Upbit Review 2024: Exploring Korea's Largest Crypto Exchange

As the popularity of cryptocurrencies continues to soar, the landscape of crypto exchanges has become increasingly crowded with options. Indeed, CoinGecko lists 217 exchanges, while CoinMarketCap tracks 245 spot crypto exchanges.

This growth in the crypto exchange market has had a double whammy of effects — on one hand, users have plenty of options to choose from, but they also face challenges in distinguishing reputable exchanges from those that may lack reliability.

That's where The Coin Bureau comes in, helping readers with reliability, security, and essential features when selecting a crypto exchange.

In this Upbit review, we'll examine its origins, the regulatory headwinds it has faced in its native South Korea, how much fees it charges and countries where it doesn't offer its services.

For this review, I only had access to Upbit's Singapore exchange.

Upbit Review Summary

Upbit is South Korea's largest cryptocurrency exchange. It allows you to trade 37 tokens but lacks the diverse product offerings that have now become a staple of crypto exchanges.

What is Upbit?

Upbit is a South Korea-based cryptocurrency exchange operated by Dunamu, which launched the exchange in October 2017. In its home country, it is the largest crypto exchange. More recently, the Monetary Authority of Singapore granted Upbit Singapore a major payment institution licence, which allows the exchange to enhance its product offerings.

As it currently stands, however, Upbit doesn't do much beyond letting users buy and sell crypto.

It doesn't offer a diverse range of products like many other crypto exchanges. This means you won't find an earn product, copy trading, a crypto card, trading bots or loans on Upbit, products that have now become the norm in exchange offerings.

Users also cannot engage in margin trading as the exchange only offers three order types:

- Market orders: These only require specifying the amount to be sold or the total to be bought. These orders are executed at the best available price instantly.

- Limit orders: A limit order allows users to set both price and amount. If the set price differs from the market price, the order remains unfilled until conditions match.

- Stop-Limit orders: These orders automatically execute a limit order when the stop price is reached. They are primarily used for implementing stop-loss or take-profit strategies. However, it's important to note that stop-limit orders are not available in all markets.

According to CoinGecko, Upbit's 24-hour trading volume is $3.69 billion, second only to Binance.

If you're looking for an exchange that goes beyond trading, you should check out our picks for the best crypto exchanges.

Upbit KYC

Upbit is a centralized exchange, which means it has to adhere to strict KYC measures designed to fight money laundering and terrorist financing.

The exchange introduced an enhanced anti-money laundering (AML) policy and system in 2020 to adhere to new regulatory standards. This system incorporates AML compliance solutions tailored for digital asset exchanges, encompassing tools for know-your-customer (KYC) procedures, risk assessment, and reporting suspicious transactions.

Upbit's AML solution draws inspiration from major financial institutions in South Korea. Key features include a consolidated KYC process merging watchlist filtering with customer risk assessment, alongside a suspicious transaction reporting system enabling analysts to identify relevant transactions and submit reports to the Korea Financial Intelligence Unit.

Unique to digital asset transactions, the system integrates blockchain analysis tools.

As noted, Upbit has four KYC levels, each unlocking a little bit more than the last. The exchange only accepts passports and government-issued IDs.

Upbit Supported Cryptocurrencies

Upbit allows users to buy and sell 37 digital assets, including blue chips like Bitcoin and Ethereum. Here are a few other cryptos you can buy and sell via Upbit:

Interestingly, there are some major names missing, including Ethereum Layer-2s like Arbitrum, Optimism and Polygon. Big-name Layer-1s such as Solana and Avalanche can't be traded via Upbit either.

Bad news for memecoin aficionados: You won't find memecoins on Upbit. We recommend KuCoin for those most interested in memecoin trading and altcoin gems.

Upbit Security

In 2019, Upbit reported the theft of 342,000 Ether from its hot wallet, valued at approximately $50 million at the time of the incident. Dunamu CEO Lee Seok-woo confirmed the incident in a post on X but stopped short of labelling it as a hack. The exchange made users whole and transferred all remaining crypto assets to cold storage.

Upbit is also a frequent target of hacks.

The exchange reported over 159,000 hacking attempts in the first half of 2023, up 117% from the first half of 2022 and a whopping 1,800% from the first half of 2020, Cointelegraph reported. Upbit has intensified security measures by increasing cold wallet holdings to 70% and enhancing security for hot wallets.

Upbit has not experienced any security breaches since the 2019 incident.

