In just a few years, Bitcoin went from a fringe fascination to captivating the attention of both professional and mom-and-pop investors.

Whether driven by curiosity or the pursuit of making some dough, many people today are eager to get their hands on Bitcoin. However, the process of buying Bitcoin can come off as daunting amid the many options available today. Which exchange do I choose? How do I pay? Where do I store BTC? These are all genuine questions to ask before you embark on your crypto journey.

In this Buying Bitcoin in Europe guide, we'll show you how to buy Bitcoin in Europe, where to store it and highlight some of the best exchanges — with a dash of trading wisdom thrown in.

Before we go any further, feel free to check out our picks for the best crypto exchanges and the best decentralized exchanges.

Where to Buy Bitcoin in Europe

In Europe, you can buy Bitcoin from a crypto exchange or a Bitcoin ATM. Here are our top picks in no particular order for the best exchanges to buy Bitcoin in Europe.

SwissBorg

SwissBorg is a regulated crypto platform located in Switzerland and is available in many countries around the world, but has become an especially popular platform for European-based users looking to buy, sell, trade, and invest in cryptocurrencies.

SwissBorg's mobile-first approach has led to this platform becoming our top pick for users looking for the most beginner-friendly option for buying cryptocurrencies. The app is well laid out, streamlined, and familiar to users who are already well-versed in navigating mobile apps.

Unlike the other mentions on this list, SwissBorg is more of a crypto wealth management platform as opposed to a trading platform. With “one-click-buy” options and access to intuitive crypto portfolio budling products called Thematics, SwissBorg makes buying and investing in cryptocurrency as simple as possible and the fees are reasonable.

SwissBorg is not suitable for advanced crypto traders or those needing to perform technical analysis as there is no charting functionality, but many users prefer this as they only need a place to buy and sell.

With SwissBorg's robust security protocols, great customer support, Cyborg AI-powered analysis tools that are easy to understand at a glance and their powerful Thematics investment bundles, this platform is definitely one to consider. We cover all the functions and features in our in-depth SwissBorg Review.

👉 Sign Up for SwissBorg and Get up to 50 EUR Free!

eToro

A traditional financial investment company, eToro launched its crypto vertical in 2014, five years before Satoshi Nakamoto mined Bitcoin's genesis block in 2009. For reference, Bitcoin closed in 2014 at $320.19.

Today, the platform boasts over 30 million users who can buy and sell 70 cryptoassets, including Solana, Ethereum, Ripple and Cardano.

eToro charges a flat 1% fee to crypto asset transactions. There's also a monthly inactivity fee if an account remains dormant for 12 months, although deposit fees are waived due to the platform's extensive payment options.

We have a guide on how to buy Bitcoin on eToro if you'd like to get into the weeds.

👉 Sign up for eToro and diversify your investments all in one place!

Disclaimer: Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Kraken

Unlike many other crypto exchanges, which tend to roll out an array of products and services, Kraken chooses to keep things simple.

You won't find crypto loans, lending even a crypto-earn product, which have become a staple of exchange offerings these days. However, Kraken offers crypto staking for 12 tokens with up to 24% in yearly rewards. It's important to note that Kraken targets a 15% commission based on the rewards you receive from the network.

CER, which rates crypto exchanges on security, ranks Kraken second. Turning to fees, traders with a 30-day volume of up to $50,000 can expect to pay maker/taker fees of 0.16%/0.26%. The more you trade, the lower your trading fees you'll have to pay. You can find out more on the Kraken fees page.

Our full Kraken review also touches on the exchange's key features, deposits and withdrawals, KYC and much more.

