M6 Labs Crypto Market Pulse: Rise of Depin, Solana Madness & Base Ready To Moon

The article discusses three main topics in the crypto space: the rise of Solana and its memecoins, the potential growth of the AI sector in crypto, and the overlooked opportunities in the DePin (Decentralized Physical Infrastructure Networks) industry.

The first section focuses on Solana, highlighting its recent surge in popularity and the influx of memecoins on the blockchain. The article mentions the bullish metrics around Solana, such as the increase in new addresses, transaction fees, and total active addresses. It also discusses the impact of Solana's memecoins on the overall market and mentions notable memecoins like Wif and Bonk.

The second section highlights the potential growth of the AI sector in crypto. It mentions the anticipated flow of billions of dollars into this sector over the long term and emphasizes the importance of DePin, which focuses on the structural side of supporting AI coins. The article discusses the implications of DePin and its potential to revolutionize infrastructure development and enhance efficiency, accessibility, and innovation.

The third section explores the opportunities in the DePin industry. It provides an overview of the current state of DePin, including the number of projects and market capitalization. The article discusses the goals and benefits of DePin, such as acceleration and responsiveness, cost-effectiveness, global accessibility, and integration with decentralized finance. It also highlights promising DePin projects, including Aethir, GamerHash, GPUnet, ionet, and Kamino.

The article concludes by discussing the rise of Base, Coinbase's ecosystem on the Base chain. It mentions the adoption and engagement metrics of Base, including TVL (Total Value Locked), revenue generated, and community and Dapp engagement. The article emphasizes the potential and opportunities in Base, pointing out the strategic deployment of features, the upcoming developments, and the shift in investor sentiment from Solana to Base.

Overall, the article provides a comprehensive overview of the rise of Solana, the growth potential of the AI sector, and the opportunities in the DePin industry and Base ecosystem. It offers insights into the current state, trends, and promising projects within these sectors, giving readers a broader understanding of these areas in the crypto space.

The article discusses three main topics in the crypto space: the rise of Solana and its memecoins, the potential growth of the AI sector in crypto, and the overlooked opportunities in the DePin (Decentralized Physical Infrastructure Networks) industry.

The first section focuses on Solana, highlighting its recent surge in popularity and the influx of memecoins on the blockchain. The article mentions the bullish metrics around Solana, such as the increase in new addresses, transaction fees, and total active addresses. It also discusses the impact of Solana's memecoins on the overall market and mentions notable memecoins like Wif and Bonk.

The second section highlights the potential growth of the AI sector in crypto. It mentions the anticipated flow of billions of dollars into this sector over the long term and emphasizes the importance of DePin, which focuses on the structural side of supporting AI coins. The article discusses the implications of DePin and its potential to revolutionize infrastructure development and enhance efficiency, accessibility, and innovation.

The third section explores the opportunities in the DePin industry. It provides an overview of the current state of DePin, including the number of projects and market capitalization. The article discusses the goals and benefits of DePin, such as acceleration and responsiveness, cost-effectiveness, global accessibility, and integration with decentralized finance. It also highlights promising DePin projects, including Aethir, GamerHash, GPUnet, ionet, and Kamino.

The article concludes by discussing the rise of Base, Coinbase's ecosystem on the Base chain. It mentions the adoption and engagement metrics of Base, including TVL (Total Value Locked), revenue generated, and community and Dapp engagement. The article emphasizes the potential and opportunities in Base, pointing out the strategic deployment of features, the upcoming developments, and the shift in investor sentiment from Solana to Base.

Overall, the article provides a comprehensive overview of the rise of Solana, the growth potential of the AI sector, and the opportunities in the DePin industry and Base ecosystem. It offers insights into the current state, trends, and promising projects within these sectors, giving readers a broader understanding of these areas in the crypto space.

GM, Anon! The crypto space is volatile and fast-moving with the market reaching ATHs and then dramatically dumping. We’ve recently seen Solana and its memecoins go out of control! Almost as quickly, we’re seeing a rotation into the Base ecosystem.

Furthermore, the AI sector is poised for significant growth in the crypto space, with many anticipating billions of dollars flowing into this sector over the long term. However, another industry often overlooked by AI investors is DePin, which focuses on the structural side of the technology supporting AI coins. Lastly, we’ll also be looking at all the action developing on Base. Let’s dive in!

Today we’ll be covering.

- Solana on the rise - The various bullish metrics around SOL

- Solana memecoin ecosystem

- Solana's upcoming airdrops (Nyan Heroes, Parcl, Kamino, Drift)

- Why it’s not all good news

- Revising DePin Fundamentals

- DePin metrics and developments

- How to earn with Aethir

- Io.net’s airdrop program

- Getting involved with GamerHash

- Taking advantage of Gpu.net’s points program

- The rise of Base

- Key Base metrics

DePin

The Opportunity

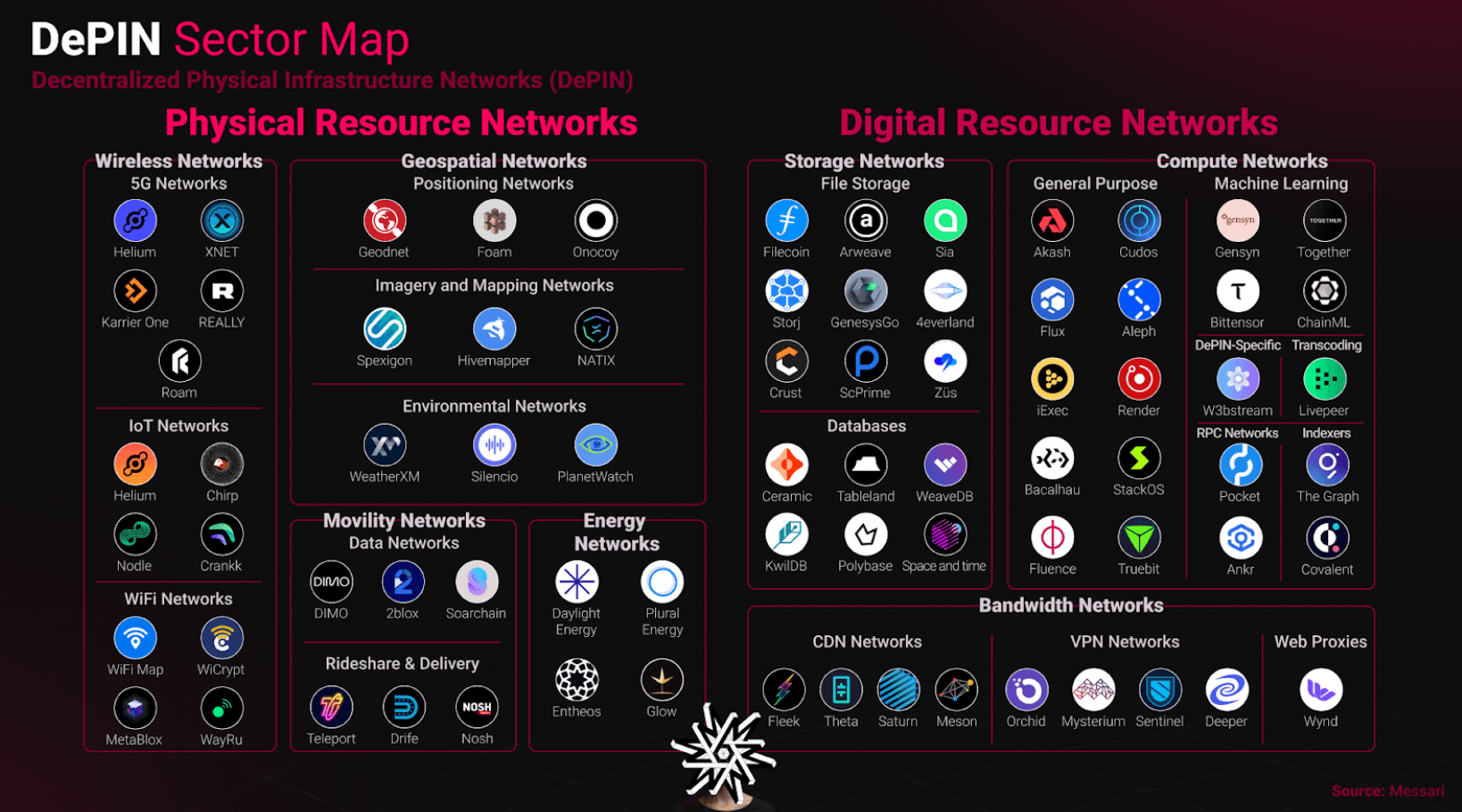

In their 2023 report on DePin, Messari introduced the concept of Decentralized Physical Infrastructure Networks. This report delved into how blockchain technology can revolutionize the deployment and management of real-world physical infrastructure and hardware networks. Messari envisioned a future where the construction and upkeep of such networks are incentivized through tokens, employing cryptographic economic protocols.

Anticipating substantial growth, Messari predicted that DePin could attain a market value of $3.5T by 2028. Recent advancements in DePin projects suggest that Messari's forecasts are proving to be accurate.

Setting The Stage

Decentralized Physical Infrastructure (DePin) transforms how we conceive, build, and interact with infrastructure projects. We have covered this sector before, wherein we rightfully named it the “next frontier of blockchain revolution.” If you have been following the news, then you will know that DePin is one of the hottest sectors in crypto right now.

But what makes it so special? Why are some of the smartest people in crypto actively working and researching DePin?

The reason is twofold:

- Firstly, DePin fits perfectly in the intersection of two of the most innovative fields in the world – crypto and AI.

- It is an actual real-world use case of crypto.

DePin redefines the methodology behind infrastructure development and opens up a myriad of possibilities for enhancing efficiency, accessibility, and innovation in the physical world.

At its core, DePin leverages blockchain technology to facilitate a crowd-sourced model for infrastructure projects.

This model harnesses collective intelligence, skills, and resources to accelerate the development and deployment of infrastructure. By tokenizing aspects of these projects, DePin provides a tangible means to incentivize and reward contributions, ensuring a more engaged and invested community.

The Implications of DePin

The implications of such a system are profound.

- Acceleration and Responsiveness: Traditional infrastructure projects, often mired in bureaucratic red tape and hindered by centralized decision-making processes, can be sluggish and inefficient. DePin, by contrast, promises to drastically accelerate these projects, potentially boosting their development by 10 to 100 times.

- Cost-Effectiveness: Utilizes a decentralized approach to tap into unused and idle resources, optimizing allocation and significantly reducing waste and overhead costs compared to traditional infrastructure projects.

- Global Accessibility: Facilitates permissionless scaling, enabling infrastructure solutions to transcend geographical and jurisdictional boundaries, making them accessible worldwide.

- Neutrality and Collective Ownership: Operates on a model of inherent neutrality and collective ownership, contrasting with the exclusionary and profit-driven motives of conventional infrastructure.

- Integration with DeFi: Enhances viability and utility by integrating with decentralized finance systems for frictionless micropayments, facilitating funding and ensuring equitable benefit distribution.

- Resilience and Adaptability: Promotes a new era of more resilient and adaptable infrastructure capable of meeting the evolving demands of society.

- Bridging Digital and Physical Worlds: Acts as a bridge between the blockchain ecosystem and physical infrastructure, potentially redefining the convergence of our physical and digital realities.

Current State Of DePin

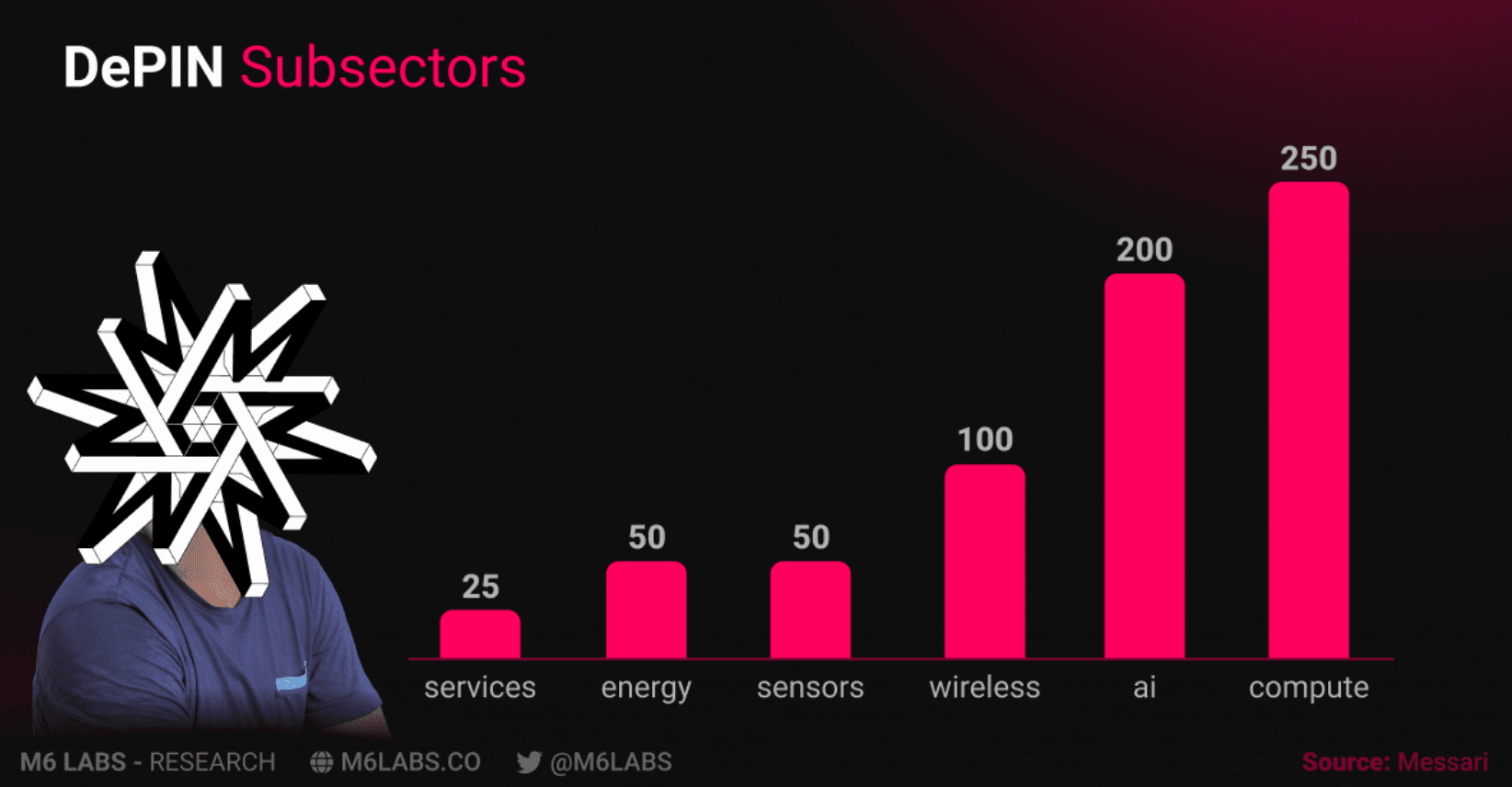

The DePin ecosystem currently encompasses more than 650 projects spread across six core subsectors, covering critical infrastructure compute, AI, wireless, sensors, energy, and services.

