Every crypto enthusiast, trader, and investor worldwide wants to know a definitive time when the crypto famine will end and we will once again feast on an epic cryptocurrency bull run.

Let's not forget we are experiencing a phase of uncharted waters. In 2020, the world got walloped with Covid-19, which, quite frankly, probably changed how we view the way we live and work forever.

The ongoing battle between companies and employees to return to office-based work continues and the fallout from the Ukrainian war along with rising inflation has driven prices worldwide to impossible highs.

Today, a second-hand car costs as much as an almost new vehicle did a few years ago due to parts and chips for cars in production being unavailable to import. We've lost market confidence for sure.

The FTX collapse, rising inflation, the disinterest in NFTs, ongoing regulatory issues for cryptocurrency exchanges and declining confidence in decentralisation have all played their part. And let's not forget; there's a new shiny object in town. Artificial intelligence (AI) has taken centre stage for global attention. Search YouTube and hundreds of videos promise viewers they can make thousands of dollars using AI.

Perhaps AI seems less risky than crypto investing or trading. Or maybe it's the doomsayers warning of the millions of job losses that AI may cause. Whatever the reason, I believe it adds to the crypto community's general malaise. However, numerous crypto AI projects are springing onto the market.

This article explores the crypto bear market and determines if we can look forward to shaking hands with a bull market any time soon.

Understanding Crypto Bear Markets

This section takes a spin around crypto bear markets to help you better understand why they happen, how long they last, and the signs of a market gathering momentum for a bull run.

How Long Do Crypto Bear Markets Last?

The cryptocurrency market is still new compared to financial markets such as stocks, real estate, and Forex. For the latter, we have years, if not decades of historical data highlighting chart patterns, support and resistance zones, economic and political cycles, and more. It's easier to measure Forex and stocks based on this history. The crypto bull or bear market sentiment is what drives the prices. A bull market gives investors confidence while a bear market creates crypto fear.

Although Bitcoin began in 2009, it wasn't until its bull run in 2017 that the media and the masses worldwide sat up and started to take notice. Until then, there were very few altcoins, and analysing chart patterns was as interesting as watching your goldfish swim around its bowl. Therefore, we can only start mapping charts from that point, and whilst five years of data might seem like enough, many feel it isn't.

We cannot definitively affirm how long a crypto bear market lasts because it's all still relatively new and primarily dependent on macroeconomic factors outside our control. 2018 to 2019 was miserable for crypto, and prices continued moving sideways for much of 2020. So, that's about a two-year cycle.

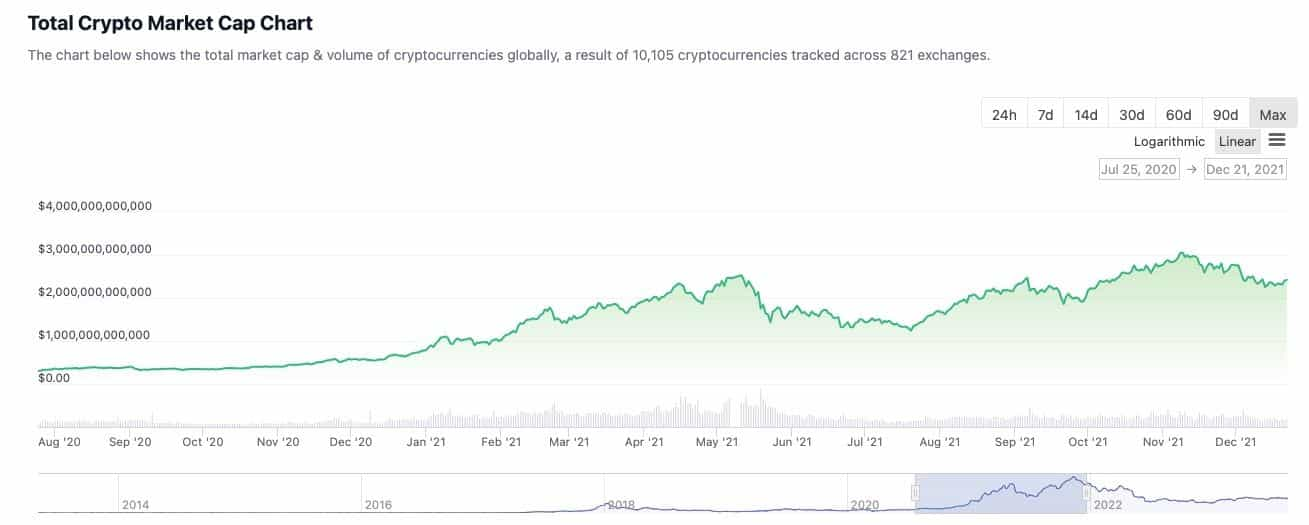

In November 2020, Bitcoin and altcoin prices edged upwards, generally quadrupling the previous highs. Prices continued an upward trend for a year, but it's a bit of a dog leg on the charts, with a big double top. In November 2021, prices dropped like a big dipper and haven't made many gains since then.

