Scalping is a rapid-fire trading style that aims to capture micro-price moves within minutes or seconds; an approach well suited to crypto’s high volatility and 24/7 markets. Because opportunities can appear and vanish between ticks, automation often outperforms manual clicks: humans react in ~200–250 ms, while well-connected systems can execute in single-digit milliseconds thanks to low-latency data streams and co-located infrastructure.

In this guide, we distill the landscape into seven credible options, explain where each bot shines, and outline risks and safeguards so you can choose confidently. If you’re new to automation, start with our primer on crypto trading bots before exploring the detailed reviews that follow.

Quick Verdict — Which Bot Wins in 2025?

Top 4 Scalping Bots 2025

| Rank | Bot | Why it wins | Ideal for |

|---|---|---|---|

| 1 | ArbitrageScanner | Strong cross-venue alerts with a no-API-keys model; fast Telegram notifications keep custody with you. | Pro users targeting CEX–DEX spreads with manual confirmations. |

| 2 | 3Commas | Polished SmartTrade with trailing TP/SL for momentum entries and exits across many venues. | Traders who want clean UX and rule-based momentum tools. |

| 3 | Bitsgap | Mature GRID implementation plus multi-exchange management from one terminal. | Range and arbitrage-curious users needing multi-exchange control. |

| 4 | Pionex | Built-in bots that run free in the cloud with zero subscription cost; ideal for testing grid or DCA strategies safely. | Beginners who want hands-off automation without monthly fees. |

Comparison Table (2025 Snapshot)

(Legend: ✅ = available, — = not available. Pricing verified Oct 24, 2025; always check the official pricing pages for updates.)

| Bot | Starting Price | Free Trial | Mobile App (iOS/Android) | Best For | Key Features | Our Verdict |

|---|---|---|---|---|---|---|

| ArbitrageScanner | Start $99/mo | 1-day by request | Web/Telegram | Pro arbitrage scalpers | No API keys, CEX/DEX scanners, Telegram alerts | #1 Overall |

| 3Commas | Free / Pro $49/mo | Yes – trial available | ✅/✅ | Momentum traders | SmartTrade, trailing TP/SL, 15+ exchanges | Best UX |

| Cryptohopper | Explorer $29/mo | 3-day free trial | ✅/✅ | AI breakout scalpers | AI tools, cloud-hosted, Marketplace | Great AI Value |

| Bitsgap | Basic $29/mo | 7-day PRO trial | ✅/✅ | Multi-exchange grid scalping | GRID bot, multi-exchange terminal, AI assistant | Top Arbitrage Option |

| Pionex | Free | N/A (free to use) | ✅/✅ | New scalpers | Built-in bots, 0.05% spot fee, cloud execution | Best Free Bot |

| Coinrule | Free – $39.99/mo | Yes (Free plan) | ✅/✅ | No-code strategy builders | IFTTT-style rules, TradingView sync | Best for Beginners |

| CryptoRobotics | From $19/mo or profit-sharing | Varies (e.g., 7-day signals promo) | —/✅ | AI scalpers | ML-based signals, autofollow, demo trading | Smartest AI Bot |

| Gunbot | Lifetime $59 one-time | No | —/— | Market-making scalpers | Self-hosted, deep customization, REST API | Best for Market-Making |

Why Automation Is Essential for Scalping

Scalping aims to capture very small price moves that can appear and disappear in the blink of an eye. Automation matters for three core reasons: speed, emotion-free execution, and consistency.

Speed

Humans typically take 200–250 milliseconds to react to a simple visual cue, which is about a quarter of a second, before any decision or mouse click even happens, as shown in a peer-reviewed study and a benchmark dataset. By contrast, co-located trading systems at crypto exchanges can route orders in single-digit milliseconds; for example, WhiteBIT colocation advertises execution “in just 5 ms.” In markets where prices update many times per second, that gap can be decisive.

Emotion-free execution

Automated strategies follow predefined rules without hesitation or fear. This removes the “should I click now?” pause and the second-guessing that often turns small losses into larger ones. In practice, the bot checks a condition and sends the order, simply no adrenaline involved.