- These projects collectively hold a market capitalization exceeding $22B and generate approximately $15M in on-chain annual recurring revenue (ARR).

- Notably, the number of nodes within DePINs has surged by over 600,000, showcasing significant growth trends.

Anticipated growth factors include the market's expected expansion to $3.5T by 2028, escalating demand for high-quality streaming and online content, increased necessity for valuable datasets across diverse industries, and a rising need for online data storage solutions and software-based DePINs.

Furthermore, the supply side is poised for expansion, with an influx of nodes and the emergence of decentralized marketplaces connecting GPU owners with creators requiring rendering power.

Notably, DePINs derive revenue from actual utility rather than speculative investments, ensuring transparent and real-time payment mechanisms traceable on the blockchain. Founders in this sector focus on developing open-source hardware and software solutions to catalyze the growth of valuable on-chain products and services, while diversified use cases continue to emerge within the Web3 space.

For a comprehensive exploration of DePin's functionalities, don't miss this insightful three-part series by Pivot dedicated to unraveling the intricacies of DePin.

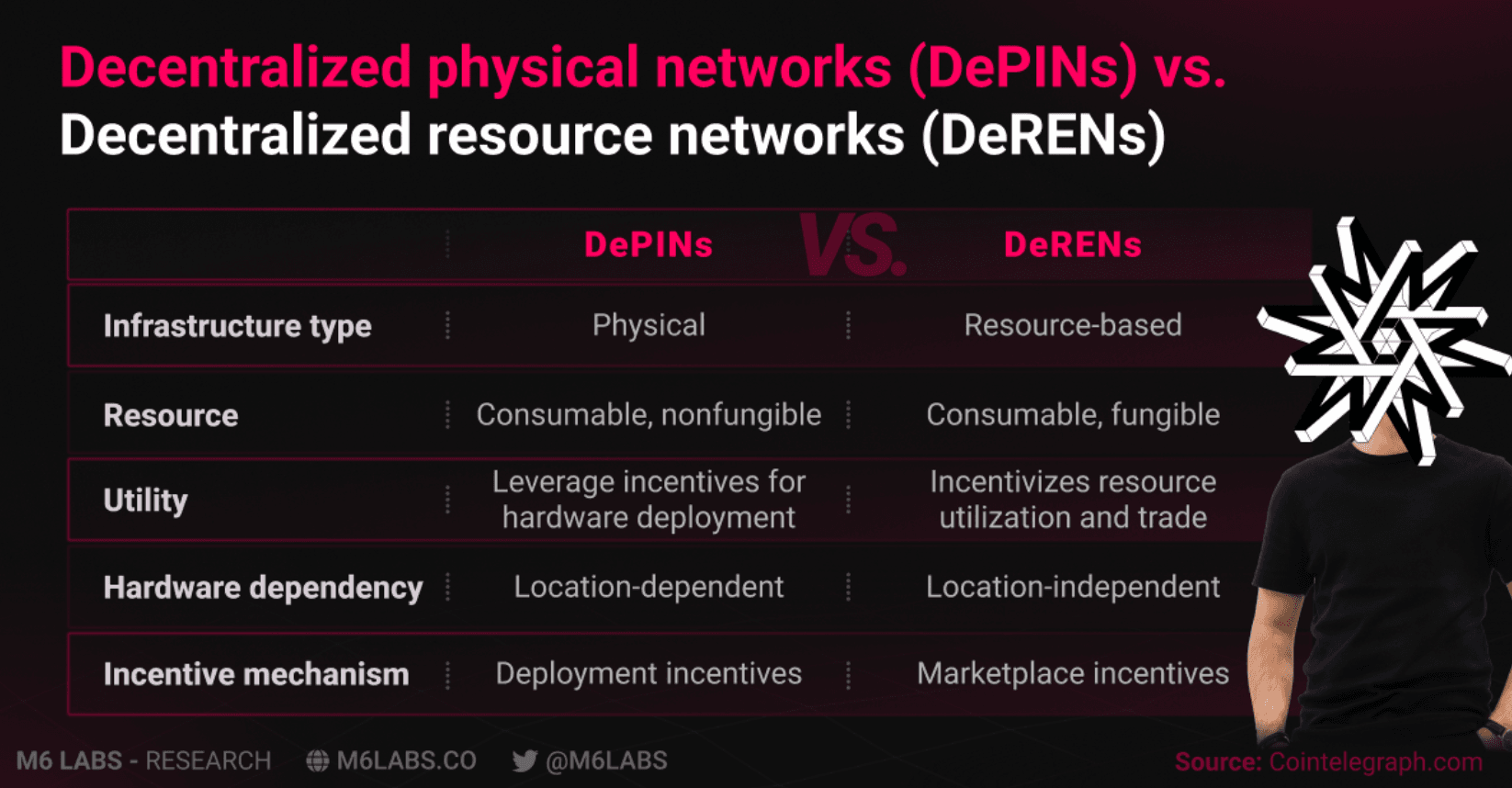

Diving Deeper: DePin & DeRen

Decentralized Resource Networks (DeRens) and DePins represent the diversification of blockchain technology across various sectors. While both aim to decentralize resources and authority, they differ in focus, functionality, and broader implications.

- DeRens primarily deal with virtual assets like computational resources and financial instruments, enabling intermediary-free exchanges and the conversion of tangible assets into digital tokens.

- Conversely, DePins focus on decentralizing physical systems such as energy networks and logistics, aiming for more efficient and universally accessible management.

- Goals include making digital services more accessible and transparent for DeRens, while DePins seek to enhance the robustness and sustainability of physical infrastructures.

- Both face challenges like scalability and security, albeit with differing emphases on digital transactions for DeRens and physical asset protection for DePins.

Promising DePin Projects

Now that you're up to speed on what DePin is and how it operates on a fundemental level, let’s take a look at some of the most promising DePin projects in the market.

Aethir

Aethir is building a distributed GPU-based compute infrastructure for dynamic, enterprise use cases.

- It connects enterprises with idle GPU resources to industries needing computational power, such as AI, virtual computing, cloud gaming, and crypto mining.

- This model maximizes resource utilization and offers a cost-effective solution for demanding industries, eliminating the need for them to invest in hardware.

- Central to Aethir's ecosystem is the $ATH token, which facilitates transactions within this vibrant marketplace.

- Demand-side participants purchase $ATH to rent computing power, while the supply-side and investors receive $ATH as rewards.

- Aethir's commitment to repurchasing $ATH with profits bolsters its value, making it a resilient investment.

Owning Aethir Checker Nodes

Checker Nodes are essential for verifying the performance and legitimacy of Containers in Aethir's network, helping maintain its integrity.

Owners of these nodes get a share of 15% of all $ATH tokens from the mining rewards pool. With only 100,000 nodes available and a four-year unlock schedule, each node receives a monthly allotment of $ATH, offering a return on investment.

The launch of Checker Nodes has a tiered pricing structure that benefits early adopters. This encourages quick participation due to competitive pricing and the potential for FOMO.

Find out how to purchase your Checker Nodes here.

Io.net

io.net provides access to distributed GPU clusters for machine learning, addressing issues like limited availability, high costs, and poor hardware choices in centralized services.

Like Aethir, io.net also aggregates idle GPU into a DePIN, offering significant computing power for computational-intensive industries.

io.net enhances its offerings with three products: io.net Cloud for scalable GPU clusters, io.net Worker for computation management, and io.net Explorer for network insights, providing a complete solution for GPU resource users and suppliers.

IONet’s Ignition Airdrop Program

GALXE’s Ignition Airdrop Program offers incentives to community members for their active participation on io.net, community engagement, and contributions to network expansion.

Don’t miss out.

GamerHash

GamerHash is a platform launched in 2017 and is currently up 2600% year to date, with a current user base of 760K, initially focused on allowing gamers to earn through crypto mining.

- It's now expanding to include technical integrations and a new AI app, aiming to provide GPU power for AI, 3D rendering, LLM models, and data analysis, under the new DePin initiative.

- GamerHash is collaborating with AI L1 projects and DePin market leaders to become a B2C power provider amidst a significant GPU shortage.

- Key milestones include over 2M transactions to gamers' wallets, rewards over $15M, and a hardware value from active users surpassing $20M.

- The AI product development is phased, with plans ranging from a proof-of-concept for GPU power contribution to the integration of gaming GPUs in computing marketplaces for generative AI model work, addressing the GPU shortage and potentially solving a major issue.

- GamerHash’s native token, GamerCoin ($GHX), has a total supply of 808 million, with 80% in circulation. The platform is operational on BSC and ETH, with plans to expand to Solana.

Share your computing power and earn with GamerHash here.

GPU.net

GPU.net is a decentralized graphics processing unit (GPU) infrastructure project that plans to power the next generation of technologies, including Generative AI, Web3 Metaverses, high-end graphics rendering, and crypto mining.

Co-founded by Suraj Chawla and Kirubakaran Reddy, GPU.net secured a significant investment of $500K from Momentum 6 & Alphablockz, along with support from industry leaders like Nvidia and Taanga Studios.

As GPU.net prepares for its Testnet launch this month, it aims to revolutionize industries reliant on GPU resources. By providing an on-demand GPU infrastructure, GPU.net enables users to access powerful graphics processing capabilities seamlessly.

Users can get involved by exploring the GPU.net whitepaper and setting up as a provider or consumer. The platform offers transparent pricing, reliability, and data privacy through decentralized architecture.

GPU.net's roadmap includes partnerships, community growth, token launches, and platform scaling to accommodate thousands of node providers globally in 2024. With a focus on trustless computing, API integration with AI protocols, and niche compute clusters.

How to get involved?

Node sales are planned to go on sale from the 21st of March, so keep an eye out on their homepage here.

Gpu.net will be airdropping 5% of their tokens to users who partake in their points program. Sign up here.

That’s it for today, make sure you understand the true implications and power of DePin as it’s poised to become the next frontier of blockchain revolution.

Solana

Solana on the Rise

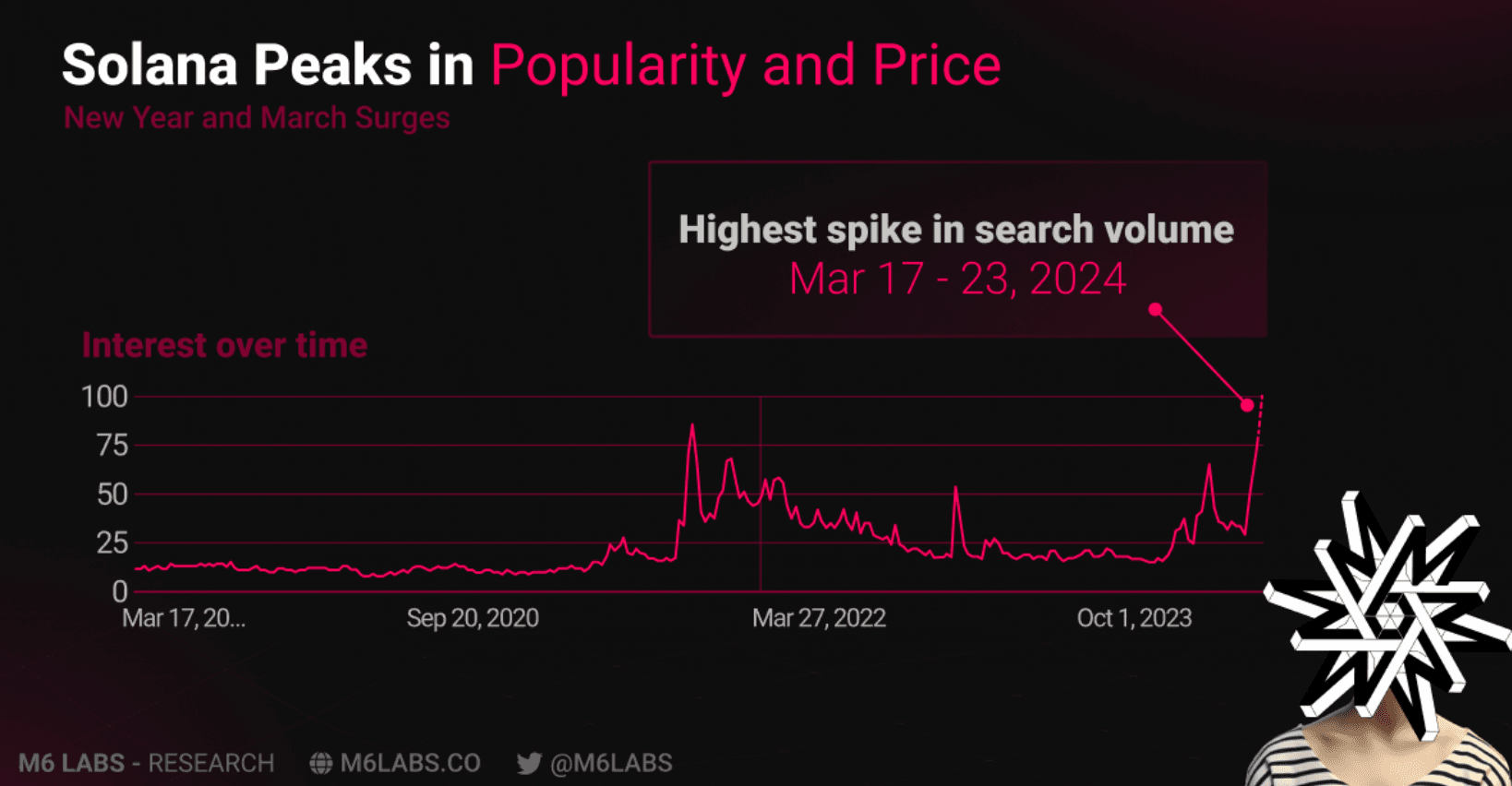

The recent surge in Solana's popularity has caught everyone’s attention. In fact, as per Google Trends data, global interest in Solana has hit a five-year peak.

This clearly shows that there is extreme intrigue and engagement from both retail and institutional investors. Central to Solana's recent explosion in popularity is the frenzy surrounding Solana-based memecoins.

