Top 5 Projects on Polygon: Best Matic DApps to Watch!

Exciting things are happening over on the Polygon network (MATIC) with the announcement of their Polygon 2.0 vision and the launch of Polygon zkEVM. With the developers hard at work, the Polygon ecosystem is expanding and the race to scale Ethereum is in full swing. It’s hard to keep track of everything that’s going on, so that’s where we come in.

In this article on the Top Projects on Polygon, we will take you on a tour through the Polygon ecosystem and showcase some of the best Matic DApps within the Polygon network. This article will also give you some background information on what Polygon is, how the MATIC token functions and where the Polygon ecosystem is headed.

This article will explore the following topics:

- What is Polygon?

- Polygon and the Matic Cryptocurrency

- The Polygon Protocol Ecosystem

- Top 5 DApps on Polygon

- Where to buy Matic

Understanding Polygon (Matic)

Polygon blockchain was previously known as Matic Network and is a "Layer 2" or "sidechain" Ethereum scaling solution that runs alongside the Ethereum blockchain. Polygon enables faster and cheaper transactions to reduce gas fees and allows users to make low-cost transactions.

The network's native cryptocurrency is called MATIC which is used for staking, paying on-chain fees, and various other on-chain functions such as governance. In February 2021, Matic Network rebranded to Polygon and shifted its focus from being a Layer 2 scaling solution that reduces gas fees to an interoperable blockchain scaling framework for building Ethereum-compatible blockchains.

What Makes Polygon Network Unique?

The Polygon network enables users to experience faster and cheaper transactions than on the Ethereum Layer (aka Layer 1). Polygon uses a technology known as Plasma to process transactions off-chain before finalizing the off-chain data onto the Ethereum main chain. This makes gas fees much cheaper for users and allows users to take advantage of regular yield farming without having to worry about slow confirmation times.

Not only is Polygon great for low-cost transactions, but it is also developing Polygon zkEVM which focuses on unlocking Ethereum scalability while maintaining security. Polygon zkEVM is the first ZK-rollup that offers EVM equivalence with fast transactions at near-zero gas cost. To learn more on this topic please visit the zkEVM website.

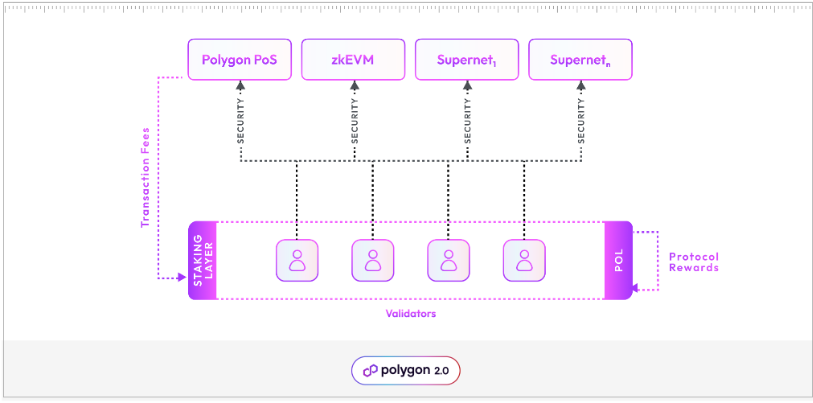

In addition to this, Polygon is building Polygon 2.0 and changing its MATIC ticker to POL. Polygon 2.0 will introduce supernets which are similar to Avalanche's subnets and will allow users to pay for gas fees with their own native token for their corresponding supernet. The supernets can be used for application-specific blockchain networks designed for specific use cases and are customizable networks. This means that each supernet or network can be tailored to meet specific enterprise or application use cases. The Polygon network upgrade will also allow validators to validate multiple chains and every chain can offer multiple roles (and rewards) to validators.

In their own words:

"This novel design secures, coordinates and aligns the Polygon ecosystem and supercharges its further growth, at the same time offering practically unlimited opportunities to POL holders." (Source: Polygon)

If that wasn't enough to impress you then perhaps the partnerships with Disney, Nike, Meta and Starbucks will. Most of these partnership announcements took place in 2022 and weren't fully appreciated by the crypto community. Time will tell as to whether these partnerships are noteworthy or not but as the Polygon network grows and the decentralized finance industry matures, Polygon is well-placed for further crypto adoption.

Polygon Network and NFTs

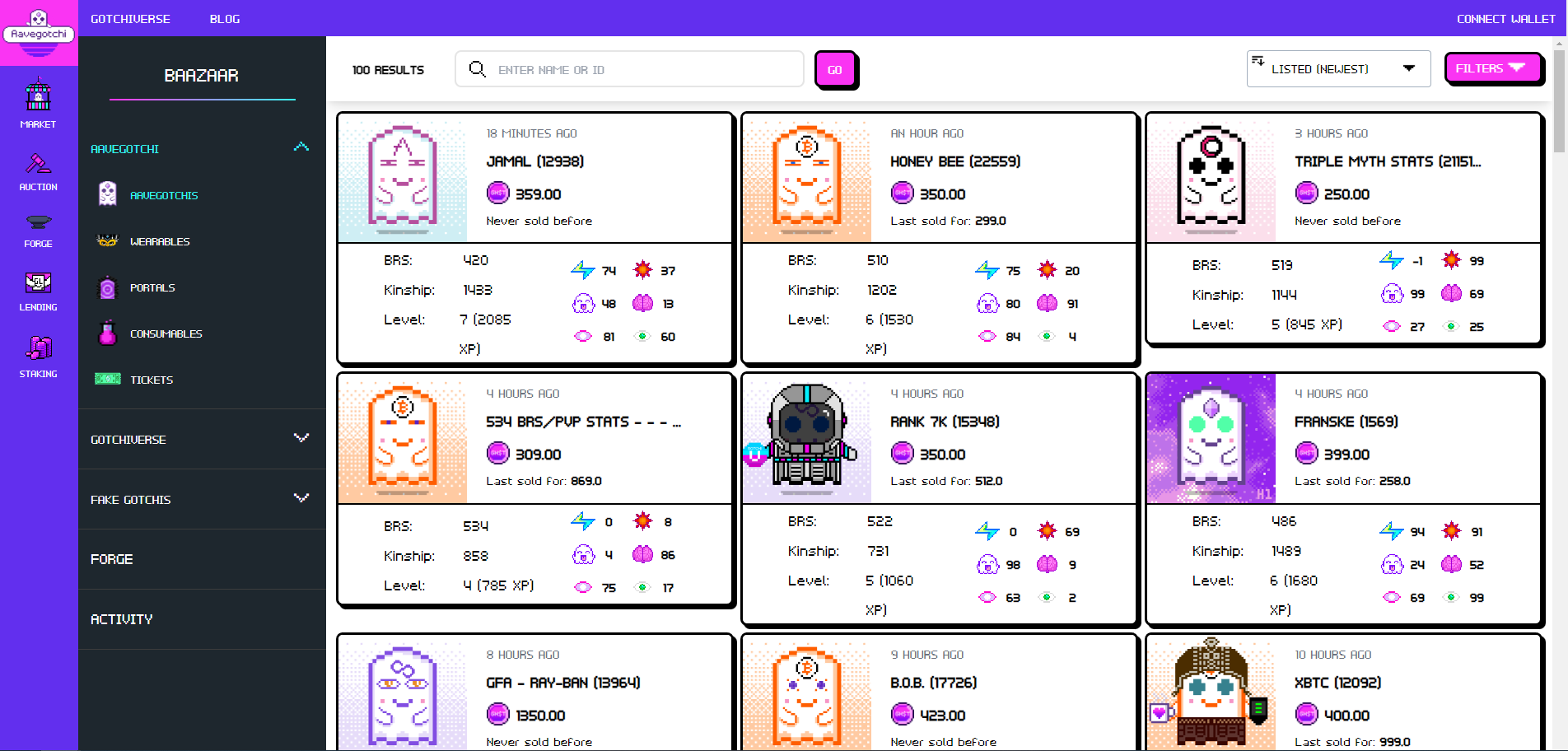

Polygon NFTs are non-fungible tokens that were either minted on the Polygon blockchain or bridged from another chain to the Polygon blockchain. Regardless of where they originated from, all Polygon NFTs benefit from the network’s low gas fees and quick transaction times relative to the Ethereum-based assets on mainnet.

Polygon has a thriving NFT ecosystem with Teams like y00ts and Hell Cats, marketplaces like OpenSea and Magic Eden and game projects like Benji Bananas and Arc8. Countless other projects all exist in the Polygon NFT ecosystem and to date, more than 843 million NFTs have been minted on the Polygon blockchain, with total volume exceeding $16 billion.

If you prefer low fees and hate failed trades on other networks then the Polygon network might be a new place to experiment. If you fancy it, here are the top 5 NFT DApps on the Polygon network according to their all-time sales volume:

- OpenSea

- Aavegotchi

- Playdapp marketplace

- Element

- Rarible

Polygon Matic Cryptocurrency

Polygon's current token is MATIC as it was formerly named Matic network before the upgrade to Polygon network in 2021. With the announcement of Polygon 2.0, the MATIC token is set to be replaced with POL but the upgrade is in name only and will not change the tokenomics.

The Matic token has a total supply of 10 billion tokens and currently has a circulating supply of 9.319 billion tokens. The Matic token can be used to govern and secure the Polygon network, pay transaction fees and be staked with a validator to earn staking income. For larger MATIC holders, a validator can be ran for other smaller users to stake to, which offers higher technical difficulty but better rewards.

Where to Buy Matic

Polygon (MATIC) tokens are available on all popular large exchanges such as Binance, OKX, Bitget, Coinbase and Kraken. The largest volumes for trading MATIC come from the USDT/MATIC trading pair on Binance which regularly receives over 10% of all trading volume.

Be sure to check out our article on the Top Crypto Exchanges if you are in the market for your first or additional crypto exchange.

If you would like to experiment with the Polygon ecosystem you can withdraw your MATIC tokens to any popular hot wallet such as MetaMask, Trust Wallet or OKX Wallet.

For long-term storage of Polygon, we recommend hardware wallets such as Trezor or ELLIPAL.

Now that we're all caught up on all things Polygon, Matic, and the Polygon ecosystem, let's dive into the Top DApps on Polygon.

