Bitcoin vs Bitcoin Cash: Difference Between BTC and BCH

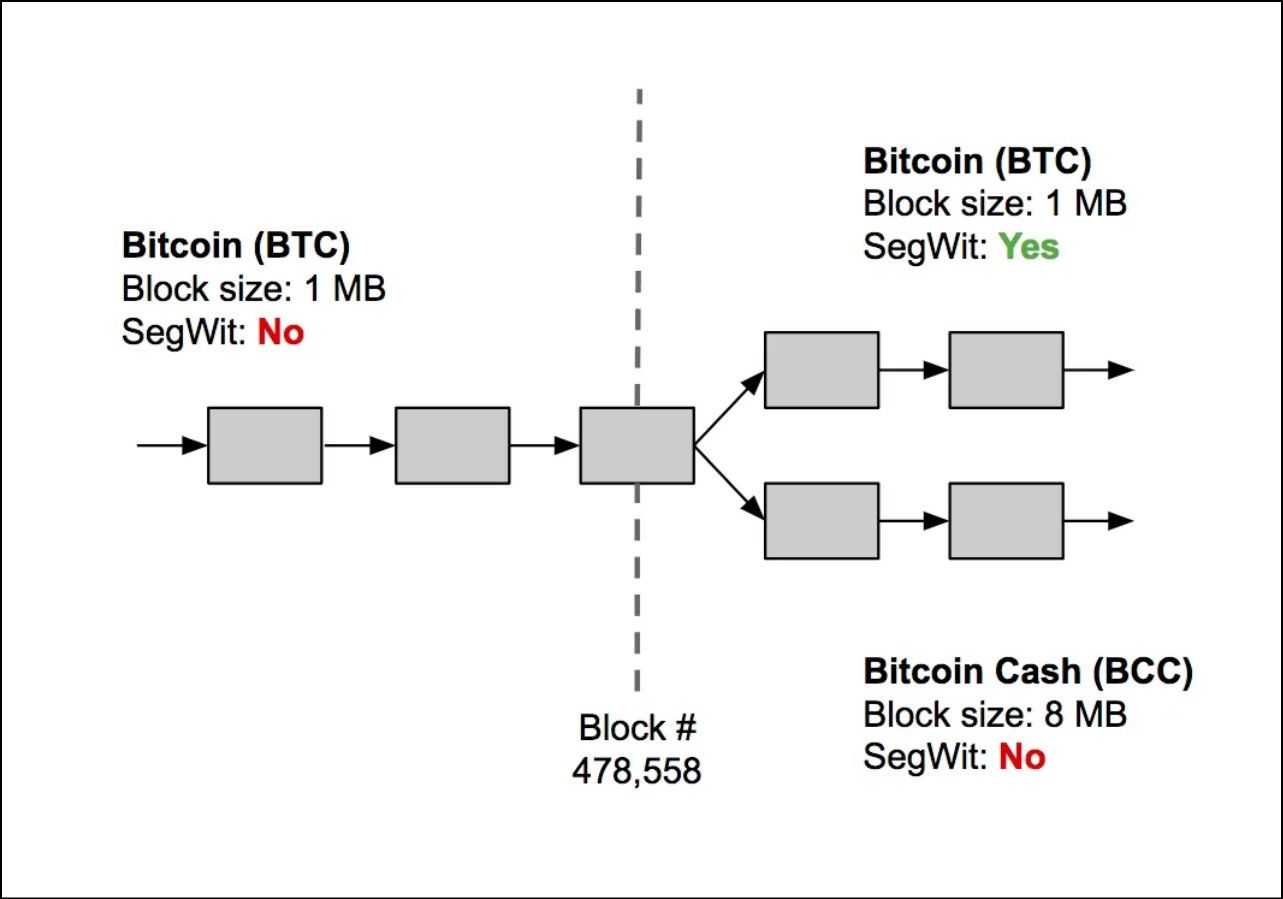

The article delves into the Bitcoin block space controversy and compares Bitcoin with its derivative, Bitcoin Cash, to shed light on the mindset of Bitcoin Cash advocates and the ideological rifts that led to the split. The Bitcoin block size issue is discussed, with the original Bitcoin having a block size of 1 MB, leading to rising transaction fees as the network expanded. The debate on how to scale the Bitcoin blockchain gave rise to two factions, one advocating for increasing the block size and the other proposing Segregated Witness (SegWit) as a solution. Eventually, a hard fork occurred, resulting in the creation of Bitcoin Cash with an 8 MB block size.