If you’re new to the idea, our introduction to algorithmic trading and this guide by Cisco on latency explain why rapid, deterministic execution matters.

Consistency

Bots do the same thing at 3 a.m. as at 3 p.m. They don’t tire, overtrade, or miss signals after a long session. That steadiness is valuable in crypto’s 24/7 order books, where a missed entry by a few ticks can erase the entire edge of a scalping setup.

Human vs Bot reaction/execution latency

| Agent | Typical reaction/execution latency | Notes |

|---|---|---|

| Human (visual reaction) | ~200–250 ms | Peer-reviewed study; benchmark dataset |

| Co-located scalping bot | ~5–10 ms | Example: WhiteBIT colocation; actual latency varies |

Top Crypto Scalping Bots of 2025

Now let's dive into our bot-by-bot breakdown of the tools we’ve shortlisted for 2025. Each bot comes with its unique identity and parameters, so it all comes down to your trading experience and requirements for scalping.

While you're at it, you can also check out our list of the best exchanges for scalping.

Note: Prices and other figures mentioned for each service were obtained on Oct. 24, 2025.

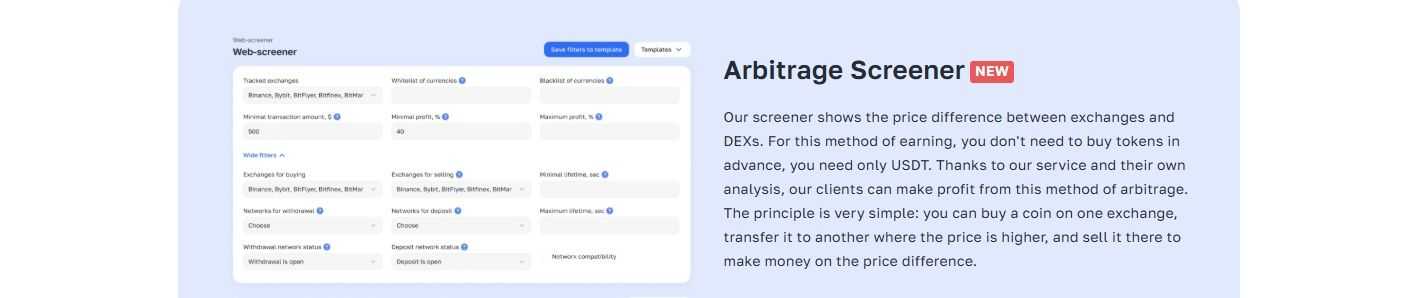

1. ArbitrageScanner — Best Overall for Arbitrage Scalping

ArbitrageScanner is a monitoring and alerting platform built to surface cross-venue price gaps so traders can act on spreads in real time. The service emphasizes a no-API-keys workflow, where you don’t connect exchange credentials, which many users view as a security plus, and it delivers opportunities via Telegram alerts for quick triage and manual execution. You can review the product and coverage overview on the project’s homepage and supporting blog.

Highlights

- Key stats: The official homepage currently states support for over 50 centralized exchanges, 25 decentralized exchanges, and 40 blockchains.

- Pricing starts at $99 per month, going up the tiers for different business levels as well.

- Wallet-analysis suite: This lets you filter for wallets based on ROI, earnings, and specific token activity; track, compare, and mirror “smart” wallets via an AI-driven “similar wallets” tool across 272 criteria.

- Real-time notifications and scan alerts: For example, spreads between CEX ↔ DEX, spot ↔ futures arbitrage, funding‐rate opportunities, and chat/channel monitoring for news, so you can act quickly when arbitrage windows open.

Pros

- A decentralized model that avoids sharing API keys; instant notifications via Telegram

- broad multi-venue coverage that helps surface CEX-DEX discrepancies promptly

Cons

- No auto-execution, which means alerts are surfaced by the tool, but orders are placed by the user, which can add steps when speed matters

Verdict: Most profitable for pro arbitrageurs who are okay with manually confirming trades as opposed to automated executions.