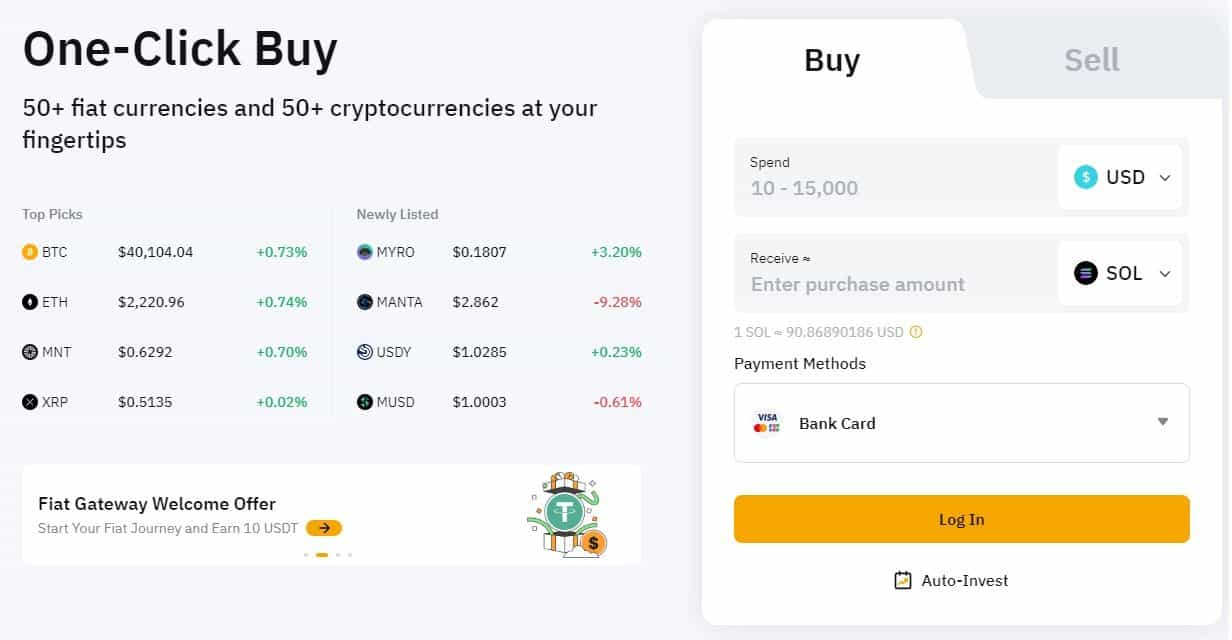

Crypto.com

Crypto.com lets you buy and sell more than 250 cryptocurrencies and you can trade with 20+ fiat currencies.

In addition to trading, Crypto.com offers the following products and services:

- A Visa-Powered Crypto Card

- A crypto-earn program where BTC is currently fetching up to 5% per annum

- Staking with returns of up to 12.65% annually

Turning to fees, for a 30-day spot trading volume of less than $250,000, the maker/taker fee is 0.0750%/0.0750%. However, if you lock up 1,000 CRO, currently valued at $82, Crypto.com will shave off 3% of the fees. Cronos (CRO) is the platform's native token. You can find out more on the Crypto.com fees page.

Security-wise, Crypto.com ranks atop CER's ranking of the most secure crypto exchanges. You can learn about everything the platform has to offer and why Crypto.com is one of our picks for the best “All-in-one” crypto exchange in our comprehensive Crypto.com review.

Bybit

Based in Dubai, Bybit is regulated by the Virtual Assets Regulatory Authority in Dubai, the Cyprus Securities and Exchange Commission and the Astana Financial Services Authority in Kazakhstan. Bybit supports over a thousand cryptocurrencies and it can be accessed in over 160 countries.

In addition to trading, Bybit users can engage in several activities, including:

- Copy trading, where you can mimic top traders' moves on autopilot.

- An earn program to generate yield on your crypto.

- Crypto loans

- Crypto lending

Bybit provides different trading fees for both non-VIP and VIP users. VIP members receive extra fee discounts based on their VIP levels. Maker/taker fees are determined by your 30-day spot trading volume. For further information, please refer to the Bybit fees section.

According to CER, Bybit rounds out the top 10 crypto exchanges with a AAA rating, the highest awarded by CER.

Our full Bybit review covers all that and much more. Bybit has become our top pick for active crypto traders looking for a professional-grade trading platform. You can also check out our following Bybit-related articles:

👉 Sign up for Bybit using our Sign Up Link and receive up to 50,000 in bonuses, $0 trading fees for 30 days and a $30 airdrop!