Bitcoin Cash is described as a hard fork of Bitcoin and focuses on larger block sizes, aiming to address congestion and high fees directly on the blockchain. It upholds Bitcoin's foundational vision as a medium of exchange. On the other hand, Bitcoin emphasizes decentralization, security, and off-chain scalability solutions like the Lightning Network. The article compares the technical information, scalability solutions, smart contract capabilities, and market positions of both cryptocurrencies.

In terms of smart contract capabilities, Bitcoin introduced Taproot, which enhances privacy and efficiency, while Bitcoin Cash uses an enhanced version of Bitcoin Script and supports covenants to enable more complex transaction structures. Bitcoin is seen as providing more complex contract-like conditions, while Bitcoin Cash focuses on transaction efficiency and usability.

The article also discusses the decentralization of Bitcoin and the transaction efficiency and scalability of Bitcoin Cash. Bitcoin's smaller block size is seen as a measure to preserve decentralization, while Bitcoin Cash's larger block size makes it more practical for everyday transactions. Bitcoin's broader recognition and adoption give it greater economic security, but Bitcoin Cash offers a straightforward user experience without the need for additional layers or secondary protocols.

The choice between Bitcoin and Bitcoin Cash depends on individual priorities and use cases. Bitcoin Cash may appeal to users valuing quick everyday transactions, while Bitcoin offers a well-established network with a broader range of functionalities and a more robust security model.

Overall, the article provides a comprehensive comparison between Bitcoin and Bitcoin Cash, highlighting their technical differences, philosophies, and potential use cases.

The article delves into the Bitcoin block space controversy and compares Bitcoin with its derivative, Bitcoin Cash, to shed light on the mindset of Bitcoin Cash advocates and the ideological rifts that led to the split. The Bitcoin block size issue is discussed, with the original Bitcoin having a block size of 1 MB, leading to rising transaction fees as the network expanded. The debate on how to scale the Bitcoin blockchain gave rise to two factions, one advocating for increasing the block size and the other proposing Segregated Witness (SegWit) as a solution. Eventually, a hard fork occurred, resulting in the creation of Bitcoin Cash with an 8 MB block size.

Bitcoin Cash is described as a hard fork of Bitcoin and focuses on larger block sizes, aiming to address congestion and high fees directly on the blockchain. It upholds Bitcoin's foundational vision as a medium of exchange. On the other hand, Bitcoin emphasizes decentralization, security, and off-chain scalability solutions like the Lightning Network. The article compares the technical information, scalability solutions, smart contract capabilities, and market positions of both cryptocurrencies.

In terms of smart contract capabilities, Bitcoin introduced Taproot, which enhances privacy and efficiency, while Bitcoin Cash uses an enhanced version of Bitcoin Script and supports covenants to enable more complex transaction structures. Bitcoin is seen as providing more complex contract-like conditions, while Bitcoin Cash focuses on transaction efficiency and usability.

The article also discusses the decentralization of Bitcoin and the transaction efficiency and scalability of Bitcoin Cash. Bitcoin's smaller block size is seen as a measure to preserve decentralization, while Bitcoin Cash's larger block size makes it more practical for everyday transactions. Bitcoin's broader recognition and adoption give it greater economic security, but Bitcoin Cash offers a straightforward user experience without the need for additional layers or secondary protocols.

The choice between Bitcoin and Bitcoin Cash depends on individual priorities and use cases. Bitcoin Cash may appeal to users valuing quick everyday transactions, while Bitcoin offers a well-established network with a broader range of functionalities and a more robust security model.

Overall, the article provides a comprehensive comparison between Bitcoin and Bitcoin Cash, highlighting their technical differences, philosophies, and potential use cases.

Few topics in the annals of cryptocurrency history have ignited as much passion and debate as the Bitcoin block space controversy. This seminal argument not only divided communities but also challenged Bitcoin's very ethos, prompting introspection on its core principles. It stirred profound questions: What does Bitcoin fundamentally represent? How would Satoshi Nakamoto, the enigmatic creator of Bitcoin, have navigated these turbulent waters?

This article delves deep into the heart of this debate by comparing Bitcoin with Bitcoin Cash, a derivative born out of the desire for a different path forward. By exploring the intricacies of both networks, we aim to shed light on the mindset of Bitcoin Cash advocates and reveal the ideological rifts that led to this significant divergence. Whether you're an investor, a technologist, or simply a curious observer of blockchain technology, understanding the nuances of this split can provide valuable insights into which network aligns best with your personal or financial objectives. Join us as we unravel the layers of this complex narrative, offering clarity on a choice that continues to resonate within the crypto community.