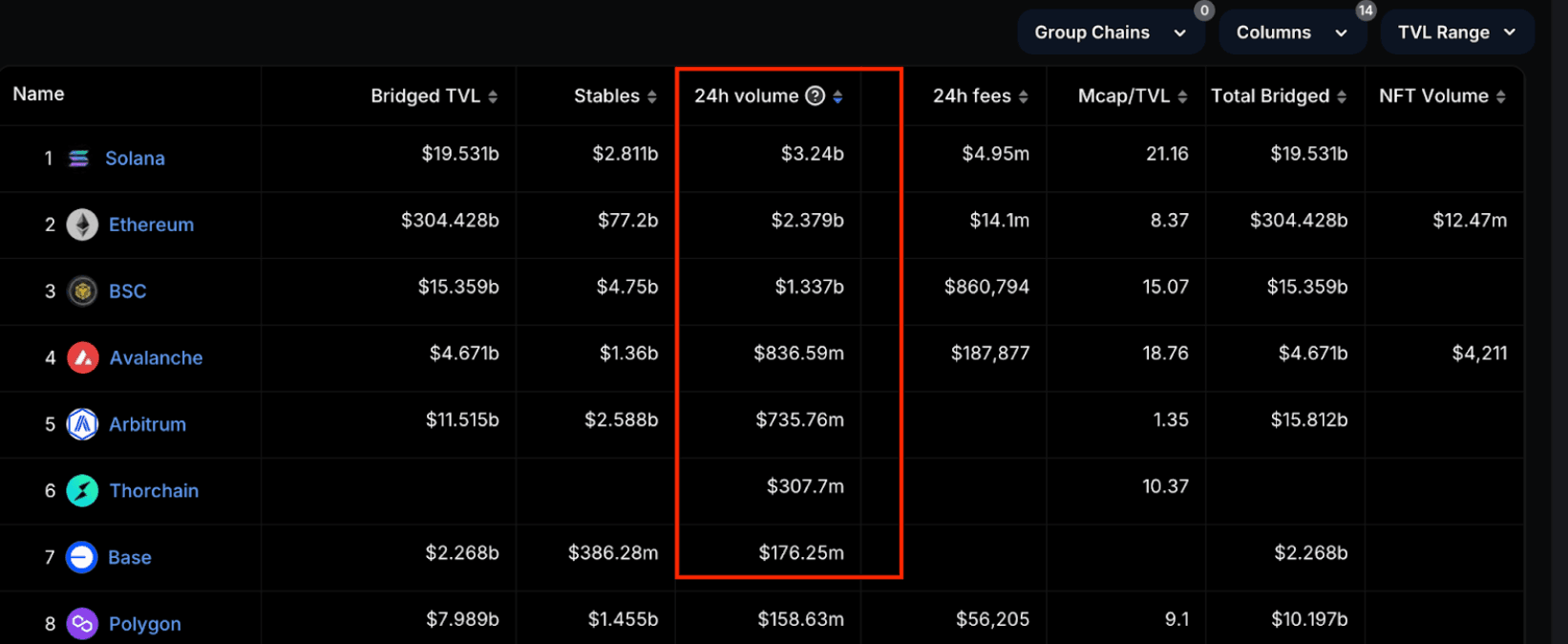

In fact, because of the memecoin-led hype, Solana even managed to flip Ethereum for the 24-hour trading volume. Solana did almost $1 billion more trading volume than Ethereum in the past 24 hours!

However, if you zoom out, it’s even more impressive.

Just look at the absolute monster volume coming in the last few weeks!

What’s the impact on the overall price? For a brief period, SOL managed to flip BNB as the fourth biggest coin in the market, as its price crossed $200, before facing bearish correction.

Solana Metrics

Following this bullish surge, let’s check out some Solana metrics.

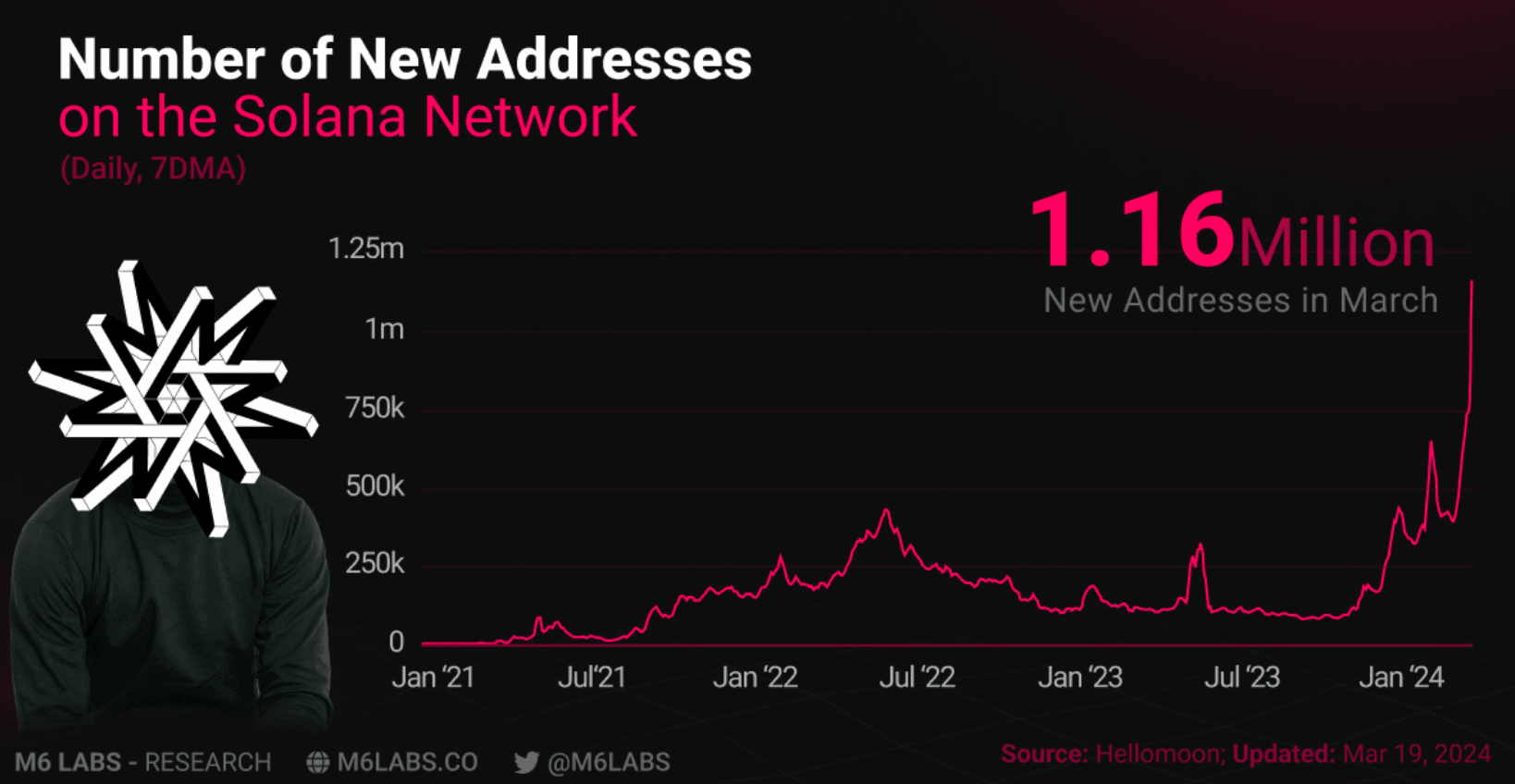

#1 Number of new addresses

The total number of new addresses entering the Solana ecosystem has spiked in March, skyrocketing from ~391,000 to 1.16 million! That’s a near 400% jump.

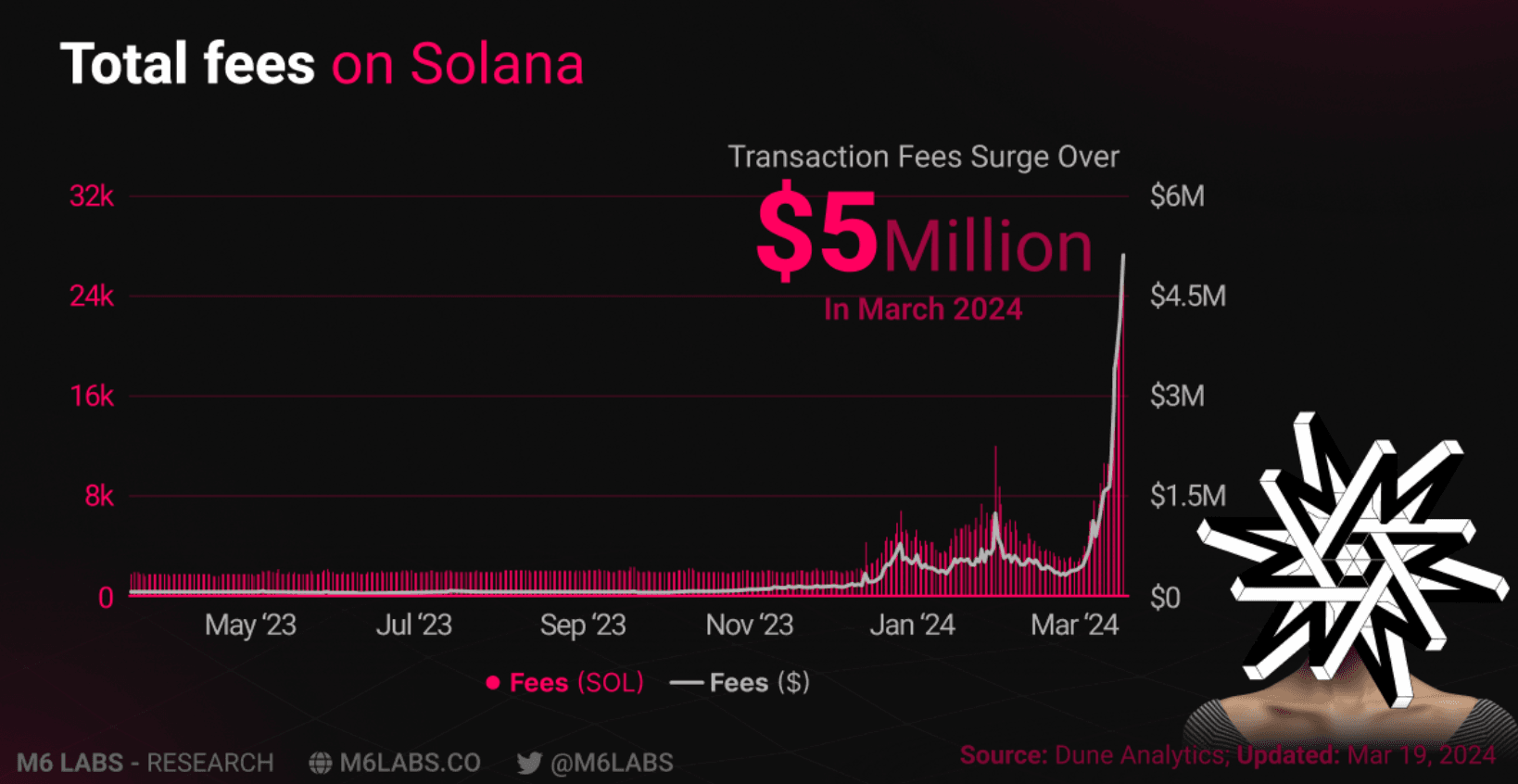

#2 Total fees on Solana

The spike in activity also equates to a spike in transaction fees. Overall fees have jumped from $378,200 to more than $5 million in March so far.

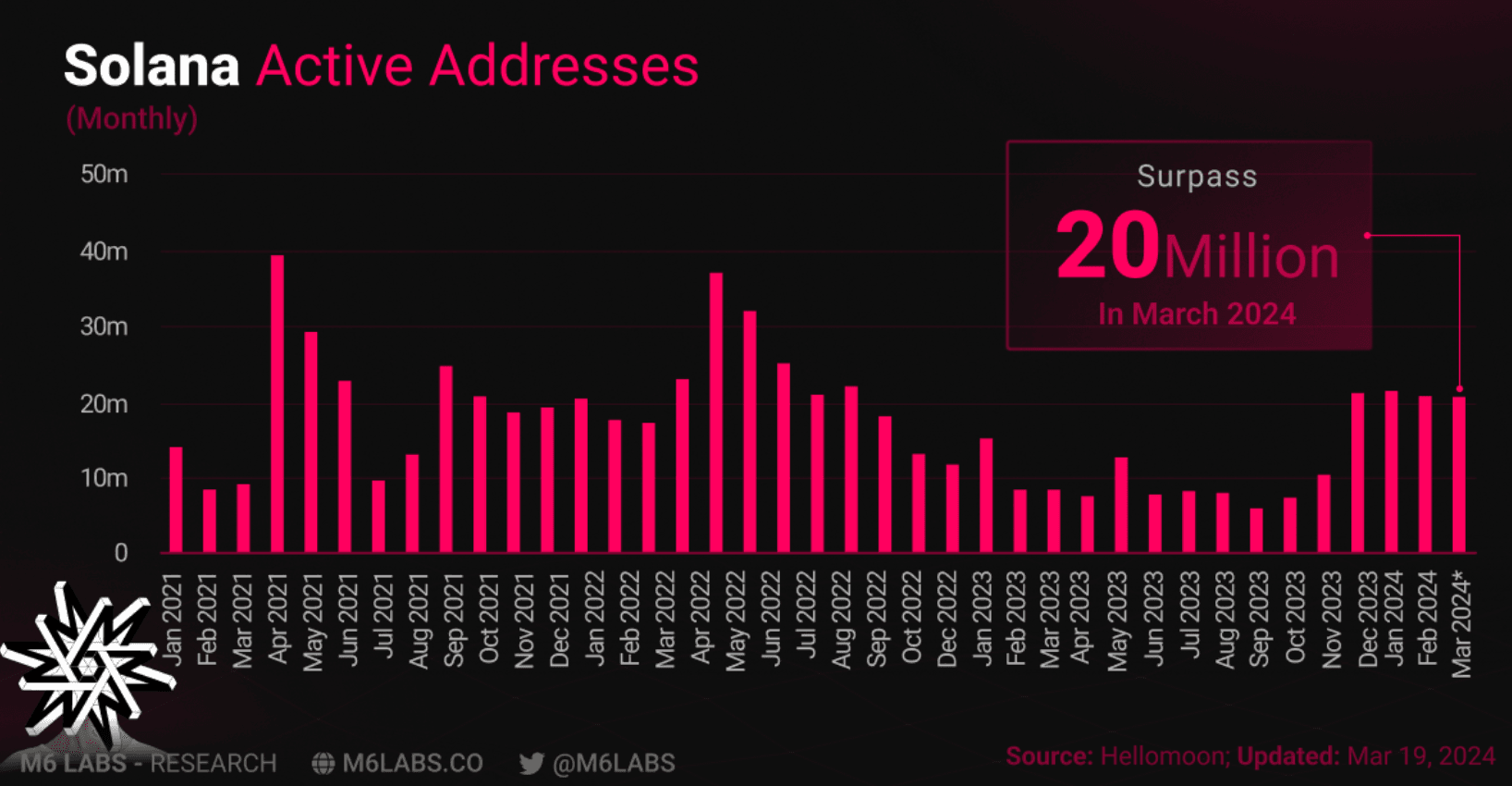

#3 Total active addresses on Solana (monthly)

The total number of active addresses in Solana in March has already crossed 20 million. With 10 days left to go, how far will this metric go?

