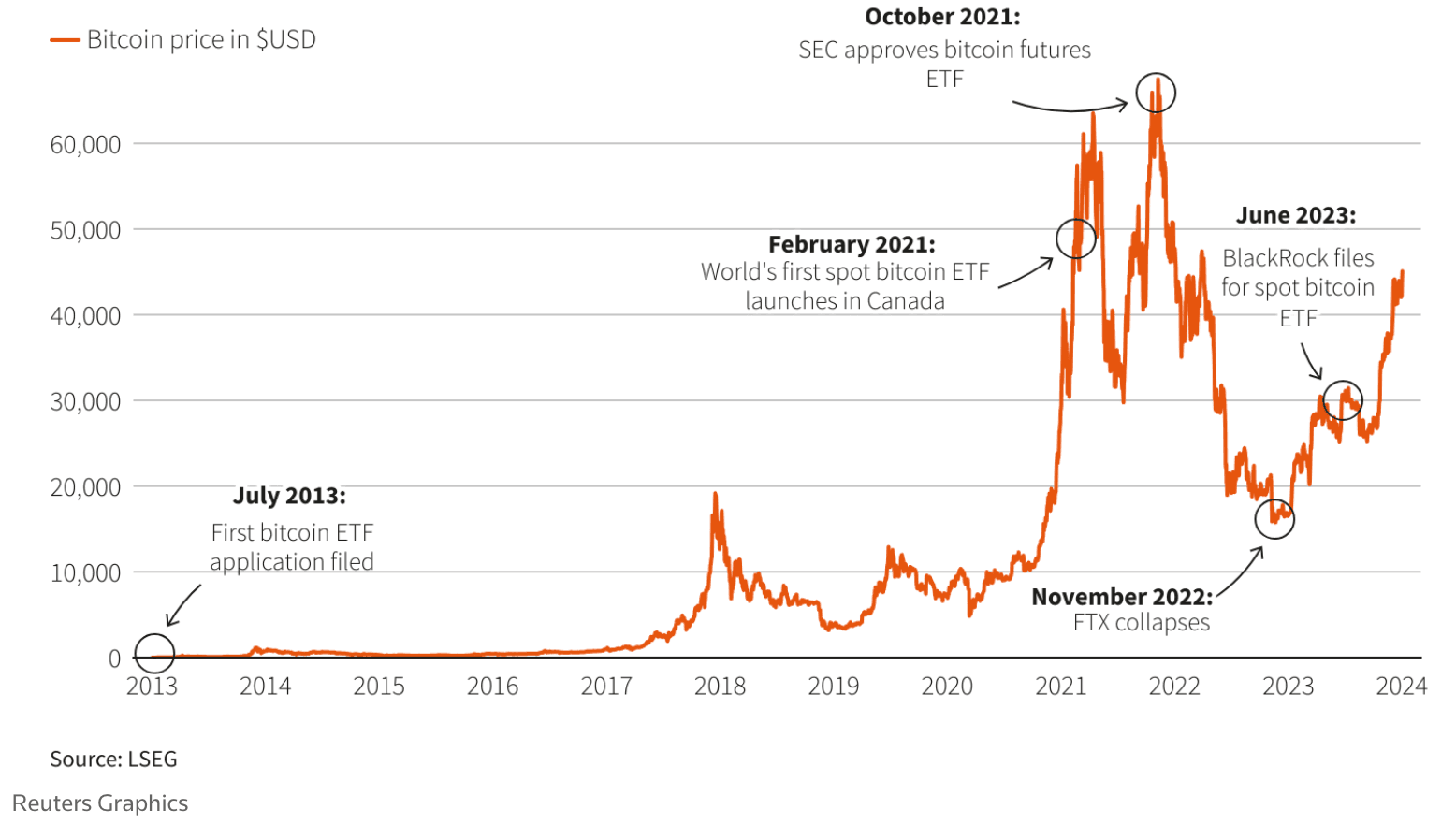

The road to a Bitcoin ETF in the United States has been long and turbulent. Since the first spot Bitcoin ETF was applied for a decade ago by the Winklevoss twins, co-founders of the crypto exchange Gemini, there has been plenty of speculation as to when, or even if, a spot Bitcoin ETF would ever be approved in the States.

Many crypto investors have been hesitant to expect an approval this time around as many of us have been hearing that an ETF could be approved “any day now” since 2017, and there have been a few noteworthy events that got hopes up, to later deflate and disappoint.

After the first spot Bitcoin ETF was approved in Canada in February 2021, many felt that had paved the way and an ETF on American soil would be soon to follow. When the SEC approved a Bitcoin Futures ETF later that same year, investors were more confident than ever that a spot ETF was just around the corner.

2021 saw another landmark event that ignited enthusiasm and assurance that digital assets were here to stay, and that was the appointment of Gary Gensler as the head of the Securities and Exchange Commission (SEC). The crypto community was elated by this appointment as they finally had an SEC Chairman who understood Bitcoin and was pro-crypto, or at least, that was the assumption after Gensler taught blockchain at MIT and had spoken highly of cryptocurrencies during his lectures.