The Bitcoin Block Space Debate

One must delve into the pivotal Bitcoin block space debate to fully grasp the distinctions between Bitcoin and Bitcoin Cash. This discussion is not just a technical dissection but a narrative that encapsulates the evolution of Bitcoin from a niche experiment to a global financial network.

Understanding the Block Size Issue

The Original Bitcoin Block Size: Bitcoin's blocks are capped at approximately 1 MB, a design that initially aimed to prevent spam attacks. This size limit means that, on average, only about 7 transactions can be processed per block every 10 minutes. While this was sufficient in Bitcoin's infancy, it became a bottleneck as the network expanded.

Rising Transaction Fees: By 2017, the Bitcoin network surged in adoption, turning it into a global network with millions of users. This spike in activity led to a significant increase in transaction fees as users vied to get their Bitcoin transactions included in the next block.

The Divergence of Solutions

The escalating debate on how to scale the Bitcoin blockchain gave rise to two primary factions, each with its own vision for Bitcoin's future:

Faction 1: Increase the Block Size

This group advocated a straightforward solution: expand the block size from 1 to 8 MB. This change would directly increase the number of transactions each block could accommodate, ostensibly easing the network congestion and reducing fees.

Faction 2: Segregated Witness (SegWit)

The second faction proposed a more intricate solution known as Segregated Witness (SegWit). This approach optimized transaction storage, effectively allowing more transactions in a 1 MB block without altering the initial block size.

The Fork and Birth of Bitcoin Cash

After extensive debates and no consensus in sight, the community reached a critical juncture. At block height #478559, proponents of the larger block size initiated a hard fork, creating a new branch of the blockchain. This marked the inception of Bitcoin Cash, embodying the vision of a cryptocurrency with an 8 MB block size to accommodate more transactions and scale effectively.

Meanwhile, the remaining Bitcoin community moved forward with the implementation of SegWit, an upgrade that would later pave the way for further innovations and optimizations in the network.

Through this split, two distinct philosophies emerged, each addressing the scalability challenge in its own unique way. Understanding this schism is crucial for anyone looking to comprehend the underlying principles and practical differences between Bitcoin and Bitcoin Cash.

Bitcoin Cash Overview

Here's a table that provides a side-by-side comparison of technical information for Bitcoin and Bitcoin Cash:

| Feature | Bitcoin (BTC) | Bitcoin Cash (BCH) |

|---|---|---|

| Year Founded | 2009 | 2017 |

| Creator | Satoshi Nakamoto | Fork of Bitcoin |

| Consensus | Proof of Work (PoW) | Proof of Work (PoW) |

| Ticker | BTC | BCH |

| Block Size | 1 MB (up to 4 MB with SegWit) | 32 MB (initially increased to 8 MB) |

| Transactions Per Second (TPS) | ~7 (varies with SegWit) | ~116 (depends on block size utilization) |

| Market Capitalization (March 2024) | Over $1 Trillion | $11 Billion |

| Circulating Supply (March 2024) | 19,682,224 | 19,667,250 |

| Max Supply | 21 million | 21 million |

What is Bitcoin Cash?

The inception of Bitcoin Cash (BCH) is intricately tied to a core statement from its whitepaper: "A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution." This line, mirroring the introduction in Bitcoin's original whitepaper, underscores that Bitcoin Cash is not just a new entity but a hard-forked continuation of Bitcoin's original promise, albeit with specific, pivotal modifications.

Core Tenets of Bitcoin Cash

- Larger Block Size: At the heart of Bitcoin Cash is its increased block size of 8 MB, further increased to 32 MB in May 2018. This change was implemented to enhance transaction throughput, diminish fees, and align Bitcoin more closely with its intended function: facilitating efficient peer-to-peer transactions. The larger block size directly responds to the congestion and high fees experienced on the Bitcoin network, especially during significant usage.

- Commitment to On-Chain Scaling: Bitcoin Cash champions the belief that true scalability and efficiency should remain on one chain, preserving the ledger's integrity and decentralization. Unlike Bitcoin's Segregated Witness (SegWit) upgrade, while improving Bitcoin's scalability to some degree, it heavily relies on off-chain solutions like the Lightning Network. Bitcoin Cash maintains that all transaction data should be processed within the blockchain to ensure maximum security and decentralization.

