You're sitting at your desk with your head in your hands. Darn it! Yet again, another loss. The crypto market once again caught you out, and you're wondering why trading cryptocurrency is so hard.

You love crypto and desperately want to master crypto trading. Still, you're considering you might be more successful in white water rafting or canoeing down a crocodile-infested Amazonian river instead of trying to profit from cryptocurrency trading.

Don't worry, I got you! I've been in your shoes (many times) and know how demoralising it is when you just cannot seem to get the right side of crypto trading profits.

There's an art to crypto trading. Success in this challenging market involves developing layers of knowledge, skills, techniques, and mental discipline. Plus, you're a unique individual, what works for one trader might not suit your trading personality. Anyhow, more on that later. For now, rest assured, by the time you've read this article top to bottom, you will understand precisely what to do to increase your chances of navigating the crypto market like a boss.

Let's go.

Why Trade Crypto?

Good question. Cryptocurrency trading is probably one of the most challenging financial markets for new traders. However, if you can master the trials and tribulations, crypto trading can be rewarding. In addition, you build a transferable skill to trade other markets such as Forex, commodities, or stock trading.

As well as having a passion for trading digital currencies, the following are practical reasons for trading cryptocurrencies: -

- Potential Profits: Although the crypto market is volatile, traders can benefit from price fluctuations by buying low and selling high.

- Diversification: Perhaps you already trade Forex or stocks and want to diversify your trading experience.

- Global Access: People worldwide can access cryptocurrency trading, which is available 24/7.

Cryptocurrency Trading vs Stock Trading

There's a significant learning curve for stock trading and cryptocurrency trading. Still, the main benefit of trading crypto is the low barrier to entry.

The following list highlights the main differences between cryptocurrency trading and stock trading: -

Regulation

Security commissions like the U.S. Securities and Exchange Commission (SEC) and the U.K. Financial Conduct Authority (FCA) highly regulate the stock market. These organisations ensure fair trading practices and investor protection.

Cryptocurrency trading is subject to less regulation, although this can vary depending on the jurisdiction.

Market Hours

Stock markets generally have specific trading hours, typically aligned with the local business hours of the country where the exchange is based.

Cryptocurrency markets are open 24/7, allowing trading anytime, including weekends and holidays.

Asset Class

Stocks represent ownership in a company, providing shareholders with specific entitlements, such as voting rights and dividends.

On the other hand, cryptocurrencies are digital assets typically with no direct ownership rights in a traditional sense.

Volatility

Cryptocurrencies are known for their high volatility, with prices often experiencing significant fluctuations within short periods. This volatility can present opportunities for traders seeking short-term profits but also increases the risk of losses.

While subject to price changes, stocks generally exhibit comparatively lower volatility, especially in established companies with stable earnings.

Information Availability

The availability of information differs between cryptocurrency trading and stock trading. Stock markets provide comprehensive financial disclosures, company reports, and analyst coverage, allowing investors to make informed decisions.

Cryptocurrencies, however, often have limited publicly available information. Traders often rely on market sentiment, tokenomics, project developments, technical analysis and crypto community discussions to assess their value.

Now you know the differences between cryptocurrency and stock trading, so let's learn about the crypto trading process.

How To Trade Cryptocurrency For Beginners

Understanding crypto charts is essential for cryptocurrency trading. Indeed, attempting to trade crypto without chart knowledge is like walking a tightrope wearing a blindfold. If you genuinely want to succeed as a cryptocurrency trader, it's essential to learn the following: -

Technical Analysis

By studying price patterns, trends, and indicators on the charts, traders can identify potential entry and exit points, gauge market sentiment, and make informed trading decisions.

Technical analysis helps traders assess historical price behaviour and predict future price movements, although it does not guarantee accuracy.

Mastering technical analysis is crucial for traders, I suggest exploring the Coin Bureau Trading Channel for valuable educational material on this topic. There, you'll find an abundance of expertly curated content by our skilled trading champion, Dan, who is a fully funded professional trader.

Market Timing

Studying the crypto charts can assist you in timing your trades effectively. You can identify historical support and resistance levels by analysing charts, indicating potential market turning points.

Understanding chart patterns, such as double tops or bottoms, and appropriately timing market entries and exits can help you optimise your trading strategies and better manage risk.

Identifying Trends

The crypto charts reveal trends in price movements, such as upward (bullish) trends, downward (bearish) trends, or ranging (consolidation) trends. Identifying and understanding these trends is crucial to align your trading strategies with the prevailing market conditions.

The Savvy crypto traders learn how to adjust their trading strategies quickly with volatile market conditions.

Risk Management

Studying the charts can assist in risk management by providing insights into price volatility and potential price targets. You can set stop-loss orders and profit targets based on chart analysis to define your risk-reward ratios (how much you can lose compared to how much you can win) and manage your exposure to potential losses.

Experienced traders will often suggest a minimum of 1:3 RTR (risk-to-reward ratio) because it helps to keep your account healthy. Avoid trading 1:1 RTR, as you will lose profitability in the long term.