Understanding Crypto Bull Runs

We all long for the bull run, but how do we define it? What are the characteristics, and do bull runs last longer than bear markets?

How Long Do Crypto Bull Markets Last?

You won't be surprised to learn that crypto bull runs generally correlate with the Bitcoin halving every four years. Yeah, we all need something to look forward to and rightly or wrongly, every crypto enthusiast gets excited about the event. You may wonder if it becomes a self-fulfilling movement. Sentiment drives prices in every financial market and is why people buy, trade, or sell financial assets, including cryptocurrencies.

While many seasoned crypto investors argue that the Bitcoin halving event is the primary factor that drives a bull run, as we all know what happens when supply halves while demand increases, interestingly, there are many prominent thinkers in the industry who believe this is nothing more than a coincidence.

It is true that Bitcoin price has increased along with major asset classes since 2009. if you take a look at stock market and real estate performance, there is an undeniable correlation. Since 2009, nearly all charts are up and to the right as we were living in a period of monetary expansion, resulting in capital inflow into real estate, stocks, and of course, crypto.

Some analysts feel that crypto prices increased due to the simple reason that there was more money entering the markets during a quantitative easing cycle and the Bitcoin halving years just happened to line up with greater macroeconomic events. I guess time will tell, this next halving could be the first time that a Bitcoin halving event takes place during a period of quantitative tightening. This halving will certainly be one to watch and crypto investors will be on the edge of their seats.

Characteristics of a Crypto Bear Market

A crypto bear market is a prolonged period of declining prices and overall negative sentiment in the cryptocurrency market. During a bear market, the value of most cryptocurrencies decreases, and investors become more cautious and risk-averse.

Here are some characteristics commonly associated with a crypto bear market:

Price Decline: When prices continuously decline, many investors may cut their losses and sell their holdings, which causes further price drops.

Extended Period of Decline: Bear markets typically last for extended periods, often several months to even years, reflected by a lack of sustained upward movement in prices.

Negative Sentiment: There is a pessimistic sentiment amongst investors and traders, and crypto enthusiasts. If the media picks up on crypto pessimism or an adverse event (FTX collapse, for example), it adds to the negative sentiment like fuel to the fire.