5 Top Polygon Projects (DApps)

In this article, we will discuss our 5 top Polygon projects by showcasing the different sectors of the DeFi ecosystem. Rather than just pick the top 5 projects in rank order based on their Total Value Locked (TVL) we will look at 5 key areas in the Polygon ecosystem:

- Real-world assets (RWA’s)

- Lending

- Decentralised exchanges (DEXES)

- Liquidity Management

- Payments

From these 5 different sectors, we can explore our top projects and showcase some of the exciting things being developed in Polygon DeFi.

Tangible

First up on our list is Tangible, a Real-World Assets (RWA) platform that focuses on taking real-world assets, tokenising them and putting them onto the blockchain by using Non-Fungible Tokens (NFTs). The Tangible platform is an ecosystem for tokenised real-world assets and the creator of Real USD, the first stablecoin backed by tokenised, yield-producing real estate. By using Real USD, the protocol allows users access to tokenised and fractionalised RWAs through their NFT marketplaces.

What does all this mean? How does it work?

- With Tangible, anyone can use Real USD to purchase valuable physical goods such as wines, gold bars, watches and real estate from world-leading suppliers.

- After the asset is purchased on Tangible, a TNFT (“Tangible non-fungible token”) is minted, representing the physical item.

- The newly minted TNFT represents the USD value of the RWA in a tokenised form.

- The physical item is then sent to one of Tangible’s secure and insured storage facilities, and the TNFT is sent to the buyer’s wallet.

- At any time, the owner of the TNFT can redeem it for the physical item, transfer it to another wallet, or sell it on Tangible’s marketplace. The TNFT is a liquid, tradable and redeemable asset, represented by an on-chain NFT.

Users can use the Tangible DApp in three ways:

- Buy RWA’s from Tangible Custody

- Buy TNFTs from other users

- Sell your TNFT to other users

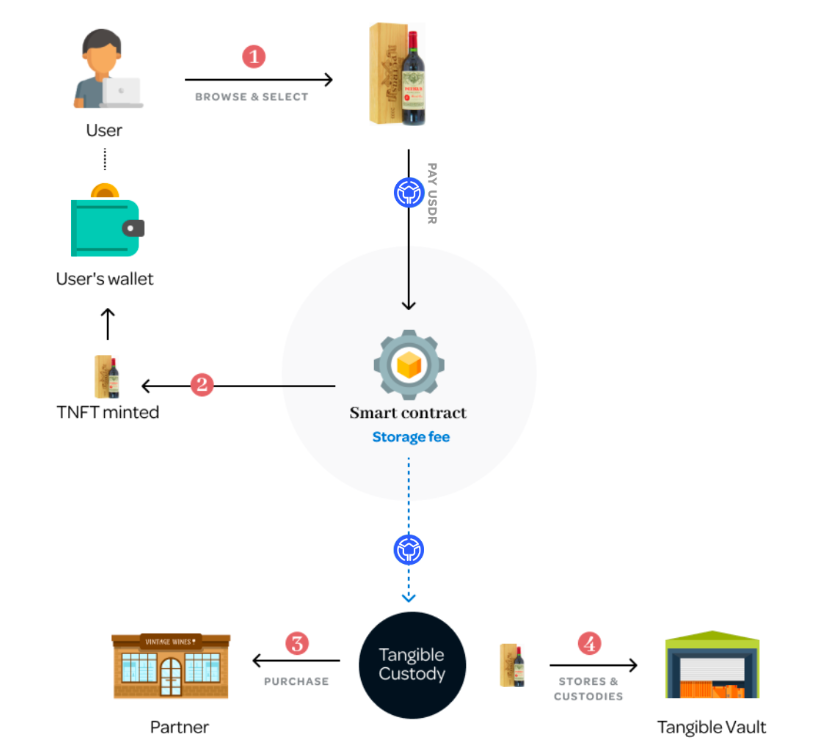

Understanding these types of procedures in a written format can be complicated, so here’s a diagram explaining the different processes associated with using the Tangible DApp. In this example, a user is purchasing a bottle of Chateau Petrus 1990 from Tangible Custody.

- The user browses Tangible’s marketplace and purchases the bottle of wine using a smart contract that processes the item price and storage fee (if relevant).

- The TNFT is minted and sent to the user’s wallet which they can use for storage, trading or selling.

- At the same time, Tangible completes the purchase of the physical item from Tangible’s Supplier Partner.

- The physical purchased item is transported to a Tangible Vault, where it is stored safely.

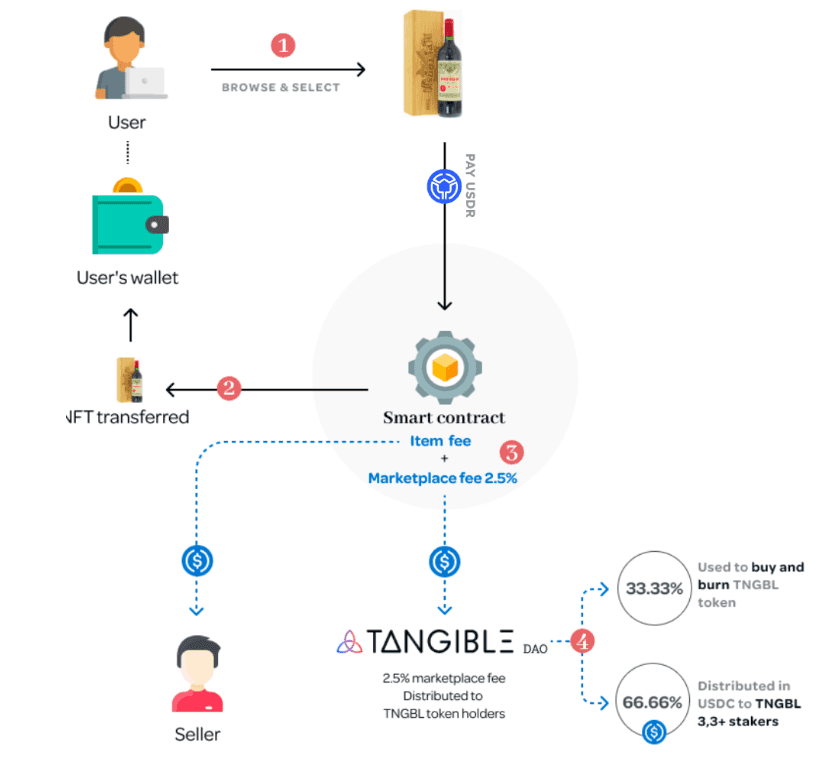

In the next diagram, we can see how a user can buy or sell TNFTs with other users and how the Tangible token (TNGBL) is used within the interaction.

- Users browse and purchase items listed on Tangible’s marketplace.

- The existing TNFT is transferred to the user purchasing the TNFT’s wallet.

- At the same time, USDC tokens are transferred from the buyer’s wallet to the seller’s wallet via smart contract which processes the 3 fees: trading, item purchase and storage fees (where relevant). The item will remain in storage until the buyer wants to redeem it.

- 66.66% of the Tangible DAO fees are paid in USDC to Tangible 3,3+ stakers and the remaining 33.33% are used to buy and burn TNGBL tokens.

In the traditional financial system, there are often large barriers to entry for the average individual as even the smallest investments in real estate are often in the 10’s of thousands of dollars. For most people, especially the younger generation who haven’t had time to accumulate wealth, this becomes nearly impossible.

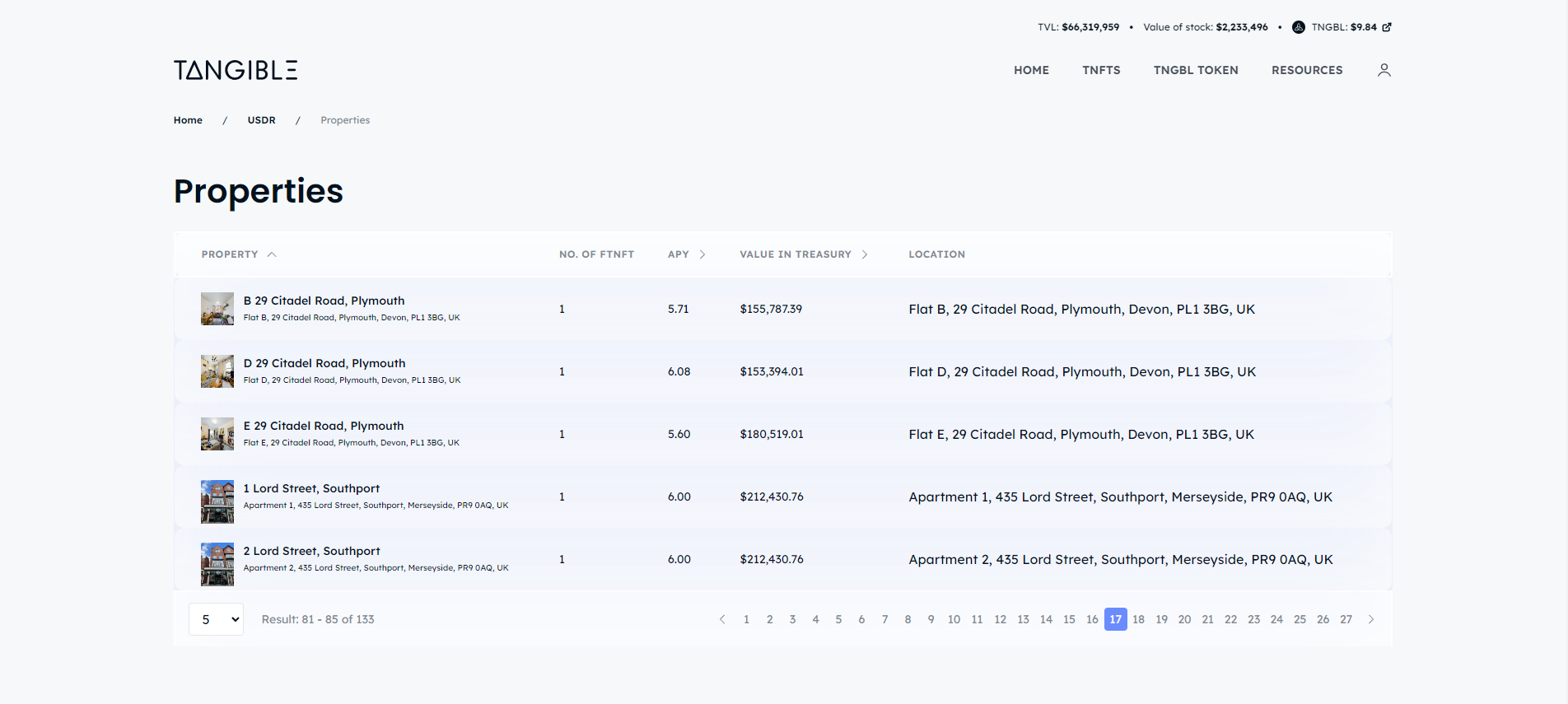

In traditional finance, investing to escape inflation and generate a yield is costly, arguably by design. That’s where Tangible’s fractional NFTs come in. Tangible fractions are smaller portions of a complete TNFT and enable the division of expensive assets such as a piece of real estate into smaller more affordable pieces. Tangible fractions allow multiple owners to share in the risks and rewards of a single investment.