Market Sentiment

Crypto traders often ignore sentiment analysis, which is a mistake because it drives the market. We have a herd mentality, meaning we tend to follow collective behaviour.

For instance, when novice traders see a large green candle formation, they start buying instead of waiting or learning how to do contrarian trading (doing the opposite to the market). Professional or institutional traders wait patiently for confirmation of market sentiment.

Understanding market sentiment gives you insights into whether the market is bullish or bearish (depending on which timeframe you trade), which can influence trading decisions. You can learn more about these concepts and more in our in-depth article on Trading Psychology.

Explanation Of The Terms Used In Crypto Trading

If you are new to cryptocurrency trading, perhaps you're confused about the jargon. Don't worry. The table below shows a glossary of daily terms used in crypto.

| Altcoin | (alternative coin) Any cryptocurrency other than Bitcoin |

| Ask | The lowest price you are willing to accept for a cryptocurrency |

| Bearish | The market is trending downwards |

| Bid | The highest price you will accept to pay for a cryptocurrency |

| Blockchain | Decentralised, distributed and immutable ledger technology that records all cryptocurrency transactions transparently |

| Bullish | The market is trending upwards |

| Exchange | A platform where users can buy, sell, and trade cryptocurrencies |

| Fiat Currency | Traditional government-issued currencies, such as the U.S. Dollar (USD), Euro (EUR) or British Pound (GBP) |

| CEX | A centralised exchange |

| DEX | A decentralised exchange |

| HODL | A term that arose from a spelling mistake of "hold," indicating a long-term strategy to hold your crypto regardless of short-term price fluctuations |

| ICO (Initial Coin Offering) | A fundraising method in which a new cryptocurrency project sells its tokens or coins to early investors in exchange for funding |

| Limit Order | A type of order where a trader sets a specific price at which they want to buy or sell a cryptocurrency |

| Liquidity | How quickly the market fills your order. Low liquidity can cause delays, meaning your order may fill at a different price |

| Market Order | A type of order where a trader buys or sells a cryptocurrency at the current (live) market price |

| Pump and Dump | A manipulative scheme where an individual or entity overinflates crypto prices to sell later to make quick profits |

| Spread | The difference between your highest bid and lowest ask price in the market |

| Volume | The total trading activity for a specific cryptocurrency within a given period, such as daily |

| Wallet | A digital or physical device used to store, send, and receive cryptocurrencies. Wallets have public and private keys for secure transactions |

| Whale | Someone (individual or entity) that holds a significant amount of cryptocurrency and has the potential to influence market prices |

Now you know more about prepping for crypto trading success, the next essential step is to find a reputable cryptocurrency exchange.

Cryptocurrency Brokers & Exchanges

This section is to help you choose the best cryptocurrency broker or exchange. There are several factors to consider:-

- Established and Reputable: Choose an exchange with proven service in the market.

- Beginner-friendly: Some exchanges have beginner-friendly interfaces.

- Security: Does the exchange have good security measures to protect your digital assets?

- Fees: Are Trading fees transparent and competitive?

- The Number Of Features: As a novice trader, you don't need the bells and whistles, but choose an exchange with a good range of features.

- Tradable Products: In the unpredictable crypto market, you may want a variety of tradable products so you can analyse the best opportunities.

Different Types Of Crypto Exchanges

There are two types of crypto exchange: -

- CEX: A centralised exchange

- DEX: A decentralised exchange

CEX is an abbreviation for "Centralised Exchange", meaning that the exchange facilitates trading activities as a central intermediary. In a CEX, the exchange platform acts as the trusted third party that matches buy and sell orders from users and holds custody of their funds.

Here are some key characteristics of centralised exchanges:

- Intermediary: CEXs serve as intermediaries between buyers and sellers, matching orders and executing trades on behalf of their users.

- Order Book: CEXs typically have an order book that displays all buy and sell orders from users, allowing traders to choose the price they want to buy or sell a cryptocurrency.

- Liquidity: Centralised exchanges, such as Binance, the worlds leading crypto exchange, offer higher liquidity than decentralised exchanges, as they attract a lot of users and provide a consolidated marketplace for trading.

- Custody: CEXs have custody of your funds. When depositing cryptocurrencies onto a centralised exchange, you trust it to securely store and manage your digital assets.

- KYC/AML Compliance: CEXs usually have KYC (know your customer) and AML (anti-money-laundering) as standard procedures to verify user identity and comply with regulatory requirements.

- Trading Fees: CEXs charge trading fees for executing trades. Trading fees are variable depending on which CEX you choose but are typically based on order types or trading volume.

- Regulatory Oversight: A centralised exchange must comply with a country's regulations and rules.

Decentralised exchanges (DEX) offer the same services but have non-custodial peer-to-peer marketplaces without an intermediatory for facilitating transactions and custody of funds. Instead, trading is executed through what are known as smart contracts.

It's worth noting that while centralised exchanges offer convenience, liquidity, and a wide range of trading pairs, there are certain risks. Since CEXs act as custodians of users' funds, there is a potential for security breaches, hacking incidents, or mismanagement of funds.

