M6 Labs: Hacks and Market Recovery

The following report is a guest post by M6 Labs created exclusively for the Coin Bureau audience. M6 Labs is a crypto-native research firm dedicated to high-quality research. The Coin Bureau team find their analysis and reports insightful and we are happy to be sharing their research with our community. None of the views or opinions expressed in this report reflect those of the Coin Bureau.

If you want to see the Coin Bureau provide more insights like this let us know! Send your feedback to: [email protected]

What a tumultuous week for the crypto world! The massive hack that struck on Thursday has left the industry in turmoil, with the full extent of the damage and the number of impacted users still unclear. This unfortunate event led to the disruption of numerous protocols, catching many by surprise. On a brighter note, there's a silver lining with significant upticks in key metrics. Despite Bitcoin's temporary pullback, various coins across different ecosystems are showing remarkable resilience and performance, bouncing back impressively after a brief dip.

L1s, L2s & DeFi

State Of The Market: Chaos, Hacks & Number Up

TLDR

- A critical security flaw in the Ledger ConnectKit library left numerous decentralized applications vulnerable.

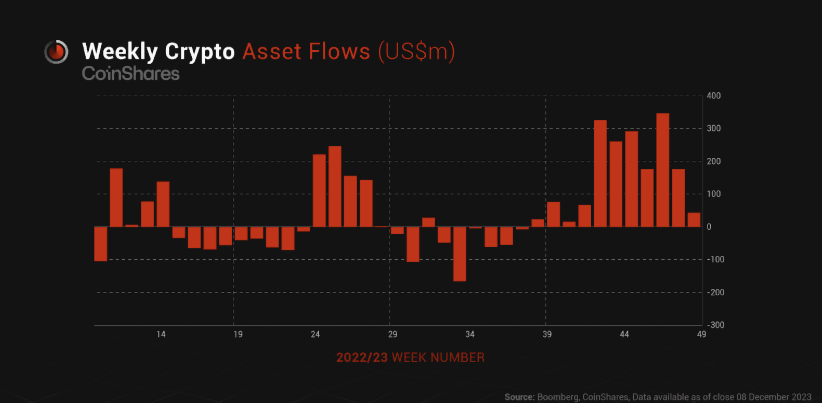

- Digital asset investment products experienced 11 consecutive weeks of inflows, although there was a recent decline.

- Notable altcoins like SOL, AVAX, and ADA have shown substantial growth

- Blockchain gaming and NFTs continue to surge in popularity

- BTC ecosystem continues to grow

In a significant development affecting the crypto landscape, a security flaw was identified in the Ledger ConnectKit library, impacting a wide range of decentralized applications. This issue originated from a compromised software library linked to the hardware wallet provider, Ledger, causing serious concerns for user asset security. Malicious code was injected into numerous decentralized application front-ends, making them vulnerable to exploitation. In response to this threat, several projects, including Kyber and RevokeCash, temporarily disabled their front-ends as a precautionary measure.

- Security experts at Blockaid classified this as a "supply chain attack," where the authentic library software was substituted with a malicious code designed to exfiltrate assets. The breach was reportedly linked to a compromised content delivery network responsible for hosting the software library.

- The vulnerability left all decentralized applications relying on LedgerHQ/connect-kit open to attacks. Following the incident, Tether blacklisted the hacker's address, and Ledger has since released a software patch to mitigate the issue.

Inflows: Digital asset investment products have seen 11 consecutive weeks of inflows, reaching $43M, but this marks a decline compared to previous weeks. Short positions have also gained traction due to price appreciation and perceived downside risks.

- Europe leads in digital asset inflows with $43M, while the US follows with $14M (half of which is in short positions). Hong Kong and Brazil, however, experienced outflows of $8M and $4.6M, respectively.

- Bitcoin remains a major focus for investors, attracting $20M in inflows, contributing to a year-to-date total of $1.7B. Short positions in Bitcoin also gained $8.6 million in inflows, likely due to concerns about the sustainability of current price levels.

- Ethereum has seen a turnaround with six consecutive weeks of inflows totaling $10M, despite previously experiencing year-to-date outflows of $125M.