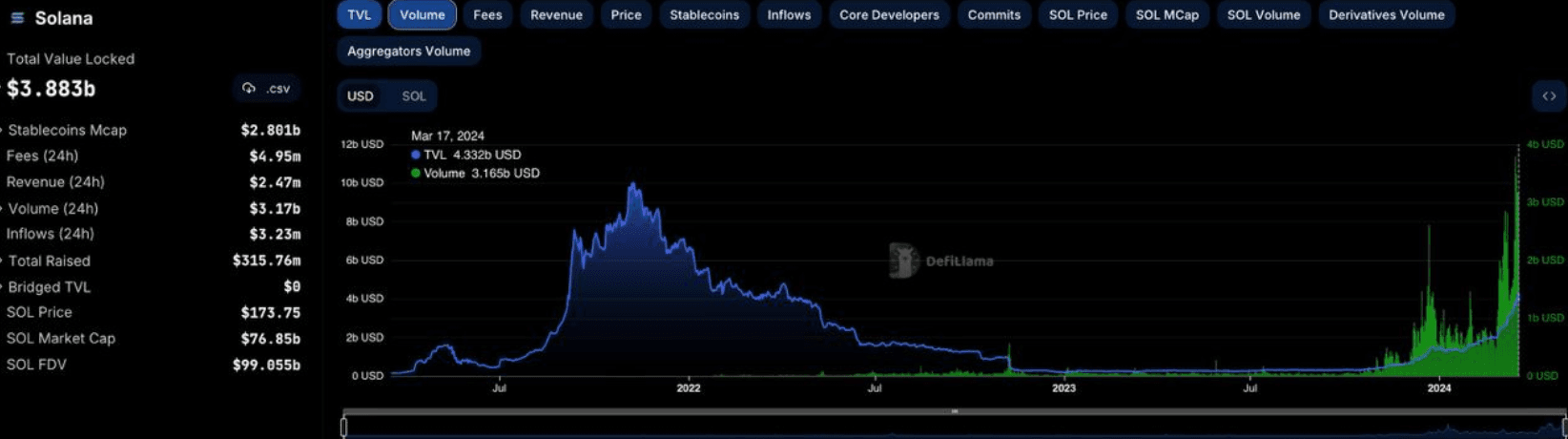

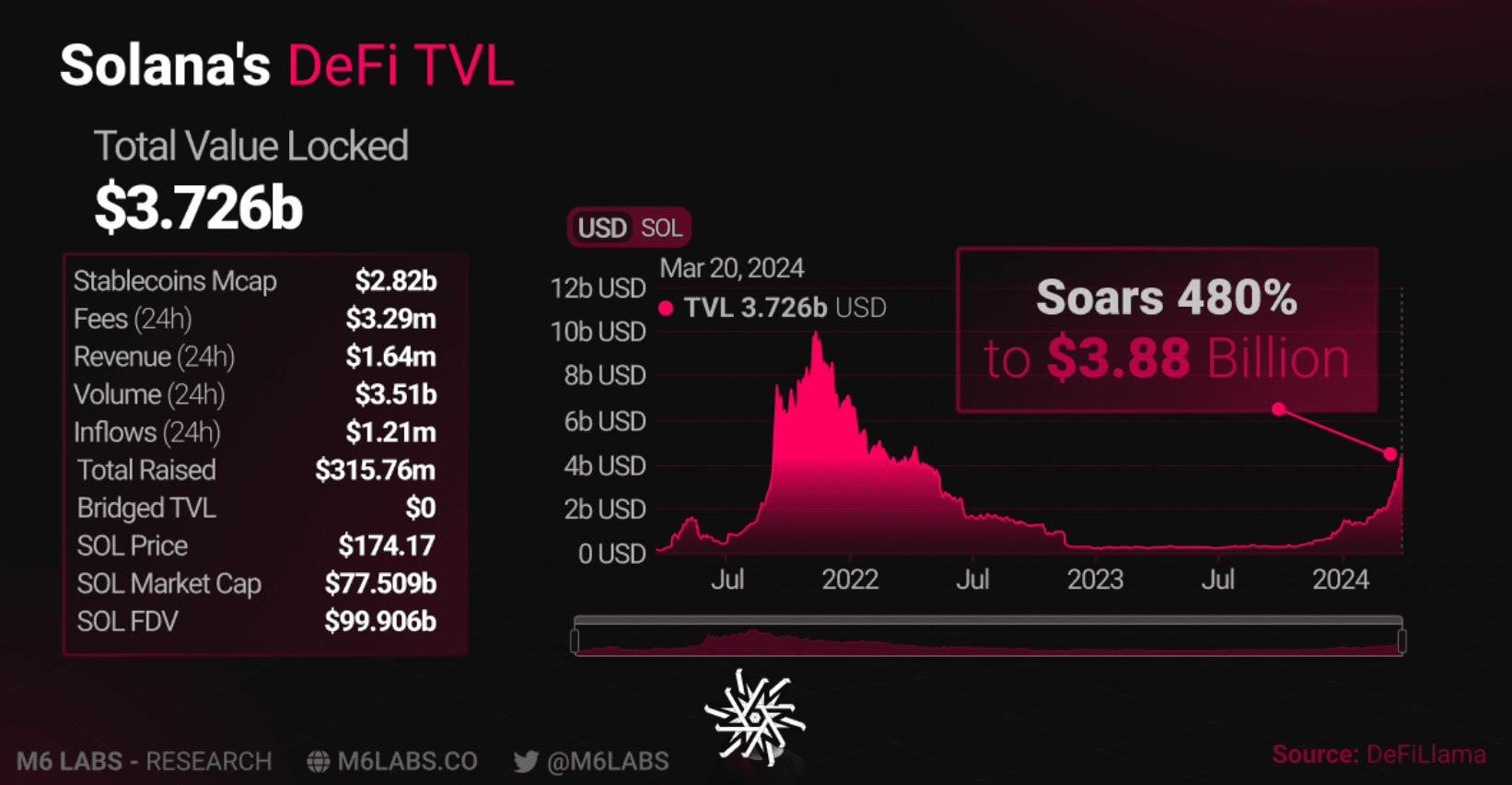

#4 TVL

Solana’s DeFi sector has also benefited from this injection of liquidity. Total value locked in Solana has jumped by ~480% from $671.2 million to $3.88 billion since the beginning of the year.

The scary part is that there is still tremendous upside. Back in November 2021, Solana’s TVL peaked at ~$10 billion. Can Solana rally to gather that much liquidity and reach new highs?

Now that we're up to speed on the state of Solana, let's delve into what everyone's curious about... What in the name of Doge is happening with memecoins on Solana?!

Solana, The New Home Of Memecoins

Solana has emerged as the go-to blockchain for meme enthusiasts. In recent weeks, there has been a surge in the number of memecoins launched on Solana, with some reaching market caps in the hundreds of millions within a single day. Let's explore some of the top performers and learn how you can get involved in this aspect of the crypto market if you're new to it.

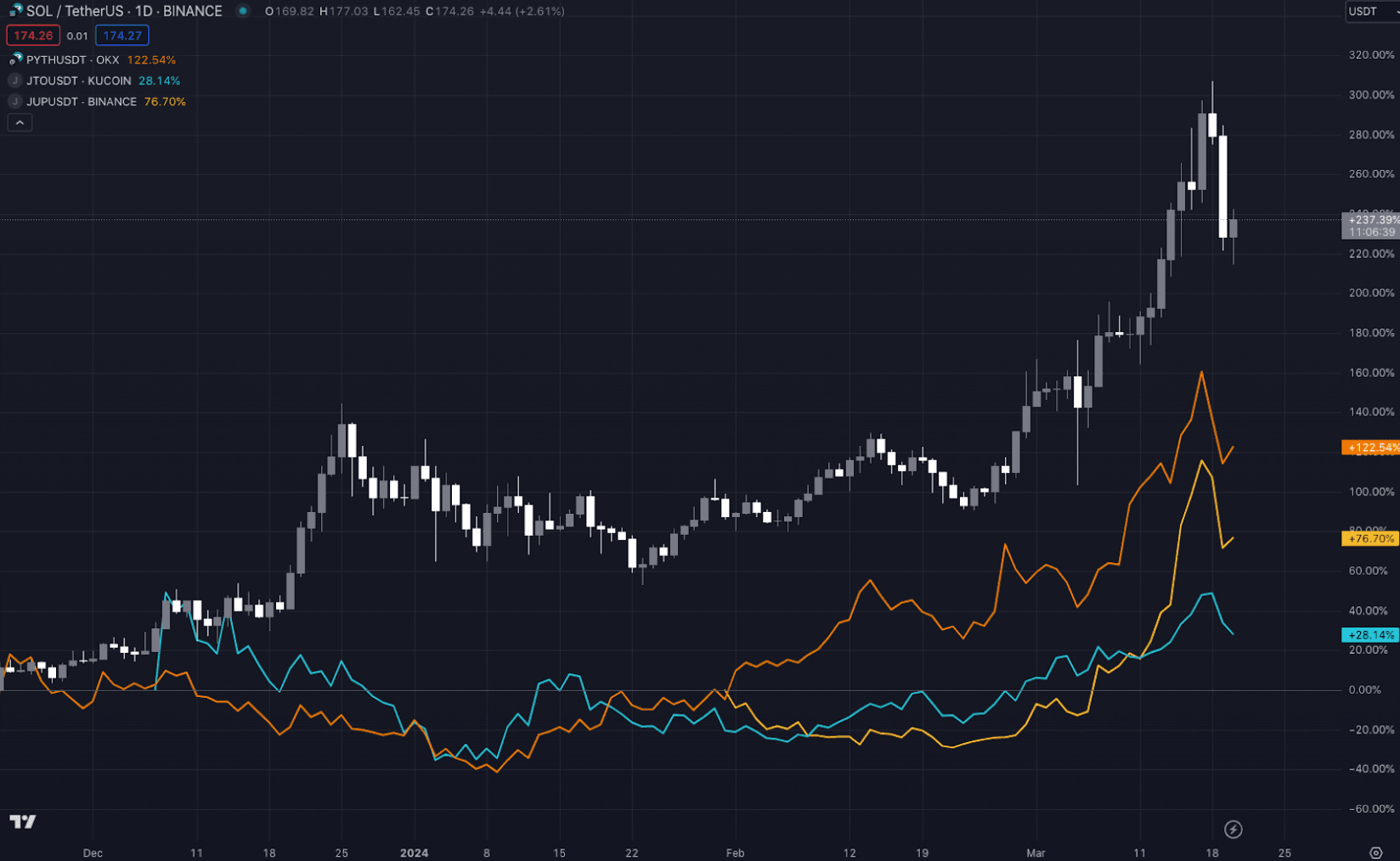

Firstly, let's examine some recent significant Solana airdrops, which overall seem to be performing well. This suggests ongoing interest and consequent liquidity influx into the ecosystem. Although not solely memecoins, the enthusiasm surrounding these airdrops ignited excitement within the ecosystem, thus fueling the frenzy surrounding memecoins. Take note that Pyth has been one of the next performing tokens after its community airdrop.

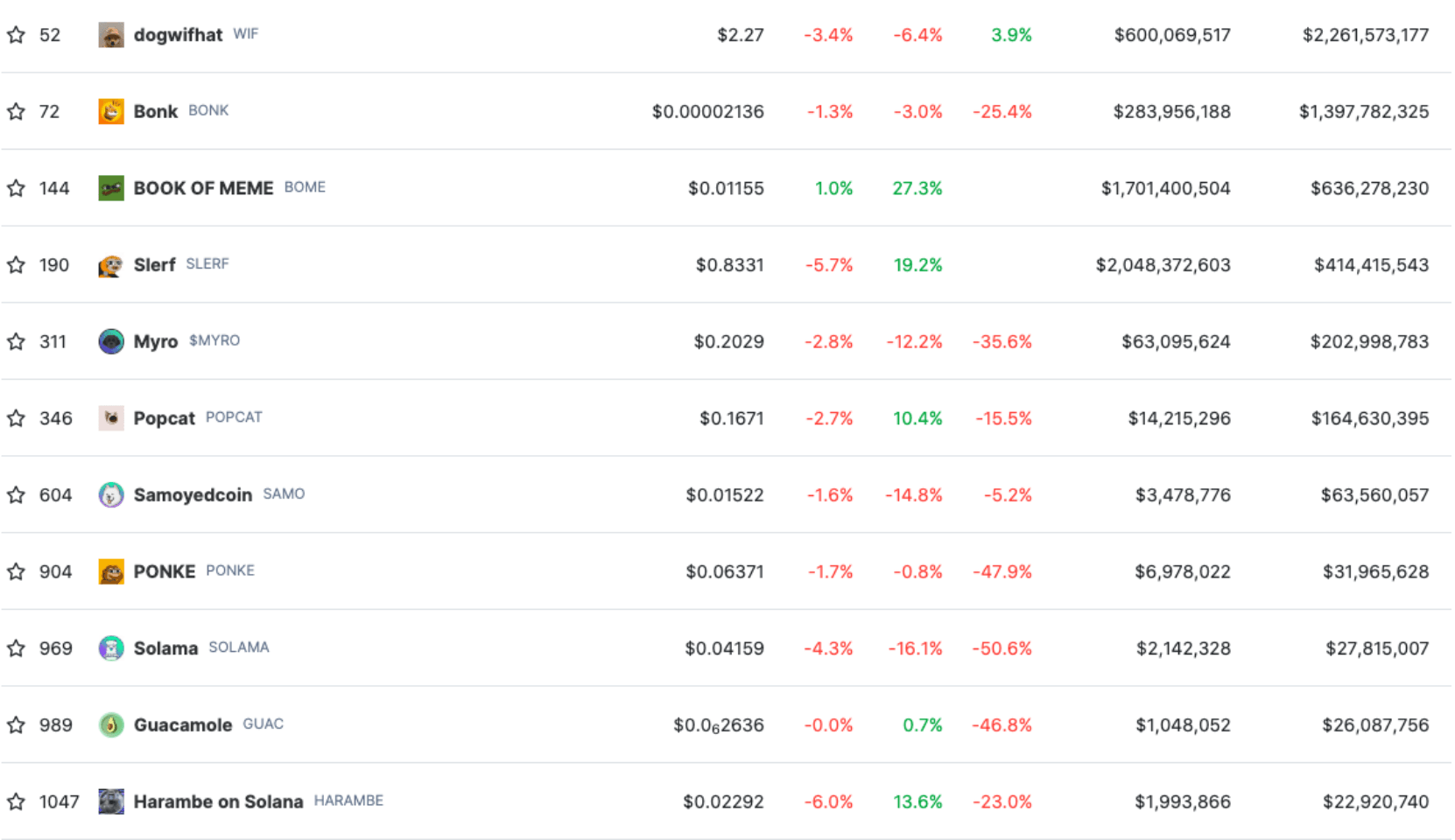

Moving onto the major Solana memecoins, Wif and Bonk are at the forefront, followed by the recent industry-backed launch of Bome taking third place. Wif currently ranks 52nd in terms of crypto market capitalization, valued at approximately $2.3B.