To learn more about the top reputable exchanges, check out our analysis of the Top Crypto Exchanges in the industry.

Understanding the Basics of Crypto Charts

This section will help you understand how crypto charts work.

Introduction To Crypto Charts

Everyone has their favourite charts that suit their crypto trading strategy. Some crypto exchanges have a specific trading platform with helpful tools. Alternatively, you may prefer doing your analysis with MetaTrader 4 or 5, which you can download to desktop or mobile.

Although this chart software has an excellent range of trading tools, I didn't get along with it. Charting on the mobile is tricky and caused me to have more losses.

My Favourite charting platform for trading cryptocurrencies is TradingView. You get quite a lot with the free version, but there are also paid plans for traders with more demanding needs. The charts on TradingView are clean and easy to use, allowing traders to set alerts, hide indicators when necessary, save their favourite pairs to watch, and much more.

Types Of Crypto Charts

After choosing your preferred software, your next decision is what chart style to use for analysis. The following shows the most popular charts for trading cryptocurrencies: -

- Japanese Candles: On each timeframe, you have red (price going down) and green candles (price going up). There are multiple candle patterns used for analysis.

- Line Charts: A line chart is one continuous line tracking price movement.

- Bar Charts: Not dissimilar to candles, except bar charts are simply red and green bars indicating price movement.

- Heikin Ashi: "Heikin-Ashi is a Japanese trading indicator and financial chart that means "average pace". Heikin-Ashi charts resemble candlestick charts but have a smoother appearance as they track a range of price movements, rather than tracking every price movement as with candlesticks." (Source: Wikipedia)

- Renko: A Renko chart is "bricks" that show price movement. The difference from other charts is that if a price stays in a range, the brick doesn't move and is not time associated.

Choosing The Best Chart For Analysis

I suggest practising with the different charts in a demo account. Most novice crypto traders prefer Japanese candles. However, Heikin Ashi, though similar, can be easier to read. Other than Renko, they are all time-based, and I advise giving them a try as some traders prefer different charting styles.

Renko is a learning curve. When you look at a Renko chart in hindsight, it appears to be one of the easiest charting methods, but it takes a particular personality to wait for a brick to form and is the only charting style based purely on price movements, not taking time into consideration.

I found bar and line charts too challenging to assess support and resistance or identify chart patterns, most traders stick to traditional candlestick charts as the wicks or “shadows” of the candles provide traders with valuable insights.

Market Structure And Cycles

The cryptocurrency market has a unique market structure and price movement cycles. Here's an overview of these aspects:

Market Structure

Cryptocurrency trading is a global market operating 24/7, even during holidays and weekends. Most trading is on centralised cryptocurrency exchanges that act as intermediaries facilitating buying and selling of cryptocurrencies.

Market Cycles

The cryptocurrency market is known for its volatility. Like most financial markets, price action will trend upwards (bullish) or downwards (bearish). These cycles are not always easy to understand but mainly driven by market sentiment. For instance, when Bitcoin (BTC) prices rose to almost $20k in December 2017, market sentiment was bullish, and everyone was buying BTC.

As prices dropped in early 2018, investors and traders lost confidence in Bitcoin and started selling. As the price decreased further, it increased selling, eventually leading to a bear market. Within a year, Bitcoin was $3,900.

So many things can affect crypto market prices. A casual remark by an influencer, institutional adoption, new partnerships, a blockchain upgrade or negative news can all cause price action changes.

Another factor to consider is that a crypto's price does not move in straight lines. The market always has price corrections, a kind of breathing period. If the price trends upwards or downwards, at some point, it will have a price correction by returning to the last price move.