Economic Indicators and Market Outlook: The United States recently reported a Consumer Price Index (CPI) annual rate of 3.1% for November. This figure represents a slight decrease compared to the previous data and marks the lowest inflation rate since June of this year. This moderation in inflation has prompted speculation on Wall Street regarding a potential resurgence in the Bitcoin and broader crypto market. Investors often perceive crypto as a hedge against inflation, and this development may influence market sentiment moving forward.

Airdrops and Liquidity: In a noticeable trend reminiscent of the previous bull market, we are witnessing the resurgence of airdrops as a means to attract users. However, these airdrops have evolved beyond mere promotional tools. They are increasingly being utilized to inject liquidity into user ecosystems. This approach is gaining popularity because it encourages user participation and investment in both emerging and established crypto projects, potentially paving the way for the next surge in market activity.

Regulatory Landscape: In the arena of regulatory matters, influential figures like Senator Elizabeth Warren continue to express apprehensions about the crypto market. This ongoing dialogue underscores the enduring struggle between the rapidly expanding crypto industry and regulatory authorities.

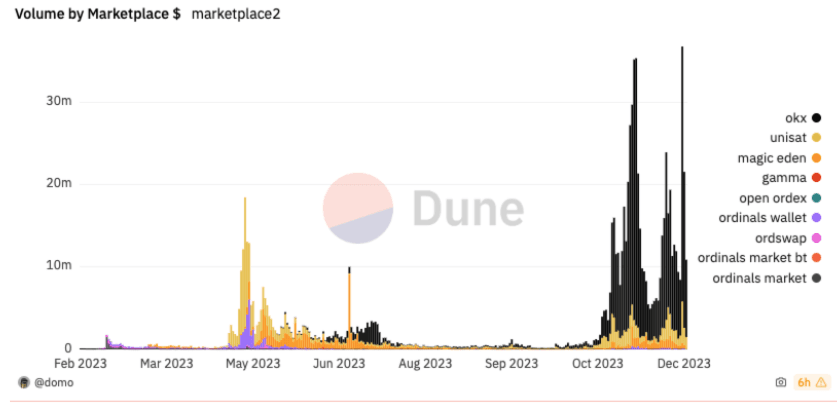

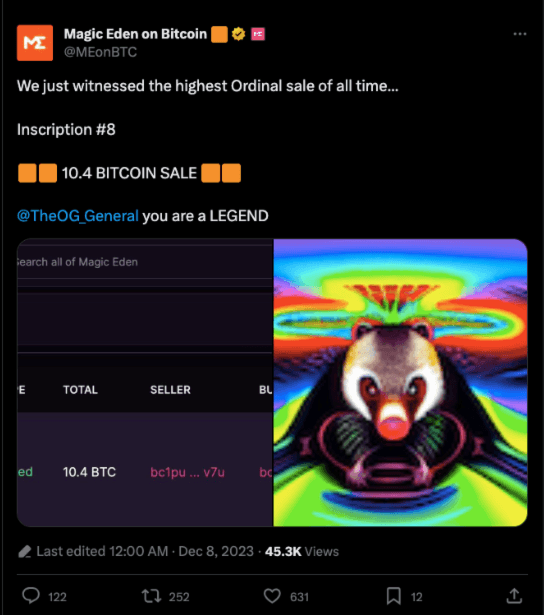

Bitcoin Ecosystem and BRC-20 Token Developments: The Bitcoin ecosystem is evolving with the introduction of Taproot Assets on the Lightning Network, signaling the advent of a multi-asset era. Binance's recent listing of the BRC-20 project Sats (1000SATS) and the introduction of new trading pairs reflect the platform's commitment to expanding its asset offerings. This move is part of Binance's broader strategy to diversify trading options and strengthen its presence in the market. A notable event in the Bitcoin Ordinals space was the sale of an Ordinals inscription from the Honey Badgers collection for an impressive 10.4 BTC, highlighting the burgeoning interest and perceived value in Bitcoin-based NFTs.