Gensler's time at the helm turned out to be incredibly polarizing, fraught with accusations of corruption and campaigns to have him fired, with the entertaining #firegarygensler campaigns on eX-Twitter. The once hopeful bureaucrat has arguably done more damage to the crypto industry and its reputation with his regulation by enforcement actions and witchhunts than all the hacks, scams and exchange collapses combined.

It was beginning to look like we would never have a Bitcoin ETF under Gensler's leadership.

Interest was again reignited in 2023 when Blackrock, the world's biggest asset manager applied for a spot Bitcoin ETF. This was of paramount importance as Blackrock is often joked as being another branch of the government, and CEO Larry Fink reportedly spends more time in Washington than in his own office “advising” politicians. Fink is often heard using the phrase “As I told Washington” in conversations, making us wonder who is really calling the shots, but that is a topic for another time.

So it looks like it came down to Gensler vs Fink. Gensler, who had declined every one of the dozens of ETF applications before Blackrock, and Fink at the head of Blackrock, a company that had an impressive 99.8% ETF approval record. We have heard rumours that the previous ETF application denials were all rejected by design until Blackrock was ready to play its hand, or perhaps, it finally came down to Fink's sway in Washington overpowering Gensler's disdain for such a product, I am afraid we will likely never know.

Either way, we now have the long-anticipated Bitcoin ETF. So, what now?

Bitcoin ETF- What Happens Now?

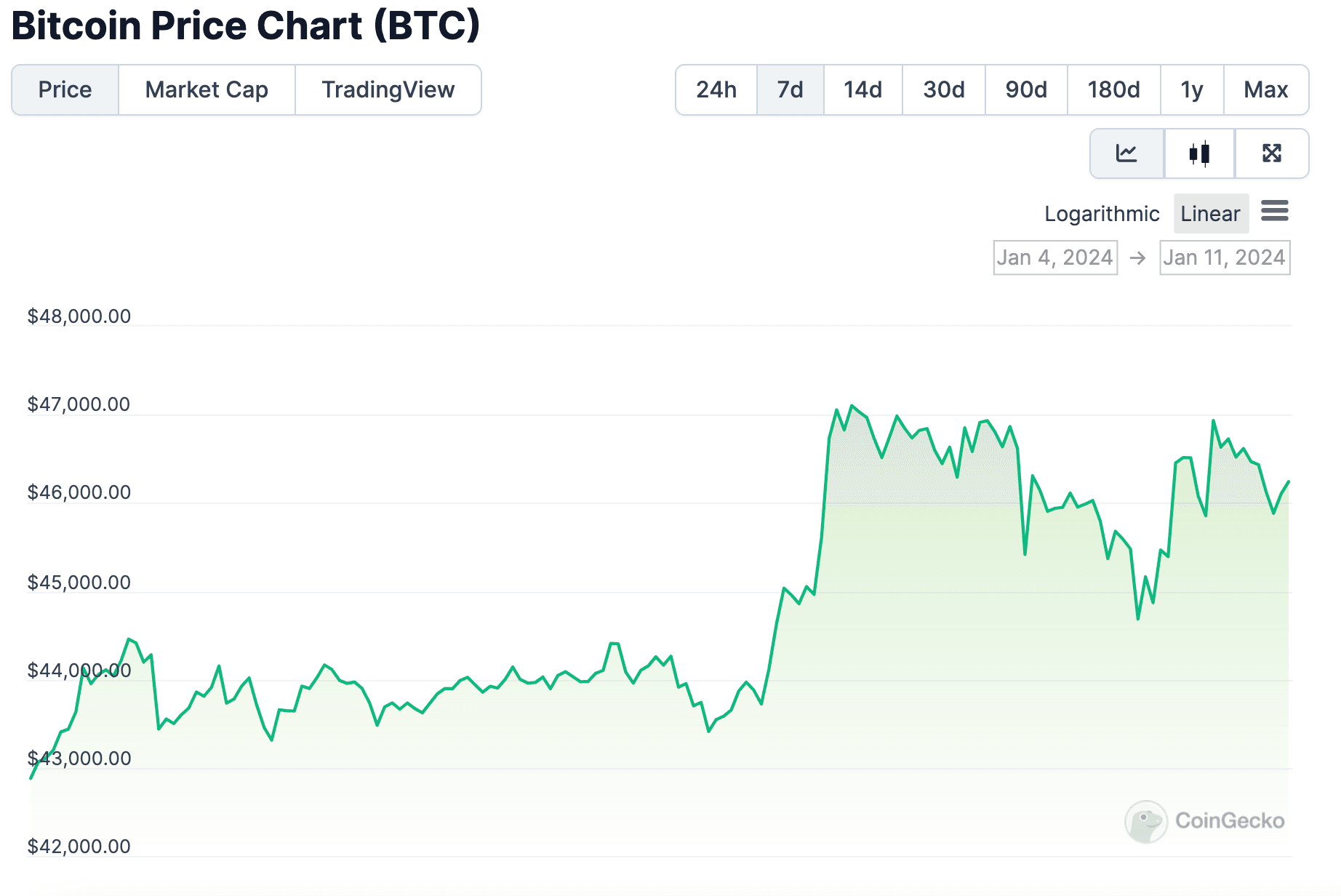

The initial announcement of the approval was met with mixed emotions from the crypto community regarding Bitcoin's price. Many prominent thought leaders felt that the approval was already priced in and the price needle was unlikely to move, while others were expecting fireworks, a guaranteed upshot to over 50k, with some even anticipating Bitcoin hitting the 75-100k range within the opening days.