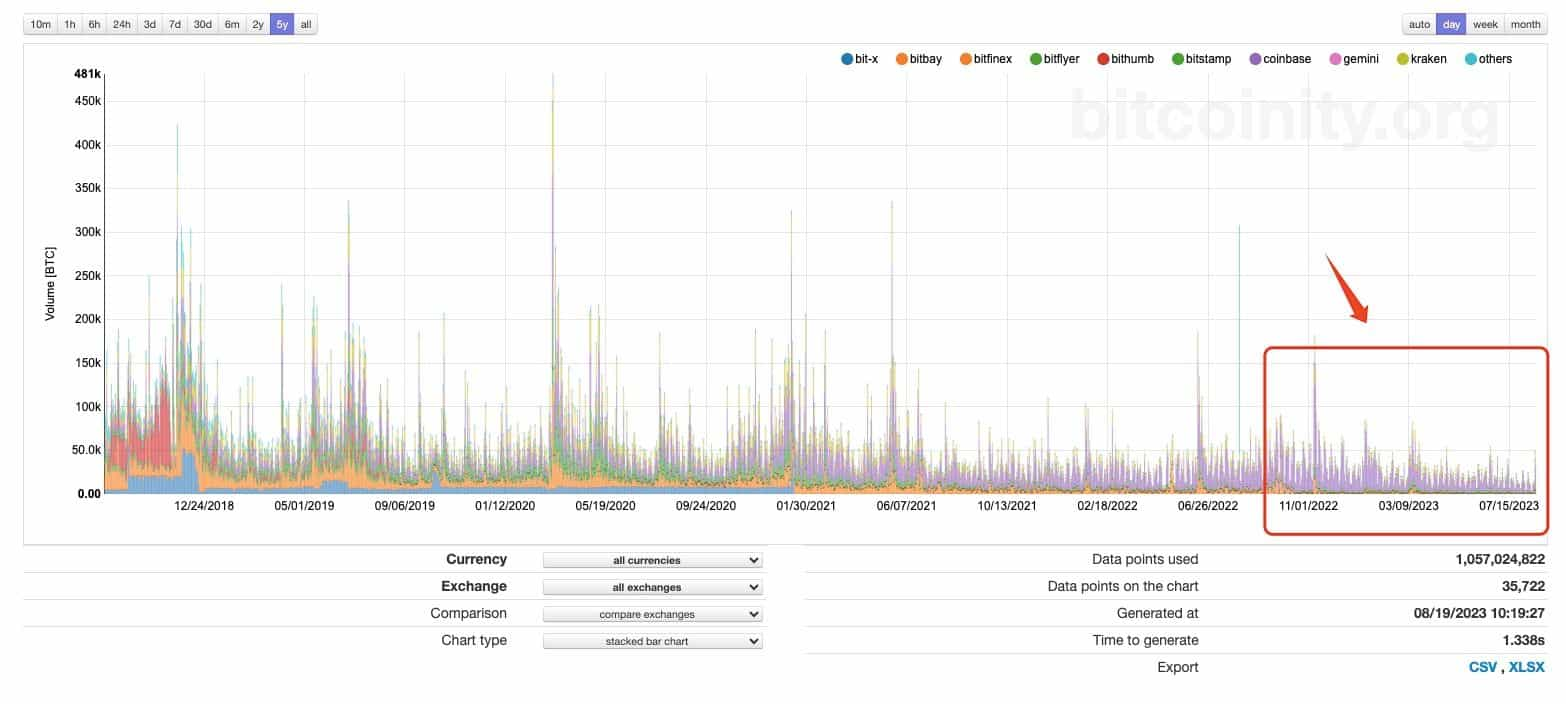

Reduced Trading Volume: As prices decline, trading activity tends to decrease. Investors become less active as uncertainty and fear take hold, leading to lower trading volumes on exchanges. In fact, in recent months Binance announced the lowest trading volumes seen in 2 Years.

Increased Volatility: While declining prices generally characterise bear markets, there can be periods of heightened volatility. Sharp price fluctuations can occur due to panic selling, short-term speculation, low trading volume, and market manipulation.

Lack of New Investors: In a bear market, new investors may hesitate to invest in the crypto market due to the prevailing negative sentiment and uncertainty about the future direction of prices.

Project Failures and Consolidation: Weaker projects and cryptocurrencies may struggle to survive during a bear market. Some projects, already on shaky ground financially, may face further difficulties, leading to project failures or consolidations within the industry.

Regulatory Concerns: Regulatory uncertainty and government intervention can contribute to a bear market. News of potential regulations or bans on cryptocurrencies in certain regions can negatively impact prices. 2023 has been a prime example of this with the SEC taking legal action against dozens of crypto projects and exchanges.

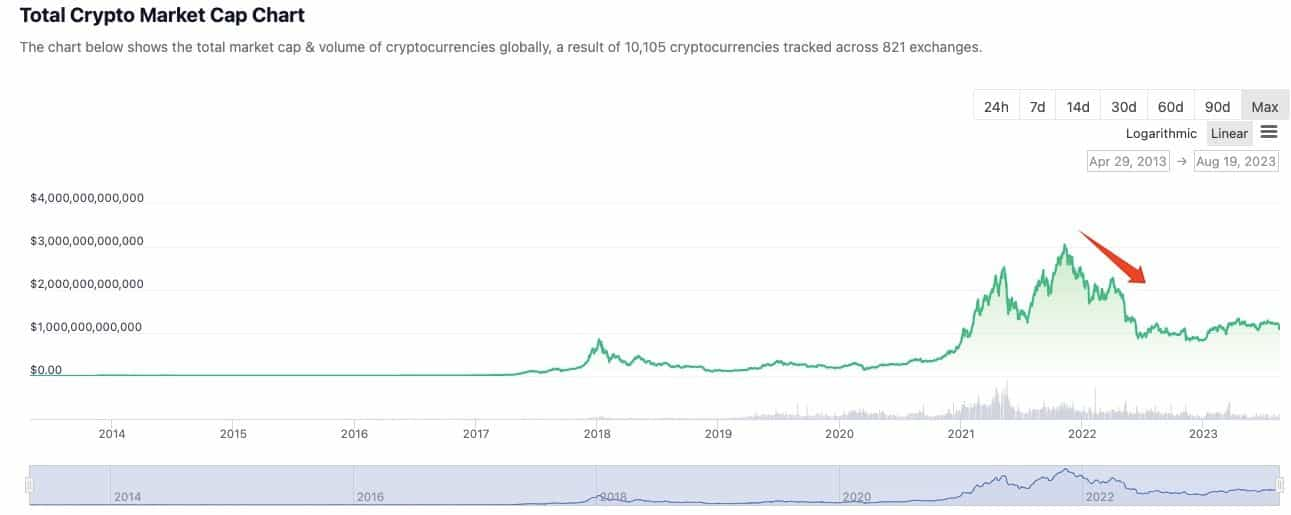

Loss of Value: During a bear market, the total market capitalisation of the entire cryptocurrency market can shrink significantly. Many investors may experience substantial losses in their portfolios.

A Longer Recovery Period: Recovery from a bear market can be slow as it takes time for market sentiment to shift. It often requires a combination of positive news, technological advancements, and renewed investor interest/confidence to reverse the downward trend.

Remember that cryptocurrencies are a highly volatile and unpredictable asset. Whether in a bull or bear market, crypto market volatility can be dramatic.

Market cycles can vary in duration and intensity, and not all downturns necessarily lead to extended bear markets. Price action never moves in a straight line. prices "breathe" and consolidate before gaining momentum again.

What Causes a Crypto Bear Market?

A crypto bear market typically arises from a combination of factors that lead to a prolonged period of declining prices and negative sentiment. While the specific triggers vary from one bear market to another, some common factors include:

- Overvaluation and Speculative Bubble Burst: A common trigger for bear markets is when the prices of cryptocurrencies become overinflated due to excessive speculation and investor FOMO—eventually, the bubble bursts, leading to a market correction and subsequent bearish trend.

