fuel was created to be similar to the “gas” used in the Ethereum network. With the launch of the mainet the Theta Fuel tokens are being used as the reward token of the Theta network.

One of the most important aspects of the Theta mainnet launch was the introduction of Theta Fuel (TFUEL), the “gas” or payment token of the Theta Network. TFUEL powers on-chain operations like payments to relayers for sharing a video stream, or deploying or interacting with smart contracts.

Relayers earn TFUEL for every video stream they relay to other users on the network. You can think of Theta Fuel as the “gas” of the protocol. In conjunction with THETA, the staking and governance token of the protocol, these two tokens make up the economic system of Theta Network.

Once the network moves to version 3.0 in the spring of 2021 Theta will add a new mechanism for staking and burning TFUEL.

Network Participants

There are numerous stakeholder and nodes that help prop up the Theta Token ecosystem. The network was created with 5 major groups of stakeholders:

- Streamers/Influencers – These are the content producers of the network who produce live content and videos for later consumption. They are rewarded with Theta tokens for their contributions.

- Viewers – The users who come to THETA.tv to consume video content. They provide viewer engagement, which is arguably the most important part of the entire video streaming network. Viewers are rewarded for viewing and engaging with videos and can also choose to be rewarded for viewing advertisements.

- Advertisers – They use the platform to promote services and products to the viewers. They spend Theta tokens to buy advertising time in the network, and to sponsor influencers.

- Caching Nodes – These are the computers and servers that provide the network with caching services to improve the quality and delivery of the video stream. They are also rewarded with Theta tokens.

- Ingest Nodes – These are nodes which assist in providing various bitrates, stream resolutions, etc. They provide their services to the caching nodes for live streams and are rewarded for doing so.

Most recently Theta introduced their new Guardian Nodes with the May 2020 launch of version 2.0 of the mainnet. Guardian nodes are designed to finalize blocks in the Theta multi-BFT consensus protocol. These Guardian Nodes are meant to be run by members of the Theta community, and are rewarded with TFUEL. Those wishing to run a Guardian Node must have a computer or server with minimum technical specifications, and must stake 1,000 THETA tokens.

The hardware requirements to run a Guardian Node are:

- Internet speed: 5Mbps+ up and down;

- CPU: 8 cores or more;

- Memory: 32 GBytes or more;

- Disk size: 1TB or more, SSD hard drive preferred.

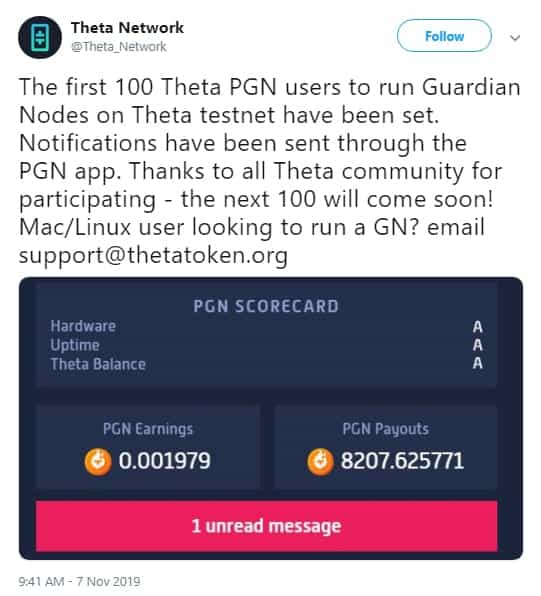

The on-boarding on pre-Guardian nodes began in March 2019, and as of November 2019 Theta announced the first 100 Guardian nodes have been selected to run on the Theta testnet.

By May 2020 the Guardian nodes were transitioned to mainnet and began helping validator nodes in securing the network, producing blocks, and earning TFUEL for their contributions. The addition of the Guardian nodes helps to ensure that no single entity or group can easily control the Theta staked in the ecosystem, significantly improving the decentralization of the network.

Guardian Nodes earn a share of all the new Theta Fuel (TFUEL) generated on Theta blockchain, which is 250m annually. The proportion of TFUEL you earn as a GN depends on how much THETA you have staked relative to the total number of THETA.