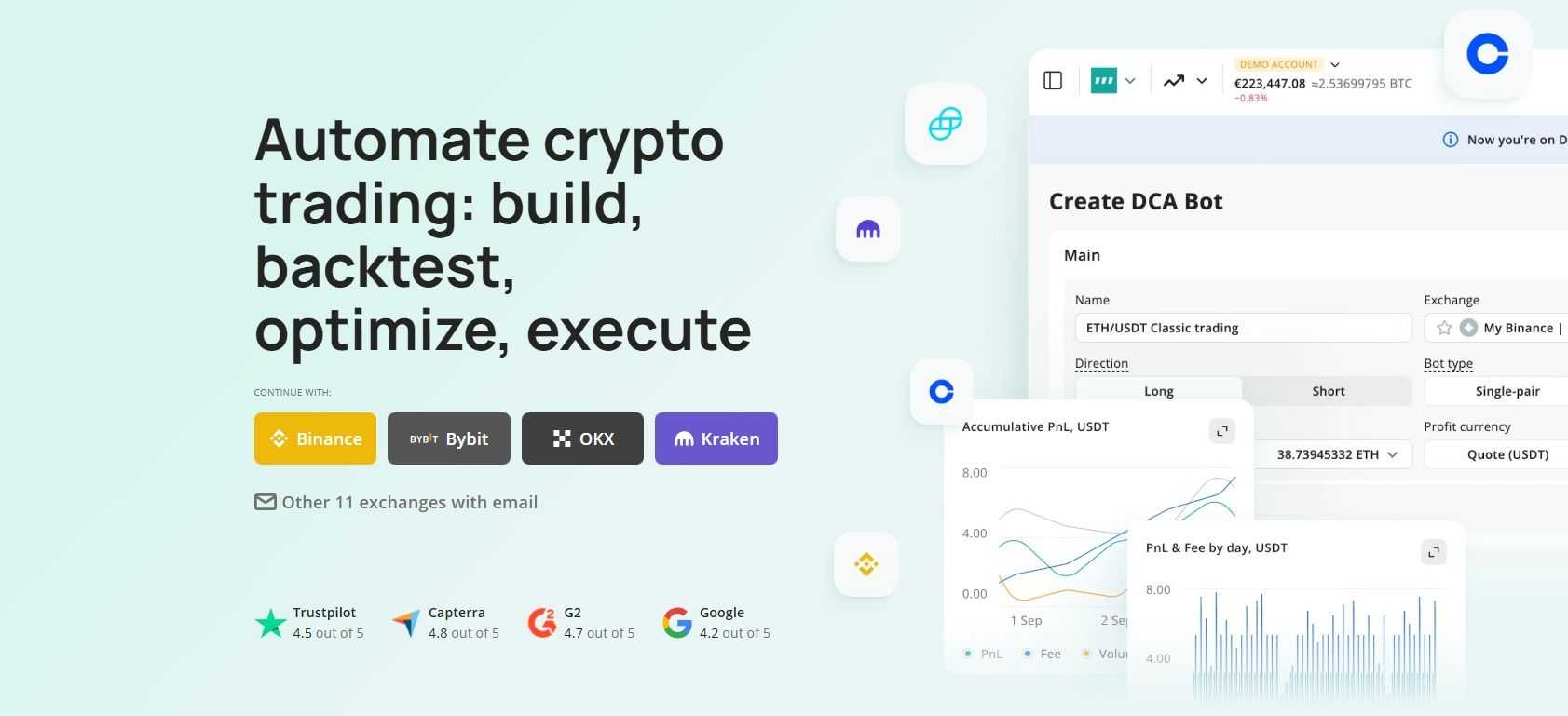

2. 3Commas — Best for Momentum Scalping

3Commas centers on its SmartTrade terminal, which lets users combine entries, take-profit targets, and stop-loss protection in one ticket, with trailing orders that automatically follow the price to help capture momentum. The platform provides a supported exchanges roster (including major spot and derivatives venues; availability varies by region per the help center). For newcomers, the help docs and trailing stop-loss guide explain how trailing logic works in plain terms.