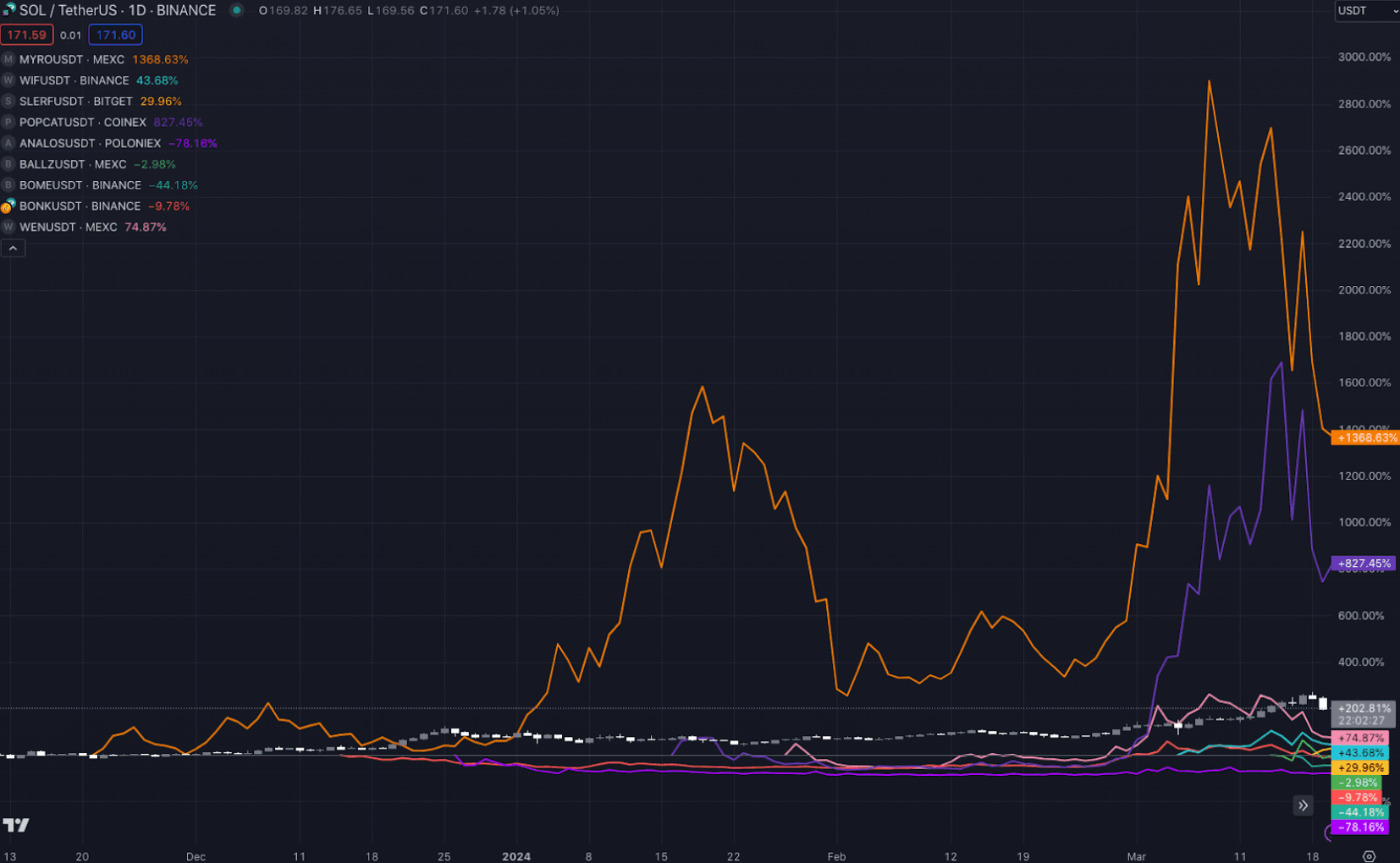

When comparing the performance of popular memecoins on Solana, Myro has been one of the best recent performers, followed by Popcat. Interestingly, Analos, initially hyped and among the first to gain traction, has witnessed a decline in popularity, highlighting the danger of how quickly sentiments can change in the memecoin market.

Shattering all expectations was the organic growth of Wif, which recently resulted in a photo of the original Dogwifhat meme being sold as an Ethereum NFT for a record-breaking $4.3M. The proceeds from the sale will go to the South Korean owners of the dog, Achi, who captured the endearing image in 2018. Adding to the top signals, the Wif community raised over $670K through a fundraiser to advertise on the Las Vegas Sphere.

Then came the incredible speed of new memecoins, racing to astonishing market caps such as Slerf and other coins focused on political memes like Joe Boden, Donald Tremp, and Elizabeth Whoren.

Despite a significant developer error resulting in the destruction of a substantial portion of its supply and a $10M loss for investors, memecoin Slerf has defied expectations by surging in trading volume to over $7B, an insane development when one considers Slerf is barely a week old.

Memecoin ICOs: Presales

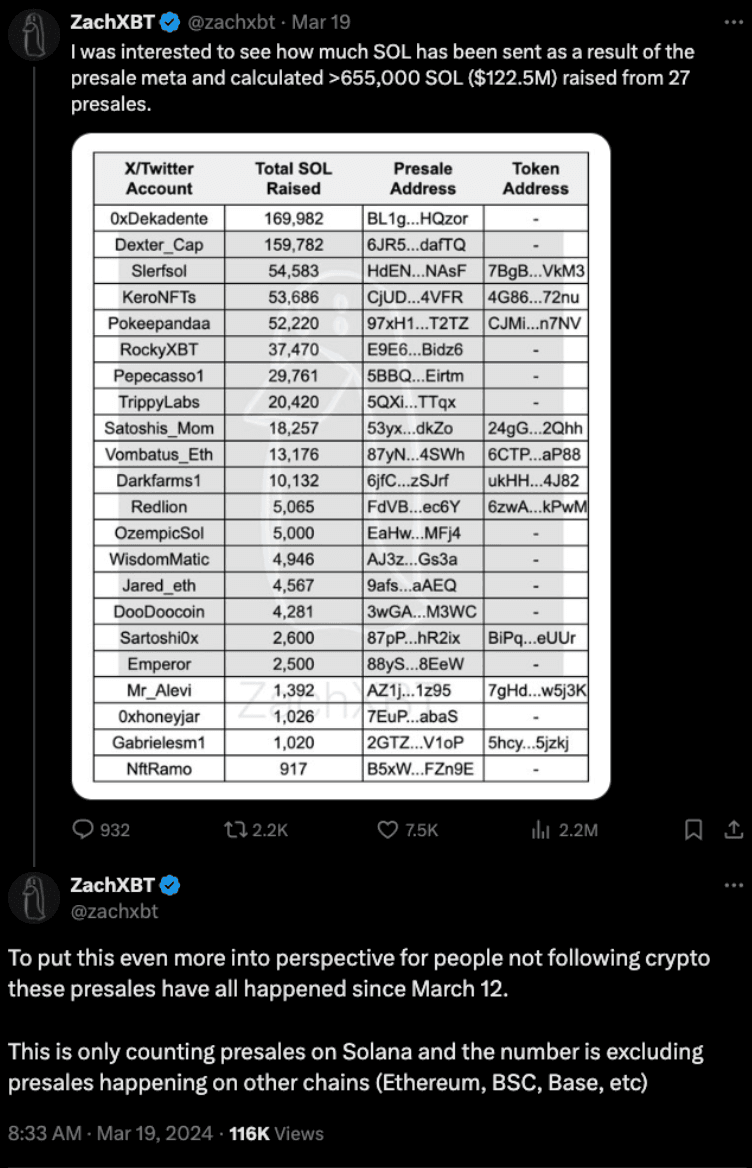

Intensifying the excitement was the initiation of presales, which are fundraising events where investors contribute funds to a project's wallet address in return for a proportionate share of future tokens depending on the amount invested. This phenomenon evokes memories of the ICO boom from 2017.

- There has been a surge in presales for memecoin launches on Solana, with 33 presales conducted since March 12, raising over 796K SOL.

- These presales, driven by FOMO, have led to significant price gains, as seen with the example of the Book of Memes presale, which saw a coin surge of over 1M %in less than two days! However, presales come with risks, as the funds collected are owned by one person who has total control over their use, as evidenced by the case of Slerf, where investor funds were burned.

Getting In On The Action

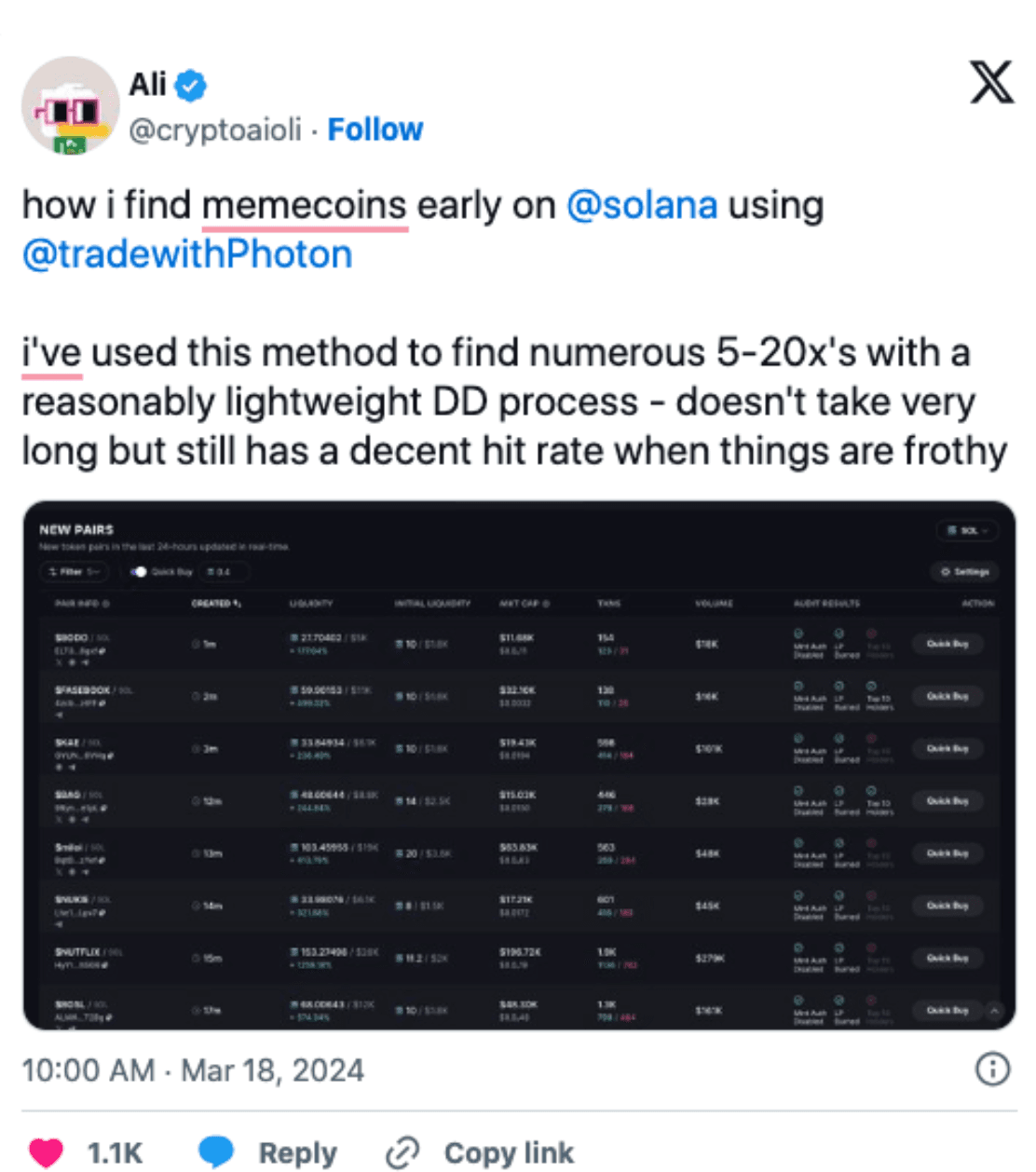

How do traders find and buy into these tokens? Traders begin by browsing and filtering tokens using Photon or other tools such as Dexscreener, focusing on volume, market cap, and liquidity.

They then delve deeper by evaluating Twitter engagement and participating in Telegram groups to gauge community sentiment. While inherently speculative, adept traders can identify high meta plays with significant potential rewards. Dive deeper into the process with this useful thread by Ali.

Since this market is still in its early stages, users are beginning to understand how its dynamics will unfold. It's probable that Solana will gain further popularity, and the meme frenzy will persist throughout this bull market. Take advantage of opportunities on Solana such as...

Nylan Heroes

9 Lives Interactive, a game development studio based in Singapore, has successfully raised $3M in funding to facilitate the worldwide release of Nyan Heroes, an action-packed "hero shooter" game incorporating assets from the Solana blockchain.

- Scheduled for a limited early access testing phase from March 26 to April 9, the game will be available on the Epic Games Store.

- In conjunction with the early access period, players can engage in a play-to-airdrop initiative, earning incentives in the form of the $NYAN token.

- Already, over 200,000 players have registered for the campaign, representing more than 120,000 distinct Solana wallets.

- Get involved by following the thread linked below to earn MEOWS, which will translate to $NYAN.

Parcl

Parcl, a Solana-based real estate trading platform, is set to convert user-earned points into tokens in April, potentially distributing $160M if PRCL maintains its current trading price.

- The platform allows users to trade on real estate market prices with up to 10-fold leverage, using its own data feed to track price changes per square foot in select markets.

- By earning points through platform interactions, users become eligible for the upcoming token airdrop.

- Since launching its V3 product in November, Parcl has facilitated over $210M in total volume, with a points program introduced in December.