Any TNFT owner can easily sell any percentage on Tangible's marketplace by using the site's fractionalisation tools. The seller determines the price of the entire available percentage as well as the minimum fraction any single user can buy.

Here’s an example:

- Owner of a $100,000 real-estate TNFT puts 40% on sale for $42,000.

- Owner specifies a minimum purchase size of 1%

- Multiple buyers purchase 1% for $420 or 1.5% for $630 until 40% cap is met.

- Fractions are then sent to the user’s wallet and the original TNFT is locked in a smart contract vault.

- If the initial TNFT had early user TNGBL and USDC rewards, these claimable benefits pass on to the fractions and the fraction owners. Thus, people with small incomes can still achieve a yield.

What’s important to consider in this scenario is if the off-chain RWA real-estate example used above appreciates in price, perhaps due to inflation, theoretically the users' 1% share should also increase in value. This has massive implications for people with lower incomes as users are able to escape inflation by holding a small fraction of a larger real-world asset that they otherwise would not be able to invest in and have exposure to.

The Tangible TNFT concept and the tokenisation of off-chain physical assets onto the blockchain seems like the start of bigger things to come in the blockchain industry. I’ve been hearing about the desperate need for real-world utility and adoption in cryptocurrency since 2018 but the infrastructure to facilitate this wasn’t available. Fees were too high with slow confirmation times, liquidity was too thin, NFTs barely existed and DeFi was primitive. In order for something like Tangible to operate successfully in the real world, it needs all of these things in abundance and I think in 2023, users might finally have what we need to enable this.

Polygon offers fast and cheap transactions, TVL in DeFi is significantly larger than in 2018 and across multiple blockchains, NFTs are a household name and the proliferation of stablecoins, DeFi protocols, and decentralized applications have all created the perfect environment for DeFi projects like Tangible to succeed.

Whether or not real-world assets such as real estate can be tokenized onto the blockchain in a safe and efficient manner is yet to be seen and is a mammoth task. If DeFi protocols such as Tangible can succeed, I believe it would be a huge step towards cryptocurrencies' inevitable goal of tokenising everything and be one the best projects for the adoption of crypto assets.

Aave

If you’ve been around the DeFi space a while or are an Ethereum DeFi native it’s highly likely you’ve used Aave or similar lending DApps such as Compound before. As far as DeFi applications go, these DeFi projects are about as ‘bread and butter’ or 'OG' as you can get. They are tried and tested, exist on multiple blockchains and boast a high total value locked (TVL).

Aave offers decentralized lending and borrowing which allows users to earn interest on their assets on the Polygon blockchain as well as other networks such as Ethereum, Avalanche, Optimism, Arbitrum and in the past year, Metis.

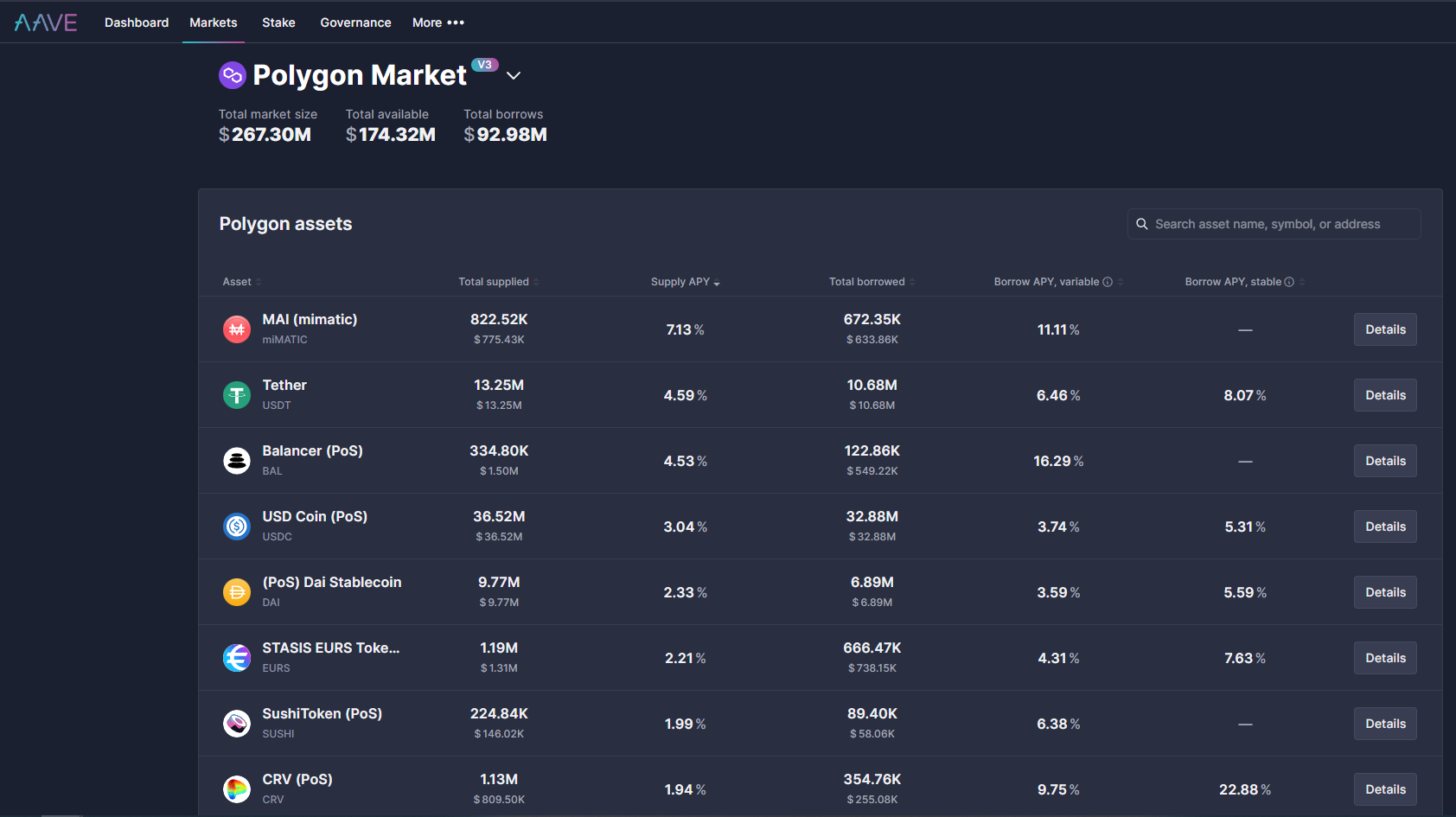

As a decentralized lending market, the function of Aave is simple, it allows users to provide liquidity and lend or borrow assets in liquidity pools by using the supply and borrow smart contracts. Users can supply crypto assets, enable them as collateral and borrow assets against them without worrying about impermanent loss. Users supplying to Aave will earn interest and users borrowing from Aave will need to pay interest. If a user is borrowing from Aave they must keep track of their crypto portfolio, specifically their loan-to-value ratio (LTV) and keep their health factor above 1.00 or else they will reach their liquidation level.

Each of the liquidity pools have different rates depending on your chosen market with variable rates on the supply side and two options on the borrow side. If you’re looking to borrow assets such as stablecoins, you have two options, a variable rate or a stable rate. Typically for borrowing stablecoins using the stable rate the APY’s are slightly higher. Ultimately, the APY cost for borrowing and supplying will be determined by market participants and the utilization of liquidity pools.

To understand how trusted and integral the Aave platform is within DeFi, here are some hard-hitting TVL metrics to appreciate the scale of Aave’s success:

- The total TVL for Aave on all blockchains is $5.771 billion.

- Aave is ranked 3rd place in Ethereum TVL rankings.

- Aave is ranked in 1st place for TVL on the Polygon blockchain with a TVL of $315.1 million.

- Aave is ranked 2nd place for TVL for ALL of cryptocurrency.

With those kinds of metrics, I would be doing a disservice not to include Aave in the top projects within the Polygon ecosystem. Oftentimes in crypto, it can be more fashionable to chase a new narrative and follow the hype but at the heart of all things DeFi is the non-fancy, dependable Aave. Aave just does what it needs to do and keeps working as intended for its users. The simple and intuitive UI makes for a pleasant UX and is often a great place for yield farming when liquidity mining incentives are added to an ecosystem.

Ecosystem incentives in the form of liquidity mining are provided by a blockchain's ecosystem to encourage users to add liquidity to the protocol and increase the blockchain's total value locked (TVL). Examples of liquidity mining include the Avalanche (AVAX) incentives which started on the 21st of April 2022 or the Optimism (OP) incentives which started on the 5th of August 2022.