Readers can find additional context in our Coin Bureau 3Commas review.

Highlights

- SmartTrade execution & trailing tools: Unified orders with simultaneous TP/SL and trailing TP/SL designed to “chase” price during momentum.

- Exchange coverage: An official exchange page lists supported venues and features; regional notes apply.

- Plans: Limited features for free, then Pro mode starts at $49 per month, with more advanced plans available. The pricing page outlines Free (paper-trading) and paid tiers; subscriptions help clarify limits and billing.

- Mobile access is available via the iOS app (rated 4.7 as of October 23, 2025) and Android app (rated 4.4). (Ratings are stated as of October 23, 2025)

Pros

- Robust SmartTrade with trailing logic for momentum management.

- Broad exchange support and mobile apps for on-the-go adjustments.

- Clear docs for beginners.

Cons

- Feature availability differs by exchange; some tools aren’t uniform across venues.

- Regional restrictions may limit access to certain exchanges or features.

Verdict: A strong fit for traders who favor rules-based momentum entries with trailing exits and want SmartTrade’s one-ticket control across multiple exchanges.

3. Cryptohopper — Best AI-Assisted Scalper

Cryptohopper offers AI-driven tools alongside a rules-based terminal, so traders can combine automated entries with clear risk controls. Strategies can be sourced from a curated Marketplace, including templates, strategies and third-party signals, and evaluated with built-in backtesting before going live. Because the platform is hosted in the cloud 24/7, bots continue to monitor and act even when the user is offline, with access from web and mobile.

Highlights

- AI signals & templates: Users can subscribe to Marketplace signals and deploy preconfigured templates.

- Backtesting: The documentation explains how to simulate strategies on historical data and then push configurations to live trading.

- 24/7 cloud operation: The platform is cloud-hosted for continuous operation with web and mobile access.

- Pricing starts at $29 per month, with free usage for the basic and limited versions.

Pros

- Accessible setup with Marketplace templates and signals.

- Built-in backtesting and AI selection to iterate quickly.

- Cloud 24/7—no local server required.

Cons

- Outcomes depend on the quality of chosen signals or community strategies; third-party offerings vary.

- Some features or exchange integrations can differ by venue.

Verdict: A user-friendly choice for traders who want AI-assisted signals, quick template-based deployment, and backtesting to refine settings, without managing their own infrastructure.

Signal → Execution → Profit (conceptual)

| Step | What happens | Where it’s managed |

|---|---|---|

| Signal | Subscribe to Marketplace signals or use AI selection | Marketplace / Bot settings |

| Execution | Bot places orders per your configuration; manage on the cloud platform | Web / Mobile |

| Profit / Loss Review | Evaluate results and iterate with backtesting | Docs / Bot dashboard |

For a broader overview, see our review of Cryptohopper.

4. Bitsgap — Best Multi-Exchange Bot

Bitsgap is a multi-exchange automation platform best known for its GRID bot, unified terminal, and cloud operation. Users connect venues via API and manage positions across supported exchanges from one interface. Grid strategies can be launched with templates or tuned with advanced settings. While Bitsgap publishes educational material on arbitrage, its current feature pages prioritize grid/DCA; cross-exchange arbitrage is typically executed manually via the terminal.

Highlights

- GRID + multi-exchange: Quick deployment with templates and monitoring across exchanges.

- Advanced controls: Fine-tune ranges, levels, and behavior via advanced GRID settings.

- Pricing for the main features starts from $29 per month for the basic level, with a 7-day trial period.

- Arbitrage angle: Official guides explain concepts; no prominently advertised dedicated arbitrage bot at present.

Illustrative example (not a performance claim): $5,000 ETH grid in a defined range buys lower and sells higher on each step; results depend on range, spacing, fees, and staying within the band. Let's see how that looks.