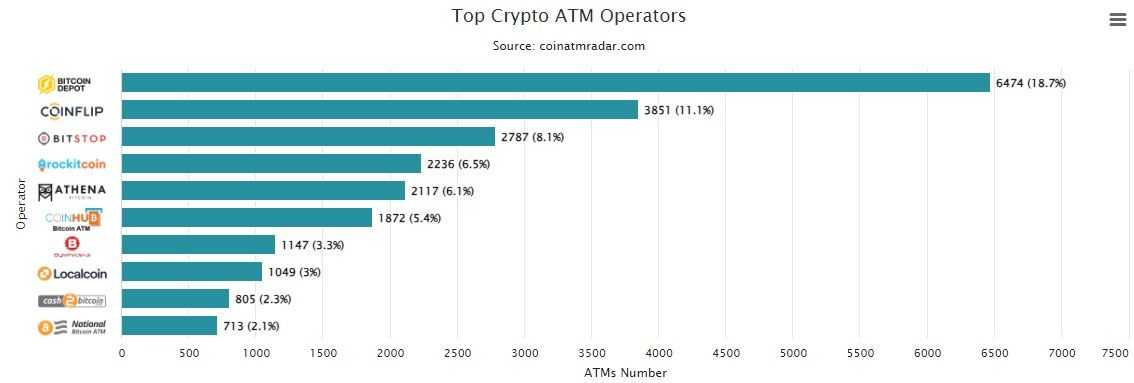

Bitcoin ATMs

Bitcoin ATMs, managed by third-party entities, are self-service kiosks enabling the purchase, and sometimes sale, of Bitcoin. Identity verification levels at Bitcoin ATMs vary depending on the operator, with some requiring customers to hold an account with their service.

These ATMs can be found in places that attract a lot of foot traffic like airports and shopping malls.

Crypto ATMs have grown at a breakneck pace. As of January 2017, there were only 970 such ATMs across the world. Fast forward to Jan. 31, 2024, and the total stands at over 34,600. Today, the top 10 crypto ATM operators run 23,051 kiosks, or 66.6% of the total. There are 488 other operators, who run another 11,552 crypto ATMs, representing 33.4% of the total.

Purchasing Bitcoin through a crypto ATM looks very much like using a debit card, except that you'll be inserting cash instead of a card (most crypto ATMs only accept cash). Here's a step-by-step guide:

- STEP 1: Determine the amount of cash you wish to convert into Bitcoin.

- STEP 2: Provide your Bitcoin wallet address. Crypto ATMs typically feature a camera to scan the QR code of your Bitcoin wallet address.

- STEP 3: Complete the transaction by paying in cash. Ensure to review the fee structure beforehand, as hidden fees or inflated Bitcoin prices may apply to certain operators.

After completing the payment, the corresponding amount of Bitcoin will be sent to your wallet. It can take a few days for BTC to reflect in your wallet.

According to Crypto Dispensers, crypto ATMs charge a fee of 10% to 23% of the total amount. For example, if you deposit $500, you'll lose $115 to fees and receive BTC worth $385. Oof!

How to Buy Bitcoin in Europe

Before we go any further, it's important to be aware of a few considerations:

- Research: You must do some homework on Bitcoin's market dynamics and historical price trends before you buy BTC. It would also be a good idea to stay on top of regulatory developments and industry news to make informed decisions.

- Security Measures: You should implement robust security measures such as two-factor authentication (2FA), utilizing hardware wallets for offline storage, and practising discretion when sharing sensitive information online. We'll discuss more on securely storing your Bitcoin holding a little later in the article.

- Dollar-Cost Averaging: That's just a fancy way of saying “investing a fixed amount of money into Bitcoin at regular intervals, regardless of market fluctuations.” DCA helps to smooth out price volatility and may result in more favourable average purchase prices over time.

- Long Investment Horizon: While short-term price fluctuations are inevitable, focusing on the underlying fundamentals and potential long-term value proposition of Bitcoin will keep you from panic selling.

Right, with that out of the way, here's a step-by-step guide on how to buy Bitcoin.

STEP 1: Create an Account

The inaugural step in your Bitcoin expedition involves setting up an account with a cryptocurrency exchange that aligns with your preferences and requirements. Registration typically involves providing basic details such as your email address or mobile phone number, followed by a standard Know Your Customer (KYC) verification process.

KYC includes the submission of documents like a driver's license or passport to verify your identity. This is done to ensure that the exchange remains in compliance with regulatory protocols aimed at thwarting illicit financial activities.

STEP 2: Deposit Funds

Upon successful account creation, the next step entails funding your freshly minted account. Your choice of deposit method significantly influences the efficiency and cost-effectiveness of acquiring Bitcoin.

Cryptocurrency exchanges offer several deposit options like linking debit or credit cards, engaging in peer-to-peer (P2P) transactions or direct cryptocurrency deposits.