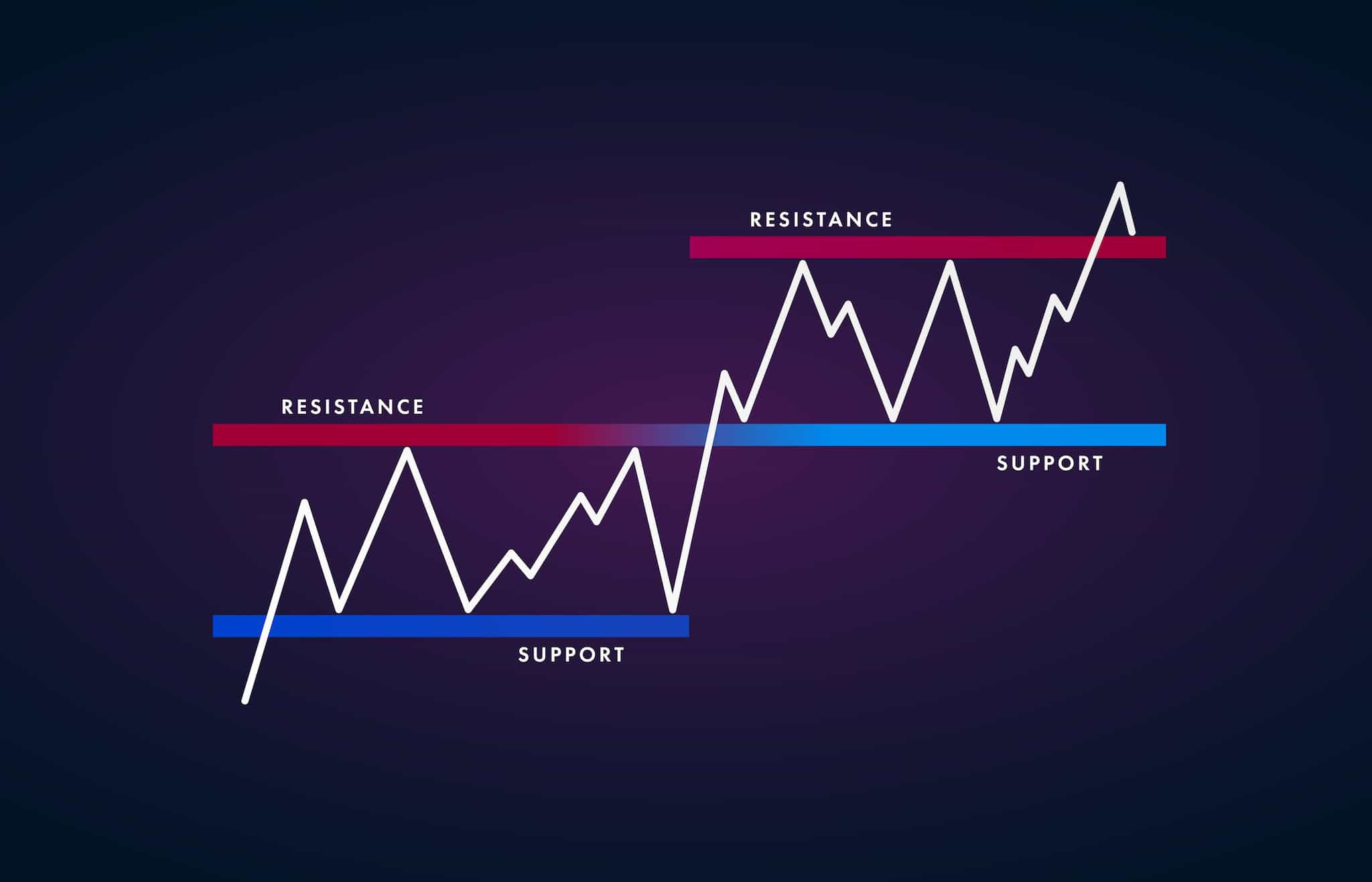

Note: Market corrections create a zig-zag pattern on the charts, as you can see below, price will often return to previous points of support and resistance during a correction.

Structure Of A Crypto Trade

The structure of a crypto trade typically involves several components.

Here's a breakdown of the typical shape of a trade: -

- Trading Pair: In cryptocurrency trading, you select a crypto pair. For example, BTC/ETH, where you can buy or sell Ether (ETH) using Bitcoin (BTC).

- Order Types: There are various types of orders you can place to execute a trade:

- Market Order: A market order is a real-time execution to buy or sell a crypto pair at the current market price.

- Limit Order: A limit order allows you to specify a price for buying or selling a cryptocurrency. The trade only executes if the market reaches or exceeds the set price.

- Stop Order: A stop order (a stop-loss or stop-limit order) allows you to set a trigger price. When the market reaches or falls below the trigger price, the stop order becomes a market order and executes the trade.

- Bid and Ask Prices: The bid price is the highest price you accept for the crypto. The ask price represents the lowest price you are willing to take.

- Order Book: The order book shows all the open buy and sell orders for a specific cryptocurrency trading pair. It shows the bid and ask prices along with the corresponding quantities.

The order book helps traders assess market liquidity and identify potential trading opportunities. It's not always possible to view the order book. It depends on the exchange. - Trade Execution: A trade gets executed when a buyer's bid matches a seller's ask price. The exchange platform matches the orders and facilitates the transaction between the buyer and seller.

- Trade Confirmation: After trade execution, you receive a confirmation indicating the transaction details, including the executed price, quantity, and any applicable trading fees. (always check exchange trading fees before opening a trade)

After you place the order, you have two choices: -

- Let the trade run to your exit or stop loss

- Monitor the trade and exit manually

If you have correctly analysed the charts and feel confident about your choice, letting the trade run often generates more profits than exiting manually. In the latter, traders may leave money on the table and regret interfering with the trade.

Crypto Chart Indicators

When you first start trading cryptocurrencies, you probably want to try every available indicator. I advise doing that in a demo account to learn what does and doesn't work.

Introduction To Indicators

There are hundreds of different indicators, which you can find on the charting software. You can also source "expert advisors" and other paid indicators. For example, on TradingView, many traders create indicators that others can use for free and paid.

The objective of indicators is to help you assess the direction and sentiment of the crypto market. The problem with indicators is that 99% of them lag, so you can see what happened with price action afterwards and not when needed.