Prominent BRC-20 tokens have gained considerable attention, with listings on top-tier exchanges. This includes tokens like BANK and BISO, which have shown market presence with their unique offerings. The ALEX $B20 token, part of the ALEX B20 ecosystem, a BRC-20 Orderbook DEX, is another example of the growing acceptance and scope of these digital assets.

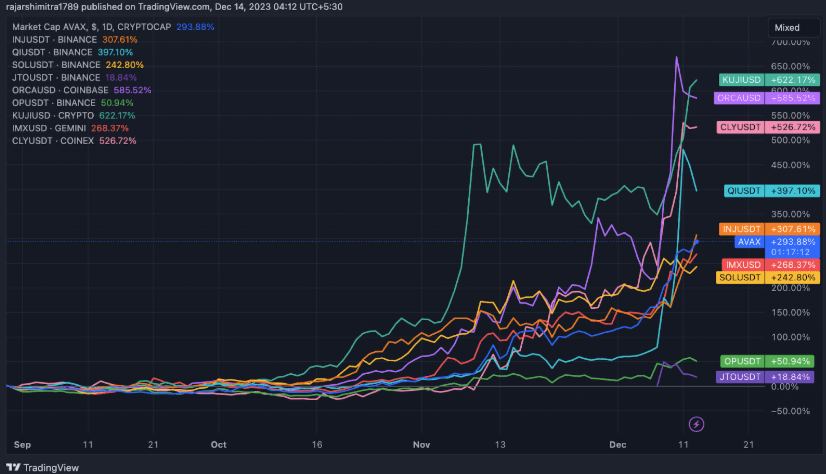

Noteworthy Developments in Other Tokens: Solana (SOL), Avalanche (AVAX), and Cardano (ADA) have been highlighted for their significant growth. SOL leads with 419% gains, followed by AVAX at 201%, and ADA at 105%. These tokens have managed to perform well even when major crypto like Bitcoin and Ethereum faced pressure. Avalanche, in particular, has seen increased development activity and a rise in the number of developers. The network's Cortina upgrade in April 2023 facilitated easier support for Avalanche’s X-Chain by exchanges, contributing to its growth.