- Regulatory Concerns and Government Actions: Announcements of stricter regulations, bans, or crackdowns on cryptocurrency-related activities often cause a loss of investor confidence.

- Market Manipulation and Scams: Manipulative practices such as market manipulation, pump-and-dump schemes, and fraudulent projects cause a loss of trust and confidence.

- Security Breaches and Hacks: High-profile security breaches and hacks of cryptocurrency exchanges and platforms can result in substantial losses and may trigger a sell-off.

- Macroeconomic Factors: Broader economic factors, such as global economic downturns, financial crises, and geopolitical tensions, can impact investor sentiment across all asset classes, including cryptocurrencies. Economic uncertainty can lead to risk aversion and a decrease in cryptocurrency investments.

- Lack of Adoption or Use Cases: If cryptocurrencies fail to gain widespread adoption or cannot prove real-world use cases, investor enthusiasm can wane, leading to a price decline.

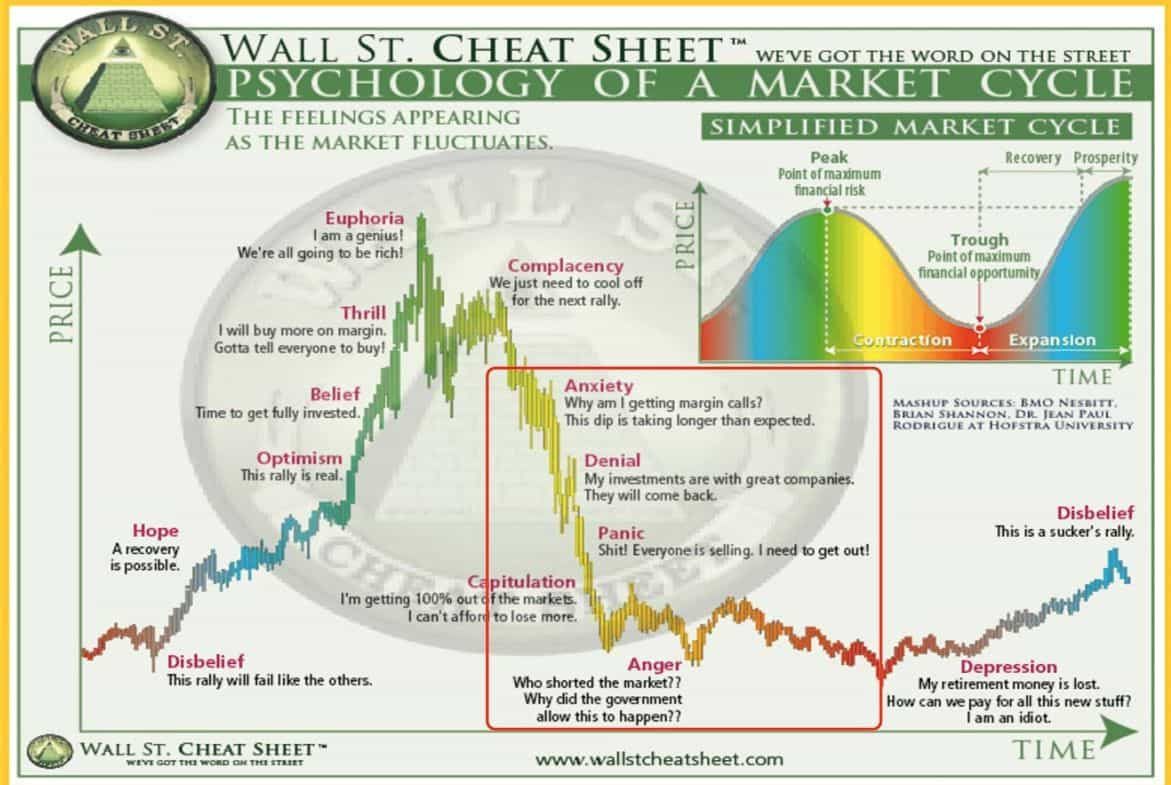

- Market Psychology and Fear: Investor psychology plays a significant role in market movements. Fear and panic spread as prices decline, leading to widespread selling and further price drops.

- Market Cycle Dynamics: The cryptocurrency market is known for its cyclical nature, with periods of bull markets followed by bear markets.

- Media Influence: Media coverage can impact investor sentiment. Negative news stories or sensationalised reporting can impact investor confidence.

These factors often correlate, leading to a complex web of contributory influences that compound the onset and duration of crypto bear markets.

So, we've closely examined the crypto bear markets, and now it's time to explore bull markets.

Characteristics of a Crypto Bull Market

A crypto bull market is a period of sustained optimism, rising prices, and positive sentiment in the cryptocurrency market. During a bull market, the value of most cryptocurrencies significantly increases, and investors become more confident about risk-taking.

Here are some characteristics commonly associated with a crypto bull market:

Price Rally: A sustained increase in cryptocurrency prices builds market confidence.