- The PRCL token will mainly serve governance purposes, with 7%-8% earmarked for the community airdrop.

- Get involved here.

Kamino

Kamino is a Solana-based DeFi platform offering lending, borrowing, and various vaults for users to deploy multiple DeFi strategies.

- The platform utilizes its own data feed to track real estate market prices and enables users to bet on price movements. Kamino recently introduced its governance token, $KMNO, which allows holders to participate in on-chain governance decisions.

- To qualify for the $KMNO airdrop, users can earn points through Kamino products, which will be converted into $KMNO tokens during the airdrop.

- The point program aims to expand the platform's user base and reward loyalty. The initial $KMNO airdrop is scheduled for late Q1 or early Q2 2024, with multiple airdrops planned over several months.

- Get involved here.

Drift

Drift Protocol is a perp exchange on Solana currently running its airdrop program.

- This platform offers an opportunity for traders to engage in perpetual trading, which involves going long or short on assets using stablecoins as collateral, with leverage ranging from 2x to potentially hundreds.

- The exchange allows for both short-term trading strategies and hedging against other positions. To participate in the airdrop, traders can earn points through using Drift products, which will be converted into $DRFT tokens during the airdrop.

- Start trading perps here on Drift to build up points.

It’s Not All Good News

This wave of enthusiasm around memecoins has led to what some are calling "peak degeneracy," with significant amounts of capital flowing into memecoin presales, often with little guarantee of return. This trend raises important questions about the sustainability and risks associated with such speculative investments.

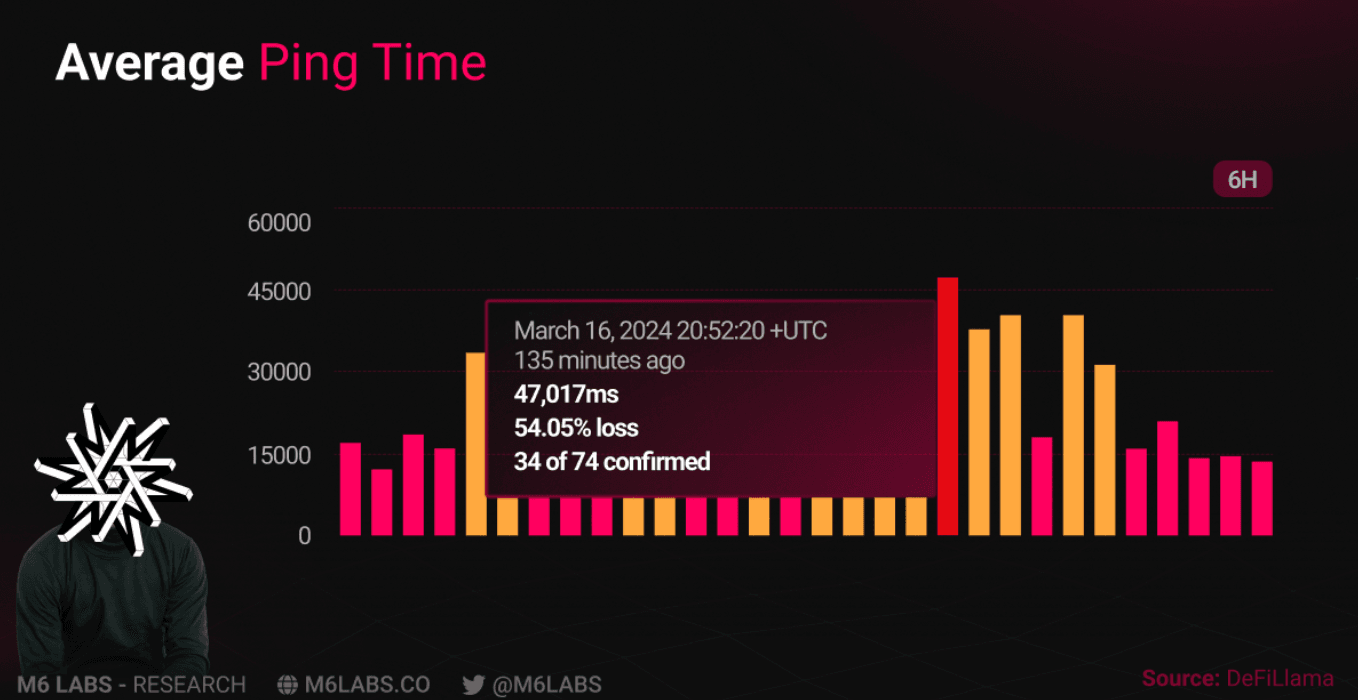

Additionally, the heightened activity has led to performance bottlenecks in the Solana network, impacting its overall functionality.

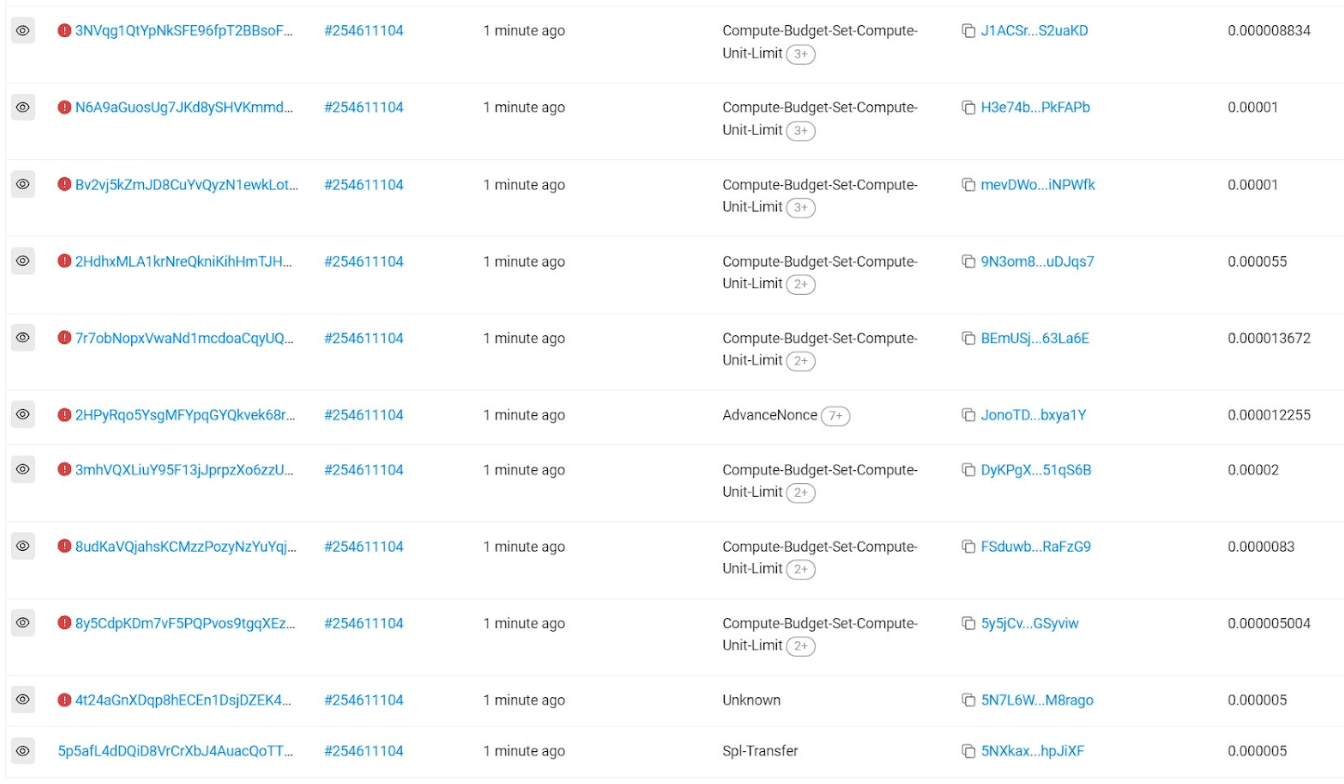

The Solana network experienced significant congestion, with average ping times ranging from 20-40 seconds and ping losses between 30-50%

This led to a high rate of transaction failures, with 50-80% of transactions failing.

The congestion lasted for several days, primarily due to an influx of non-vote transactions failing. This was exacerbated by high levels of spam and Miner Extractable Value (MEV) activities associated with meme coin transactions, further contributing to the 50-80% failure rate of transactions.

Even Ledger had to tweet about Solana’s congestion issues.

Despite these hurdles, the Solana ecosystem continues to exude a sense of excitement and attract substantial user engagement and liquidity, even in the face of the recent market correction.

Base

If you're not bullish on Base, are you even in the crypto game? Coinbase stands as the undisputed juggernaut of the North American crypto market, with a multifaceted approach spanning retail exchange services, groundbreaking development projects like the Base chain, and robust custodial solutions for institutional players.

With major corporations entrusting their assets to Coinbase and most American users turning to Coinbase, the potential for growth is undeniable. Positioned to dominate both retail and institutional volumes in the world's most crucial crypto market, Coinbase is primed for unparalleled expansion.

Moreover, by actively engaging in the political sphere, Coinbase is solidifying its influence and paving the way for itself for a very bright future. With strong political ties, market dominance, and a burgeoning ecosystem, Coinbase could soon overshadow competitors and emerge as the foremost choice for retail crypto use. Watch out, Solana – Coinbase and Base are on the rise!