GRID spacing trade-offs — conceptual

| Spacing | Levels | Trade frequency | Use case |

|---|---|---|---|

| Tight | 120 | Higher | Narrow, choppy ranges |

| Medium | 60 | Moderate | Balanced ranges |

| Wide | 20 | Lower | Broad ranges |

Pros

- Mature GRID bot with advanced controls.

- Multi-exchange management via supported exchanges.

- Always-on cloud.

Cons

- No dedicated arbitrage bot on official feature pages.

- Outcomes vary with range, spacing, and fees.

Verdict: A strong pick for traders who need multi-exchange control and a flexible GRID implementation.

Check out our detailed review of Bitsgap for more information.

5. Pionex — Best Free Grid Bot

Pionex is a crypto exchange with built-in bots that run in the cloud, so newcomers can deploy strategies without managing servers. The platform emphasizes zero subscription fees for its bots, as users pay trading commissions only, and it maintains low spot trading fees overall, which helps smaller accounts keep costs predictable. Depth is supported by aggregated liquidity sourced from major venues, improving order execution for grid-style scalping.

Highlights

- Zero subscription fees: Bots are free to use; Pionex states that users pay trading fees only and clarifies in its official blog that there’s no extra bot charge.

- Binance-powered liquidity: Pionex describes the exchange as a large Binance broker that aggregates liquidity from Binance (and historically Huobi/HTX), which can aid fills for grid orders.

- Grid bots for passive use: The Grid Trading Bot guide explains the “buy low, sell high” range logic, making it approachable for small, semi-passive setups.

Pros

- No monthly bot cost; 0.05% spot fee helps smaller balances.

- Built-in grid bot with cloud execution, and no VPS required.

- Liquidity aggregated from Binance can support tighter spreads.

Cons

- Exchange-native approach means tools are tied to the Pionex venue rather than your existing CEX accounts.

- Feature availability and pairs can differ between Pionex Global and Pionex.US.

Verdict: Best entry point if you want to try scalping without paying.

Get more information from our detailed review of Pionex.

6. Coinrule — Best No-Code Automation

Coinrule is a no-code automation platform that lets traders build rules with IFTTT-style logic and connect them to supported exchanges. Strategies can be deployed from a library of template rules and refined using TradingView integration for signal-based entries and exits. Because the service is cloud-based, rules keep running without a local server, which suits beginners who want conditional logic trading without writing code.

Highlights

- IFTTT rules: Build conditions and actions with guided menus using IFTTT-style rule creation.

- TradingView integration: Route TradingView signals to open/close trades within one rule.

- Templates: Access a library of templates (plan limits shown on the pricing page: ~10 on Starter, 50 on Investor, 200+ on Trader).

- Pricing: Free plan available; paid plans start at $39.99/month (Investor), with higher tiers adding more rules, templates, and TradingView support.

“If BTC ↑ > 1% in 5 min → sell 50%”

| Trigger | Condition | Action |

|---|---|---|

| Price move | BTC increases > 1% within 5 minutes | Sell 50% of position (with optional stop/TP) |

Verdict: A strong fit for retail users who want conditional logic trading powered by IFTTT-style rules, TradingView signals, and an expandable template library, without writing code.

7. CryptoRobotics — Best AI + HFT Hybrid

CryptoRobotics is a multi-exchange automation platform that emphasizes AI-assisted decisioning and signal-driven execution inside a web terminal. The company’s materials describe AI bots that generate hourly predictions and retrain regularly, alongside scalping bots designed to execute numerous small trades rapidly, features that suit users who want machine-guided entries without running their own infrastructure. You can onboard through a marketplace of bots and signals and manage everything from a browser, with operations marketed as automatic 24/7.

Highlights

- AI pattern detection: The platform’s AI bots state they predict hourly and retrain on fresh data, and the signals hub repeats this cadence, indicating an ML-based approach to pattern recognition.

- Scalping focus: Official scalping pages describe bots that execute numerous trades quickly to capture micro-move, which is useful for rapid, rules-based scalps.

- Marketplace templates & copy/auto-follow: Users can browse a marketplace of bots and signals and opt into Autofollowing for strategy mirroring.