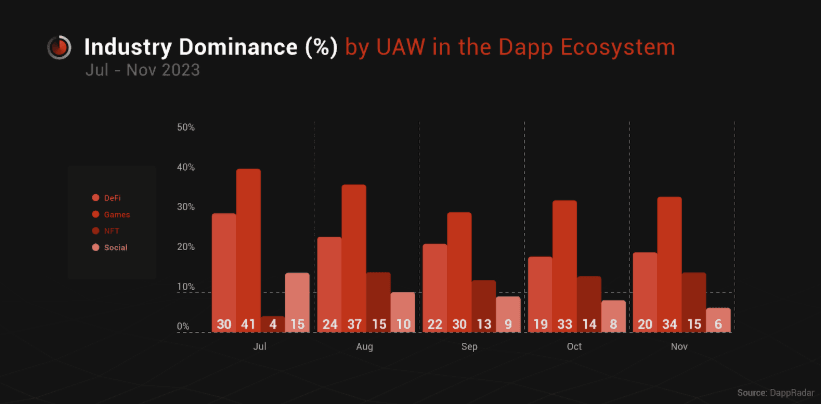

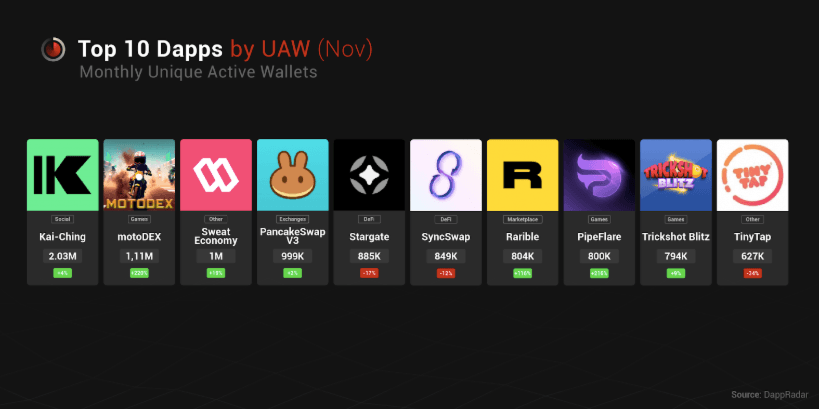

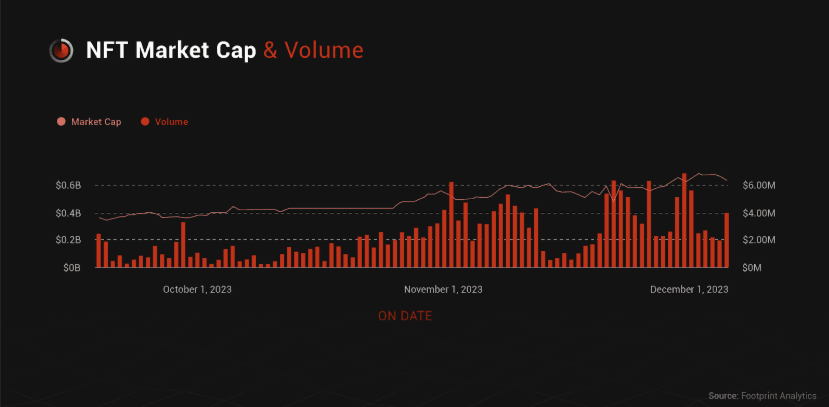

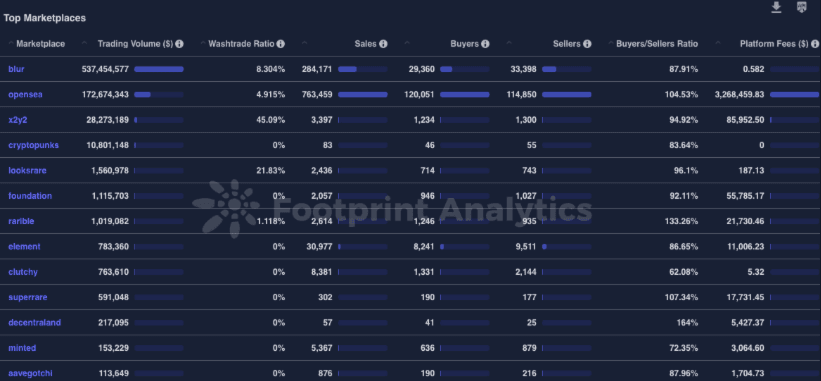

Blockchain Gaming and NFTs Surge: Blockchain gaming has seen exponential growth, representing 34% of the decentralized application industry. With 1.2M daily unique active wallets engaged in blockchain gaming, the sector's robust growth is a testament to its increasing popularity and potential for expansion. In the realm of NFTs, trading volumes have soared, surpassing $994M. Despite shifts in market share, Blur maintains its position as the dominant NFT marketplace, followed by OKX. OpenSea, despite experiencing a drop in market share, continues to hold a significant number of active traders.

Dapp Growth and Diversification: Among the top 10 dapps ranked by Unique Active Wallets (UAW), there was a resurgence in industry diversification. Dapps on the Near blockchain, such as KAI-CHING and Sweat Economy, stood out. These Dapps attracted attention through partnerships and initiatives, leading to substantial user adoption.

Rising Trends in AI and Gaming Coins: The AI sector in crypto is gaining traction, with coins like $RNDR and $FET showing notable increases in value. The gaming sector is not far behind, with the largest gaming coin, $IMX, and others like $BEAM, $GOG, $MYRIA, and $UOS making substantial gains. Gaming launchpad coins have also become increasingly popular, with significant gains in $SFUND, $GAFI, and $CGG.

Altcoin Market and SocialFi Protocols: In the broader altcoin market, BitTorrent Token ($BTT) emerged as a top performer. The launch of the $TREE coin, related to the Tree News service, indicates growing interest in utility tokens within the social media space. $DESO, a leading SocialFi protocol, has also witnessed a considerable uptick in value.