As an example, if you stake 100,000 THETA and the total network has 300m THETA stake, you are staking 0.033% of the THETA total staked to the network. That would translate into your node earning about 0.264 TFUEL per 100 block period, or 6,944 TFUEL monthly.

THETA EdgeCast

The core thesis for THETA has always been to build a fully decentralized video infrastructure that could benefit all the involved stakeholders from the platforms to the content creators and down the very end-users.

One of the ways to bring this to market includes the ability for end-users and content creators to choose which platform will be the most benefit to them. This doesn’t only include new, decentralized platforms. It also includes the existing advertiser sponsored platforms such as YouTube and Twitch, along with existing subscription based services like Netflix and Amazon Prime.

In order to make this a reality the Theta team released the beta of Theta EdgeCast in November 2020. This is the very first totally decentralized video streaming dApp built completely on the native Theta blockchain, including smart contracts. Theta EdgeCast has the ability to do video capture, the transcode it in real-time, and to cache and relay it to users all around the globe. This is a fully decentralized solution with no central servers or services. It is all accomplished through the more than 2,000 Theta edge nodes operating globally.

EdgeCast comes as part of the Edge Node application, and users can now broadcast streams on EdgeCast or view other users EdgeCast streams, as well as earn TFUEL via the Edge Caching and Edge Compute features. The Edge Node now encompasses all aspects of decentralized video streaming, distribution, and compute in one streamlined app.

The Theta team sees EdgeCast as a preview of the future, when Theta.tv evolves from its current hybrid platform status to a fully decentralized platform. In the long term they see decentralization as a key feature for all media and entertainment. They are positioning Theta to be a part of this future, and upgrades like EdgeCast bring the project closer to this future.

With Theta as the infrastructure users of 5G, smart TVs, mobile devices, and future connected devices will have a means to efficiently transfer video and data without the need for a centralized entity controlling the ecosystem. With Theta every user and device on the network will be able to benefit from the storage, transmission, and delivery of video and other data streams.

THETA Mainnet 3.0

The Spring of 2021 is set for the projected launch of Theta Mainnet 3.0 which will introduce TFUEL staking and burning, among other changes. That’s just two years after Theta initially introduced its peer-to-peer decentralized video delivery infrastructure. One year ago Theta introduced Guardian nodes to that infrastructure, as well as adding Enterprise validator nodes run by premier global partners such as Google, Samsung, Binance, Blockchain.com, and Gumi.

After Mainnet 2.0 was released in May 2020 the EdgeCast technology was introduced, adding significant enhancements to the Theta network and the video streaming capabilities of the decentralized edge network that’s been developed by Theta.

In December 2020 Theta added support for Turing-complete smart contracts, opening up a whole new realm of potential use cases and dApp feature sets. For example, the smart contract support has made it possible for Theta to launch ThetaSwap v1, the very first decentralized exchange (DEX) for the Theta network. Future upgrades could see fully digitized item ownership, innovative payment-consumption models, transparent royalty distributions, trustless crowdfunding mechanisms, and much more.

With these improvements as the foundation, Theta is now working on releasing Theta Mainnet 3.0 with two primary protocol innovations.

The first of these is the addition of Elite Edge Nodes. These are Edge Nodes that have had TFUEL staked to them, making them Elite Edge Nodes. This will enable Uptime Mining and will allow Elite Edge Nodes to earn TFUEL through the staked TFUEL, while also earnings additional TFUEL by providing higher performance for video platforms.

The overarching goal of the Theta crypto economics design is to properly incentivize and reward all Theta ecosystem stakeholders, and thus ensure the security and utility value of the Theta network. This includes a new 2-4% TFUEL inflation mechanism through Uptime Mining.

Basically Elite Edge Nodes will earn rewards based on the amount of TFUEL staked and the total uptime of the node. Additionally, there will be a lower and an upper limit on the amount of TFuel that can be staked to an Elite node. The lower limit is necessary to prevent sybil attacks, will be explained later. The upper limit is to ensure the most optimal level of decentralization. If users want to stake more TFuel than the upper limit, they can launch multiple edge nodes and split their TFuel across those nodes.