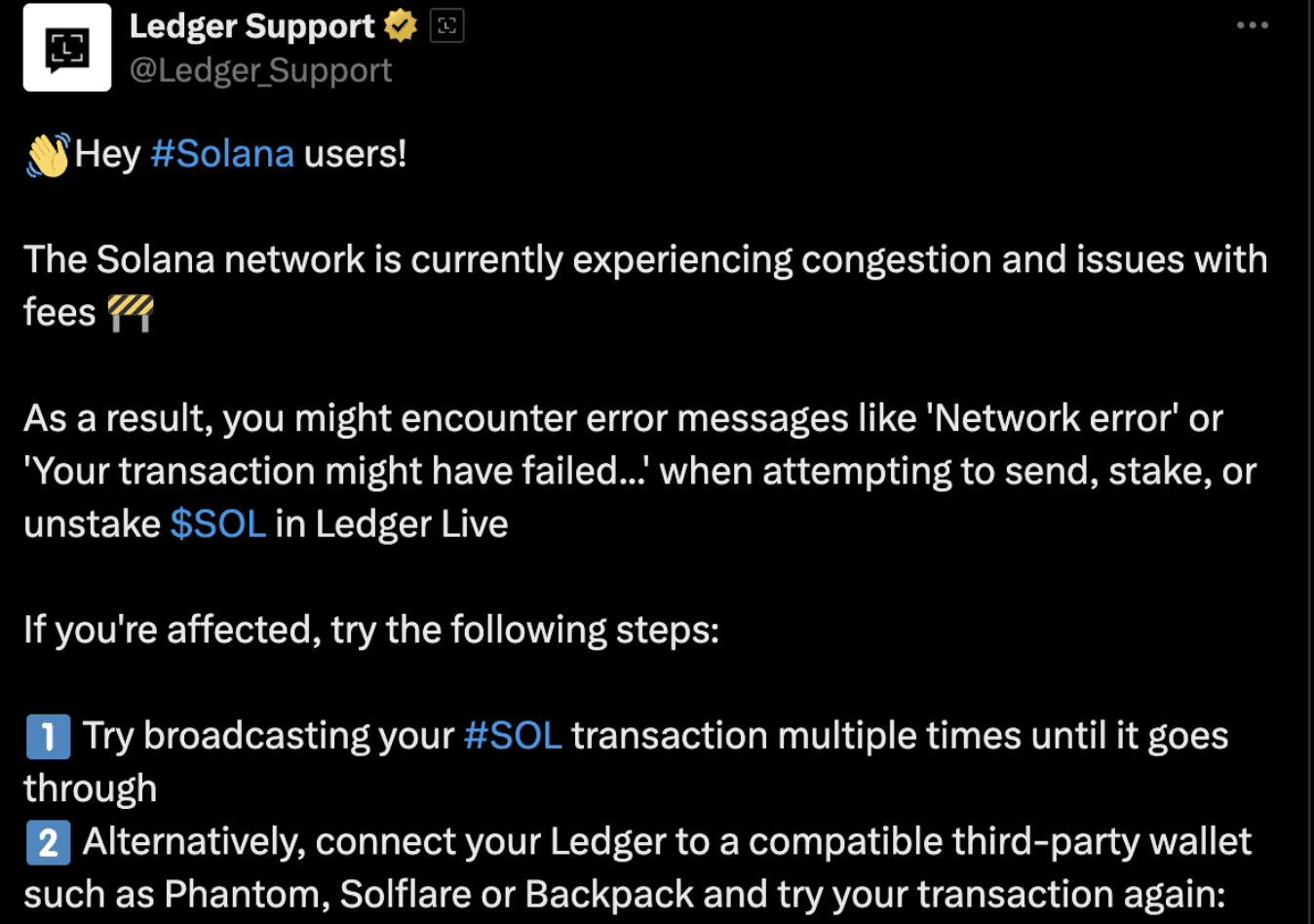

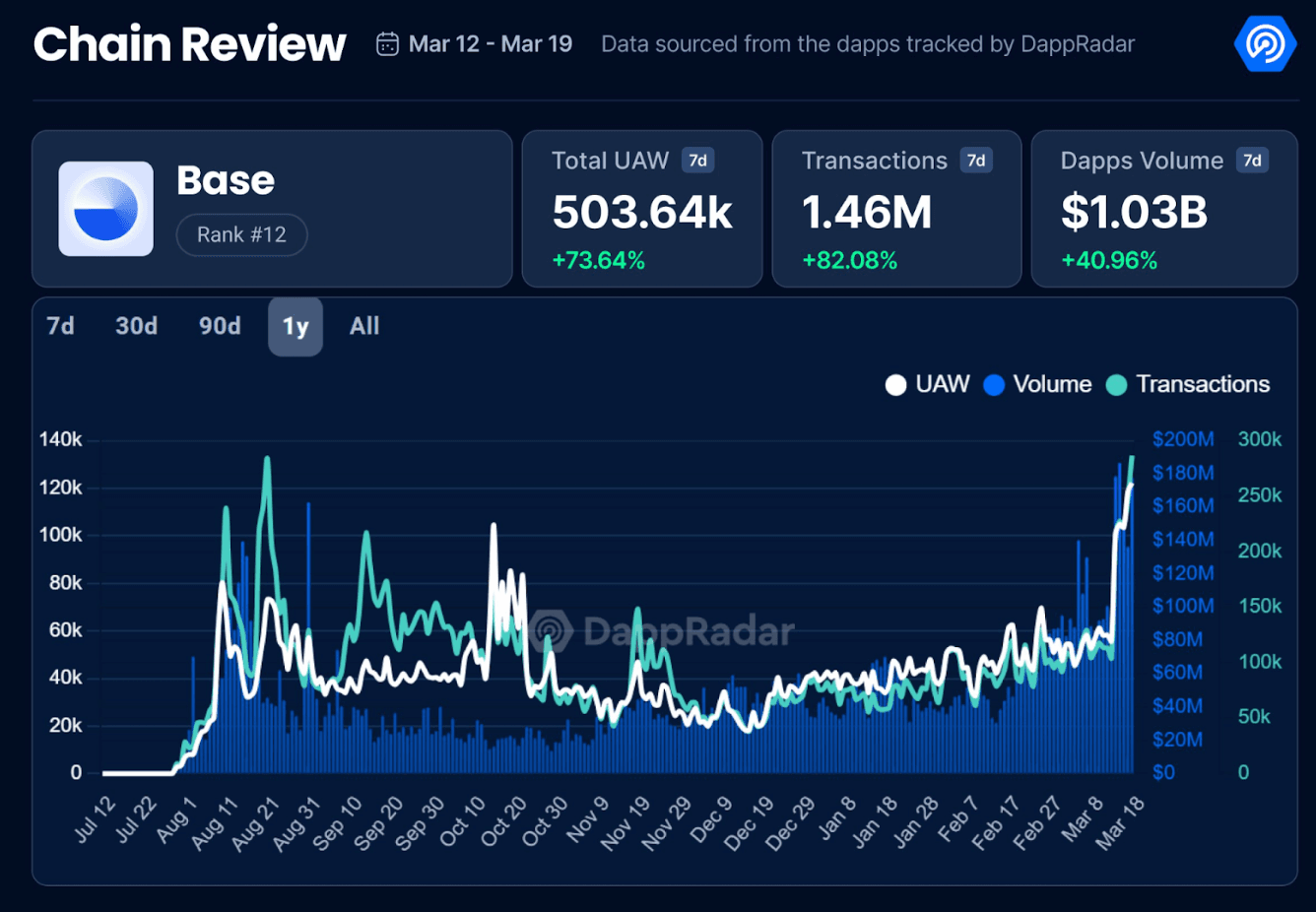

Base's adoption is skyrocketing, with transaction data and TVL breaking new records.

Since the end of February, TVL on Base has jumped from $386M to $776M, more than doubling in valuation.

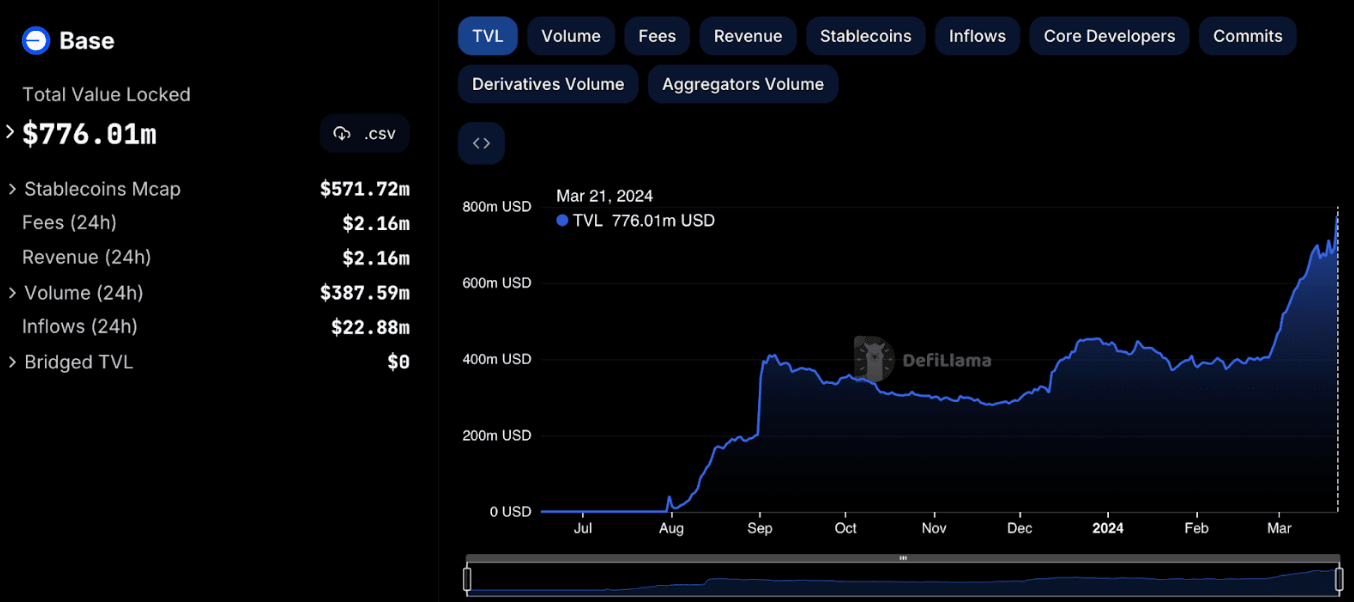

Looking at the hottest apps on Base, we can see that Aerodrome is by far the biggest app with $340M TVL, with the top two Dapps being decentralized exchanges.

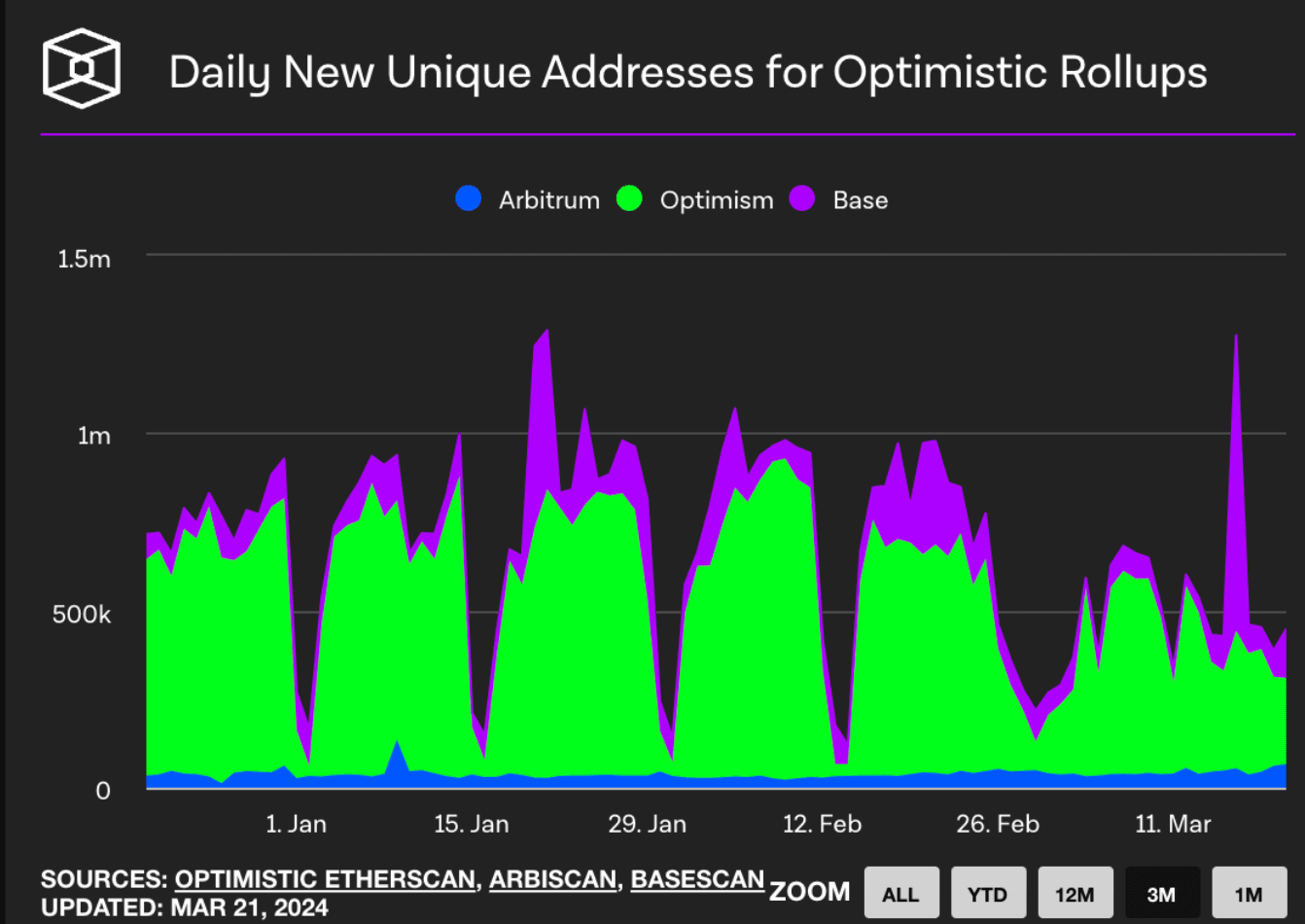

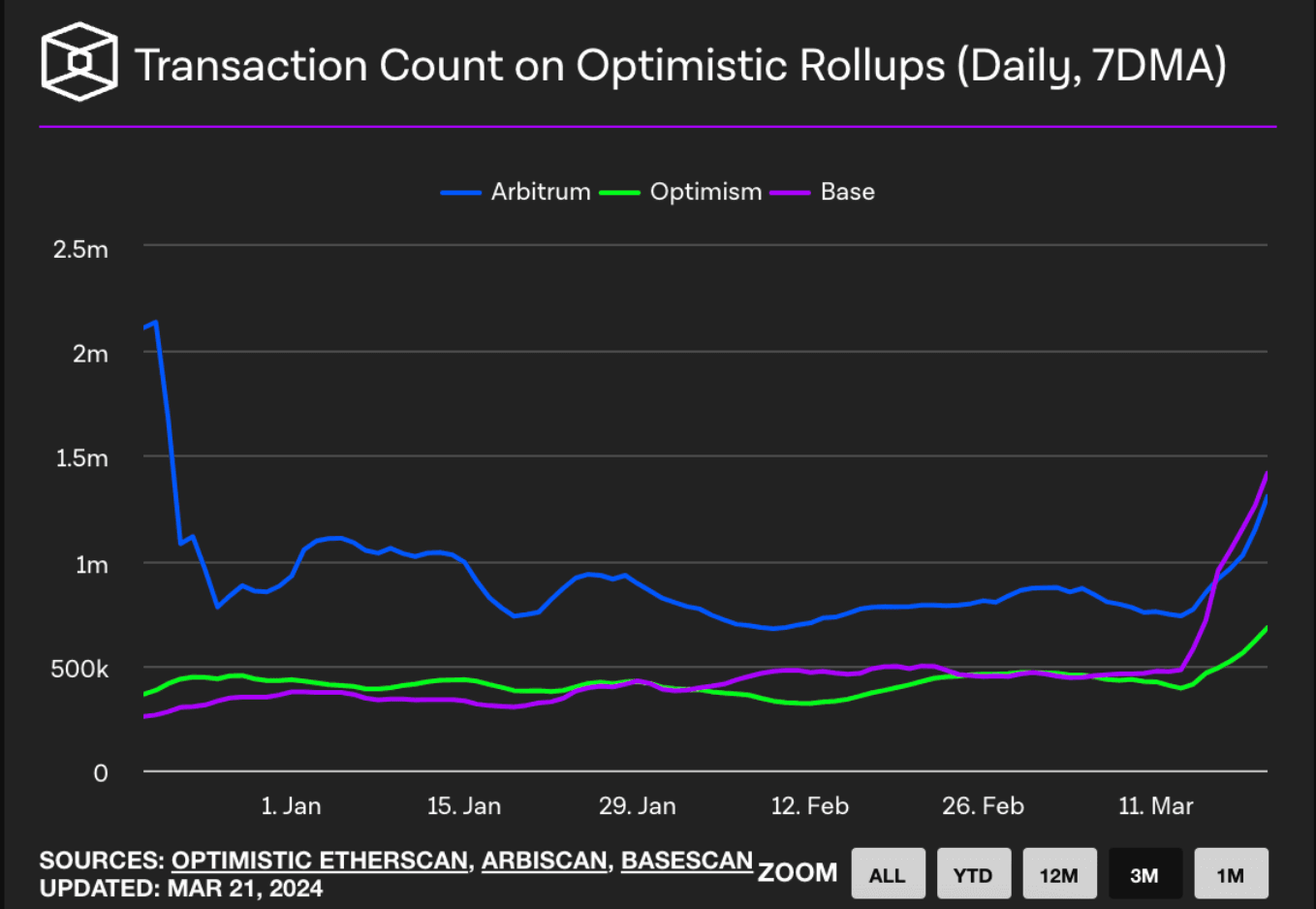

Over the last two weeks, the number of new unique addresses entering Base far outpaced ther L2 competitors like Arbitrum and Optimism.

These new addresses are not active users. They are busy interacting and making transactions. As a result, the number of transactions on Base has easily outpaced Optimism and Arbitrum.