Although debit and credit cards offer speed and convenience, you must pay close attention to associated fees. Opting for bank transfers often proves more economical, with certain platforms even waiving transaction fees. However, bear in mind that bank transfers come with longer processing times, typically spanning 3 to 5 business days for funds to show up in your account.

When using credit cards for Bitcoin purchases, it would be a good idea to talk with your bank as many financial institutions classify such transactions as cash advances, subjecting you to exorbitant interest rates.

STEP 3: Purchase Bitcoin

With money in your account, you can purchase Bitcoin. Along your journey, you'll encounter various order types designed for diverse trading strategies:

- Market Order: Facilitates swift execution at the prevailing market price.

- Limit Order: Enables specification of the desired purchase price for Bitcoin. Execution occurs solely when the stipulated price threshold is met.

- Stop-Loss Order: Engineered to mitigate potential losses by triggering a market order to terminate a trade once the price plummets to or below a predetermined threshold.

- Trailing-Stop Loss Order: Incorporates a dynamic "trailing" mechanism that automatically adjusts the stop price in response to market fluctuations, offering adaptive protection against adverse price movements.

If you are looking to get into crypto for the first time you may find our following guides helpful:

- How to Build a Crypto Portfolio

- How to Build a Crypto Portfolio Using Modern Portfolio Theory

- Beginner's Guide to Technical Analysis

What Are The Fees to Buy Bitcoin

Fees associated with buying Bitcoin have many moving parts — how you pay, the size of your transaction and even network congestion can influence fees.

- Exchange Fees: Bitcoin transactions on cryptocurrency platforms typically incur fees for buying, selling, and trading digital assets. These fees may be structured as a percentage of the transaction amount or a fixed sum, varying across different exchanges. You must carefully scrutinize the fee schedule of your exchange before executing a transaction.

- Payment Method: The choice of payment method used to fund your Bitcoin account can significantly impact the fees. Opting for funding via credit card or payment services like PayPal may entail higher fees compared to alternatives such as bank transfers or cryptocurrency deposits.

- Withdrawal Fees: If you intend to transfer Bitcoin to a personal wallet, you may be hit with withdrawal fees by the exchange. Additionally, network fees, influenced by factors like network congestion and transaction priority, may apply during the withdrawal process.

The fees may also influenced by:

- Transaction Size: Some exchanges have a tiered fee structure in place, meaning larger transactions might result in higher fees, either as a percentage of the transaction amount or a fixed sum.

- Market Conditions: During times of heightened market activity, you may encounter higher fees or broader spreads between buying and selling prices. You must stay abreast of prevailing market conditions before executing any transactions.

Best Places to Store Bitcoin

Like most beginners, your first experience of buying Bitcoin will take place on an exchange. This means once you've bought BTC, it will be stored in your on-exchange wallet. While convenient, this opens you up to a few risks:

- Lack of Control: When you store your Bitcoin in a custodial wallet, you relinquish control over your private keys. This means that you are dependent on the custodian (in this case, the crypto exchange) to manage and secure your funds. If the exchange experiences any issues or decides to restrict your access for any reason, you may find yourself unable to access or use your Bitcoin.

- Security Vulnerabilities: Custodial wallets are attractive targets for hackers because they often hold large amounts of Bitcoin belonging to multiple users. If the custodial wallet provider's security measures are breached, your Bitcoin could be stolen.

- Regulatory Risks: Custodial wallet providers may be subject to regulatory requirements that could impact your ability to access or use your Bitcoin. For example, if an exchange is required to comply with anti-money laundering (AML) or know-your-customer (KYC) regulations (which all centralized exchanges are), they may freeze your account or restrict your transactions if they suspect any suspicious activity.

- Counterparty Risk: By entrusting your Bitcoin to a custodial wallet provider, you are exposing yourself to counterparty risk. If the custodian goes out of business or declares bankruptcy, you may lose access to your funds entirely. For reference, millions of users lost access to their funds when the FTX crypto exchange went bust.

Given these risks, we've always been big proponents of off-exchange, self-custodial wallets. There's no shortage of these storage solutions — choose from hardware wallets, desktop wallets or mobile wallets, many of which are free! (So no excuses for keeping crypto on an exchange unless you are actively trading them!)