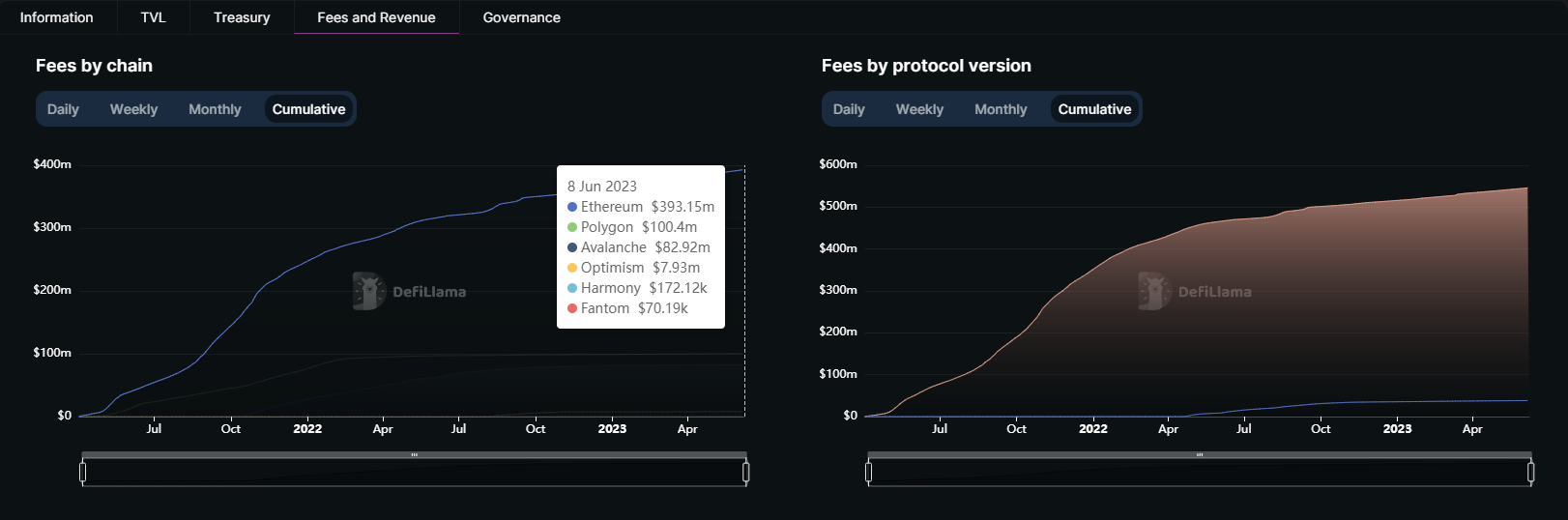

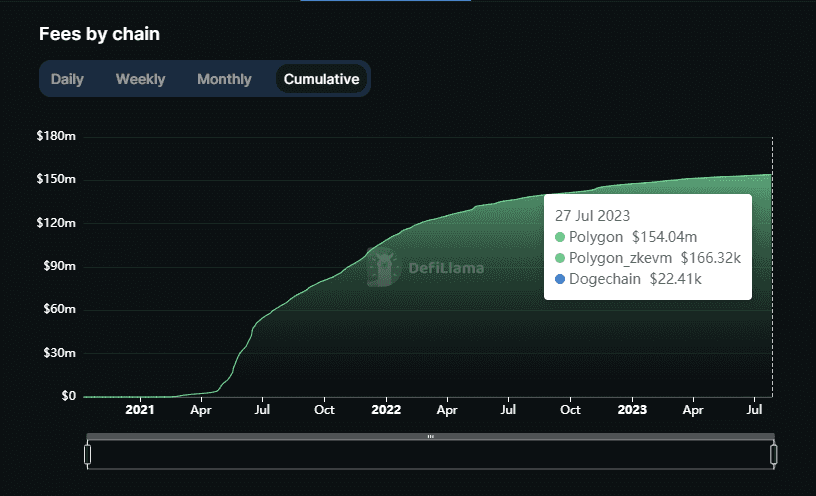

Aave lending is big business and as a project, they’ve successfully created a solid fee-earning revenue model. The total amount of fees earned to date are over $500 million with the majority of fees earned from Ethereum with $393.15 million and Polygon 2nd with a respectable $100.4 million.

There are many different Aave protocol versions with some even dedicated to RWA’s such as Centrifuge, but the large majority of fees come from the V2 version as it’s the oldest.

So, does that mean there’s nothing else to look forward to with Aave? Not at all, Aave DAO has just launched their GHO stablecoin on Ethereum mainnet. Following the approval of the Aave Improvement Proposal, users of Aave V3 on Ethereum are be able to mint GHO stablecoin against their ETH collateral. This adds Aave to the list of other top DeFi protocols that have launched their stablecoins such as MakerDAO with DAI and more recently Curve Finance with crvUSD.

If you want to learn more about this cornerstone of DeFi, we have a dedicated Aave Review you can check out to learn more.

Gamma

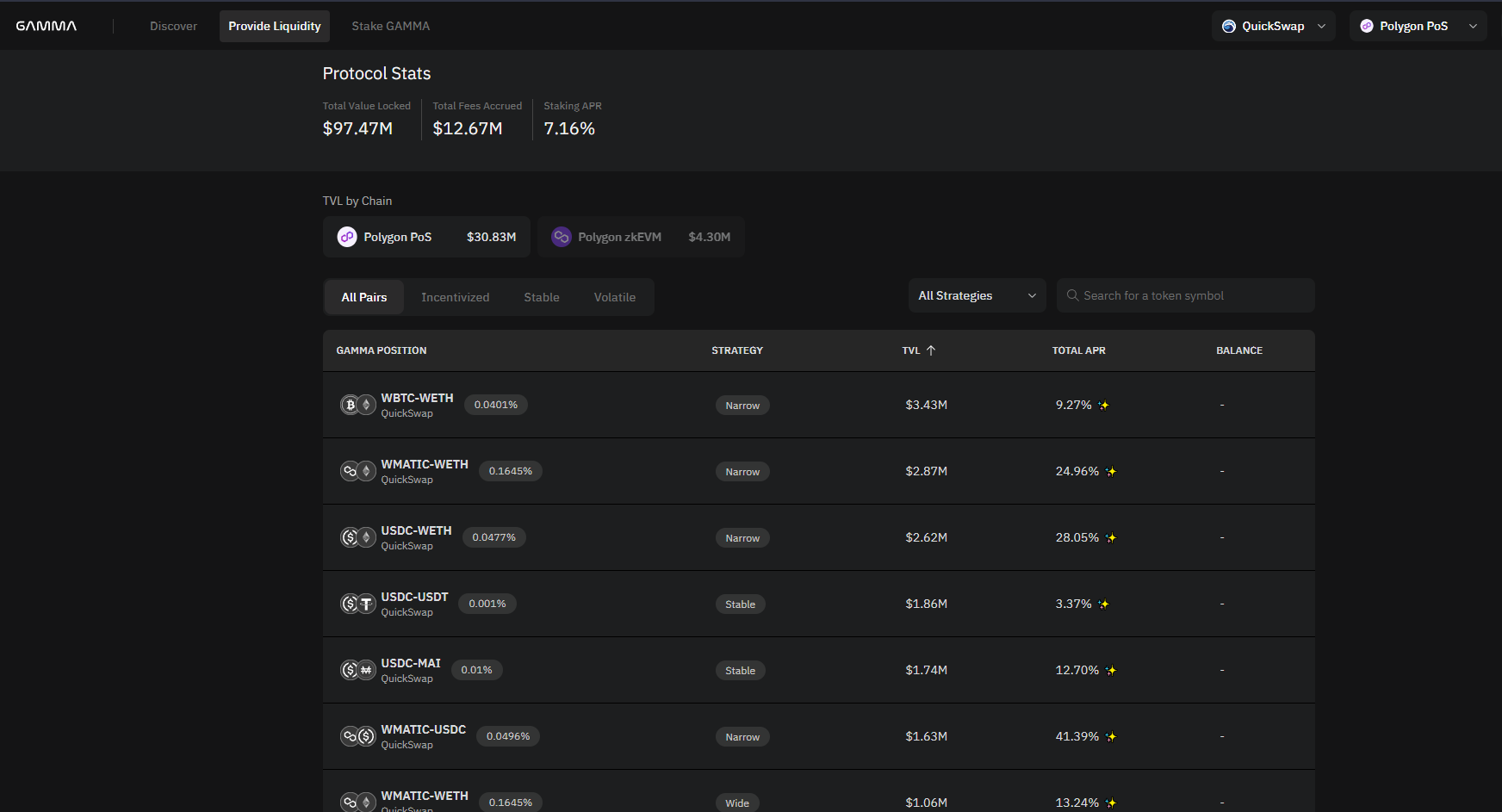

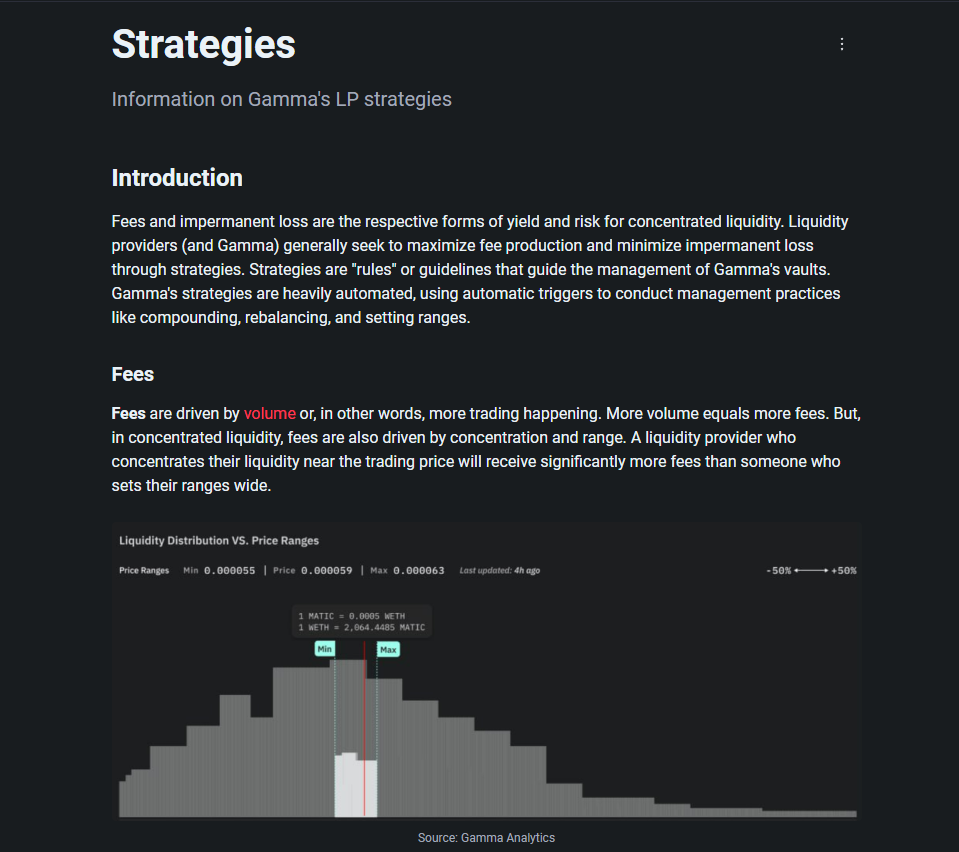

Our next Polygon network project is Gamma, a liquidity management and market-making strategy protocol which offers non-custodial, automated and active concentrated liquidity management services.