Positive Sentiment: There's an upswing in confidence and positivity towards the crypto market, compelling investors, traders and crypto enthusiasts to "join in.”

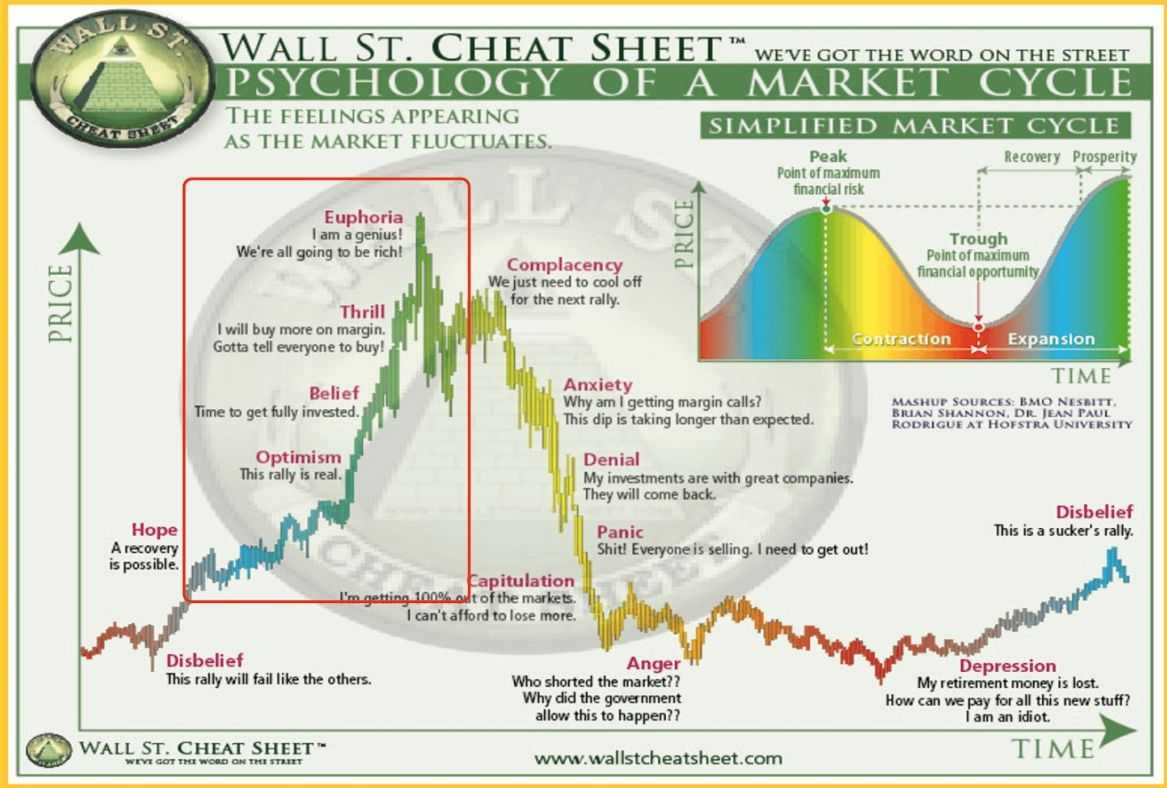

Here’s another look at the trading psychology chart, showcasing the positive sentiment leading to FOMO and Euphoria.

High Trading Volume: As prices rise and trading confidence increases, crypto exchanges report increased trading volume.

New Investors and Speculators: Bull markets attract new investors seeking to exploit the upward trend.

FOMO (Fear of Missing Out): When crypto prices rise, FOMO kicks in. That can lead to increased buying activity and upward pressure on prices. For example, in 2017, complete crypto novices rushed to buy BTC, with some mortgaging their houses to buy Bitcoin!

Media Attention: Mainstream media coverage of cryptocurrencies is more positive during bull markets, as rising prices and market enthusiasm make for compelling stories.

Innovation and Development: For example, during the 2021 crypto bull run, many new crypto projects sprung up on the market.

Strong Fundamentals: During bull markets, positive news and developments related to technology, adoption, and partnerships often lead to a more buoyant market.

Market Capitalisation Growth: The total market capitalisation of the cryptocurrency market tends to increase during bull markets as crypto prices rise.

Shorter Corrections: While corrections (temporary price declines) can still occur in a bull market, they are often short-term and less severe than those in bear markets.

Rising Interest from Institutional Investors: Bull markets can attract the attention of institutional investors, including hedge funds, asset managers, and investment firms.

Broader Adoption: Positive market conditions can encourage more widespread adoption of cryptocurrencies and blockchain technology as businesses and individuals become more open to using and integrating these technologies.

It's important to remember that cryptocurrency investing is no less risky, whether we are in a bull or bear market. It takes experience to know when to buy, sell or trade your crypto holdings.

What Causes a Crypto Bull Market?