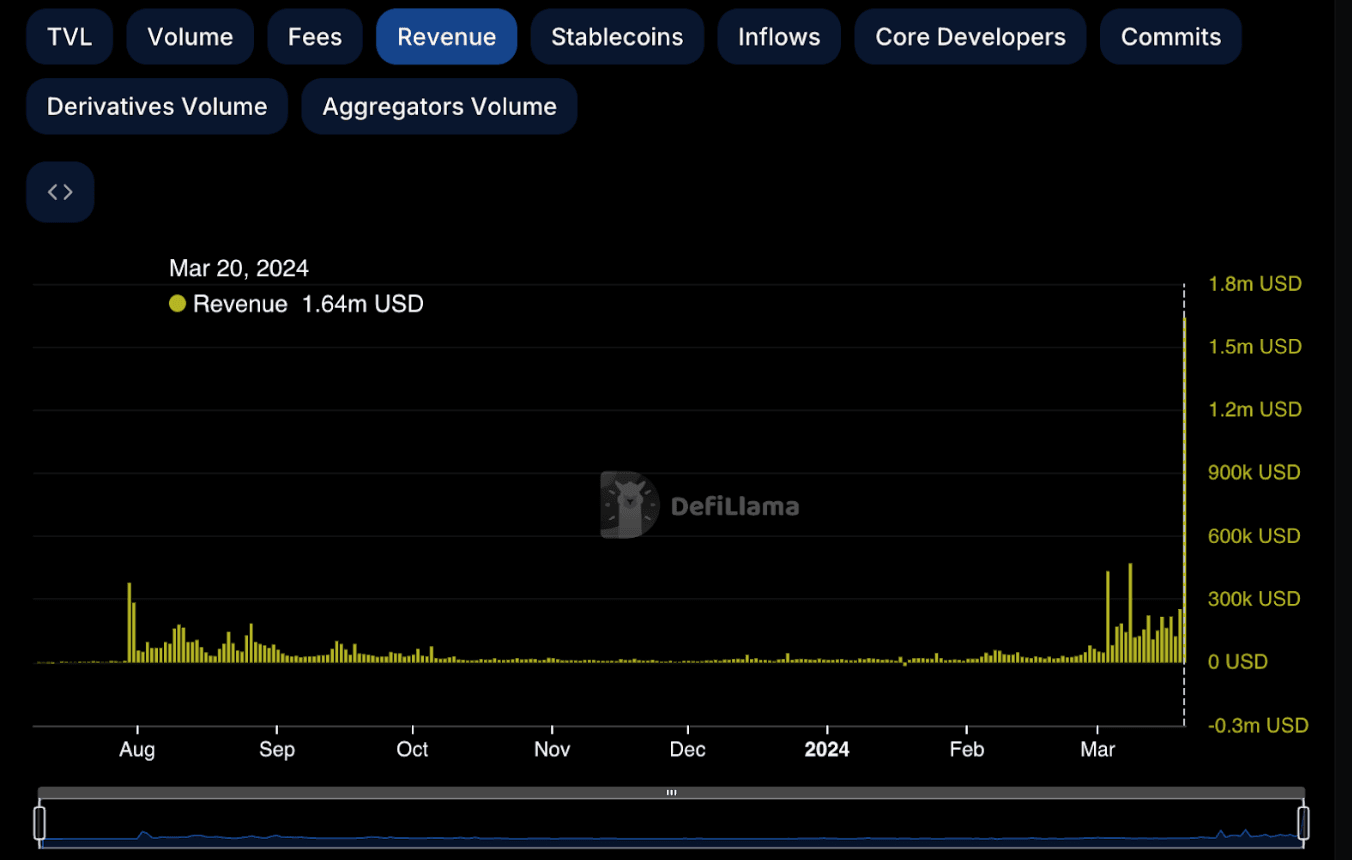

Let’s look at the revenue generated.

As you can see, overall revenue generated has crossed $1M, reaching as much as $1.64M on March 20! This is far higher than anything Base has ever generated.

Community and Dapp Engagement

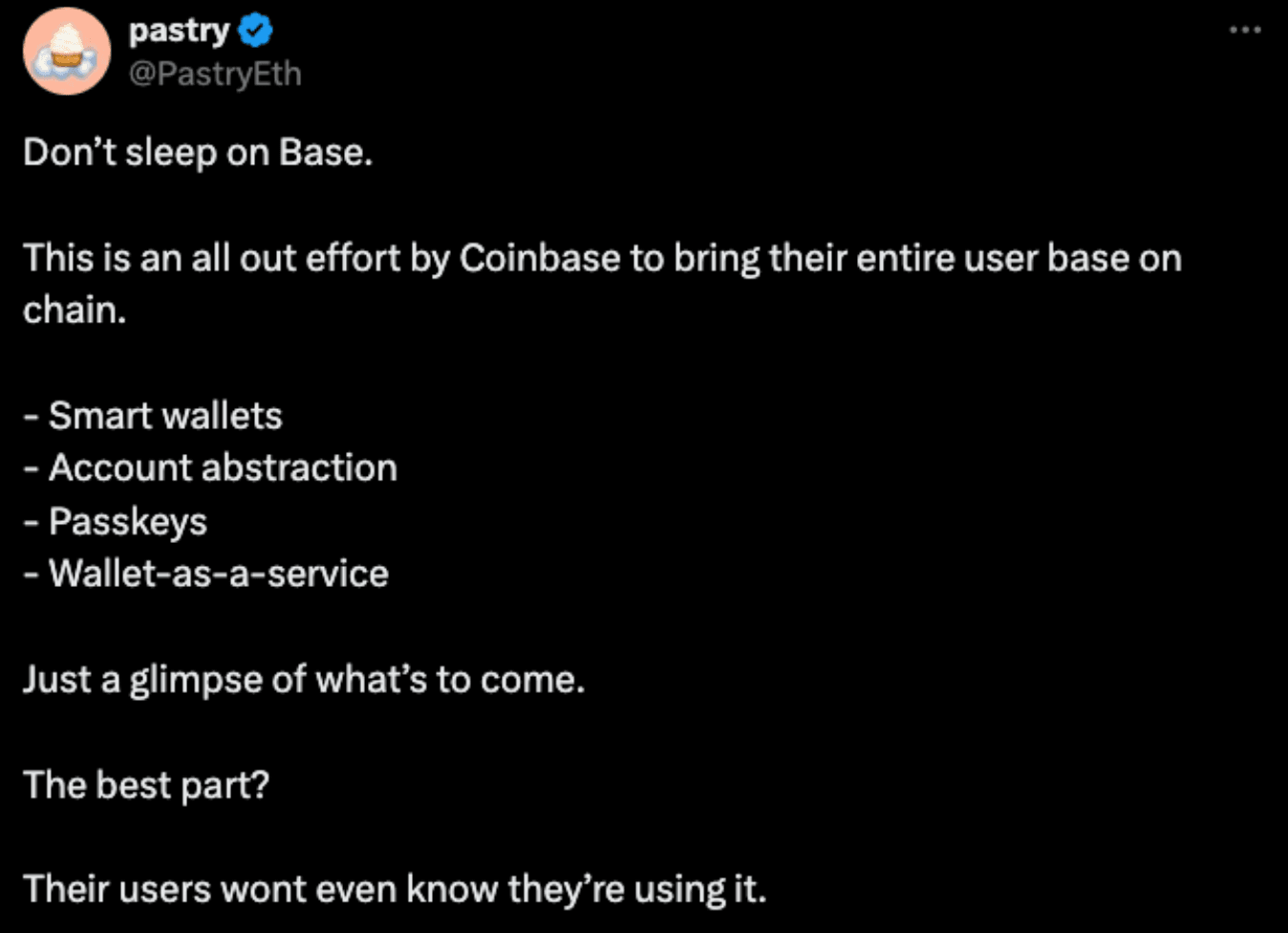

The platform's strategic deployment of features like smart wallets, account abstraction, passkeys, and Wallet-as-a-Service (WaaS) is simplifying on-chain interactions for Coinbase's massive user base, many of whom may not even realize they're engaging with blockchain technology.

- The Base community is pivotal to its growth, with a call to action for developers and contributors to enhance visibility and participation.

- This community-driven approach is crucial for the long-term vitality of the ecosystem.

- Dapp activity on Base has surged, with a notable 73% increase in Unique Active Wallets and a transaction volume reaching $1.03B, highlighting vibrant engagement and utility within the platform.

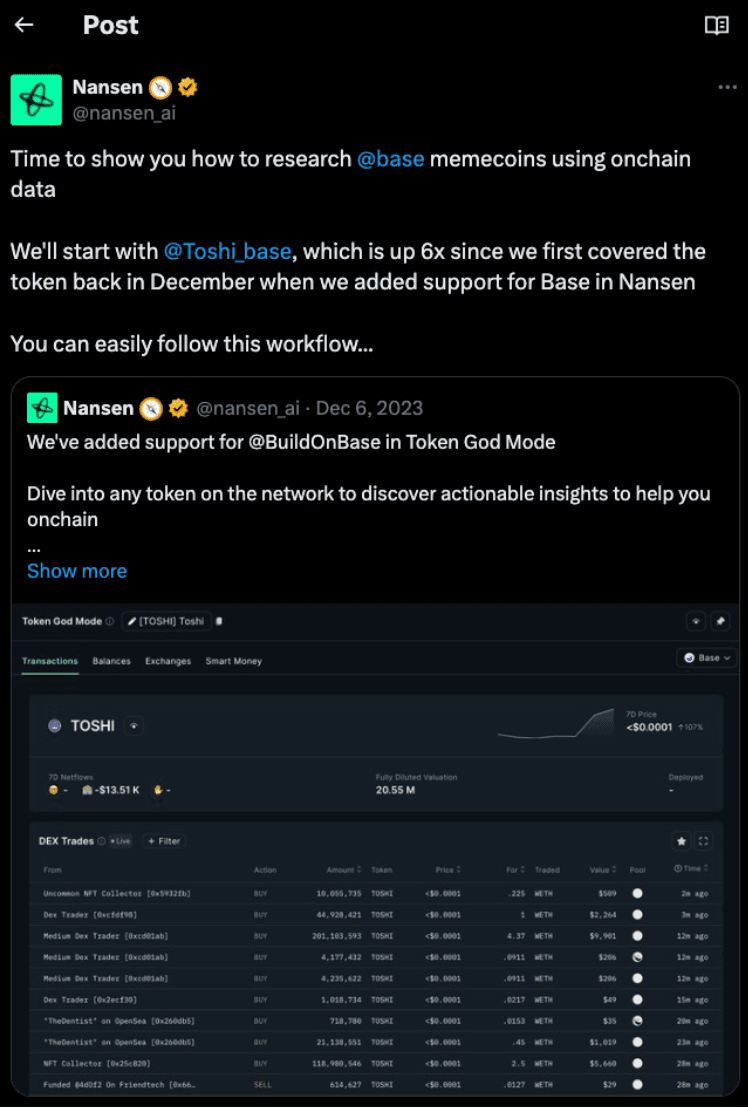

Nansen's analysis reveals a positive sentiment among "Smart Money" investors, with strategic buying and selling patterns that provide valuable insights for navigating the memecoin market on Base.

A World Of Opportunity

Base is still in its nascent stages, yet the momentum is steadily gaining traction. The recent revelation by CEO Brian Armstrong regarding a complimentary Coinbase NFT mint, coupled with hints of an impending airdrop, has ignited speculation and enthusiasm within the Base ecosystem.

The outcome of the Dencun upgrade for Base has led to a substantial reduction in transaction fees, significantly enhancing Base's appeal to retail investors. Furthermore, the proliferation of Base-related memes, spanning from established favorites like Toshi and Brett to newcomers like Normie and Boge, highlights the burgeoning excitement surrounding Base.

Additionally, notable developments such as the upcoming launch of Friendtech v2 by the end of April and the debut of Coinbase's Wallet-as-a-Service (WaaS) on March 8th, signify a pivotal juncture in Base's path towards mainstream adoption. So, how can you seize this opportunity? Let's delve deeper!

Follow The Money

Solana's congestion issues have become increasingly problematic, especially in facilitating the trading and deployment of memecoins. This bottleneck not only affects transaction speed but also hampers the efficient utilization of assets within the network. Moreover, the lack of robust mechanisms to mitigate sniping and whale activities in contracts adds another layer of complexity to Solana's challenges.

In response to these limitations, Base emerges as a promising solution, offering a viable pathway to address these pressing issues. With its innovative features and infrastructure, Base is positioned to attract users seeking a more seamless and efficient trading experience.

Anticipating the potential of Base, savvy investors have begun strategically accumulating Base memes in recent weeks, recognizing the opportunity presented by its growing ecosystem and the imminent influx of mainstream users.

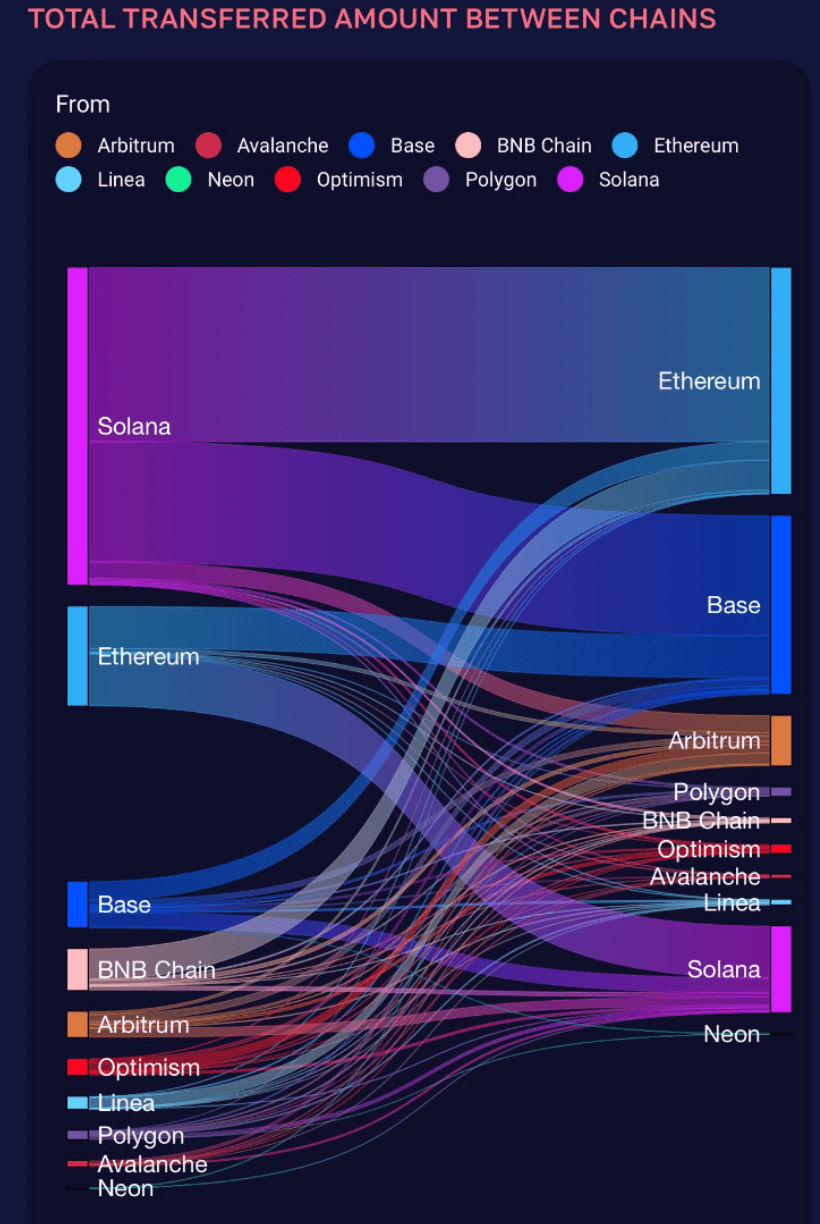

Furthermore, quantitative data indicates a noticeable shift in investor sentiment, with an increasing number of users transitioning their assets from Solana to Base.

Peeping Under The Hood

Some of the best opportunities you'll discover on Base will emerge through thorough due diligence. This can be accomplished in several ways. Utilize Dexscreener to monitor new token releases and those gaining significant traction. Alternatively, consider leveraging Nansen for deeper insights. While some features may require a pro account, users can still explore the platform's capabilities. Check out the post below to educate yourself on effective workflows.

That's it for this week Anon! See you next week

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.