Here at The Coin Bureau, we'd choose hardware wallets over anything else. While not as convenient, they offer an enhanced level of security, making them a reliable option for protecting your Bitcoin holdings. Hardware wallets like the Ledger Nano X, Ledger Nano S Plus, and Trezor (Model T, One and Safe 3) stand out because of their robust security features. Still unsure? Check out our picks for the best Bitcoin wallets.

Interested in more? You can learn about the types of crypto wallets available or just skip to how hardware wallets work.

We also go into far greater detail on the security strengths and weaknesses of crypto storage devices in our Crypto Safety Guide.

Trading Tips for Beginners

Crypto trading ain't no stroll through the park! It's a ride of wild price swings and heart-stopping volatility. But don't let that scare you off; there are many folks out there nailing it in the crypto game.

Here are a few savvy tips to help make crypto trading easy for you.

- Research, Research, Research: Just like you wouldn't jump into buying a car blindfolded, diving into crypto trading requires some serious homework. Spend time learning the ropes of financial markets, trading strategies, and get cozy with the crypto you're eyeing.

- Play It Safe: Don't be that person who throws all their eggs in one basket. Set your risk tolerance level and stick to it. Think of stop-loss orders as your safety net — they're there to save your bacon when things get rocky.

- Have a Goal: Before you hit the virtual trading floor, know what you're aiming for. Whether it's funding your next adventure or splurging on that dream car, having a clear goal keeps you focused and motivated.

- Keep Emotions in Check: Sure, that meme coin might be tempting, but let's not let emotions run the show. FOMO? Nah, we're not about that. Trading with a level head and understanding your trading psychology is key.

- Start Small: New to the game? No worries. Dip your toe in with a small investment or try your hand with a demo account. It's like learning to swim — start in the shallow end before you dive into the deep.

- Stay Informed: Keep your finger on the pulse of what's happening in the world. From global events to crypto regulations, staying informed helps you stay one step ahead in the crypto game.

How to Buy Bitcoin in Europe: Closing Thoughts

This guide outlined the steps to buy Bitcoin in Europe, highlighting some of the best platforms, including both crypto exchanges and Bitcoin ATMs. The exchanges we've highlighted here offer a diverse array of features, solid security measures, and various other options that cater to both crypto newbies and advanced traders.

Users must take into account a multitude of factors, including setting up their accounts, depositing funds, and familiarizing themselves with different order types. In addition, being mindful of the fees linked to transactions, payment methods, and withdrawals is essential for a cost-effective buying process.

Frequently Asked Questions

Websites like Coin ATM Radar maintain a list of active Bitcoin ATMs across the world. Simply choose the country you're in and an interactive map will open. There, you can see all Bitcoin ATM locations.

The cost of buying Bitcoin varies depending on several factors, including the exchange you use, the payment method you choose, and the current market conditions. Exchanges typically charge fees for executing trades, processing deposits and withdrawals, and converting fiat currencies into Bitcoin. These fees may be structured as a percentage of the transaction amount or a fixed sum.

In addition, payment methods may incur additional fees, especially if you opt for credit/debit card transactions or other instant payment methods. It's essential to carefully review the fee schedule of your chosen exchange and consider the total cost before making a purchase.

Choosing a crypto exchange involves considering several factors to ensure it aligns with your preferences and requirements. Some key considerations include:

- Security: Look for exchanges with robust security measures, such as two-factor authentication (2FA), cold storage of funds, and regular security audits.

- Supported Cryptocurrencies: Ensure the exchange supports the cryptocurrencies you wish to buy or trade.

- Fees: Evaluate the fee structure of the exchange, including trading fees, deposit and withdrawal fees, and any other applicable charges.

- Payment Methods: Consider the payment methods supported by the exchange and choose one that suits your preferences and offers competitive fees.

- User Experience: Assess the user interface and experience of the exchange to ensure it is intuitive and easy to navigate.

- Regulatory Compliance: Verify that the exchange operates in compliance with relevant regulations and has a good reputation for regulatory compliance and transparency.

There are several crypto exchanges available in Europe that cater to users in the region. Some popular options include:

- eToro: A traditional financial investment company offering a wide range of cryptocurrencies and user-friendly features.

- Kraken: A reputable exchange known for its security measures and straightforward approach to trading.

- Crypto.com: A comprehensive platform offering cryptocurrency trading, staking, and other financial services.

- Bybit: A regulated exchange with a wide range of cryptocurrencies and innovative trading features.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.