Blue Chips and Majors Overview

Avalanche

Avalanche (AVAX) has more than doubled over the last 30 days, with the price crossing $40 and the marketcap nearing $15B. This surge is primarily driven by its strategic focus on real-world assets and GameFi. Critical partnerships with traditional finance giants like JPMorgan Chase and CitiBank and the launch of the $50M Avalanche Vista fund for RWA development have bolstered this growth. Additionally, Avalanche's unique subnet architecture, catering to the rapidly growing $1.4T global gaming market, positions it as a leader in the GameFi sector.

Injective

Injective (INJ) has surged by 80% over the last 30 days and is nearing $30. The overall marketcap is reaching $2.5B. INJ has recently experienced a significant increase in social media activity as reported by AlphaScan data. This rise in activity has led to INJ becoming one of the most mentioned tokens on social media, ranking just behind Bitcoin. Additionally, 37% of all monthly mentions of INJ occurred in the past week, indicating a rapidly growing interest in the project, evidenced by the concentration of mentions in a brief period.

- Benqi(QI) has risen by over 250% this past week, with the token price crossing $0.025. Meanwhile, Benqi’s TVL has crossed half a billion dollars and is currently the largest platform on Avalanche. Overall TVL has jumped by >75% this past month.

- Vector Finance(VTX) has gone up by ~125% this past week and is presently the 5th largest platform on Avalanche. It accounts for >$50M in TVL.

- Solana (SOL) is still trending in the green, having jumped by 13% this past week and marketcap reaching $31B. A couple of days back, SOL dumped to $65, causing ~$20M in long liquidations. The price has recovered above $70 since then,

- Jito (JTO) is nearing $3, while the Jito platform has seen its TVL near $430M, thanks to the much-hyped JTO airdrop that happened last week.

- Orca (ORCA) has more than doubled its price in the past week and has crossed $5.50, with marketcap crossing $250M. Orca’s TVL has surged by 40% this past week and has crossed $120M.

- Optimism (OP) has performed admirably, with a 30% increase this past week. This surge is largely attributed to Coinbase launching futures trading for the OP token.

- Husky Avax (HUSKY) has skyrocketed by over 1000% this past month as its overall market cap approaches $13.5M.

- Kujira's (KUJI) market value has surged following key developments in the Cosmos network, notably the integration of Bitcoin via the inter-blockchain communications protocol, a joint effort by Osmosis, Nomic, and Kujira.

- Immutable (IMX) experienced a surge of over 50% in the past week, following VanEck's projection that IMX could enter the top 25 coins by market cap, buoyed by the anticipated release of high-profile games like Illuvium.

- Colony (CLY) has more than quadrupled its price this past month, with the token crossed $0.35 and the overall market cap fast approaching $35M.

- Beam (BEAM) has jumped by 50% over this past week as the bulls look to break past the $0.025 level. BEAM has also benefited from the VanEck report highlighting the GameFi sector's promise.

- Celestia (TIA) has soared over 40% in the past week, nearing $15. The increase began with speculation, even before Polygon's Tuesday announcement of integrating Celestia's "data availability" solution into its blockchain development kit.

- Echelon Prime (PRIME) has surpassed the significant $10 mark, registering a 14% increase in the last 24 hours. This follows a notable monthly rise from $5.87 to $10.20.

- DeFi Kingdoms (JEWEL) experienced a 14% decline over the past week, stabilizing at the $0.50 support level.

- ALEX Lab (ALEX) has surged nearly 140%, approaching the key $0.35 level, and has achieved a market capitalization exceeding $220M.

- Kamino Finance, now approaching a $130M TVL, ranks among the top five DeFi protocols on Solana, potentially indicating an upcoming airdrop similar to Jito's strategy.

Smart Money Movements

Smart Money has recently been taking profits and securing their gains. They utilise some of the profits to acquire fresh tokens with good growth potential.