Some traders combine indicators so they can gather confirmation data. However, it can quickly get out of control when so many indicators are simultaneously operating. You may feel overwhelmed and unable to clarify what is happening in the market.

Types Of Indicators

Although there are hundreds of technical indicators, the below list highlights the ones most commonly used by traders: -

Moving Averages (MA)

The objective of a moving average is to "smooth out" price data and identify trends. They calculate the average price over a specific period and plot it on the chart.

The two main types of moving averages are:

- Simple Moving Average (SMA): Calculates the average price over a specified number of periods equally.

- Exponential Moving Average (EMA): The EMA is more responsive to market conditions and gives more weight to recent prices.

Moving averages can help identify support and resistance levels and spot trend changes. I use an EMA crossover strategy as a trading signal on the daily chart.

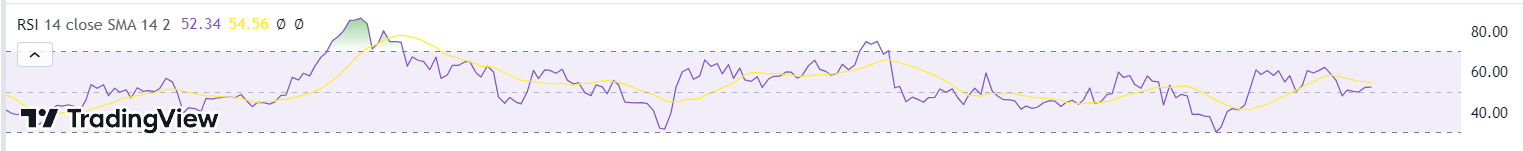

Relative Strength Index (RSI)

The RSI is a popular momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is used to identify "overbought" and "oversold" conditions in the market.

A reading above 70 suggests overbought crypto, indicating a potential price correction, while a reading below 30 suggests it is oversold. However, in my experience, I found the RSI unreliable. The price action often continues way beyond its assessment of being considered “overbought” or “oversold.”

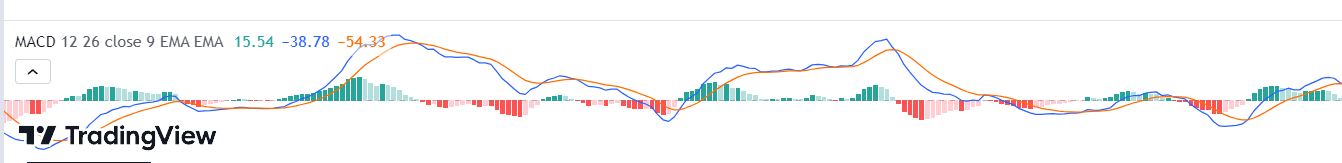

MACD (Moving Average Convergence Divergence)

The MACD is a trend-following momentum indicator. It consists of two lines: the MACD line and the signal line. The MACD line represents the difference between two exponential moving averages, while the signal line is a smoothed average of the MACD line. Crossovers between the MACD and signal line can generate buy or sell signals.

I found it more beneficial to have EMAs on the chart rather than use the MACD indicator.

Fibonacci Retracement

Fibonacci retracement is a tool that uses horizontal lines to identify potential support and resistance levels based on Fibonacci ratios. These ratios derive from a mathematical sequence in which each number is the sum of the two preceding numbers. The challenge with the Fibonacci tool is to assess where to place it on a chart correctly.

Bollinger Bands

Bollinger Bands consist of a simple moving average and two standard deviation bands plotted above and below the moving average. They provide a measure of price volatility. When the price is within the bands, it suggests a range-bound market, while a breakout outside the bands may indicate a trend reversal or a strong momentum.

Here's a breakdown of the components and interpretation of Bollinger Bands:

- Middle Band: A simple moving average (typically a 20-period SMA) that serves as the baseline or centerline of the Bollinger Bands.

- Upper Band: It signifies the upper limit or resistance level where prices tend to have a higher probability of reversing or facing selling pressure.

- Lower Band: It represents the lower limit or support level where prices tend to have a higher probability of bouncing back or increased buying pressure.

Bollinger Bands help identify support and resistance zones. They expand and contract based on market volatility and can help spot price breakouts.

The challenge with Bollinger Bands is how messy they look on the charts, which can be confusing for newer crypto traders.

Technical Analysis Tools

When you master technical analysis, it's like discovering the secret formula to a magic trick. You start to see chart patterns, forming trendlines, price consolidation and breakouts. Whilst it's not the absolute answer to trading success, learning technical analysis helps to reduce uncertainty and give you more precise trading signals.

Types Of Technical Analysis Tools

We discussed the different types of technical indicators, so let's look at how to find trendlines, support and resistance and historical patterns on the charts.

Finding trendlines in a trending market is easy for beginners, and you can also add support and resistance lines for further confirmation.

The below image shows the upper line (resistance) and the lower line (support).

The following section will look at how to read candlestick charts.