A cryptocurrency bull market is a sustained period of rising prices and positive sentiment in the cryptocurrency market. Several factors can cause prices to trend upward for sustained periods:

- Positive Technological Developments: Advancements in blockchain technology, protocol upgrades, scalability, security, and functionality improvements can generate enthusiasm among investors and developers, driving positive sentiment and price increases.

- Increased Adoption and Use Cases: Real-world adoption of cryptocurrencies can demonstrate the practical utility of blockchain technology and attract more users and investors.

- Institutional Interest: The involvement of institutional investors, such as hedge funds, asset managers, and investment firms, can bring credibility and substantial capital to the market and drive market prices.

- Market Sentiment and Psychology: Positive news stories, media coverage, increasing prices, and investor confidence attract more buyers, leading to further price appreciation. This positive feedback loop contributes to a bullish trend.

- Positive Regulatory Developments: Clarity in regulations and supportive regulatory environments in key markets can boost investor confidence and encourage institutional participation.

- Global Economic Conditions: During economic uncertainty or financial instability, investors may hedge their investments against traditional financial markets with alternative assets like cryptocurrencies.

- Supply and Demand: Limited crypto supply and increasing demand can lead to price appreciation. Cryptocurrencies with deflationary mechanisms, like Bitcoin's fixed supply, can experience increased value as demand rises.

- Halving Events: Bitcoin halving events occur every four years, reducing the rate of new coin issuance. These events historically coincide with periods of increased demand and price appreciation.

- Technical Analysis: Traders and analysts often use technical analysis to identify potential trends and entry points for buying.

- Bullish Macro Trends: Broader macroeconomic trends, such as low-interest rates, quantitative easing, and a growing distrust in traditional financial systems, drive the demand for alternative assets like cryptocurrencies.

- Project Development: When crypto projects upgrade their ecosystem, take on new partners, launch a new product etc., it can attract more users, developers, and investors, creating a positive feedback loop that drives price growth.

Understanding these contributory factors can help you make better decisions when assessing the complexities of the crypto market.

What Was The Longest Bull Market In History?

It's tricky to assess benchmarks for crypto bull market cycles as it's still in its infancy. Bitcoin and altcoin prices rose rapidly from April to November 2021 before nosediving off a cliff.

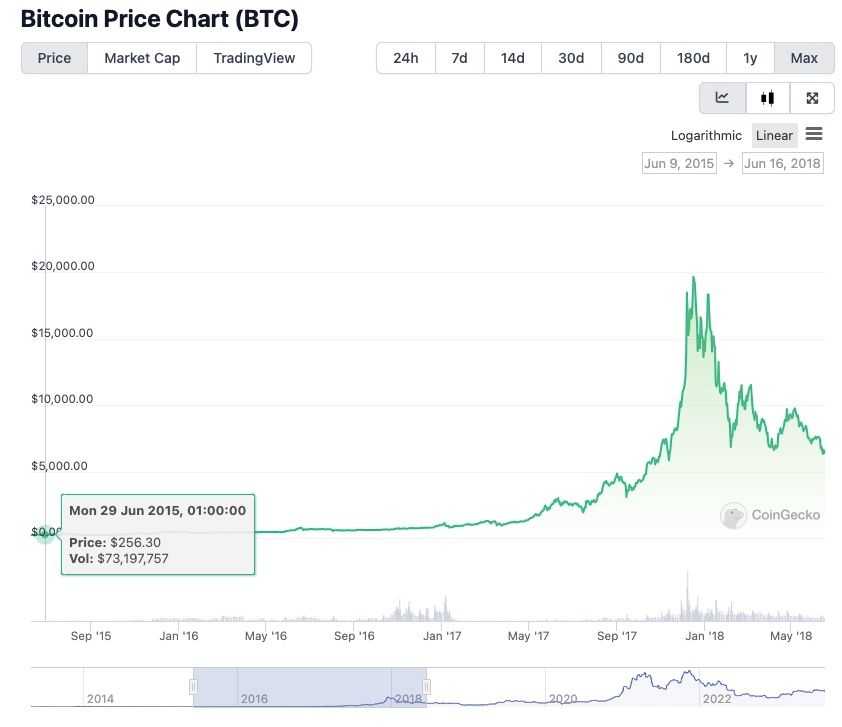

Some analysts consider the longest Bitcoin bull market occurred between 2015 and 2018. During that time, Bitcoin's price rose from a low of around $250 to a high of just under $20,000.

It is important to note that there are differentiating opinions of what constitutes a bull or bear market.

The stock market is easier to assess because it became digital in 1971.

"The current bull market that started in March 2009 is the longest bull market in history. It topped the bull market of the 1990s that lasted 113 months. However, the current bull market, which has seen the S&P 500 rise 330% in its 10+ years, is still second to the 90s bull run, which returned 417%." Source: Investopedia

What Is The Longest Bear Market In History?

It depends on how you measure a bear market. One way is to assess the negative year-on-year returns. Bitcoin had 410 days of price decline from 2013 to 2015 from around $1,000 down to $200.

In more recent history, if we measure from Bitcoin failing to form a new all-time high on the March 2022 price rally, then we have been in a bear market for 506 days (and counting), marking the longest crypto bear market in history.