In addition to TFUEL staking, there will also be a TFUEL burning mechanism added as a cost for using the Theta edge network. This burning mechanism is being added as a balancing force against the additional supply that will come from the TFUEL inflation mechanism.

When Theta Mainnet 3.0 is launched there will be a minimum of 25% of each TFUEL payment to the network burned, effectively making it a cost for using the network. The Theta team believes that in the long-run, as Theta’s edge network becomes more widely adopted, this could meaningfully reduce the supply of TFuel.

These changes and more can be studied in greater detail in the Theta Mainnet 3.0 whitepaper.

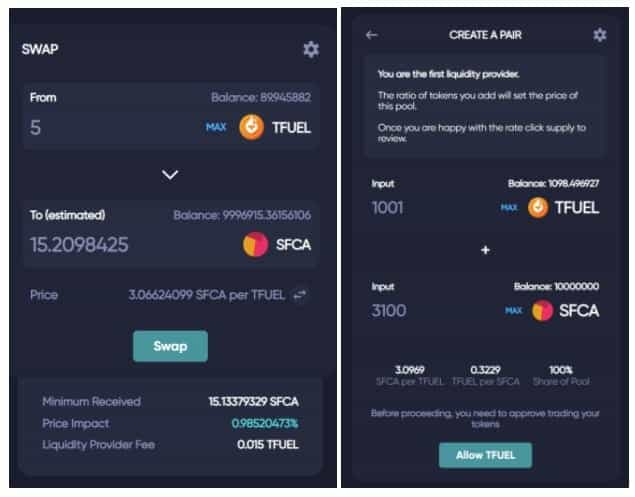

ThetaSwap DEX

With the addition of Turing-complete smart contracts to the Theta network many potential new use cases have been added to Theta, and one of these has been realized with the launch of the ThetaSwap DEX, the first decentralized exchange on the Theta blockchain. It is based on the Automated Market Maker logic similar to that of UniSwap. It allows users to exchange their newly-created TNT20 tokens built on Theta blockchain in a trustless, non-custodial way. Just hours after the release of the DEX on February 4, 2021 there were already a number of Theta streamers and community leaders creating their own TNT20 tokens. It is expected that this activity will only increase as the community and ecosystem grows.

The creation of a decentralized exchange was seen as necessary for Theta, given the new tokens being created on the blockchain. The Theta DEX gives users an easy way to trade the new tokens, and gives markets an efficient way to price the tokens. Now that ThetaSwap has been created there is a way for TNT20 tokens to function completely.

Streamers will now be able to issue loyalty tokens that will have real value to their fans, while pools or DAOs can fund media ventures more easily. There are many exciting new ways to monetize content on Theta now that ThetaSwap is active.

Version 1 of ThetaSwap allows trading of TFUEL and TNT20 tokens, but future versions will add functionality for THETA trading via a version of the THETA token in a TNT20 wrapper (similar to wETH or wBTC which you may have used in other DeFi protocols, you would use wTHETA in ThetaSwap).

Several stablecoins issuers have also expressed interest in bringing their assets to Theta blockchain in TNT20 form, making it even easier to trade on ThetaSwap. There are continued upgrades planned for ThetaSwap throughout 2021.

Theta Token Team & Partners

The Theta Token team is led by CEO and co-founder Mitch Liu, who was also co-founder of the video streaming site SLIVER.tv as well as Gameview Studios and Tapjoy.

A second co-founder is Jieyi Long, who was also a co-founder at SLIVER.tv as well as holding a PhD in computer engineering from Northwestern University. SLIVER.tv is a video game streaming service similar to Twitch, and is one of the backbones in the Theta Token infrastructure.

Adding to the knowledge and growth of Theta is an experienced group of Media Advisors, which includes YouTube co-founder Steve Chen, and Twitch co-founder Justin Kan.