Reading Candlestick Charts

Most new crypto traders use Japanese candles for chart reading, which is the simplest form of technical analysis.

Body: The body of a candlestick reflects the price range between the candle's opening and closing price during a specific period (e.g., minute, hour, day).

The candle body is typically coloured or shaded to indicate whether the closing price was higher or lower than the opening price.

- Bullish Candle: If the closing price is higher than the opening price, the body is usually coloured green (some traders prefer white), indicating a bullish price movement.

- Bearish Candle: If the closing price is lower than the opening price, the body is usually coloured red (or black if you choose), indicating a bearish price movement.

- Wick: A candle wick extends from the top and bottom of the candle's body. It represents the price range between the highest and lowest traded prices during the candle's time period.

- Upper Wick: The upper wick extends from the top of the body and represents the high price when the candle is formed and completed. It shows the highest and lowest price before reversing or closing lower.

- Lower Wick: The lower wick extends from the bottom of the body and represents the low price reached during the time (for example, a one-hour candle). It reflects the lowest level the price dropped before reversing or closing higher.

Candlestick Patterns

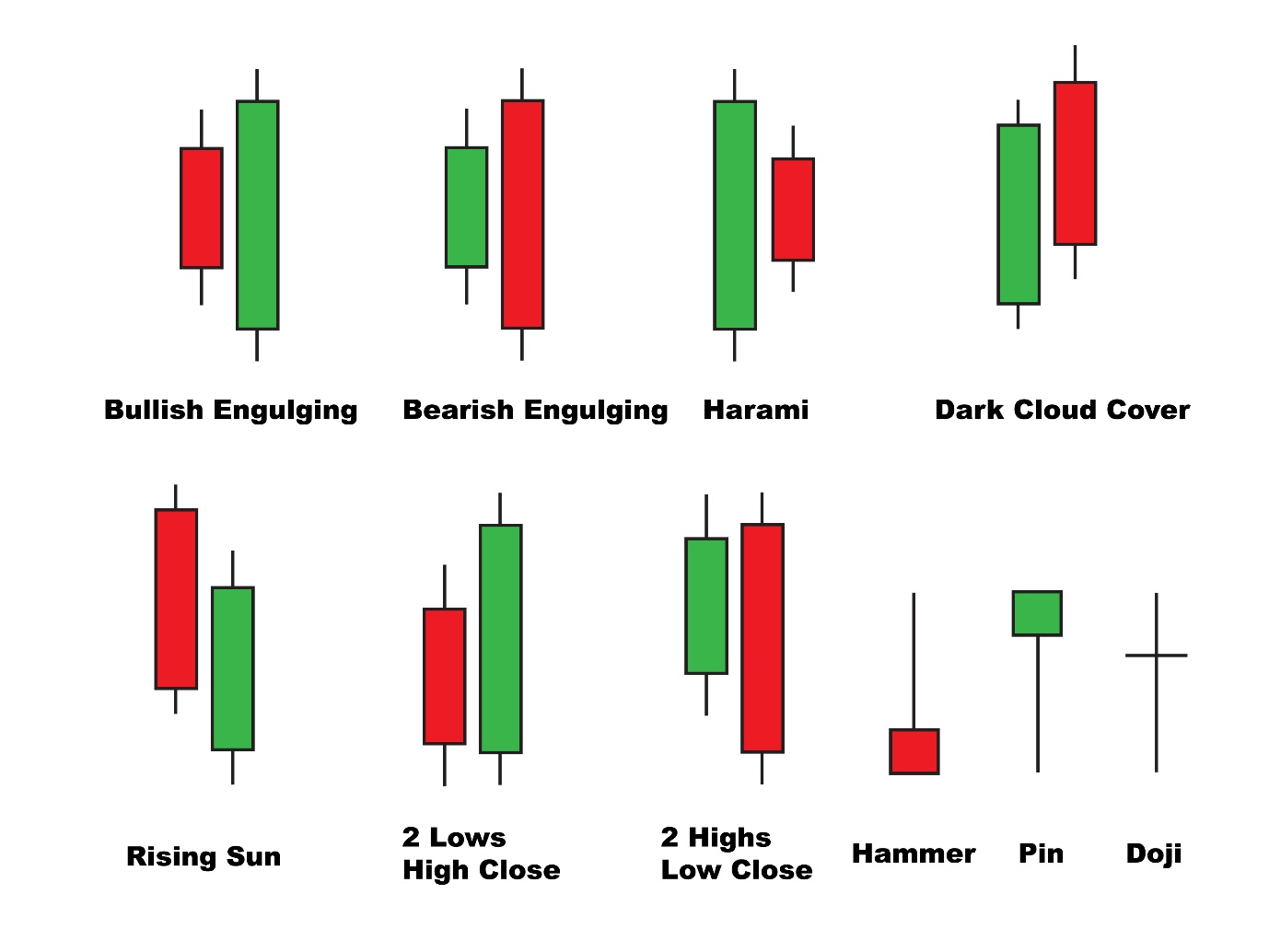

The combination of candlestick bodies, wicks, and their positioning can form various patterns that traders analyse to identify potential trend reversals, continuation patterns, or market sentiment.