Tokens

RWA

Smart Money added more $PLANET to their holdings following the news of a new staking model:

$TRADE

An all-in-one platform for everything RWA, $TRADE gained traction from Smart Money after Coinbase CEO Brian Armstrong wrote about RWA:

DePIN

Smart Money is detected in $AIOZ as well, they're positioning themselves for the DePIN narrative.

AI

$AIFI has caught Smart Money's attention as the first DeFi Protocol aggregating yield using AI, check it out here.

BRC-20

Smart Money is taking profits on major BRC-20 tokens like $MUBI and $BSSB. So consider taking some profits off if you're up decently.

SocialFi

Smart Money began accumulating $FWB right after its launch, a p2p subscription model project on TG, can be a good play when SocialFi narrative gains hype again.

GameFi

$KAP is a gem in GameFi that Smart Money started acquiring.

Smart Money is also detected in $SHRAP, a gaming project market-made by DWF, and $NGL, an OG GameFi project which is still on top of their game.

Smart Money is taking profits on $PRIME, it has become a common activity among early whales that bought it early.

Layer1

$TET was among Smart Money's purchases this week, a brand new Layer1 that has recently gained attention:

Yield Farms

The latest high APR Stablecoin farming strategy involves depositing $PLX into Liquid Loans, borrowing $USDL against the collateral ($PLX), depositing the $USDL into the stability pool, this pool offers 326% APR!

*Note: If you want to implement this strategy using only stablecoins and not being exposed to $PLX, you can deposit stablecoins into Phiat on PulseChain, borrow $PLX against your stablecoins with a low borrow rate, and then use that $PLX to deposit into Liquid Loans.*

Extra Finance on BASE has been popular among Smart Farmers too.

NFTs

Smart Money swept some Honey Comb NFTs as Berachain gained traction on CT again:

Smart Money minted some Poglin NFTs as well; they're now live on OS, representing an innovative multimedia world backed by Animoca, consisting of anime and games:

This is just a preview of our L1, L2 and DeFi Weekly report, be sure to check out the full version of this report here. Be sure to also check out our Bitcoin Weekly report here.

NFTs & Gaming

Project Updates

- The popular PC game Splitgate has integrated Bitcoin's Lightning Network, offering players a novel way to earn Bitcoin. This integration represents a significant convergence of traditional gaming with crypto, and specifically BTC.

- Donald Trump pitches ‘Mugshot Edition’ NFTs to his supporters for $99 each.

- FIFA drops NFTs that offer chance at World Cup final tickets, moves to Polygon.

- Gods Unchained rated 'Adults Only' for play-to-earn elements, booted from Epic Games Store.

- 'Pegaxy' game studio Mirai Labs leaves Polygon for Avalanche Subnet.

- Pudge Penguins announces Pudgy World Alpha powered by zkSync, releasing Q1 2024.

- 'My Neighbor Alice' game migrates from BNB Chain to Chromia with the new season.

- Ultra reveals first digital PC game that can be resold via NFT license.

- Champions Arena is ushering In a ‘New Generation’ of In-Game NFTs.

- Electronic music duo Disclosure drop AI-Powered NFTs on Beatport.

- Google Cloud to run validator on crypto gaming network XPLA.

The Future of Blockchain Gaming

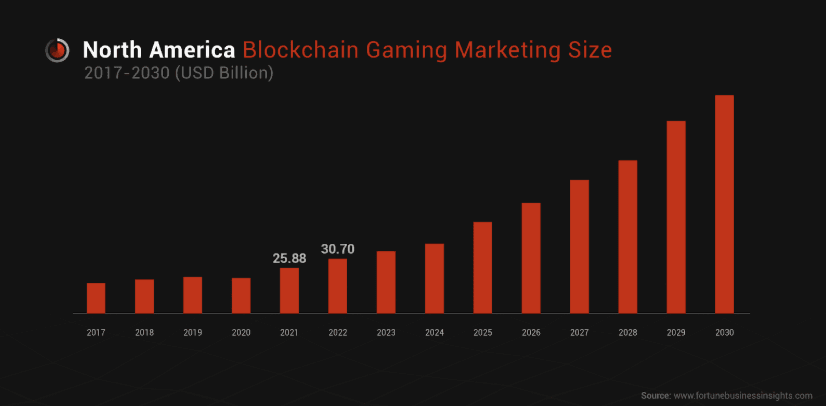

According to a recent study by Fortune Business Insights the global blockchain gaming market, valued at $128.62B in 2022, is projected to grow to $614.91B by 2030, at a CAGR of 21.8%. This market encompasses games using blockchain technologies like NFTs and crypto, enabling players to earn through transactions.