- Upholding Bitcoin's Foundational Vision: Proponents of Bitcoin Cash often point to Satoshi Nakamoto's original vision of Bitcoin as a digital store of value and a medium of exchange. For Bitcoin to serve effectively as a medium of exchange, it must facilitate transactions that are not only secure but also fast and affordable enough for daily use.

- A Pragmatic Approach to Scalability: Bitcoin Cash emerged as an immediate, practical solution to the scalability challenge when the network faced extreme congestion. While SegWit presented a forward-looking approach, it required further time for development and refinement. In contrast, increasing the block size offered an instant remedy to the network's pressing issues, aiming to restore Bitcoin's utility as an effective, decentralized peer-to-peer electronic cash system.

Through these core tenets, Bitcoin Cash strives to realign the cryptocurrency with what its supporters believe to be Satoshi Nakamoto's original aspirations, emphasizing usability, low fees, and reliable, on-chain transaction processing.

Bitcoin vs Bitcoin Cash: Key Differences

Bitcoin and Bitcoin Cash represent two distinct paths within the cryptocurrency landscape, each with unique technical characteristics and philosophical underpinnings. Here are the key differences between them:

- Block Size Limit:

- Bitcoin: Maintains a 1 MB block size limit, although Segregated Witness (SegWit) effectively allows more data to be processed by separating transaction signatures.

- Bitcoin Cash: Upon its creation, Bitcoin Cash initially increased the block size limit to 8 MB, with subsequent updates allowing for even larger blocks. This is intended to process more transactions per block, reducing fees and transaction times.

- Scalability Solutions:

- Bitcoin: Focuses on off-chain scalability solutions like the Lightning Network and SegWit to improve scalability without directly increasing the block size. SegWit also optimizes block space usage, allowing more transactions to fit into a block.

- Bitcoin Cash: Advocates for on-chain scalability through larger block sizes, aiming to address congestion and high fees directly on the blockchain without relying heavily on multi-layer solutions.

- Philosophical Approach:

- Bitcoin: Often viewed as digital gold, it's considered more of a store of value than a medium of exchange due to its limited transaction throughput and higher fees during peak times.

- Bitcoin Cash: Positions itself as a peer-to-peer electronic cash system, emphasizing its utility for everyday transactions with lower fees and faster confirmation times.

- Transaction Fees:

- Bitcoin: Due to the limited space in each block, Bitcoin can experience higher transaction fees, especially during periods of network congestion.

- Bitcoin Cash: Generally offers cheaper transactions due to its larger block size, which can accommodate more transactions.

- Consensus and Network Effects:

- Bitcoin: It has a larger user base, more recognition, and a more extensive network effect, which contributes to its value and security.

- Bitcoin Cash: While it has a significant user base, it is smaller than Bitcoin, which affects its liquidity, adoption, and perception in the crypto ecosystem.

- Development and Innovation:

- Bitcoin: Has a more conservative approach to changes, focusing on security and stability, with innovations like Schnorr signatures and Taproot.

- Bitcoin Cash: More open to larger protocol changes to improve scalability and transaction efficiency, as demonstrated by its block size increases and other protocol enhancements.

- Market Position:

- Bitcoin: Remains the most recognized and valued cryptocurrency, often serving as a benchmark for the entire crypto market.

- Bitcoin Cash: While significant in its own right, it holds a smaller market capitalization and is less influential in the broader cryptocurrency landscape.

Understanding these differences is crucial for anyone looking to engage with or invest in these cryptocurrencies, as each offers distinct advantages, challenges, and use cases.

Smart Contract Capabilities of Bitcoin vs Bitcoin Cash

The Taproot upgrade significantly enhanced Bitcoin's (BTC) capability to support more complex transactions, including those that could be considered rudimentary smart contracts, while maintaining its emphasis on privacy and efficiency. Comparing this to Bitcoin Cash's (BCH) approach to smart contracts provides an interesting contrast, as each network has different priorities and design philosophies.

Bitcoin's Enhancements with Taproot

- Schnorr Signatures: Taproot introduces Schnorr signatures, which allow for more privacy and efficiency in transactions. They enable the aggregation of multiple signatures into one, a feature beneficial for multi-signature transactions and smart contract execution.

- MAST (Merkelized Abstract Syntax Trees): MAST allows for creating conditions under which a transaction can be spent. It improves privacy and efficiency by only revealing the conditions met when the transaction is spent rather than all possible conditions.