The following is a small selection of candlestick patterns: -

- Doji: A doji candlestick occurs when the opening and closing prices are very close, resulting in a small or non-existent candle body. It suggests market indecision and potential trend reversal.

- Hammer: A hammer candlestick has a small body near the top end of the range and a long lower wick. It indicates a potential bullish reversal after a downtrend.

- Shooting Star: A shooting star candlestick has a small body near the bottom end of the range and a long upper wick. It suggests a potential bearish reversal after an uptrend.

- Engulfing Pattern: An engulfing pattern occurs when a bullish or bearish candle fully engulfs the previous candle's body. It suggests a potential reversal in the direction of the engulfing candle.

Candlestick charts provide visual representations of price movements and patterns, helping traders to identify trends, support and resistance levels, and potential entry or exit points.

By analysing the relationship between candlestick bodies, wicks, and patterns, traders can gain insights into market sentiment and make informed trading decisions.

It's important to consider other technical indicators and factors in conjunction with candlestick patterns for comprehensive market analysis.

Introduction To Fundamental Analysis

Fundamental analysis involves assessing the underlying value and factors affecting cryptocurrencies, such as technology, adoption, partnerships, and regulatory developments. It consists of some research on the project behind the cryptocurrency.

Fundamental analysis might seem time-consuming, but it can make a tremendous difference as part of your trading plan.

- Decide which cryptocurrency you want to trade.

- Browse the project's website (blog, whitepaper, roadmap etc.) and social media channels for updates and news. For example, visit Ethereum's site if you want to trade ETH.

- Check crypto news sites, Twitter feeds etc.

- Check the project's community buzz.

- Assess the overall sentiment for fundamentals for the project.

Fundamental analysis can help you determine how a crypto's price may go, but there are many other factors to consider.

The Factors That Affect Cryptocurrency Prices

Many things can affect cryptocurrency prices. Sometimes, price spikes appear random, but if you dig deeper, you may find something like a tweet from Elon Musk or another influencer.

Other factors include the following: -

- Supply and Demand: Prices rise with increased demand and decrease with too much supply.

- Regulatory Environment: For example, the SEC announces a crackdown.

- Technological Advancements and Adoption: Increased security and scalability, and ecosystem upgrades.

- Market Manipulation: Unfortunately, "pump and dump" situations happen with individuals or entities manipulating the market for a quick profit.

- Macroeconomic Factors: Inflation, interest rates, geopolitical events and mainstream economic instability can drive investors to different asset classes.

- Media Coverage and Social Media: as mentioned earlier, social media can play a big part in influencing crypto prices

Fundamental analysis is effective when it forms part of your trading plan. It can become a powerful component towards choosing the best crypto trading opportunities.

Sentiment Analysis

Sentiment analysis in cryptocurrencies involves understanding and analysing the overriding sentiment expressed in online discussions, social media, news articles, and other textual data related to cryptocurrencies.

The goal is to assess the overall sentiment of the crypto community, investors, and the general public's attitude towards specific cryptocurrencies, market trends, and related events.

Monitor social media channels and crypto news, and check for upcoming ICOs or upgrades. During these events, the mass market decides whether prices will go up or down and buy and sell accordingly.

After you've decided how to manage fundamental, technical and sentiment analysis, the next step is to determine the best charting software for your needs.

Best Crypto Charting Software

Many crypto exchanges have charting software, but the below alternatives are popular with many crypto traders: -

TradingView

TradingView is a widely popular online charting platform traders use across various markets, including cryptocurrencies. It has multiple technical analysis tools, indicators, drawing tools, and customisable charting features.

Many of the most popular crypto exchanges have integrated TradingView directly on their platforms, free for users. It's my favourite platform as it provides access to real-time data and allows users to share and collaborate on trading ideas.

CoinMarketCap

CoinMarketCap provides information on crypto prices, market capitalisation, trading volume, and other metrics. I suggest fact-checking project information as often it is not updated on the platform.

CoinMarketCap offers basic charting functionality, allowing users to visualise price movements and trends for over 26,500 cryptocurrencies.

CoinGecko

CoinGecko is another popular online cryptocurrency data aggregator that provides market data, price charts, and other insights. CoinGecko's charting features allow users to analyse price trends, compare cryptocurrencies, and track historical data.

MetaTrader

Download the free MetaTrader software to your desktop and access multiple trading tools and market order options. Before downloading, check that you can connect MT4 or MT5 from your crypto exchange if they use that charting software.

These are just a few examples of charting software available for crypto trading. It's advisable to test and evaluate different platforms based on your specific needs, including features, ease of use, availability of real-time data, and integration with preferred exchanges.

Tips for Successful Crypto Trading

#1: The Importance Of Having A Trading Plan

I cannot stress the importance of a trading plan, yet so few novice crypto traders commit to creating one. Crypto trading is a strategic process with many moving parts. Traders need a strategy, trading goals and defined risk management.