While this has marked one of the most difficult times in Bitcoin's history, it is not the worst drop it's had.

- Between February 21st, 2018 and March 18, 2019, Bitcoin's price dropped from $10, 250 to below $3,200, marking a 70% drop.

- In 2011, Bitcoin's price fell from $31.50 to $2.01, over 93%… Ouch, that would have been a great opportunity to buy the dip.

When Could This Bear Market End?

There are potentially multiple factors that could contribute to the end of the crypto bear market, and, in truth, the synergy between these factors could mark the defining improvements.

The End of The European Conflict

The Russian invasion of Ukraine caused a major blow to the world economy and disrupted supply chains, with the long-term effects continuing to cause worldwide problems. Energy, fuel, and food prices have seen substantial increases.

Though, we will also point out that while Western governments are happy to be able to place the blame for inflation on Russia’s belligerence, let’s not hide from the fact that much of the inflation is the result of what many feel was an irresponsible fiscal response to the pandemic and lockdown restrictions imposed by our leaders.

People are losing confidence in their ability to meet their financial needs. The effect on the crypto market has been challenging, with many smaller or newer projects falling by the wayside.

Ending the war could instil confidence and hope that people can meet their basic needs and have money left over to invest or trade.

Reduced Interest And Inflation Rates

Mortgage payments have increased by as much as 50% in some cases. Reducing interest rates would result in people having better cash flow for investing in crypto and other assets. Inflation is at an all-time high in many nations and there is a lot of uncertainty about the future. When people are uncertain about the future, they typically tend to tighten their belts and become more risk-averse.

Fewer Incidences of Regulatory Lawsuits And Bans

Since 2021, regulatory authorities like the SEC (Securities and Exchange Commission) have been trying to impose regulatory measures on cryptocurrency exchanges. The constant crypto media news about bans and lawsuits caused significant uncertainty in the crypto community.

- The SEC issued a lawsuit against Ripple in 2020, accusing the company of selling its token (XRP) in an "unregistered security offering." In July 2023, the court ruled that the XRP token is not a security if sold on an exchange to individuals. However, it is classed as a security if sold to institutional investors. What a shambles.

- In June 2023, the SEC charged Coinbase for "operating as an unregistered securities exchange, broker, and clearing agency". (Source SEC)

- In June 2023, the SEC filed charges against Changpeng Zhao, the Binance founder (and against Binance entities). The list included operating clearing agencies, unregistered exchanges, misrepresenting trading controls, and more. (Source SEC)

And this is just a few of the examples of the SEC playing judge, jury, and executioner. It’s entirely these kinds of legal debacles that cause so much uncertainty in the market. When they "attack" leading exchanges that have served millions of clients worldwide for many years, it feels personal to the crypto community.

Quantitative Easing

The idea of quantitive easing is to help spur growth in the economy, subsequently resulting in making investing and spending money easier by stimulating the financial markets. It can boost asset prices, help encourage borrowing, get people spending and lift the economy, contributing to GDP growth.

Quantitive easing isn't ideal. It does come with some risks and disadvantages. Creating money out of nothing can contribute to inflation and stagflation down the road. The latter leads to increased living costs but might fail to yield economic growth. In addition, QE can impact a nation's currency value, ultimately leading to depreciation.

I don't believe there is "one thing" that can help the crypto market bounce back. Until the level of uncertainty reduces, price action may remain static. The crypto community is eager to return to the heady days of prices ramping up daily, but it will take a combination of positive events before that can happen. However, bear in mind that is my opinion. I could be completely wrong.

When Will the Next Crypto Bull Run Begin?

We're nearing quarter four in 2023, and the crypto market is static. Despite a few price bumps, trending upward seems unsustainable. There's not enough confidence in the market or capital inflows. With the economic uncertainty, people are less inclined to spend on anything other than essentials. I don't intend to be doom and gloom, but let's be realistic.

There are some incredible blockchain projects in the market, and they may be worthy of investment. Still, we need to see inflation and interest rates decrease. We want to hear about fewer regulatory lawsuits and crypto bans in some countries.

One thing that caused some ripples of excitement in the crypto space was the proposed BlackRock Bitcoin ETF. It's a financial product that would allow investors without Bitcoin holdings to have exposure to BTC price movements. It's like buying shares in Bitcoin instead of holding the "product as an asset."

The ETF tracks the value of Bitcoin's performance as an underlying asset. The benefit is that you don't need a digital wallet or an account with a cryptocurrency exchange. It's a well-known and regulated investment structure ideal for financial diversification. Like buying shares in publicly owned stock, you can buy and sell shares daily with the Bitcoin ETF.

Here is a look at how the price of gold reacted when the first gold ETF was approved in 2004.

Many Bitcoin holders are hoping BTC price will see similar price action once a Bitcoin ETF is approved and the floodgates of institutional money come flowing in.

A Bitcoin ETF may not be a utopian solution, and it's not without risk. However, it has refreshing potential for helping guide us out of the bear market and increasing confidence in the community.