- Tapscript: This is the scripting language introduced with Taproot. It enhances Bitcoin's scripting capabilities and makes it easier to implement complex conditions for transaction spending.

- Privacy and Efficiency: Taproot enhances privacy by making complex transactions indistinguishable from simple ones when they're spent. It also reduces the data size of complex transactions, leading to efficiency gains.

Bitcoin Cash Smart Contract Capabilities

- Scripting Language: Bitcoin Cash uses an enhanced version of Bitcoin Script, a stack-based language. It's not Turing-complete, meaning its capabilities are limited compared to fully-fledged smart contract platforms.

- CashScript and Spedn: These high-level languages facilitate writing smart contracts on BCH. They compile down to Bitcoin Script, making smart contract development more accessible.

- OP_CODES: BCH has re-enabled and added new OP_CODES to expand its scripting capabilities and allow for more complex transaction types.

- Covenants: Bitcoin Cash supports covenants, which offer a way to specify rules about how BCH can be spent, enabling more complex transaction structures.

The Taproot upgrade significantly enhanced Bitcoin's (BTC) capability to support more complex transactions, including those that could be considered rudimentary smart contracts, while maintaining its emphasis on privacy and efficiency. Comparing this to Bitcoin Cash's (BCH) approach to smart contracts provides an interesting contrast, as each network has different priorities and design philosophies. While Bitcoin's scripting language emphasizes privacy and security, Bitcoin Cash leans toward transaction efficiency.

Comparison

- Complexity and Capability: While BCH's smart contract capabilities are more explicit and accessible, they are still fundamentally limited by the constraints of Bitcoin Script. Conversely, Taproot doesn't drastically expand Bitcoin's smart contract capabilities but significantly enhances the efficiency and privacy of complex transactions, which can include contract-like conditions.

- Developer Accessibility: With CashScript and Spedn, Bitcoin Cash might be more accessible to developers looking to create simple smart contracts without the complexity of Ethereum's Solidity. Taproot’s Tapscript improves developer options on Bitcoin but remains complex compared to dedicated smart contract platforms.

- Use Cases: Bitcoin Cash's smart contract capabilities are geared towards financial transactions with some level of programmability. Bitcoin's Taproot upgrade focuses on enhancing privacy and efficiency, particularly for complex transactions like those involving multi-signature requirements or conditional spending, which can be viewed as basic smart contracts.

In summary, Bitcoin Cash has more explicit tools and languages for creating smart contracts than Bitcoin, which enhances its capabilities for complex and private transactions using Taproot. However, neither Bitcoin nor Bitcoin Cash are designed to compete directly with platforms like Ethereum in terms of smart contract complexity and breadth of possible applications.

Bitcoin's Decentralization vs. Bitcoin Cash's Transaction Efficiency

When comparing Bitcoin's decentralization to Bitcoin Cash's transaction efficiency and scalability, it's crucial to assess how these characteristics influence their utility in the real world. Let's delve into these aspects to determine if one can build a case for using Bitcoin Cash over Bitcoin in real-world applications.

Bitcoin's Decentralization and Ecosystem Innovations

Bitcoin's commitment to a smaller block size is often viewed as a measure to preserve decentralization. This commitment leads to an expensive and congested network. Bitcoin mitigates these bottlenecks with scalability solutions like the Lightning Network, which allows for fast and low-cost off-chain transactions, and Rootstock, which enables smart contracts. These innovations enhance Bitcoin's scalability and functionality without altering its core block size.

Bitcoin Cash's Transaction Efficiency and Scalability

Bitcoin Cash increased the block size limit to make the network more practical for everyday transactions. Bitcoin Cash's approach can be appealing for users prioritizing fast and inexpensive transactions, especially for smaller, everyday payments. Its commitment to on-chain scaling is designed to offer a straightforward user experience without the need for additional layers or secondary protocols.

Comparing the trade-offs:

- General User Experience: Off-chain scaling can introduce more steps than direct transactions on the Bitcoin Cash network for a general user.

- Economic Security and Recognition: Bitcoin's broader recognition and adoption give it greater economic security than BCH. This widespread acceptance, coupled with its extensive ecosystem, can offer users more opportunities and use cases.

- Long-term Viability: Bitcoin Cash may (or may not) preserve Nakamoto's original vision, but Bitcoin's off-chain solutions offer a balance between efficiency, asset acceptance, and decentralization.