Your plan should include trading tools and resources, a trading schedule (when, where, and how you trade), and research and market analysis methods.

In addition, I must mention trading psychology. Controlling your emotions when trading can be tricky, even if you are the most rational person on the planet. As part of your trading plan, you can formulate a decision strategy, such as “When the market moves against my live trade, I will XXX.”

Finally, your trading plan should include a trading journal. It was the single best thing that helped me identify self-sabotaging patterns.

A trading plan will change as you evolve as a cryptocurrency trader. Update it regularly and monitor your progress by reading your notes regularly.

So, if you're ready to start cryptocurrency trading, you may want to know how much money you need.

#2: How Much Money Do You Need To Trade Crypto?

One of the main attractions for cryptocurrency trading is the low financial barrier to entry. You can get started for $50 or less with most cryptocurrency exchanges.

The challenge of low barriers to entry is the risk. Professional traders suggest a risk management plan of trading no more than 1% to 2% of your capital per trade. So, starting with $50 means your stop loss can be no more than 50 cents. Novice traders navigate this situation with smaller stop losses, which is rarely the answer because the market will bounce you out when it retraces in standard price action.

Regardless of how much capital you have, practice trading with a demo account for at least three months. That helps you become familiar with what you can and cannot do in the crypto market with limited capital.

Conclusion

To sum up, there are many benefits to trading cryptocurrencies. For a start, the entry barriers are excellent compared to stock trading.

Successful cryptocurrency trading depends on a combination of factors: -

- Fundamental, Technical and Sentiment Analysis

- Understanding market structure and cycles

- What technical indicators to use (if any)

- What charting software to use

- Identify candlestick patterns

- Ability to read the charts

- Research and analysis

- Having a trading plan

- Risk Management

You may feel overwhelmed by how much you need to learn when you are new to cryptocurrency trading. Which indicator is the best? How do I spot candlestick patterns and interpret their meaning? Your questions may seem endless.

Don't worry. It takes time. Still, if you commit to continuous learning, you master the crypto terminology, identify your first trade signal by analysing support and resistance, and suddenly crypto trading becomes more intuitive.

After a while, the analysis seems less daunting, and your trading account steadily grows as you learn how to become a consistent cryptocurrency trader.

My final note is to remind you that crypto trading is challenging. If you're making mistakes, don't beat yourself up. 95% of traders fail because they don't commit to mastering the trader's mindset. Nor do they focus on daily learning and improvement. As you're here, reading this article, I happily assume you are the exception.

Go you!

In my opinion, success is 90%+ about mastering crypto trading psychology. That's how it was for me. I was a technical analysis ninja but still lost 40% of my account in the first two years.

After studying applied neuroscience, I finally understood why I couldn't make consistent profits.

That was my turning point.

I had no emotional attachment when I returned to trading, and my account grew steadily. If you'd like a deep dive into how to master your emotions, get a cup of coffee, get comfortable and read the in-depth trading psychology article.

Combine everything you have learned in this guide to crypto trading, open a crypto exchange account and start mastering the art of trading crypto.

Frequently Asked Questions

The most important indicators to use when reading a crypto chart are the ones you fully understand and can confidently analyse.

They are both ends of the spectrum, and neither is less important than the other. Technical analysis is a rational (technical) overview of the patterns on the crypto charts.

Fundamental analysis is an overview of the market influences around a crypto project. For example, if a project completes an upgrade, its token price might increase. Or it could be an ICO that raises the price.

Charting software is a personal choice. TradingView is one of the most popular options for crypto traders. MetaTrader 4 or 5 is also popular with crypto beginners.

Firstly, register with an established and reputable cryptocurrency exchange, such as: -

It's not advisable to trade cryptocurrency without using a chart. It's essential to assess the trend, monitor chart patterns and support and resistance zones.

Trading crypto without a chart is comparable to gambling because you would mostly choose trades by guesswork or on the word of another trader.

Professional traders can make a good living trading cryptocurrencies. Still, it is not easy. 95% of traders fail because it is a volatile market with significant risks.

It's not impossible to become a profitable crypto trader, but we'd advise taking a long-term view of success and committing to improving your trader's mindset and continuous learning.

You would need a reasonable amount of capital to make $100 a day trading crypto with a low-risk strategy. Professional traders might return a modest 5% to 10% monthly profit but may have a six-figure trading capital.

Instead of focusing on how much money you want to make, focus on becoming a better cryptocurrency trader because that will lead to better results.

If you can devote considerable time and effort to learning how to trade cryptocurrencies and develop a robust trader's mindset, you have more chance of success. It may not be your best route if you struggle with impulsivity or don't want to learn the nuts and bolts of trading crypto.

It's tricky to give exact figures. Most crypto traders will lose money, but the successful 5% of traders may make six figures and above. However, most traders will openly share that it took them many years and trials and tribulations before they became profitable.

There's much to say about determination. If you learn from your mistakes and have realistic goals, you could become part of the 5% of profitable traders.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.