The Theta Token team has forged several crucial partnerships, including one with Twitch that will allow viewers to earn Theta Fuel Tokens (TFUELHETA) by sharing their bandwidth to broadcast streams.

It also has partnerships with Steam, a video game provider, and with the decentralized cloud computing blockchain Aelf. One other key partnership is with the startup accelerator Play Labs. More recently it has formed partnerships with SamsungVR and with Littlstar, a media platform that gives Theta access to 100+ million Playstaion platforms.

Theta Token Community

The community behind any blockchain project is certainly an important factor to consider as it helps with both spreading the news about the platform, and ultimately with adoption.

The largest community following Theta is on Twitter, which you might expect as Twitter followings seem to be highest for blockchain projects. Theta Network has nearly 83,000 Twitter followers.

What is surprising is the number of Facebook followers the project has. Typically blockchain projects don’t see much activity from Facebook, but the Theta Network’s Facebook page has over 62,000 followers.

Telegram has become increasingly important for blockchain projects, and they often use Telegram as their first place to share news, and as a place to carry on discussions about changes within the platform and community. Theta has almost 11,000 Telegram members, which isn’t a bad showing on that platform.

Another surprise for the project comes from Reddit, which is usually a popular hangout for cryptocurrency enthusiasts, but in the case of Theta there are just 3,300 followers for the Theta subreddit. There are also over 5,000 followers on a defunct Theta subreddit that moved almost a year ago.

Token Price Performance

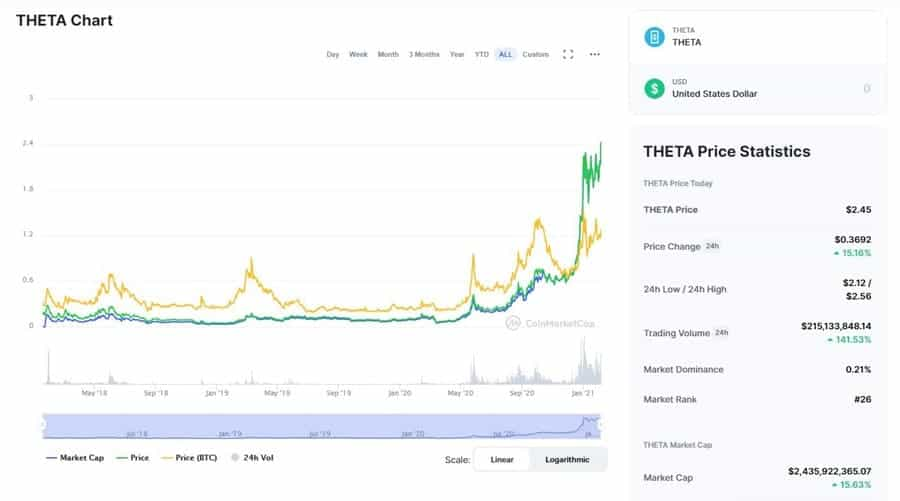

Rather than holding a public ICO, the Theta Token team held a private sale in which $12 million was raised. The pre-sale token price was $0.15 and by the following month the price had more than doubled to an all-time high of $0.314425 on January 27, 2018. Price wouldn’t return to that level until May 2020. And from May 2020 until February 2021 the price continued climbing, reaching a new all-time high of $2.56 on February 5, 2021.

Of course the initial all-time high was during the huge rally in blockchain markets in January 2018. And the new all-time high is occurring during another huge rally in cryptocurrencies that’s been lifting many of the most popular and successful projects to new all-time highs.

TFUEL Price History

TFUEL appeared on exchanges on March 28, 2019 at an opening price of $0.017001 and it closed nearly unchanged that day at $0.017193. Price fell over the next several weeks, but a spike higher in late May allowed TFUEL to print an all-time high of $0.025061 on May 25, 2019.

Price fell off that high and in March 2020 TFUEL printed its lowest price ever of $0.0008894. That low was followed by a rally that would culminate with TFUEL hitting its highest level ever at $0.04020 on December 27, 2020.