- Backtesting context: The team publishes guidance on backtesting and coverage of specific bots having undergone testing and backtests; we do not cite performance figures here unless presented in official, auditable form.

- 24/7 cloud operation: Multiple product pages reference automatic 24/7 trading, indicating bots continue running when users are offline.

- Pricing: In addition to profit-sharing (pay a % of net profit only when profitable), prices start from $19/month for certain tiers and tools, with details evolving over time. You can have a free account as well with limited services.

Pros

- AI-guided signals with hourly model updates and marketplace onboarding.

- Web-based, always-on operation with multi-exchange connectivity.

Cons

- Performance varies by bot and market regime; official materials discuss methods but avoid audited returns.

- Pricing models differ across bots (subscription vs profit-sharing), so costs can be strategy-specific.

Verdict: Promising AI engine; worth exploring for tech-savvy traders who want ML-assisted signals and automated execution without maintaining their own stack.

Gunbot — Best for Market-Making Scalping

Gunbot is a self-hosted trading bot known for deep customization and a toolkit that appeals to power users who want to control every part of their setup. The official documentation emphasizes that it runs on your own computer or server, keeping API keys local and configurations private. Advanced users can fine-tune strategies (from grid styles to market-making variants) and even extend logic with custom JavaScript via the custom strategies framework, or integrate tools through the REST API. Gunbot supports a wide exchange roster across spot and futures markets, and its Market Maker ecosystem is documented in the project’s official marketplace archive. Because trades are dispatched directly from your environment (not a shared cloud), advanced users can optimize request pacing and cycle times using exchange settings, a practical edge for market-making or scalping workflows where responsiveness matters.

Highlights

- Deep customization & local hosting: Self-hosted operation per the docs; extend behavior with custom JS and the REST API.

- Market-making focus: Access to Market Maker scripts and variants via the official archive; broad exchange support for spot/futures.

- Latency management (practical): Tune forced wait times between API requests to optimize bot cycles for fast markets.

- Pricing: No monthly fee; lifetime license currently starting from $59 on the official plans page.

Pros

- Maximum control, privacy, and extensibility for advanced traders.

- Wide exchange coverage and strategy library.

Cons

- Self-hosting requires setup, monitoring, and basic sysadmin hygiene.

- Tuning market-making settings has a learning curve.

Verdict: A powerful choice for market-making scalpers who want local hosting, granular control, and code-level customization instead of a one-size-fits-all cloud bot.

How to Choose the Right Scalping Bot for You

Start with three inputs: your skill, capital, and goal, and then map to a tool that matches your constraints. If you’re new, simplicity and low fixed cost matter more than exotic features. As you gain experience, execution control, exchange coverage, and latency become bigger drivers.

Your Skill × Capital × Goal → Suggested Bot

| Skill level | Typical capital | Primary goal | Suggested bots |

|---|---|---|---|

| Beginner | <$2k | Learn safely; low fixed cost | Pionex (built-in bots; zero subscription fees), Coinrule (no-code rules) |

| Intermediate | $2k–$10k | Momentum or range trading across venues | 3Commas (SmartTrade + trailing), Bitsgap (GRID + multi-exchange) |

| Advanced | $10k+ | Arbitrage, market-making, AI signals | ArbitrageScanner (alert-only, no API keys), Gunbot (self-hosted, customizable), CryptoRobotics (AI signals + autofollow) |

Cost vs value (quick checks)

- Zero subscription model: Pionex bots are free to use; you pay trading fees (spot 0.05%), helpful for small balances.

- Subscription tiers: 3Commas, Bitsgap, Cryptohopper, and Coinrule scale features as you pay more.

- Lifetime license: Gunbot offers a one-time license (advanced users trade off setup time for control).

- Alerting service: ArbitrageScanner is built around alerts via Telegram; costs vary by plan.

- Profit-sharing option: CryptoRobotics supports pay-on-profit models for some bots, which can align fees with outcomes.