While Bitcoin's price saw a small jump, it appears those who believed the news of the approval was already priced in were correct, at least, for the short term.

What this event signifies is that institutional capital and retail now have a frictionless vehicle for gaining Bitcoin exposure and ease of adding Bitcoin to their investment portfolios. While there were no “fireworks” within hours of the announcement, this is likely a stream that will turn into a river of inflows over time.

The marketing war between issuers and the competition among them in terms of fees and distribution networks is just getting started with results remaining to be seen. Smaller firms may use creative ads, while larger players like ProShares and Invesco can spend millions on advertising due to their unit investment trust structures. With the Superbowl around the corner, it will be interesting to see who wins the best advertisement slots to push their ETF.

The largest target market of these ETFs is fund managers and advisors of clients who make up 70% or more of the assets in the global ETF landscape.

Asset Inflows & Increased Accessibility

This Bitcoin ETF launch is expected to break records in terms of asset inflows. Drawing from previous similar events, comparing to Bitcoin Future's ETFs, the most successful ETF launch in history was the ProShares Bitcoin Strategy ETF (BITO) that launched in October 2021, hitting $1 billion in assets under management (AUM) within a few days of launch. This event proved that there is massive investor interest in these products.

In a recent interview with Anthony Pompliano, James Seyffart, an ETF research analyst at Bloomberg Intelligence stated that they have been hearing rumours that many of these ETF issuers have hundreds of millions worth of capital lined up to invest in the opening days, among rumours that Blackrock alone has $2 billion lined up and ready to deploy, though he is quick to state that he will “believe it when he sees it”. If these rumours are to be believed, this will be the most successful launch in history in terms of asset inflows.

It is difficult to predict for sure, but general consensus is that inflows will be measured in billions in the opening days and weeks of the launch. Over the year, Seyffart is on record stating that he believes total net inflows will be somewhere between 10 and 25 billion.

It is reasonable to speculate that over the coming years, these ETFs combined could achieve 1-2% of total ETF assets under management, resulting in around 80 to 100 billion in total AUM.

Global Impact

America has long been the dominant player on the global stage for investments and financial regulations. The approval of the spot Bitcoin ETF in the U.S. will likely have a strong influence on global regulatory decisions in other parts of the world, leading to greater global acceptance and adoption of Bitcoin. We have already seen calls from lawmakers in Hong Kong signal interest in greenlighting their own spot Bitcoin ETF hours after it was announced in the United States. Other nations are expected to follow suit in the coming weeks.

Reduced Volatility

The ETF may lead to reduced Bitcoin volatility and dampened upside potential as more capital will result in a less volatile asset, similar to how Gold rarely experiences moves in excess of 5% to the up or downside.

There is also a chance that we will see Bitcoin's price significantly stabilize as advisors and asset managers have set allocation goals. Asset managers, institutions, and “smart money” are among the best traders in the world and have the capital to influence the markets, they will be actively buying Bitcoin when the price drops and selling for client profit starting most likely around the 5% profit point to reach their client portfolio allocation percentage goals, which could effectively cap upside and downside movements.

As Bitcoin market cap grows, double-digit returns in a year may be a thing of the past and Bitcoin's life post-ETF may never again be considered the asymmetric investment of a lifetime.

Closing Thoughts

The approval of the spot bitcoin ETF has affected different parties in different ways. For Bitcoin retail investors, this ETF has legitimized Bitcoin as a viable investment class among Wall Street and TradFi. For institutional firms, it allows them to meet the demands of clients who are interested in Bitcoin exposure without needing to go through the complexities of self-custody. Asset managers stand to benefit from charging management fees for these products.

This development has been bitter sweet as it stands to have a massively positive impact for those who see Bitcoin as an invisible asset, but to many true Bitcoiners, this is among the worst events that could have happened to Bitcoin as a soverign currency or store of value. Bitcoin was developed as an alternative to the corrupt financial system and there are many in the space who are dismayed to see that Bitcoin has now become just another financial aspect that Wall Street has absorbed. Bitcoin is now part of “the system” that early adopters hoped it would save us from.

Then there are others who feel it is not so black and white. Bitcoin has the incredible adaptability and ability to be many things to many people, whether it be a peer-to-peer currency, store of value, or a life raft for those needing an asset that exists outside of the confines and control of their national currencies and economies, but one thing is for sure and that is that for better or for worse, Bitcoin will never be the same.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.