- The COVID-19 pandemic boosted this market's growth due to increased online gaming. The growth is also driven by rising demand for NFTs and crypto in gaming. However, regulatory frameworks for crypto and NFTs could restrain market growth.

Notable Companies and Market Share Insights

Providers of blockchain-based games are progressively developing titles that offer interactivity between games, allowing players to utilize assets across multiple games, fostering a connected and dynamic gaming environment. This ecosystem facilitates a seamless transition for players between various gaming experiences.

Collaborations between blockchain gaming providers and other technology firms aim to extend the reach of their platforms to a global audience of players. For instance, in October 2022, Sky Mavis unveiled a multi-year partnership with Google Cloud to bolster the security of Ronin.

Ronin, introduced by Sky Mavis in February 2021, represents a blockchain network constructed using the Ethereum virtual machine. Ronin's primary objective is to expedite transaction processing while significantly reducing gas fees for its rapidly expanding user base.

Google Cloud assumes a pivotal role in ensuring the security and governance of the blockchain network, along with monitoring validator uptime. Users and investors of this market are advised to keep a close eye on:

- Dapper Labs

- Sky Mavis

- Splinterlands

- Animoca Brands

- Immutable

- Uplandme.

- Illuvium

- Mythical Games

- Autonomous Worlds

Blue Chip and Market Overview

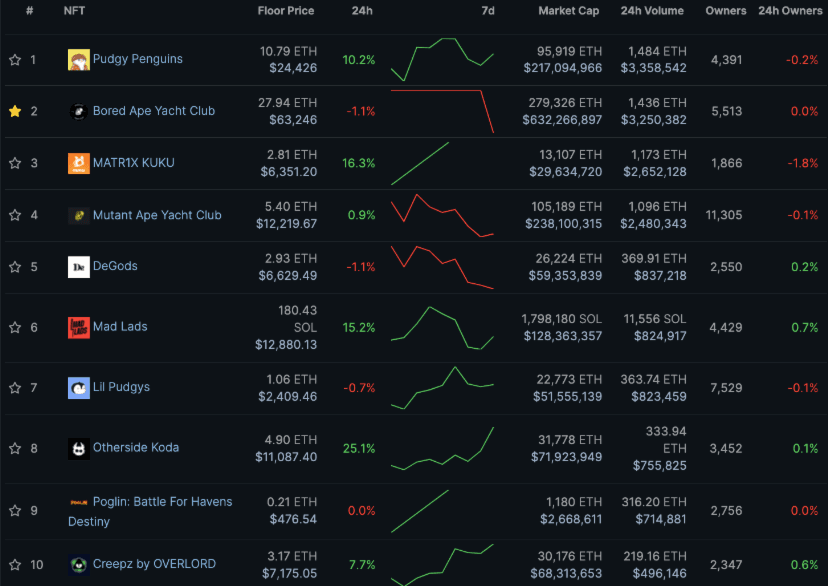

In a remarkable twist, Pudgy Penguins has surged to the top spot in terms of trading volume. This impressive achievement can be attributed to their strategic partnerships, including collaborations with notable companies like Walmart, as well as their active involvement within the cryptocurrency sphere. Meanwhile, Mad Lads remains a strong performer, capitalizing on the recent success of the Solana ecosystem.