In conclusion, whether one chooses Bitcoin Cash for its transaction efficiency or Bitcoin for its decentralized nature and innovative off-chain solutions depends on individual priorities and use cases. Bitcoin Cash presents a compelling case for those valuing quick, everyday transactions. However, Bitcoin's off-chain scalability solutions may offer a viable and attractive trade-off for users who prioritize a well-established network with a broad range of functionalities and a more robust security model.

Where to Buy and Store Bitcoin and Bitcoin Cash

The Coin Bureau extensively covers cryptocurrency purchase and storage. Rather than repeating the same information repeatedly, here is a curation of Coin Bureau articles covering everything related to cryptocurrency purchase and storage.

General Cryptocurrency Knowledge

All About Bitcoin

- How to Buy Bitcoin on eToro

- How to Buy Bitcoin in the US

- How to Buy Bitcoin in Canada

- How to Buy Bitcoin in Europe

- How to Buy Bitcoin UK

- How to Buy Bitcoin on OKX

- How to Buy Bitcoin on Binance

- How to Buy Bitcoin on Bitget

All About Bitcoin Cash

- Step-by-Step Guide to Buying BCH on Local Bitcoin Cash

- Bitcoin Cash Wallets: Top 10 Safest Places to Store BCH

Closing Thoughts

In concluding our comparison between Bitcoin and Bitcoin Cash, it's evident that each offers distinct advantages based on differing priorities and philosophies within the cryptocurrency space. Bitcoin Cash focuses on transaction efficiency and scalability through larger block sizes, aligning with its vision of being a peer-to-peer electronic cash system suitable for everyday transactions. On the other hand, Bitcoin emphasizes decentralization, security, and a broader ecosystem of innovative solutions, including off-chain scalability options like the Lightning Network, which cater to a variety of user needs beyond simple transactions.

The choice between Bitcoin and Bitcoin Cash ultimately hinges on individual preferences for transaction speed and cost versus the broader utility and robustness of the network. As the cryptocurrency landscape continues to evolve, both Bitcoin and Bitcoin Cash will remain pivotal players, each catering to different segments of the digital economy.

Frequently Asked Questions

Bitcoin Cash (BCH) is a cryptocurrency that was created as a fork of Bitcoin in 2017, primarily to increase the block size to improve transaction efficiency and reduce fees. It aims to be a peer-to-peer electronic cash system, in contrast to Bitcoin's evolving role as 'digital gold'. Yes, pre-fork BTC holders also own an equivalent amount of BCH. If they held Bitcoin in a wallet where they control the private keys or on an exchange that supported the fork, they received an equal amount of Bitcoin Cash.

Segregated Witness (SegWit) is a protocol upgrade implemented on Bitcoin that increases the block's effective capacity without changing its size limit. It achieves this by separating the transaction signatures (witness data) from the transaction data. This segregation means that more transaction data can fit into the 1 MB block, while the witness data is counted separately, allowing for a theoretical increase in block size up to 4 MB. This change improves the network's capacity and efficiency without a direct increase in the block size limit.

While Bitcoin Cash incorporates the core security features of Bitcoin, its security is generally considered slightly less robust than Bitcoin's, primarily due to its smaller network size and hash rate. In blockchain technology, a higher hash rate indicates greater network security, as it requires more computational power to attempt a 51% attack. Since Bitcoin has a larger network and a higher hash rate, it is typically viewed as more secure compared to Bitcoin Cash.

Bitcoin Cash transactions are generally faster and cheaper than Bitcoin transactions due to its larger block size. While Bitcoin transactions can become slow and expensive during times of congestion due to the 1 MB block limit, Bitcoin Cash's increased block size allows for more transactions per block, reducing wait times and fees. However, the exact difference in speed and cost can vary based on network congestion and usage levels at any given time.

Bitcoin Cash (BCH) was primarily designed to be an efficient medium of exchange with its increased block size allowing for quicker and cheaper transactions. As a store of value, BCH's performance is subject to debate. Compared to Bitcoin (BTC), which has gained widespread recognition as a digital store of value akin to gold, BCH has not achieved the same level of market adoption or perception as a value reserve. While some investors may see potential in BCH's utility and adopt it as part of a diversified cryptocurrency portfolio, its value as a store of value is generally considered less proven than Bitcoin's, especially given its shorter history and greater price volatility. Investors typically assess a store of value based on its long-term stability and acceptance, areas where Bitcoin currently has a stronger track record.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.