The Crypto Bear Market: Closing Thoughts

Bitcoin has changed the world as we know it, and many believe it is the way forward. Altcoins (any coin that is not Bitcoin) tends to behave in a similar manner to Bitcoin, it is often stated that Bitcoin drives the broader crypto market, and history supports that claim.

We now appreciate that Bitcoin tends to move in four-year cycles, some say due to economic cycles, some say it’s due to the four-year halving, which is next due in May 2024. Now, the potential of the Blackrock ETF could signify a positive change in the crypto market.

For some additional insight from one of the leading minds in crypto, I will share a Coin Bureau Clips video to wrap up this article and provide an expert view on Bitcoin and the bear market.

The Coin Bureau was fortunate enough to have Simon Dixon speak at the 2023 Coin Bureau Live Conference in London. This video highlights his insight into Bitcoin's cycles and how BTC has never before been in the middle of a quantitive tightening cycle. It is a very intriguing and interesting take that has changed the minds of many Bitcoin investors.

Scroll to 3hr 24mins to watch Simon's presentation.

Simon is the CEO & Co-Founder of BnkToTheFuture.com, an online investment platform.

Benjamin Cowen, Quantitative Analyst and Founder of the popular YouTube channel and newsletter called Into the Cryptoverse also has an interesting take on the subject.

Listen to Ben's discussion on Bitcoin (at the one-hour mark). He believes that things need to get considerably worse for altcoins. His opinion is that Bitcoin's dominance needs to be significantly higher before we can hope to see the beginning of another bull market.

Here at Coin Bureau HQ, like the rest of you, we hope the cryptocurrency bear market will end soon and we watch with interest for the subsequent developments.

Frequently Asked Questions

If crypto price history is anything to go by, judging by the duration of previous bear markets we may be between 50% and 75%, but nothing is certain in financial markets. Many analysts are looking at Q1-Q2 of 2024 for the markets to turn around, while other analysts such as Darius Dale at 42Macro feels we could be heading a recession in Q4 of 2023 or Q1 of 2024, which would likely stifle any chance at a bull market.

Bitcoin had a rally in 2021 from April to November, when Bitcoin peaked at over $68k. However, crypto prices declined steeply from that point and continued the downward spiral for 2022.

As the global economy struggled with the Covid-19 pandemic, inflation, rising costs and the fallout from the Ukrainian war, 2023 hasn't improved. Bitcoin prices increased slightly but did not break the $30k support zone. The crypto bear market has exceeded approximately eighteen months, with only a small rally in 2022.

Generally, we are still in a bear market (August 2023). Bitcoin (BTC) and Ethereum (ETH) reflect the entire crypto market as the leading blockchains by market cap, and both have been on a steady decline since November 2021.

Experts predict that 2023 is unlikely to experience a rally, and it could be 2024 before we see significant price gains again.

Most professional traders adopt the "buy low and sell high" trading principles. However, determining the top and the bottom of the market is a lifelong issue for most novice traders. It's about being sensible. For example, buying Bitcoin (BTC) at the high of $68k would have been a colossal mistake. However, is BTC a "bargain buy at $30K?" Perhaps, but time will tell if price will go lower or is destined for upwards price action from here.

Some experts suggest that the crypto market follows stock market patterns. However, it's an undisputable truth that a bear market happens before, during or after an economic recession.

Bear markets often correlate with factors such as: -

- Unemployment Rates

- Interest Rates

- Inflation

That's a tricky question to answer. Bitcoin is still 50% below the November 2021 high of $68k. The global economy is struggling, and regulatory issues remain problematic for many cryptocurrency exchanges, especially in the United States.

After the FTX collapse in 2022, some countries opposed crypto trading and began doubling down on anti-crypto campaigns (China, for example).

Crypto analysts give us one tiny fragment of hope, anchoring on the Bitcoin halving in May 2024, primarily because it might trigger demand for BTC. Bitcoin halving occurs every four years, reducing mining rewards by 50%.

Although there's no direct link to a correlation between halving and a bull run, we measure it from the short-term history of crypto price action patterns.

A crypto winter is generally a situation where exchanges and investors experience a continuous decline in crypto prices across the entire market.

A crypto winter is three months minimum and can last for over 18 months.

Primarily the 4-year crypto cycle correlates with Bitcoin's halving every four years. The four phases are: -

- Accumulation

- Markup

- Distribution

- Markdown

Interestingly, stock market analysts also discuss a 4-year cycle. It's called the Presidential cycle because when a new president is elected, prices tend to rise during the first two years (when people feel confident about a new leader). Then, prices decline for the next two years.

In short, nobody knows for sure why we have four-year cycles in the financial markets. The financial industry tends to follow tried and tested historical patterns which are a reflection of human behaviour, psychology and sentiment is the most widely believed reason.

The primary reason for Bitcoin's halving is to counteract inflation. Supply and demand are the driving forces behind market activity. So, by reducing supply, demand for Bitcoin "should" increase, and prices will reflect that, even if demand stays the same.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.