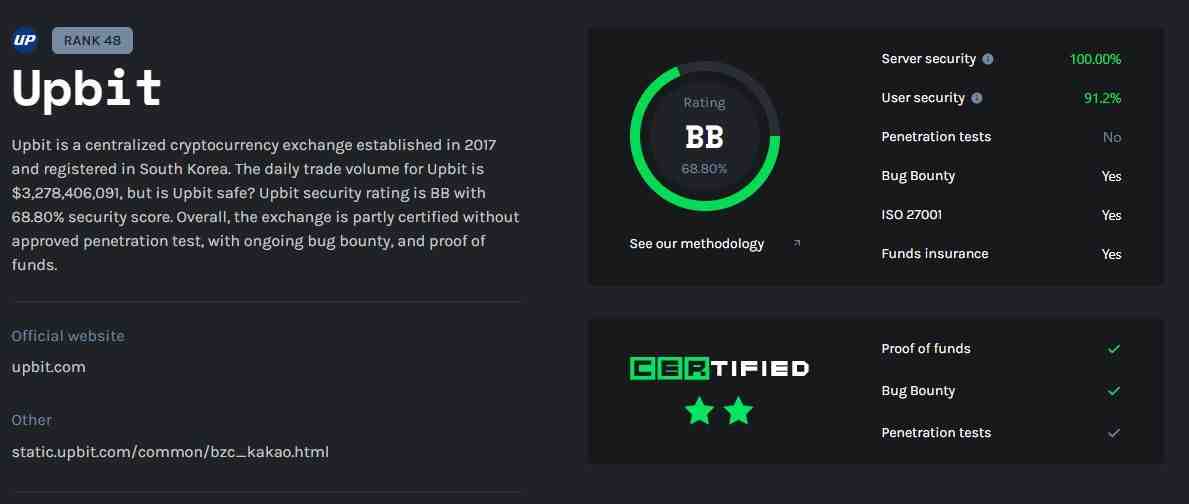

The exchange has a middling BB rating from CER, which assesses crypto exchange security.

Upbit's Regulatory Headwinds

In December 2018, Three senior employees of Upbit, including founder Song Chi-Hyung, were formally charged with fraud by the Prosecutors' Office of the southern district of Seoul, CoinDesk reported. They were accused of engaging in fraudulent transactions between September 2017 and December 2017, allegedly using a fake corporate account to make fake orders worth 254 trillion won ($226.2 billion) to inflate trading volume figures and attract more customers.

They were also accused of selling 11,550 Bitcoins to customers through rigged transactions, resulting in a profit of 150 billion won ($133.8 million). Upbit denied the allegations, claiming that the transactions were made to provide liquidity and stabilize the market, and that it did not benefit from or trade in this process. However, the exchange admitted to engaging in some transactions early for marketing purposes, which comprised about 3% of the total volume at the time.

A judge in 2020 found the Upbit employees not guilty.

Upbit Fees

Upbit charges a maker and taker fees as exchanges do:

- The "Maker" fee applies when a trader adds liquidity to the order book by placing a limit order that is not immediately filled.

- The "Taker" fee applies when a trader removes liquidity from the order book by placing a market order or a limit order that is immediately filled.

- For stop-limit orders, both maker and taker fees apply.

The fees vary depending on the market and currency being traded.

- In SGD Markets, both maker and taker fees are 0.25% for limit, market orders and stop-loss orders.

- In BTC markets and USDT markets, there is a discount for both maker and taker fees when using limit and market orders, reducing from 0.25% to 0.2%.

| Market | Limit Order | Market order | Stop-Limit |

|---|---|---|---|

| SGD Markets | 0.25% | 0.25% | 0.25% |

| BTC Markets | 0.2% | 0.2% | 0.2% |

| USDT Markets | 0.2% | 0.2% | 0.2% |

Upbit Deposit and Withdrawal Limit

Upbit currently supports the deposit and withdrawal of roughly 40 assets.

Deposit and withdrawal limits vary based on verification levels, ranging from Level 1 to Level 4. Users cannot withdraw or deposit at Level 1, while Level 4 offers unlimited deposits and withdrawals for digital assets, with withdrawal limits in SGD varying from SGD 50,000 to SGD 100,000 per transaction and per day.

It's important to note that SGD deposit/withdrawal only unlocks at Level 4 verification — you must successively complete identity verification (Level 2), residential address verification (Level 3) and bank account aerification (Level 4).

For more information, you can check out the Upbit deposit and withdrawal section.

Upbit Unsupported Countries

Upbit doesn't offer its services in countries on the US Treasury Department's Office of Foreign Asset Control and countries on the Financial Action Task Force's black and grey lists.

In addition, the exchange doesn't provide services to residents of the U.S. due to the "complexity of the country's regulatory environment."

Upbit Review: Closing Thoughts

As the largest cryptocurrency exchange in South Korea, Upbit commands a significant presence and facilitates the trading of various digital assets. Upbit's product offerings are relatively limited compared to other exchanges, lacking diverse features such as earning products, copy trading, and crypto cards.

As users navigate the complex landscape of cryptocurrency exchanges, they must weigh Upbit's strengths, including its market position and regulatory compliance efforts, against its limitations to make informed decisions regarding its suitability for their trading needs.

Frequently Asked Questions

Upbit is a prominent cryptocurrency exchange based in South Korea, operated by Dunamu. Launched in October 2017, it has grown to become the largest exchange in the country, facilitating the buying and selling of various digital assets.

Upbit supports the trading of a variety of digital assets, including major cryptocurrencies like Bitcoin and Ethereum, as well as altcoins such as Tron, Cosmos, Ripple, Litecoin, and Cardano. However, some notable cryptocurrencies may be absent from its offerings.

Yes, Upbit operates under regulatory frameworks, adhering to strict Know Your Customer (KYC) and anti-money laundering (AML) measures to comply with local regulations. The exchange has introduced an enhanced AML policy and system to meet regulatory standards.

Upbit charges maker and taker fees for trades, with the fees varying depending on the market and currency being traded. Maker fees apply when adding liquidity to the order book, while taker fees apply when removing liquidity. The fees are subject to discounts in certain markets.

No, Upbit does not offer its services to residents of the U.S. due to regulatory complexities there.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.