Buying & Storing THETA & TFUEL

The two largest exchange services for THETA are being provided by Binance Exchange and BkEx. There’s also decent volumes being exchanged at Huobi Global, UpBit, and DigiFinex. There’s a handful of other exchanges selling THETA, but with smaller volumes.

The majority of trading volume in TFUEL is at Binance, although there is a decent amount being exchanged at Upbit. There are only a few other exchanges listing TFUEL and the volumes being exchanged are negligible.

The Theta native wallet was released just days before the mainnet was launched. On March 9, 2019 Theta announced the release of the native web wallet, which can be used for both THETA and TFUEL tokens. This who prefer more security in their cryptocurrency storage can opt for the Trezor or Ledger hardware wallets.

There are also several third-party wallets that support storage of THETA and TFUEL and these include the Trustwallet and the Atomic wallet. Theta Labs has also released mobile versions of the Theta wallet for both Android and iOS

Development & Roadmap

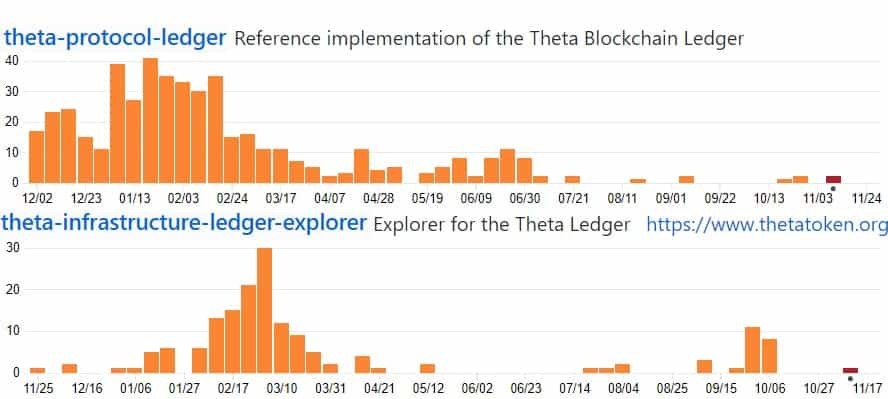

This all sounds well and good but how much development output have the team been pushing recently?

One of the best ways to get a sense of this is to look into a project's GitHub. By observing the total commits to their open source repositories, we can get a sense of the raw output.

So, I decided to dive into the Theta Token GitHub. Below are the total commits to the top two most active repos over the past 12 months.

As you can see, the developers have still been busy working on the core protocol. This is a bit less than we would expect from a project in this stage of development but its still progress.

In fact, if we were to look at sites such as CoinCodeCap, it is clear that the Theta Labs code output falls quite far behind. There are a further 8 code repositories but none of these had any reasonable development in them recently.

In terms of the Roadmap,

they have done very well and have an impressive amount of work planned for 2021, some of which has already been completed and implemented.

If you wanted to keep up to date with the latest business developments, then you are best suited to follow their Twitter account as well as their official blog.

Conclusion

Since the launch of the Theta live streaming platform back in 2016 the project has come a very long way. With THETA now live on the SLIVER.tv platform and the mainnet working well and nearly ready for version 3.0, the team has been working to expand the partnerships and reach of the Theta Network.

Video streaming has a huge and increasing demand in the 21st century, and the Theta Token team is looking to make their platform the go-to blockchain for video streaming. It remains to be seen if they can succeed, but they have a very talented and experienced team and a solid vision. Plus they have a very good start compared with some other similar projects.

There are more interesting things being planned now the network is launched, including shared mining rewards to distribute rewards among several users; anti-piracy measures to dis-incentivize piracy.

They are also planning for the inclusion of a general service platform that goes beyond streaming videos, but provides such services as smart streaming contracts. The team has also been looking into ways to integrate the Theta platform into smart TVs, which would theoretically give Theta hundreds of millions of new users.

Despite some recent downward pressure the THETA token is the 24th largest coin on Coinmarketcap.com, while TFUEL is the 116th largest. Both tokens are at or near their all-time highs, and with the launch of version 3.0 of the mainnet, which will add staking of TFUEL, it’s quite possible the rally in these tokens has only begun.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.