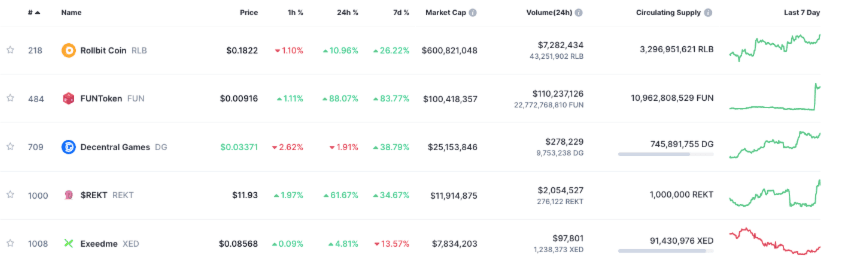

Rollbit continues to dominate the crypto-gambling ecosystem

Historical Sale of Ordinals Inscription: An Ordinals inscription from the Honey Badgers collection was sold for an impressive 10.4 BTC, equivalent to around $450K. This sale was facilitated through the Solana-based NFT marketplace Magic Eden.

Additionally, the renowned auction house Sotheby's recently hosted the first public sale of works from a Bitcoin Ordinals collection titled “BitcoinShrooms” created by the digital artist Shroomtoshi. This event marks a historical moment in the fusion of art and blockchain technology, further showcasing the potential of Bitcoin Ordinals. It seems that Bitcoin inscriptions that are NFT-orientated will become a common feature of what is considered Bluechip NFTs, commanding similar price tags as their Ethereum counterparts in the future.

Moving on, a recent report by DappRadar revealed interesting key insights into the direction of the NFT and crypto gaming industry. November 2023, the Dapp industry saw significant growth while also facing new challenges. This suggests that the industry is in a dynamic phase of development. Some key points from the report include:

- Record Daily Unique Active Wallets (UAW): The number of Daily Unique Active Wallets (UAW) reached a notable milestone, hitting 3.4M. This signifies a strong interest and engagement in the dapp ecosystem. The increase in UAW indicates that more individuals are actively using blockchain-based applications daily.

- Blockchain Gaming Dominance: Blockchain gaming accounted for 34% of the Dapp industry. This sector experienced robust growth, with 1.2M daily unique active wallets.

NFT Trading Volume: NFTs have continued to gain traction, with trading volume exceeding $994M.

Market Share in NFTs: Blur is still the dominant marketplace for NFTs, while OKX has shot to second place after opening its marketplace. OpenSea, despite a drop in market share, still retains significant number of active traders.

Degen Corner

- Immutable (IMX) experienced a surge of over 50% in the past week, following VanEck's projection that IMX could enter the top 25 coins by market cap, buoyed by the anticipated release of high-profile games like Illuvium.

- The CEO of Pixelmon has confirmed the development of a token, though no specific release date has been announced yet. Considering the recent surge in Pixelmon's popularity and the project's overall turnaround, it appears that this venture is on track to become a leading gaming NFT collection. Investing in a few Pixelmons might be a wise move for those with available capital.

- Overworld is a free multiplayer RPG set in a fantasy world where players can team up for Monster Raids, Dungeons, PvP battles, and item creation. Jeremy Horn, a game executive with 15 years of experience working with major IPs like Harry Potter, Star Wars, Avatar, and Far Cry, leads Overworld as the CEO and founder. He is also a co-founder of Xterio, further contributing to his expertise in the gaming and entertainment industry.

- Rainicorn is a deflationary NFT farming token that offers its holders the unique ability to create limited edition NFTs and trading cards, which are curated by both established and up-and-coming artists.

- Shrapnel on Avalanche stands as an ambitious AAA first-person shooter game currently in development by Neon Machine, a gaming studio that has successfully secured $37.5M for its development efforts.

- Skyweaver (Polygon), is a digital trading card game from the creators of Parallel, is brought to you by Horizon Blockchain Games. This free-to-play game provides players with the opportunity to amass, exchange, and engage in battles using an extensive range of distinctive cards. Horizon enjoys substantial support from two gaming industry giants: Ubisoft and Take-Two. Who contributed significantly to a Series A funding round that raised an impressive $40M.

- Ordinals still confusing you? Dive into this latest thread put together by members of the Cryptopragmatist team.

- Be sure to also check out this second thread for further Ordinal-related educational content.

This is just a preview of our NFT Weekly report, be sure to check out the full version of this report here.

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.