Ok sounds great, but what exactly is that?

I hear you, let's explain. To cut a long story short it means users can earn more rewards for depositing their crypto assets into liquidity pools. Gamma will manage the liquidity you deposit to help you earn interest at a higher rate by actively managing that liquidity automatically. If you're looking to maximise your yield farming and boost your crypto portfolio then using a yield optimizer such as Gamma is a good place to start.

To understand Gamma's value proposition and how it works, we need a quick history lesson on how the automated market maker system has developed over time. This next section is a little complicated, so if you don't have time to read through it here are the 3 key takeaway points:

- Gamma was created to solve all of the challenges of concentrated liquidity created in V3 Uniswap.

- Rather than manage your liquidity yourself and find an efficient price range, Gamma will do this for you automatically.

- If you deposit your crypto assets into Gamma liquidity pools (vaults) on Polygon, you can earn higher yields with much less work and much lower gas fees.

If you're interested in the more technical aspects of how Gamma works, prepare for a crash course. For most of cryptocurrency history, the only way to trade assets was to trade on a centralized exchange or trade directly peer-to-peer. For users who didn't want to use a centralized entity and preferred to practice self-custody, there wasn't any other option.

In comes Uniswap, born in late 2018, it was the first true Automated Market Maker(AMM) which allowed users to trade or 'swap' Ethereum-based assets in a decentralized manner. Uniswap introduced decentralized liquidity pools where liquidity providers could deposit their assets into two-sided liquidity pools and earn trading fees as rewards.

During the 2020 DeFi boom, protocols would compete for liquidity by offering incentives to users. This process is now known by many names, including yield farming, liquidity mining, or mercenary capital.

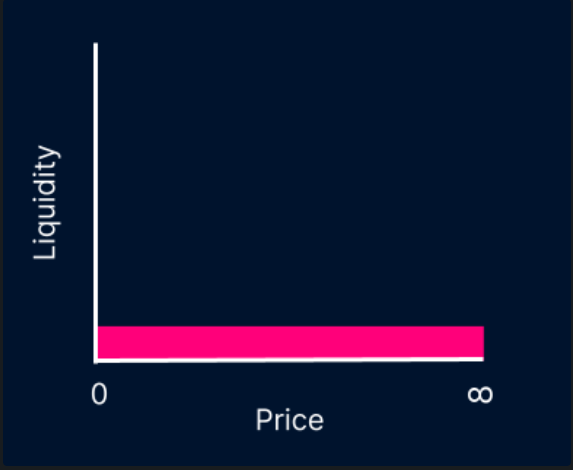

Everything worked well but gradually a long-term problem emerged during this growth period. Uniswap was not as efficient as it could be, it lacked capital efficiency. Liquidity could only be provided full range across the entire price of the asset which meant all liquidity providers chose the same position and the only thing that changed was how much they put in.

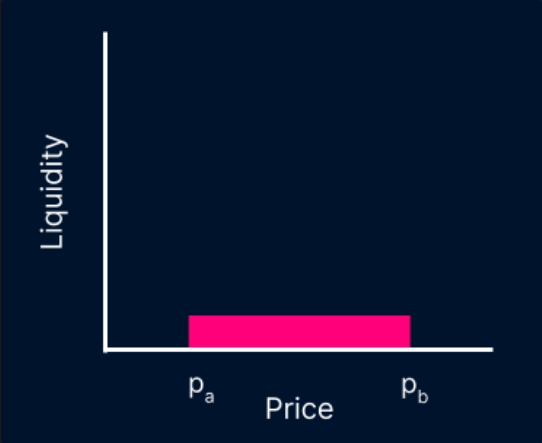

In March 2021, Uniswap released concentrated liquidity which allowed users to choose the price range of where they wanted to provide liquidity. This relatively simple change had dramatic effects on the market. Liquidity pools became much more efficient. The liquidity concentration and range began to adjust in real time to match the needed liquidity for any pool and thus a dynamic new market emerged in the world of liquidity.

However, concentrated liquidity came with its own set of problems and for the average DeFi user, trying to set the right liquidity price ranges became increasingly complex and risky due to impermanent loss.

Enter Gamma. Gamma is a Concentrated Liquidity Manager (CLM) whose main job is to solve all of the challenges of concentrated liquidity. Gamma's vaults provide liquidity providers (users) with the most optimized performance on a variety of blockchains. Gamma does this by:

- Mitigating impermanent loss

- Accumulating fees and compounding yield

- Using proper strategies

Gamma is one of the largest liquidity managers in crypto, 2nd only to Arrakis Finance. Gamma exists on other chains but the cheap gas fees on Polygon allow users to do their yield farming with ease and is a welcome addition to Polygon DeFi.

That's a wrap for Gamma, I hope the history lesson wasn't too dull, the merits of Gamma are clear and I hope it can become a useful addition to your yield farming strategies.

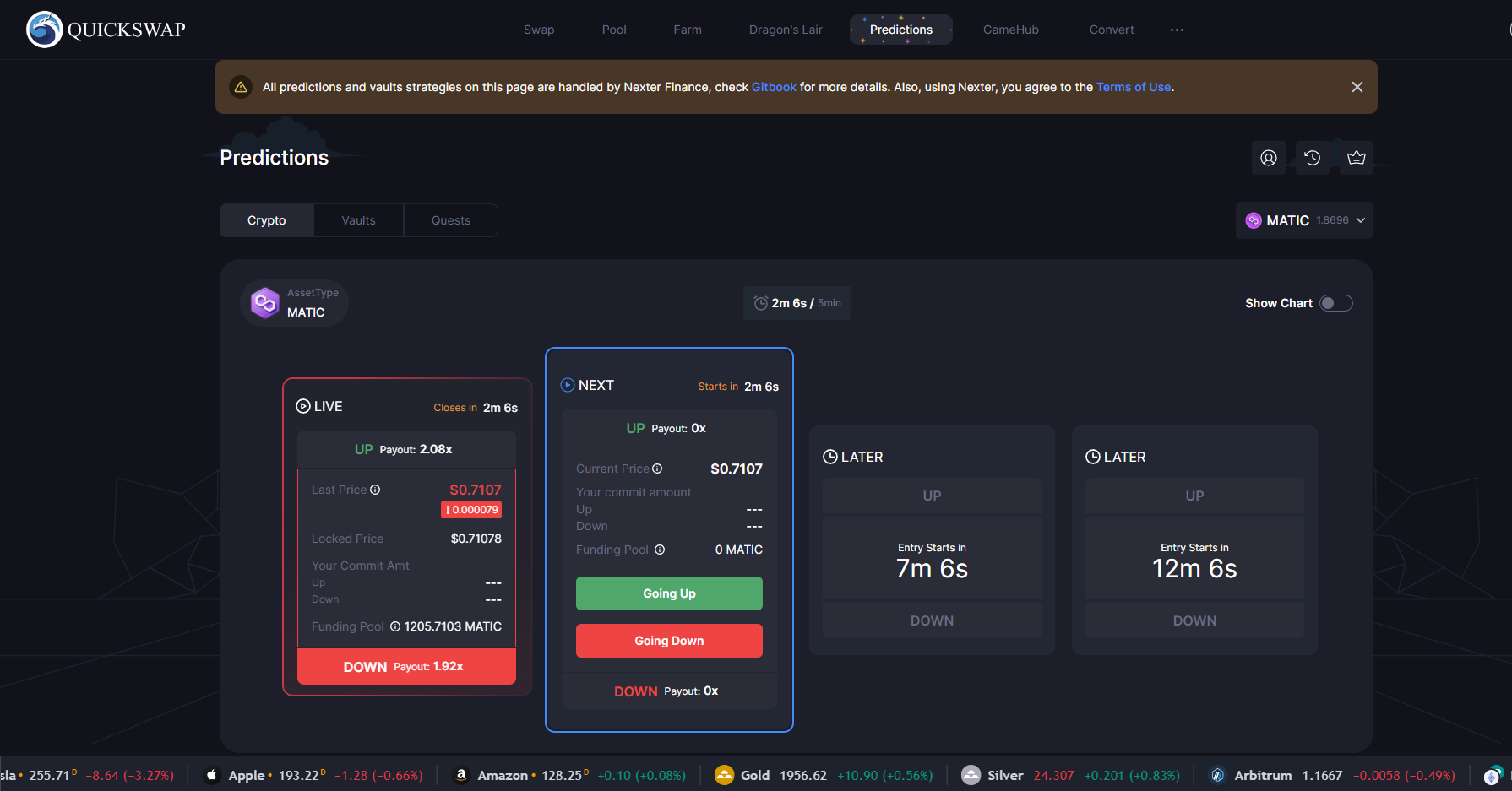

QuickSwap:

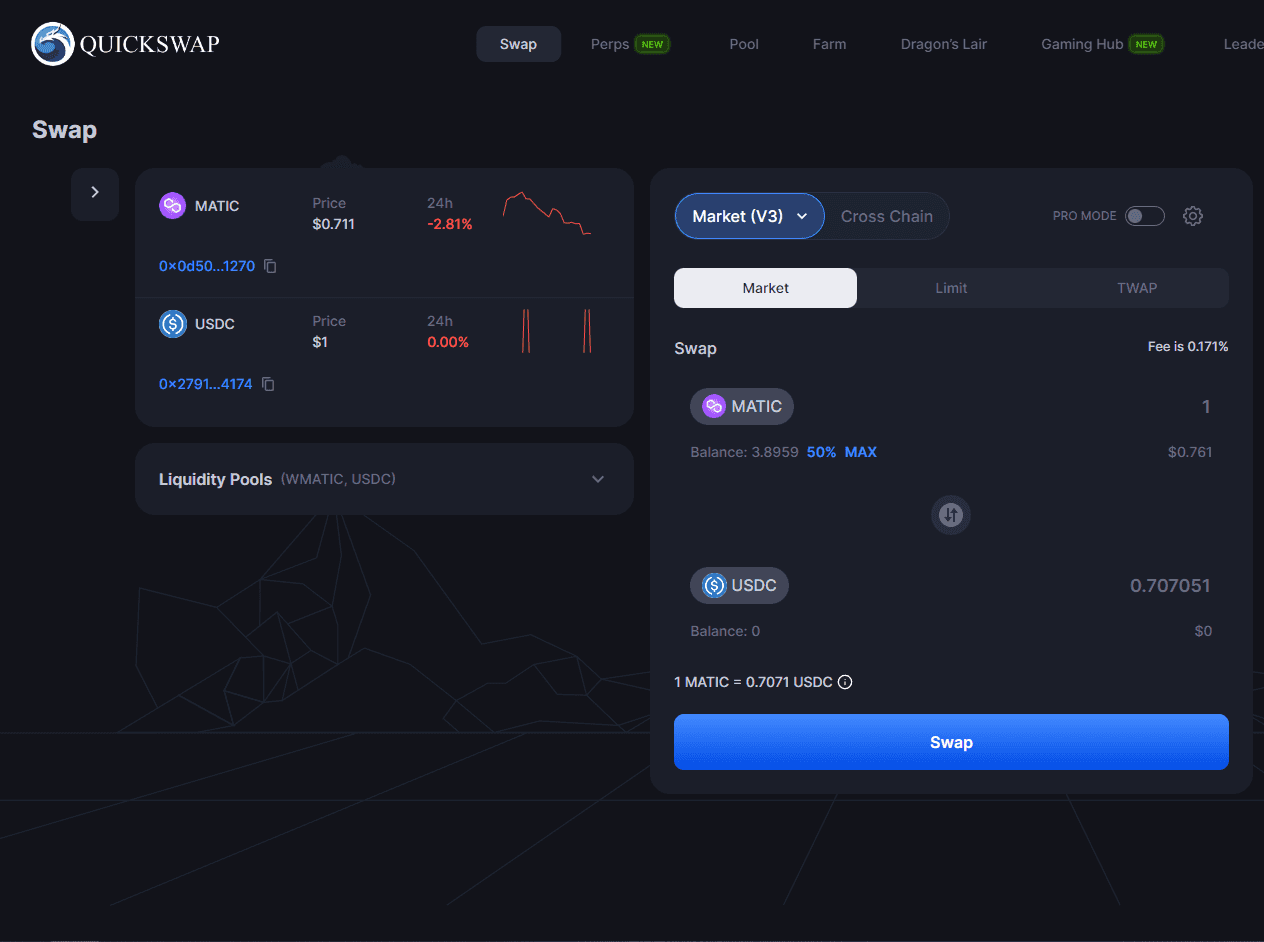

At the core of all things decentralized finance are decentralized exchanges. Decentralized exchanges on Polygon allow users to make trades at lightning-fast speeds with cheap gas fees and some of the best prices around. If this sounds like something you need then QuickSwap on Polygon is worth looking into.

QuickSwap is a decentralized exchange or 'DEX' which allows users to swap digital assets at competitive prices in a decentralized manner using smart contracts. Quickswap adopted Uniswap's Automated Market Maker (AMM) model by forking the code and allows users to bypass crypto exchanges and trade with self custody.

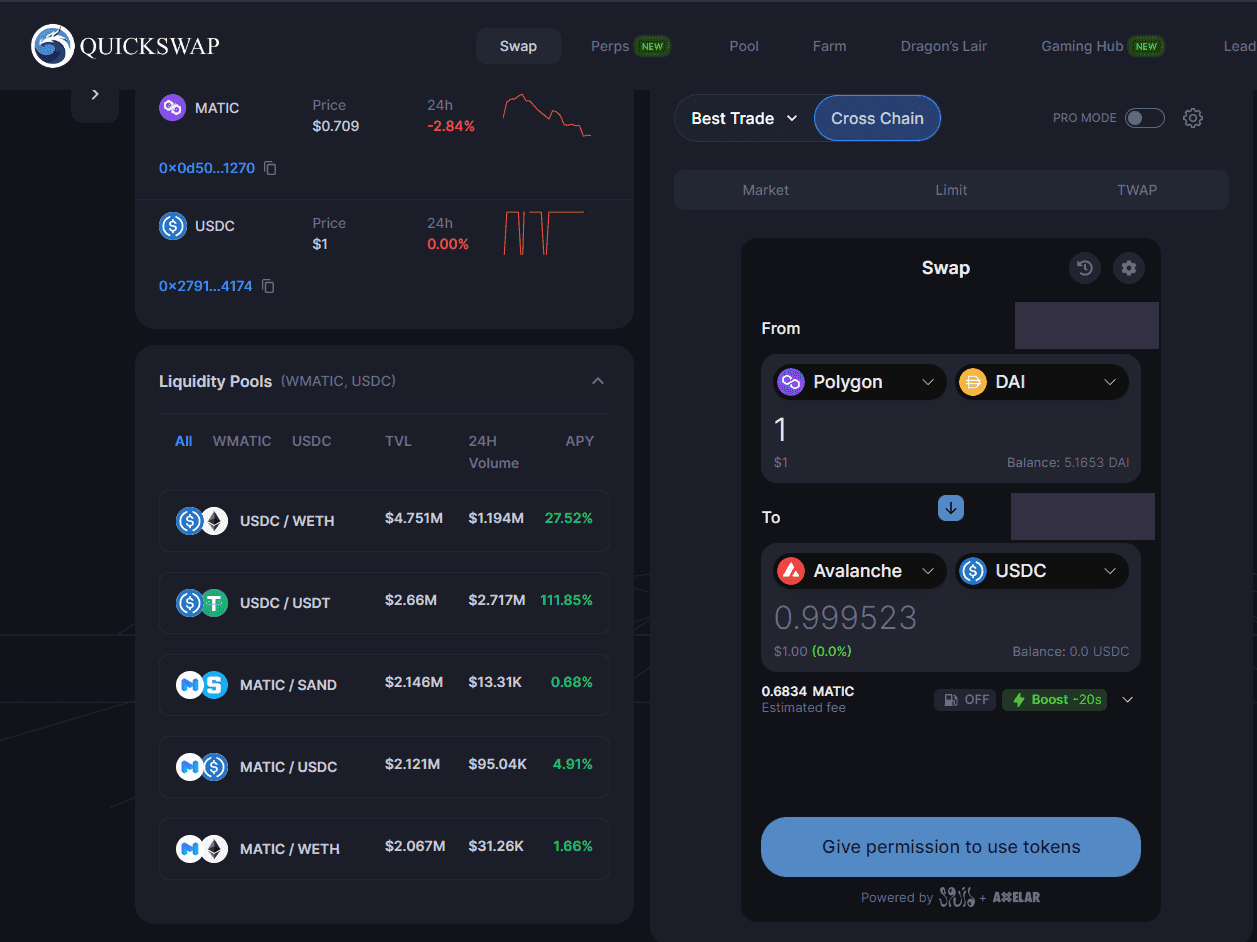

QuickSwap also offers users the ability to swap one asset for another asset across multiple blockchains through what is known as a cross-chain swap. QuickSwap uses Axelar and SquidRouter for their cross-chain swaps and currently supports swaps across 11 different blockchains. In the future, it will support a further 22 Cosmos ecosystem swaps after they complete their integration with Satellite bridge, powered by Axelar.

Not content with being 'just' a cross-chain decentralized exchange, QuickSwap has also offers the following features:

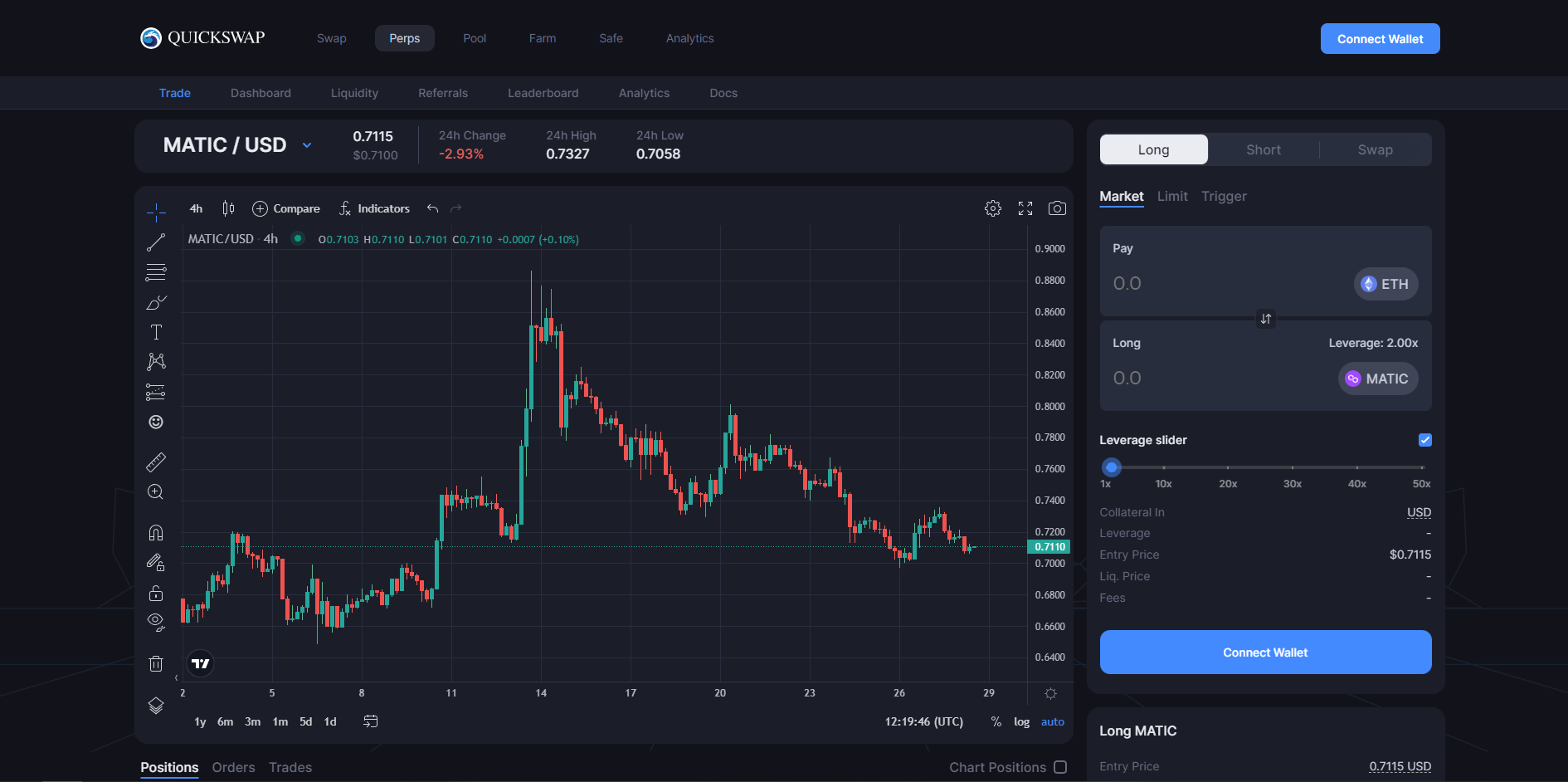

- Perpetual futures contracts on Polygon zkEVM

- Liquidity Pools to facilitate the users' decentralized trades with V3 concentrated liquidity pools as shown below:

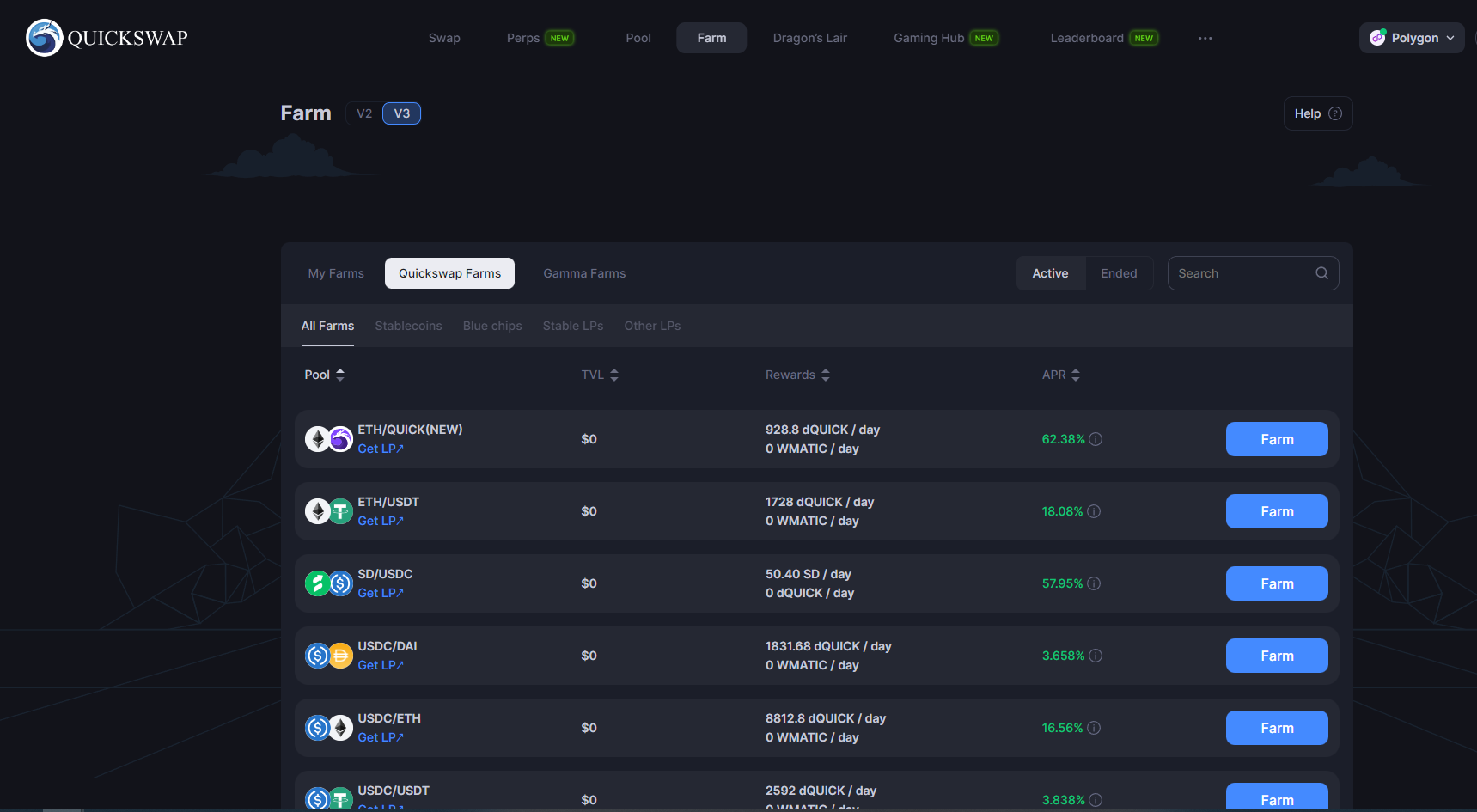

- Farm section for yield farming your liquidity position with optional Gamma integration as a yield optimizer:

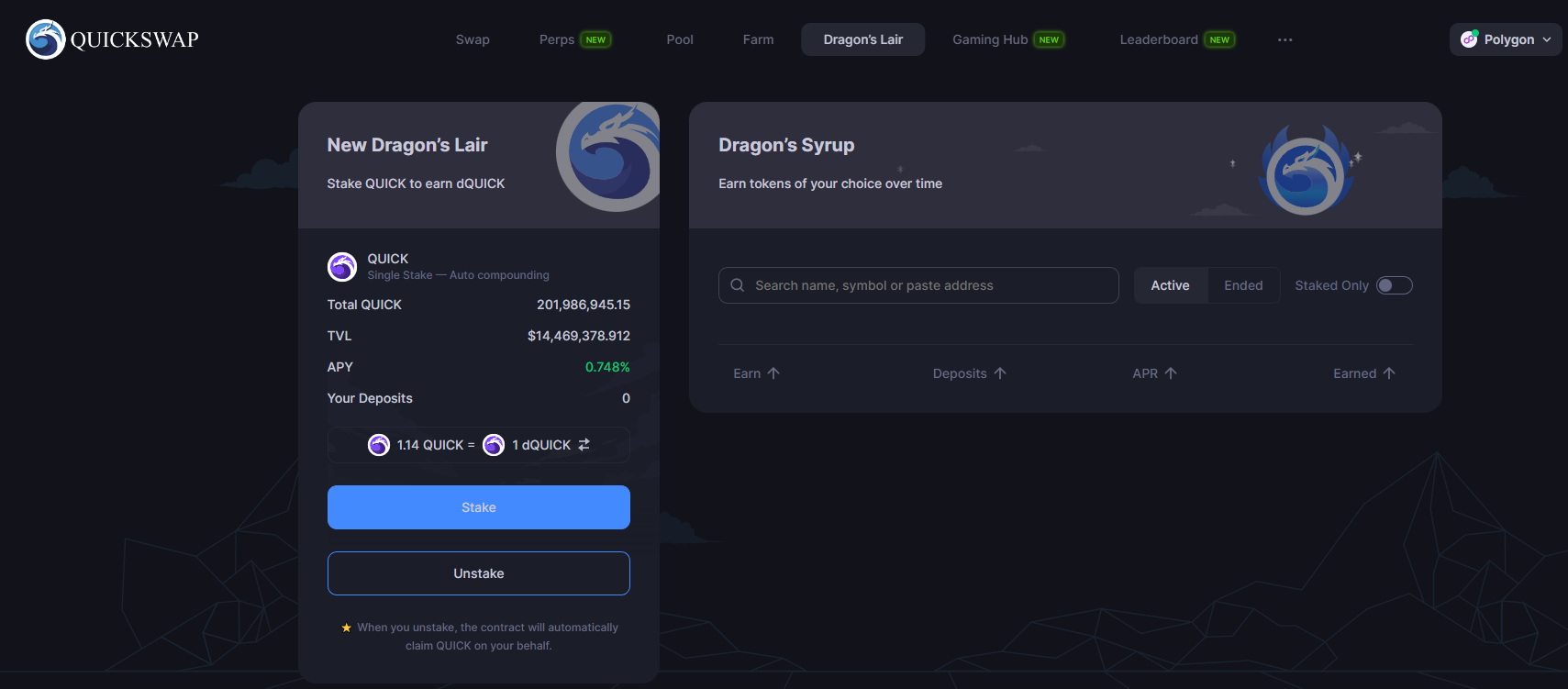

- Dragons Lair for staking QuickSwap's native token QUICK to earn a share of fee revenue:

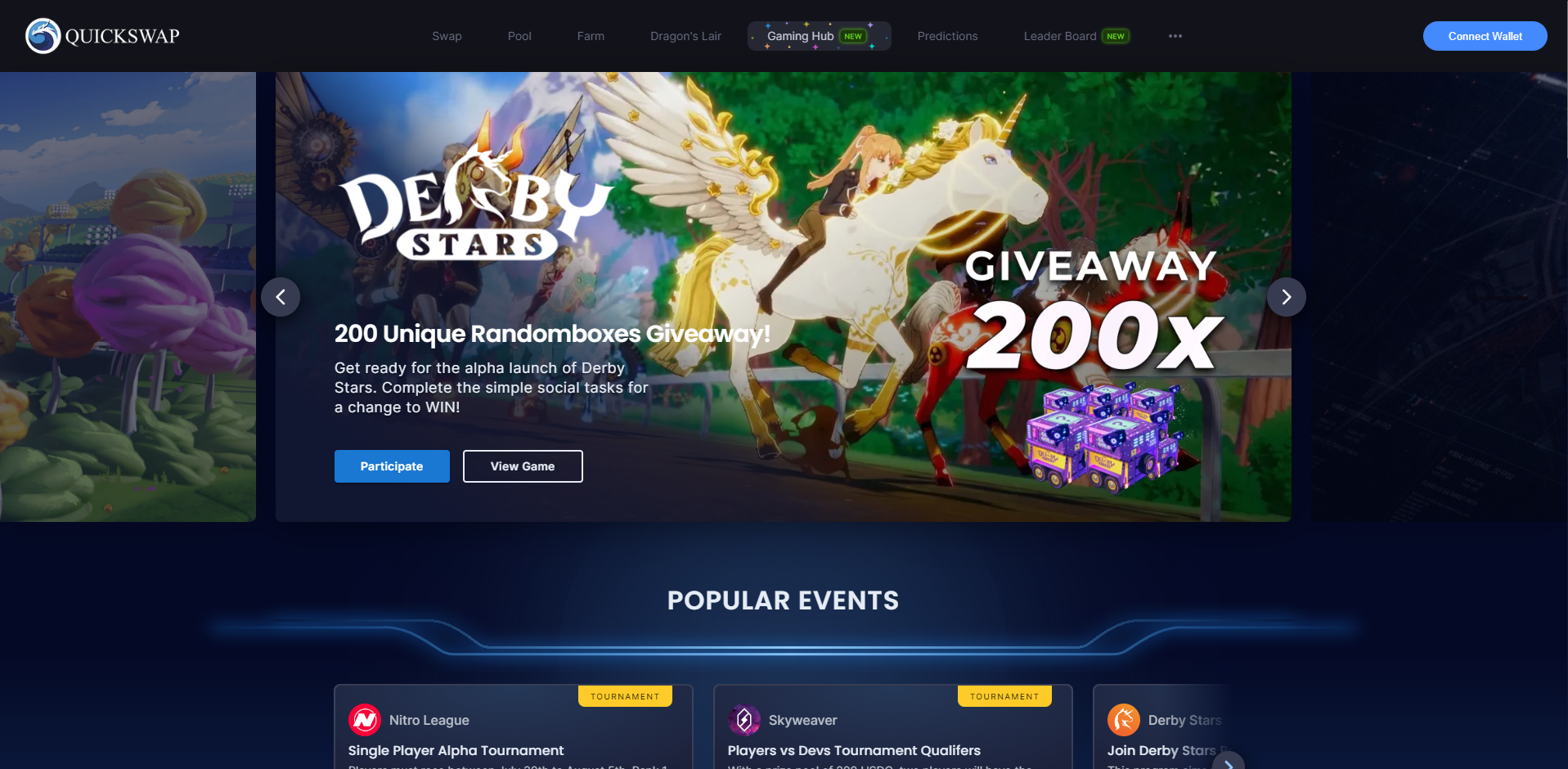

- Gaming Hub in partnership with VersaGames to showcase decentral games:

- Prediction markets powered by Nexter Finance

QuickSwap is the largest of the decentralized exchanges with a Total Value Locked (TVL) of $107.7 million just in front of Uniswap with $91.8 million TVL. It's popular with users and has generated over $150 million in fees since its inception.

QuickSwap is one of the great DeFi protocols and allows users to use a wide range of tools all in one location. It is one of the best-decentralized crypto exchanges in the Polygon network and is constantly developing with a bright future. Be sure to check out our QuickSwap review to learn more about this revolutionary DEX.

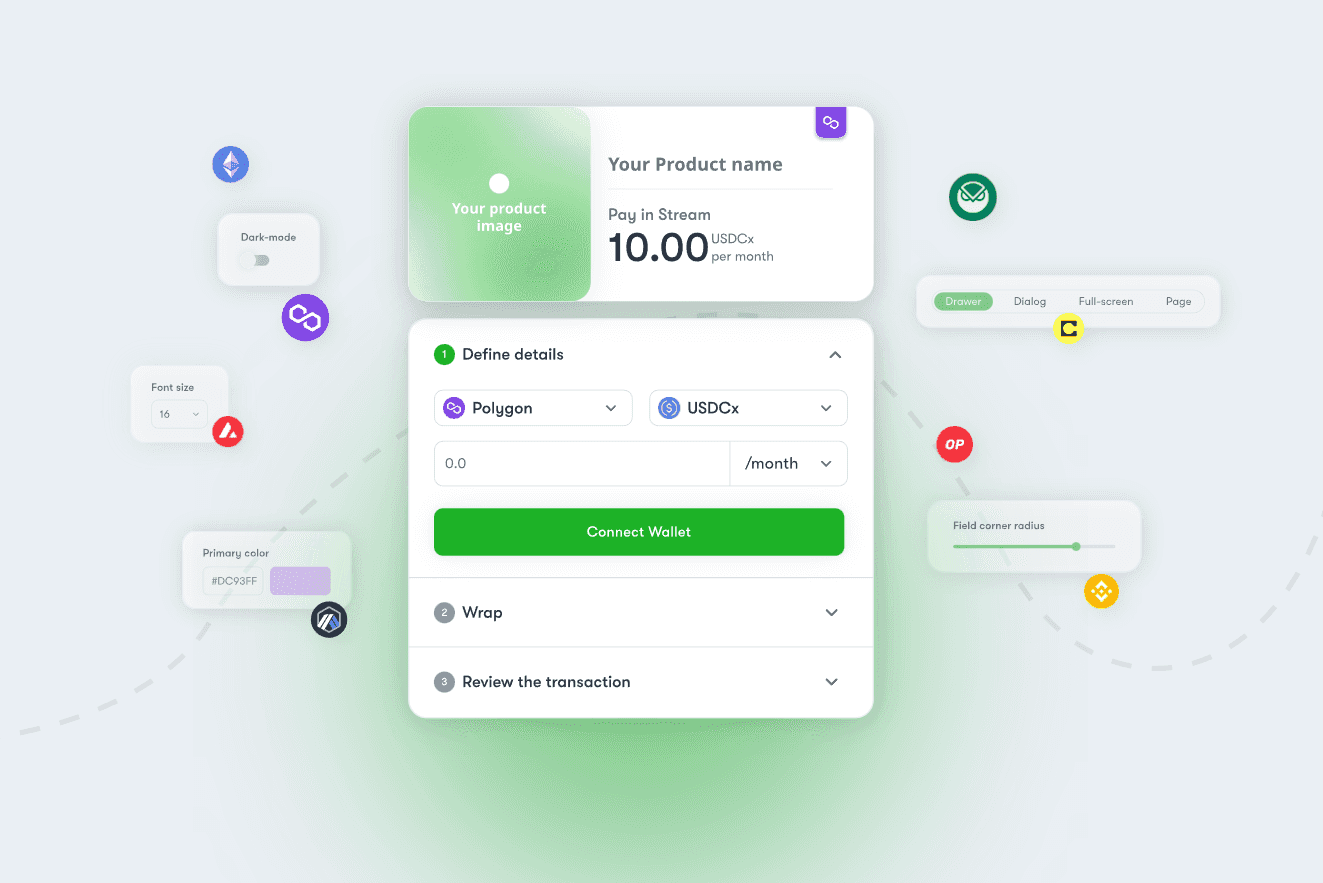

Superfluid

Last but not least on our list is Superfluid. A little bit of a wild card choice as Superfluid is ranked number 54 on the Total Value Locked (TVL) rankings on defillama but I think it's got real potential, let's take a look.

For the successful adoption of crypto assets we're going to need to re-vamp the old traditional financial system of that there is no argument. However, we also need to match the basic functions that we use during our daily lives. That's where Superfluid comes in.

In our traditional financial system, payments are a constant and important part of working life. How many times have you heard someone say: 'I'll wait until my next paycheck' or 'Your phone bill is due this week'. These payments are often automated for our convenience so we as users don't have to worry about our paycheck arriving or making sure we pay off our phone bill on time. In crypto, we always like to match what traditional finance can do or go one better. Superfluid is aiming to go one better with its 3 main products:

Subscriptions

With Subscriptions, users benefit from Superfluid's web3 services which they can use to build their perfect subscription checkout and begin accepting recurring crypto payments. By using Superfluid, users can eliminate merchant fees, reduce third-party dependencies and mitigate de-platforming risk by self-hosting their own branded Superfluid Subscriptions checkout.

Vesting

If you're a crypto project and need to streamline your management of vesting rewards then Superfluid's Vesting product can help. Users can manage their vesting schedules via a simple UI, keep vesting tokens available in their wallet and let recipients stream their vested tokens to DeFi as they receive them.

Payroll

If you're running a crypto-native online business then payroll can be a hassle. Manually sending each employee their salary every month is tedious and allows for human error. In collaboration with Coinshift, Superfluid's Payroll product allows users to settle employees' and contributors' compensation without frictions or fees. User tokens flow in a continuous stream to recipients, until you edit their compensation or choose to stop it.

As more crypto-native businesses, Decentralised Autonomous Organisations (DAOs), and DeFi protocols with large treasuries are created, it's important that payment services such as Superfluid continue to innovate. As crypto natives who are interested in creating a fairer and more decentralized world, these projects deserve our attention and I believe will become standardized for many companies as we integrate cryptocurrency into society. For these reasons, Superfluid has earned a spot on the top 5 projects. Superfluid doesn't have a token yet but who knows, if there's a service provided then there inevitably will be fees generated and if there are fees generated then there's a possibility of fee sharing.

Other Projects on Polygon To Watch Out For

Stargate Finance

Stargate Finance is doing some interesting things in advancing its vision of an omnichain future. Their protocol has a clean UI and nice UX which provides users with easy-to-understand bridging from one chain to another. Stargate is built by the Layer Zero team which are rumoured to be releasing their Layer Zero token in the future, so interacting with their DApps before that might be worthwhile for a potential airdrop.

Beefy Finance

Beefy Finance (BIFI) is a yield aggregator which enables users to yield farm easily with the added benefit of incentives and auto compounding which increases earning potential. With Beefy Finance, users can deposit their Liquidity Pool tokens (LPs) from external DEXes into vaults, single-stake their crypto assets or stake their BIFI tokens to earn yield. Beefy Finance is a top project with an impressive rollout on 21 different blockchains.

Top 5 Polygon Projects: Conclusion

In conclusion, my top pick out of the 5 Polygon projects would be Tangible. It's always been a hope of mine that the real world will eventually become tokenized and essentially everything will exist on chain. I believe that blockchain technology enables users and all humans, in general, to operate more efficiently by increasing the speed of capital flow and decreasing the cost of those operations.

My only hesitation is Tangible uses USDR which is their own stablecoin for transactions. Crypto's history with stablecoins and how they are backed is very poor so naturally, I am cautious of putting too much capital into anything with an untested stablecoin.

Tangible also uses the 3,3 strategy formed by Olympus DAO with OHM which didn't end very well so there are some alarm bells associated with that. As always I would advise caution, never invest what you can't afford to lose and do your own research.

Frequently Asked Questions

According to Defillama the top 3 most successful projects based on Total Value Locked (TVL) are Aave, Quickswap and Uniswap V3.

QuickSwap

Over 30,000 according to some sources.

On Polygon there really isn't much that you can't do. If you want to trade NFTs, dabble in DeFi, stake to earn yield or explore the metaverse you can do it all. There are DApps for nearly every use-case in crypto.

Competing L1 chains are Solana, Binance Smart Chain and Cardano.

Competing L2 chains are Optimism, Abitrum and zkSync Era.

Yes, Polygon has a vibrant NFT ecosystem with more than 843 million NFT's minted on Polygon and a total volume exceeding $16 billion.

Absolutely, with Polygon zkEVM and Polygon 2.0's supernets, along with an impressive list of heavy-hitting partnerships, Polygon has a great future ahead of it.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.