Tip: Match tool complexity to your time budget. If you can’t monitor frequently, prefer cloud-hosted automation and clear risk controls (e.g., SmartTrade TP/SL or grid ranges) over high-touch arbitrage or market-making.

How Scalping Bots Actually Work (Technical Deep Dive)

Before we get into the nitty-gritty, here’s the big picture: every scalping bot listens to market data, turns rules into trading signals, and manages risk so small edges aren’t wiped out by a bad tick. Think of it as a factory line: data in → decision → order → risk checks, running continuously in the background. Let's see how bots receive data with minimal delay, how they turn indicators into trades, and how guardrails like stops and backtests keep the process disciplined.

Data Feeds & APIs (REST vs WebSocket latency)

Scalping bots live on market data. A REST API is like checking prices by refreshing a page, where each request asks the server for the latest snapshot. A WebSocket keeps a live connection open so the server can push updates the moment they occur. Exchanges design WebSocket streams specifically for low-latency tick data and order-book events (see Binance WebSocket Streams and Coinbase WebSocket overview). For scalping, that push model usually beats polling: fewer gaps, faster reaction, and less overhead when many symbols are tracked at once.

Strategy Execution (Indicators → Signal → Trade → Exit)

Under the hood, bots follow a simple loop: ingest data, compute indicators, generate a signal, and place a trade with predefined entries, exits, and position size. The logic can be as simple as a moving-average cross or as specific as a grid with fixed ranges. Platforms such as 3Commas and Bitsgap expose this as configurable fields (price triggers, trailing rules, order types) so users don’t need to code. The crucial point is determinism: once your conditions are met, the bot sends the order consistently, with no hesitation, helping reduce the “human delay” that often undermines scalps.

Risk Control & Backtesting (stop-loss triggers, drawdown limits)

Good scalping is controlled scalping. Most tools let you set stop-loss and take-profit orders (see SmartTrade TP/SL and trailing stops) so exits happen automatically if price moves against you or in your favor. Many also support daily loss caps or drawdown limits, which pause trading if the account falls by a set percentage, which are simple guardrails that protect small accounts from a bad session. Before deploying, backtesting lets you simulate a strategy on historical data to check basic behavior and parameter sensitivity (see backtesting basics shared before).

Backtests are not guarantees, as live liquidity, slippage, and latency differ, but they help you avoid obvious pitfalls and pick sensible ranges for fast-moving markets.

You might want to take a broader view of risk in our guide on risk mitigation.

Scalping Strategies That Work With Bots

Market-making (tight spreads) → Advanced users can run local, customizable tooling with Gunbot to quote both sides of a pair and capture the spread repeatedly. Self-hosting and granular controls suit traders who can fine-tune tick sizes and refresh cycles.

Breakout (signal-first) → Cryptohopper pairs AI/Marketplace signals with automated execution, so when price bursts out of a range, the bot can place entries and protective stops quickly, even if you’re offline.

Grid (range trading) → When price oscillates, Pionex’s Grid Bot and Bitsgap’s GRID bot buy small increments near the lower band and sell near the upper band, aiming to monetize chop while you manage risk with ranges and position sizing.

Momentum (trail-and-ride) → 3Commas SmartTrade combines entries with trailing TP/SL, letting winners run as price trends, and cutting losers fast.

Arbitrage loops (venue spreads) → ArbitrageScanner surfaces CEX–DEX price gaps; the edge comes from latency; prices update at different speeds across venues. The tool sends Telegram alerts so you can route orders on your own accounts and lock spreads before they close.

Risks and How to Manage Them

Scalping compresses decisions into milliseconds, so small issues can snowball. Keep an eye on technical, market, operational, and psychological risks, and set guardrails before you go live.

Technical: API latency, outages, or dropped feeds can derail entries. Exchange incidents are posted on status pages, and rate limits on order or data endpoints are enforced per Binance API docs and Coinbase WebSocket guidelines that we shared above.

Market: Fast moves widen spreads and increase slippage, shrinking edge; see overviews of slippage and low latency for why timing matters.

Operational: Misconfigured API keys or missing IP whitelists raise security risk; exchanges provide per-key permissions and IP controls (e.g., Binance API key setup).

Psychological: Over-optimizing settings, chasing losses, or disabling stops mid-session can undo days of gains.

Risk → Mitigation

| Risk | Mitigation |

|---|---|

| API latency / outages | Monitor exchange status; prefer WebSocket feeds; set bot retry/backoff; pause on persistent delay. |

| Rate limits / throttling | Respect limit policies; stagger requests; reduce symbol count. |

| Slippage / spread spikes | Use limit orders where possible; cap max slippage; avoid illiquid pairs; trade during higher-liquidity sessions. |

| Key security / permissions | Restrict API keys (no withdrawals), IP whitelist, rotate regularly. |

| Over-optimization / revenge trading | Predefine daily loss caps and cool-offs; keep stops on; review logs after, not during, drawdowns. |

Example: Exchange-side API delays can cause missed or worse fills, another reason to monitor latency and configure fail-safes before deploying at scale.

Closing Thoughts

Choosing a scalping bot is really about fit. If you’re starting small, Pionex (free, built-in bots) and Coinrule (no-code rules with TradingView signals) keep setup light and costs predictable. Momentum traders who want one-ticket control and trailing management tend to gravitate to 3Commas, while range traders and multi-venue users appreciate Bitsgap for its mature GRID and unified terminal.

If you’re comfortable moving fast and placing your own orders from alerts, ArbitrageScanner surfaces CEX–DEX spreads without API key sharing. Hands-on quants and market makers often prefer Gunbot for local hosting and deep customization, and experimenters who want model-guided entries can explore CryptoRobotics for AI and autofollow options.

Remember: bots don’t remove risk, they remove inefficiency. Start with a demo account or paper trading before deploying real capital, and always consider fees, exchange access in your region, and fail-safes like stops and daily loss caps.

Frequently Asked Questions

If you’re looking for a reliable free crypto trading bot, Pionex stands out as the best option in 2025. Unlike most third-party automation platforms that charge monthly subscription fees, Pionex integrates its bots directly into the exchange, allowing you to trade for free. You only pay the standard 0.05% spot trading fee per transaction.

It offers 16+ built-in bots, including Grid, DCA, Rebalancing, and Smart Trade tools, all running on cloud infrastructure, so you don’t need a VPS or coding skills. The exchange sources aggregated liquidity from Binance and HTX (Huobi), helping bots fill orders efficiently even in volatile markets.

Tools with low fixed costs and simple setup are ideal; platforms that offer built-in or no-code bots and clear risk controls. Start with a free tier or paper trading so you can learn without financial pressure.

You can begin with a few hundred dollars, but fees, slippage, and minimum order sizes matter. Aim for enough capital to place properly sized orders while keeping risk per trade small (e.g., 0.5–1% of account).

Many major platforms integrate with both, but availability can vary by region and product type (spot vs. futures). Always confirm current support on the bot’s official “exchanges” page before connecting API keys.

Speed comes from infrastructure (co-location, WebSockets, efficient code) more than brand names. Cloud-hosted bots reduce downtime, while self-hosted setups near the exchange can minimize network latency.

Yes. Most platforms let you run several strategies simultaneously. Just avoid overlapping rules on the same pair and set global limits (max positions, daily loss caps) to prevent unintended risk stacking.

Use each platform’s backtesting tool to simulate rules on historical data, then forward-test with paper trading. Treat backtests as a sanity check; as live execution, liquidity, and latency can produce different outcomes.

Grid strategies try to monetize range-bound chop by buying lower and selling higher within a set band. Arbitrage seeks price gaps across venues; the edge relies on fast routing and fees low enough to lock the spread.

No. Bots automate execution and discipline, but market conditions, fees, and slippage determine results, as losses are always possible.

“Safest” depends on your risk controls, not just the software. Prefer platforms with transparent documentation, robust API permissions, and strong guardrails (stops, max drawdown, and pause-on-error settings).

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.